Join Our Telegram channel to stay up to date on breaking news coverage

According to a recent analyst prediction, Bitcoin could reach $100,000 by the end of the year. This comes after Bitcoin reclaimed the $90,000 level, moving closer to its all-time high of $93,000. The analyst shared their insights on X, noting that the crypto market remains highly volatile. They also predicted strong performance for altcoins soon.

Currently, the total market cap of the cryptocurrency sector has exceeded $3 trillion, with 24-hour trading volume reaching $186.7 billion. This market rally has shifted attention to the crypto market, encouraging investors to explore established coins and emerging projects. Below, we examine some of the best crypto to buy right now.

Best Crypto to Buy Right Now

Ondo has launched a feature enabling instant conversions between its tokenized short-term U.S. Treasuries fund (OUSG) and PayPal’s stablecoin, PYUSD. Meanwhile, Pepe Unchained continues to draw interest during its presale, with total funds raised exceeding $38 million. Solana’s decentralized exchange (DEX) ecosystem recently achieved a notable milestone, surpassing $70 billion in monthly trading volume.

1. Ondo (ONDO)

Ondo has introduced instant conversions between its tokenized short-term U.S. Treasuries fund (OUSG) and PayPal’s stablecoin, PYUSD. This allows investors to move in and out of Ondo’s core product, the Ondo Short-Term U.S. Government Treasuries, using PYUSD as a bridge. OUSG is a tokenized fund that primarily invests in the BlackRock USD Institutional Digital Liquidity Fund, offering exposure to U.S. government securities in a digital format.

The integration follows PayPal’s recent announcement that it is enabling PYUSD transactions on Ethereum and Solana through LayerZero, further expanding its use. Ondo’s introduction of this feature comes as tokenized real-world assets gain traction in the market, reflecting the increased adoption of blockchain technology for traditional financial instruments.

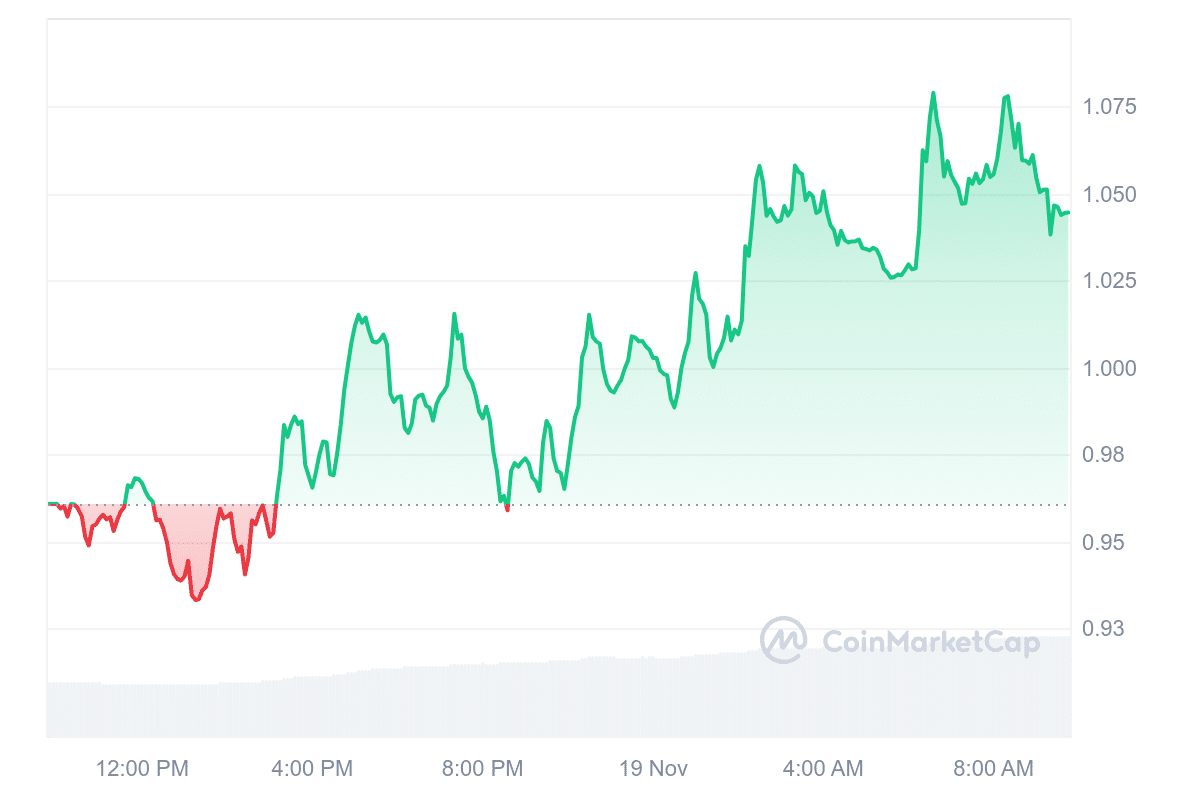

The ONDO token is currently trading at $1.04, reflecting an 8.72% increase over the last 24 hours. It is trading near its cycle high with a 24-hour volume-to-market cap ratio of 0.5155, indicating strong liquidity. Market sentiment for ONDO remains bullish, with the Fear & Greed Index showing a value of 90, signaling extreme optimism.

Price predictions suggest that the ONDO token could see significant growth, with Coincodex estimating a potential rise to $3.51 by December, representing a 233% increase. As tokenized finance continues to evolve, developments like these show how blockchain technology is being integrated into traditional financial markets.

2. Bitcoin Cash (BCH)

Bitcoin Cash recently introduced two significant features as part of its May 2025 upgrade: the Targeted Virtual Machine Limits CHIP and the BigInt CHIP. The Targeted Virtual Machine Limits CHIP aim to expand the blockchain’s capacity for handling smart contracts by increasing computational power over 100 times while cutting node resource usage in half.

This reduces system overhead, making contract execution and audits more efficient. It also enables the integration of advanced technologies like post-quantum cryptography, zero-knowledge proofs, and homomorphic encryption, which are important for improving security and competitiveness.

Moreover, the BigInt CHIP brings high-precision arithmetic to the network, reducing the length of smart contracts by over ten times. This update supports complex applications like automated market-making, decentralized stablecoins, and cross-chain bridges. Bitcoin Cash now facilitates these operations with lower transaction costs and maintains compatibility with low-cost hardware, addressing efficiency and accessibility without compromising security.

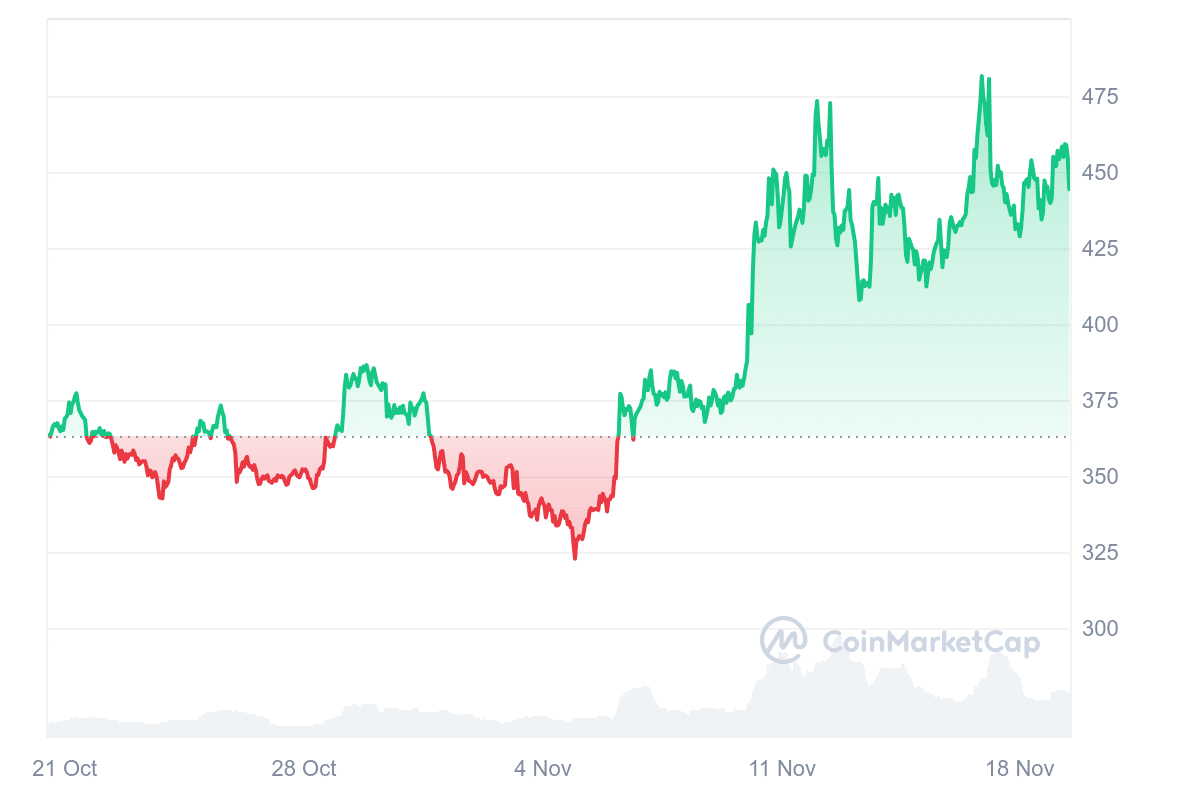

These updates enhance the blockchain’s contract capabilities and strengthen overall performance. Despite the technological advancements, Bitcoin Cash saw a cautious market response. According to the BCH’s 24-hour chart, the token reached a 24-hour high of $469.26. At press time, the token declined by 0.85% to $444. This reflects a measured reaction from the market as the impact of these upgrades unfolds.

3. Pepe Unchained (PEPU)

Pepe Unchained is gaining attention during its presale, with over $38 million raised so far. The project introduces a new approach to meme coins by launching its blockchain to address the limitations of earlier projects like Pepe (PEPE).

https://www.youtube.com/watch?v=VcRdnhAsloc

The presale, which ends in 23 days, has seen daily funding exceed $1 million since announcing its 30-day timeline on November 13. Currently priced at $0.012895 per token, PEPU seeks to differentiate itself from PEPE by adding technological functionality rather than relying solely on community-driven hype.

LAYER 2 AUDIT COMPLETE

Today we have some exciting news to share with the community!

As you’ve probably noticed, the presale is ending in less than a month.

The token and fully operational Layer 2 will launch a few days after the presale has concluded.

We are happy to share… pic.twitter.com/huhsEGj71U

— Pepe Unchained (@pepe_unchained) November 18, 2024

This has attracted investors speculating on future returns, especially with plans to list the token on tier-1 exchanges after the presale. The excitement around PEPU reflects the potential of meme coins to evolve, but investors should carefully consider the risks, including market volatility and reliance on the niche’s popularity. As with any early-stage crypto project, thorough research is essential before investing.

4. Arbitrum (ARB)

Arbitrum is a Layer 2 scaling solution that aims to improve Ethereum’s performance by making transactions faster and cheaper. It works alongside Ethereum to handle a larger number of transactions without overwhelming the main network, which supports the development of decentralized finance (DeFi) and other applications.

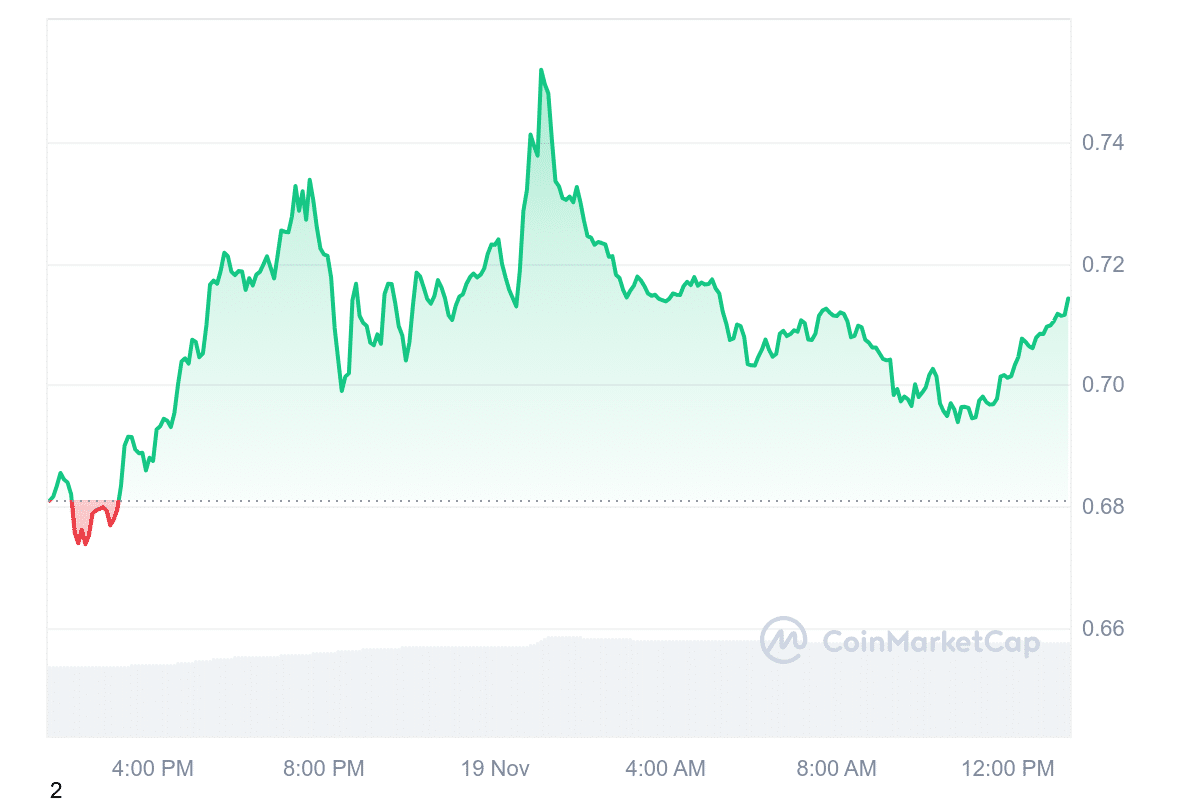

The current price of ARB is $0.7142, with a 24-hour trading volume of $742 million and a market cap of $2.81 billion. Its price increased by 5.03% over the last 24 hours. The asset recorded 16 days of positive price movement in the previous 30 days.

Furthermore, the token’s high 24-hour volume-to-market-cap ratio of 0.3340 suggests strong liquidity. Market sentiment is bullish, with the Fear & Greed Index indicating extreme optimism at 90.

📜 Hot off the Press: @G7_DAO released the 2024 State of Web3 Gaming report in collaboration with @naavik_co!

Arbitrum takes the spotlight with 72% YoY growth, hosting 119 game titles and is the most widely adopted network for new gaming chains, at 23 over the past 12 months.🧵 pic.twitter.com/PsvS0CbSc5

— Arbitrum (💙,🧡) (@arbitrum) November 14, 2024

For November, Coincodex forecasts suggest the price may range between $0.7042 and $2.37, with an average target of $1.385432. If the higher end of the range is reached, this could result in potential gains of 235.68%. Projections for December 2024 estimate the price could trade between $2.33 and $3.30, with an average of $2.90, representing a potential ROI of 366.43% from current levels.

Arbitrum’s future growth depends on its ability to maintain developer interest and expand its ecosystem. While its role in enhancing Ethereum’s scalability makes it significant, market volatility and broader industry conditions could influence its performance.

5. Solana (SOL)

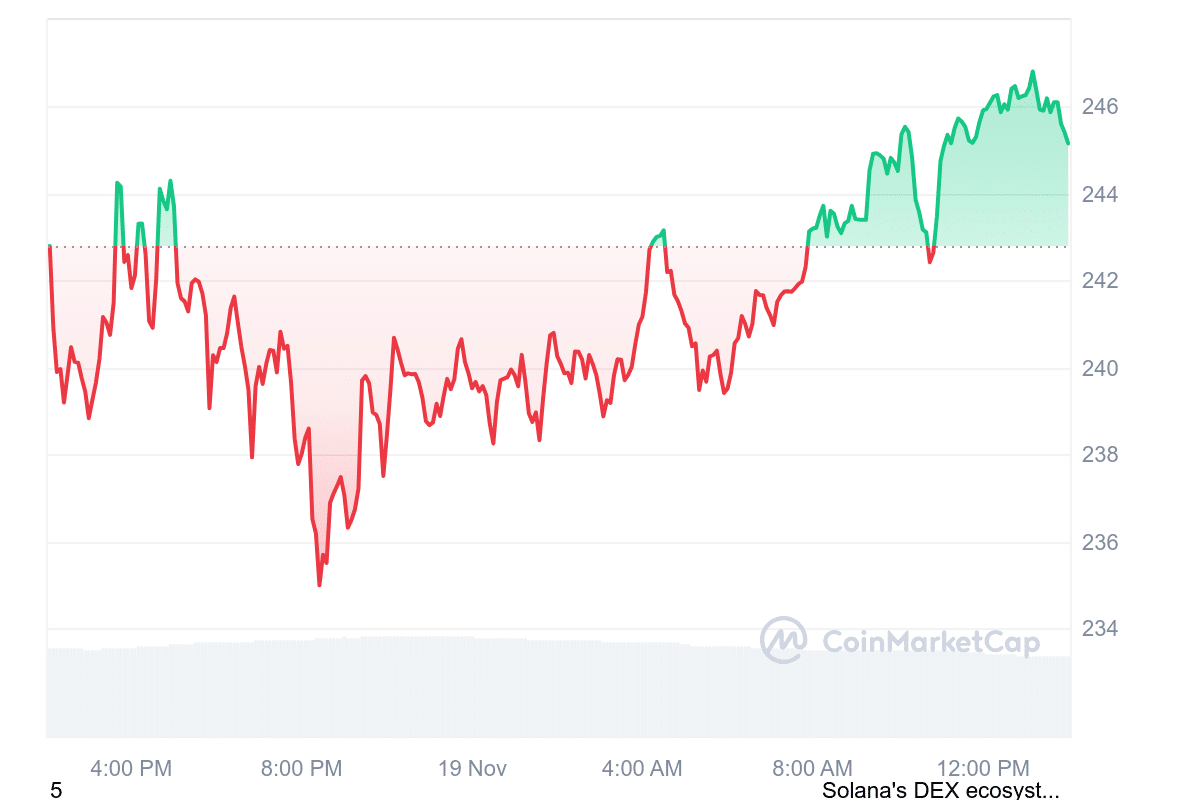

Solana recently surpassed $70 billion in monthly trading volume across its decentralized exchange (DEX) ecosystem, marking a new milestone for the network. Daily trading volumes consistently exceeded $5 billion, peaking at $6.88 billion on November 12. This sustained activity has allowed Solana’s DEX ecosystem to outpace Ethereum in trading volume over the past week.

The price of Solana (SOL) has reached $245, approaching its all-time high of $259. This increase has boosted the network’s market capitalization to $116 billion. Solana is trading 62.68% above its 200-day simple moving average (SMA) of $150.97, reflecting strong momentum over a longer time frame.

The 14-day Relative Strength Index (RSI) is 67.01, which indicates neutral market conditions, suggesting the price may trade sideways in the near term. Solana has recorded 19 green days out of the last 30, demonstrating consistent positive performance. The network also shows high liquidity with a volume-to-market-cap ratio of 0.1368, indicating active market engagement.

our marketing team is growing exponentially 🤯 https://t.co/UKsMuzCrBU

— Solana (@solana) November 18, 2024

Solana’s strong trading activity highlights its ability to handle high volumes efficiently. However, with the asset trading near a cycle high, price movement in the short term may depend on broader market conditions and the network’s continued growth in usage.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage