Join Our Telegram channel to stay up to date on breaking news coverage

Investors constantly search for the best cryptocurrencies to capitalize on growth opportunities and secure significant returns. In the market, certain altcoins are attracting interest due to their robust performance metrics and increasing adoption, which are driven by positive technical analysis and favorable market sentiment. This article analyzes these altcoins, highlighting their strong potential for substantial returns.

Best Cryptocurrencies to Invest in Right Now

Recently, Lido introduced a new feature called the Decentralized Validator Vault, which was initiated by the Mellow team. At the same time, Optimism Labs is advancing a new initiative to create a more unified multichain environment. Their latest project, the Superchain, seeks to simplify interactions across various Ethereum Layer 2 networks.

Meanwhile, Pyth Network has also made strides by partnering with TON to enhance data accessibility for developers within the TON ecosystem. These developments make each of these tokens the best cryptocurrencies to invest in right now.

1. Lido DAO (LDO)

Lido DAO provides a staking infrastructure for multiple blockchain networks. One of its most notable offerings is a liquid staking solution for Ethereum. Through Lido, users can stake their ETH and receive stETH (Lido-staked ETH) tokens in return.

These tokens represent the user’s staked ETH and any accrued staking rewards. Recently, Lido introduced a new feature called the Decentralized Validator Vault, initiated by the Mellow team, a member of the Lido Alliance. This vault is a centralized hub for user stakes to access Distributed Validator Technology (DVT) benefits and incentives.

Moreover, it aims to increase the number of Distributed Validators in the Simple DVT Module, further decentralizing and strengthening Lido’s node operator set on Ethereum. Additionally, it seeks to enhance network security while allowing stakers to earn rewards from stETH and DVT provider incentives from protocols like SSV, Obol, and Mellow.

Furthermore, the vault will initially operate with limited capacity, gradually expanding as the Simple DVT Module grows following a successful DAO vote. The ultimate goal is to support approximately 11,868 validators, equally distributed between Obol and SSV, over the coming months. This expansion could involve around 380,000 ETH, accounting for about 4% of Lido’s total staked assets.

Introducing the Decentralized Validator Vault ft. @mellowprotocol, @Obol_Collective & @ssv_network 🎉

This vault aims to boost the adoption of Distributed Validators via the Lido Simple DVT Module, enhancing network security and increasing overall validator numbers.

The initial… pic.twitter.com/k199y1uyfN

— Lido (@LidoFinance) August 13, 2024

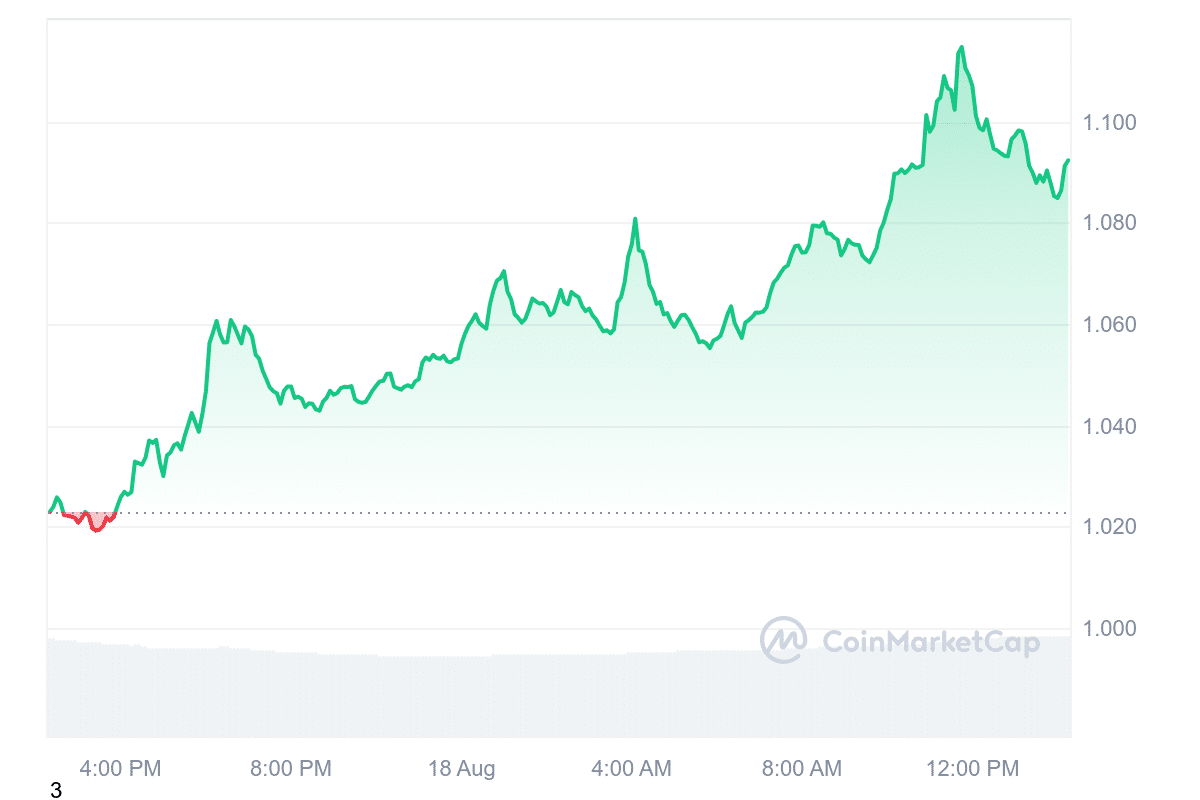

In light of these developments, Lido’s native token, LDO, has shown upward momentum, making it one of the best cryptocurrencies to invest in right now. The token has surpassed the $0.7 support level, trading at $1.09, with a 6.73% intraday increase at the reporting time. LDO also exhibits high liquidity based on its market cap.

The 14-day Relative Strength Index (RSI) stands at 51.64, indicating a neutral position where the cryptocurrency may trade sideways. Price predictions suggest that LDO could rise by 230.43%, potentially reaching $3.57 by September. This prediction reflects optimism about the token’s future performance, although market conditions will ultimately determine the outcome.

2. Pepe Unchained (PEPU)

Pepe Unchained is making waves in the memecoin sector, recently achieving $9.3 million during its ongoing presale. This token aims to stand out by offering faster transactions and potentially higher returns for investors while capitalizing on the hype that surrounded the original Pepe meme project.

A total of 8 billion PEPU tokens are available and distributed in a way designed to promote sustainable growth. Specifically, 20% of the tokens are set aside for the presale, with an additional 20% allocated to marketing.

These steps aim to generate early interest and keep investors engaged. Another 10% is reserved to support liquidity, fund the project, and ensure stability within the chain. The largest portion, 30%, is designated for staking, a move intended to encourage long-term participation.

Furthermore, the project features its staking option, offering an annual yield (APY) of 224%. This high return rate may appeal to those looking for passive income opportunities. The PEPU token is currently priced at $0.0090901, with a target of $9.6 million for the presale’s completion. The project expects the token’s value to increase incrementally with each phase, ultimately leading to its official launch.

We’ve just hit $9M! 🎉

Pepe Unchained is unstoppable, and it’s all thanks to you! pic.twitter.com/jdvgHIXjuj

— Pepe Unchained (@pepe_unchained) August 16, 2024

Investors can purchase PEPU using ETH, USDT, or BNB tokens, except those who choose BNB will not be eligible for staking rewards. Additionally, purchases can also be made using bank cards, adding flexibility.

Meanwhile, Pepe Unchained has outlined a roadmap with several post-presale growth phases. The project anticipates that the value of PEPU will be appreciated as these milestones are reached. PEPU is taking a strategic approach to the memecoin market, combining technology with careful planning to attract diverse investors.

3. Optimism (OP)

Optimism operates as a layer-two blockchain built on Ethereum that utilizes optimistic rollups and aims to enhance the scalability of the Ethereum network. Transactions are recorded on Optimism, but the security of these transactions relies on the Ethereum mainnet. This approach provides scalability benefits while maintaining the robust security Ethereum offers.

Moreover, Optimism Labs is advancing a new initiative to create a more unified multichain environment. Their latest project, the Superchain, aims to simplify interactions across various Ethereum Layer 2 networks.

A key feature of this initiative is introducing a native interoperability layer within the OP Stack, designed to enable seamless communication between different chains. This interoperability layer includes several key components, which include a messaging protocol to facilitate chain communication.

The Superchain is soon becoming one.

We'll be bringing a unified experience for transferring assets, building apps, and UX with chains or apps across the Superchain.

— Optimism (@Optimism) August 12, 2024

It further features a new SuperchainERC20 token standard to ensure asset compatibility and a shared-proof system to enhance overall security. Additionally, Optimism Labs plans to integrate open-source standards, such as ERC-7683, to facilitate asset transfers across ecosystems.

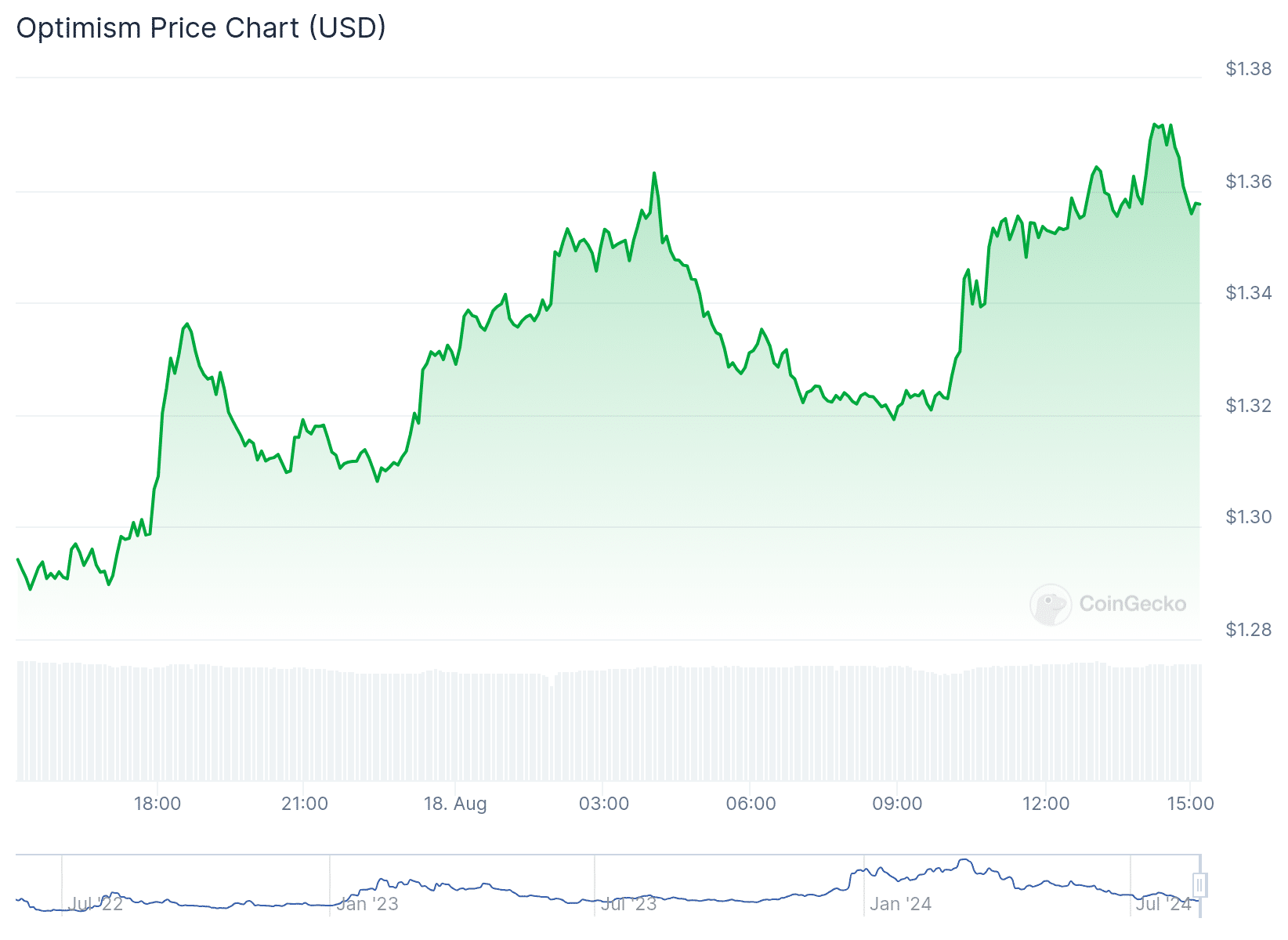

The team expects this interoperability layer to go live by 2025, following comprehensive testing on devnet and testnet platforms. As for the current market performance, Optimism’s price stands at $1.36, reflecting a 4.95% increase over the past 24 hours, with a trading volume of $166 million.

4. Gala (GALA)

Gala is a web3 ecosystem that operates on its layer-1 blockchain, GalaChain. Initially designed to support Gala Games, Gala Music, and Gala Film, GalaChain has recently expanded its scope.

It now invites external developers and projects from various industries to utilize its open-source developer resources, streamlining the integration of web3 technology. Furthermore, Gala aims to empower users and creators across multiple sectors worldwide and become the first blockchain to reach one billion users.

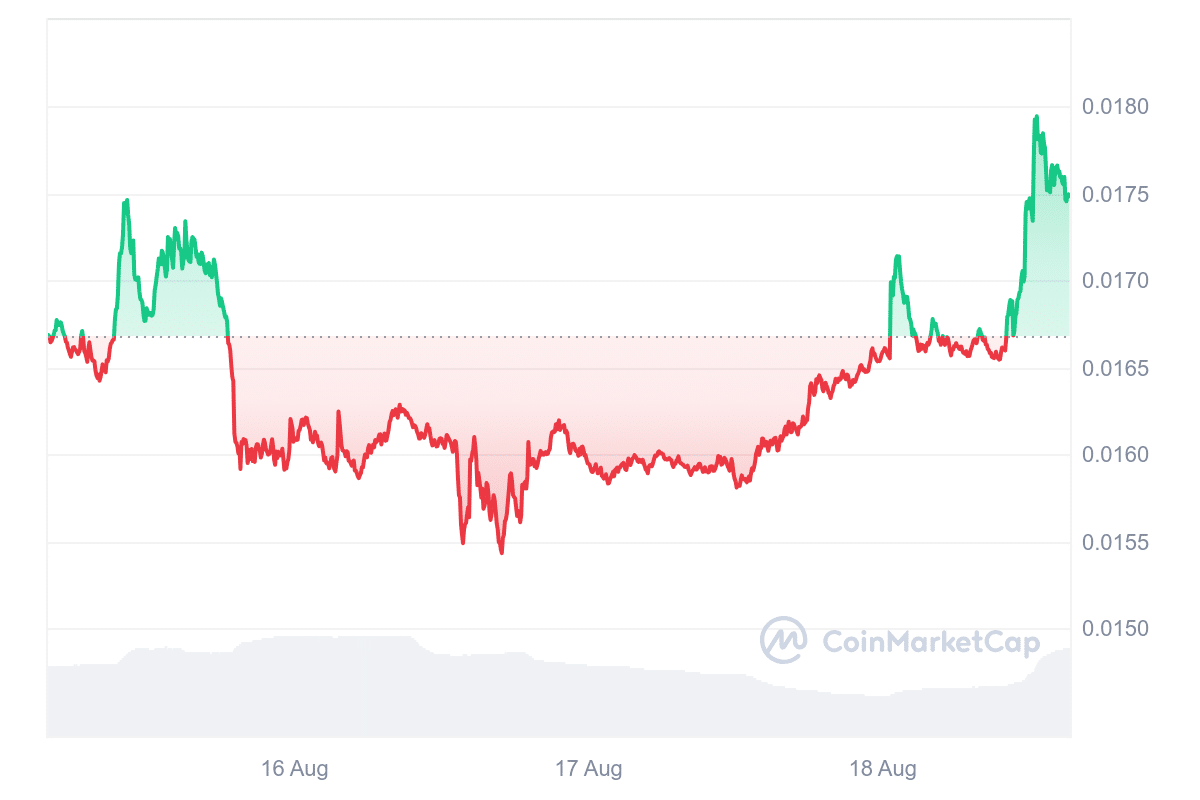

By offering tools like the GalaChain SDK and Creator Portal, the platform makes it easier for innovators to bring the advantages of Web3 to their communities. Meanwhile, the GALA token has risen by 9.19% at press time, placing it among the top gainers of the day, according to CoinMarketCap.

Over the last 24 hours, GALA’s trading volume has increased by 75.61%, reflecting heightened investor interest. Moreover, the token’s 14-day RSI is 34.39, indicating that it is currently in a neutral zone and may continue to trade sideways.

5. Pyth Network (PYTH)

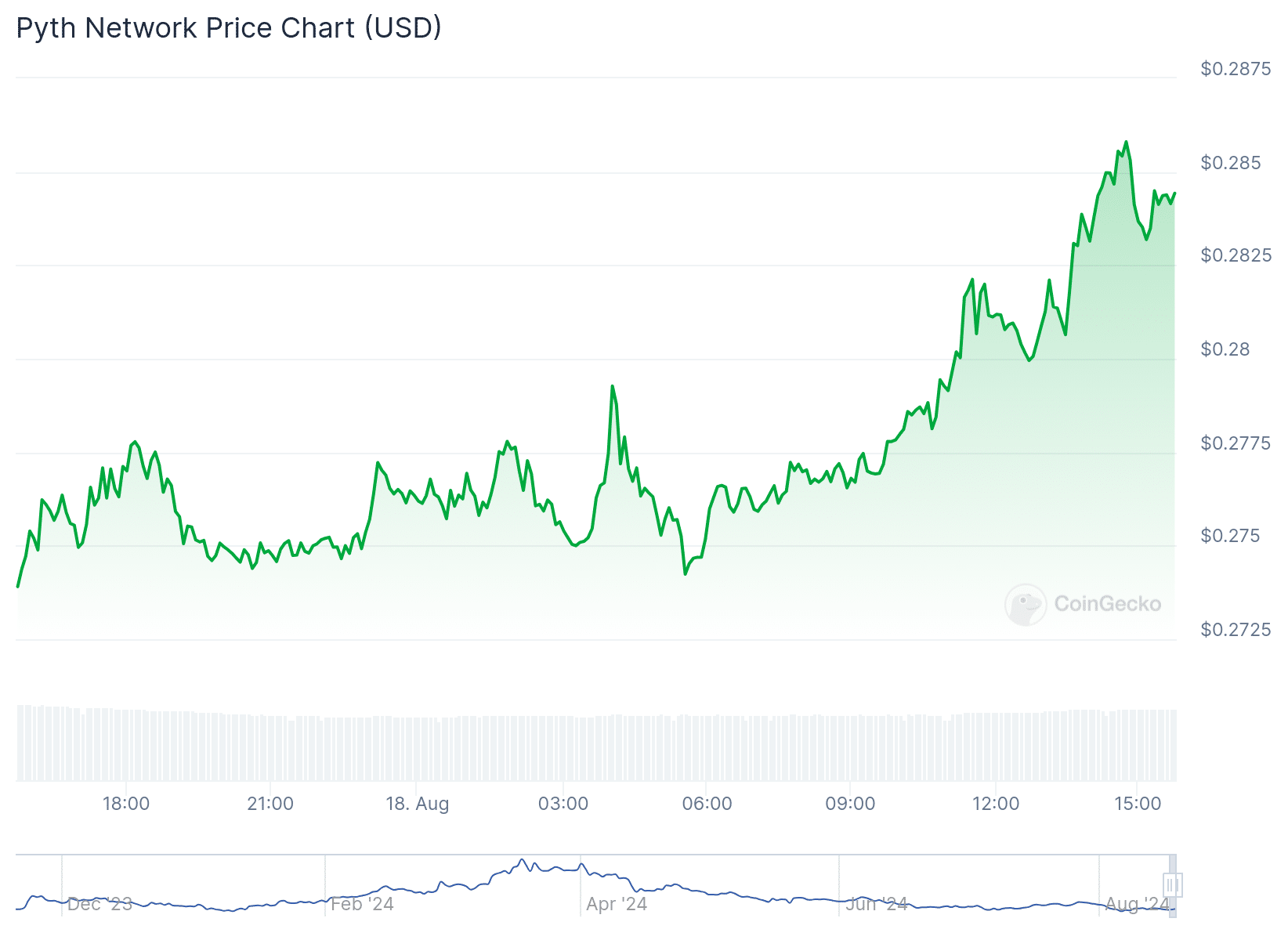

Pyth Network recently partnered with TON to enhance data accessibility for developers within the TON ecosystem. This collaboration aims to integrate Pyth’s Oracle technology, which supplies real-time, institutional-grade price data, into the TON blockchain. The primary objective is to provide developers with accurate and timely data for building dApps that stand out in the competitive blockchain sector.

By using Pyth’s data streams, DeFi projects on TON can access precise and up-to-date pricing information. This allows for developing more advanced financial services capable of handling transactions swiftly and efficiently. These features are important for serving a global user base, particularly as the demand for decentralized finance grows.

Moreover, this collaboration can be attributed to the upward trend of the PYTH token. The token is priced at $0.2832 at press time, reflecting a 2.52% increase over the past 24 hours. The 14-day RSI for PYTH is currently at 51.94, indicating a neutral position. This suggests that the token might experience sideways trading in the near term.

Also, price predictions suggest significant potential for growth. According to CoinCodex, the price of PYTH is expected to rise by 229.90%, potentially reaching $0.929482 by September.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage