Join Our Telegram channel to stay up to date on breaking news coverage

Stablecoins maintained a significant presence in the crypto market, accounting for $51.39 billion. This amount equals 89.68% of the total crypto market’s trading activity over the same duration. Bitcoin, the leading cryptocurrency, observed a minor decline in dominance, now standing at 51.67%, marking a decrease of 0.28% within the day.

6 Best Cheap Crypto to Buy Now Under 1 Dollar

Coinbase, a prominent U.S.-based cryptocurrency exchange, recently petitioned the Securities and Exchange Commission. This petition was a request for customized regulations specifically tailored for digital assets. However, the SEC, chaired by Gary Gensler, officially declined this request, asserting that the current securities framework adequately governs crypto asset securities.

1. BitTorrent (BTT)

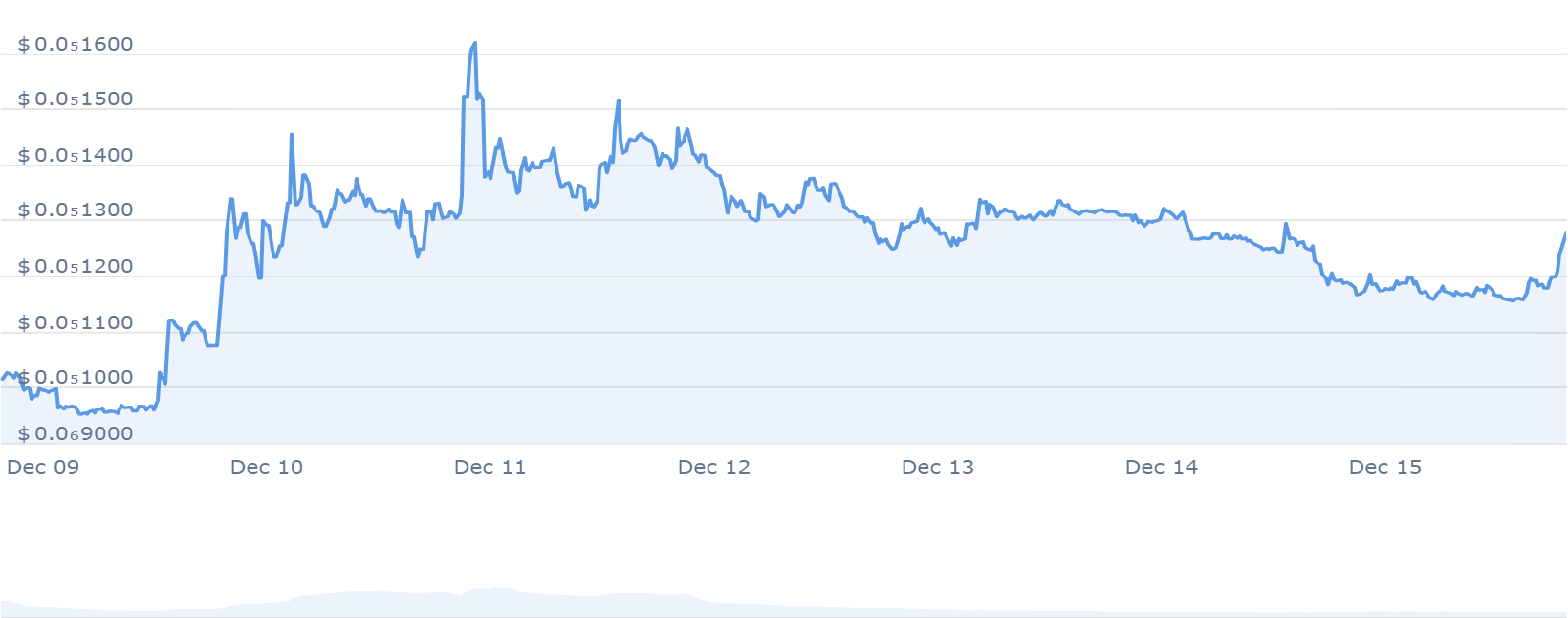

BitTorrent-New (BTT) has seen a significant price jump of 96% in the last year. This upward trend puts it ahead of 65% of other top cryptocurrencies. It’s consistently traded above the 200-day moving average, a sign of stability.

In the past 30 days, BitTorrent has had 16 days of positive growth, making up 53% of that period. This has made it attractive to traders due to its high liquidity, backed by its market cap.

Regarding its supply, BitTorrent’s yearly inflation rate is 0.64%. Out of the maximum supply of 990.00 trillion BTT, there are currently 951.42 trillion BTT in circulation. Over the last year, around 6.10 trillion BTT was created, maintaining a controlled inflation rate.

📢#BTFS V2.3.4 beta(Hopper) is Now Live Updates are as follows:

✅Added support for the BTIP-52 proposal

✅Optimized the BTIP-25 proposal, which adds AWS S3-compatible API services to the BTFS protocol

✅The code structure has been optimizedhttps://t.co/SHaYA1UfzJ pic.twitter.com/FEfzAd5t0f— BitTorrent (@BitTorrent) December 13, 2023

Experts predict a bullish trend for BitTorrent-New (BTT). The Fear & Greed Index scores 67, indicating ‘Greed.’ In the Tron Network sector, BitTorrent holds the second spot in market capitalization.

2. Gas (GAS)

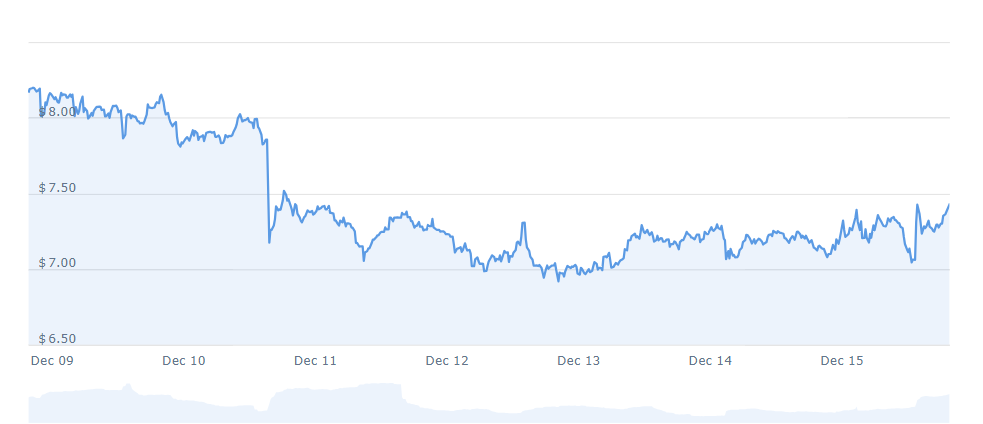

Gas leapt by 236% in the past year, overtaking 83% of the top 100 cryptocurrencies. Currently, it’s trading above its 200-day average, showing price stability. Moreover, GAS’s market cap indicates good liquidity.

Sentiments lean towards a bullish Gas price prediction, aligned with a Fear & Greed Index score of 67 (Greed). With 65.51M GAS in circulation out of a maximum of 100.00M GAS, the yearly supply inflation rate is notably high at 546.81%. This has led to the creation of 55.38M GAS last year. In addition, Gas ranks #2 in the NEO Network sector by market cap.

Experts foresee Gas as a promising crypto, predicting a maximum price of around $5.35 post-market recovery. Plus, an estimated average price of $4.72 by 2023. However, a major bearish market trend could lead to a minimum price of $4.09 in 2023.

3. dYdX (DYDX)

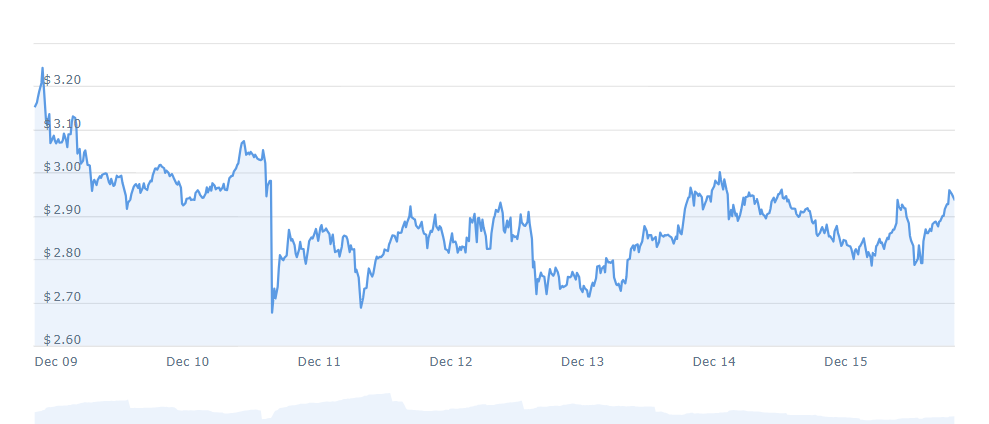

The dYdX Foundation has delegated 2.3 million DYDX, 88.4% of its staking capacity, to 10 Validators. This move shows the Validators’ importance in the dYdX ecosystem and the Foundation’s commitment to securing the dYdX Chain network. They followed clear principles for this delegation based on best practices for Validators and Stakers.

Right now, the sentiment about dYdX’s price prediction is neutral, and the Fear & Greed Index sits at 67 (Greed). Currently, 183.77 million DYDX tokens are circulating out of a maximum supply of 1 billion. Over the past year, dYdX’s price has increased by 78%, performing better than 60% of the top 100 crypto assets. It’s also doing well in trading, staying above the 200-day simple moving average. Moreover, DYDX’s market cap suggests substantial liquidity within the market.

The dYdX Foundation is delighted to announce the decision to start delegating DYDX 🔒

The Foundation has delegated a total of 2.3M DYDX to 10 Validators based on the framework set out in the Stake Delegation Principles guideline.

Read to learn more👇https://t.co/0wU7xcdCu7

— dYdX Foundation 🦔 (@dydxfoundation) December 15, 2023

Experts are looking at dYdX as a potential standout crypto shortly. They predict that DYDX might hit a high of around $5.13 when the crypto market bounces back. The expected average price for DYDX by 2023 is around $4.53. But if the crypto market takes a big downward turn, it could drop to a low of $3.92 by 2023.

4. Immutable (IMX)

Immutable has introduced the Immutable zkEVM, a new platform made with Polygon Labs. This tech aims to shake up gaming by tackling gas fees, making them vanish for players.

This move could make it a lot cheaper for people to try out new games. Game makers can cover gas fees for users with the Immutable Passport, making it easier for them to start playing. Immutable also plans to foot the gas bill for all games in its ecosystem at the start. The estimate is that the game studios will cost around $500 to $1,000 for every 100,000 players.

Immutable zkEVM is gas-free for gamers!

Gas Fees? Zero.

We are proud to announce that Immutable zkEVM and Immutable Passport will be capable of eliminating gas fees for all players!… pic.twitter.com/CJBV8XZI7w

— Immutable (@Immutable) December 13, 2023

Immutable hosts over 200 games on its platform, not just on zkEVM. Moreover, Immutable is performing well, with its price increasing by 370% annually. This means the coin performs better than most other top 100 crypto assets. The token has also been trading consistently higher than its initial sale price and has good liquidity based on its market cap.

5. Bitcoin Minetrix (BTCMTX)

Bitcoin Minetrix, a cloud mining platform, revolutionizes by introducing tokenization to address concerns within third-party cloud mining. Its goal is to offer individuals a secure, transparent way to engage in decentralized Bitcoin (BTC) mining.

The project has attracted substantial engagement, with over 400,000 BTCMTX tokens already staked. The reported annual percentage yield (APY) stands at 103,225%, but this figure will likely decrease as more tokens get staked.

Regarding token distribution, Bitcoin Minetrix allocates 42.5% of BTCMTX tokens to fund mining operations, while 35% is directed towards marketing and BTCMTX growth. Additionally, 15% rewards active community participation, and 7.5% serves as BTCMTX staking rewards until their cloud mining platform is developed.

https://twitter.com/bitcoinminetrix/status/1735706516001362064

The ongoing presale raised over $5,343,365 by offering BTCMTX tokens at $0.011 per token. During this phase, 70% of the total token supply (2.8 billion BTCMTX) is accessible through investments in Ethereum (ETH) or Tether (USDT). However, it requires a minimum investment of $10 for interested participants.

6. Kava (KAVA)

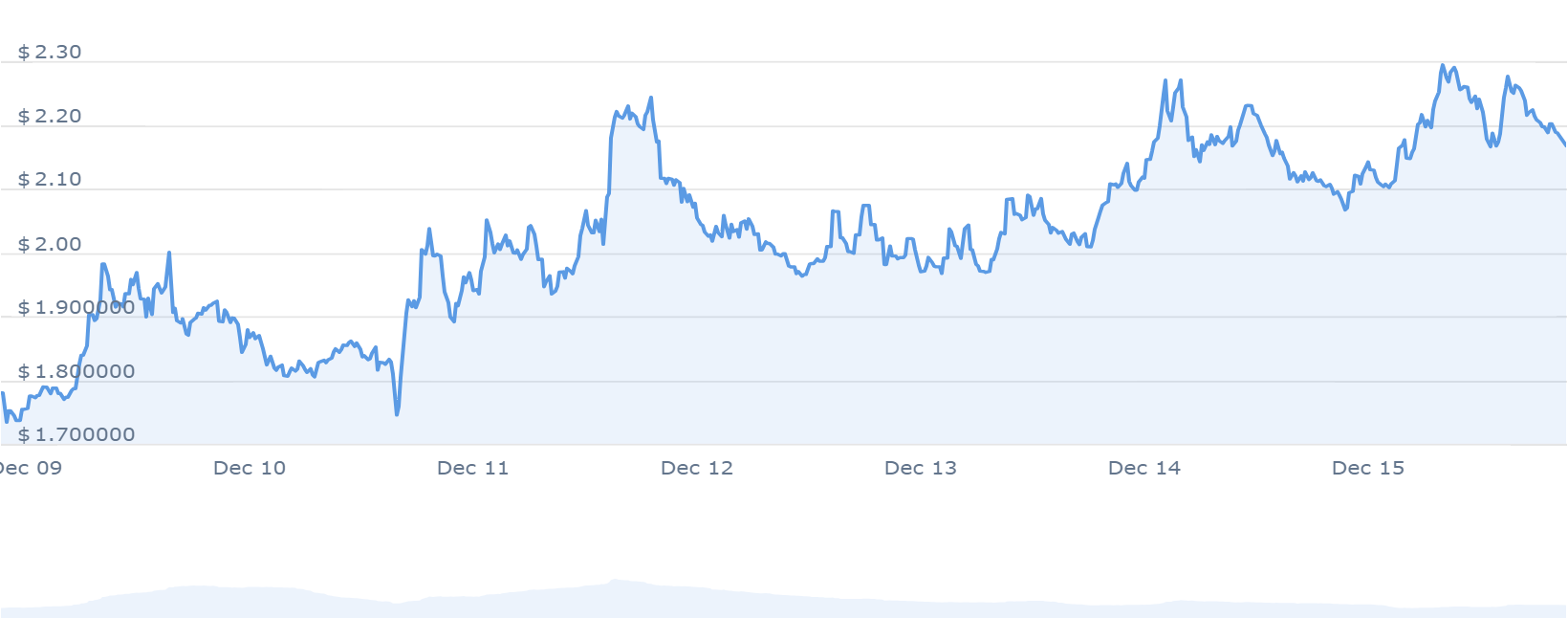

Kava and Injective recently joined forces to make stable assets like USDt more accessible in decentralized finance (DeFi). Kava plans to issue USDt in the Cosmos ecosystem, backed by the Tether foundation. This collaboration allows USDt from Kava to flow directly into Injective. Plus, Kava is offering token rewards to encourage people to use USDt on Injective.

This teamwork marks a big step forward in DeFi, blending the strengths of both platforms. Furthermore, it makes things smoother for users and strengthens Injective’s role in handling cross-platform assets.

Kava’s market seems positive, with predictions bullish and a Fear & Greed Index showing ‘greed’ at 67. There’s a circulating supply of 1.03 billion KAVA out of a maximum of 324.13 million KAVA. Moreover, Kava had an inflation rate of 210.47%, creating 698.02 million KAVA in the past year.

Expanding access to stable assets like $USDT across the #Cosmos is critical to global #DeFi adoption. Onward! ⚛️ 👨🚀 https://t.co/slJtxwxID7

— Kava (@KAVA_CHAIN) December 14, 2023

In rankings, Kava stands 10th in the DeFi Coins sector and 38th in the Layer 1 sector. Some good signs include trading above the 200-day moving average. Due to its market cap, it has also seen 16 out of the last 30 days in green (53%) and high liquidity.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage