Join Our Telegram channel to stay up to date on breaking news coverage

Today’s market dynamics reflect a blend of enthusiasm and caution. With a total trading volume surpassing $345.70 billion in the last 24 hours, sentiments remain notably bullish. This is indicated by the crypto Fear & Greed Index registering a reading of 74, firmly in the “Greed” territory.

A select few cryptocurrencies have delivered substantial returns to investors. Others have, however, seen their market value decrease significantly. This article looks at some altcoins that are currently worth considering.

6 Best Altcoin to Buy Now

Some of the altcoins experiencing notable upswings are Monero, Aave, and Pendle. Injective launched a Layer-3 chain on Arbitrum to improve its infrastructure and support collusion within the blockchain ecosystem. This move has seen analysts suggest an upward price movement might be on the horizon.

Moreover, WienerAI merges dog meme culture with artificial intelligence, capturing significant attention in the crypto community. Jack Dorsey predicts this top cryptocurrency could reach $1 million by 2030.

1. Aaves (AAVE)

Aave is an innovative decentralized lending protocol that enables crypto lending and borrowing. The token employs a P2P strategy in its mode of operation, enabling users to engage in these financial activities without intermediaries like banks.

Moreover, $AVEE is used for governance and transaction fee payment within the project’s exosystem. Token holders possess the power to influence decisions and the direction of the project. They do this through voting on proposals concerning protocol changes or the addition of new assets.

Furthermore, the team recently introduced a staking mechanism that allows users to earn rewards by staking their tokens. This feature will enable users to share in the platform’s fees. At press time, AAVE’s market performance reflects stability and growth.

Introducing @StaniKulechov, Founder of @aave who will be returning to speak at Stable Summit II

Join us for a comprehensive exploration of stablecoins, featuring technical deep dives with industry giants.

You do NOT want to miss this. Grab your early bird passes now 🎟️ pic.twitter.com/f1CJyMsvcw

— StableSummit (@stable_summit) May 24, 2024

Aave’s positive indicators are demonstrated by a bullish sentiment analysis. The token also posts a Fear & Greed Index of 74. Analysts foresee potential price surges if Aave establishes partnerships with other protocols.

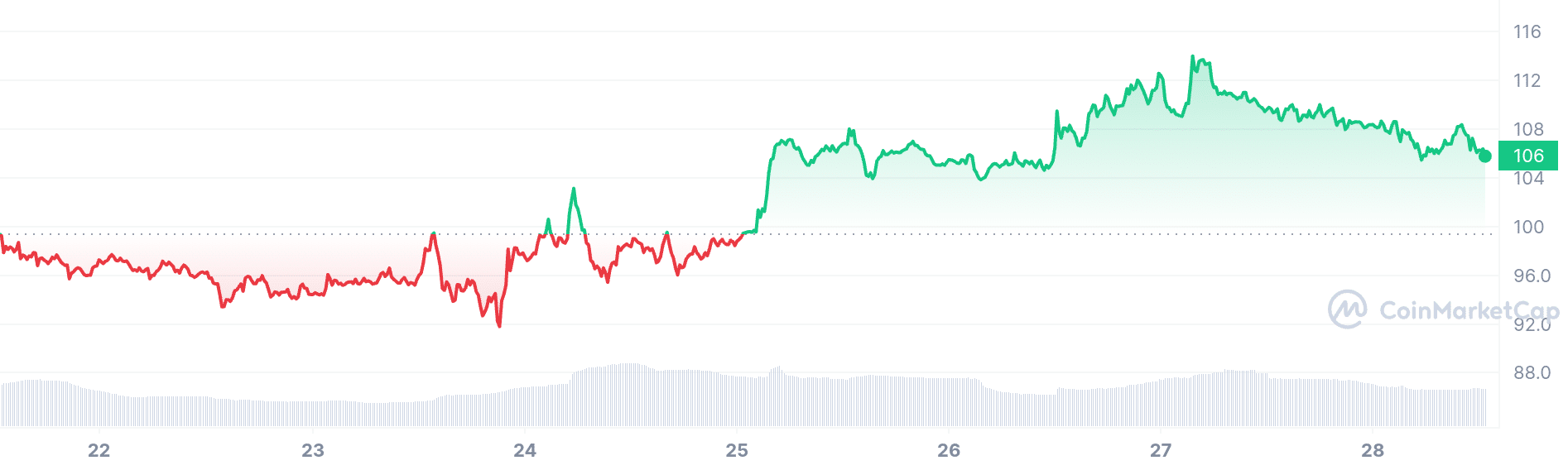

The token is priced at $105.98, indicating a 16% increase in the last seven days. It is trading above the 200-day simple moving average, suggesting a favorable market trend. Its liquidity, determined by market capitalization, indicates a healthy level of trading activity.

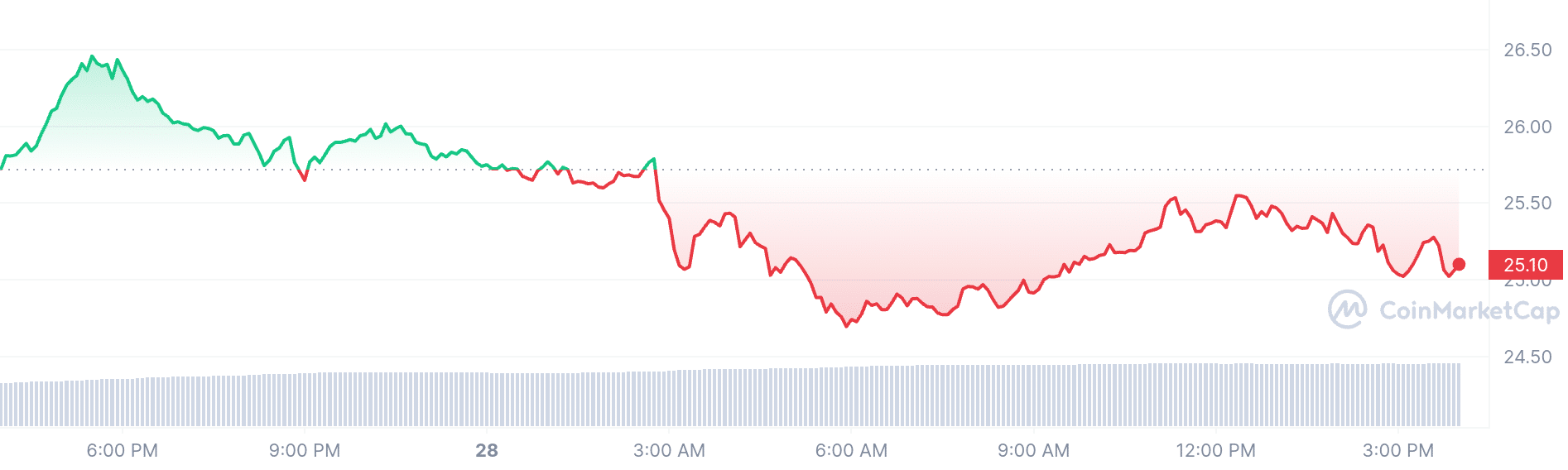

2. Biconomy (BICO)

Several platforms use the Biconomy relayer network to provide gasless transactions. Some of these platforms are Curve Finance, Perpetual Protocol, Decentral Games, and Sapien Network. The platform allows developers to easily integrate Biconomy with a software development kit. Users can sign transactions with private keys, making the platform non-custodial and trustless.

Furthermore, Biconomy’s multichain relayer protocol improves the user experience of decentralized applications (DApps). The project aims to make Web3 products as intuitive as Web2 products. It offers an infrastructure that addresses several Web3 bottlenecks.

Biconomy enables users to onboard without paying gas fees. It also allows them to pay gas in any ERC-20 token for transactions they make. The platform simplifies blockchain interactions and speeds up transaction confirmations.

You focus on getting more users & increasing activity

And we will take care of gas fees for you 😉

Apply for a gas grant if you are building on @base to get upto 30,000$ in gas credits!

Check below for details👇 pic.twitter.com/Md4M9R0ZOR

— Biconomy (@biconomy) May 27, 2024

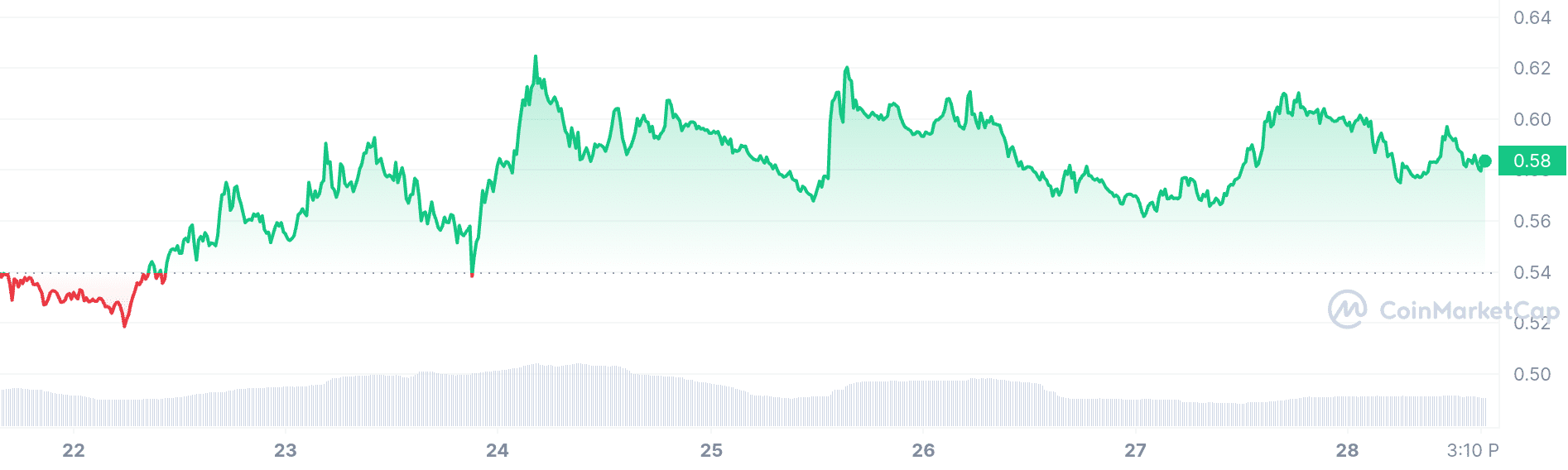

BICO trades at $0.579414, indicating an 8.03% in the last seven days and 101% in the previous year. It trades 116.10% above the 200-day simple moving average (SMA) of $0.26812. In the last 30 days, it has had 13 green days, with a low volatility of 9%, suggesting stable price movements.

3. WienerAI (WAI)

WienerAI offers something special with its AI features that are unlike other playful meme coin cryptos. With its advanced AI trading bot, WienerAI gives investors a smart tool on the blockchain to help them make more profits quickly. Users just need to ask, and the WienerAI bot quickly searches the market for answers.

Furthermore, the token stands out because of its powerful AI abilities. These unique features distinguish it from several other meme coins. This year, AI cryptos and meme coins have become popular, suggesting that $WAI might see a quick rise in price when it launches on an exchange.

Apart from helping users trade on decentralized exchanges (DEXs), it also assists in getting the best prices. The platform offers this service at no cost and defends against front-running bots. Investors in $WAI tokens can make passive income by staking them in the smart contract, starting from the presale.

AI Meme Coin Presale WienerAI Raises $3M – Next Crypto to Explode? @WienerDogAI https://t.co/qc9bN4w1lQ

— Bitcoin.com News (@BTCTN) May 27, 2024

In addition to trading and protection against unfair bots, WienerAI offers a swap protocol and protection against certain types of manipulation. The WienerAI presale has already raised over $3.3 million. Also, the tokens are currently priced at $0.000711.

4. Arbitrum (ARB)

Arbitrum is an innovative altcoin that supports unmodified EVM contracts. The platform allows existing Ethereum DApps to run without code changes. It can also handle thousands of transactions per second with low fees and fast finality while maintaining Ethereum’s security.

The Ethereum layer-two scaling solution uses optimistic rollups to improve Ethereum’s speed, scalability, and cost-efficiency. It leverages Ethereum’s security while offering higher throughput and lower fees by moving most computation and storage off-chain. Holding $ARB enables holders to vote on protocol changes, fund allocation, and Security Council elections.

Meanwhile, a decentralized network of validators actively stakes ARB tokens. These validators secure the network and empower token holders by distributing fees. This innovative system eliminates reliance on a centralized operator, fostering a democratic and resilient ecosystem.

Are you an @arbitrum OG?

Have the Arbitrum Odyssey badge?

We appreciate you and have an NFT for you. Mint it.

link: https://t.co/oHIBqgaenB pic.twitter.com/rcwXj7IcVy

— Orderly Network (@OrderlyNetwork) May 27, 2024

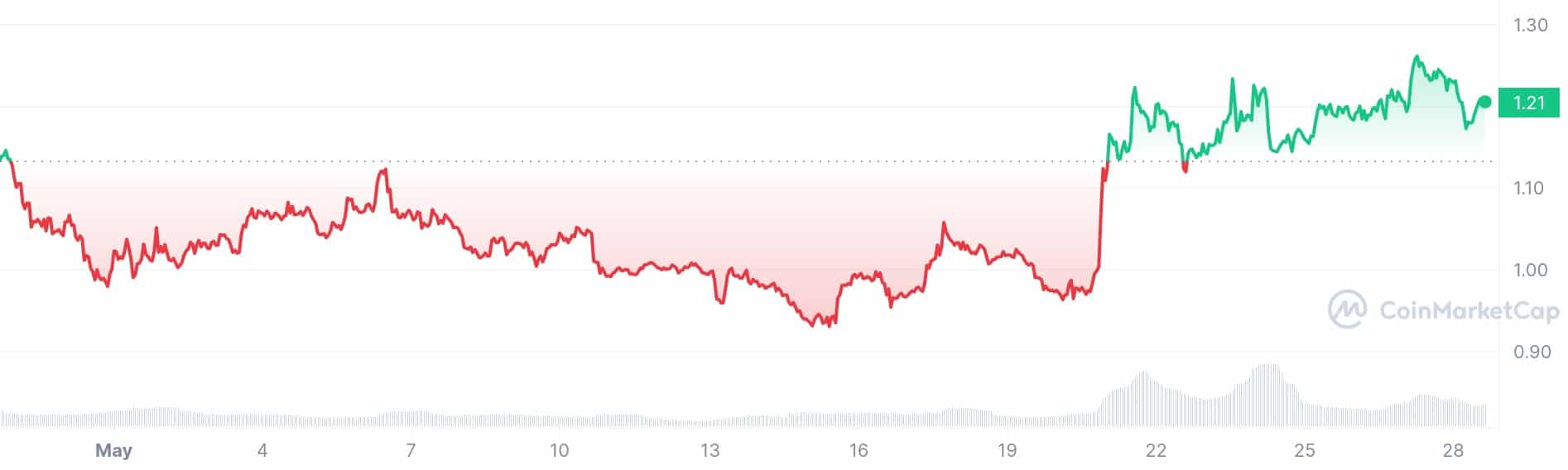

ARB trades at $1.20 today. Although the preceding year has seen a modest 3% rise, the token is up 8% over the previous month. ARB is trading at a noteworthy 10.70% above the 200-day SMA of $1.03856.

Meanwhile, a 14-day RSI of 71.26 shows signs of overbought conditions for the token. In the past 30 days, it had 15 green days, coupled with a 6% 30-day volatility. Moreover, boasting high liquidity, it maintains a robust 0.4348 volume-to-market cap ratio, indicating sustained investor interest.

5. Injective (INJ)

Injective’s YTD and post-launch charts show upward trends, with increases of 261.76% and 2296.23%, respectively. The project offers high speed and low fees, attracting more projects and users. The team burns a percentage of protocol fees weekly, potentially increasing the token’s price as supply diminishes.

Furthermore, the team has launched a Layer-3 chain on Arbitrum to enhance its infrastructure and interoperability. This Layer-3 development, featuring the inEVM network, allows developers to create customizable chains using Arbitrum’s Orbit toolkit. The integration supports connections between Ethereum, Solana, and Cosmos, making Injective more versatile for developers.

The platform has also partnered with Band Protocol to enhance its accessibility. Band Protocol integrates with Injective’s inEVM, providing secure and reliable data feeds. This integration allows Band oracles to supply crucial data for DeFi, derivatives, and other applications directly on the inEVM.

Can’t code? No problem. @discoverinj has built the best solution for you 🧑💻 https://t.co/goVND0vRZh

— Injective 🥷 (@injective) May 27, 2024

Furthermore, Band Protocol significantly enhances Injective’s ecosystem capabilities by delivering accurate and timely data. INJ is trading 127.12% above the 200-day Simple Moving Average (SMA) of $11.02. This SMA demonstrates positive performance compared to its token sale price.

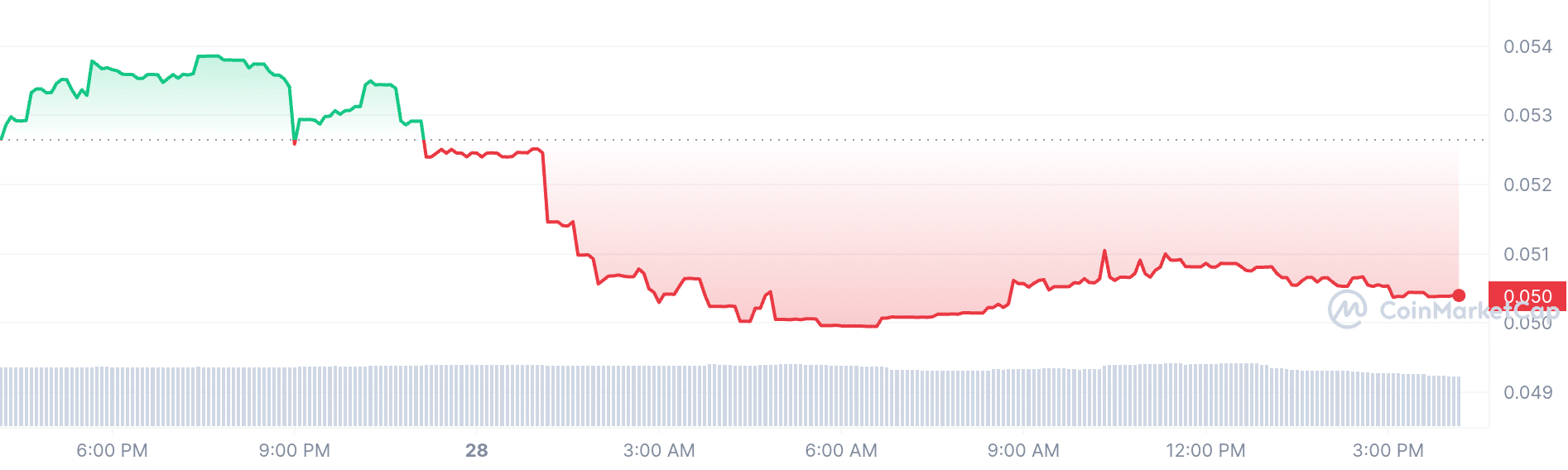

6. RuneBridge (RB)

RunesBridge enables interoperability by developing several bridges. These bridges connect Ethereum Virtual Machine (EVM) networks to the Bitcoin network through the Runes Protocol. It allows users to transfer assets between chains securely and cost-effectively. RunesBridge enhances Bitcoin’s utility by interacting with other blockchain networks.

The project does this while ensuring safety and ease of use. Moreover, the platform emphasizes user-friendliness. It also provides a seamless experience for managing digital assets across different networks.

Meanwhile, RunesBridge has collaborated with TunaChain to cultivate a vibrant Bitcoin ecosystem. It has also successfully deployed a bridge between Ethereum and ZetaChain, a strategic partner. Notably, the token is trading than its 200-day SMA

🤝 Excited to announce the partnership between #RunesBridge and @SatoshiBEVM!

🔋 The Satoshi Protocol aims to provide a cornerstone for DeFi and make BTC truly spendable in daily usage by offering a CDP-style stablecoin. This marks a significant step in the evolution of… https://t.co/iRNV68csa5 pic.twitter.com/wMALfvp15s

— RunesBridge (@RunesBridge) May 25, 2024

The token trades at $0.05038 today. It has posted 20 green days in the last 30 days and trades above its 50-day SMA. Overall, RunesBridge offers a promising solution for blockchain interoperability, making it a profitable investment choice.

Learn More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage