Join Our Telegram channel to stay up to date on breaking news coverage

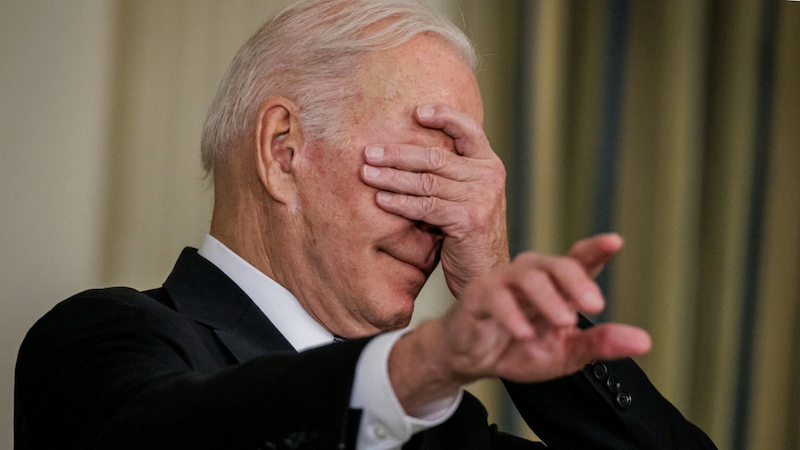

In yet another pathetic display of the absurdities that we have come to expect from this presidency, on Tuesday, Joe Biden presented a startling juxtaposition by claiming that “MAGA House Republicans” favor “tax loopholes that help wealthy crypto investors” but oppose food safety inspections.

In support of his proposed budget for fiscal year 2024, which has so far not made much progress due to unified Republican opposition in the U.S. House, Biden posted on Twitter.

We don’t have to guess what MAGA House Republicans value. They’re telling us. pic.twitter.com/BM6JGMEFeq

— President Biden (@POTUS) May 9, 2023

Although Republicans prefer to reduce “programs critical to seniors, middle-class, and working families” over revising tax laws “to ensure that the wealthy and big corporations pay their fair share,” Biden argues that cutting the budget is a universal desire.

A flurry of comments on Crypto Twitter followed the prominent mention of cryptocurrency. A frequent refrain:

“What tax loopholes?”

Billy Markus, the co-creator of Dogecoin, responded,

I gave y’all more money than I made off this stuff, while taking all the risk. You also realize most American crypto users aren’t rich, but are using crypto cuz they don’t feel like they have enough to make ends meet—because of you guys?

In comparison to his tweet, Biden’s budget plan offers a little more information.

Operation Choke Point 2.0

As we have reported before, since late last year, the Biden administration has been engaged in a coordinated attack against crypto, actions that have come to be known collectively under the moniker “Operation Choke Point 2.0”.

Not long ago, Bittrex, Coinbase and Tron have come under attack from the SEC, and the exchange Binance has also come under fire from another American government organization, the CFTC. Government representatives have been stepping up to attack crypto businesses after being blindsided by the growth of the bitcoin industry.

These SEC actions have received a variety of responses. The cryptocurrency community as a whole holds the opinion that the U.S. government overreacts in its enforcement actions, that its regulations are either unclear or inappropriate for web3-related assets and activity, and that regulators should work more closely with the industry to create new regulations for what some see as a novel method of approaching the exchange of value.

These tax accusations are thus the latest in a long string of attacks that have been unfolding over the last couple of months.

Tax Accusations

According to a White House information sheet, “Crypto investors are currently not subject to the same rules of the road that investors in stocks or other securities have to follow, allowing them to report excessive losses.” For instance, unlike an investment in stocks or bonds, a cryptocurrency investor can sell a cryptocurrency at a loss, claim a significant tax loss to lower their tax liability, and then repurchase that same coin the very next day.

According to the President, recovering $24 billion would require amending the tax laws “to apply to crypto assets just like they apply to stocks and other securities.”

However, Peter Conradi, community manager at Web3 creative platform Async Art and community moderator for digital artist Beeple, begged Biden to back off.

He responded on Twitter, saying,

Take your foot off the [brakes] of a technological and financial revolution that other countries are tapping into. Many of us simply strive to innovate and create new markets and opportunities for citizens; the majority of us are not wealthy.

The United States is derided throughout the world for its unclear regulatory guidelines on cryptocurrencies, which has led crypto businesses to expand abroad, hire lawyers, and collapse deals—possibly impeding the market itself. The industry has been getting smaller thus far, according to the tendency.

Gary Gensler, the chair of the Security and Exchange Commission, has intensified his campaign against cryptocurrency firms that the SEC claims are selling unregistered securities this year in response to criticism over the lack of oversight over the defunct crypto exchange FTX: Genesis in January, Do Kwon’s Terraform Labs in February, Justin Sun and his companies in March, and Bittrex in April.

However, there are dissenting opinions inside his own organization.

Republican senators are lined up to reject a U.S. central bank digital currency (CBDC), with Florida Governor Ron DeSantis calling it a likely venue for Democrats to impose “Woke Politics.” At the same time, the White House is arguing for a 30% excise tax on the energy used by cryptocurrency miners.

Related

- SEC accuses Bittrex of conducting unregistered business

- The U.S. Crypto Crackdown May Restructure the Sector

- Operation Choke Point 2.0: US goes after crypto amid confusion and uncertainty

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage