[table_of_conent]

Decentralized finance (DeFi) ecosystems enable anyone to access key financial services, like trading, global remittance, insurance, and loans, without third parties.

Many DeFi projects have native crypto tokens, enhancing ecosystem benefits and providing financial exposure to their long-term growth. But what is the best DeFi crypto to buy in 2025?

Read on to explore high-potential DeFi tokens, learn how this market works, and what risks to consider.

| # | Coin | Price | 24h % | Market Cap | Volume | 24h Range |

|---|---|---|---|---|---|---|

| 1 |

|

14.7 | -1.29% | $9,653,006,030 | $363,754,216 |

14.57

―

14.99

|

| 2 |

|

2207.65 | -0.53% | $7,646,311,769 | $19,305,271 |

2183.71

―

2234.69

|

| 3 |

|

20.92 | 2.77% | $6,986,719,003 | $122,966,258 |

19.86

―

21.41

|

| 4 |

|

1 | 0.01% | $3,255,654,669 | $100,118,415 |

0.999594

―

1.001

|

| 5 |

|

5.23 | -2.82% | $3,139,055,555 | $143,253,350 |

5.21

―

5.38

|

| 6 |

|

175.1 | -0.02% | $2,644,125,887 | $210,540,995 |

172.31

―

178.88

|

| 7 |

|

0.30972 | -5.15% | $1,719,914,074 | $138,702,846 |

0.305573

―

0.328225

|

| 8 |

|

1549.43 | -0.89% | $1,293,203,883 | $59,405,260 |

1519.96

―

1570.7

|

| 9 |

|

155.16 | -1.45% | $1,210,835,154 | $3,109,506 |

154.99

―

158.94

|

| 10 |

|

2.88 | -0.53% | $836,187,442 | $58,715,974 |

2.85

―

2.98

|

| 11 |

|

0.855273 | -1.26% | $768,016,001 | $63,320,394 |

0.845394

―

0.875607

|

| 12 |

|

13.18 | -0.17% | $753,009,804 | $8,426,765 |

13.09

―

13.27

|

| 13 |

|

0.149392 | -1.80% | $541,472,752 | $29,600,082 |

0.148597

―

0.158411

|

| 14 |

|

0.00039914 | -13.53% | $399,147 | $21,795 |

0.00039838

―

0.00047082

|

Chainlink

LINKWrapped stETH

WSTETHHyperliquid

HYPEDai

DAIUniswap

UNIAave

AAVEEthena

ENAMaker

MKRBinance Staked SOL

BNSOLRaydium

RAYLido DAO

LDODeXe

DEXEPyth Network

PYTHJupiter Project

JUP

Top Decentralized Finance Coins in 2025

Below, we discuss the best DeFi crypto to buy right now. These projects are aimed at long-term holders rather than short-term speculators. Therefore, while volatility should still be expected, these top-quality DeFi projects are here to stay.

1. Chainlink (LINK)

Chainlink is one of the key players in the broader DeFi industry. It provides “oracles” to blockchains and smart contracts, connecting Web 3.0 ecosystems with real-world data. This is a crucial service, considering that without oracles, smart contracts can only collect data from within their respective ecosystem.

Put otherwise, an ERC20 smart contract can’t make decisions based on what’s happening outside of the Ethereum blockchain. With Chainlink, real-world data is not only reliable but also obtained without bias. It reaches consensus by aggregating data from multiple trusted sources. Those sources receive financial incentives when providing reliable data, paid in LINK.

Chainlink Price Chart

(LINK)Chainlink (LINK)

Chainlink’s global use cases are limitless. Key industries that Chainlink will revolutionize include banking, trading, supply chain management, and insurance. For example, consider an insurance company aimed at frequent flyers. They pay out whenever a customer’s booked flight is canceled or delayed by more than three hours.

Chainlink would obtain real-time flight data from independent sources (e.g. airports, flight trackers, etc.) and feed this directly into the insurance’s systems. A smart contract could automatically pay customers when flights are canceled or delayed, reducing human input, fees, and settlement times. This is just one example of many.

Find out more about Chainlink:

2. Wrapped stETH (WSTETH)

Some analysts claim that Wrapped stETH is the best DeFi crypto to buy. It’s backed by Lido and designed specifically for active DeFi users. So, how does Wrapped stETH work? First, let’s take a step back by explaining how Lido functions. Lido is a trusted liquid staking platform for ETH. So, when you stake ETH, you get an equal amount of Lido Staked (StETH).

This provides instant liquidity to ETH stakers, allowing them to use the StETH tokens elsewhere. However, many users will manually “wrap” StETH, meaning they receive Wrapped stETH (wstETH). Those wstETH tokens then provide access to the wider DeFi industry. For instance, wstETH can be used for yield farming, lending, or borrowing.

Wrapped stETH Price Chart

(WSTETH)Wrapped stETH (WSTETH)

Crucially, while Wrapped stETH is backed by Lido, it’s a fully decentralized token secured by smart contracts. Moreover, Wrapped stETH isn’t pegged to ETH but it is loosely correlated to the ETH price. This means Wrapped stETH provides long-term exposure to Ethereum while being ideal for DeFi income.

Find out more about Wrapped stETH:

3. Hyperliquid (HYPE)

Hyperliquid provides all-in-one solutions for the DeFi industry. At its core, Hyperliquid is a layer-1 blockchain offering industry-leading performance levels. For a start, it can handle up to 200,000 transactions per second, making it highly scalable for the Web 3.0 era. This scalability even outperforms legacy systems like Visa, MasterCard, and PayPal.

Additionally, Hyperliquid makes DeFi transacting cost-effective, even when facilitating micro-transactions. It also ensures fast settlement times, a crucial requirement for DeFi stakeholders. It has a block finality time of just 0.07 seconds, regardless of network demand. Hyperliquid doubles as a top decentralized exchange (DEX).

Hyperliquid Price Chart

(HYPE)Hyperliquid (HYPE)

It enables traders to buy and sell cryptocurrencies without GAS fees, with leverage of up to 50x offered. Unlike traditional DEXs, Hyperliquid uses the order book system. However, it’s fully on-chain, ensuring transparency and safety. This extends to perpetual futures, meaning no more cries of “foul play,” as is often the case on centralized exchanges (CEXs).

Hyperliquid, as one of the best DeFi crypto to buy, also offers a “HyperEVM” platform. This is where developers can build DeFi applications and NFT projects. The ecosystem token, HYPE, was launched as recently as November 2024. HYPE provides many functions within the Hyperliquid blockchain, including transaction fee settlement, staking, and governance.

Find out more about Hyperliquid:

4. Uniswap (UNI)

Uniswap was founded in 2018 and remains one of the most important areas of DeFi. In a nutshell, Uniswap is the most active and liquid DEX on the Ethereum blockchain. It was a pioneer of the automated market maker (AMM) system, which allows users to trade cryptocurrencies without needing another market participant.

Uniswap’s AMM concept also does away with order books. Instead, Uniswap uses decentralized liquidity pools, which anyone can fund. For example, consider the ETH/USDT pool. Someone holding USDT can buy ETH without placing market or limit orders. The exchange rate is determined by the AMM system, which considers volume, liquidity, and other core factors.

Uniswap Price Chart

(UNI)Uniswap (UNI)

The purchased USDT tokens are then automatically added to the user’s wallet via a smart contract. Therefore, Uniswap never touches client-owned cryptocurrencies. Uniswap supports virtually all tokens on the ERC20 standard, as it’s the go-to DEX for new Ethereum projects. That said, Uniswap is also the market leader for trading layer-2 tokens.

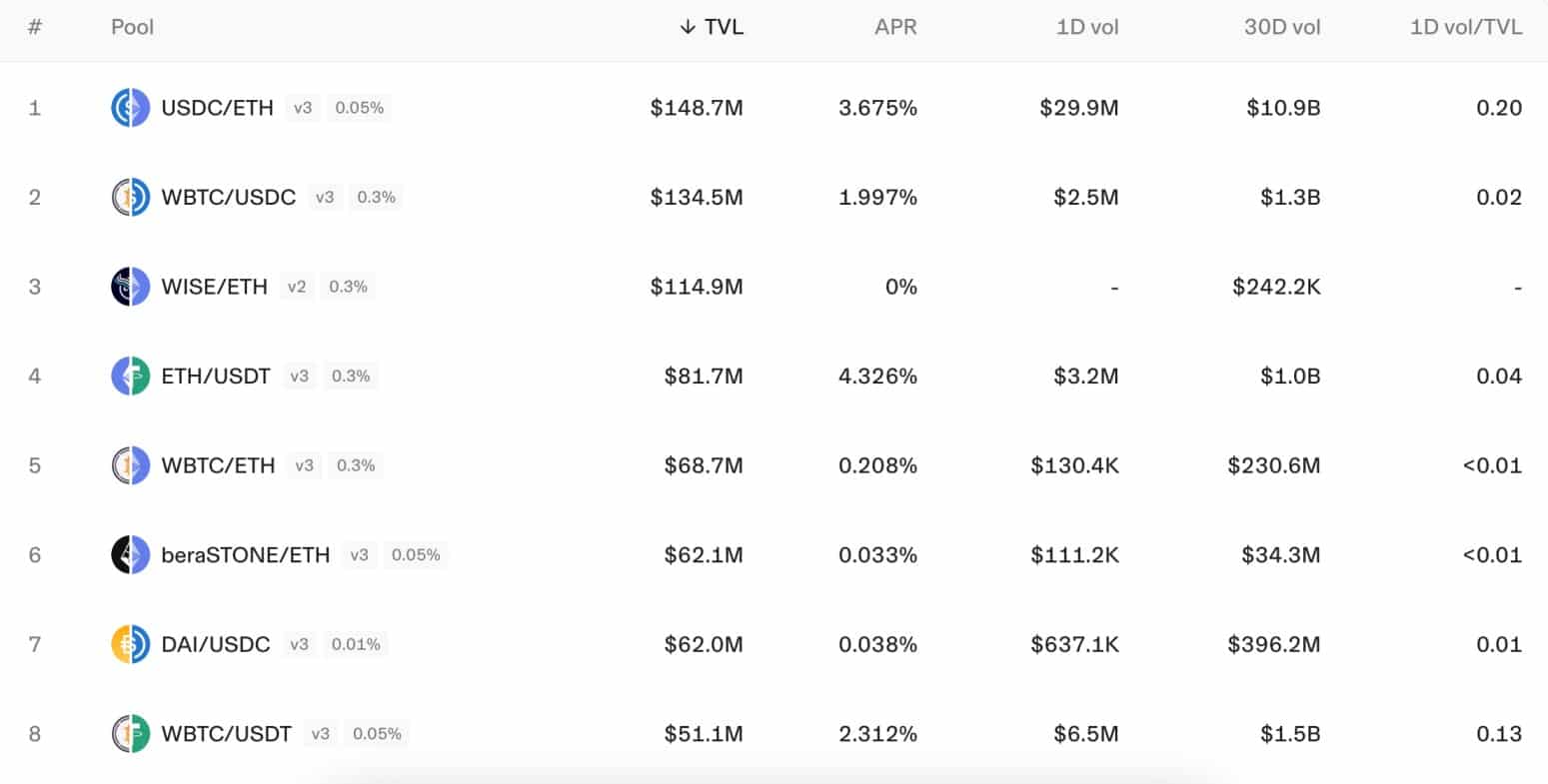

This includes meme coins from Base, Arbitrum, Blast, and Polygon. Going back to Uniswap liquidity pools, anyone providing liquidity earns passive income. Earnings are generated from the 0.3% trading commission charged on Uniswap trades. Therefore, Uniswap is not only one of the best DeFi crypto to buy but it’s also one of the most sustainable and self-sufficient.

Find out more about Uniswap:

5. Dai (DAI)

While Dai isn’t the best DeFi crypto to buy for financial speculation, it’s a top-rated stablecoin that offers many benefits. Most importantly, unlike other leading stablecoins like Tether and USD Coin, Dai is decentralized. This means users don’t need to trust a centralized entity, vastly reducing the risks of de-pegging from the dollar.

In addition, with no centralized controller, Dai holders don’t need to worry about blocked transactions or worse, frozen balances. So how does Dai remain pegged to the US dollar if it isn’t backed by fiat currencies? Dai, through the MakerDAO, issues new tokens when backed by crypto collateral.

Dai Price Chart

(DAI)Dai (DAI)

Accepted cryptocurrencies are voted on by the MKR holders, which is also part of the MakerDAO ecosystem. Currently, this includes ETH, LINK, BAT, WBTC, GUSD, and more. The underlying collateral, provided by the borrower, can be liquidated if market prices fall sharply. This ensures the Dai ecosystem is sustainable in the long run.

Those holding Dai can earn competitive staking rewards without worrying about short-term volatility. Dai is also ideal for cross-border payments, with transactions settled in seconds via the Ethereum blockchain.

Find out more about Dai:

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- 250,000+ Monthly Active Users

How We Picked The Best DeFi Coins to Buy

There’s a huge selection of DeFi cryptocurrencies in the market, making investment decisions particularly challenging. This includes tokens backing DeFi exchanges, lending protocols, stablecoins, and everything in between.

Investors also need to consider market capitalization, average trading volumes, supported exchanges, and the respective blockchain ecosystem (e.g., Ethereum or Solana). Read on to understand how we picked the best DeFi coins for this guide.

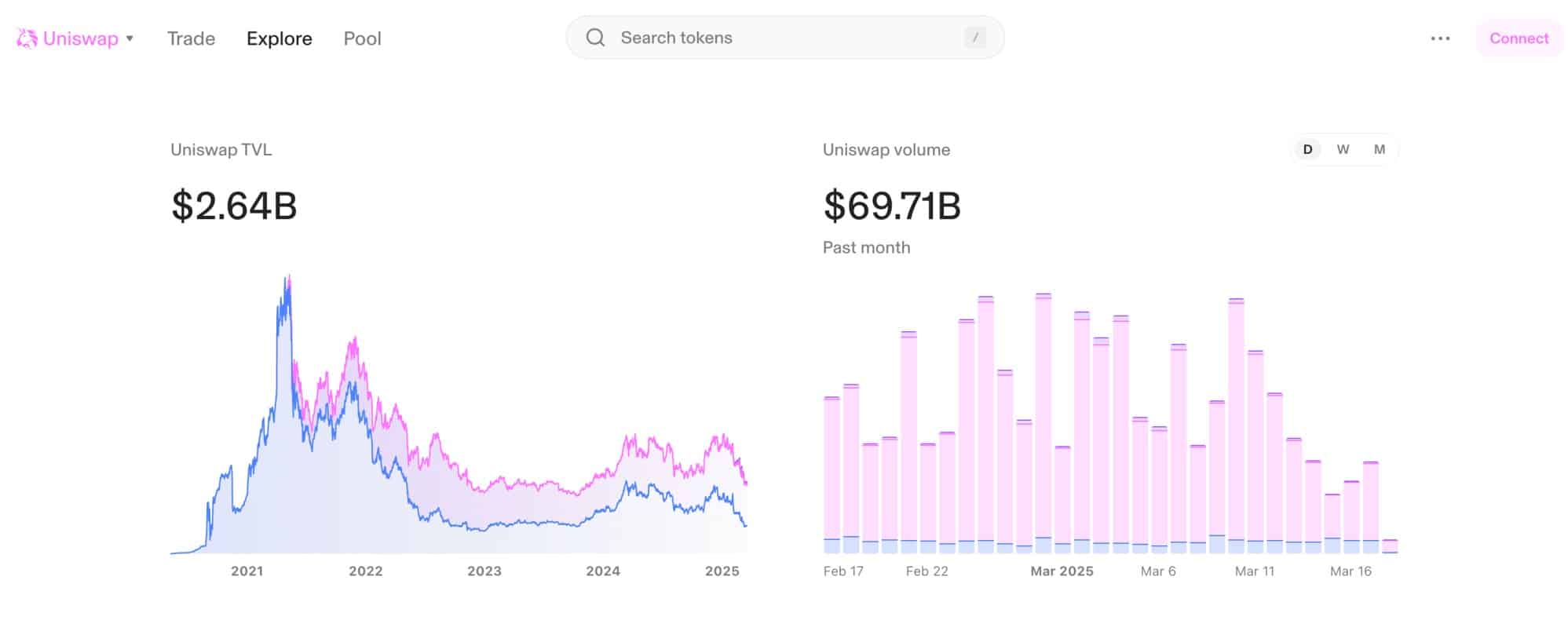

Total Value Locked (TVL)

Total Value Locked (TVL) is one of the most important metrics when analyzing DeFi protocols. Put simply, it shows much “value” is locked in the respective ecosystem. This could be related to lending, staking, yield farming, and other earning tools. Crucially, DeFi projects with a high TVL show that people trust the respective ecosystem.

They’re prepared to lock their tokens in smart contracts to benefit from what the ecosystem has to offer. For example, several billion dollars worth of cryptocurrencies are locked in Uniswap liquidity pools. This ensures Uniswap traders have sufficient liquidity to buy and sell cryptocurrencies without needing another market participant.

Those providing Uniwap with liquidity earn a share of the trading fees collected, ensuring a financial incentive. Similarly, billions of dollars worth of cryptocurrencies are also locked in Maker Protocol, which underpins the Dai stablecoin. You can easily check DeFi TVLs on data aggregation sites like DappRadar.

Web 3.0 Utility and Use Cases

Utility is also a valuable metric when choosing the best DeFi crypto to buy. This requires investors to assess what role the DeFi ecosystem will have in the Web 3.0 era. Put otherwise, does the DeFi project offer something innovative and unique, and will it actively be used in the future of the internet?

A good example is Chainlink, which specializes in oracles. Chainlink is a top DeFi project, considering it bridges the gap between smart contracts and real-world data. Without oracles, smart contracts can only engage with information provided by their respective blockchain. As such, Chainlink opens the doors to a much broader Web 3.0 industry.

Similarly, Dai is the ideal stablecoin to hold when actively using DeFi protocols. It’s fully decentralized and backed by approved cryptocurrencies, as per governance votes. Dai can be used to earn passive yields without the volatility of traditional cryptocurrencies. It’s also a good option for cross-border payments, considering its speed and security.

Ecosystem Growth

We also explored ecosystem growth when choosing the best DeFi crypto to buy. This can broadly be split into two key categories – user growth and protocol expansion. Starting with the former, the most successful DeFi ecosystems continuously attract more active users.

For example, Solana DEXs like Raydium have enjoyed rapid increases in trader numbers in the past 12-24 months. Similarly, Aave continues to attract more lenders and borrowers, helping its ecosystem grow to new heights. Increased users also mean more transactions, resulting in higher revenues for the ecosystem.

For example, we mentioned that Uniswap charges a 0.3% commission on token swaps. Those commission revenues increase as more traders join the Uniswap exchange, courtesy of higher trading volumes.

The second aspect is protocol expansion. This typically means additional features and functionality. For example, a Solana DEX might initially only support SPL tokens. But offering cross-chain functionality with Ethereum and BNB Chain would be a major advantage. After all, users can access these ecosystems without using a competitor DEX.

Developer Activity

We also analyzed developer activity when ranking the best DeFi crypto to buy. This highlights how active the core team is. Active development means regular updates, new features, and higher innovation. These metrics can give the respective DeFi ecosystem a competitive edge. A good starting point is to assess the project’s roadmap.

Consider whether historical objectives were achieved on time. And how ambitious and innovative any new objectives are. It’s also a good idea to explore GitHub, one of the most active places for avid developers. Successful projects also encourage dialogue on GitHub, showing genuine excitement from within the developer community.

Conversely, DeFi projects with limited developer activity are a major red flag. This could show that the core team has lost interest or there simply isn’t enough operating capital to grow.

Partnerships

Partnerships are another factor that can drive DeFi ecosystems to sustainable long-term growth. It helps projects expand their reach and, ultimately, increases adoption over time. For example, consider the leading DeFi projects on Ethereum like Tether, USD Coin, Chainlink, Dai, Uniswap, and Aave.

These projects have bridged with layer-2 networks like Polygon to offer a more cost-effective service. Sending USD Coin on Polygon, for example, is significantly cheaper than using Ethereum. Similarly, Uniswap has partnered with Circle on how DeFi can improve the multi-trillion dollar FX markets.

Circle, which backs USD Coin, also announced recently that it offers support for Unichain, Uniswap’s native layer-2 network. These examples show that partnerships can not only expand use cases but also functionality for existing stakeholders.

Tokenomics and Staking Rewards

Tokenomics is an important metric for all prospective crypto investments. Not only DeFi coins but also the best meme coins, stablecoins, and more. Only those with sustainable and transparent tokenomics will succeed in the DeFi era.

First, we evaluated the total and circulating supplies, verified by blockchain analytics. Some DeFi projects, even those with multi-billion dollar valuations, have an unlimited supply. This means existing holders continuously face dilution when new tokens are issued. That said, an uncapped supply isn’t necessarily a red flag if there are sufficient safeguards in place.

For example, if there are smart contracts with a predictable and modest release each month, this won’t impact the project’s sustainability. However, if new tokens can be issued at any time, that’s a big issue. Whoever controls those tokens could engage in reckless spending or worse, significant dumps on public exchanges.

Another metric we assessed was staking rewards. This is because earning opportunities are one of the key reasons to buy DeFi. While we, like many, are attracted to high-stakes APYs, they must be sustainable long-term. Nobody wants to see another Terra USD, which capitulated after losing its peg to the US dollar. The result was billions of dollars worth of losses.

Governance Models

Governance is central to DeFi. Put simply, many DeFi projects offer a native governance token, allowing holders to vote on key proposals. This means the broader DeFi community has a voice, ensuring transparency and democracy. This is unlike traditional companies, where decisions are made by C-suite executives.

However, not all DeFi governance systems are created equal. Voting power is often based on the number of tokens held, meaning disproportionate governance between whales and casual holders. This means large-scale holders have a great say when casting votes. One solution is to delegate votes to trusted community members.

This ensures decisions are made based on the number of individual votes received. Another solution is to weight votes based on how long tokens have been held. This means early adopters often have a louder voice, considering they’ve been loyal to the DeFi ecosystem for longer. Irrespective of the method used, governance votes should be enforced.

Latest Trading News

Where to Buy & Trade DeFi Cryptos

So far, we’ve revealed the best DeFi crypto to buy and what to look for when building a DeFi portfolio. Next, we’ll discuss the best places to buy and sell DeFi cryptocurrencies.

Centralized Exchanges (CEXs) vs. Decentralized Exchanges (DEXs)

DeFi cryptocurrencies can trade on CEXs, DEXs, or a combination of both. Understanding the difference between the two exchange structures is crucial.

CEXs

CEXs are the most popular option when trading cryptocurrencies online. Not only DeFi coins but all blockchain niches. Major CEXs like Kraken and Coinbase are regulated entities. They can legally accept fiat payments, making depositing and withdrawing funds much easier.

For example, users can buy DeFi coins instantly with a debit/credit card. Similarly, some CEXs support fiat withdrawals, meaning profits can be withdrawn to the preferred payment type. CEXs also use the traditional order book system, which appeals to experienced traders.

CEXs, however, don’t align with the DeFi ethos. For a start, they’re Know-Your-Customer (KYC) heavy. Most CEXs require personal information and a government-issued ID. CEXs also operate centralized servers. A hack, or internal malpractice, could mean a loss of customer funds.

DEXs

DEXs operate completely differently from CEXs. They function on a blockchain via smart contracts, meaning a decentralized experience without intermediaries. There’s no account opening process like CEXs, with traders connecting a non-custodial wallet to their chosen DEX. By extension, DEX traders aren’t required to provide personal information or contact details.

Let alone any KYC documents like passports, driving licenses, or proof of address. DEXs don’t use conventional order books either, with trades facilitated by liquidity pools. So, when you want to trade DeFi coins on a DEX, you’re performing a crypto-to-crypto swap.

- For example, suppose your non-custodial wallet currently holds USDT on the Ethereum blockchain.

- You visit the Uniswap exchange and connect the wallet anonymously.

- You want to buy SHIB using the USDT balance.

- Uniswap’s liquidity pool shows the current exchange rate and once confirmed, the swap is executed within seconds.

- Via a secure smart contract, the purchased SHIB is deposited in the connected wallet, which you then disconnect from Uniswap.

The key takeaway with DEXs is that there are no centralized counterparty risks or restrictions. You don’t need to trust that your cryptocurrencies are being kept safe, as DEXs never directly touch client-owned funds. You’re always in full control of the wallet’s private keys, ensuring a safe and autonomous trading experience.

Pros & Cons of Buying DeFi Tokens on CEXs

While DEXs have many benefits, an overwhelming percentage of DeFi traders prefer CEXs. Especially tier-one platforms like Binance, Coinbase, and Kraken. These platforms operate like traditional online brokers, where users open accounts, provide KYC documents, and deposit money with convenient payment methods.

There’s often no requirement to directly use spot exchanges or even place orders, as CEXs often provide “instant buy” services. This means users simply need to type in the required DeFi token and the amount. For example, you might want to buy $500 worth of Hyperliquid with a Visa card.

The DEX executes the purchase and the HYPE tokens are deposited in the account wallet. No understanding of private keys or wallet security is needed, making CEXs a good choice for beginners. Another benefit of CEXs is they typically offer advanced trading features, such as customizable charts, technical indicators, TradingView integration, and bespoke order types.

This is in addition to a fully-fledged customer service team, often with 24/7 support. However, some drawbacks should also be considered, even if you’ve got limited experience with DeFi trading. First, CEXs have a single point of failure, meaning client-owned funds could be at risk if their wallet safeguards are breached.

- ByBit, for example, was recently hacked for over $1.5 billion worth of ETH. Fortunately, ByBit covered client balances 1:1, meaning no funds were lost. However, if ByBit didn’t have sufficient capital, clients might not have been so lucky.

- Similarly, FTX filed for bankruptcy in 2022, with the then-CEO and founder Sam Bankman-Fried eventually sentenced to 25 years in prison for multiple counts of fraud. FTX customers with accounts at the time will receive some of their funds back, although this should be another reminder of the risks CEXs present.

Ultimately, “not your keys, not your coins” is a key consideration when choosing between CEXs and DEXs. Put otherwise, CEXs should only be considered if you’re comfortable trusting a third party to store your DeFi coins. If there’s any doubt in this department, DEXs are a legitimate alternative.

Why DEXs Are the Preferred Choice for DeFi Crypto

In our view, DEXs are the preferred choice when trading the best DeFi crypto to buy. You’re in complete control from the get-go, with no requirement to trust a centralized entity with your funds. As mentioned, DEXs are built on the blockchain and traders aren’t asked for any personal information or KYC documents.

This means you can buy and sell DeFi tokens anonymously and privately. What’s more, any funds traded are never stored by the DEX, as you’re merely executing crypto-to-crypto swaps. All trades are conducted via smart contracts, deposited from and to the connected non-custodial wallet.

Therefore, unlike CEXs, you don’t need to worry about a single point of failure or internal fraud. Nor do you need permission to transfer funds – DEXs have no means to interfere with any of your trades. Another benefit is that DEXs often support millions of DeFi tokens from their respective blockchain ecosystem.

For example, Uniswap supports almost all DeFi tokens from Ethereum, Polygon, Base, and Arbitrum. Similarly, Raydium supports most DeFi tokens from the Solana blockchain, which uses the SPL standard. In contrast, CEXs like Kraken and Binance offer a limited range of DeFi cryptocurrencies, potentially leading to missed opportunities.

However, DEXs also come with drawbacks. First-time traders might find the DEX process intimidating, as there’s no centralized account or deposit framework. Instead, DEXs facilitate crypto-to-crypto swaps, so you’d need some digital assets before starting. That said, an increasing number of DEXs are installing fiat on-ramps.

This means major DeFi tokens like DAI and ETH can be purchased with credit cards and other convenient methods. Nevertheless, DEXs are generally more expensive than CEXs. Users must pay standard trading commissions and network fees. The latter can be costly during busy market conditions, especially when engaging with the Ethereum blockchain.

Best Wallets for Storing DeFi Cryptos

We’ve explored where to access the best DeFi crypto to buy, covering the pros and cons of CEXs and DEXs. Another consideration is which wallet to use when storing DeFi tokens.

Security, user-friendliness, custodianship, supported networks, and fees are just some factors to consider. Read on to discover the best Bitcoin wallets for safe DeFi storage.

Best Wallet – The Overall Best Option for Storing and Trading DeFi Tokens

Overall, we rate Best Wallet as the market leader, especially for those actively trading DeFi tokens. First, unlike many wallets, you won’t be confined to a single DeFi ecosystem. Best Wallet supports over 60 DeFi networks, ranging from Ethereum and Solana to Base, Arbitrum, and XRP. This means millions of DeFi tokens from a wide range of ecosystems can be stored in one safe place.

Best Wallet, which comes as a mobile app for iOS and Android, also provides access to the DeFi trading market. It comes with an in-built exchange aggregator, which connects to hundreds of decentralized liquidity providers (e.g. Uniswap, Curve, PancakeSwap, etc.). This means wallet balances can be used to trade DeFi tokens securely and anonymously.

Cross-chain trading is also supported, ensuring Best Wallet users can buy and sell DeFi tokens across networks. Best Wallet also supports fiat services without KYC requirements. Payment methods include Visa, MasterCard, Skrill, Neteller, and more. Another feature is Best Wallet’s launchpad tool, providing access to the newest DeFi tokens before they trade on exchanges.

MetaMask – A Good Option for Trading EVM-Compatible DeFi Tokens via a Browser Extension

With over 100 million users globally, MetaMask is another popular option when storing DeFi tokens. It comes as a secure extension for multiple browsers, including Chrome, Edge, and Firefox. An iOS and Android app is also available, although less widely used than the browser extension.

Nonetheless, we should mention that MetaMask is best suited for Ethereum Virtual Machine (EVM) compatible networks. This includes Ethereum and the leading layer-2 networks like Base, Arbitrum, Blast, and Polygon. As such, you can’t store DeFi tokens from other ecosystem standards like Solana.

MetaMask does, however, seamlessly connect with popular DeFi platforms. This includes Uniswap, SushiSwap, OpenSea, Curve, Yearn.finance, Decentraland, and others. It’s also a user-friendly DeFi wallet that comes packed with additional features. For example, MetaMask users can buy and sell cryptocurrencies with fiat payment methods.

Do note that fees are high, and KYC will be required. MetaMask also supports Ethereum and Polygon staking but again, fees are high. We should also mention the “Gas Station” feature, with users being able to pay DeFi swap fees in their preferred token. This is a game-changer, as ordinarily, ERC-20 tokens can be traded unless the user holds sufficient ETH.

Trust Wallet – Multi-Chain Wallet App Supporting Over 100 DeFi Network Standards

Trust Wallet is one of the most popular DeFi wallets in the market, boasting over 140 million users. It supports over 100 network standards, translating to over 10 million tokens. This includes Ethereum, Base, Solana, BNB Chain, Arbitrum, XRP, Litecoin, and Polygon. While Trust Wallet offers a browser extension, this comes with less functionality than the mobile app.

Therefore, the iOS and Android app is the best option when storing DeFi cryptocurrencies. Trust Wallet is secured by encrypted private keys and secret passphrases, ensuring a non-custodial experience from the get-go. No personal information or KYC documents are needed either, allowing users to buy, sell, and trade cryptocurrencies anonymously.

Trust Wallet is a feature-rich wallet, including access to DeFi applications like Uniswap, PancakeSwap, and Raydium. It also offers staking rewards on the most popular cryptocurrencies, not to mention an instant conversion tool. Trust Wallet also connects with applications via WalletConnect.

This is ideal for accessing DeFi platforms on desktop devices while retaining security via the mobile app. Trust Wallet also offers an in-built fiat tool, including support for Visa and MasterCard payments. However, we found that minimums and fees are higher than other wallet providers.

Hardware Wallets (Ledger, Trezor) – The Most Secure Way to Store DeFi Cryptocurrencies

Another option to consider is hardware wallets, with Ledger and Trezor being the industry leaders. This is the most secure storage solution, especially for those holding a large quantity of DeFi tokens. Unlike hot wallets, hardware wallets remain offline at all times. This eliminates the risk of being hacked remotely.

The private keys are encrypted and stored within the wallet itself, ensuring transactions can’t be approved without the physical device. In most cases, hardware wallets are connected to a software application (desktop or mobile) via Bluetooth or a USB cable. The transaction is approved when entering a PIN or the device.

Hardware wallets are also secure even if the physical device is lost, damaged, or stolen. Users receive a secret passphrase when installing the wallet, allowing them to recover the funds remotely. However, hardware wallets also come with some drawbacks. First, the most advanced models cost hundreds of dollars, which might not be worth it if you’re a casual trader.

Additionally, hardware wallets lack convenience when actively trading DeFi tokens. Just remember – you won’t be able to buy or sell any cryptocurrencies unless you’re with the hardware device. We also found that hardware wallets support a fewer range of DeFi standards, so market access is even more limited.

Risks & Challenges of Investing in DeFi Cryptos

Many industry experts believe that DeFi will eventually become a trillion-dollar market. However, the existing DeFi market is not only nascent but fraught with risks. Like all emerging markets, considering these risks before investing is crucial.

Let’s take a closer look at what risks and challenges the DeFi industry currently faces.

High Volatility

Even the best DeFi crypto to buy will face high volatility risks. Prices rise and fall based on many factors, from investor confidence and development goals to ecosystem expansion and broader industry sentiment. The key risk to remember is that not all DeFi investments will return a profit. On the contrary, many investors lose significant money.

- For example, SushiSwap was once billed as a “Uniswap Killer”.

- Its native token, SUSHI, achieved significant success during the 2020/21 bull cycle.

- Peaking at $23.38, SushiSwap’s market capitalization surpassed $2.6 billion.

- However, SushiSwap never reached the heights many DeFi analysts thought it would achieve.

- Today, SushiSwap not only trades at a micro-fraction of its former valuation but it also facilitates a tiny percentage of UniSwap’s daily trading volumes.

Therefore, those investing in SushiSwap during the “hype” stage will now be looking for substantial losses.

DeFi Scams

Another risk to consider is that some DeFi cryptocurrencies are nothing but scams. Buying into these projects will leave you worthless tokens, potentially resulting in a 100% loss.

Some of the most common DeFi scams are summarized below:

- Fake Projects: These DeFi projects claim to be building unique and innovative products for the Web 3.0 era. They’re often backed by well-designed websites and highly in-depth whitepapers. However, no product exists, nor is there any intention to build one. The only objective is to trick victims into buying its native DeFi token.

- Rug Pulls: While commonly associated with meme coins, rug pulls frequently happen in the DeFi spac,e too. Project founders invest time and money creating hype and fear of missing out (FOMO), encouraging new investors to buy its tokens. The rug pull happens when the project withdraws its liquidity from the respective DEX. The price crashes to almost zero, leaving holders with untradable tokens.

- Malicious Smart Contracts: Investors should also be wary when connecting to DeFi ecosystems, such as DEXs or lending protocols. Scammers have been known to build imitation websites, where victims believe they’re connecting their wallet to the intended DeFi platform. However, once connected, a malicious smart contract will be deployed. The result? The wallet’s contents are drained, with no means to ever recover the funds.

As a decentralized concept, DeFi is highly attractive to cybercriminals. After all, DeFi transactions are conducted anonymously, meaning no accountability when scams are successful. This is why global regulators are increasingly focusing on DeFi risks, which we discuss shortly.

Smart Contract Risks & Hacks

Smart contracts sit at the heart of the DeFi ecosystem. They allow transactions to be conducted without third parties, with smart contract terms ensuring transparency and immutability. However, while smart contracts don’t present conventional counterparty risks (e.g., mishandling client funds or fraud), hacks and vulnerabilities remain a threat.

One of the most damaging examples was the Wormhole Hack in 2022:

- Wormhole facilitates cross-chain functionality, allowing users to move digital assets between Ethereum and Solana.

- A hacker discovered a smart contract vulnerability, allowing them to mint Wormhole ETH (wETH) without it being backed by “real” ETH (as is the norm when wrapping ETH).

- Over 120,000 “fake” wETH was withdrawn from Wormhole, valued at over $320 million at the time.

- Those wETH tokens were subsequently sold on DeFi exchanges.

This is just one example of many high-value DeFi hacks. Therefore, never assume that DeFi investments are 100% safe just because they’re backed by smart contracts.

Impermanent Loss

One of the most popular DeFi earning tools is liquidity provision. This means you’re providing DEXs with liquidity, allowing them to offer tradable markets without order books. In return, you receive a small share of any trading commissions generated from the provided liquidity. Liquidity provision requires an equal amount of two tokens, which creates a trading pair.

For example:

- Suppose ETH is valued at $3,000. And USDT is valued at $1.

- If you provide 2 ETH ($6,000), you’d also need to provide 6,000 USDT ($6,000).

Now, the key risk is “impermanent loss”. In a nutshell, impermanent loss happens when you could have earned more had you not provided the liquidity. Put otherwise; your earnings would be higher simply by leaving those tokens sitting idle in a wallet. This happens when one of the two tokens increases or decreases in value relative to the other.

Liquidity Risks

Liquidity is another key risk when investing in DeFi. Especially when using liquidity pools with a low TVL. This can cause high slippage, meaning you get fewer tokens than you had initially anticipated. A lack of liquidity can also make it challenging to cash out a profitable position.

Even a modest sell order could cause the token price to crash, turning a profitable trade into a losing one, considering you’d need to accept an unfavorable price. The best safeguard is to stick with popular DeFi ecosystems with the highest TVLs. For example, major pairs like ETH/USDT on Uniswap or SOL/USDC on Solana.

Regulatory Uncertainty in the DeFi Space

The broader DeFi industry is largely unregulated. It’s one of the most complex spaces to regulate due to its borderless and anonymous nature. After all, DeFi transactions are conducted by connecting a non-custodial wallet. No personal information, such as the user’s nationality, is collected.

This makes it nearly impossible to detect and prevent money laundering risks. As seen with the recent $1.5 billion ByBit hack, the North Korean-linked Lazarus Group has already converted over $300 million. Therefore, the DeFi ecosystem presents major hurdles for financial intelligence units around the world.

The US Securities and Exchange Commission (SEC) previously issued Uniswap a Wells Notice, citing Uniswap’s status as an unregistered broker and exchange. The SEC has since dropped the case, meaning a major win for DeFi. Even so, stablecoins are another area that governments are increasing regulatory scrutiny.

The European Union, for instance, has placed strict limits on Tether and USD Coin transactions, leaving some exchanges to delist them. Therefore, DeFi investors should keep a close eye on regulatory developments. Any major changes could directly impact investments.

How to Avoid Bad DeFi Investments

We’ll now discuss some best practices when making DeFi investments. This will reduce the risks of making poor investing decisions.

Long-Term vs. Short-Term DeFi Investment Strategies

DeFi might not be the best niche if you’re a short-term speculator. Instead, you might be more suitable for meme coins or shit coins. The best DeFi crypto to buy are long-term projects building for the Web 3.0 era. Their underlying tokens offer specific use cases and utility. So, while they’ll still witness price volatility, long-term holders typically see the biggest growth.

After all, the DeFi marketplace is nascent. Holding for multiple years is the smartest move, considering the broader industry is heavily undervalued. If you’re comfortable committing long-term, consider an affordable dollar-cost averaging (DCA) strategy. Choose an amount and frequency, such as $75 weekly or $300 monthly.

This will provide a balanced approach to the DeFi market without being overexposed to a single cost basis. For example, you might buy $300 worth of UNI at $6 in the first month. In the second, you might get UNI at $5, as per the broader market dip. This means you get a discounted price whenever prices drop.

Be Wary of Unsustainable DeFi Yields

DeFi investing isn’t just about price increases. It’s also highly suitable for earning passive income, whether that’s through staking, liquidity provision, or lending. However, it’s important to look past the available yields when choosing a DeFi platform. Those offering the highest APYs often have low TVLs, meaning the risks are considerably high.

For example, Uniswap is currently offering a 4.3% APY on its ETH/USDT pool. This pool has over $81 million in TVL. Conversely, many ETH/USDT pools on other DeFi platforms offer APYs of over 10%. Closer inspection shows that TVLs are often under $1 million, vastly increasing the risks of slippage, impermanent loss, and even rug pulls.

Ensure Your Portfolio Is Diversified

DeFi is a high-growth market, with the most successful investors making considerable gains. However, choosing the best DeFi crypto to buy is no easy feat. In fact, picking just one project is a major risk. Sure, you could get lucky and witness massive returns on that one investment.

However, if that DeFi project fails, you could lose most of the amount invested. As such, the safer option is to build a diversified DeFi portfolio. That way, if one of your investments goes bad, you’ve still got exposure to other projects (which could perform much better).

There are many different ways to diversify in the DeFi market. A good starting point is to pick several DeFi niches, such as DEXs, lending and borrowing, stablecoins, staking, and yield farming. Then pick several projects within each niche, covering multiple blockchain ecosystems for the most risk-averse strategy.

For example, within the DEX niche, you might consider exchanges like Uniswap (Ethereum/Base), Pancakeswap (BNB Chain), and Raydium (Solana). Each exchange has a native DeFi token, UNI, CAKE, and RAY, respectively. Repeat this process for each DeFi niche, ensuring you’ve got a well-balanced portfolio that’s primed for solid long-term growth.

Are DeFi Investments Taxed?

To conclude this guide on the best DeFi crypto to buy, we should briefly mention how taxes work in this industry. Similar to any other crypto niche, DeFi tokens are subject to capital gains taxes in most countries. So, if you invest $1,000 into a DeFi token and cash out at $4,000, you’ve made a capital gain of $3,000, which could be taxable.

However, DeFi investments are also subjective to income taxes when generating earnings. This covers anything from staking and liquidity provision to airdrops and lending yields. The DeFi rewards are typically added to your income for the tax year, based on the value when received.

FAQ – Best DeFi Crypto to Buy in 2025

DeFi cryptocurrencies support decentralized finance ecosystems, often providing benefits for holders. This can include governance rights, enhanced staking rewards, and access to airdrops.

Many factors should be considered when choosing the best DeFi crypto to invest in, including token use cases, developer activity, ecosystem growth, and the ongoing roadmap. Investors should also research price performance, market capitalization, and tokenomics.

The safest way to invest in DeFi is to keep investment amounts small, diversify across multiple niches, and ensure you're using a secure wallet. You should also stick with reputable DeFi ecosystems like Uniswap and PancakeSwap.

Yes, DeFi tokens are ideal for earning passive income. Popular methods include providing liquidity to DEXs and depositing tokens into staking pools.

Some DeFi projects are outright scams, with no intention of building for the Web 3.0 era. Smart contract hacks and unfavorable DeFi regulations are other risks to consider.

No, DeFi is largely unregulated, considering its decentralized, anonymous, and borderless characteristics. Governments are increasingly looking at ways to regulate this industry.

According to DappRadar data, the top DeFi projects by TVL are Sky, LIDO, Aave, Ethena, and Etherfi.

The best way to access new DeFi tokens is via the Best Wallet launchpad. Users get priority access to pre-listing tokens, meaning the lowest cost price available. What makes a DeFi crypto different from other altcoins?

How do I choose the best DeFi crypto to invest in?

What are the safest ways to invest in DeFi?

Can I earn passive income with DeFi tokens?

What are the biggest risks of investing in DeFi?

Is DeFi regulated, and does it face legal risks?

What are the top DeFi projects by Total Value Locked (TVL)?

How can I get early access to new DeFi tokens?

References

- Decentralised finance (DeFi) and DAOs (Federal Financial Supervisory Authority)

- DeFi TVL Rankings (DappRadar)

- The Trades That Triggered TerraUSD’s Collapse (Chainalysis)

- Crypto’s biggest hacks and heists after $1.5 billion theft from Bybit (Reuters)

- Samuel Bankman-Fried Sentenced to 25 Years for His Orchestration of Multiple Fraudulent Schemes (US Department of Justice)

- Customers of failed crypto firm FTX set for refunds (BBC)

- DeFi Fans Are Courting Traders in $7.2 Trillion Currency Market (Bloomberg)

- Lessons from the Wormhole Exploit: Smart Contract Vulnerabilities Introduce Risk; Blockchains’ Transparency Makes It Hard for Bad Actors to Cash Out (Chainalysis)

- North Korean hackers cash out hundreds of millions from $1.5bn ByBit hack (BBC)