Join Our Telegram channel to stay up to date on breaking news coverage

The Axie Infinity price is up 12% in the last 24 hours to trade at $6.93 as of 2:30 a.m. EST as volume surged 405%.

On-chain metrics point to growing demand for the AXS token and the Axie Infinity price now stands almost 70% up from an October 20 low of $4.09.

Axie Infinity Price: On-chain Metrics Support Bullish Outlook

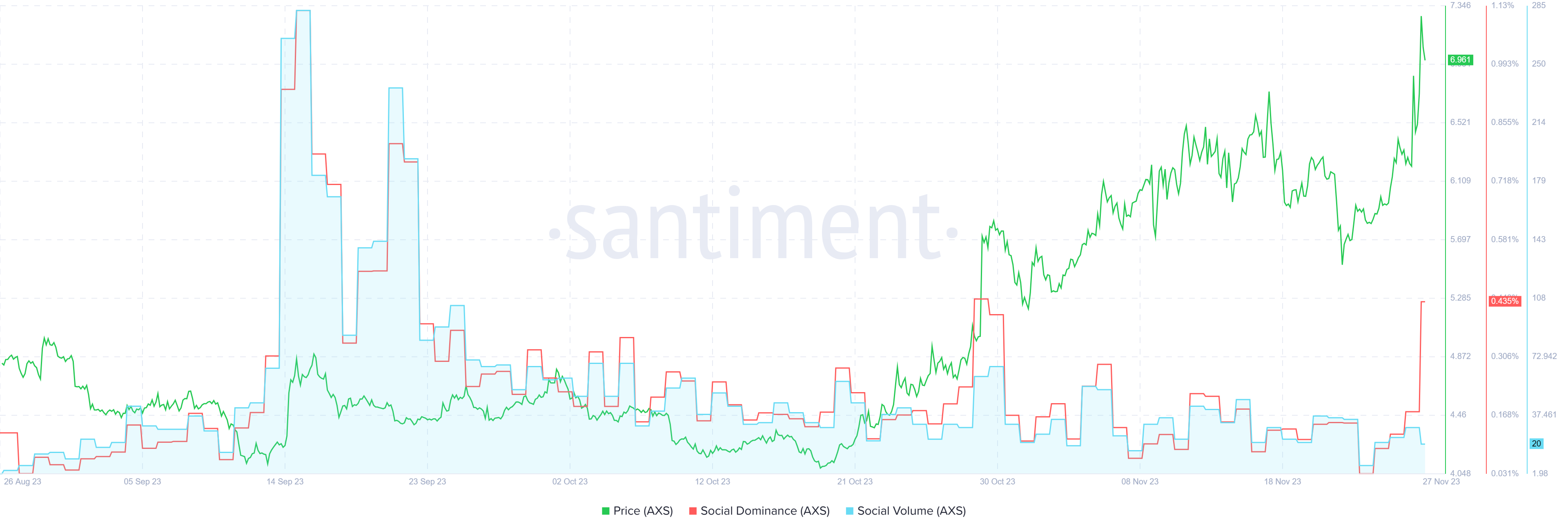

For starters, social dominance and social volume metrics for AXS continue to soar. This shows that the share of the altcoin’s mentions on crypto-related social media is rising, relative to a pool of more than 50 other projects.

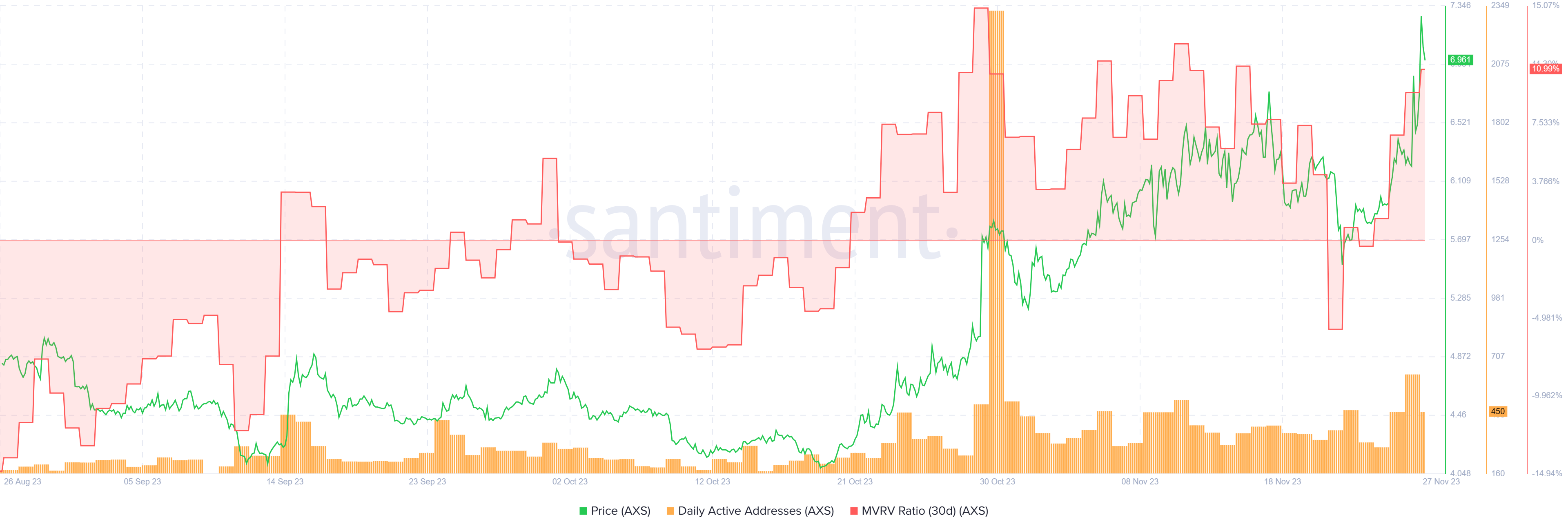

Also, the daily active addresses metric is broadly bullish, showing the number of unique addresses involved in AXS transactions daily. It points to a growing crowd interaction for AXS as investors continue speculating on the Axie Infinity price.

The Market Value to Realized Value (MVRV) ratio is also up showing that almost 11% of AXS holders that bought the gaming token over the past month are in profit.

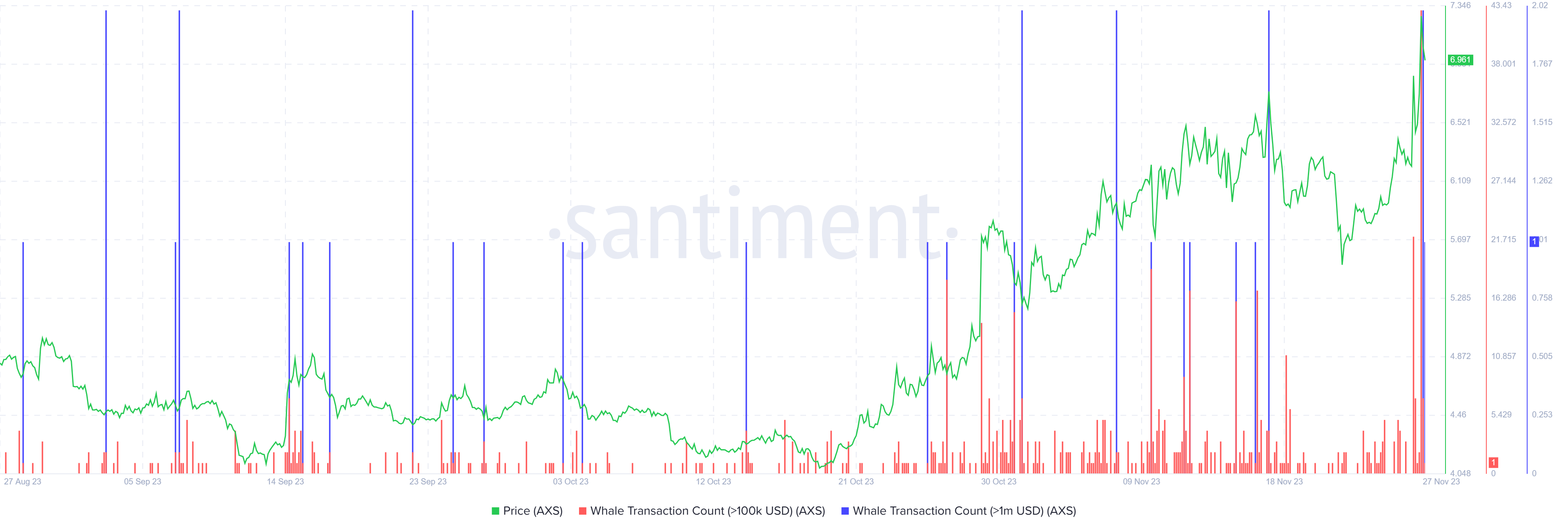

In addition, the whale transaction count metric corroborates the bullish outlook. Based on this metric, which shows the number of addresses transferring more than $100,000 and $1 million worth of AXS is increasing.

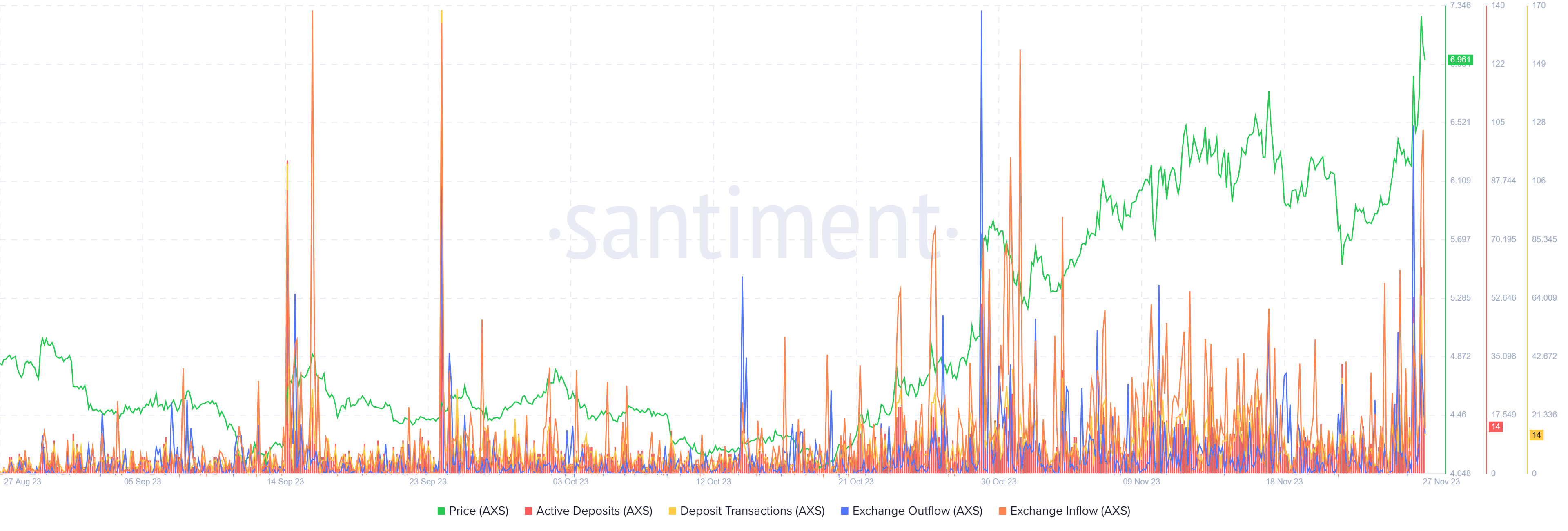

Nevertheless, there appears to be a rise in short term sell pressure for AXS tokens, indicated by the spike in active deposits indicated on the chart below. This outlook is supported by the spike in deposit transactions, with the exchange inflow and outflow ratios supporting a demand boom for the gaming token.

Investors are also pushing to buy the AXS token, suggested by the spike in Tether (USDT) market cap as fresh capital flows into exchanges. This is bullish for Axie Infinity price.

Axie Infinity Price Prognosis As AXS Records On-chain Demand Boom

Axie Infinity price still has more upside potential, indicated by the northbound Relative Strength Index (RSI). This shows increasing momentum as more bulls flock to AXS. The Awesome Oscillator (AO) is also showing green histogram bars, suggesting the bulls have established a strong presence in the AXS market.

Increased buying pressure above current levels could see Axie Infinity price extend to breach the $7.53 resistance level. In a highly bullish case, the gains could extend for the price to tag the $8.00 psychological level, standing roughly 15% above the current level.

In highly ambitious cases, the gains could extend higher for Axie Infinity price to test the $8.50 range high. Such a move would constitute a 20% climb above current levels.

Notably, Axie Infinity price must record a decisive candlestick close above the consequential encroachment (CE) of the fair value gap (FVG) at $7.05. This will be the confirmation of the continuation of the move north and will be seen once the price closes above the CE.

For the layperson, the FVG represents an imbalance in the market, or inefficiency that needs to be filled. For as long as the price has not tagged this gap, extending from $6.73 to $7.34 in the daily chart below, there remains a magnetic pull on the price north.

Converse Case

On the flip side, considering the deposit transactions and the exchange inflows metrics are showing spikes on Santiment, it points to an intention to sell. This is possibly as investors who bought AXS during the November 20 dip book profits after the 30% climb.

The ensuing selling pressure could send Axie Infinity price south, potentially losing the $6.32 support level. In the dire case, the dump could extend for the price to drop below $5.50, levels last tested on November 21 when the price kicked off.

For the bullish thesis to be invalidated, however, Axie Infinity price must descend past the $5.00 psychological level to record a candlestick close under $4.37.

Meanwhile, attention has shifted to LPX, a presale token providing investors entry to a space where crypto whales abound. Here, you could find the next 10x trade.

Promising Alternative to Axie Infinity

LPX, the ticker for the Launchpad XYZ ecosystem, is the surefire alternative for Axie Infinity. It offers investors a chance to learn how to become winners by disclosing secrets of web3 crypto trading.

Interested investors who buy LPX can also access their favorite non-fungible token (NFT) access cards using $LPX tokens.

Visit Launchpad XYZ website to buy LPX in the presale here.

Also Read:

- How to Buy Launchpad XYZ – LPX Token Presale

- 5 Best Crypto ICOs To Buy In 2023 – Next Altcoins Set To Explode

- Best Cryptos With Most Potential To Buy In 2023 – Top 11 List

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage