Join Our Telegram channel to stay up to date on breaking news coverage

‘Best crypto to buy now’ is one of the most searched cryptocurrency-related terms in Google, and each day InsideBitcoins lists some options.

In the latest cryptocurrency market update, the total market capitalization stands at $1.44 trillion, reflecting a marginal decrease of 0.51% over the past 24 hours. Simultaneously, the 24-hour trading volume for cryptocurrencies has experienced a notable decline, registering a 49.03% decrease and totaling $147.74 billion.

Best Crypto to Buy Now

With stablecoins maintaining a stronghold and the DeFi sector sustaining its presence, investors and observers are urged to stay vigilant. These metrics are valuable indicators of ongoing trends and developments in cryptocurrency.

1. Quant (QNT)

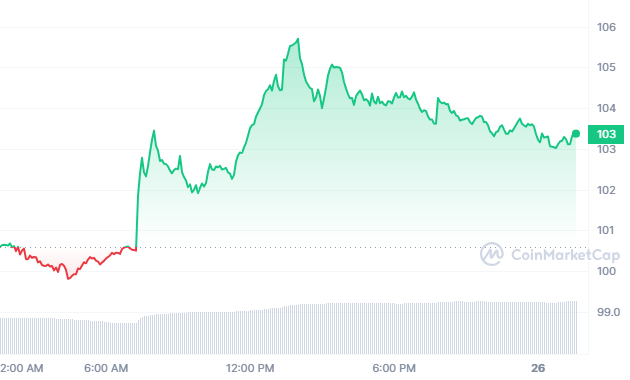

Quant is priced at $103.07, showing a 2.98% increase in the last 24 hours. The coin currently holds a market share of only 0.09%. Out of a maximum supply of 14.88M QNT, the circulating supply for QNT is 12.07M.

Quant’s performance metrics consistently indicate stability as it trades above the 200-day moving average. The project has shown positive performance, with 16 positive days out of the last 30. The project is known for having high liquidity due to its significant market capitalization.

The Stellar Community Fund fuels Stellar & Soroban innovation, with over 320M XLM awarded, 500 submissions recognized, 80 startup teams, and 2.1K community members — join the movement!

— Stellar (@StellarOrg) November 22, 2023

It is currently ranked #17 in the Ethereum (ERC20) Tokens sector and #25 in the Layer 1 sector. QNT’s price prediction leans towards a bullish outlook. Concurrently, the Fear & Greed Index registers at 73, indicating a sentiment of greed among market participants.

2. EOS (EOS)

In collaboration with PassPay, EOS Labs has recently announced a strategic alliance to enhance its digital payments platform by utilizing the EOS blockchain. This initiative seeks to introduce crucial financial services in Japan, focusing on issuing the stablecoin JPYW—the exclusive stablecoin licensed for the Japanese Yen.

The alliance indicates a strategic move to fortify the EOS Network’s position in the Japanese market, aligning with the growing adoption of blockchain technology in the region. Notably, the EOS token secured regulatory approval from the Japan Virtual and Crypto Asset Exchange Association (JVCEA) in August. Various Japanese exchanges, including Binance Japan, have recently added EOS to their listings.

Over the past 30 days, EOS has shown a positive trend for 18 consecutive days, marking a noteworthy 60% uptick. The cryptocurrency stands out for its robust liquidity, evident from its substantial market capitalization. Currently, EOS is actively traded on Binance.

Today, the price of EOS is $0.700756, with a 24-hour trading volume reaching $173.98 million. The market cap is reported at $777.52 million, contributing to a market dominance of 0.05%. Moreover, EON has experienced an increase of 1.41% intraday, representing a moderate interest.

PassPay has announced a strategic alliance centered on leveraging #EOS for its innovative digital payments platform in Japan.

This partnership includes the issuance of the $JPYW stablecoin on #EOSEVM, the only licensed stablecoin for the Japanese Yen. 🇯🇵https://t.co/9BoDxxcm5z https://t.co/Og0ZZcrRMI pic.twitter.com/TjAYmeeN79

— EOS Network Foundation (@EOSNetworkFDN) November 21, 2023

On April 29, 2018, the value of EOS reached an all-time high of $22.83. Conversely, its all-time low was recorded on October 23, 2017, at $0.479237. The current sentiment surrounding EOS’s price prediction is neutral, and the Fear & Greed Index indicates a score of 73 (Greed)

Regarding supply metrics, EOS boasts a circulating supply of 1.11 billion EOS out of a maximum supply of 1.06 billion EOS. Last year, the yearly supply inflation rate was 3.19%, creating 34.34 million EOS. EOS holds the 14th position in the Proof-of-Stake Coins sector, ranks 2nd in the EOS Network sector, and occupies 36th in the Layer 1 sector.

3. Huobi Token (HT)

Huobi Token has a circulating supply of 162.23 million HT out of a maximum of 500 million HT. The yearly supply inflation rate sits at 5.79%, creating 8.88 million HT over the past year.

Presently valued at $2.90, HT has a market cap of $470.08M with a trading volume of $21.99M in the last 24 hours. Despite a modest 0.74% increase in the last day, the token holds a market dominance of 0.03%.

🔥#HTX #PrimePool #9 Goes Live!

Lock $TRX Flexibly now

Share $80,000 USDT of $VRTX!Click to start>> https://t.co/VC5x0a5MYy pic.twitter.com/JWK4qjOwND

— HTX (@HTX_Global) November 23, 2023

Furthermore, it achieved its pinnacle on May 12, 2021, reaching an all-time high of $39.68, while its lowest point was recorded on January 30, 2019, at $0.888347. Post its peak, the token’s lowest subsequent price was $2.22, marking a cycle low, and its highest reached $3.29 as a cycle high. Market sentiment leans bearish, and the Fear & Greed Index stands at 73.

According to market cap, Huobi Token ranks 11th in the Exchange Tokens sector, 30th in Ethereum (ERC20) Tokens, and 45th in the Layer 1 sector. Its trading price is above the 200-day simple moving average, indicating a positive trend. Over the last 30 days, the token has experienced 18 green days, constituting 60% of the observed period.

4. TG.Casino (TGC)

TG.Casino has launched its presale campaign, drawing significant attention from the crypto community. With unique staking and buyback mechanisms, the project has raised over $2,965,482 towards its $5,000,000 goal. The $TGC Token, emerging as one of the best crypto to buy now, offers a 25% cashback on all losses incurred during betting.

This approach aims to increase staking rewards while reducing the token supply. As TG.Casino gains popularity and generates more revenue, they intend to enhance the intrinsic value of TGC tokens. Experts and analysts are closely monitoring how these staking and buyback mechanisms will impact the supply and demand dynamics of TGC.

24 hours until the price of $TGC increases🌟 pic.twitter.com/kugckrFOp5

— TG Casino (@TGCasino_) November 26, 2023

Moreover, TG.Casino has received recognition from YouTuber John Crypto Bury for its substantial staking rewards, which he considers a significant advantage. Participants in the presale can achieve an impressive Annual Percentage Yield (APY) of 1,500% on their TGC tokens. Early investors are also promised exclusive rewards upon the platform’s official launch on Telegram, providing additional incentives for engagement.

Overall, TG.Casino distinguishes itself through innovative staking and buyback mechanisms, coupled with a strong performance in the presale. These unique features offer an approach to staking rewards and token value appreciation, capturing the interest of the crypto community.

5. Stellar (XLM)

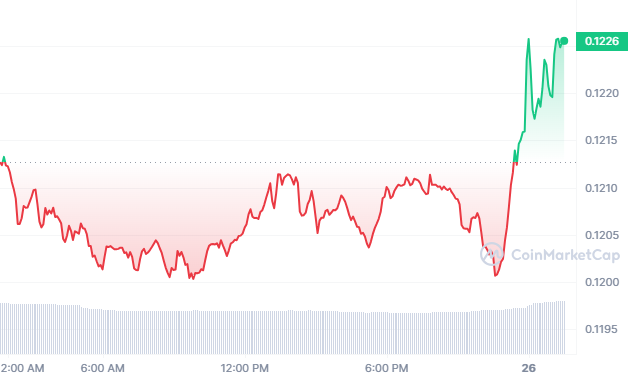

Will XLM maintain its place as the best crypto to buy now? Stellar is priced at $0.121863, with a 24-hour trading volume of $101.15 million. The market cap is $3.41 billion, representing a 0.24% market dominance. Over the last 24 hours, XLM has seen a modest 0.82% price increase.

Stellar peaked at $0.930121 on January 4, 2018, and hit its all-time low of $0.001227 on November 18, 2014. The lowest price post-all-time high was $0.027660, and the highest since then was $0.796465. Currently, market sentiment for Stellar is considered bullish, with a Fear & Greed Index reading of 73 (Greed).

Regarding supply metrics, Stellar’s circulating supply is 28.00 billion XLM out of a maximum of 50.00 billion XLM. The yearly supply inflation rate is reported at 8.96%, creating 2.30 billion XLM in the last year. Stellar holds the top spot in the Stellar Network sector and is ranked 15th in the Layer 1 sector by market capitalization.

Technical indicators suggest that Stellar’s 200-day Simple Moving Average (SMA) is expected to rise next month, reaching $0.120181 by December 25, 2023. The short-term 50-day SMA is projected to hit $0.124923 by the same date. The Relative Strength Index (RSI) currently stands at 54.87, signaling a neutral market position.

From borderless tech challenges to common ground principles, get insights on navigating regulatory complexities in the blockchain with @tajinder_66 and @DenelleDixon on block by block — #Meridian2023 edition.

🎧 https://t.co/zXRQilqA86 pic.twitter.com/q9LqeoEsOk

— Stellar (@StellarOrg) November 16, 2023

Over the past year, XLM has seen a 36% increase in price, outperforming 60% of the top 100 cryptocurrencies. Additionally, it has consistently traded above its 200-day SMA and experienced 18 green days out of the last 30, indicating a 60% positive trend.

In summary, Stellar’s recent performance, market position, and technical indicators suggest a neutral to positive outlook. However, as with any investment, thorough research and consideration of various factors are crucial before making informed decisions.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage