Join Our Telegram channel to stay up to date on breaking news coverage

Brazil’s Securities and Exchange Commission (CVM) has made history by approving the world’s first spot XRP exchange-traded fund (ETF), marking a significant milestone for the cryptocurrency market. This development strengthens XRP’s position as a leading digital asset and could attract substantial capital inflows. As seen with Bitcoin, ETF approvals often lead to increased market interest and price surges. In the past 24 hours, XRP has gained over 6% and is pushing towards the $3 mark.

Meanwhile, regulatory uncertainty continues to affect the U.S. market, but former U.S. President Donald Trump’s recent support for Ripple on Truth Social has further fueled XRP’s momentum. In light of this bullish prediction, investors are searching for the best altcoins to invest in today.

6 Best Altcoins To Invest In Today

Injective continues to bridge the gap between traditional finance (TradFi) and decentralized finance (DeFi), making steady advancements in the sector. BTC Bull Token (BTCBULL) is gaining momentum, having raised over $2 million within its first week of presale. Meanwhile, Celestia is currently valued at $3.24, boasting a market capitalization of $1.73 billion and a 24-hour trading volume of $94.91 million.

EOS Network has introduced Spring v1.1, a new update designed to enhance efficiency, scalability, and overall performance. Additionally, Filecoin’s integration with Cardano via Blockfrost is providing developers with a decentralized and cost-effective storage solution. PYTH is trading at $0.2161, with a market cap of approximately $783.61 million. On a broader scale, Bitcoin has rebounded to around $96,000, while XRP has surged by 6%.

1. Injective (INJ)

Injective is making steady progress in merging traditional finance (TradFi) with decentralized finance (DeFi). Co-founder Eric Chen recently discussed this shift on CNBC, emphasizing how Injective’s infrastructure is enabling financial markets to move on-chain. One of its key innovations is the TradFi Stock Index, which consolidates multiple publicly traded indices into a single on-chain product. This approach provides unrestricted access to both individual users and institutions.

The network has seen significant activity, surpassing 1.5 billion on-chain transactions and producing over 100 million blocks. While these metrics highlight strong adoption, Injective is focusing on further expansion. Upcoming initiatives include the launch of new decentralized applications (dApps), the integration of real-world assets (RWAs), and additional tools to enhance on-chain financial solutions.

Injective co-founder @ericinjective went on @CNBC to discuss how Injective is enabling the world of traditional finance to move on-chain with its groundbreaking infrastructure and new financial primitives.

Injective's recent launches, such as its TradFi Stock index, combine… pic.twitter.com/OAj41Xykv0

— Injective 🥷 (@injective) February 19, 2025

In the market, Injective’s token (INJ) currently holds the #58 ranking, with a market capitalization of approximately $1.52 billion. The token is priced at $15.38, reflecting an 11.73% increase over the past day. Trading volume in the last 24 hours stands at $116.33 million, accounting for 7.63% of the market cap.

2. BTC Bull Token ($BTCBULL)

BTC Bull Token (BTCBULL) is gaining significant traction in the market, raising over $2 million in its first week of presale. Interest in Bitcoin-linked projects remains high, and BTCBULL stands out with its unique reward system that benefits holders as Bitcoin’s price climbs.

BTC Bull Token rewards investors by distributing actual Bitcoin when BTC surpasses key price milestones, starting at $150,000. Each time Bitcoin’s price increases by another $50,000, BTCBULL holders receive additional BTC airdrops directly to their wallets. This mechanism provides multiple opportunities for investors to earn Bitcoin without purchasing it outright.

Beyond Bitcoin rewards, BTCBULL incorporates a deflationary burn system that activates when BTC reaches $125,000. Additional burns will occur at higher price levels, reducing the overall supply of BTCBULL over time. The project also includes a staking protocol with an estimated annual yield of 196%. Since its launch, investors have staked over 536 million tokens, and once the presale concludes, rewards will be distributed over two years.

BTC Bull Token’s presale continues to gain momentum, raising around $200,000 daily. Investors can participate using crypto, credit or debit cards, or the Best Wallet mobile app. To ensure transparency, the BTCBULL team has undergone security audits by Coinsult and SolidProof, both of which confirmed no honeypot risks.

Looking ahead, BTCBULL is expected to launch on an Ethereum-based decentralized exchange, with Uniswap as the most likely listing platform. If trading volume and liquidity grow sufficiently, centralized exchange listings may follow.

Visit the BTC Bull Token Presale

3. Celestia (TIA)

Towns Protocol is working towards a decentralized future for online communication, allowing communities to maintain control over their digital spaces and content. The platform has integrated Celestia (TIA) as its underlying infrastructure to support scalability.

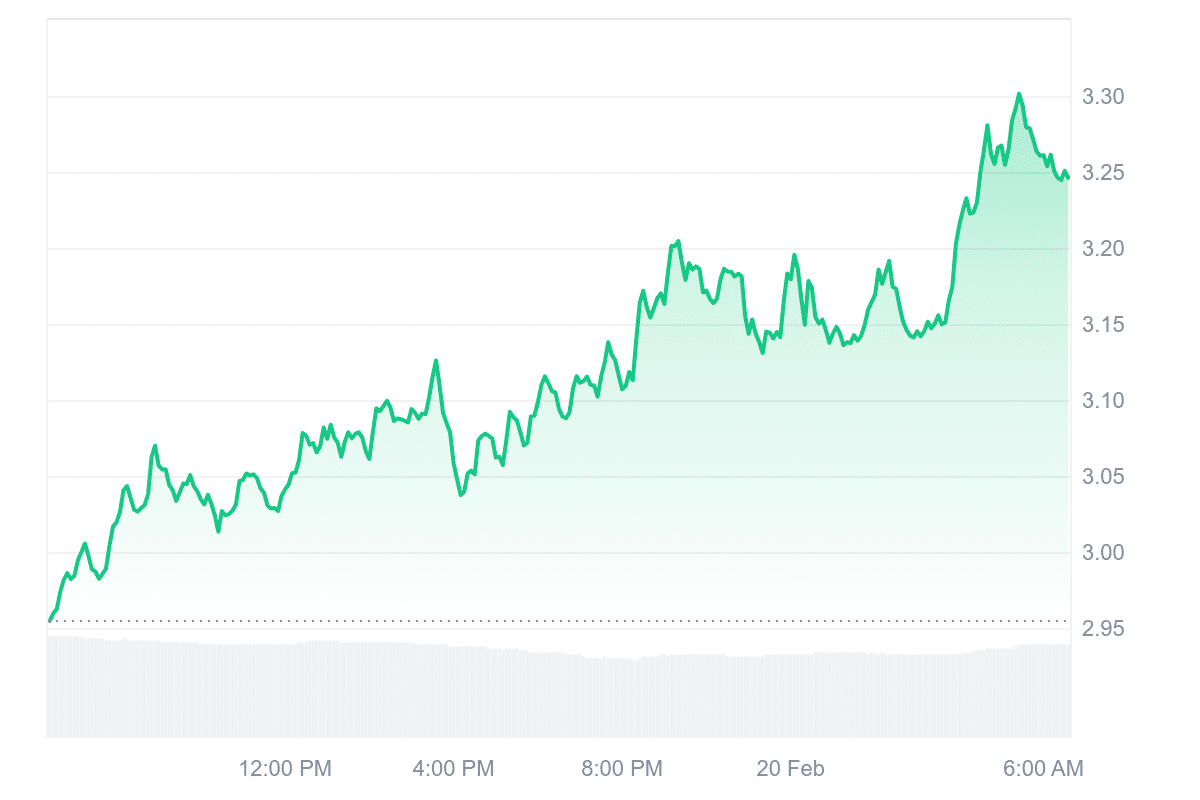

Currently, Celestia is trading at $3.24, with a market capitalization of $1.73 billion and a 24-hour trading volume of $94.91 million. The ratio of volume to market cap suggests a relatively high level of liquidity.

Scale at the speed of conversation

and keep what you create

with Celestia underneath 🦣 https://t.co/5BwwyWFYJl

— Celestia 🦣 (@celestia) February 19, 2025

Looking ahead to February 2025, market projections indicate that Celestia’s price may rise significantly, with estimates ranging from $3.26 to $11.29. The average forecasted price is $6.22, representing a potential increase of 93.24%. If this trend materializes, the return on investment could reach 250.77% compared to the current valuation.

4. EOS (EOS)

EOS Network has released Spring v1.1, an update that aims to improve performance, efficiency, and scalability. This upgrade enhances key network functions, speeds up transactions, and optimizes resource allocation.

One of the notable improvements is faster block processing, which increases transaction speed. Additionally, optimized bandwidth usage helps reduce congestion by managing resources more effectively. The update also introduces a Pause & Sync feature, allowing smoother upgrades without disrupting network operations. Furthermore, enhanced smart contract performance ensures more efficient execution of decentralized applications.

Spring v1.1: The latest update boosts the $EOS network with faster speeds, improved efficiency, and better scalability.

What's New in Spring v1.1?

⚡ Faster Block Processing

🌐 Smarter Bandwidth Usage

⏸ Pause & Sync for Upgrades

⚙️ Enhanced Smart Contract Performance… pic.twitter.com/2qoKcHiGxo— EOS Network (@EOSNetworkFDN) February 19, 2025

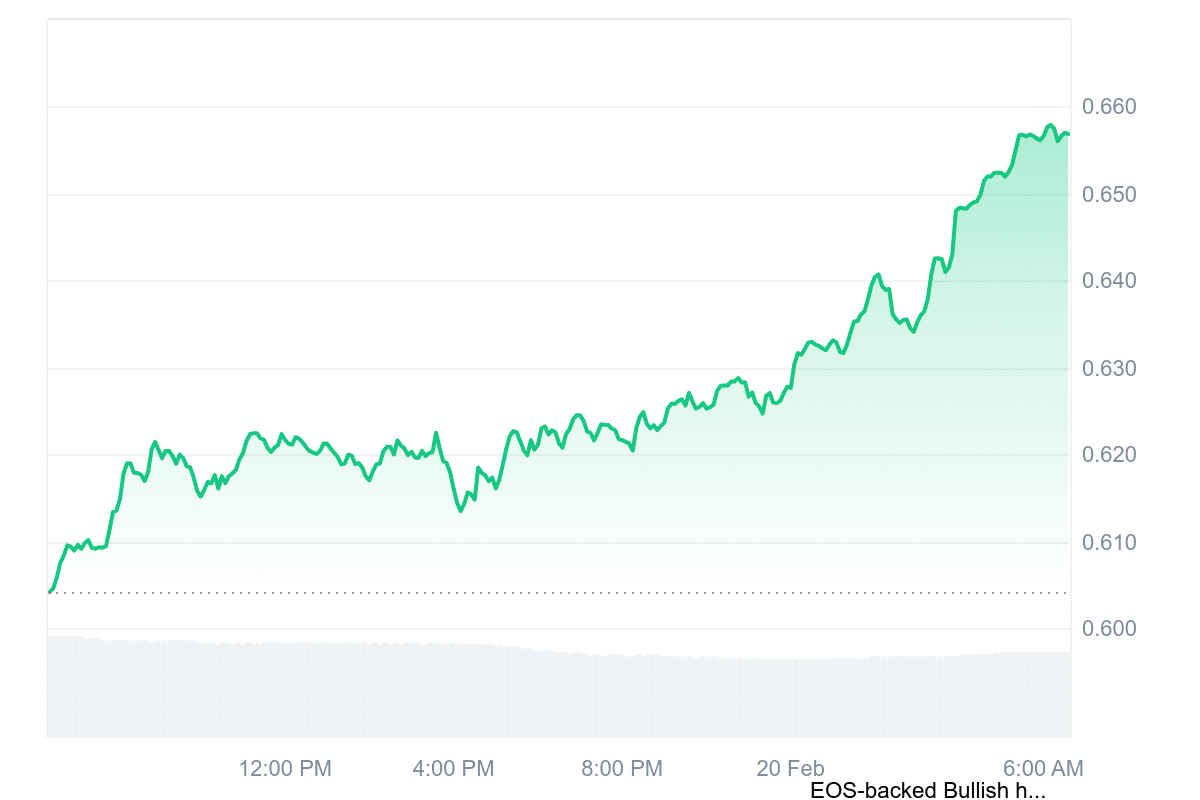

In terms of market performance, EOS is currently priced at $0.6568, reflecting a 7.99% increase over the last 24 hours. Its market capitalization is approximately $1.01 billion, and its 24-hour volume-to-market cap ratio is 0.1644, indicating relatively high liquidity.

5. Filecoin (FIL)

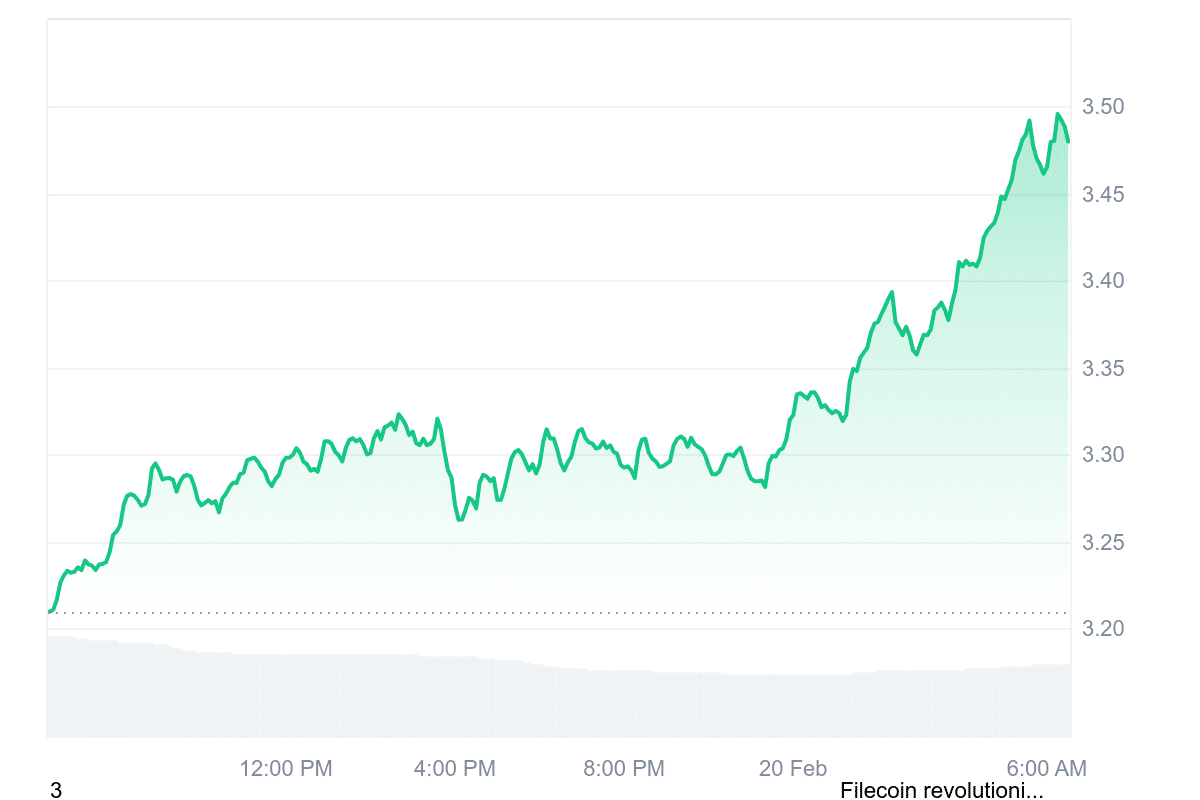

Filecoin’s integration with Cardano through Blockfrost offers developers a decentralized, cost-efficient storage solution. This integration simplifies data management by providing reliable, easily accessible storage without requiring complex infrastructure.

The platform is designed for scalability and efficiency, making it suitable for AI and other data-driven applications. Its decentralized nature enhances security and transparency while reducing operational costs. With a market capitalization of approximately $2.2 billion and a 24-hour trading volume-to-market cap ratio of 0.1184, Filecoin demonstrates strong liquidity.

Building on @Cardano? Get fast, cost-effective, and decentralized storage. @blockfrost_io integrates Filecoin, giving developers a simple way to store data reliably, access it quickly, and cut costs—without managing complex systems. Scalable, efficient, and built for speed. pic.twitter.com/AhLpYi4xzL

— Filecoin (@Filecoin) February 19, 2025

At a price of $3.48 per FIL token, reflecting a 7.72% increase in a day, the asset has shown notable movement. FIL’s combination of affordability, accessibility, and decentralized functionality positions Filecoin as a practical choice for developers seeking streamlined data storage solutions.

6. Pyth Network (PYTH)

Pyth Network, a decentralized oracle provider, facilitates real-time market data exchange across more than 40 blockchains. Its first-party oracle technology enhances investor accessibility through major European exchanges and exchange-traded notes (ETNs).

As of now, PYTH is priced at $0.2161 and has a market capitalization of approximately $783.61 million. The asset’s price has increased by 7.06% in the past day, reflecting recent market activity.

Market projections indicate a potential increase of 83.11% in PYTH’s value over February. The estimated average price for the month is around $0.3969, with fluctuations between $0.2122 and $0.7132. If the trend holds, investors could see a potential return of 229.02%.

Integrate Pyth Core on HyperEVM: https://t.co/D7rIXLteIb

For seamless integrations, 20 assets are sponsored and regularly pushed on HyperEVM including $BTC, $ETH, $SOL, $HYPE, $HFUN, $PURR, $USDC, $USDe, and more: https://t.co/9s34w94oAv

— Pyth Network 🔮 (@PythNetwork) February 19, 2025

Following an expected positive performance in February, PYTH’s price may continue its upward trajectory in March. Forecasts suggest a price range of $0.6494 to $0.9906, averaging at $0.8263. This represents a projected increase of 281.37% from the current level, with a potential return on investment (ROI) of 357.17%.

Learn More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage