Join Our Telegram channel to stay up to date on breaking news coverage

Chainlink (LINK) price escaped a five-week-long consolidation on February 17, soaring 32.36% above the $6.429 support level. However, the $8.563 level price rejected the price, turning it down 13.95% between February 20 and March 2. This price action has formed a bullish flag pattern that positions LINK price for a 25.13% breakout to $9.57.

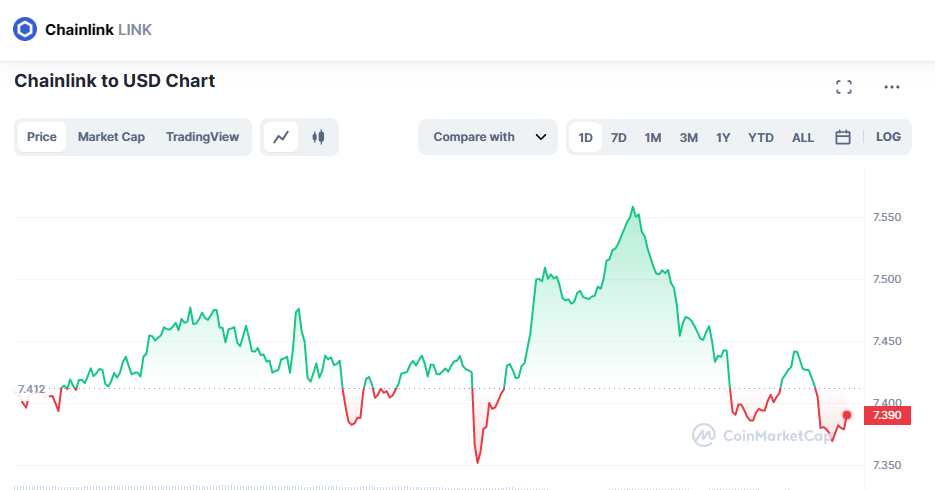

At the time of writing, Chainlink was trading at $7.389, down 0.37% on the last day. The token’s market capitalization had also plummeted 0.46% over the same timeframe, with evidence of reduced trading activity on the LINK market.

Chainlink is a blockchain abstraction layer supporting universally connected smart contracts. The network allows blockchains to interact securely with external data feeds, events, and payment methods. It also delivers the critical off-chain information that complex smart contracts require to dominate the digital agreement space. Chainlink does all these through a decentralized oracle network.

A large open-source community of data providers, node operators, smart contract developers, researchers, and security auditors drive the Chainlink Network. This happens as the ecosystem concentrates on guaranteeing decentralized participation for all node operators as well as other network contributors.

Chainlink Launches Platform To Help Web2 Connect With Smart Contracts

Web3 services platform Chainlink has recently launched a new self-service, serverless platform. The platform will help developers link their decentralized applications (dApp) or smart contracts to any Web2 API.

Tomorrow, we'll go behind the scenes of Chainlink Functions on the latest #Chainlinked Twitter Spaces. Find out:

-Why Functions was created

-Key features for builders

-New use case possibilitiesSet a reminder ⏰ ⬇️https://t.co/DFJrI6DBYU pic.twitter.com/nsHfKn31r6

— Chainlink (@chainlink) March 1, 2023

Christened Chainlink Functions, the new platform will also enable developers to run customizable computations on Web 2 APIs within minutes via its network. On this development, the Chief product officer at Chainlink Labs, Kemal El Moujahid said:

Our goal is to enable developers to combine the best of web3 smart contracts with the power of Web 2.0 APIs. What this creates is a massive opportunity to build apps that combine the best of smart contracts and Web 2.0.

Notably, the platform will make it easy for developers to leverage decentralized infrastructure conveniently. This will give them access to traditional Web 2.0 APIs, like Amazon Web Services (AWS) and Facebook’s Meta platform. Accordingly, developers will enjoy the benefits of these services while still building on a decentralized platform.

Chainlink's new platform lets web3 projects connect to Web 2.0 systems like AWS and Meta https://t.co/E0qo4ci6S0 by @jacqmelinek

— TechCrunch (@TechCrunch) March 1, 2023

Chainlink Functions will also give developers access to Chainlink’s decentralized oracle network. This allows smart contracts to interact with off-chain data sources securely. It means developers will be able to create more nuanced and complex dApps capable of interacting with real-world data securely and in a decentralized fashion.

Functions gives builders:

-Limitless connectivity to the real world

-Trust-minimized security via the same infrastructure powering the Chainlink Network

-A serverless runtime environment for custom compute

-Self-serve in a few lines of codeExplore👇 https://t.co/0fOY5wvp7u

— Chainlink (@chainlink) March 1, 2023

Notably, the platform will also solve challenges within the blockchain sector, including scalability and interoperability. Giving developers access to traditional Web2 services enables them to build more scalable and interoperable decentralized applications. In turn, this helps drive blockchain technology adoptions as it makes it more practical for real-world use cases.

LINK Price Forms A Bullish Flag As It Readies For A Breakout

Following a lot of uncollected liquidity around $8.28, the LINK price turned down to a low of $7.098 on February 28. This came as investors waited to buy the dip. The price recovered on March 1, however, bouncing almost 7% as it recouped most of the ground lost during late February.

The Chainlink price action since mid-February has led to the formation of a bullish flag pattern. This technical formation is positive, facilitating the extension of an uptrend. The LINK price action is consolidating within the two parallel trend lines in the opposite direction of the uptrend. This is before breaking out and continuing the uptrend.

At press time, LINK is auctioning for $7.389. The price confronted immediate resistance due to the upper boundary of the chart pattern at $7.597. A daily candlestick close above this level will open the path for the LINK price to target higher levels.

LINK/USD Daily Chart

An increase in buyer momentum beyond the upper boundary could set the path for more gains for LINK price. Beyond that, the price would be looking at the $8.0 level as the next possible roadblock. Breaching past it would set up the price to test the top of the flag post at $8.563, a 32.36% climb from the $6.429 support level.

If buying momentum remains intact at this level, the price could make a 10.92% ascent to its target of $9.57. Such a move would have completed a 25.13% breakout from current levels.

There was a lot of downward support for the LINK price as it was sitting on the 50-day Simple Moving Average (SMA) for support. This supplier congestion zone, which embraces the midline of the chart pattern, facilitated the Wednesday breakout. Its position at $7.128, the 200-day SMA at $6.995, and the 100-day SMA at $6.767 were ideal breathing rooms. Here, bulls could replenish and come back to the market stronger.

The moving average convergence divergence (MACD) was also moving in the positive region above the mean line. This showed the bulls were still leading.

On the downside, if investors give in to their selling appetite, LINK price could drop below the SMAs and escape the flag’s lower boundary downwards. Such a move would expose the token’s price to start losing value.

Once Chainlink’s price descends below the foot of the flag post at $6.429, the bullish narrative would become completely invalidated for the short term. This could send the price toward the $5.463 swing low before investors can expect another recovery.

The relative strength index (RSI) was moving downwards to show bulls exiting the market. The price strength at 50 was also concerning, showing the price could easily assume a downtrend. The shade of the histograms soaked in red also added credence to the bearish sentiment.

LINK Alternative

While we watch whether Chainlink price will break out above the chart pattern, consider TARO, the native token of the RobotEra ecosystem. TARO is in the presale stage, where collection has reached $971,000.

RobotEra is the next big P2E metaverse game where participants can build the world of Taro their own way by becoming robots, making discoveries, playing, and earning.

Create your own Robot companion and watch 'em come to life! 🤖

Collect minerals, build factories and get yourself a one-of-a-kind Robot that can join your adventures and be sold as an NFT!

Unleash your inner artist ⬇️https://t.co/nBnvUcnbzU#NFTCollection #NFTCommunity #P2E pic.twitter.com/4qBfg8LsaP

— RobotEra (@robotera_io) March 2, 2023

The TARO token powers the whole RobotEra metaverse from development to the in-game currency, P2E gameplay, NFTs, and in-game store.

Buy TARO directly with USDT or ETH. After the presale ends, you will be able to claim your $TARO tokens.

Read More:

- Bitcoin Price Prediction for Today, March 1: BTC/USD Ready for a Cross Above $24,000

- Solana Price Bulls Try Their Luck At Last Line Of Defense – Here’s Why A 100% Rally Is On The Cards

- This New Crypto is Making Real Estate Investment Accessible to Everyone with $100 NFTs – Here’s How it Works (Metro)

Join Our Telegram channel to stay up to date on breaking news coverage