Join Our Telegram channel to stay up to date on breaking news coverage

As sustained green candles inch closer, altcoins have positioned themselves as the best tokens to invest in. However, picking the best altcoin to add to your portfolio requires time and effort. Hence, this article simplifies the search by highlighting some of the top altcoins worthy of consideration by investors at this moment.

6 Best Altcoins to Invest in Right Now

With the market’s transition towards a sustained green phase, the spotlight is now on certain tokens for their investment potential. Neo, Polygon, and Chainlink have captured attention as standout altcoins, lauded for their unique features and promising prospects in the market.

In the market arena, Visa partners with Transak for crypto withdrawals & payments via Visa Direct. Therefore, users can exchange crypto for fiat and pay at 130M+ Visa-accepting merchants globally, ensuring seamless integration for wider crypto adoption.

1. Chainlink (LINK)

Protocol Labs has partnered with Chainlink to aid new startups through the Chainlink BUILD program. Under this partnership, Protocol Labs will support Chainlink BUILD members with tools and services. This also includes decentralized storage credits and engineering assistance.

In the market segment, Chainlink is showing positive sentiments. As such, trading activities are ongoing as investors as the greed score is up to 60. Riding on the positive wave, LINK is above its 200-day moving average, hitting a 128% value increase over the past year.

Moreover, Chainlink has outperformed most other cryptocurrencies, including Bitcoin and Ethereum, in terms of price performance. With a circulating supply of 568.10 million LINK out of a maximum of 1.00 billion LINK, Chainlink maintains good liquidity based on its market cap.

.@decubate has established a channel partnership with @chainlinklabs.

This partnership helps support Chainlink BUILD members by providing them with access to Decubate’s launchpad, incubation and advisory services, vesting and staking portals, and more.

— Chainlink (@chainlink) January 29, 2024

Furthermore, the token has a yearly inflation rate of 11.83%, creating 60.10 million LINK tokens last year. Also, Chainlink remains at the top of the DeFi Coins sector and second in the Ethereum (ERC20) Tokens sector by market capitalization.

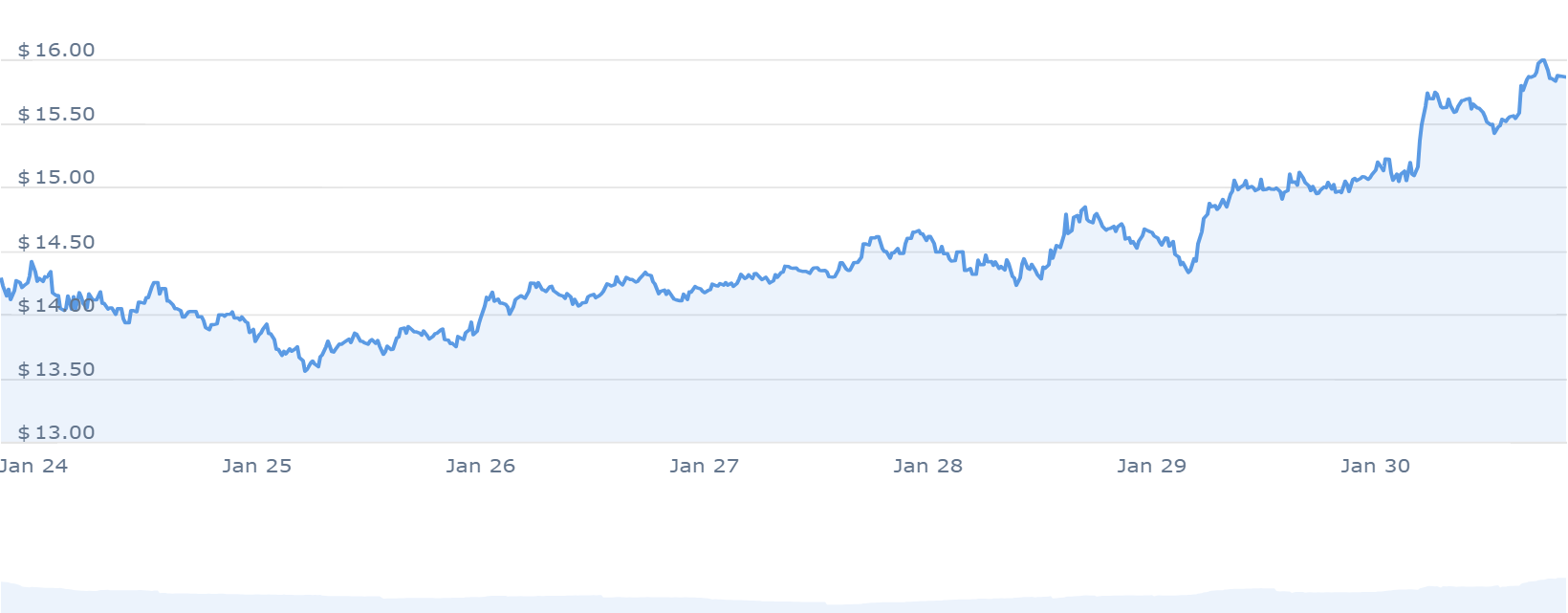

2. Neo (NEO)

Neo has inaugurated its new office in Hong Kong, aligning with the city’s push to become a central hub for Web3 technologies. This expansion aims to boost the Smart Economy and support local Web3 developers while attracting regional investment.

Furthermore, Neo’s recent performance has been promising, with a bullish sentiment and greed score of 60. Over the past year, Neo’s price has surged by 43%, outperforming most other top 100 crypto assets. Similarly, it’s trading above its 200-day moving average, indicating stability and boasting high liquidity.

Moreover, Neo’s solid fundamentals and investor backing position it for growth. Also, collaborations with other networks could propel Neo’s coin price above $41.02 by 2024. In a continued bullish market, it’s anticipated to hover around $37.15.

🎆 Neo opens a new office in @cyberport_hk (Hong Kong’s Web3 & digital tech hub) & joins the Cyberport Incubation Programme, taking a leading role in supporting local developers and advancing Web3 in Asia.

Read more: https://t.co/StlUgRaucd

— Neo Smart Economy (@Neo_Blockchain) January 29, 2024

In summary, Neo’s expansion in Hong Kong signals its commitment to Web3 development. Investors should keep a close watch on Neo as it continues to navigate the crypto landscape and explore new opportunities.

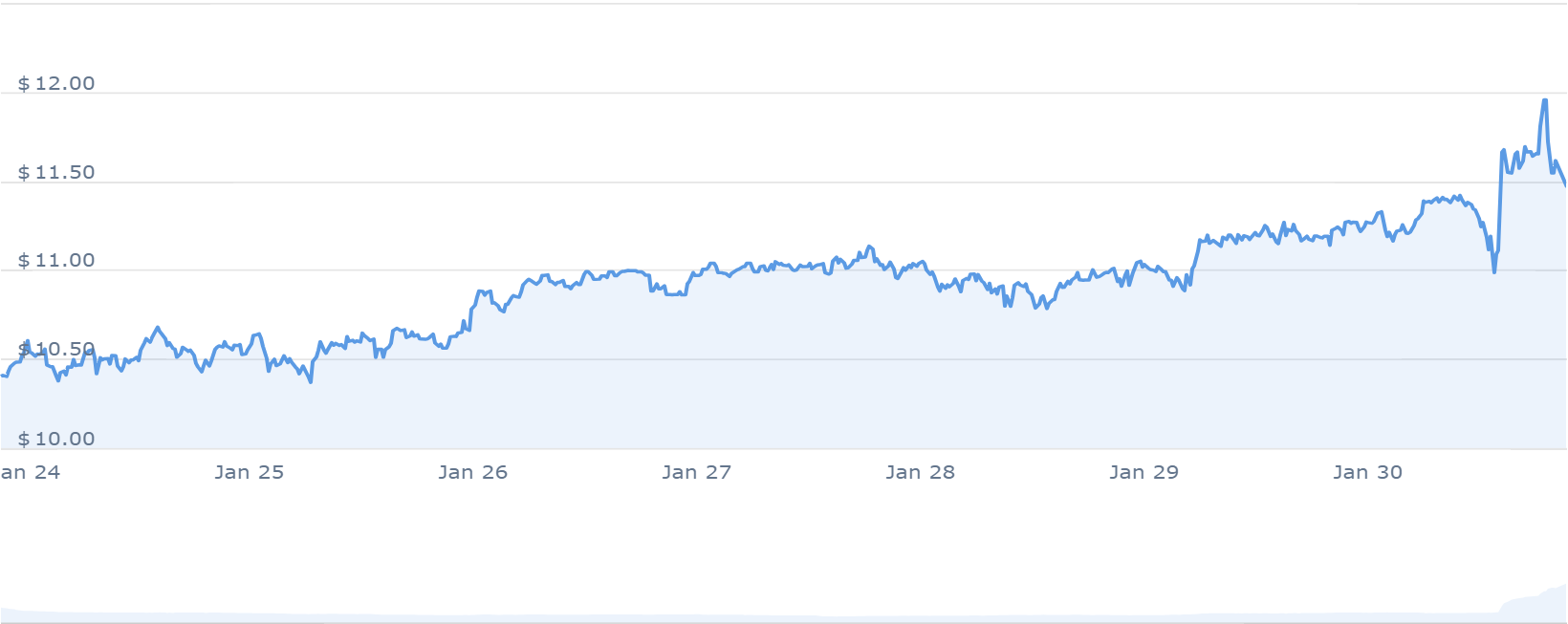

3. Frax Share (FXS)

Frax Share is slowly making a resurgence after hitting $10.13 in today’s trading session, trading $171.76 million in volume. This rise also trickled down to FXS’s market cap, which grew 1.49% to $775.01 million. Over the past 24 hours, FXS has experienced a 1.23% price increase, signaling positive investor sentiment. This sentiment aligns with a Fear & Greed Index reading 60, indicating a preference for greed among market participants.

Furthermore, FXS is trading above its 200-day simple moving average, indicating a favorable trend. Likewise, the project demonstrates strong liquidity, with 76.51 million FXS tokens circulating out of a maximum supply of 99.90 million. Moreover, the yearly supply inflation rate is 372.03%, creating 60.30 million FXS tokens in the last year.

New sets of $FXB auctions are live for users! After the initial starting batches sold out, the new auctions are live today. $FXB Curve pool and farms are up on both @arbitrum as well as mainnet @CurveFinance!

FXB UI:https://t.co/RTkRrJrh3e https://t.co/2RdQJ6qTOL

— Frax Finance ¤⛓️¤ (@fraxfinance) January 24, 2024

Equally, Frax Share shows promising growth potential, particularly if it collaborates with other networks. Therefore, experts predict the coin will hit $31.98 for FXS by 2024, supported by its robust fundamentals and dedicated community.

4. Bitcoin Minetrix (BTCMTX)

Bitcoin Minetrix has unveiled a groundbreaking model, enabling users to stake BTCMTX tokens for cloud mining credits. With a focus on inclusivity, the project has raised over $6 million, catapulting its ambitious objectives. In the ongoing presale, Bitcoin Minetrix has surpassed $9.4 million of its $8 million target, selling tokens at $0.0126 each. This represents 70% of the total token supply, amounting to 2.8 billion BTCMTX out of 4 billion tokens available.

A notable aspect of the project is its staking pool, which currently holds over 400,000 BTCMTX tokens and offers an impressive annual percentage yield (APY) of 103,225%. This innovative approach aims to decentralize control, ensuring a robust mining ecosystem.

Bitcoin Minetrix’s community-based approach has resonated with the crypto space, while its unique tokenomics model adds depth to the initiative. Therefore, Bitcoin Minetrix’s innovative mining model, community engagement, and successful fundraising position it as a promising project. As the presale continues, interested investors are urged to explore the project’s offerings and potential benefits.

5. Maker (MKR)

Even though the DAO Maker’s sentiment is neutral, the high greed of 60 shows that it is poised for a bull. Over the past year, Maker’s price stayed mainly in the green zone, rallying 213% to outstrip 84% of the top tokens. Likewise, it trades above its 200-day moving average, boating high liquidity on platforms like Binance, supported by its substantial market cap.

Furthermore, its yearly inflation rate is negative 5.65%, indicating a controlled token supply. With its strong fundamentals and dedicated community, DAO Maker shows promise for future growth. Collaborations with other networks could further boost its value, potentially pushing the DAO Coin price beyond $3.57 by 2024.

Even without such collaborations, the overall bullish trend in the crypto market suggests a sustained average price of around $3.24 for the DAO Maker Coin by 2024. In summary, DAO Maker presents a promising investment opportunity for crypto enthusiasts seeking long-term growth.

6. Polygon (MATIC)

The zkEVM network, a fusion of Immutable and Polygon technologies, has launched its mainnet ahead of schedule for game studio partners. The aim is to improve gaming experiences and create more engaging gameplay.

Last March, Immutable and Polygon teamed up to develop a specialized zkEVM for gaming. After ten months of work, the Immutable zkEVM mainnet is live for selected partners and game studios. Players using the Immutable Passport wallet can enjoy fee-free transactions.

The platform prioritizes diverse gameplay and smooth interaction, ensuring quick transactions. Polygon’s price outlook is positive, with a Fear & Greed Index at 60, indicating decent market sentiment.

The next upgrade for Polygon zkEVM will, effectively, make the network a Type 2 ZK-EVM. What does that mean for developers? It means that you can deploy your code on Polygon zkEVM exactly as it is on Ethereum—just copy-paste and go, no modifications necessary.

The 10-day… pic.twitter.com/GThNxj7V6F

— Polygon Foundation (@0xPolygonFdn) January 27, 2024

Polygon is actively trading above its 200-day moving average, demonstrating strong performance compared to its initial sale price. It also boasts high liquidity and is listed on Binance. Overall, the early mainnet launch of zkEVM aims to enhance gaming experiences through innovative blockchain tech. The Immutable-Polygon partnership is aligned to create richer gameplay.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage