Join Our Telegram channel to stay up to date on breaking news coverage

- What Bitvo CEO Pamela Draper says many bad actors have now left the crypto space in Canada

- Why She points out FTX and Binance in particular

- What next Canada is one of the few jurisdictions worldwide with a crypto regulatory framework

The president and CEO of Bitvo Pamela Draper has said that the departure of FTX and Binance from the Canadian crypto space was a sign that bad actors have been ‘shaken out’ of the maket.

Speaking at the Collision conference held on June 29, she said that despite the persistent challenges faced by the cryptocurrency industry, such as issues related to money laundering, market volatility, and evolving regulatory frameworks, certain institutions have managed to endure while many competitors have faltered.

This sentiment aligns with the remarks she made during a recent conference on the present state of the blockchain sector.

Crypto Firms Unwilling to “Make the Investment” in Canada

Draper, who also heads many other companies alongside Bitvo, stated that not a lot of cryptocurrency companies- including trading platforms or crypto exchanges – were willing to put in the effort required to create a foothold in Canada.

She attributed this phenomenon to the regulatory framework, which mandates that any venture operating in the country must adhere to the rules set by the authorities.

In 2021, Canadian regulators introduced requirements that gave cryptocurrency firms a two-year window to register as an “investment dealer” or “regulated marketplace,” with the expectation of achieving full compliance by 2023.

These regulatory obligations have contributed to the hesitancy of many cryptocurrency companies to enter the Canadian market.

Speaking to Cointelegraph, Draper emphasized that achieving full legal permission to operate in Canada involves a significant amount of effort and financial investment.

She highlighted the challenges associated with complying with the regulatory regime, including the need to establish a dedicated staff, infrastructure, and the associated legal fees required to navigate the licensing process with the securities commission.

Canada One of the Few Jurisdictions Where There’s Actually a Regulatory Regime – Draper

Draper made sure to appreciate the presence of a regulatory framework in Canada, acknowledging that many other countries are still working towards integrating such regulations into their financial systems.

Compared to numerous other nations, Canada was one of the early adopters in developing a comprehensive set of regulations that companies had to adhere to before entering the Canadian crypto ecosystem.

“At least in Canada, you have a framework you can follow where you know the guidelines. You may not necessarily agree with every single aspect of it, but you know the sandbox.”

Draper added while addressing a question about recent crackdowns on cryptocurrency companies.

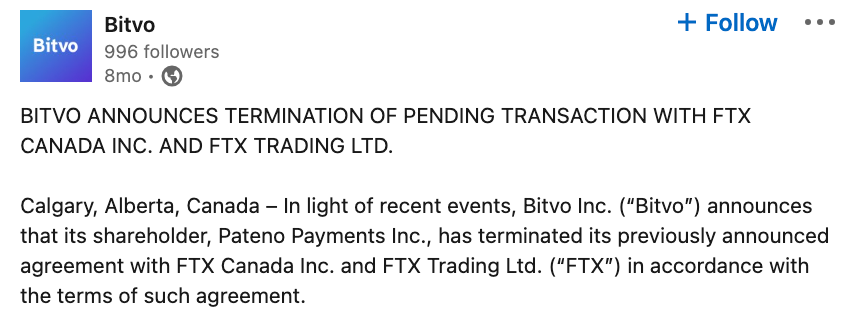

Bitvo was to be Acquired by FTX

As one of the prominent crypto trading platforms in Canada, Bitvo had plans to be acquired by the FTX exchange in order to strengthen FTX’s presence in the Canadian market.

However, the merger plan was short-lived as the company declared bankruptcy in November.

Reflecting on the situation, Draper expressed her surprise and disappointment, stating that the alleged misconduct by FTX seemed inconsistent with the public statements made by its founder, Sam Bankman-Fried, and the overall narrative surrounding the merger acquisition.

Draper further explained that if the acquisition had gone through, Bitvo would have been entangled in the bankruptcy proceedings of FTX.

She stated that with the removal of such companies, a lot of the bad actors had been shaken out of the market.

Several Exchanges Scaled Back Due to Imposing Regulatory Restrictions

Recently, several prominent firms, including Bybit, Binance, dYdX, OKX, and Paxos, have announced that they are scaling back or completely exiting their operations in Canada.

Canadian lawmakers have also released a report recently that examines the advantages and disadvantages of the crypto industry and its impact on the country’s financial market.

This report provides valuable insights into the prevalence of cryptocurrencies within Canada and sheds light on the regulatory considerations associated with this emerging sector.

Related News

- Canadian Lawmakers Publish Recommendations in Support of Blockchain Adoption

- Binance Exits Canada Amid Regulatory Differences with the CSA

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage