Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin’s price movements over the weekend have stabilized, with the digital asset holding steady at just over $61,000. Meanwhile, most altcoins have followed suit, showing gains in the past 24 hours. NEAR Protocol, Ethena, and Fantom have emerged as the best tokens to invest in.

In light of this, investors are now seeking altcoins that demonstrate growth potential, making them worth considering for their portfolios. This article analyzes the best cryptocurrencies to invest in right now.

Explore the top cryptocurrencies to invest in today with insights on features, market trends, and growth potential.

Best Cryptocurrencies to Invest in Right Now

The Meme Games has garnered considerable attention from investors, raising over $355,000. Furthermore, the Aptos Foundation has launched Ondo Finance’s yield-bearing stablecoin, Ondo US Dollar Yield (USDY), on the Aptos blockchain. Similarly, Ethena Labs recently introduced its stablecoin, USDe, on the Solana network, allowing users to transact with USDe across various Solana applications.

1. The Meme Games (MGMES)

The Meme Games is a meme coin project linked to the ongoing 2024 Paris Olympics. It is the only cryptocurrency project focused on this niche, attracting investors’ significant attention. The project combines popular meme characters with elements of competition and rewards, making it an intriguing option for crypto investors.

As the sole gamified, Olympics-themed meme coin of the year, The Meme Games offers a distinct use case in crypto. Currently in its presale phase, The Meme Games has raised over $355,000, with a target of reaching $1 million. Investors can purchase MGMES tokens through the presale website by connecting an Ethereum or BNB Chain wallet.

69 people have won a 25% bonus by picking $PEPE at the #MemeGames!

Coincidence or destiny? 🏆

Choose from 5 meme icons and you could score a 25% bonus on your $MGMES purchase if they win the race! 🔥

Join now! 👉 https://t.co/lbYNWg8iXr#Paris2024 #Presale #Crypto #Alts pic.twitter.com/q4Tdbzkpo5

— The Meme Games (@MemeGames2024) August 2, 2024

Furthermore, the total supply of MGMES tokens is capped at 2.024 billion. This supply is allocated to support the project’s growth and to encourage long-term holding. Specifically, 38% of the tokens are designated for the presale, 9.3% for game winnings, 10% for staking, and 15% for marketing. The remaining 20% is split between liquidity and project funds.

In The Meme Games, each character has an equal chance of winning, introducing an element of unpredictability. If a participant’s chosen meme athlete wins, they receive a 25% bonus on their MGMES tokens. This feature allows investors to increase their holdings. Users can purchase tokens multiple times and select different characters to improve their odds.

Staking MGMES tokens currently offers an annual return of 587%, though this rate may change depending on the number of stakers. This high return rate allows investors to accumulate tokens before MGMES lists on exchanges.

In addition, the presale of MGMES tokens will end on September 8, coinciding with the closing ceremony of the Paralympics. The token is scheduled to be listed on decentralized exchanges on September 10, where its price may rise.

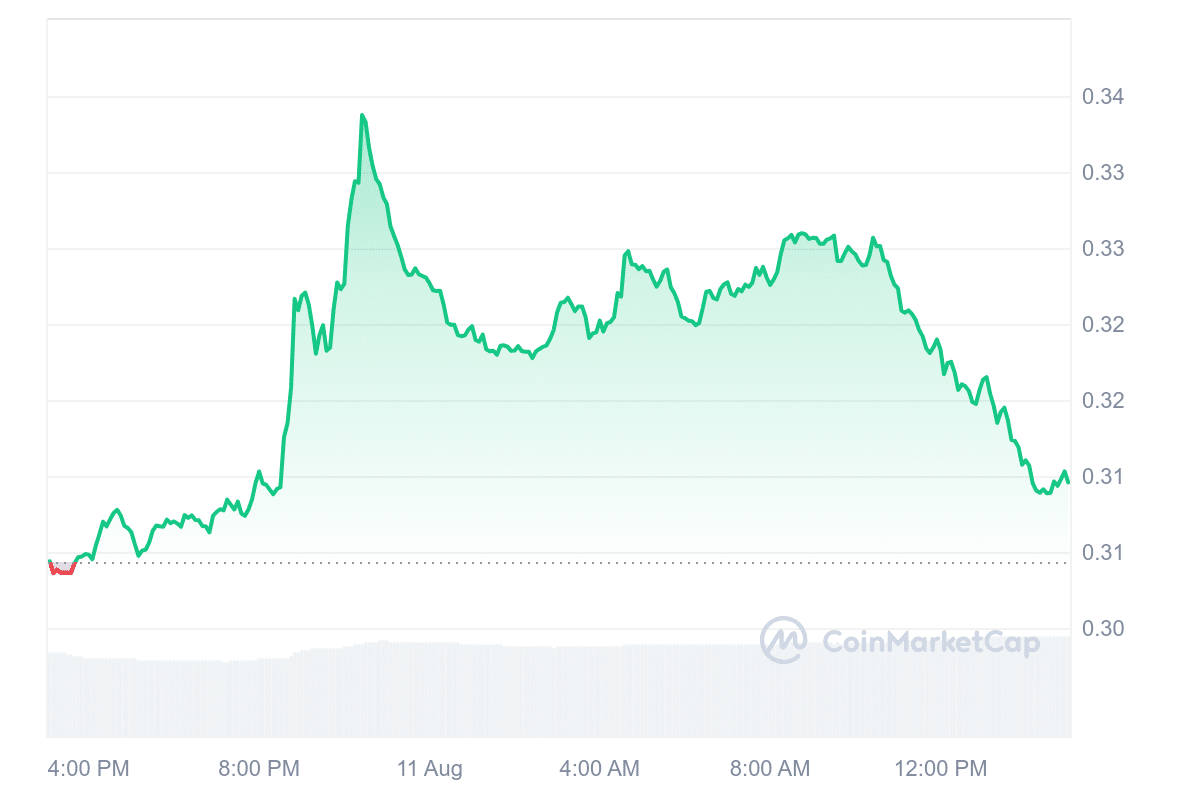

2. Ethena (ENA)

Ethena is a protocol built on Ethereum that aims to create a synthetic dollar that is not dependent on traditional banking systems. It offers a crypto-native alternative for holding value in dollars and a savings instrument accessible worldwide.

Recently, Ethena Labs introduced its stablecoin, USDe, on the Solana network. This launch enables users to transact with USDe across various Solana applications. Borrowers can also use SOL as collateral for USDe loans, subject to approval by Ethena token holders.

USDe has been integrated with platforms like Kamino Finance, Orca, and Drift Protocol. It will soon be available on Jito. Users can earn Ethena Sats, which can be converted to ENA, by providing liquidity in USDe or using it as collateral for margin trades.

USDe is live on Solana as of today, August 7th

Read below for a list of our app integrations with USDe and sUSDe 👇 pic.twitter.com/vik1qESbN5

— Ethena Labs (@ethena_labs) August 7, 2024

The stablecoin aims to maintain its peg to the U.S. dollar while generating yield through Lido Staked Ethereum (stETH) and short positions in the Ethereum perpetual futures market. Furthermore, Ethena’s synthetic dollar maintains its U.S. dollar peg using a different approach than traditional stablecoins like USDT and USDC, backed directly by fiat or physical assets.

Instead, USDe employs derivative hedging strategies. It uses collateral positions in Ether and Bitcoin and an arbitrage system for minting and redeeming to stabilize its value. This innovative mechanism sets USDe apart in the stablecoin market.

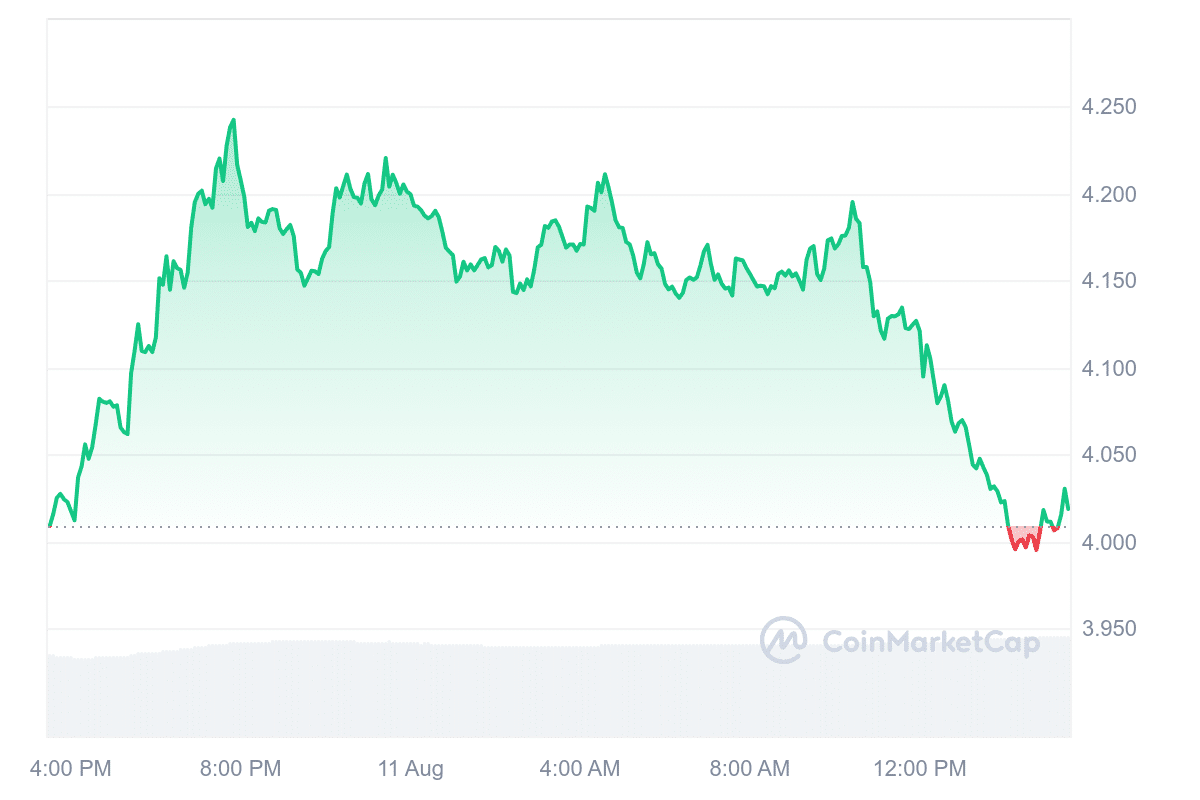

3. NEAR Protocol (NEAR)

NEAR Protocol is focused on speed, security, and scalability. Its design allows developers to create decentralized applications (dApps) with ease. The platform can process thousands of transactions per second at low costs, positioning it as a strong contender in the blockchain space.

The NEAR token is performing well, currently trading above its 200-day simple moving average. This indicates strong market confidence. Additionally, the token benefits from high liquidity thanks to its substantial market capitalization. The project’s active community and ongoing development efforts make it one of the best cryptocurrencies to invest in right now.

Chain Abstraction, the final frontier

The day has arrived. NEAR Protocol’s Chain Signatures tech has moved into mainnet.

We’re ready to move forward. Together. To a Chain Abstracted future.

It’s time to tear down the barriers to entry, liquidity, and usability.

Cont… pic.twitter.com/DgSzphk0Ct

— NEAR Protocol (@NEARProtocol) August 8, 2024

Furthermore, NEAR Protocol has also gained attention for integrating artificial intelligence into its ecosystem, drawing comparisons to Ethereum. The platform recently launched Chain Signatures, allowing users to interact with multiple blockchains using a single NEAR account. This enhances the platform’s ability to support cross-chain decentralized finance (DeFi) applications.

Moreover, Chain Signatures enable users to sign transactions on nearly any blockchain directly from their NEAR account, simplifying the process of interaction with different blockchain networks. This innovation opens the door to bridgeless Omnichain DeFi, a significant step towards more integrated and seamless blockchain experiences.

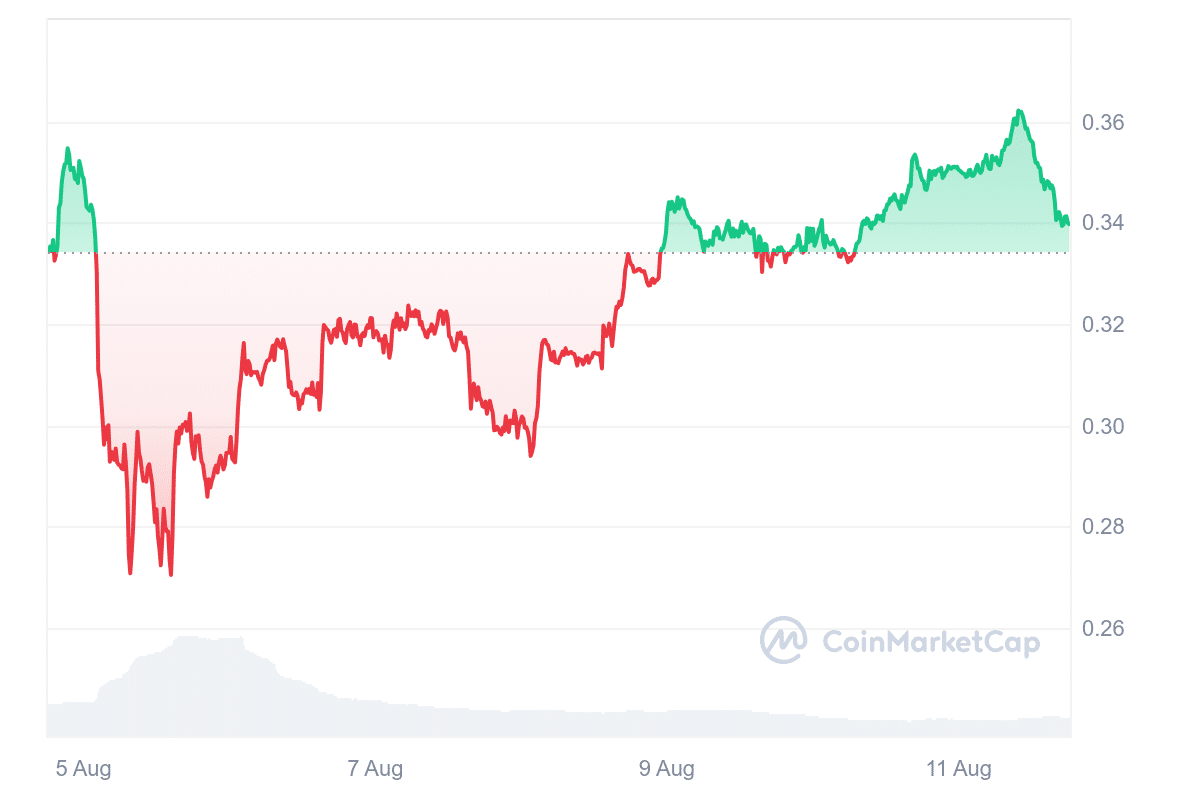

4. Fantom (FTM)

Fantom is a smart contract platform that utilizes a directed acyclic graph (DAG) structure to offer decentralized finance (DeFi) services. Unlike traditional blockchain platforms, the platform employs a unique consensus algorithm to address issues like transaction speed. The developers claim that Fantom’s consensus mechanism can finalize transactions in under two seconds, significantly enhancing the efficiency of smart contract operations.

The platform’s in-house token, FTM, plays a crucial role in its ecosystem. Fantom’s new consensus mechanism promises higher capacity and improved security than platforms that rely on traditional proof-of-stake (PoS) algorithms. This positions Fantom as a potential solution for the scalability challenges faced by many existing smart contract platforms.

Recently, FTM has seen notable price movements, with its value rising to $0.3397. Its trading volume has also seen a boost, increasing by 12.47% to reach $62 million. Over the past year, FTM’s price has grown by 42%, outperforming 53% of the top 100 crypto assets during the same period.

Moreover, the token has shown positive performance in USD and ETH terms. From a technical perspective, the 14-day RSI for Fantom stands at 61.03, suggesting that the token is currently neutral and may experience sideways trading soon.

5. Ondo (ONDO)

Ondo Finance is a decentralized financial protocol that uses blockchain technology to offer institutional-grade financial products and services. Its goal is to function as an open, permissionless, decentralized investment bank.

Despite a general decline in major tokens, Ondo’s token (ONDO) trades between $0.54 and $0.94, suggesting growth potential. Moreover, if ONDO manages to break past its nearest resistance at $1.19, it could potentially gain up to 100%.

Recently, the Aptos Foundation announced the launch of Ondo Finance’s yield-bearing stablecoin, Ondo US Dollar Yield (USDY), on the Aptos blockchain. According to the announcement, USDY, an instrument backed by United States Treasurys, will be available for non-US residents using the Aptos blockchain.

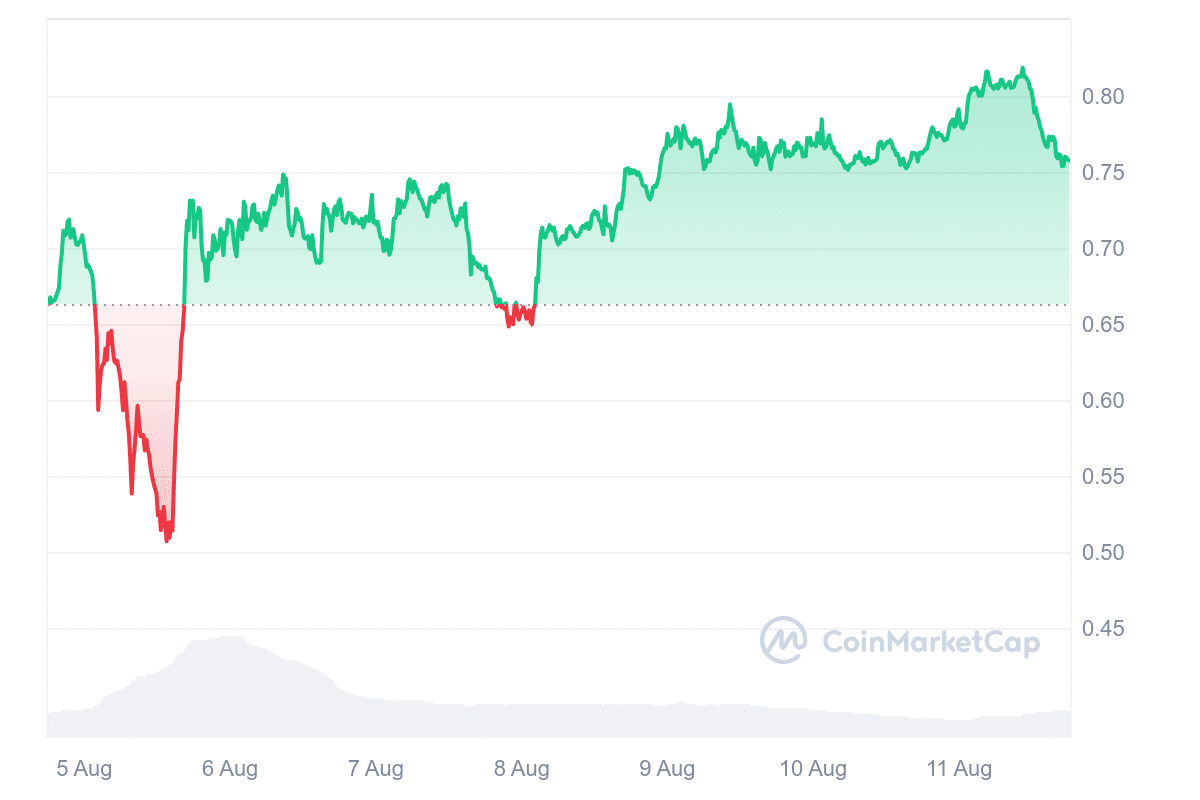

Furthermore, the ONDO token has experienced a weekly surge of 13.93%, hitting $0.7585 in value. Additionally, it has high liquidity, evidenced by a volume-to-market cap ratio of 1.8855. The current market cap is $1 billion, while the 24-hour trading volume is $131 million.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage