Join Our Telegram channel to stay up to date on breaking news coverage

BCH Price Prediction – February 10

Today, the price of Bitcoin Cash slides below $500 after rejection at the $539 level.

BCH/USD Market

Key Levels:

Resistance levels: $600, $650, $700

Support levels: $400, $350, $300

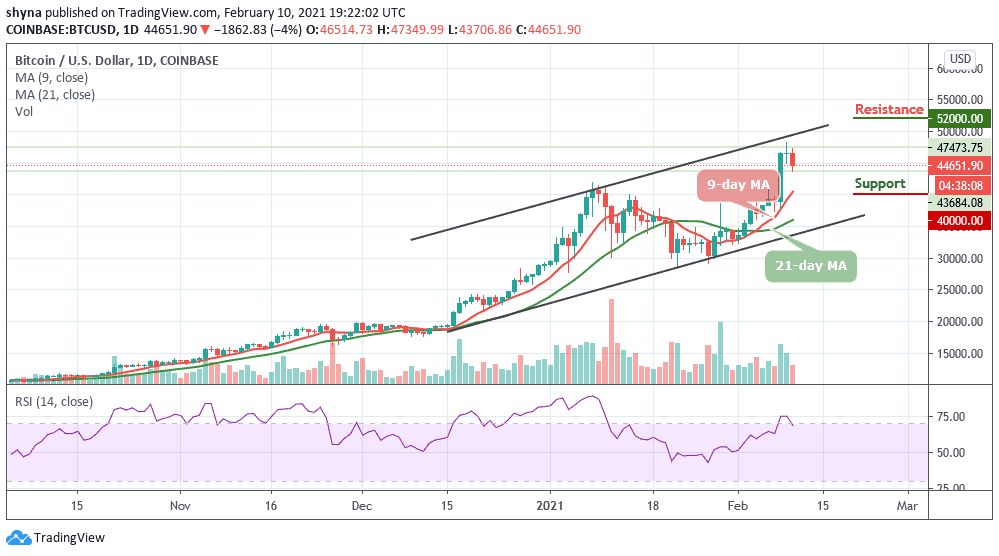

As revealed by the daily chart, BCH/USD is rolling down within the market with a loss of 6.58%. Meanwhile, the current downfall was expected as the altcoins were hitting huge counters, and the market had to come under selling pressure. However, should Bitcoin Cash slide below the 9-day and 21-day moving averages, the bears might dominate the market.

What to Expect from BCH

On the upside, a sustainable move above the moving averages may ease the downward trend and create momentum for the bulls with the focus to move the market to the next resistance levels of $600, $620, and $640 respectively. At the moment, the technical indicator RSI (14) moves below 60-level, which indicates that the downward momentum may come to play out.

However, in as much as the 9-day moving average stays above the 21-day moving average, the coin may continue to follow an uptrend or remain within the consolidation area. In addition, it is good to note that the recent consolidation within the channel is necessary for the bullish action. On the other hand, the support levels could be found at $400, $350, and $300.

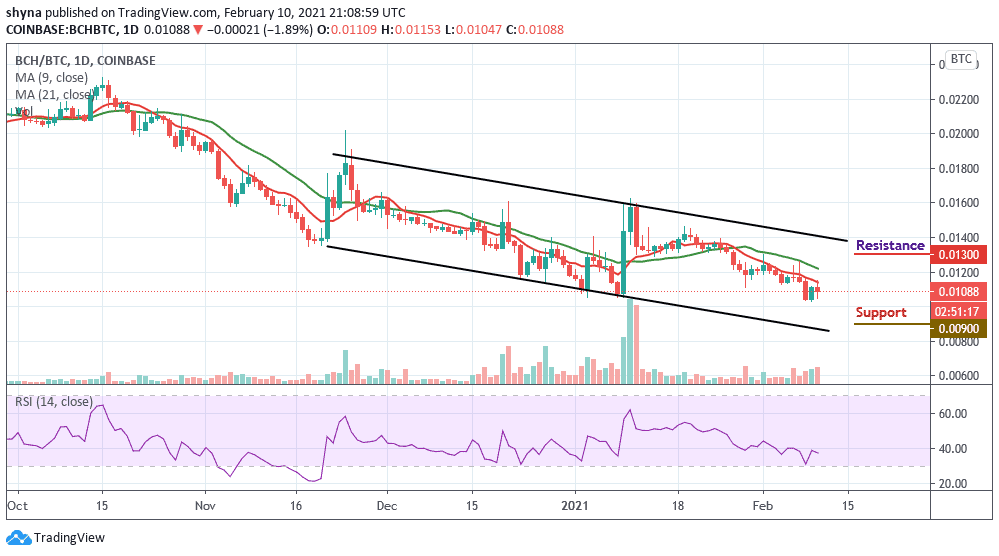

Against Bitcoin, the market continues to follow the downtrend and a short-term bearish breakout is most likely to play out because the technical indicator RSI (14) signal line is moving below the 40-level and when turning downward, the price could break below the lower boundary of the channel to find the nearest support level at 1000 SAT.

Therefore, if the buyers could gather and succeed in breaking above the 9-day and 21-day moving averages, the market price may likely touch the next resistance level of 1300 SAT and above. In other words, a retest could lower the price to the support level of 900 SAT and below.

Join Our Telegram channel to stay up to date on breaking news coverage