Join Our Telegram channel to stay up to date on breaking news coverage

Continuing our previous discussion of the best altcoins to invest in right now, we now introduce a fresh compilation of assets for you to consider. Before delving into this list, let’s take a moment to review some recent financial updates.

6 Best Altcoins to Invest In Right Now

Established and widely recognized cryptocurrencies typically command higher prices and are currently undergoing a bearish trend.

However, this scenario is anticipated to change, opening up enticing investment prospects within alternative tokens. Here are the top six alternative tokens worth considering for inclusion in your portfolio.

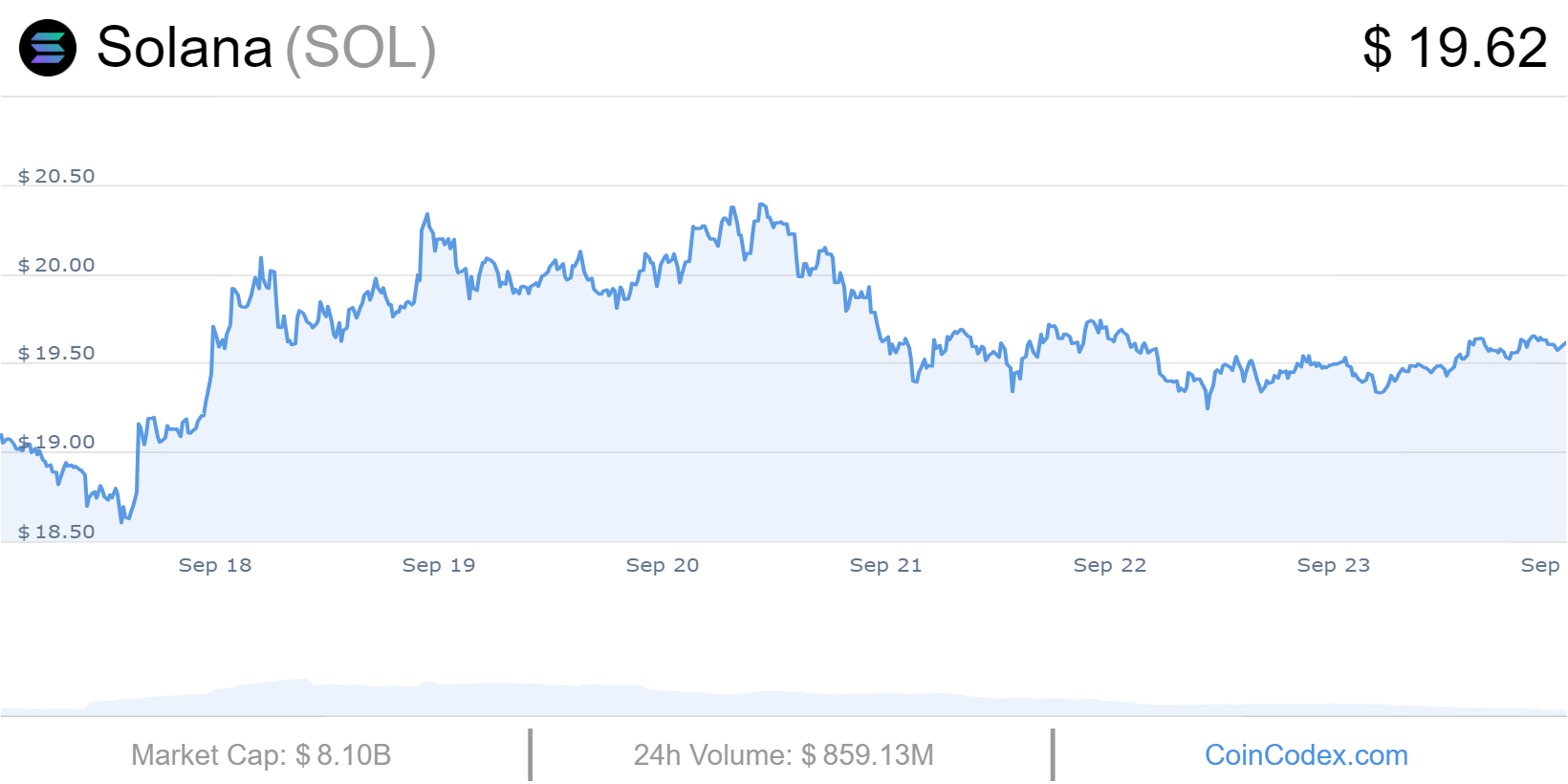

1. Solana (SOL)

Solana operates as a blockchain platform, combining Proof-of-Stake (PoS) consensus with Proof-of-History (PoH) mechanisms to balance high throughput and robust security. PoH, a cryptographic method, timestamps events using time intervals, assisting in ledger state verification before creating new blocks.

Solana’s swift processing capabilities have garnered substantial attention within the cryptocurrency community. This is made possible through a hybrid protocol, effectively shortening transaction and smart contract validation times. Theoretically, Solana’s architectural design could support up to 710,000 transactions per second (TPS).

Solana’s primary mission revolves around facilitating the development of decentralized applications (DApps) and enhancing scalability by integrating PoH consensus with the underlying PoS consensus.

The native digital currency within the Solana network is the Solana (SOL) token. Moreover, Solana accommodates the creation of additional tokens, provided they adhere to the guidelines outlined in the Solana Program Library (SPL).

The Hyperdrive Hackathon is heating up, with over 4,000 builders from across the world! 🔥

Projects are due on October 15, with up to $1 million in prizes & seed funding up for grabs.

Sign up & start building to launch your crypto startup on Solana. ⬇️https://t.co/0HfrxRWgbd

— Solana (@solana) September 20, 2023

Through the Delegated Proof-of-Stake (DPoS) mechanism, SOL token holders can opt to delegate their tokens to vote for validators involved in transaction processing on the network.

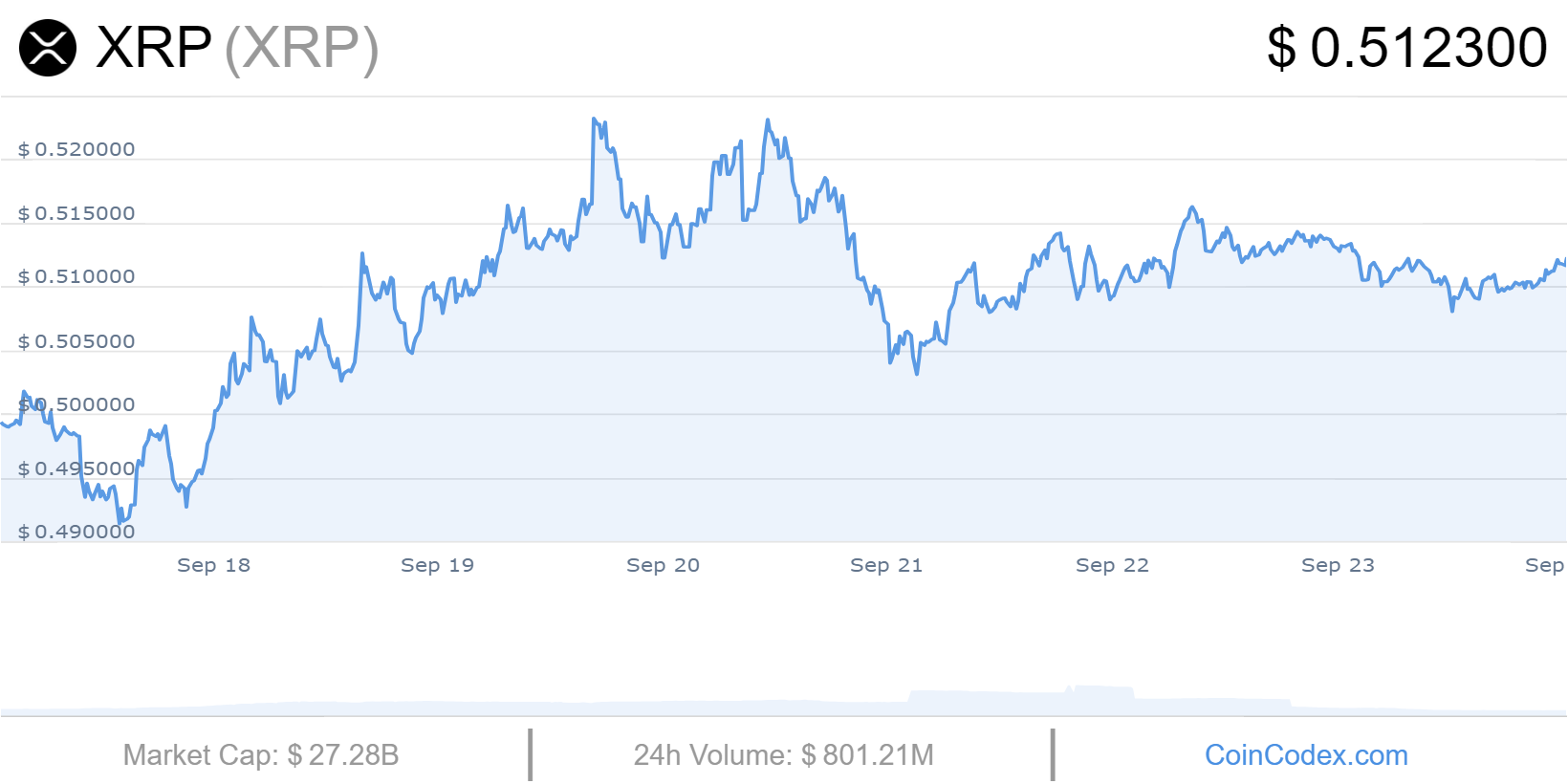

2. XRP (XRP)

XRP operates as a decentralized payment network with the primary objective of potentially replacing the conventional SWIFT money transfer system. Unlike some blockchain networks, XRP employs a unique consensus model where all authorized nodes must validate transactions.

This design ensures robust security measures without compromising transaction efficiency, resulting in an average transaction completion time of around four to five seconds.

The XRP Ledger (XRPL) serves as an open-source, permissionless, and decentralized technology, offering several notable advantages. Transactions on XRPL are notably cost-effective, with fees as low as $0.0002 per transaction.

Furthermore, XRPL boasts impressive transaction speed, typically settling transactions within 3-5 seconds. Scalability is another strong point, with XRPL capable of processing up to 1,500 transactions per second. A key highlight of XRPL is its environmentally friendly nature, carbon-neutral, and energy-efficient.

💡 24/7/365 availability

🔍 Transparency throughout the journey

👍 Low cost

✅ Instant settlementRipple’s Aaron Sears makes the case for crypto-enabled payments in the latest #CryptoInOneMinute.⏱️ pic.twitter.com/mw4dCOxBfw

— Ripple (@Ripple) September 22, 2023

Additionally, XRPL introduces innovative features such as the first decentralized exchange (DEX) and built-in custom tokenization capabilities within its protocol. It’s important to note that XRPL has a proven track record, operating reliably since 2012, having closed an impressive 70 million ledgers.

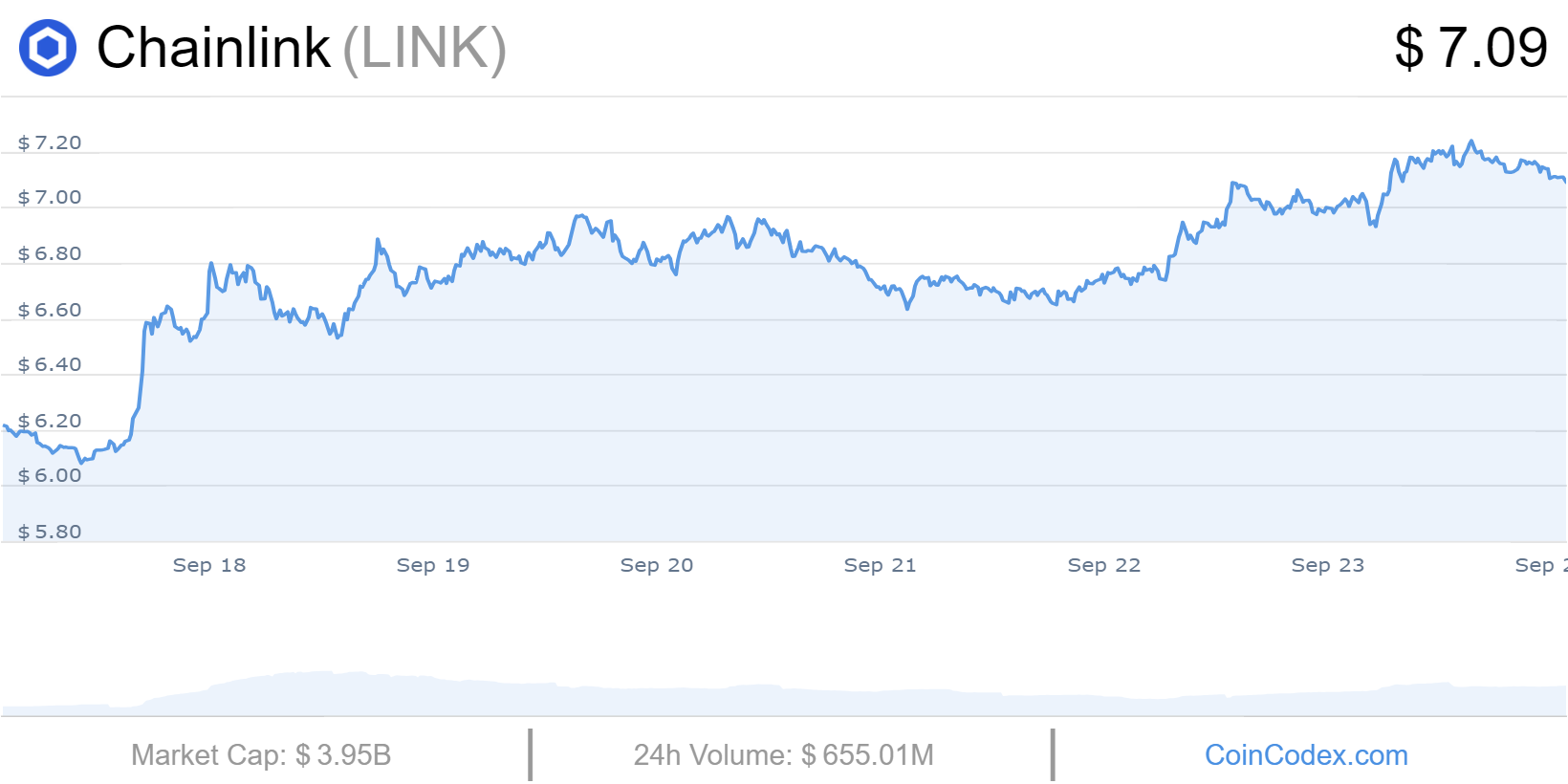

3. Chainlink (LINK)

Chainlink is a blockchain abstraction layer designed to address the “oracle problem” encountered by smart contract-enabled blockchains like Ethereum. Its fundamental role is to act as an intermediary between the off-chain and on-chain realms, allowing smart contracts to access real-world data and interact with external sources seamlessly.

Fundamentally, Chainlink operates through a decentralized oracle network consisting of various independent nodes following a standardized data collection method.

These nodes facilitate the secure and trustless data transfer from external sources and APIs to smart contracts. This mechanism ensures that smart contracts can execute predetermined actions when specific conditions are met.

The LINK token is a pivotal component within the Chainlink ecosystem, which functions as an ERC-677 standard token on the Ethereum platform. LINK tokens hold a critical role while retaining the core properties of ERC-20 tokens.

With thousands of independent decentralized oracle networks each dedicated to performing specific functions with maximum reliability, #Chainlink resides at the fifth level of secure system design. pic.twitter.com/VPRwm5UsYV

— Chainlink (@chainlink) September 23, 2023

They compensate node operators, who also employ LINK tokens as collateral. In essence, node operators are motivated to provide accurate data, as submitting erroneous information may result in losing their collateral.

In summary, Chainlink’s mission revolves around addressing the oracle problem by establishing decentralized oracle networks that facilitate the seamless flow of real-world data to smart contracts. This plays a vital role in enhancing the functionality and reliability of smart contracts, thereby paving the way for their broader adoption across various applications.

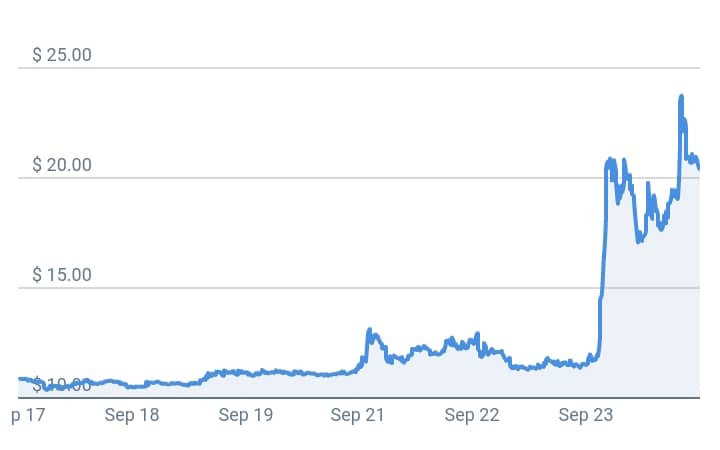

4. Cream Finance (CREAM)

CREAM Finance functions as a decentralized DeFi lending protocol within the yearn.finance ecosystem. It offers financial services to individuals, institutions, and protocols in a permissionless and open-source manner. Notably, the platform is compatible with multiple blockchains, including Ethereum, Binance Smart Chain, Polygon, and Fantom.

One of CREAM Finance’s notable features is its inclusive yield farming rewards program. Users can participate by supplying supported assets as collateral, enabling them to borrow and lend assets while earning rewards in CREAM tokens. In return, the platform generates revenue from swapping, lending, and borrowing fees.

CREAM Finance also enhances liquidity for significant DeFi assets through automated market making (AMM). It supports a diverse range of tokens, including major stablecoins, governance tokens, and other leading cryptocurrencies.

As an ERC20 token on the Ethereum network, CREAM harnesses the power of Ethereum Virtual Machines through smart contracts. This empowers users to create decentralized autonomous organizations (DAOs) for their communities, promoting better composability by enabling the integration of various financial services.

C.R.E.A.M. lending markets have launched on Base. Users can now supply and borrow $WETH $cbETH $USDbC $DAI at https://t.co/JmBbwhFr2h on @BuildOnBase.

All supply/borrow activity with the new Base C.R.E.A.M. markets will be accounted for.

— Cream Finance 🍦 (@CreamdotFinance) August 24, 2023

Summarily, C.R.E.A.M Finance offers a decentralized lending and borrowing solution while actively contributing to the liquidity of essential DeFi assets. Its multi-chain compatibility, open-source nature, and capability for smart contract-based DAOs make it a versatile player in the DeFi ecosystem.

5. Sweatcoin (SWEAT)

Sweatcoin is a cryptocurrency initiative aimed at promoting physical activity and encouraging a healthier lifestyle. Users can accumulate sweatcoins by simply walking or running through the Sweatcoin app, which can then be redeemed for rewards within the app.

The SWEAT cryptocurrency is being developed on the NEAR blockchain platform, known for its scalability and support for smart contracts. It’s worth noting that, upon launch, SWEAT will be accessible as both a NEP-141 token on NEAR and an ERC-20 token on Ethereum.

One key feature of the Sweatcoin cryptocurrency is the implementation of “Movement Validators” to verify the authenticity of user-generated activity data.

Sweatcoin emphasizes its commitment to user data privacy, asserting that it will never sell user-generated data. Nevertheless, they intend to introduce an optional data monetization program, enabling users to earn rewards by sharing their data with third parties.

Hey America, how are you building your crypto portfolio?

If you join Sweat Wallet by Oct. 16, 2023, you can use our crypto-to-crypto trade feature powered by @OrderlyNetwork to build and manage your portfolio right in #SweatWallet#SWEATUS

Want in? Join using the link below⤵️ pic.twitter.com/vxO5mdGgst— Sweat Еconomy 💧 (@SweatEconomy) September 22, 2023

Furthermore, the project plans to launch the Sweat Wallet app, providing users access to various decentralized finance (DeFi) services. This wallet will offer token conversion, yield generation through Sweatcoin staking, liquidity provision, and more.

6. Launchpad (XYZ)

Launchpad XYZ is a blockchain startup with ambitions to reshape the landscape of Web 3.0 investments. Within the Web 3.0 investment domain, various products like utility tokens, NFTs, play-to-earn games, and ICOs coexist. Launchpad XYZ endeavors to simplify the Web 3.0 experience for newcomers and seasoned investors through its ecosystem.

The cornerstone of Launchpad XYZ’s approach revolves around comprehensive analysis, insights, sentiment analysis, and data provision. The ultimate aim is to equip crypto investors, regardless of their experience level, with valuable information to facilitate well-informed decisions.

From an investment perspective, Launchpad XYZ employs a stake-to-access mechanism designed to drive demand for LPX tokens. Additionally, LPX is required to cover fees when participating in fractional asset investments. Furthermore, LPX token holders can enjoy reduced trading fees on the Launchpad DEX.

Individuals interested in acquiring LPX tokens, either for utilizing the platform’s features or as an investment, can do so through the Launchpad XYZ presale. The presale comprises 10 stages, each incrementally adjusting the token’s price.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage