Join Our Telegram channel to stay up to date on breaking news coverage

Coin prices are on the downtrend once more, despite the ensuing 24-hour gain. Still, investors remain confident – even with DAO tokens.

Decentralized Autonomous Organizations (DAOs) are getting more traction right now, and it looks like a great time for investors to get in and enjoy gains. Below, we list out the best DAO coins in the market for investors to consider:

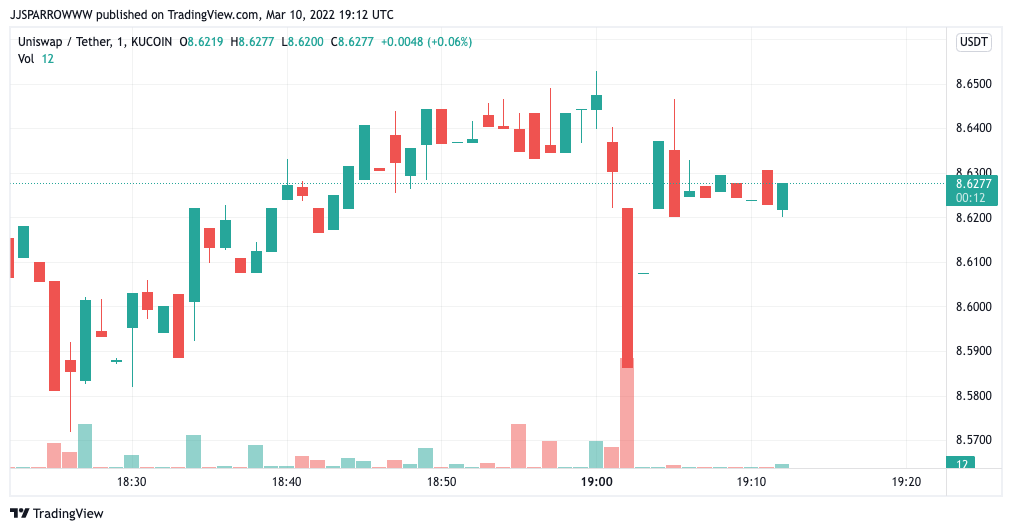

1. Uniswap (UNI)

UNI is one of the most valuable coins in the market. While the DeFi space has been relatively quiet, Uniswap has continued to make some impressive moves. This month, the exchange built out an interface that facilitates the conversion of ERC-20 tokens to Ether and sends the coins to the official wallet of the Ukrainian government.

This is part of Uniswap’s attempts to support the Ukrainian resistance following the Russian invasion. The Ukrainian government has so far received over $50 million in crypto donations, and Uniswap’s feature will go a long way in keeping that income source flowing.

UNI is also among the assets added to the Compass Crypto Basket Fundamental DeFi Index” (CCBFDEFI) – a DeFi investment index launched by Swiss-based fund manager Compass Financial Technologies. This should boost investor sentiment and increase appeal for the coin going forward.

2. Terra (LUNA)

TerraUSD is one of the largest by market cap. With a $14 billion in value, the asset trails only USDT, USD, and BUSD.

The Terra DAO has also inked a major sponsorship deal with the Washington nationals. The deal, which is the first sports sponsorship for a DAO, will see Terra commit $38 million over the next five years after a proposal from Terra founder Do Kwon got passed.

With the Terra ecosystem still growing and LUNA solidifying its place among the top 10 cryptocurrencies by market cap, many believe that this asset could be the SOL of 2022.

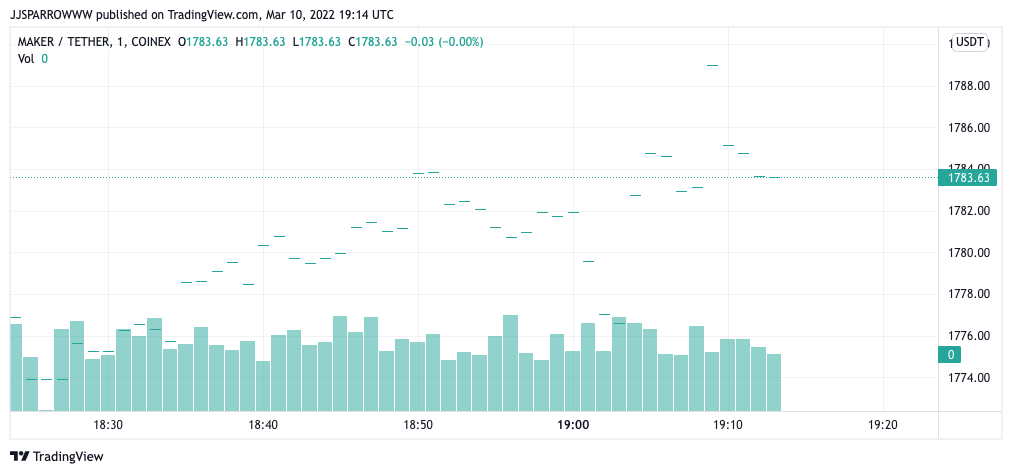

3. Maker (MKR)

The MakerDAO was one of the first DAOs to break into the mainstream. The decentralized credit platform supports DAI – a dollar-pegged stablecoin that is among the largest stablecoins in the world by market cap. Anyone can use Maker to open a vault, lock collateral, and generate DAI as a debt against their looked funds. The DAI debt incurs a stability fee, paid when the borrowed DAI is refunded.

The digital asset has become especially popular thanks to the growth of the DAO business model. With MakerDAO paving the way for other DAOs, investors have been quick to invest in the platform’s MKR token.

There isn’t much fundamental news for Maker, although the platform took a massive step towards improving security when it launched a $10 million bug bounty program last month. Security remains a major use for DeFi protocols and DAOs, and Maker’s investment in bolstering its security infrastructure should inspire investor confidence in the platform.

4. Aave (AAVE)

Aave is another DeFi protocol that needs no introduction for industry players. The platform offers lending services, allowing users to borrow and lend coins in a decentralized manner. Lenders can lock their funds in the pool and lend them out, earning yields on assets they supply to the protocol.

Aave uses an algorithm to automatically adjust yields on coins across its protocol, although the force of demand and supply play a major role in deciding the appropriate interest rates.

Like many DeFi protocols, Aave has been relatively quiet. It joined UNI as part of the coins listed on the Compass Crypto Basket Fundamental DeFi Index” (CCBFDEFI), meaning that there’s a lot of demand for it internationally.

Also, Aave made a surprise announcement last month when it launched Lens Protocol – a decentralized social media platform that looks to challenge the Facebook-Twitter duopoly. Built on Polygon, Lens Protocol focuses on ensuring user privacy and identity control.

5. Kyber Network (KNC)

Kyber is a decentralized exchange that allows users to swap coins – primarily, swapping ETH for other ERC-20 tokens. The exchange uses a diverse set of liquidity pools, allowing users and DeFi protocols to tap into them and source funds for trading.

Kyber’s mission has primarily been to bring other protocols into their ecosystem. They’ve focused on building a developer-friendly protocol that allows anyone to integrate their technology into smart contract-powered chains. As a result, several vendors, protocols, and applications use Kyber infrastructure. These include bZx, InstaDApp, and even the Coinbase Wallet.

With so much growth, Kyber hasn’t stopped. This week, the KyberSwap decentralized aggregator launched on Arbitrum – an Ethereum layer-two scaling network. The team explained that this move would help users bypass Ethereum’s high transaction fees and transaction latency.

Read more:

Join Our Telegram channel to stay up to date on breaking news coverage