Join Our Telegram channel to stay up to date on breaking news coverage

The cryptocurrency market continues to grow steadily, with a total market cap reaching $3.16 trillion, reflecting a 0.63% increase in the last 24 hours. Trading activity has also surged, with a total daily volume of $103.74 billion, marking a 6.88% rise. Notably, decentralized finance (DeFi) accounts for $6.92 billion, making up 6.67% of total trading volume.

With market activity picking up, selecting promising cryptocurrencies becomes crucial for investors seeking opportunities. Several digital assets continue to shape the crypto market, each offering unique features and growth potential. As such, investors are looking for the best cryptocurrencies to invest in right now.

Best Cryptocurrencies to Invest in Right Now

Litecoin has seen a significant price surge, climbing 9.76% in the last 24 hours and surpassing the $130 mark. Meanwhile, BTC Bull Token is gaining traction during its presale, drawing interest due to its Bitcoin rewards system. The project has already raised $2.3 million through its initial coin offering (ICO). XRP has also shown steady growth, trading at $2.53 after a 5.16% increase over the past week.

1. XRP (XRP)

The potential launch of an XRP exchange-traded fund (ETF) marks a step forward in expanding cryptocurrency investment products beyond Bitcoin and Ethereum. The recent filing by MEMX with the Securities and Exchange Commission (SEC) signals growing interest in regulated digital asset funds. If approved, an XRP ETF would offer investors a structured way to gain exposure to the token without directly holding it.

Regulatory clarity plays a key role in this development. XRP’s inclusion in ETF discussions suggests a more defined legal standing, potentially supporting Ripple’s ongoing legal matters. This shift reflects the evolving stance of regulators toward cryptocurrencies, which could open the door for more digital assets to enter the ETF market.

XRP is trading at $2.53, reflecting a 5.16% gain over the past week. It remains above its 200-day simple moving average (SMA) of $1.6338 by 55.52%, indicating a strong long-term trend. Market liquidity remains high, making it accessible for traders. However, the price is still 35% below its all-time high, showing room for potential movement.

We have a new look in our products, on our website, and right here on social.

We're building for the next chapter with the vision that continues to drive us — the Internet of Value and transforming the way you move value around the world.

➡️ https://t.co/cG4F8wiggi pic.twitter.com/eaIoza86YK

— Ripple (@Ripple) February 14, 2025

The 14-day Relative Strength Index (RSI) sits at 39.05, suggesting neutral market conditions. This means XRP is neither overbought nor oversold, implying possible sideways price action in the short term.

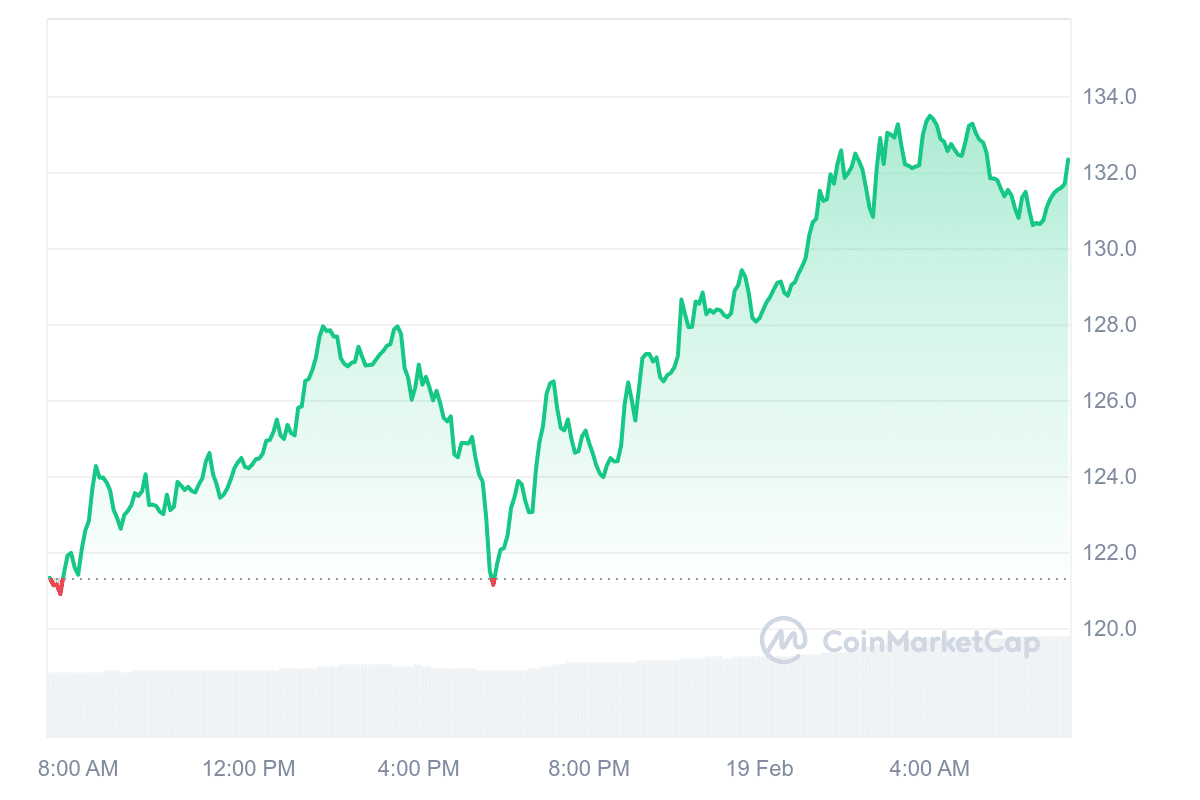

2. Litecoin (LTC)

Litecoin has experienced a notable price increase, rising 9.76% in the past 24 hours and surpassing $130. This growth can be attributed to increasing optimism surrounding cryptocurrency exchange-traded funds (ETFs). Market sentiment remains bullish, reflecting investor confidence in potential regulatory advancements.

Currently, Litecoin is trading 41.49% above its 200-day simple moving average of $93.61, indicating strong upward momentum. Over the last 30 days, Litecoin recorded 16 green days, showing consistent positive performance. The 24-hour volume-to-market cap ratio of 0.6209 suggests high liquidity, meaning it is easily traded.

The 14-day Relative Strength Index (RSI) stands at 49.05, which places the asset in a neutral zone. This implies that Litecoin is neither overbought nor oversold and may continue trading sideways. Its yearly inflation rate is 1.65%, reflecting the gradual introduction of new coins into circulation.

Despite market fluctuations, Litecoin’s recent performance suggests stability, making it a cryptocurrency worth monitoring. Its price movements align with broader trends in digital assets, particularly in response to regulatory developments. For market participants exploring the best cryptocurrencies to invest in right now, Litecoin’s historical resilience and recent performance make it an asset of interest.

