Join Our Telegram channel to stay up to date on breaking news coverage

The allure of altcoins has grown significantly in today’s crypto market. As investors seek various opportunities to get returns, the search for the best altcoins to invest in becomes paramount. Therefore, this article compiles the best altcoins that could shape the future of DeFi, offering returns to investors.

7 Best Altcoins to Invest in Right Now

In premarket trading, stocks associated with the crypto sector experienced rallies. Key players such as Riot Blockchain and Marathon Digital registered increased by 4.2% and 5%, respectively. Microstrategy, a prominent Bitcoin investor, observed a 2.5% uptick while leading cryptocurrency exchange Coinbase recorded a 4.4% rise.

1. Pepe (PEPE)

Pepe has displayed notable market activity recently, with its daily price chart indicating a substantial surge in buying demand. The coin’s value witnessed an upswing from the low of $0.0000011. Pepe holds at $0.0000014, demonstrating a 20% increase over the last 24 hours.

Furthermore, the 24-hour trading volume is $34.9 million, pointing towards heightened interest in daily trading activities. The Relative Strength Index (RSI-14) trend line has experienced an upward movement. As such, it trades above the midline at 56, signaling a prevailing bullish sentiment. The Simple Moving Average (SMA-14) level indicates potential volatility in the coming hours.

the $PEPE treasury is about to be transferred into a multi-sig @safe under the following address:

0x310039f661E9fBD3518D2820221eD135fC99cBdD pic.twitter.com/xCHSD8mDan

— Pepe (@pepecoineth) December 22, 2023

Moreover, the 4-hour price chart for PEPE/USDT shows that bullish momentum is strengthening, leading the coin to surpass moving averages. However, resistance is encountered around the $0.0000015 mark, where bears actively prevent upward movement.

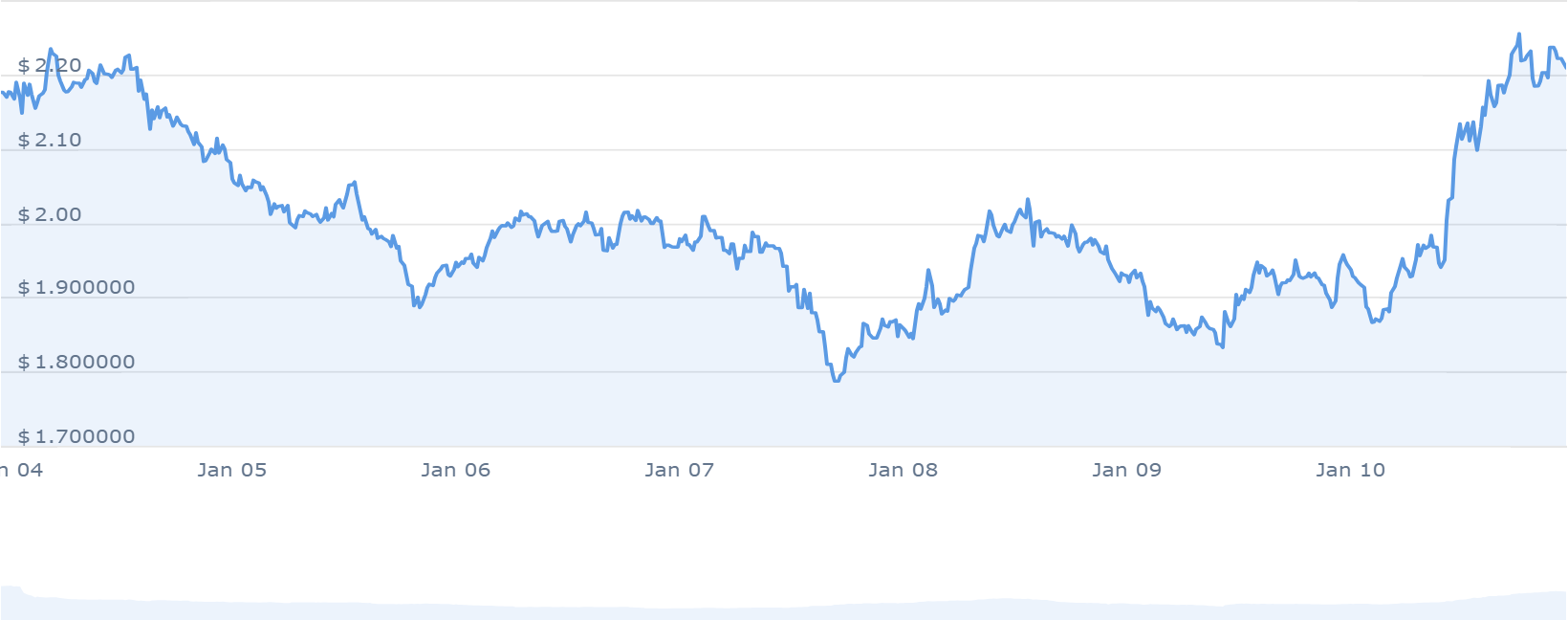

2. Arbitrum (ARB)

The ArbitrumDAO has recently received a comprehensive proposal detailing the upgrade of ArbOS to version 11. This thoroughly tested proposal aims to fortify support for the Arbitrum (ARB) token. The aim is to improve various services within Arbitrum, including Arbitrum Orbit, Arbitrum One, and Arbitrum Nova.

A significant modification in this implementation involves integrating support for EVM Shanghai. It also includes addressing specific pre-compile contract behaviors. Moreover, it involves fine-tuning the gas pricing parameters of the Arbitrum network.

Custom gas tokens for Arbitrum Orbit chains are now supported!💙🪐

Orbit chains can now use any ERC20 token for their transaction fees, allowing projects to build vibrant native economies.

Since the initial launch of Arbitrum Orbit, custom gas tokens have been the most… pic.twitter.com/pxWh582q4M

— Arbitrum (💙,🧡) (@arbitrum) January 4, 2024

Industry experts express optimism about the potential impact of these upgrades on Arbitrum’s performance in the upcoming year. Meanwhile, Arbitrum’s trading volume has recently increased by over 50%. Analysts anticipate this bullish trend to continue, marking a positive trajectory for the Arbitrum network.

3. Synthetix (SNX)

Synthetix has entered a transformative phase with its recent Andromeda upgrade, incorporating a deflationary mechanism into the Perps V3 engine. Following the Andromeda release on Base Network, 40% of the fees generated by the Perps V3 engine will be set aside. This fee will actively contribute to acquiring and burning SNX tokens, drawing inspiration from Yearn Finance contracts.

Nonetheless, the success of this deflationary strategy hinges on the strategic distribution of fees arising from the protocol’s multi-chain implementations. The breakdown of fee allocation on Base explicitly designates 40% for SNX buyback and burning.

Missed our latest Liquid Conversations on Infinex's upcoming launch? Here's what you need to know about @infinex_app.

– Infinex: The CeFi 🤝 DeFi gateway

– Standout Features: Social login, L1 deposit, smart wallets, auto bridge.

– Launching with SNX Andromeda & Perps V3 on @base pic.twitter.com/c7nPqQ7gg7— Synthetix ⚔️ (@synthetix_io) January 9, 2024

In addition, 20% goes to Perps Integrators, and the remaining 40% is allocated to USDC liquidity providers. Integral to the dynamic deflationary push is SIP-345, a Synthetix Improvement Proposal. This system actively introduces the buyback and burn mechanism while dynamically broadening the project’s collateral base by incorporating USDC on Base.

4. Polkadot (DOT)

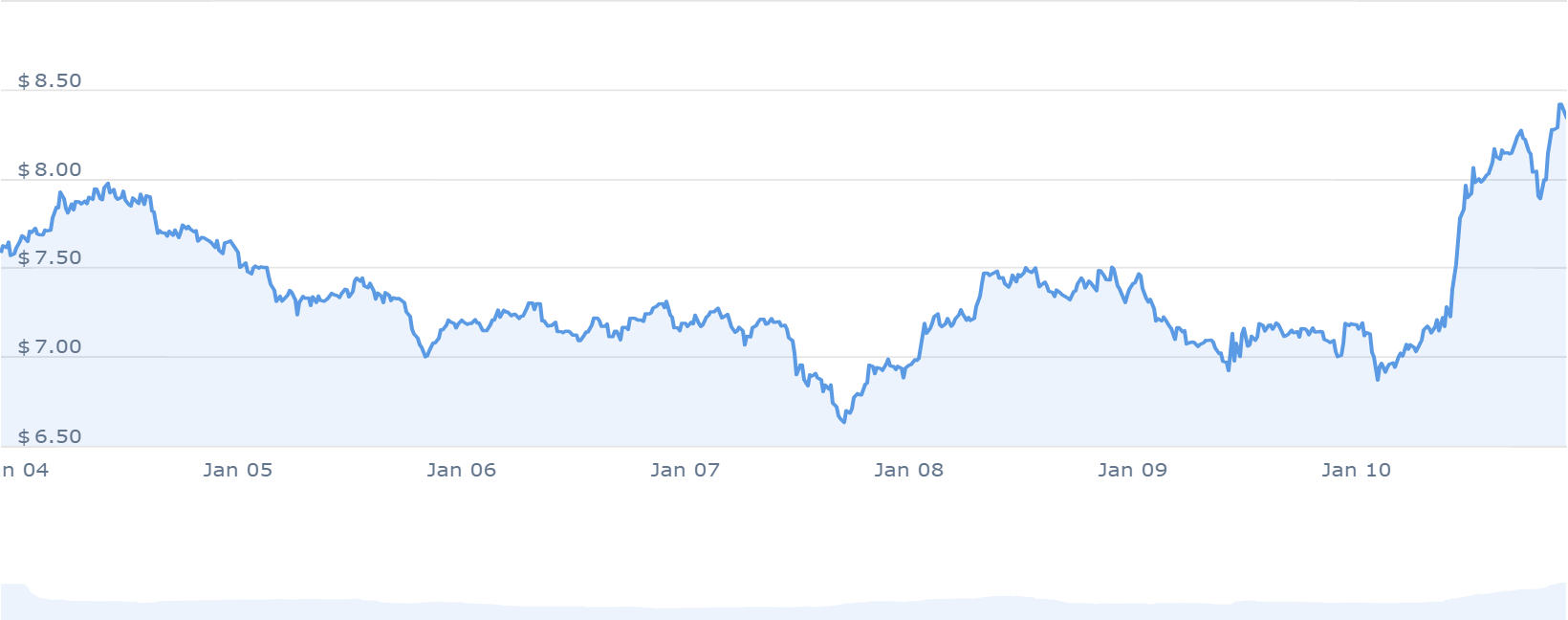

Polkadot has surged nearly 17%, indicating a bullish momentum, with analysts anticipating a push toward the $10 threshold. The current market analysis showcases robust bullish signals, with support firmly established around the $6.65 level against the US dollar.

Moreover, the price is trading comfortably above the $8.00 zone and the 100 simple moving average (4 hours), affirming a positive trend. In supply metrics, Polkadot boasts a circulating supply of 987.58 million DOT out of a maximum supply of 1.00 billion DOT. It currently holds the seventh position in the Proof-of-Stake Coins sector and ranks eleventh in the Layer 1 sector.

🔄 Swaping USDC on Ethereum for native DOT is easy with Chainflip, a decentralized, trustless protocol powered by 150 independent validators.

⛓️ Chainflip enables users to swap native assets across different blockchain networks without the need for wrapped tokens, and eliminates… pic.twitter.com/pvovyR4drz

— Polkadot (@Polkadot) January 11, 2024

Highlighted performance indicators for Polkadot encompass a 71% rally over the past year, outperforming 51% of the top 100 coins. The coin maintains its position above the 200-day simple moving average, demonstrating positive performance relative to its token sale price. Additionally, Polkadot exhibits high liquidity based on its market capitalization.

5. Meme Kombat (MK)

Meme Kombat has actively attracted attention by surpassing the $6,604,001 mark in its ongoing presale, on its way to achieving a $8,000,000 goal. The project stands out by implementing an innovative gaming platform tailored to enthusiasts.

$6.6 million has been passed💫$MK is moving quickly and we are working hard to create a captivating gaming experience👾 pic.twitter.com/JQh2OBWoRU

— Meme Kombat (@Meme_Kombat) January 11, 2024

Furthermore, Meme Kombat distinguishes itself by actively integrating staking and betting functionalities. This offers users many ways to engage with the platform while actively earning rewards. 50% of the MK token supply is available at $0.279 per token in the presale. Therefore, this establishes a firm hard cap of $10 million. This dual-action approach significantly amplifies the usability of MK tokens within its user base.

Crucially, Meme Kombat has set plans to list its tokens actively on a decentralized exchange. In addition, 10% of the total supply will be allocated to provide liquidity and expedite trading actively. This strategic move, detailed in Meme Kombat’s whitepaper, underscores the project’s commitment to fostering decentralized trading of MK tokens.

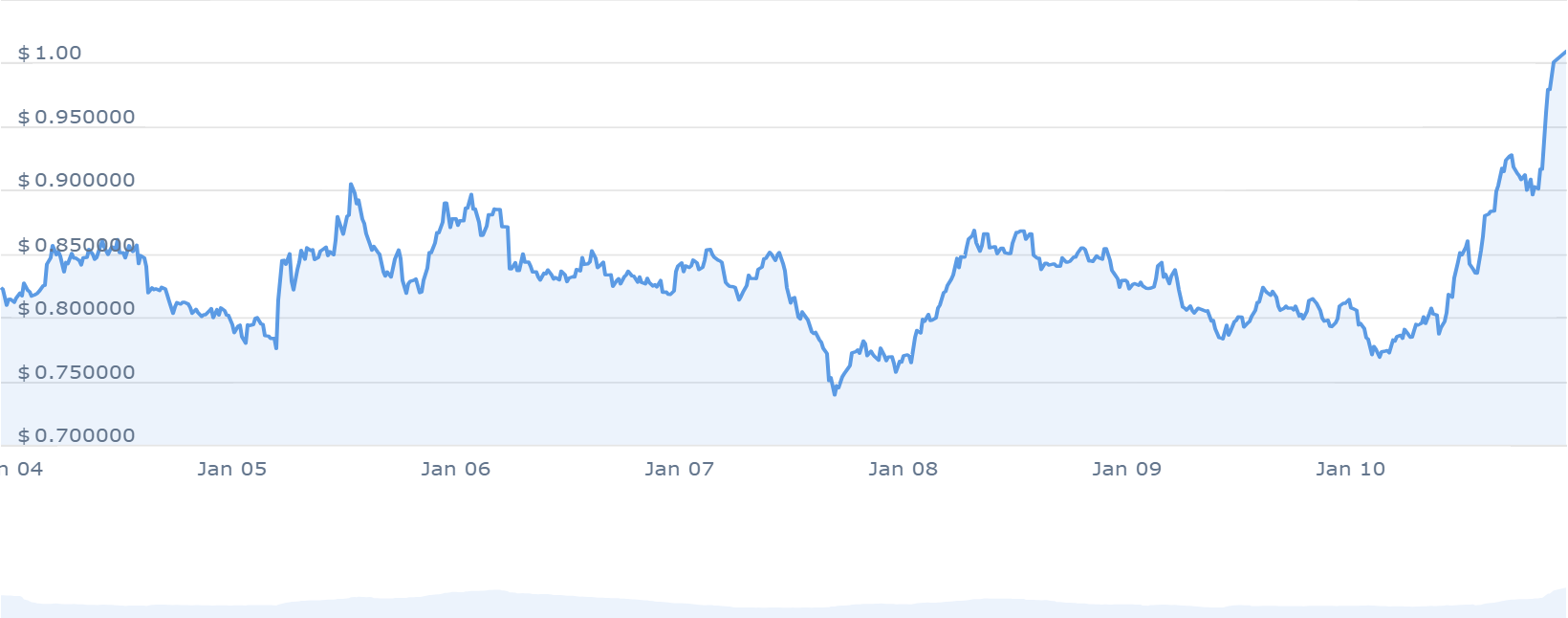

6. Sui (SUI)

Sui demonstrates a bullish sentiment in its price prediction, complemented by an Extreme Greed reading of 76 on the Fear & Greed Index. The circulating supply of Sui Crypto presently stands at 1.10 billion SUI out of the maximum supply of 10.00 billion SUI. Also, it secures its rank at #36 in the Layer 1 sector by market cap.

Furthermore, Sui actively trades above the 200-day simple moving average, affirming its positive performance compared to the initial token sale price. Over the last 30 days, the token has notched up 18 green days, constituting 60% of the observed period. Its proximity to the cycle high underscores its current active trading stance.

Learn about how @bluefinapp logs billions in volume on its Sui-based DeFi platform, giving its users a first class experience through sub-second finality and a simplified onboarding experience.https://t.co/IOVTeri2FB

— Sui (@SuiNetwork) January 10, 2024

Moreover, Sui Crypto boasts high liquidity, gauged by its market cap, indicating robust investor interest and market participation. As market dynamics evolve, Sui Crypto emerges as a project with a consistent performance record. As such, it is actively positioning itself as a significant player within the Layer 1 sector.

7. Immutable (IMX)

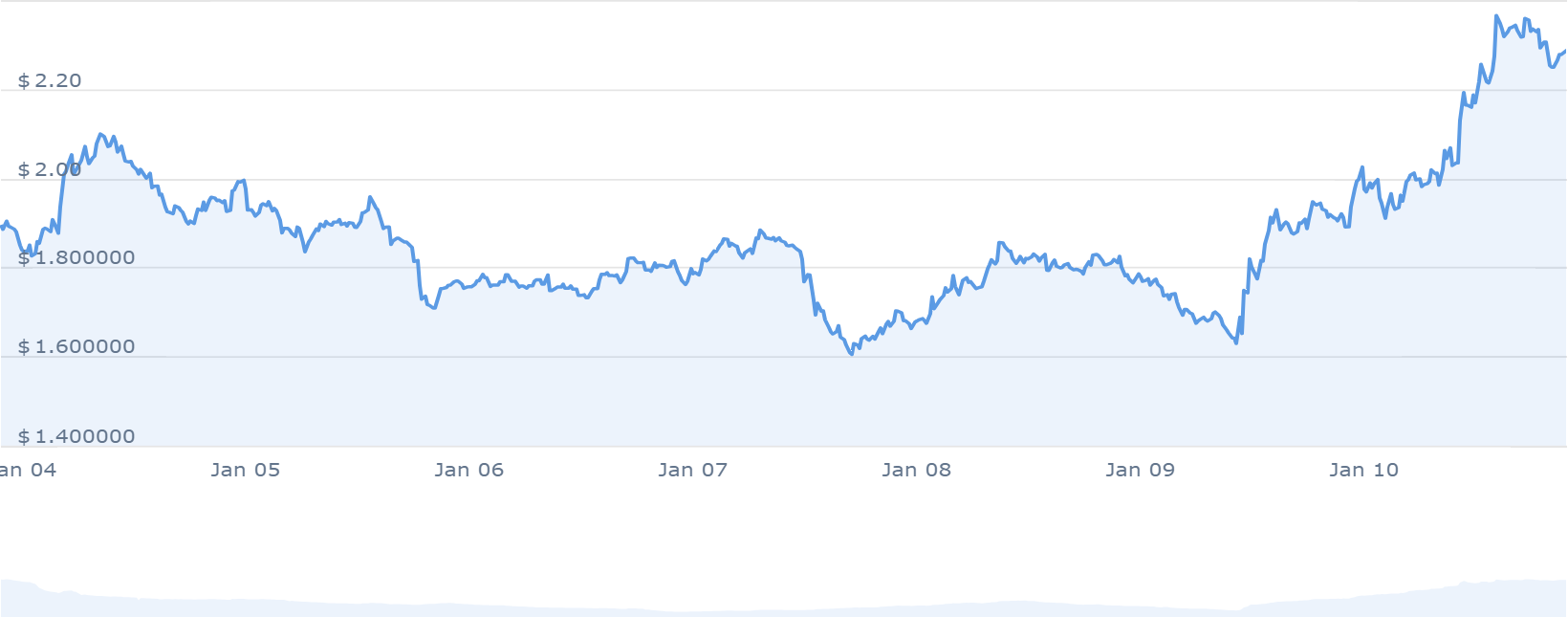

Immutable’s price is $2.21, reflecting a 13.06% increase in the last 24 hours. With a 24-hour trading volume of $189.77M, the project boasts a market cap of $2.92B, commanding a market dominance of 0.16%. Notably, it ranks third in the Layer 2 sector by market capitalization.

IMX’s sentiment indicators suggest a bullish outlook, with the Fear & Greed Index registering 76, indicating extreme greed in the market. The circulating supply of Immutable X stands at 1.32 billion IMX out of a maximum supply of 2.00 billion IMX.

Learn about how @bluefinapp logs billions in volume on its Sui-based DeFi platform, giving its users a first class experience through sub-second finality and a simplified onboarding experience.https://t.co/IOVTeri2FB

— Sui (@SuiNetwork) January 10, 2024

IMX’s witnessed a 361% price increase in the past year, outperforming 88% of the top 100 crypto assets. It’s trading above the 200-day simple moving average. In addition, maintaining positive performance about the token sale price indicates a stable position.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage