Join Our Telegram channel to stay up to date on breaking news coverage

We cover some contenders for the best cryptocurrency to buy right now, potentially worth adding to your watchlist over the coming days.

Choosing the best crypto to buy hinges on market trends, project fundamentals, and advancements. Widely recognized options like Bitcoin and Ethereum offer stability, while newer projects show promise with innovation and community support. This article examines promising tokens for well-informed decisions, highlighting standout assets, current trends, and factors that will shape investors’ strategies in the market.

Best Crypto to Buy Now

Today’s review of cryptocurrency investment opportunities examines tokens that seem like good bets for potential returns. Through a comprehensive analysis, we identify these tokens as compelling choices for potential investors seeking value in the current market landscape. We will unravel the reasons behind Uniswap’s significant recent growth and Meme Kombat’s amassed interest. Furthermore, it assesses the buzz around Arweave, highlighting these tokens as top picks to invest in.

1. Uniswap (UNI)

Uniswap Labs recently introduced a security enhancement named Permit 2, addressing a critical vulnerability of “infinite token allowances.” This vulnerability posed a potential threat to user funds. With the implementation of Permit2, Uniswap aims to enhance user protection and control over digital assets.

Furthermore, Permit2 brings added security and control by enabling users to set time limits on token approvals. This feature empowers users to restrict third-party access to their funds for specified periods, reducing the risk of unauthorized access. Moreover, Uniswap significantly contributes to Ethereum’s scarcity, burning an impressive 9,001 ETH from the circulating supply in the last 30 days.

This underscores Uniswap’s role in the Ethereum ecosystem regarding trading volume and influencing the coin’s scarcity dynamics. The continuous burn of ETH by Uniswap acts as a decreasing force on Ethereum’s supply. It fosters scarcity and potentially bolsters the asset’s long-term value.

Uniswap Routers have burned 9,001 ETH in the past 30 days. 🔊🦇

Making Uniswap the #1 burner of ETH. 🫡 pic.twitter.com/1DdlV0o2CJ

— Uniswap Labs 🦄 (@Uniswap) January 18, 2024

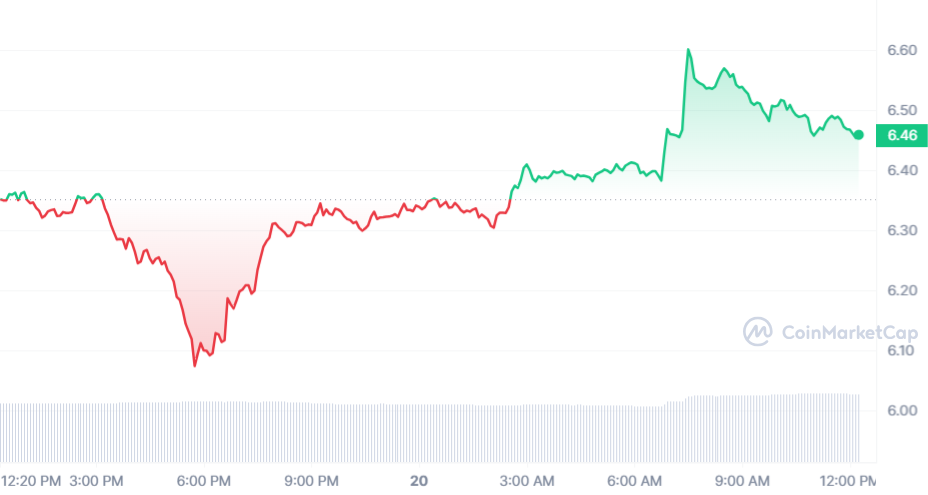

As a result, UNI has seen an intraday increase of 3.44% and a 7% increase over the past year. It is trading above the 200-day simple moving average. Uniswap ranks #4 in the DeFi Coins sector by market cap and #2 in the Exchange Tokens sector. The token also ranks #1 in the Yield Farming sector and #7 in the Ethereum (ERC20) Tokens sector.

2. Akash Network (AKT)

Akash Network has experienced significant growth recently, driven by strategic initiatives that showcase its resilience as a decentralized cloud computing platform. The AKT token has performed greatly in the past year, with an impressive rally of 1,127%. This growth places AKT among the top-performing assets, outpacing 97% of the top 100 cryptocurrencies.

Furthermore, the AKT price experienced an intraday uptrend of 9.98%, and it’s currently trading higher than its 200-day average. This positive trend aligns well with its initial token sale price. Moreover, experts predict a positive future for AKT, with a bullish sentiment.

An excellent walk-through on how to use Akash Chat's open-source code to run your own AI model deployment on the Supercloud using $AKT. https://t.co/NAshuPlH3D

— Akash Network (@akashnet_) January 17, 2024

The Fear & Greed Index, sitting at 52, suggests a neutral market sentiment. Also, 225.63 million AKT tokens are circulating out of a maximum supply of 388.54 million. At the same time, 111.77 million AKT tokens were created due to a yearly supply inflation rate of 98.17%. Akash Network holds the 17th position in the Proof-of-Stake Coins sector and is ranked 6th in the AI Crypto sector.

3. Meme Kombat (MK)

Meme Kombat, a blockchain initiative, seeks to merge the popular meme culture with the competitive dynamics of battle arenas. The project is operating on the Ethereum network. Furthermore, MK aims to deliver a distinct gaming experience through advanced technology and decentralization.

What a beautiful sight to behold!

We reached $7.1 million in the presale💪 pic.twitter.com/bvCfVmhK1h

— Meme Kombat (@Meme_Kombat) January 19, 2024

Moreover, Meme Kombat has amassed significant interest, indicating early traction among potential investors. The project is geared toward gaming enthusiasts. It introduces a combination of staking and betting features to enhance the utility of MK tokens, providing users with opportunities to earn rewards.

The project’s whitepaper states the allocation of 10% of tokens for liquidity upon listing on decentralized exchanges. At the same time, this strategic move aims to facilitate seamless and decentralized trading of MK tokens.

In its ongoing presale, Meme Kombat has successfully raised $7,198,962.54 out of the $8,000,000.00 target. The current presale structure offers 50% of MK tokens at $0.279 each, with a maximum cap of $10 million. This aligns with the project’s commitment to fostering decentralized trading.

MK’s focus on utility positions the token as an intriguing option for investors and users. The innovative platform and staking incentives make Meme Kombat the best cryptocurrency to buy now.

4. Arweave (AR)

Arweave’s recent market performance indicates a modest increase of 1.14% in the last 24 hours. The token’s current price is hovering above the 200-day simple moving average. AR has seen a positive uptrend last year, witnessing a 13% price increase.

Moreover, Arweave achieved its all-time high on November 5, 2021, reaching $90.68. Conversely, its all-time low was recorded on April 30, 2020, at $0.430141. Since the last cycle low, the token experienced a peak of $11.64, demonstrating a remarkable recovery.

Arweave’s liquidity is notable, particularly on the Binance exchange. Subsequently, The coin’s positive performance compared to its token sale price suggests a steady trajectory. AR is ranked #43 in the Layer 1 sector. Further, Arweave’s circulating supply is 65.45 million out of a maximum supply of 66.00 million.

Arweave, Open Data, and the Social Layer: Arweave as Layer 0 for Onchain Social

An "Arweave | 📑 In-depth" post:@LensProtocol, @useOrbis, @farcaster_xyz, and others, some of which are already using Arweave, have started gaining more adoption thanks to great interfaces and… pic.twitter.com/biGY045gSZ

— Only Arweave (@onlyarweave) January 15, 2024

The yearly supply inflation rate is noteworthy at 1,206.25%, resulting in the creation of 60.44 million AR over the past year. Despite this inflation, the Fear & Greed Index reflects a neutral sentiment at 52. However, the coin price prediction sentiment leans bullish, meaning investors feel optimistic about the token.

5. Frax Share (FXS)

Frax Finance recently revealed Frax Bonds (FXB), a utility token designed to convert easily into 1 FRAX stablecoin upon maturity. This unveiling signifies the successful implementation of Frax’s v3 roadmap, showcasing its commitment to introducing new features.

Investors can acquire FXBs on-chain through a permissionless process utilizing a gradual Dutch auction (GDA) mechanism in governance-approved batches. Frax Bonds are versatile, finding utility across various DeFi applications, including participation in Curve Finance pools. They are trading pairs seeking leverage and facilitating trustless debt repayment.

This development has generated heightened demand for FXS, the native token of Frax Share, resulting in substantial growth. The Frax Share price is $9.01, with a 24-hour trading volume of $128.16 million. The token’s market cap is $688.54 million, with a market dominance of 0.04%.

Furthermore, the FXS price has risen by 4.03% in 24 hours, and the outlook for Frax Share appears bullish. The Fear & Greed Index registers at 52, indicating a neutral stance. The token trades above the 200-day simple moving average, showing a positive trend.

Today FRAX v3's $FXB module goes live! This

completes the FRAX v3 design and all new feature deployment. This is a watershed moment because of the unique design and utility of FXBs within DeFi.— Frax Finance ¤⛓️¤ (@fraxfinance) January 19, 2024

Equally, one impressive metric is the current yearly supply inflation rate, which is 371.33%. This signifies the creation of 60.19 million FXS tokens over the past year. While the market dynamics demonstrate positive trends, potential investors should carefully consider these metrics and stay informed about the project’s ongoing developments.

In the crypto scene, major tokens and altcoins witnessed a downturn this week, contributing to a widespread decline in their market values. Cardano experienced a 9% decrease in its value. Similarly, S&P Global Market Intelligence data revealed substantial declines in the prices of two other altcoins – Arbitrum and Ethereum Classic.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage