Join Our Telegram channel to stay up to date on breaking news coverage

Crypto traders are always on the hunt for the best cryptocurrencies to buy on any given day – we list some high potential coins in this post.

The current crypto market capitalization is $1.60 trillion, marking a decline of -2.65% in the last 24 hours. Meanwhile, the total trading volume for cryptocurrencies in the same period has surged by 23.81%, reaching $230.79 billion.

Best Crypto to Buy Now

Bitcoin maintains a dominance of 52.47%, even with a dip of 0.19% in the last 24 hours. The crypto market cap is at $1.60 trillion, dipping at -2.65% during the same period. What’s interesting is the surge in the 24-hour market volume, hitting $230.79 billion—a robust leap of 23.81%.

Bitcoin’s dominance also took a tiny step back by -0.12%, settling at 51.74%. These numbers give us a snapshot of the recent crypto hustle, showcasing the ups and downs in trading volumes, market cap, and how individual assets, especially the big players like Bitcoin, perform.

1. Dogecoin (DOGE)

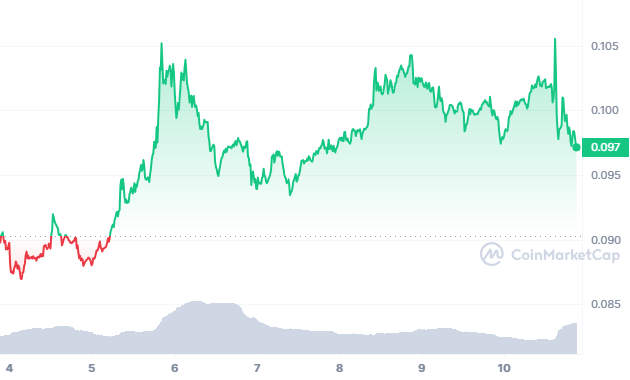

Dogecoin is displaying a positive trend by trading above its 200-day simple moving average. It has shown consistency over the past 30 days with 20 consecutive green days, constituting a 67% positive performance. This indicates a stable and upward trajectory in the short term.

Delving into its circulating supply, Dogecoin currently stands at 142.19 billion DOGE. The annual supply inflation rate, reported at 7.17%, translates to the creation of 9.52 billion DOGE in the last year. These figures shed light on the coin’s ongoing issuance and its impact on the overall supply dynamics.

Community celebration of 10 years of Dogecoin, on Spaces today at 6PM CST with @djdoge69 – join in and share your best memories from 10yrs of Do Only Good Everyday and remembering where it all began. https://t.co/nSgkoB262d pic.twitter.com/8Jkp9u2dZg

— Dogecoin (@dogecoin) December 6, 2023

Examining Dogecoin’s price history reveals noteworthy milestones. It peaked on May 8, 2021, touching an all-time high of $0.738595. In contrast, its lowest recorded price was on May 7, 2015, at $0.00008547. The coin experienced a cycle low at $0.049701 after its all-time high, with a subsequent process high of $0.156883.

DOGE’s price prediction sentiment is neutral. The Fear & Greed Index stands at 74, indicating a prevailing sentiment of greed. Potential investors must consider this sentiment index alongside other factors when evaluating their investment decisions.

A key factor contributing to Dogecoin’s appeal is its high liquidity, evident in its market cap. Latest data shows that DOGE ranks #2 in the Proof-of-Work Coins sector. It also ranks #1 in the Meme Coins sector and #7 in the Layer 1 sector. This underscores its significant market presence and investor interest.

2. Solana (SOL)

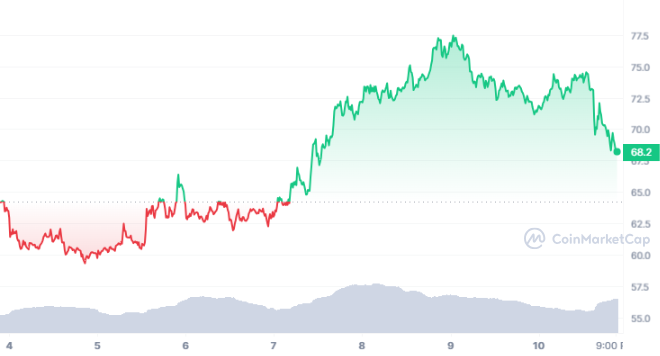

Solana has 426.25 million SOL in circulation out of a maximum supply of 533.68 million. Over the past year, it experienced a 17.45% yearly supply inflation rate, creating 63.34 million SOL. Additionally, Solana has shown a significant 401% increase in price, outperforming 93% of the top 100 cryptocurrencies.

Moreover, Solana trades above its 200-day simple moving average, indicating positive momentum. The project exhibits favorable liquidity metrics, aligning with its market capitalization.

If you know one thing about Solana, it's that the ecosystem👏is👏everything👏 That's why three artists from across the world are here to create, live from the show floor🎥

Don't miss the Artists in Residence exhibition today at #ArtBaselMiamiBeach!https://t.co/jMFWmVE31d pic.twitter.com/k6DxCmju2Y

— Solana (@solana) December 9, 2023

Examining historical price points, Solana peaked on November 6, 2021, at an all-time high of $259.52. On the other hand, its all-time low was recorded on May 11, 2020, at $0.503701. Solana’s lowest price since its all-time high was $8.12, with the highest SOL since the last cycle low reaching $77.60.

SOL ranks 2nd in Proof-of-Stake Coins, 2nd in the Solana Network sector, and 5th in the Layer 1 sector.

3. Mina (MINA)

Mina has undergone notable price fluctuations in the past year. It peaked at $6.49 on November 11, 2021, marking an all-time high, while hitting its lowest point at $0.348931 on October 11, 2023, signifying an all-time low. Over the last year, the yearly supply inflation rate has been 34.93%, creating 263.00 million MINA.

The sentiment regarding Mina Protocol’s price prediction is bullish, per market analysis. The Fear & Greed Index stands at 74, indicating a state of greed in the market. In terms of circulating supply, the MINA has 1.02 billion MINA out of a maximum supply of 824.10 million MINA.

Testworld Mission 2.0 Track 3 Update – End of Epoch 3 ✅

In Epoch 2, Network Performance Testing discovered three issues relating to libp2p library, block production, and memory use. The libp2p issue has now been resolved ☑️ Other fixes related to block production and memory use…

— Mina Protocol (httpz) 🪶 (@MinaProtocol) December 1, 2023

Mina Protocol holds the 36th position in the Layer 1 sector based on market capitalization. Noteworthy statistics include a 44% increase in price over the last year, outperforming 53% of the top 100 crypto assets. Furthermore, Mina Protocol is currently trading above the 200-day simple moving average.

Over the last 30 days, 60% of this period has seen positive price movements, evidenced by 18 green days. The project demonstrates high liquidity, aligning with its market capitalization.

4. TG.Casino(TGC)

TG.Casino has made a promising start to its presale, securing over $3,786,264 in funding. Its unique staking and buyback mechanisms, designed to enhance the project’s overall viability, are keys to this success.

Unlike traditional staking systems relying on staking emissions, TG.Casino has adopted a buyback mechanism. This involves allocating a portion of the platform’s revenue to repurchase TGC tokens from the market. These repurchased tokens are then distributed to investors as staking rewards, resulting in a decrease in circulation.

The innovative nature of this approach aims to provide escalating staking rewards and reduce token supply. The ultimate goal is to strengthen the intrinsic value of TGC tokens. Industry experts and analysts closely monitor how these mechanisms influence TGC’s supply and demand dynamics.

Notably, YouTuber John Crypto Bury has recognized TG.Casino, highlighting the substantial staking rewards as a significant advantage. Presale participants have the potential to achieve a noteworthy Annual Percentage Yield (APY) of 1,500% on their TGC tokens. Additionally, early investors in the presale will be entitled to exclusive rewards upon the platform’s official launch on Telegram, providing further incentives for engagement.

We passed $3.7 million earlier today! $TGC is going absolutely ballistic🎰 pic.twitter.com/xxLtQyHdsI

— TG Casino (@TGCasino_) December 9, 2023

The success and sustainability of TG.Casino hinges on the effective execution of these mechanisms and the subsequent reception from the crypto community. Observing how these elements contribute to achieving the project’s goals and claims will be intriguing as the project evolves.

5. Sui (SUI)

Sui displays several noteworthy indicators that set it among the best crypto to buy now. It has consistently maintained a position above its 200-day simple moving average, signaling a sustained positive trend. This is further supported by its 15 green days in the last 30 days, accounting for 50% of the observed period. Such stability reflects a resilient market presence.

💥 This week, we surpassed another major DeFi milestone: $100,000,000 in bridged USDC!

Thanks to the builders who are helping fuel that growth – with seven projects standing at over $10 million in TVL and 11 projects exceeding the $2 million mark.https://t.co/sO6AU76s6n

— Sui (@SuiNetwork) December 7, 2023

SUI boasts high liquidity, with a circulating supply of 1.03 billion SUI out of a maximum supply of 10 billion SUI. This liquidity status is vital for market participants seeking efficiency in trading and transactions.

The Fear & Greed Index, a measure of market sentiment, currently stands at 74, indicating a state of greed. This metric adds an extra insight into the prevailing market mood, contributing to a comprehensive understanding of the token’s ecosystem.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage