Join Our Telegram channel to stay up to date on breaking news coverage

Here are the 5 best cryptocurrencies to buy right now. As the Tesla-instigated bear market continues, we’ve gone for a green theme with five coins that don’t use a proof-of-work consensus mechanism. While they haven’t been able to avoid today’s market-wide selloff, they may be better positioned to thrive in a more eco-minded future.

5 Best Cryptocurrencies to Buy

Cardano (ADA)

Cardano has weathered the bearish market better than most other cryptocurrencies up until now. It’s still up by around 15% over the past 30 days, whereas bitcoin and ethereum are down by 34% and 5.6%, respectively. However, it has begun to slide down with the rest of the market. Its price has fallen by 13% over the past 24 hours, although it has shown signs of a modest recovery in recent hours. It currently stands at $1.51, having been as high as $1.81 only a couple of days ago.

ADA’s resistance level has sunk from $2.45 on May 16 to just over $1.70 today. Its support level is just under $1.00, having been $1.50 a couple of weeks ago. Recent trends indicate an ongoing decline, although some commentators are continuing to talk up its chances of bouncing back strongly. YouTuber Lark Davis recently posted a video in which he claimed that Cardano is “ready to explode.”

I think that we could be in for a bit of a Cardano summer, so to speak, with loads of new applications launching in anticipation of the smart-contract launch on Cardano.

Cardano has yet to experience adoption on the scale of an Ethereum. That said, the impending launch of smart contracts on its platform could set it up to be a serious Ethereum rival. As a proof-of-stake platform, it avoids the criticisms currently affecting Bitcoin (and also Ethereum). ADA has also gained in price as Ethereum gas fees have hit record highs, potentially paving the way for future growth as Cardano becomes a fully functional alternative to Ethereum. If it does begin to truly rival Ethereum, it will certainly cement its position as one of the best cryptocurrencies to buy.

Stellar (XLM)

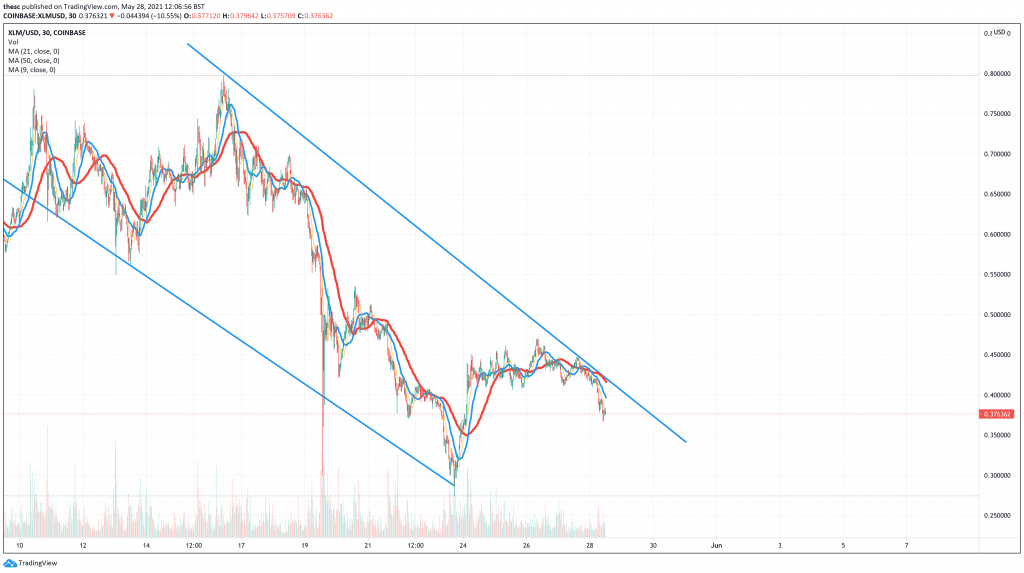

Stellar (XLM) is down by 13% over the past 24 hours, much like ADA. Its longer term decline is a little steeper than ADA’s, however. It has fallen by 25% in the past 30 days, although is still up by well over 400% across the previous 12 months.

XLM’s resistance level has dropped from $0.80 on May 16 to about $0.45 today, a fall of 43.75%. Its support level now sits at under $0.25, whereas it was as high as $0.625 on May 11.

Still, even with these declines, Stellar is one of the best cryptocurrencies to buy at the moment. It’s another proof-of-stake cryptocurrency that’s well-positioned to grow under more favorable market conditions. The Stellar Development Foundation recently invested $15 million in AirTM, a Mexico-based digital wallet and peer-to-peer exchange platform. As part of the deal, the Stellar blockchain will be integrated with AirTM’s trading platform, providing it with an opportunity for wider use.

Stellar has also been enjoying more investment interest. At the end of April, Switzerland-based investment product provider 21Shares announced it was launching an exchange-traded product (ETP) for XLM. This comes in addition to a similar ETP for ADA.

Ripple (XRP)

XRP is down by 14% over the past 24 hours. It’s also down by 25% over the past week and 37.5% over the past 30 days. Even so, it’s more than 300% up across the past year.

XRP’s resistance is currently sitting at around $1.00, and had been closer to $1.70 only ten days ago. Its support level is now close to $0.60, a mere 31.25% of the price — $1.92 — it reached on April 14.

XRP isn’t actually a proof-of-stake cryptocurrency, but its consensus mechanism does avoid using proof-of-work. As such, it’s highly energy efficient in comparison to Bitcoin, and may stand to profit as a result. On the other hand, it has an ongoing case with the Securities and Exchange Commission. Recent hearings have been favorable to Ripple though, so XRP may end up rising significantly in price if and when the company wins a positive final outcome.

Tron (TRX)

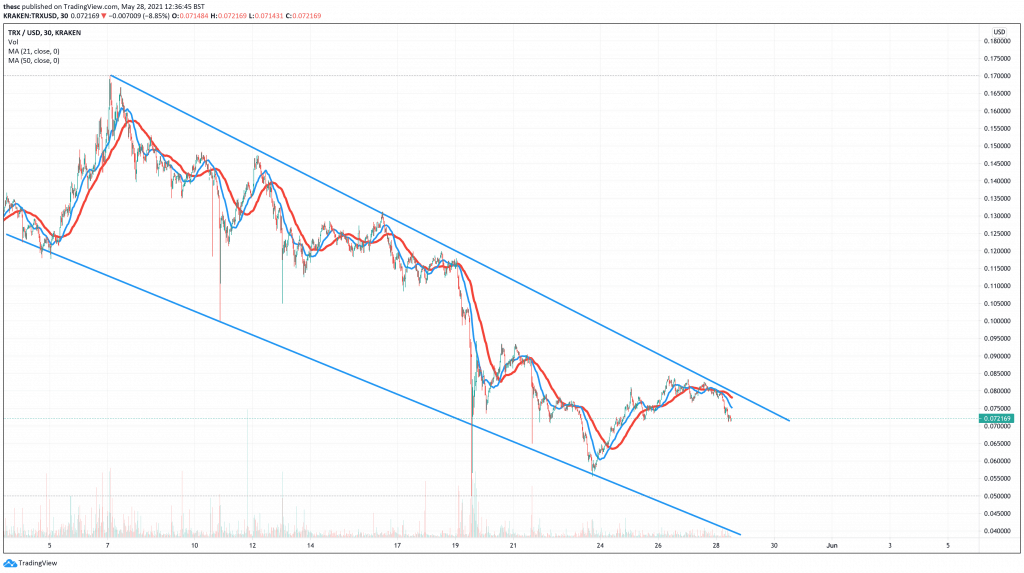

As with pretty much every other cryptocurrency, Tron (TRX) has fallen steeply over the past day. It has dived by 12% in the last 24 hours, on top of a 42% dive in the past 30 days. The cryptocurrency is up by 380% over the past year.

TRX’s resistance level stands at $0.075, down from $0.17 on May 7. Its support level is now aligned with $0.045.

Despite its slip, Tron remains a good proof-of-stake cryptocurrency for the future. It continues to be a popular platform for gambling apps, while it is also increasingly moving into non-fungible tokens. The Tron Foundation announced in April that it had reached $13.6 billion in total value locked into its DeFi system.

🎊Total Value Locked(TVL) in #TRON #DeFi Equals $13.6 Billion.

🤗All the projects are welcome to join #TRONCenturyMining.

⚒️Stake one token for #TRX, #JST, #SUN, #BTT, #WIN, #BTCST rewards, enjoy high earnings with no risk at https://t.co/EEKeRkRycI pic.twitter.com/UGjNBiXtI1

— TRON DAO (@trondao) April 15, 2021

Neo (NEO)

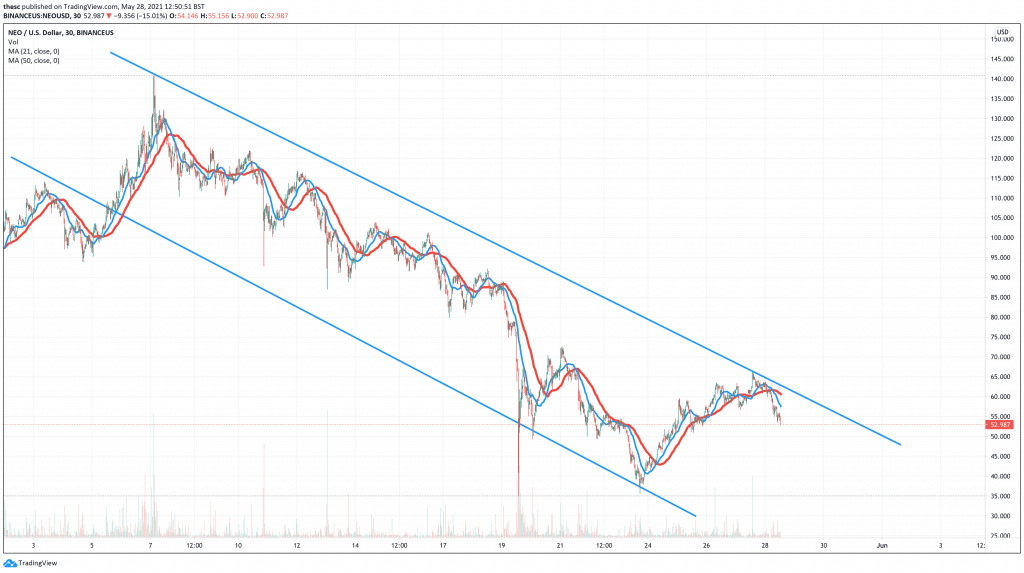

Neo’s price is currently $54, an 11% drop over 24 hours. The cryptocurrency has slumped by 42% over the past 30 days, although is more than 400% up across the past 12 months. It remains some way off the all-time high of $198, which it set in January 2018.

NEO’s resistance level is now verging towards the $60 mark, while its support level is nearing $30. It could still recover along with the rest of the market, with Neo showing considerable potential as a platform. It has a burgeoning DeFi ecosystem, with a few apps — such as Flamingo Finance and Poly Network (which also operates on other chains) — passing over $1 billion in value locked in.

Looking to buy or trade Neo (NEO) now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider

Join Our Telegram channel to stay up to date on breaking news coverage