Join Our Telegram channel to stay up to date on breaking news coverage

AUDUSD Price Analysis – July 29

The decrease in price of AUDUSD to the demand level of $0.682 is highly envisaged, when the Bears increase their pressure, the price will decrease further.

AUD/USD Market

Key levels:

Supply levels: $0.692, $0.701, $0.711

Demand levels: $0.682, $0.665. $0.648

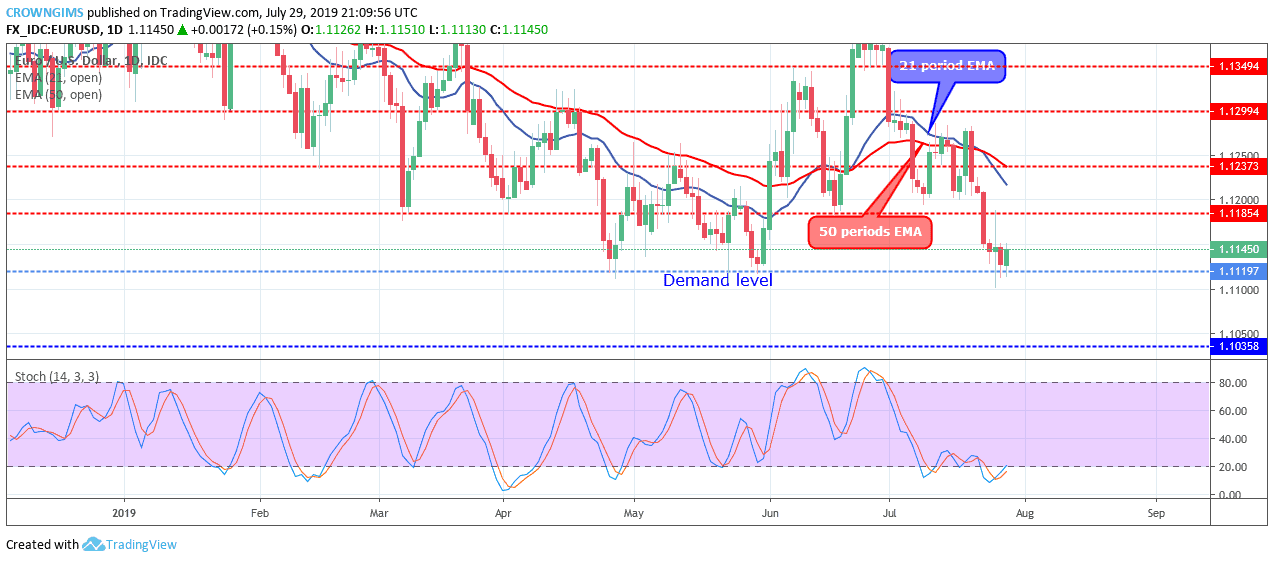

AUDUSD Long-term trend: Bearish

AUDUSD is bearish on the daily chart. The Bulls lost momentum as it was moving up towards the supply level of $0.711 on July 18. The Bears interrupted the upward movement and produced strong bearish candle on July 19. The bearish momentum pushed down the price to break the former demand level of $0.701. The bearish pressure extended to $0.692, penetrated the level and exposed the demand level of $0.682.

Last week market was closed under the bearish pressure in which the daily candle closed below $0.692 demand level. Today, the movement is bearish but at low momentum under the 21 period EMA and 25 periods EMA while the Stochastic Oscillator period 14 is below 25 levels with the signal lines strongly pointing down to indicate strong sell signal. The decrease in price of AUDUSD to the demand level of $0.682 is highly envisaged, when the Bears increase their pressure, the price will decrease further.

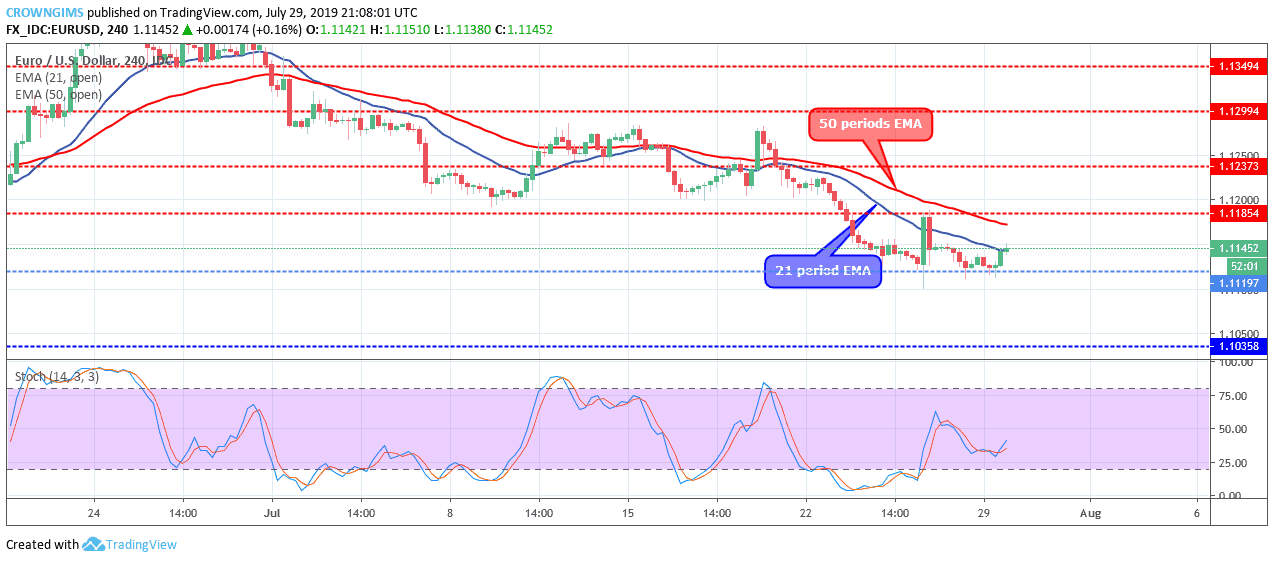

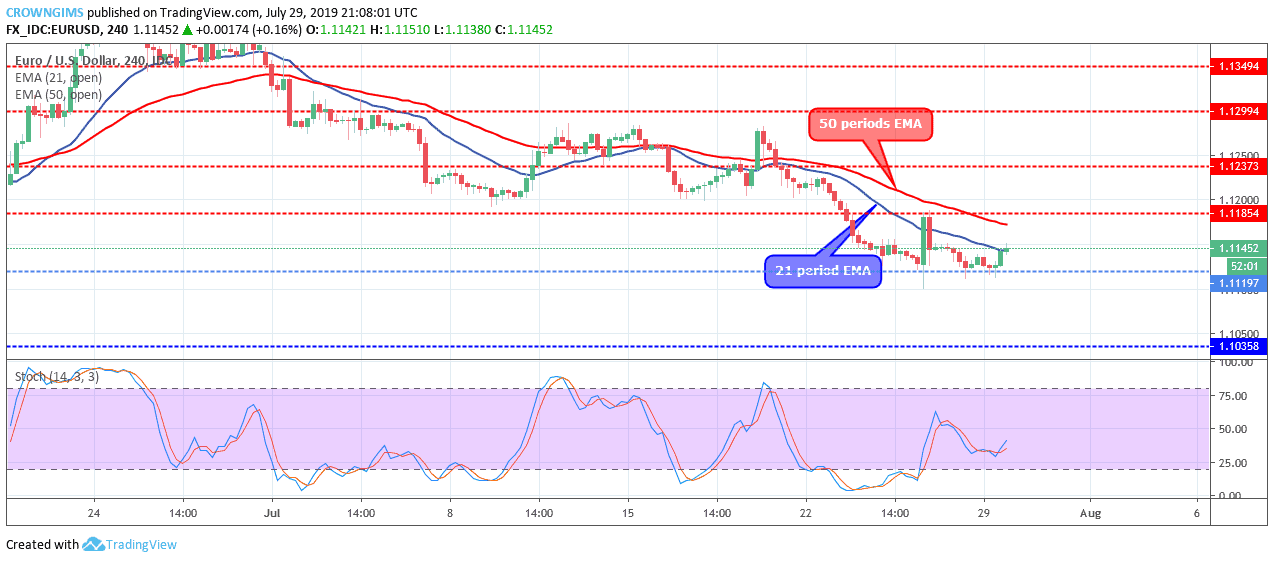

AUDUSD medium-term Trend: Bearish

AUDUSD is bearish in the medium-term outlook. On July 23, the Bears broke down the former demand level of $0.701. The price decreased further down to the $0.692 level. Before the closing of last week market, the price penetrated the level downside. Today, the price is consolidating below the level.

The 21 periods EMA has crossed 50 periods EMA downside in which the price is trading below the two EMAs as a bearish sign. The Stochastic Oscillator period 14 is below 25 levels with the signal lines flat horizontally below the 25 levels showing no direction to indicate that consolidation is ongoing.

Please note: insidebitcoins.com is not a financial advisor. Do your own research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage