Join Our Telegram channel to stay up to date on breaking news coverage

Investing in the crypto market is one of the most lucrative ventures ever, and investors are on the lookout for the top crypto to stake for the highest yields.

Staking involves locking a crypto asset for a period as a means of investment. In turn, you earn rewards in the form of the same digital currency or other cryptocurrencies. This review discusses the five best cryptocurrencies with the best annual percentage yields (APY).

1. Ethereum (ETH)

It’s no surprise that Ethereum makes the list of one of the top crypto to stake for the highest yields. The crypto asset is regarded as the king of DeFi projects. Why the tag? It enables users to make substantial returns on their investments.

The Ethereum 2.0 staking program allows users to lock some of their tokens for a period. In turn, users get rewards in the form of BETH, which is equivalent to ETH in the ratio of 1:1.

The Ethereum blockchain is making bold improvements to the Merge testnet, which will simulate the Ethereum 2.0 protocol. Using the Kintsugi testnet, developers tested the ETH Merge with transactions, bad blocks, and other chaotic inputs to reveal inadequacies in the programming.

The process provides developers with insight into the agility and viability of the protocol. That’s in addition to making more iterations to ensure it becomes more stable.

Following a mismatch in the way the proof-of-stake (PoS) consensus layer operates the execution layer, developers found that the consensus layer accidentally induced an unexpected load on the execution layer.

Using a Kiln reboot, developers remodeled the engine API to be more flexible so that the two layers would operate harmoniously.

Following the reboot of the entire crypto market, Ethereum has made a 13.30% gain in the last seven days. It’s trading at $3,110, and seems to be making efforts to break out past current resistance prices and go bullish.

Ethereum offers users access to stake on ETH 2.0 for a guaranteed APY of 4.5% to 5.2%. This APY provides investors with an excellent opportunity to earn more with Ethereum as market prices continue to surge.

2. Cardano (ADA)

The Cardano network is one of the top crypto to stake for higher yields due to several reasons.

The network protocol proposes more improvements and updates that guarantee an upscale price. Cardano has released a network update to increase its network capacity by increasing block sizes by 8KB. This takes the block sizes from 72KB to 80KB.

The network update embodies all the necessary changes that need to be made to the Cardano network. The block size increment represents an 11% increase in network capacity.

The update also factors in an increase in Plutus memory units per transaction on the mainnet from 12.5 million to 14 million.

These enhancements provide more resources for Plutus scripts to improve the DApp user experience while fulfilling the update proposal objective.

The Cardano network protocol is designed to be optimized consistently. This will allow it to manage high peak loads through continued observation of its real-world performance. Each new update is slated after carefully monitoring and assessing the network response over at least one epoch.

Cardano provides users and developers with the opportunity to stake their ADA assets to earn substantial profits at an APY of 5.09%.

ADA has realized a 12.92% increase in the last seven days and continues to surge as the entire market recovers.

3. Polkadot (DOT)

Polkadot provides higher returns when staked due to its application in enhancing the interoperability of blockchains.

As the most successful parachain network, Polkadot aims to bring Ethereum Virtual Machine (EVM) interoperability as Moonbeam (GLMR) launches on the DOT network.

The Polkadot network, after years of development, has advanced in bringing EVM compatibility to its parachain network by onboarding Moonbeam.

Upon launch, the blockchain allowed the deployment of over 80 projects in its ecosystem. It should do the same and even more in the Polkadot network.

The integration on the Polkadot network proposes to bring the cross-chain interoperability with the Ethereum Network to the sharded multi-chain protocol.

The compatibility with the Ethereum network proposes a price hike for DOT in the crypto market. This will likely result from new users delving into the Polkadot ecosystem.

Trading at $21.49, the crypto asset has gained 10.47% in the last seven days and offers users an opportunity to gain more value as they stake DOT.

Users can gain 10% on their stakes each year when they lock up their DOT for a period of 30days, 60 days, or 90 days.

4. Terra (LUNA)

Terra makes the list as one of the top cryptos to stake for the highest yields. The protocol continues to onboard several crypto projects to ensure its application in various DeFi processes.

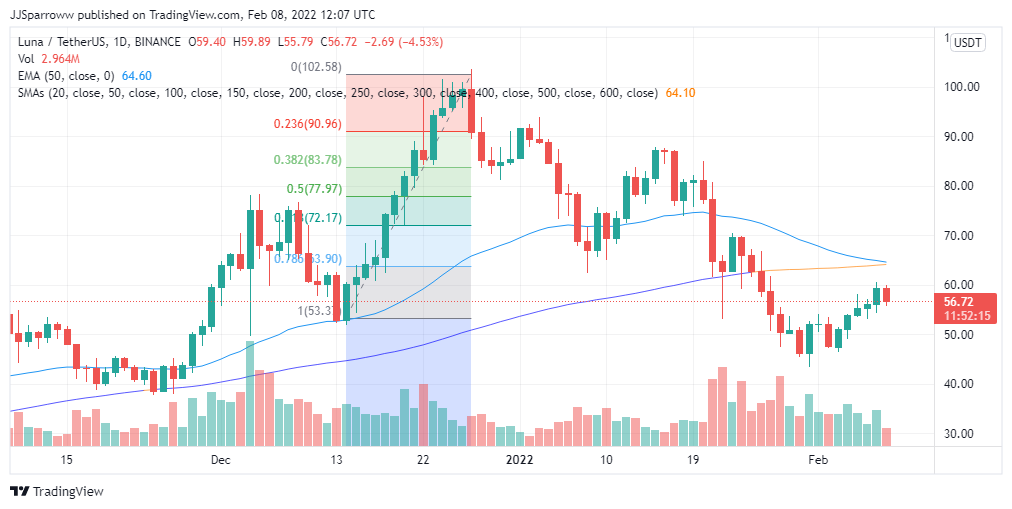

LUNA is trading at $56.83. It has recorded a 9% increase in the last seven days, indicating the asset is gaining momentum for an imminent bull run.

The price hike is due to valid reasons. One is its new integration with other crypto projects, such as its partnership with Prism protocol.

The prism protocol aims to resolve inefficiencies with the Terra blockchain. An example is inefficient liquidity access from yield-bearing assets (YBA).

The integration with Prism’s Version 1.0 will give users instant access to liquidity. Alongside that is no risk of liquidation or daily funding fees due to LUNA’s yields.

Also, the integration will provide isolation of the user’s risk of fluctuation in the price of LUNA. That’s a result of splitting the principal and yield components so that users can freely trade the asset.

The Prism protocol will also leverage Terra’s staking yield with no liquidation risk by selling future price openings.

5. Cosmos (ATOM)

ATOM has proven to be an over performer in the crypto market, providing scalable technology for blockchains. The Cosmos blockchain is on the radar as one of the top crypto to stake for the highest yields due to its ecosystem’s constant products and projects.

The Cosmos Hub is home to some of the most innovative projects in the crypto space. And testnets are a vital part of these projects. They provide an opportunity for blockchain communities to educate themselves and grow while building sustainable blockchains.

The Cosmos blockchain aims to provide several testnets. These testnets will enable developers to learn from the mishaps of previous projects. The result is more scalable blockchain applications.

Some of such testnets made available by the Cosmos Hub are incentivized testnets. They provide users with rewards for uncovering bugs, finding UX improvements, testing the network’s incentive response, and even testing the security of the testnets through coordinated attacks.

These testnets are crucial to new and improving blockchains, providing clear documentation of the system’s improvement processes, the block explorer, a test wallet, and the faucet for token distribution.

The Cosmos asset currently trades at $30.67 and has gained 5% over the last seven days, providing investors with strong motivation to buy the ATOM coin.

The staking incentive for ATOM is at 9.7% and promises investors even higher profits as ATOM price soars.

Read More:

Join Our Telegram channel to stay up to date on breaking news coverage