Join Our Telegram channel to stay up to date on breaking news coverage

We cover some contenders for the best cryptocurrency to buy right now, potentially worth adding to your watchlist over the coming days.

SEC’s boss, Hester Peirce, agrees with some of the most bullish cryptocurrency investors. This agreement is that a spot bitcoin ETF should have been approved years ago and that regulators have been standing in the way, she says.

Despite her favorable comments about the ETF, Peirce declined to say whether she thinks it will be approved. Anticipation is building before a Jan. 10 deadline to approve or deny ARK/21Shares’ spot bitcoin ETF application. Moreover, the Bitcoin price has more than doubled this year in anticipation of a vote.

ETF issuers and cryptocurrency firms have been filing to launch a spot Bitcoin ETF for years. However, the Securities and Exchange Commission has denied applications on the grounds of preventing market manipulation and protecting investors.

Best Crypto to Buy Now

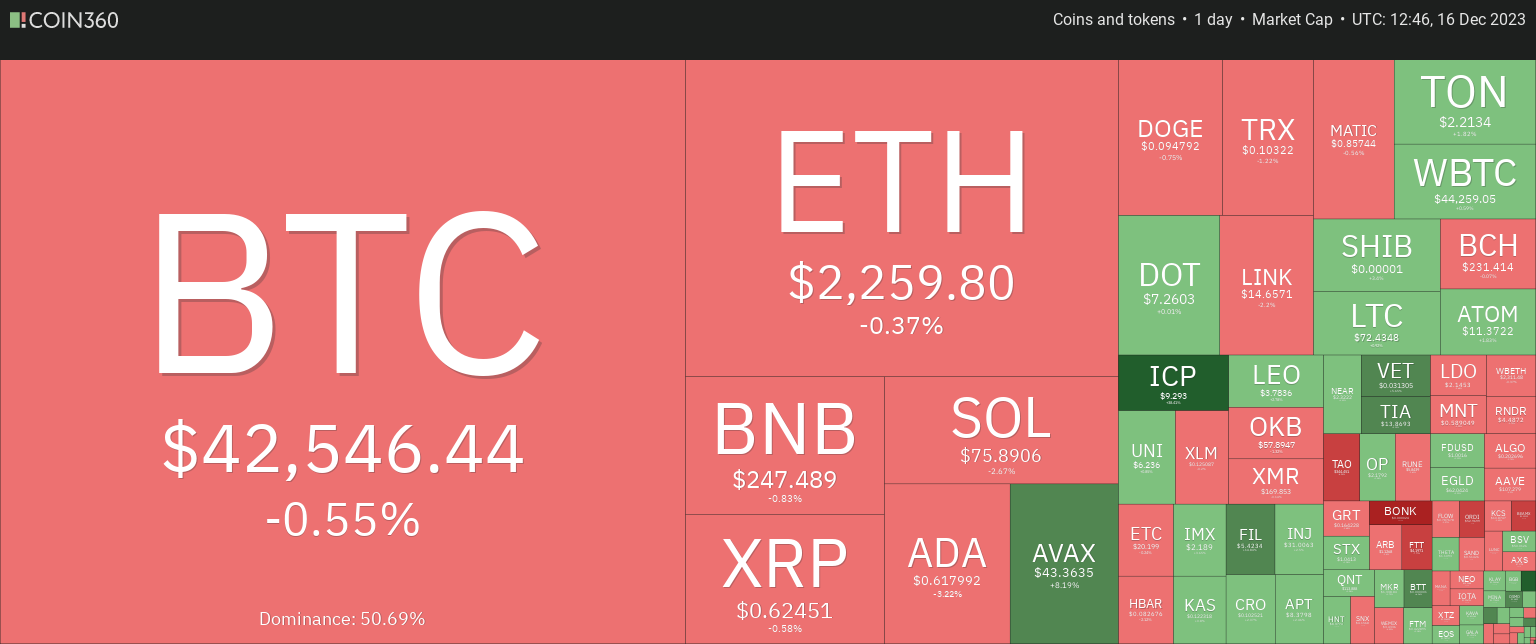

Stablecoins contribute significantly to the crypto market, with a total volume of $47.99 billion, representing 89.18% of the overall 24-hour market volume. These figures underline the stability and prominence of stablecoins in the current market landscape.

1. MultiversX (EGLD)

MultiversX has demonstrated noteworthy resilience and growth, with a 44% increase over the past year. This positions it favorably, outperforming half of the top 100 crypto assets. Its ability to maintain a trading position above the 200-day simple moving average stands out, placing it among the best crypto to buy now.

Delving into the recent market activity, EGLD has experienced positive momentum. Over the last 30 days, there have been 15 days with green, which represents 50% of the observed period. This indicates an encouraging trend and a balanced and steady market sentiment.

Connect with Ledger to core apps: up and running again ✅

The affected Ledger library wasn’t used for our products, meaning that users were never at risk.

Nonetheless, we’ve taken a proactive approach until the root cause has been dealt with. pic.twitter.com/BoJwa9LOon

— MultiversX (@MultiversX) December 15, 2023

Moreover, the project boasts high liquidity, as reflected in its market cap. EGLD ranks 27th in the Layer 1 sector. This suggests that MultiversX has garnered substantial attention and investment interest.

Additionally, MultiversX currently has 23.74 million EGLD in circulation out of a maximum supply of 31.42 million EGLD. This distribution plays a significant role in offering insights into its sustainability and potential for future growth. The sentiment analysis indicates a neutral outlook, with the Fear & Greed Index resting at 67 (Greed).

2. Stacks (STX)

Pyth Price Feeds has recently debuted on the Stacks platform, opening many opportunities for smart contract developers. This move allows these developers to tap into a comprehensive suite of over 400 real-time price feeds. It covers various assets such as digital currencies, foreign exchange pairs, commodities, ETFs, and even US equities.

Stacks leads the charge in bringing smart contracts to the Bitcoin network. Also, it paves the way for decentralized finance (DeFi) to thrive on this renowned blockchain. Stacks’ performance over the past year reveals some noteworthy trends. The platform has demonstrated remarkable resilience, outperforming 84% of the top 100 crypto assets.

STX trades above the 200-day simple moving average, a positive signal in technical analysis. Moreover, STX has experienced 17 green days in the last 30 days, constituting 57% of the observed period. This, coupled with high liquidity based on its market cap, adds another layer of strength to Stacks’ position in the market.

Stacks currently has 1.43 billion STX in circulation out of a maximum supply of 1.82 billion. The yearly supply inflation rate is reported at 6.17%, creating 82.99 million STX over the past year.

Stacks ranks 15th in the Ethereum (ERC20) Tokens sector and 26th in the Layer 1 sector. These figures show Stacks’ prominence in the broader crypto landscape.

The sentiment surrounding Stacks’ price prediction is bullish, indicating an optimistic outlook among market participants. Furthermore, the Fear & Greed Index sits at 67, reflecting a state of greed within the market sentiment.

3. yPredict (YPRED)

yPredict is making waves in the cryptocurrency market, focusing on AI applications. Notably, 100 million YPRED tokens, or 80% of the total supply, were up for grabs. Investors holding YPRED tokens receive quarterly staking rewards of up to 45% and discounts on yPredict’s AI tools.

They also enjoy free lifetime access to the platform’s crypto price prediction system. In its eighth phase, the YPRED token presale offers tokens at $0.11 each, having raised $5,501,524.36. Upon listing on exchanges, the expected token valuation is $0.12, potentially giving early presale participants a 10% gain.

🚀 Explore the future of crypto trading with #YPredict! 🤖

Harnessing AI and ML, we empower traders with data-driven insights for smarter decisions and bigger profits. Our platform invites AI enthusiasts to monetize predictive models too. 💰

Pattern recognition, sentiment… pic.twitter.com/mKyf59qM6z

— yPredict.ai (@yPredict_ai) October 11, 2023

YPRED aims to play a role in the AI-driven Web3 ecosystem, emphasizing benefits for early investors through staking rewards and discounts. Ongoing presale phases and the expected listing price aim to establish a stable foundation for the token’s value in the cryptocurrency market.

4. Dai (DAI)

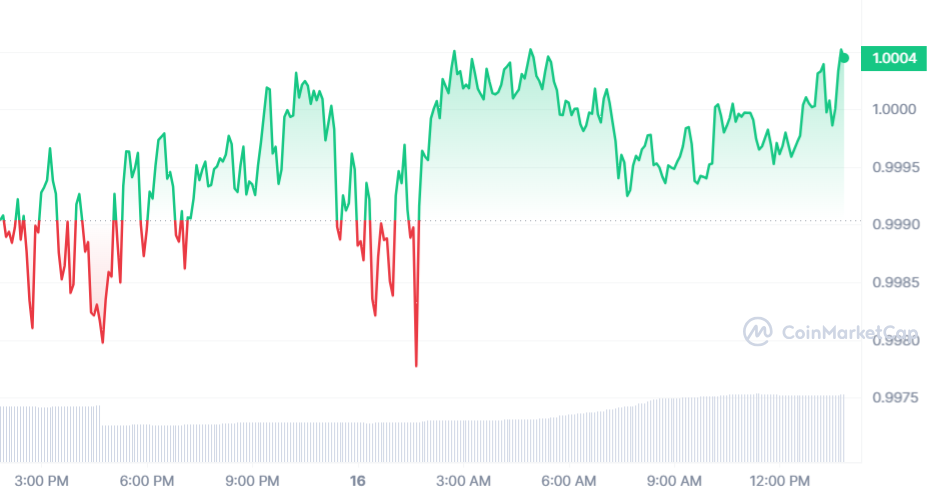

Dai is navigating the cryptocurrency landscape with a price of $0.998631, indicating a modest intraday increase of 0.03%. The token’s market activity is robust, boasting a 24-hour trading volume of $166.51M.

Moreover, Dai’s recent fluctuations saw the token hitting a low of $0.977628 and a high of $1.028460. Market sentiment leans towards a bearish outlook, complemented by a Fear & Greed Index at 67(Greed).

The project boasts high liquidity based on its market capitalization and holds significant rankings. In the DeFi Coins sector, DAI ranks 3rd, 3rd in the Stablecoins sector, and 6th in the Ethereum (ERC20) Tokens sector.

Additionally, 5.35B DAI are circulating out of a maximum supply of 5.90B DAI. This aligns with the project’s commitment to stability, making it an attractive option for investors seeking the best crypto to buy now.

5. Cronos (CRO)

In collaboration with Matter Labs, Crypto.com, and dApp developers, Cronos has achieved a notable milestone in its evolution by introducing zkEVM. This development is particularly significant as it leverages Ethereum’s Sepolia testnet. Likewise, it incorporates zkSync’s open-source prover, Boojum. Boojum is a STARK-based zero-knowledge proof system known for its efficiency in the layer-2 rollup space.

Launching a native Ethereum chain was driven by challenges bridging EVM chains and connecting Cosmos with Ethereum. Furthermore, the project emphasizes the Ethereum developer ecosystem’s richness and robustness for building DeFi and NFT applications.

Examining the financial aspects, the highest CRO price since the last cycle low is $0.120785, marking a cycle high. The current sentiment regarding Cronos’s price prediction is bullish. This sentiment is complemented by a Fear & Greed Index of 67 (Greed).

📖 Closing the year with a new #CROFam chapter: Introducing the Cronos zkEVM Chain Testnet, built on @zksync's ZK Stack Technology

🤝 An exciting opportunity for Cronos dapps to experiment with ZK layer 2 technology, join us on this journey!

👉🏻 Dive in: https://t.co/KvlWeY5Lyk pic.twitter.com/SUl4Y6UpvS

— Cronos (@cronos_chain) December 14, 2023

Key highlights over the past year include a 71% increase in price, outperforming 53% of the top 100 crypto assets. Plus, it is trading above the 200-day simple moving average. The coin has also experienced 15 green days in the last 30 days, constituting 50% of the observed period.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage