Join Our Telegram channel to stay up to date on breaking news coverage

Crypto traders are always on the hunt for the best cryptocurrencies to buy on any given day – we list some high potential coins in this post.

The Monetary Authority of Singapore (MAS) has pointed out that crypto comes with risks. The FTX incident, for example, hit regular investors the hardest, risking their life savings.

Despite these challenges, Singapore is leaning towards stablecoins, seeing them as a lasting solution in finance. The country aims to become a digital asset hub, especially for big investors. A recent report from crypto exchange Bybit shows that institutional investors are putting 45% of their crypto money into stablecoins, more than any other segment.

Singapore’s decision to regulate stablecoins shows a commitment to creating a safe environment for digital assets. This fits into their larger plan to attract big investors and build a system that can handle the ups and downs of the crypto world.

Best Crypto to Buy Now

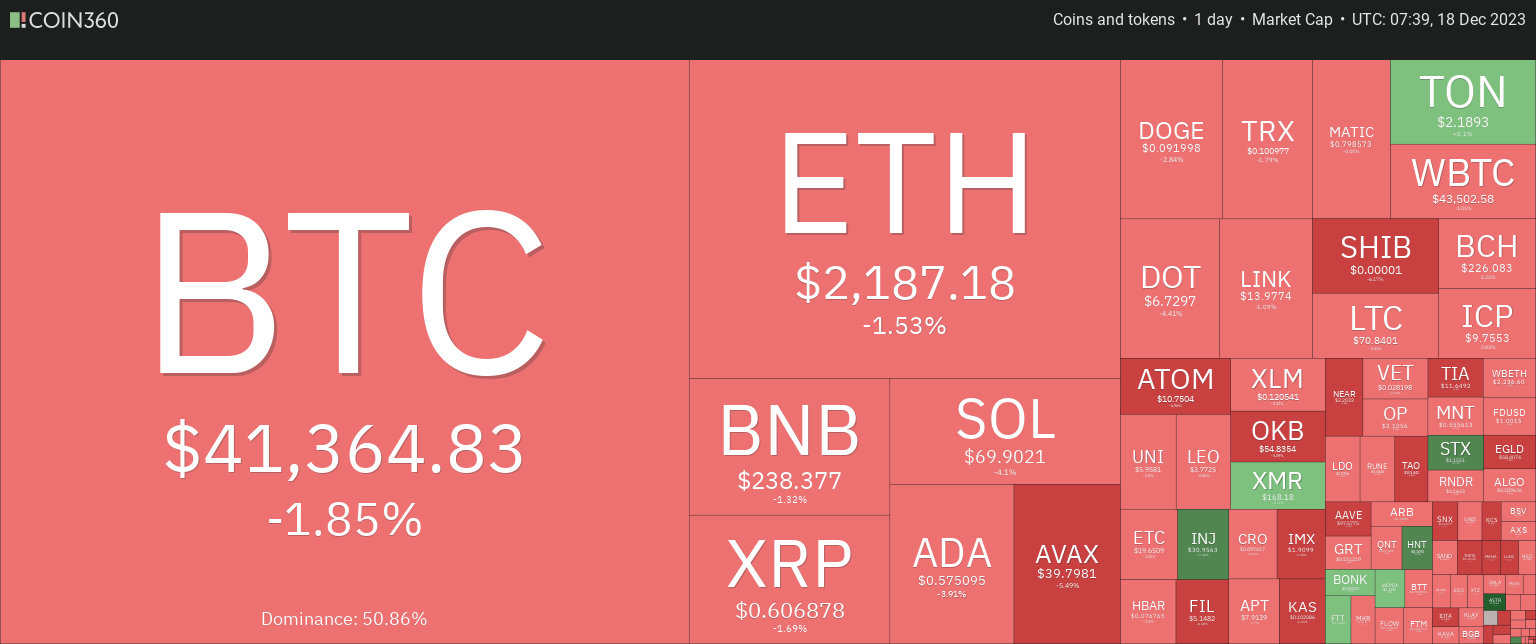

As of the latest update, the total market capitalization of cryptocurrencies stands at $1.57 trillion, reflecting a 2.00% decline over the past 24 hours. This downturn is further mirrored in the 24-hour trading volume, which has decreased by 0.17%, amounting to $159.33 billion.

1. Injective (INJ)

Injective recently integrated Kujira, a blockchain technology reshaping FinTech for web3 builders, dapps, and protocols. This integration allows users to access $KUJI on Injective, potentially boosting its market value. Currently in its early phase, the integration promises more developments and features.

Both teams aim for a long-term collaboration, exploring opportunities for further integration within the Cosmos ecosystem. For Injective users, this integration brings practical benefits. It introduces a new asset, exposing the Kujira ecosystem and its $KUJI token.

Users can diversify their DeFi options by tapping into Kujira’s unique protocols and features. Injective’s platform offers advanced DeFi features like margin trading and cross-chain swaps, enabling more sophisticated strategies.

Financially, some key metrics stand out. INJ consistently trades above its 200-day simple moving average, signaling a positive trend. Over the last year, its price surged by 2,036%, outperforming 97% of the top 100 crypto assets. These assets include Bitcoin and Ethereum.

New Injective integration: @TeamKujira

Users can now access assets such as $KUJI via the Injective Hub and dApps! pic.twitter.com/U5wjyiRdU3

— Injective 🥷 (@injective) December 12, 2023

Additionally, Recent trading activities show positive performance, with 15 green days in the last 30 days (50%). The circulating supply of INJ is 83.76 million out of a maximum supply of 100 million. However, it has a yearly supply inflation rate of 14.72%, creating 10.75 million INJ last year.

Injective ranks #5 in the DeFi Coins sector, #3 in the Layer-2-sector, and #1 in the AI Crypto sector, placing INJ among the best crypto to buy now. Integrating Kujira is a significant move for Injective, expanding its offerings and strengthening its market position.

2. Beam (BEAM)

Merit Circle DAO has partnered with Immutable to expand its blockchain gaming products on the Immutable zkEVM platform. This partnership aims to reach more players globally by combining the strengths of both companies. Immutable will integrate Beam and its digital asset marketplace, Sphere, into Immutable zkEVM as part of the collaboration.

This platform is built on Polygon, a layer-2 Ethereum scaling protocol. The integration allows Merit Circle DAO to use Immutable’s technology. Therefore, bringing advanced web3 solutions like Immutable Orderbook and Immutable Passport to Beam.

The integration has resulted in positive market trends for Beam, evidenced by its 21 green days over the last 30 days. The token has high liquidity, reflected in its market capitalization and a modest intraday increase of 2.32%.

Thanks to @TheBlock__ for covering our latest partnership with @Immutable and @0xPolygon 📰 https://t.co/TDf8kPygpJ

— Merit Circle (@MeritCircle_IO) December 10, 2023

However, it’s important to note that Beam’s price prediction sentiment is currently bearish. This contrasts with the Fear & Greed Index, which indicates a market state of Greed at 65. Moreover, BEAM has a circulating supply of 47.66 billion out of a maximum supply of 62.75 billion BEAM.

3. Celestia (TIA)

Polygon Labs’ Chain Development Kit (CDK) has recently partnered with Celestia. It aims to bring a unique data solution to Layer 2 projects in the Polygon CDK group. Platforms like OKX, Immutable, Astar, IDEX, Palm Network, and others are set to benefit.

This integration could cut gas fees by up to 100 times for Layer 2 chains connected to the Polygon 2.0 system. Celestia aims to offer a data solution that can handle storage bandwidth for multiple Layer 2 networks at the same time. How? Allowing networks to use light nodes makes Data Availability (DA) verification smooth without stressing out the network.

Now, let’s look at the market response. TIA has shown positive trends after this collaboration. Currently, the outlook for Celestia’s price is optimistic, and the Fear & Greed Index is sitting at 65 (Greed). Celestia has a circulating supply of 151.34 million TIA.

Celestia underneath ✨

The combination of Polygon CDK’s native ZK interoperability and unified liquidity with Celestia makes deploying a high-throughput Ethereum L2 as easy as deploying a smart contract. https://t.co/clrLC43JJI

— Celestia (@CelestiaOrg) December 12, 2023

In the past 30 days, Celestia has seen 15 green days, making up 50% of the observed period. It’s also worth noting that the project boasts high liquidity based on its market capitalization.

4. Meme Kombat (MK)

Meme Kombat is grabbing attention in the crypto world, with its presale hitting $3,715,679.88 out of a $5,000,000.00 goal. This early success stems from its unique gaming platform tailored for enthusiasts.

After passing the $3.5 million milestone, we look to the $5 million milestone👁️

We're getting there kombatants! pic.twitter.com/7eLqjx3n14

— Meme Kombat (@Meme_Kombat) December 17, 2023

The project introduces a unique combination of staking and betting. It offers users various ways to engage with the platform and earn rewards. Half of the MK tokens are up for grabs in the presale at $0.246 each, with a maximum cap of $10 million. This combo of staking and betting aims to make MK tokens more useful for users.

MK plans to list its tokens on a decentralized exchange, setting aside 10% of the total tokens for liquidity. This move, detailed in their whitepaper, shows their dedication to making MK tokens easily tradable in a decentralized way. Their apparent strategy and focus on utility make them interesting for potential investors and users alike.

5. ORDI (ORDI)

ORDI holds the top spot in the Bitcoin (BRC20) Tokens sector with a robust market cap, indicating high liquidity. Out of a maximum supply of 21.00M ORDI, the circulating supply is currently at 21.00M ORDI.

As for the price trends, ORDI hit its all-time high on December 6, 2023, at $69.31. The lowest price after its peak was $43.50, marked as a cycle low. The highest price since the last cycle low reached $67.89, a cycle high.

Regarding market performance, ORDI is trading above its 200-day simple moving average, suggesting a positive trend. The Fear & Greed Index is at 65, indicating a sentiment of Greed. It’s important to note that market sentiment can change, so caution is advised.

Read More

Join Our Telegram channel to stay up to date on breaking news coverage