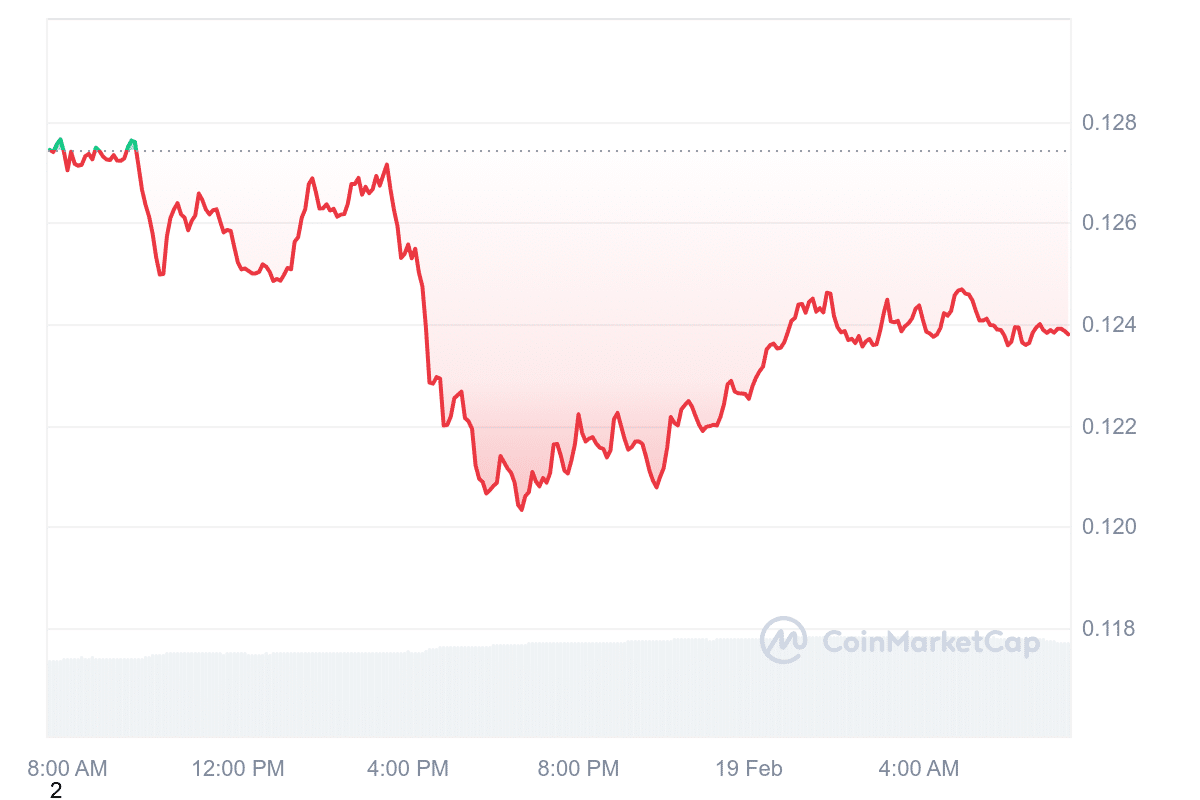

3. Kaia (KAIA)

Kaia is a blockchain project combining Klaytn and Finschia’s strengths, two networks originally developed by Kakao and LINE. The merger creates one of Asia’s largest Web3 ecosystems, integrating with messaging platforms Kakaotalk and LINE, which have a combined user base exceeding 250 million.

This integration positions Kaia as a major player in blockchain adoption across the region. The Kaia Foundation has partnered with Republic, a Web3 advisory firm, to support its expansion. This collaboration aims to enhance Kaia’s token economy and drive ecosystem growth, with a focus on gaming through the Kaia Wave accelerator and incubator program.

The partnership suggests a structured approach to developing blockchain-based applications and expanding Kaia’s utility. Currently, Kaia is trading at $0.1251, reflecting a 1.73% decline. However, its 24-hour trading volume has surged 15.10% to $20.27 million. The volume-to-market cap ratio stands at 0.0351, suggesting relatively high liquidity in relation to its market capitalization.

4. BTC Bull Token (BTCBULL)

BTC Bull Token (BTCBULL) has gained attention during its presale, attracting investors with its Bitcoin rewards system. Unlike many meme coins that depend on speculation, BTCBULL ties its incentives directly to Bitcoin’s price movements. When Bitcoin reaches predetermined milestones, token holders receive Bitcoin airdrops.

This system encourages long-term holding by offering real BTC rather than relying solely on market hype. The project has raised $2.3 million in its ICO, with its first significant reward set at $150,000.

As Bitcoin reaches new highs, BTCBULL holders will receive direct Bitcoin payouts. This feature differentiates it from other tokens that mainly focus on community-driven trends without offering tangible rewards.

Currently priced at $0.00237, BTCBULL will enter a new presale phase in three days and potentially increase in price. Investors looking for alternative crypto assets may find its reward model appealing.

Visit the BTC Bull Token Presale

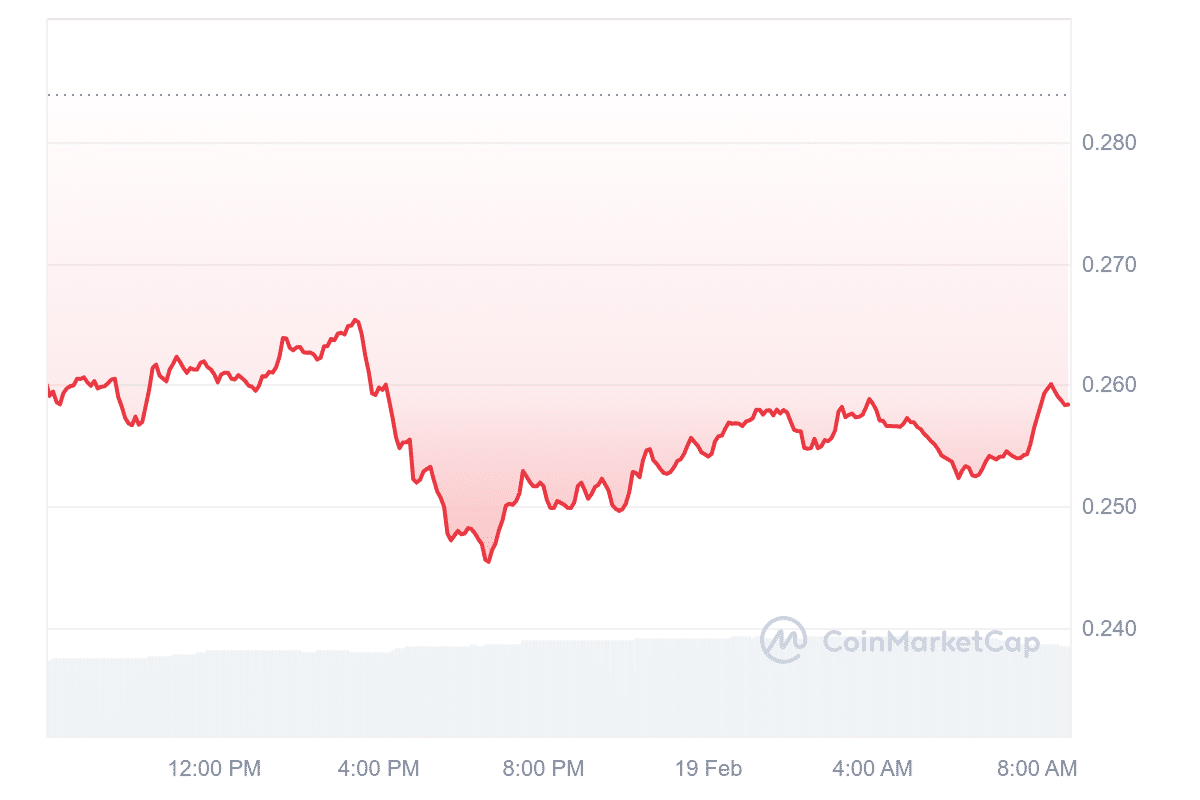

5. Algorand (ALGO)

Algorand is a blockchain network designed to offer speed, security, and efficiency. Unlike Bitcoin, which relies on energy-intensive mining, Algorand uses a pure proof-of-stake (PoS) system. This method allows users to participate in securing the network without requiring high computing power, making transactions faster and more cost-effective.

The project aims to address common blockchain challenges, such as slow transaction times and high fees. By eliminating mining, Algorand reduces energy consumption while maintaining decentralization. Its system ensures that transactions are completed quickly and reliably, essential for real-world applications that demand efficiency.

Currently, Algorand’s price is $0.261175, with a daily trading volume of $245.94 million and a market cap of $2.19 billion. The 24-hour price change shows a slight increase of 0.39%. The 14-day Relative Strength Index (RSI) sits at 55.07, indicating neutral market conditions, meaning the price may not see significant movement in either direction.

By leveraging the Algorand blockchain, @koibanx has contributed to digitizing and bringing greater efficiency and trust to Latin America’s banking sector.

9 major banks across Latin America are working on blockchain integrations with Koibanx.https://t.co/HTmCywrGtv

— Algorand Foundation (@AlgoFoundation) February 14, 2025

Algorand’s liquidity appears stable, as reflected in its market cap and trading volume ratio. This suggests that buying and selling the cryptocurrency is relatively easy without causing drastic price changes. Given its goal of improving blockchain efficiency, Algorand may appeal to those looking for a network with lower fees and reliable transaction speeds.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage