Join Our Telegram channel to stay up to date on breaking news coverage

Insidebitcoins regularly update investors with the best-trending altcoins in the crypto world.

The global cryptocurrency market currently boasts a market capitalization of $1.12 trillion, showing a marginal decrease of 0.02% within 24 hours. This minimal dip indicates some level of market volatility over a short timeframe.

Over the same period, the total trading volume for cryptocurrencies amounted to $43.1 billion, reflecting a noteworthy 9.57% decrease. In addition, decentralized finance (DeFi) transactions contributed $2.27 billion, equivalent to 5.26% of the total 24-hour crypto market volume.

6 Best Altcoins to Invest In Right Now

The cryptocurrency market exhibits minor fluctuations in market capitalization and trading volumes, highlighting the dynamic nature of this financial ecosystem. These statistics offer valuable insights to individuals tracking cryptocurrency and provide a basis for further analysis and decision-making.

1. Litecoin (LTC)

Litecoin maintained a consistent bearish trend in 2023, largely influenced by the 50-day Exponential Moving Average (EMA). It has traded within the range of $60 to $72, and recent technical indicators point to a challenging outlook. In addition, the 50-day EMA has consistently acted as a significant resistance level, with Litecoin’s current value resting at $63.97. This marks a modest intraday increase of 1.62% following a recent 4% dip over two days.

The Relative Strength Index (RSI) remains in neutral territory, below the 14-day Simple Moving Average (SMA). While short-term trends lean towards the bearish side, there are hints of potential bullish behavior if Litecoin can breach the 50-day EMA. Targets of $70 and $100 come into view. However, should bearish sentiment persist, a drop below $60 may become imminent, bringing the $50 support level under scrutiny.

Litecoin has witnessed on-chain activity despite the prevailing bearish momentum, especially from long-term investors. Following the 3rd halving event on August 2, 2023, which reduced block rewards for miners from 12.5 LTC to 6.25 LTC, expectations of a decline in Litecoin’s value were in place.

Hey @ferrari we want to pay in #Litecoin! One of the oldest and largest most reputable communities in digital finance. As you can see MILLIONS of people. AND Litecoin is one of the most used #cryptos on @BitPay !! When can we #PaywithLitecoin? pic.twitter.com/FYfWdBdhW6

— Litecoin (@litecoin) October 20, 2023

In summary, the Litecoin (LTC) price prediction for 2023 suggests the potential for reaching a maximum price level of $169.04 by year-end, with an average price of approximately $152.73. However, the minimum price could drop to $116.27 in the advent of a bear. Nonetheless, there are expectations of a bullish event in the latter half of the year, which could lead to significant LTC price increases.

2. Chainlink (LINK)

Chainlink has introduced Chainlink Staking v0.2, a significant step to enhancing the security and efficiency of its decentralized network. This development follows the successful beta launch of Chainlink Staking v0.1 in December of the previous year. The Chainlink Staking v0.1 featured a 25 million LINK staking pool, enhancing the security of the ETH/USD Data Feed. However, with the release of Chainlink Staking v0.2, the network is expanding its staking pool to 45 million LINK tokens.

Moreover, the Chainlink Staking v0.2 offers a revamped staking mechanism, providing stakeholders greater flexibility and control over their LINK tokens. This change enables users to withdraw their staked LINK tokens at their discretion. Thus improving liquidity and accessibility for participants in the staking ecosystem.

LINK has demonstrated notable growth throughout the year, with a 14.33% increase in its price over the past month. Although LINK is still significantly below its previous all-time high of $52.70, there is growing optimism about the possibility of it reaching double-digit values.

🌌 Registrations are now live for Constellation: A Chainlink Hackathon 🌌

🥇 Over $350K in prizes

👩💻 Meet new friends & developers

🏆 Cross-chain, DeFi, gaming, & other prizes

👨🏫 Workshops from top devs across Web3Sign up today to save your spot:

— Chainlink (@chainlink) October 20, 2023

Some experts anticipate significant developments for LINK in October. The coin is projected to reach the $9 mark on October 27, representing a 24.42% increase from its current price. By October 30, LINK is expected to experience a substantial surge of 39%, pushing it to $10.26. The month is expected to conclude on October 31, with LINK at a high of $10.76, following an impressive 46% rise. These projections are based on expert analysis and market trends.

3. Polygon (MATIC)

Data from CoinMarketCap reveals that Polygon (MATIC) has experienced a surge in trading activity over the past 24 hours. Analysis shows a bullish trend with a clear upward trajectory. Moreover, MATIC’s trading volume increased by 32.39% in the last 24 hours compared to the previous day, resulting in its current price of $0.5503, reflecting a 4.34% gain.

This uptick in MATIC’s value coincides with the Polygon development team’s release of a new proposal called PIP-29. The cryptocurrency market has also seen positive sentiment following the US Securities and Exchange Commission’s decision to drop charges against Ripple’s top executives.

According to price predictions, Polygon could rally to $2.12 as the broader crypto market recovers its value. A more conservative estimate suggests an average price of $1.87 by 2023. Nonetheless, with a bearish trend, MATIC’s price could decline to a minimum of $1.62 simultaneously. However, it’s important to note that these predictions are subject to change in response to market conditions.

4. Meme Kombat (MK)

Meme Kombat (MK) has recently emerged as a noteworthy player in the meme coin space. The project has garnered over $614,000 towards its goal of $1,000,000, indicating early interest from investors. In the ongoing presale, the project makes 50% of the MK supply available at $1.667 per token, with a fixed hard cap of $10 million.

Just passed 600k 🏎️

LFG! #MemeKombat pic.twitter.com/KqkdYnYiQI

— Meme Kombat (@Meme_Kombat) October 20, 2023

A notable feature of Meme Kombat is its integration of staking and betting, allowing users to stake their MK tokens on the platform. It’s worth highlighting that 30% of the total supply has been earmarked for staking rewards. Also, the annual percentage yield (APY) for staking is an attractive 112%. Furthermore, users can participate in wagering, enhancing the coin’s utility.

Meme Kombat is evolving into a unique gaming platform with the potential for long-term benefits for its users. This aspect is particularly appealing to individuals interested in the gaming-oriented cryptocurrency niche.

In anticipation of listing on a decentralized exchange, Meme Kombat has allocated 10% of the total supply to provide liquidity. This move aims to facilitate smoother trading, as detailed in the project’s whitepaper.

Visit Meme Kombat Presale.

5. THORChain (RUNE)

THORChain is a decentralized liquidity protocol that facilitates the exchange of cryptocurrency assets across various networks. The platform also ensures that users maintain full control of their assets, ensuring liquidity without needing traditional order books.

The platform’s native utility token, RUNE, serves a dual role within the THORChain ecosystem. It functions in platform governance and security by requiring nodes to commit a substantial amount of RUNE. Thus, this mechanism serves to combat Sybil’s attacks effectively.

THORChain utilizes cutting-edge technologies, including one-way state pegs, a state machine, and the Bifröst Signer Module. Similarly, it uses the Threshold Signature Scheme (TSS) protocol to facilitate seamless cross-chain token swaps.

THORChain (RUNE) price is expected to reach a maximum price of approximately $2.83 as the broader crypto market recovers. Likewise, the average price of RUNE may hover around $2.50 by 2023.

Should there be any difference in consideration between these three transactions, and why:

1) BTC to BTC

2) ETH to ETH

3) BTC to ETHShould a protocol that offers (1) or (2) be held to a different standard than (3)?

cc @lex_node

— THORChain (@THORChain) October 21, 2023

THORChain offers a promising decentralized liquidity solution with notable technical features. Nevertheless, when considering price predictions, it’s crucial to remember the cryptocurrency market’s unpredictable nature.

6. Cardano (ADA)

Cardano displays promising indicators, suggesting a bullish trend with the potential for a notable 25% gain soon. However, it is essential to approach this analysis cautiously, as it is contingent on the cryptocurrency’s ability to surpass the $0.313 resistance level.

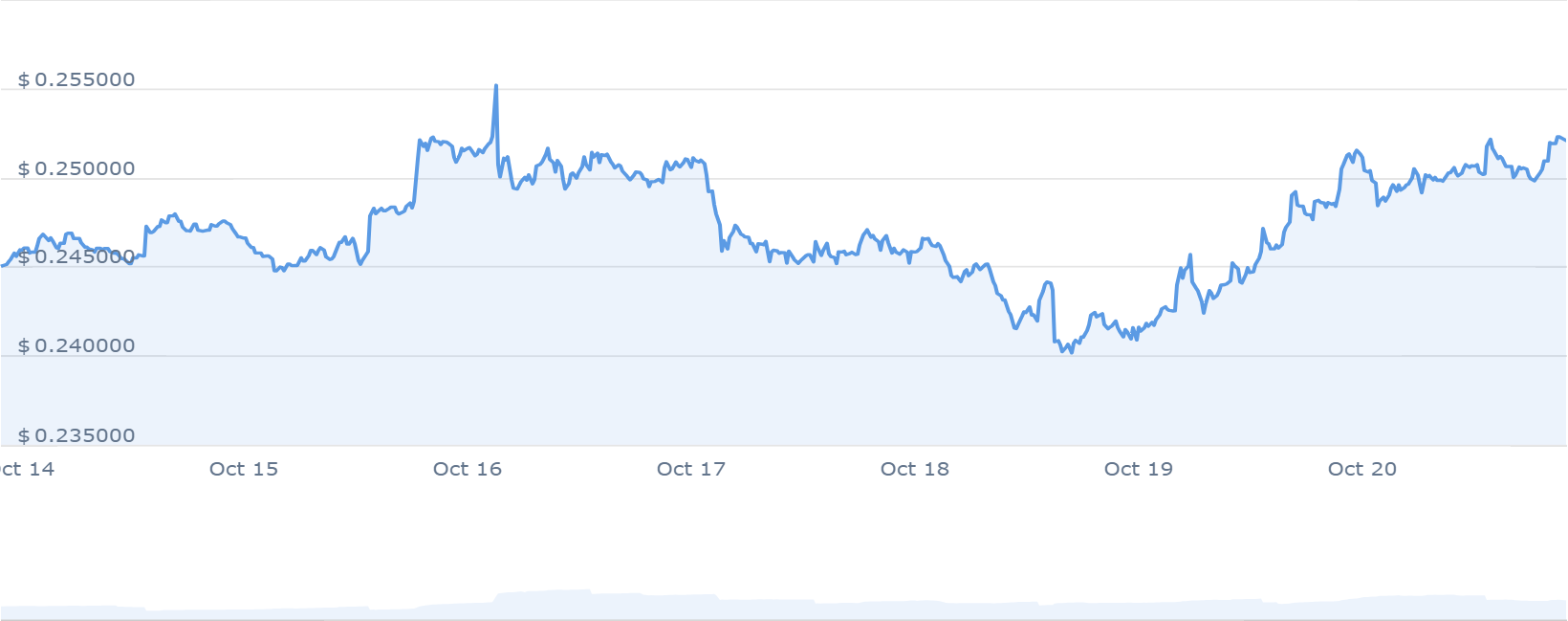

Cardano has recently exhibited a relatively steady price performance, with its most recent low of $0.243 recorded on October 13. However, the coin has registered a modest 0.44% gain within 24 hours. The next resistance levels for Cardano are situated within the $0.27 to $0.28 range. If the bulls overcome these levels, there is the potential for a 25% gain, setting a price target at $0.313.

Price projections suggest that Cardano’s maximum price may reach approximately $0.66 as the broader cryptocurrency market recovers its value. The forecast also anticipates an average price of $0.58 for ADA by 2023. If a substantial bearish trend affects the crypto market, the minimum projected price for ADA in 2023 could be around $0.51.

Hello, and Happy Monday! 🌞

Please enjoy the Cardano Community Digest, which you will receive every two weeks.

In this week’s edition, we cover:

🔹 @Cardano_CF Latest Activities,

🔹 New Delegation Strategy Announced,

🔹 @LenfiOfficial Protocol Developer Blog, pic.twitter.com/iWfUjGAiIh— Cardano Community (@Cardano) October 16, 2023

Cardano has made notable strides with recent updates, including enhancements to the Lace wallet and the platform’s persistence. Hence, these developments hold the potential to support the positive momentum witnessed in ADA’s price performance.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage