Join Our Telegram channel to stay up to date on breaking news coverage

Aave (AAVE) has drawn significant attention, thanks to its cutting-edge lending protocol and pioneering features. This interest has been further intensified by the recent announcement of a strategic partnership with World Liberty Financial, a prominent venture endorsed by former U.S. President Donald Trump, adding substantial credibility and prestige to AAVE’s growing reputation.

AAVE Key Statistics

- Current Price: $150

- Market Cap: $2.23 billion

- Trading Volume (24h): $412.40 million

- Circulating Supply: 14.93 million AAVE

- Total Supply: 16 million AAVE

- CoinMarketCap Ranking: #35

AAVE’s price movement demonstrates solid recovery. It has risen by 1.53% and 5.68% from the highest prices recorded over the last 30 and 7 days, respectively. Furthermore, AAVE has surged by 65.61% from its 30-day low and 28.07% from its weekly low, showcasing its resilience and potential for an upward momentum.

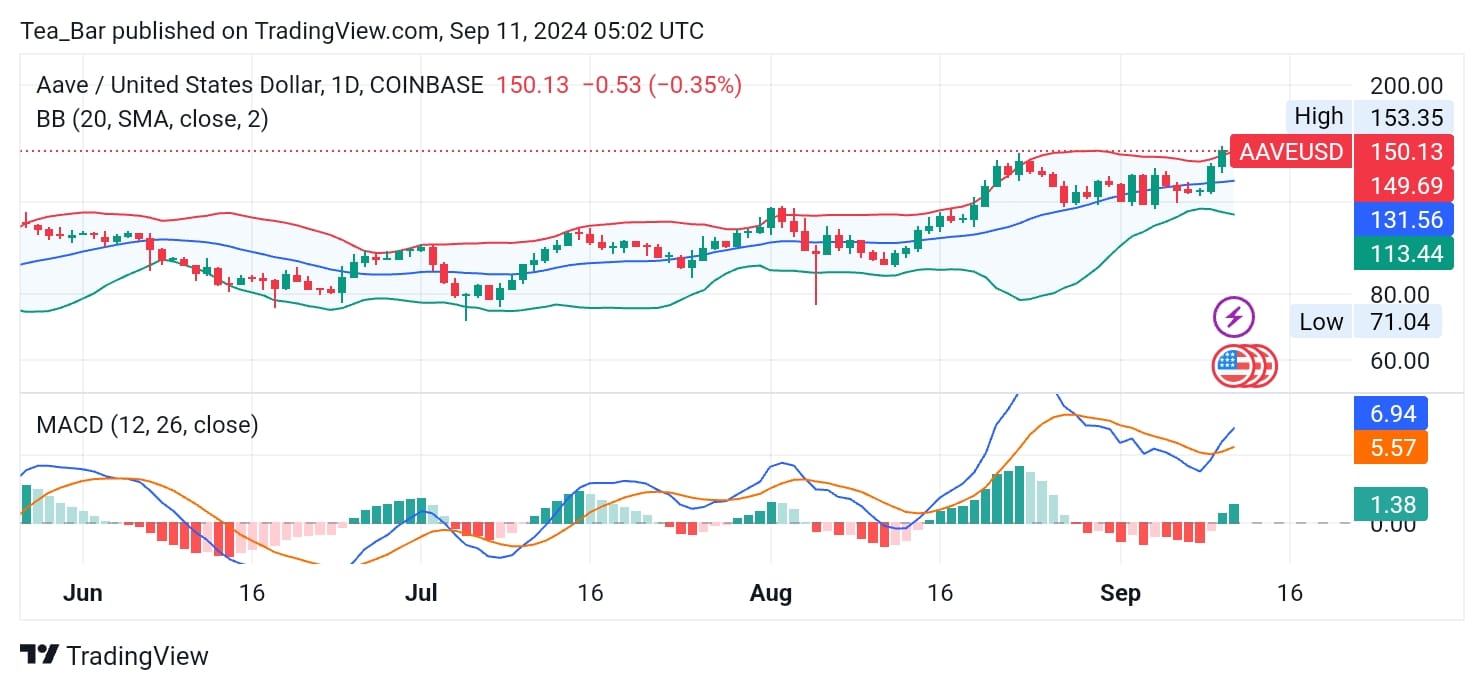

AAVE/USD Market Analysis

Key Levels

Resistance: $153, $160, $175.

Support: $149, $131, $113

The AAVE/USD chart reveals a dynamic market performance, currently trading at $150. While there has been a slight retracement of 0.35% in the past 24 hours, the price is holding strong above the middle Bollinger Band, signaling a possible continuation of its bullish run. The MACD is showing signs of an upward crossover, which could act as the trigger for a potential rally. The price action has been supported by steady buying volume, indicating that investors’ confidence remains intact.

For AAVE to maintain its bullish momentum, breaking above the $153 resistance will be crucial. If successful, the next major resistance lies at $160.50. On the downside, key support sits at $149 which if breached, could open the door to deeper retracements toward the $131 mark.

What Does the Future Hold for Aave in the Evolving DeFi Landscape?

Beyond technical indicators, Aave’s fundamentals suggest potential for further growth. Over the past year, the platform’s lending and stablecoin services have experienced notable expansion. Stani Kulechov, Aave’s founder, recently announced the upcoming launch of two specialized markets on Ethereum’s mainnet—one for EtherFi and another for Ethena—slated to debut in the coming weeks. In a tweet on September 8, 2024, Kulechov emphasized that decentralized finance is undergoing a renaissance, with Aave at the forefront of this evolution.

Is A Huge Breakout Coming For AAVE?

Aave continues to advance the DeFi space by offering tailored solutions. These specialized markets are key tools in this effort, enabling the blockchain to enhance its functionality. Through the launch of EtherFi and Ethena, Aave is providing a more adaptable and efficient trading experience for participants, further improving the platform’s overall efficiency.

AAVE/BTC Performance Insight

The AAVE/BTC pair is currently trading at 0.002656 BTC, having risen by 1.57% in the last 24 hours. The chart reveals a solid uptrend, with AAVE breaking above the middle Bollinger Band, suggesting a continuation of the bullish sentiment. The MACD indicator also shows signs of a possible trend reversal, with the blue line on the verge of crossing above the orange signal line. Should AAVE maintain this momentum, it could face resistance at 0.002708 BTC, with the next target set around 0.002800 BTC. However, failure to hold above current levels could result in a pullback to the key support level of 0.002247 BTC.

According to @tradetheflow on X (formerly Twitter), $AAVE’s current setup looks promising. He highlights that $AAVE, a DeFi pioneer, proves its long-term viability with a solid user base and business model. The strong team and partnerships, along with a healthy TVL consolidating, suggest a potential uptrend. He also notes rising visibility and early signs of momentum on the chart after a period of stagnation.

I kinda like the setup on $AAVE right now.

-DeFi OG that stood the test of time and is establishing itself as a real long-term players

-Clear PMF, real users, sustainable business model

-Top notch team

-Strong partnerships

-TVL is healthy and seems to be currently consolidating… pic.twitter.com/aOoIGz203S— flow (@tradetheflow_) September 11, 2024

Alternatives to AAVE

While Aave remains a leading player in the DeFi sector, with its cutting-edge lending protocol and pioneering features, emerging projects like Pepe Unchained ($PEPU) are also making waves. Pepe Unchained has generated significant buzz, having raised over $12.7 million in its presale, and is set to launch a decentralized exchange (DEX). With a unique approach to the meme coin sector and Ethereum compatibility, it offers a compelling alternative for investors seeking growth opportunities outside traditional DeFi platforms.

Seriously Bullish Headlines Could Pump Pepe Unchained Exponentially Higher

The staking protocol presents a compelling investment opportunity, with a projected annual yield of 177% that warrants serious consideration. The significant stake of over 902 million $PEPU demonstrates substantial community support. Investors can currently acquire $PEPU tokens at a discounted presale price of $0.0096126, with potential for substantial growth as the project achieves its next funding milestone. Pepe Unchained’s engaged community of over 13,800 followers underscores the project’s growing momentum.

A thorough analysis suggests that this meme coin is poised for significant appreciation, making it a worthy investment opportunity.

Related News

Most Searched Crypto Launch - Pepe Unchained

- Exchange Listings December 10

- ICO Sold Out Early

- Featured in Cointelegraph

- Layer 2 Meme Coin Ecosystem

- SolidProof & Coinsult Audited

Join Our Telegram channel to stay up to date on breaking news coverage