Join Our Telegram channel to stay up to date on breaking news coverage

The decentralized finance (DeFi) sector has contributed $6.99 billion, representing approximately 14.93% of the 24-hour crypto market volume. Stablecoins account for a substantial portion of this trading activity, reaching $41.26 billion. Over the past day, this constituted around 88.18% of the total crypto market volume.

7 Best Altcoins to Invest in Right Now

The upcoming deadline of January 10 is a pivotal moment for the cryptocurrency sphere, particularly regarding the potential integration of digital assets into traditional financial frameworks. This deadline marks the decision point for US regulators to approve a physically-backed Bitcoin Exchange-Traded Fund (ETF).

1. Frax Share (FXS)

Frax Finance has made a big move by teaming up with the Axelar Network to spread its key assets, like FRAX and frxETH, across different DeFi platforms. This helps more people use their coins and strengthens their position in the DeFi world.

Using the Axelar Network to share its assets across various platforms, Frax Finance is trying to make its coins more useful. The project aims to make DeFi easier for everyone to access and use. As the DeFi space grows, partnerships like this will become more important for its progress.

We're excited to work with @axelarnetwork to support the issuance of Frax-assets on @osmosiszone @0xMantle @LineaBuild @TeamKujira @MantaNetwork & @Scroll_ZKP! Expect to see all the great yields+stability Frax is known for on all these chains soon! Powered by Axelar! 🙌 pic.twitter.com/5EgW6fOHGD

— Frax Finance ¤⛓️¤ (@fraxfinance) December 16, 2023

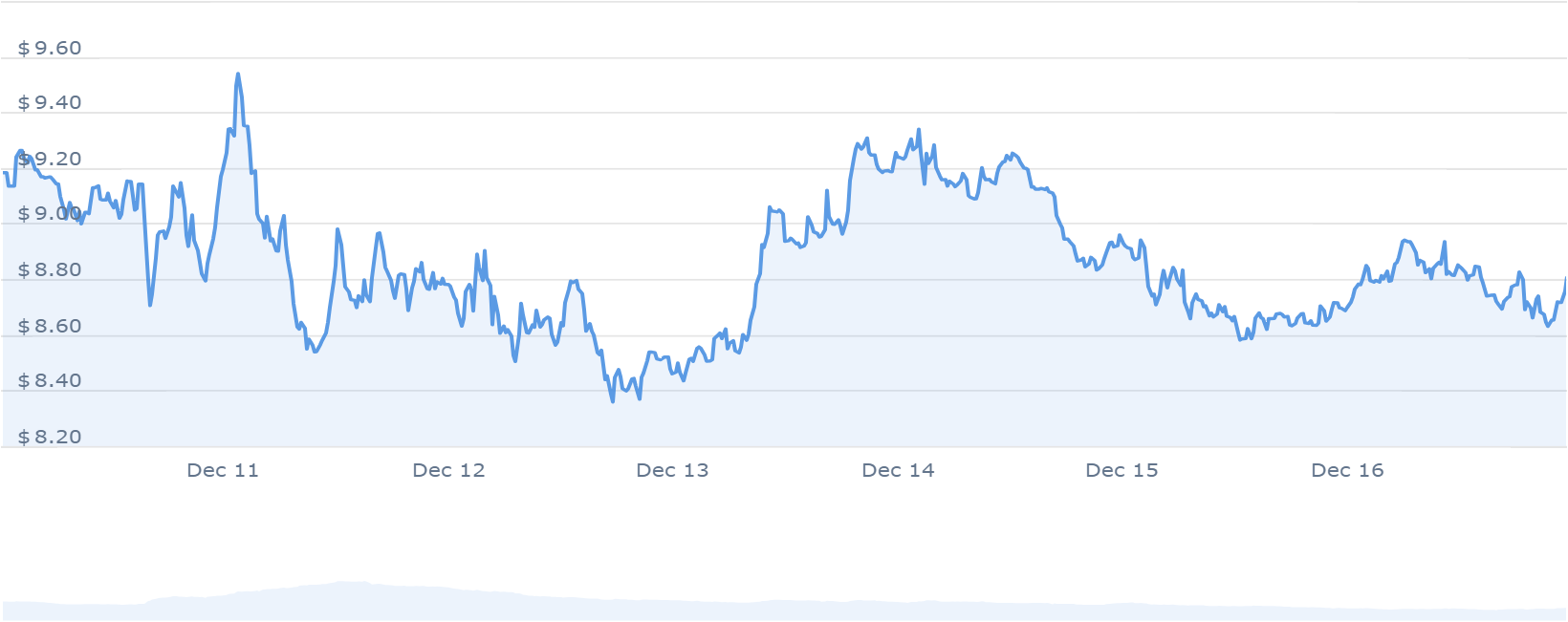

Frax Finance has shown good performance indicators, uping by 70% in a year. Hence, it did better than half of the top 100 crypto assets and consistently trades above a certain average. The coin had positive trading days in the last month, showing it’s easy to buy and sell due to its market cap.

2. Osmosis (OSMO)

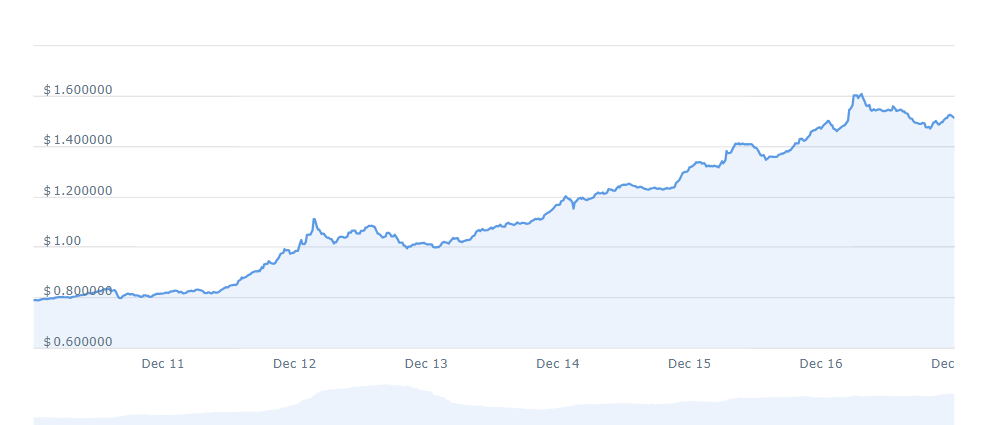

Osmosis (OSMO) coin surged strongly in late October, jumping from $0.225 to $1.5 within two months, an impressive 566% growth. This surge appears tied to news of Osmosis and Umee, the two largest decentralized exchanges (DEXs), planning to merge in the Cosmos network.

The upward trend formed a clear V-shape, breaking resistance levels at $0.686 and $0.908. recently at $1.25, OSMO indicates a solid base for potential future gains. Market sentiment predicts further price increases for Osmosis, with the Fear & Greed Index at 73. This signals a greedy market sentiment. Osmosis currently has 282.46M OSMO coins circulating out of 1.00B OSMO.

Get ready to explore the Milky Way!🥛🧪

📣 Don't miss our exclusive AMA with @milky_way_zone as they unveil their liquid staking solutions for Celestia's ecosystem and gear up for their Mainnet launch!

🗓️ December 18th

📍 Join us here: https://t.co/019lcZFM75 pic.twitter.com/wpennQltNh— Osmosis 🧪 (@osmosiszone) December 15, 2023

Highlights include a 95% price increase in the past year, outperforming 62% of the top 100 crypto assets. It’s also trading above its 200-day simple moving average. In the last 30 days, it saw positive price movements on 73% of days (22 green days). Its liquidity seems strong based on its market capitalization.

3. Cosmos (ATOM)

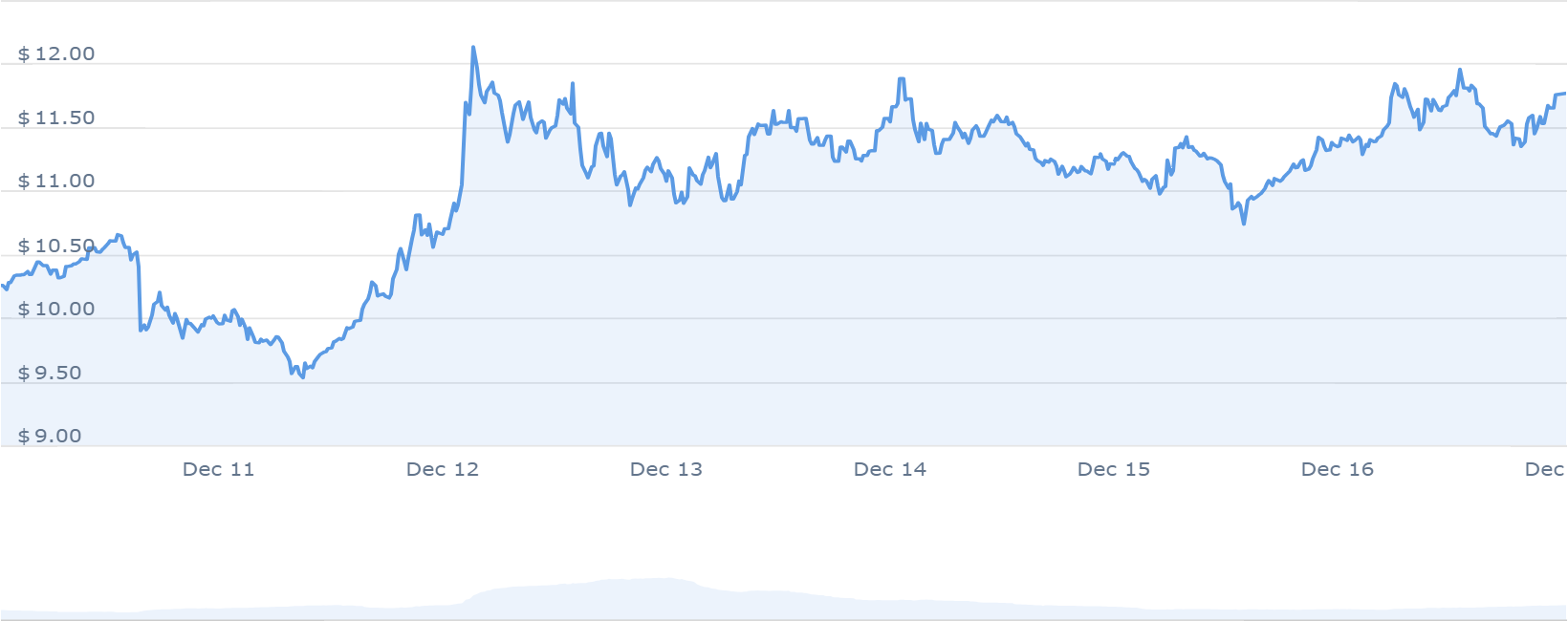

Cosmos has seen a significant % price increase of 34% over the past year. Its trading position is above the 200-day simple moving average, indicating a sustained upward trend. Compared to its token sale price, Cosmos has demonstrated positive performance.

Over the last 30 days, it has experienced 16 green days, accounting for 53% of its recent trading days. Notably, it boasts high liquidity, evident from its market capitalization. The sentiment surrounding Cosmos’ price prediction leans towards a bullish outlook. Moreover, the Fear & Greed Index sits at 73, indicating a sentiment of greed among investors.

1/ A new product product page landed on the #Cosmos website 👀

Discover the premier smart contract framework of the #interchain

Let’s dive into @CosmWasm 💥

👉 https://t.co/y2XPPEX5Zm pic.twitter.com/5kx7eYP2jc

— Cosmos – The Interchain ⚛️ (@cosmos) December 15, 2023

In terms of its circulating supply, Cosmos stands at 379.27 million ATOM. The yearly supply inflation rate is 32.44%, creating 92.90 million ATOM over the past year. As for its market positioning, Cosmos holds the #9 spot in the Proof-of-Stake Coins sector and ranks #15 in the Layer 1 sector.

4. Decentraland (MANA)

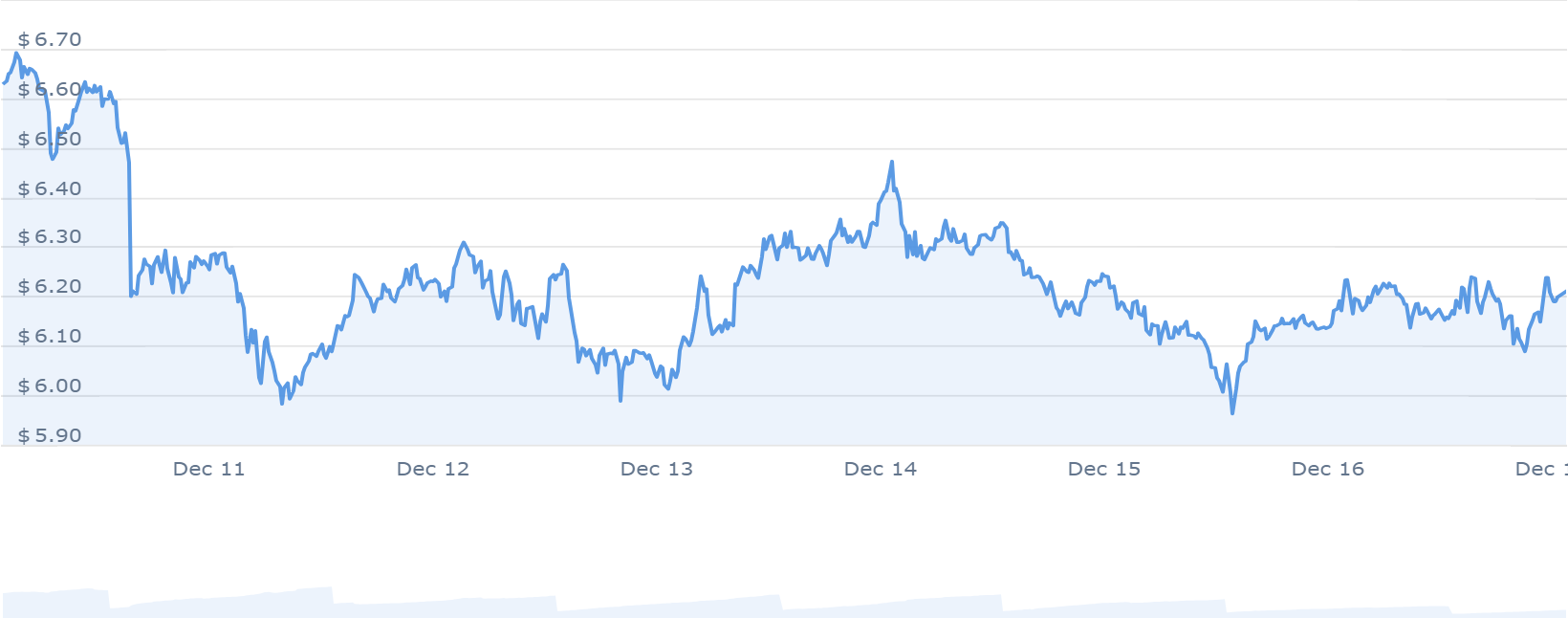

Decentraland has seen significant movements in various metrics over the past year. The price of Decentraland has surged by 49% in the last 12 months, trading consistently above its 200-day simple moving average.

Hence, this positive momentum aligns with its performance compared to its initial token sale price, indicating a favorable trajectory. Over the last 30 days, the asset has experienced 17 days of positive growth, accounting for 57% of the observed period.

Liquidity remains robust for Decentraland, evidenced by its market capitalization within the cryptocurrency space. It currently stands at a circulating supply of 1.89 billion MANA out of a maximum supply of 2.19 billion. The annual supply inflation rate is 2.05%, creating 38.01 million MANA in the past year.

Congratulations to the participants selected for the Decentraland Wellness Week Open Call! #DCLWW24

We're thrilled to see such a diverse and talented group ready to contribute to an exciting week of wellness and community building.

Gold Winners: pic.twitter.com/lHbXwRL3my

— Decentraland (@decentraland) December 13, 2023

The sentiment regarding Decentraland’s price prediction is currently neutral. Meanwhile, the Fear & Greed Index registers 73, indicating a level of greed in the market sentiment.

5. Litecoin (LTC)

Over the last year, Litecoin’s price has increased by 13%, reflecting a rally in value. LTC has experienced 16 green days, making up 53% of that time. This shows it’s been pretty consistent in gaining value.

One of Litecoin’s strengths lies in its high liquidity, which is attributed to its market capitalization. This liquidity allows for smoother trading and exchange activities within its ecosystem.

Why #Litecoin Reigns with MWEB – The innovative technology called MimbleWimble Extension Blocks (#MWEB). This groundbreaking project aims to change the dynamics of privacy and scalability in blockchain transactions. https://t.co/XBlBRKsrty pic.twitter.com/AKfelX0Lia

— Litecoin (@litecoin) December 16, 2023

Currently, predictions about Litecoin’s price are neutral, which means experts aren’t leaning towards it going up or down. However, the Fear & Greed Index tells us that most people are greedy about the coin.

6. Bitcoin Minetrix (BTCMTX)

Bitcoin Minetrix introduces a novel approach wherein users stake BTCMTX tokens to acquire cloud mining credits. The project is to decentralize control and ensure a secure mining experience for token holders.

Currently, the Bitcoin Minetrix staking pool has amassed over 400,000 BTCMTX tokens locked in staking, indicating considerable user interest. The project asserts an annual percentage yield (APY) of 103,225%, attracting attention within the cryptocurrency sphere. Notably, the project’s growth has positioned it among the top-performing cryptocurrencies, partly fueled by its successful BTCMTX presale.

#BitcoinMinetrix Stage 14 has begun! 🎉

What groundbreaking application do you foresee for #DeFi technology in the future?

How might it revolutionize your everyday routines? 🌐🚀 pic.twitter.com/IO9MTX7tRR

— Bitcoinminetrix (@bitcoinminetrix) December 17, 2023

During the presale phase, Bitcoin Minetrix has garnered over $5,405,994 by selling tokens at $0.0123 each, out of a total supply of 4 billion tokens, making 70% (2.8 billion BTCMTX) available for acquisition. Investors have the option to acquire these tokens using either ETH or USDT.

7. Uniswap (UNI)

Uniswap, a prominent player in the DeFi (Decentralized Finance) sector, has seen significant shifts in various metrics over the past year. UNI’s price has surged by 15% in the last year, signaling a positive trend for investors. Currently, the trading price stands above the 200-day simple moving average, indicating a sustained bullish momentum in the market.

Within 30 days, Uniswap has witnessed 16 green days, representing 53% of positive trading sessions. This consistent positive trend might indicate a favorable sentiment among traders and investors. Additionally, the cryptocurrency maintains high liquidity owing to its substantial market capitalization.

The Uniswap Protocol has officially passed $1.76T in trading volume. 🦄 pic.twitter.com/iQBI4sibMT

— Uniswap Labs 🦄 (@Uniswap) December 15, 2023

Regarding market sentiment indicators, the Uniswap price prediction sentiment currently remains neutral. Simultaneously, the Fear & Greed Index registers a score of 73, indicating a tendency towards greed among market participants. These metrics offer insights into the prevailing sentiment and investor behavior regarding Uniswap.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage