Join Our Telegram channel to stay up to date on breaking news coverage

Large Ethereum (ETH) purchases occurred during a turbulent week for digital assets as the cryptocurrency market reacted to shifts in international trade policies. Ethereum’s value dropped to $2,150 on Monday, mirroring declines across the broader market. However, it quickly recovered within the same trading session.

The recent acquisitions by BlackRock and Fidelity have strengthened investor confidence, with many viewing them as signals of an upcoming market rally. Optimism is growing among crypto enthusiasts, who anticipate a surge in altcoins. This outlook is fueled by broader industry developments and the political landscape, particularly following Donald Trump’s return to the U.S. presidency. Meanwhile, investors are searching for affordable tokens, particularly the best cheap crypto to buy now under 1 dollar.

5 Best Cheap Cryptocurrencies to Buy Under 1 Dollar

XDC is priced at $0.09225, reflecting a 4.05% rise over the past 24 hours. Ethena (ENA) has experienced notable trading activity. IOTA Rebased continues to advance its technology, introducing updates to enhance efficiency, security, and accessibility.

UXLINK recently revealed two key partnerships that could impact its growth and adoption within the Web3 ecosystem. Meanwhile, Solaxy has drawn interest as a meme coin in 2025, with its SOLX token presale approaching the $20 million milestone. Additionally, MicroStrategy has rebranded as Strategy and reported an increase in its bitcoin holdings for the fourth quarter.

1. XDC Network (XDC)

XDC Network has recently integrated with the Australian Digital Dollar ($AUDD), which could enhance blockchain-based trade, real-time payments, and interoperability in the Asia-Pacific region. This collaboration is expected to contribute to tokenizing trade assets while facilitating more efficient and secure transactions for businesses and consumers.

With this integration, transaction costs may decrease, while security and processing speed could improve. Additionally, it aligns with the Model Law on Electronic Transferable Records (MLETR), which supports regulatory compliance in digital trade. As a result, cross-border payments may become more seamless, benefiting both enterprises and individual users.

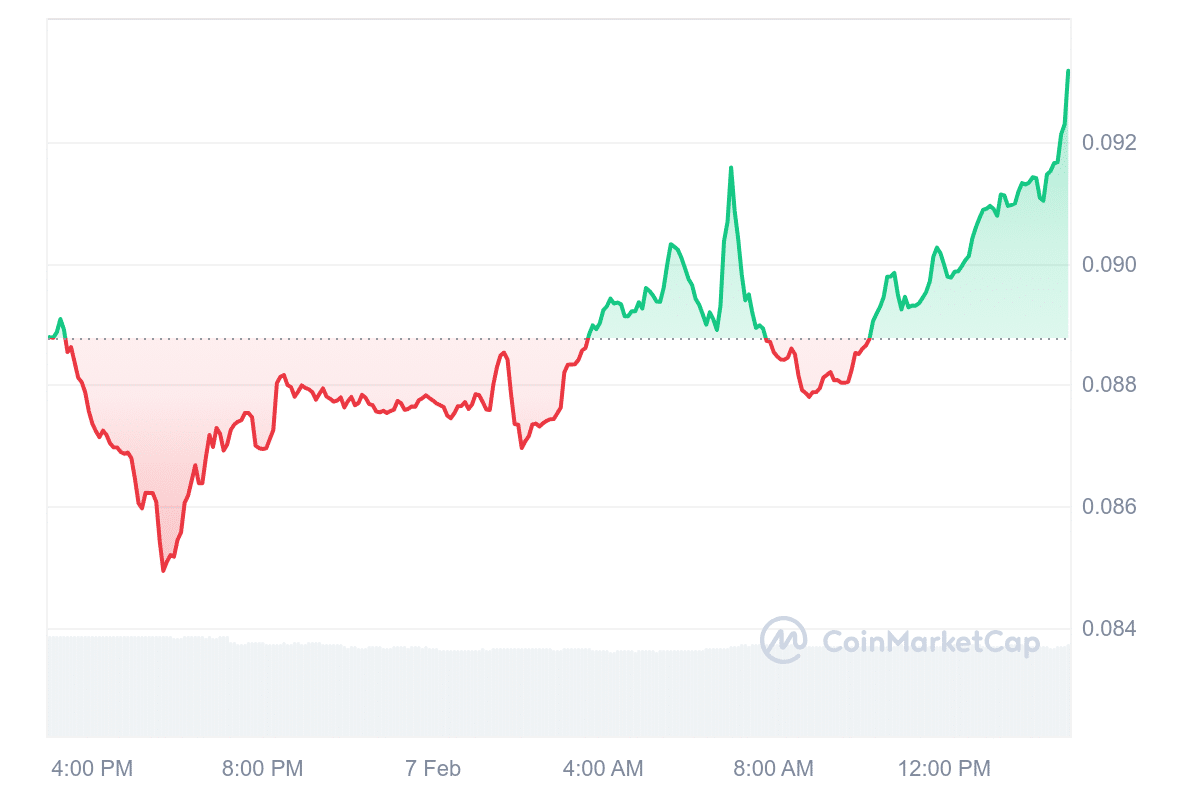

XDC is trading at $0.09225, marking a 4.05% increase in the past day. Over the last year, its price has surged by 113%, outperforming 75% of the top 100 cryptocurrencies. Furthermore, XDC is trading significantly above its 200-day simple moving average (SMA) of $0.04864, highlighting a strong price trend. The asset also demonstrates high liquidity with a market capitalization of $1.37 billion.

Market predictions suggest potential price growth in the coming months. By February 2025, XDC could experience a price increase of up to 7.21%, reaching an average of $0.098819. Further growth is anticipated in March, with a projected rise of 28.64%, potentially peaking at $0.19643. If these trends persist, long-term traders may find promising opportunities with a potential return on investment (ROI) of 113.11%.

2. Ethena (ENA)

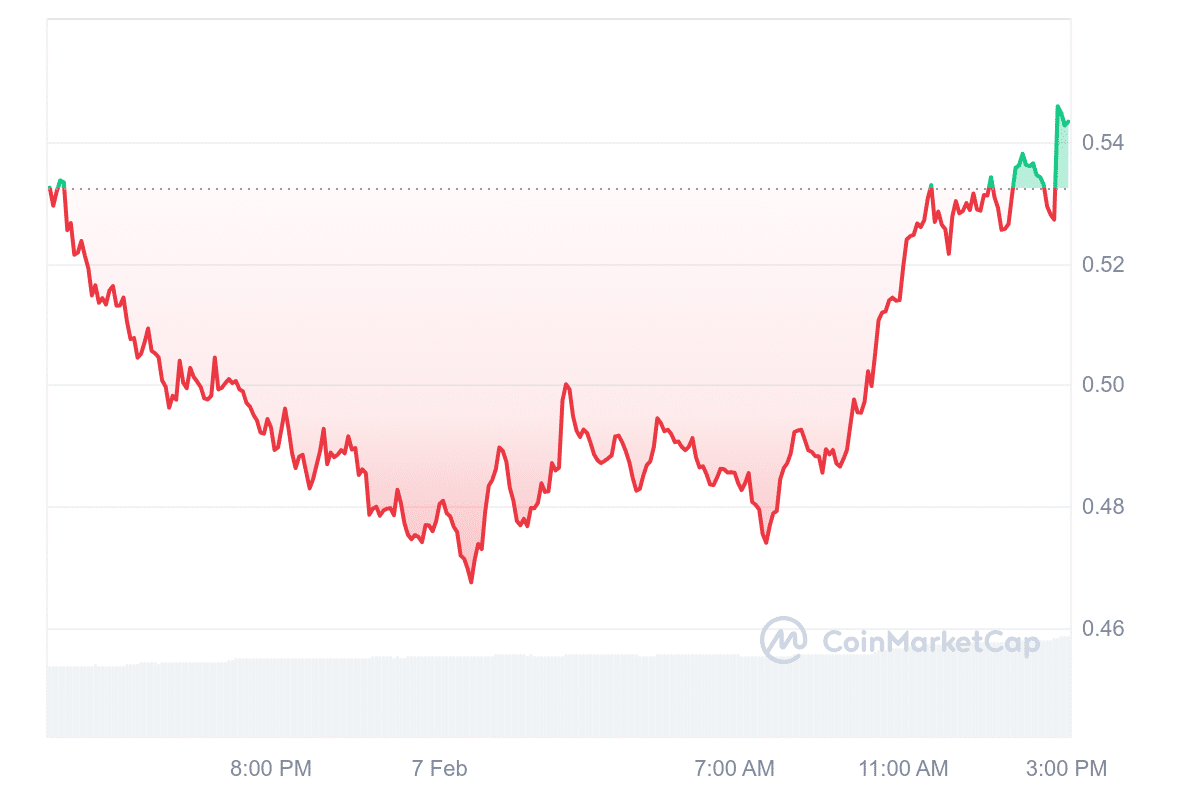

Ethena (ENA) has shown significant market activity. It is priced at $0.5433, reflecting a 1.83% increase in the last 24 hours. The asset holds a $1.69 billion market capitalization, while daily trading volume has risen 43.95% to $409.58 million. Its fully diluted valuation is $8.14 billion, with a volume-to-market cap ratio of 23.97%. These indicators suggest strong trading participation.

Market forecasts for February indicate a possible growth of 87.42%, with an expected average price of $1.0108. Price fluctuations could range between $0.5346 and $1.8262. If this trend materializes, the potential return on investment (ROI) could reach 238.61%. This suggests possible opportunities for investors seeking price appreciation.

USDe and sUSDe are both playing critical roles in emerging DeFi ecosystems

Tomorrow, @concretexyz will be launching a USDe vault and sUSDe vault to power Ethena's growth in the @movementlabsxyz ecosystem, capped to $50 million apiece https://t.co/m1X7vNRFwm

— Ethena Labs (@ethena_labs) February 2, 2025

Looking ahead to March, analysts anticipate further gains. ENA’s price could increase by 292.71%, reaching an average of $2.12, fluctuating between $1.6618 and $2.54. If these projections hold, the estimated ROI may rise to 371.22%. Given the positive performance in February, this outlook suggests a continued upward trend.

3. IOTA (IOTA)

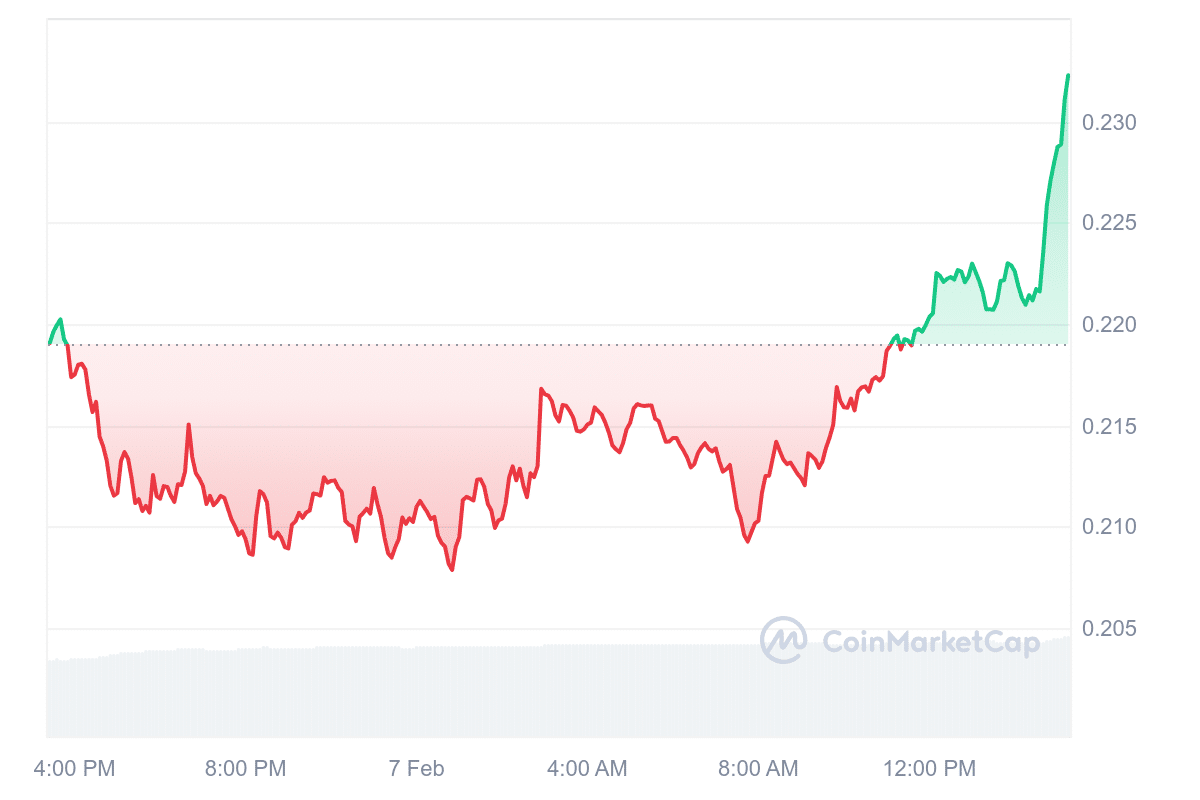

IOTA Rebased is making steady progress by enhancing its technology with key updates to improve efficiency, security, and accessibility. Recent developments emphasize a more secure and effective consensus mechanism, localized fee markets, predictable transaction costs, and fair validator selection. Additionally, multi-virtual machine (MultiVM) Layer 1 support, including EVM compatibility, strengthens its adaptability.

The project has also welcomed several established validators, staking service providers, and infrastructure partners to its test network. These industry participants, known for managing significant digital assets, contribute to the reliability and trustworthiness of IOTA’s validation process. Their presence reinforces IOTA’s efforts to establish enterprise-grade security.

Another noteworthy integration is the addition of Keyring, a hardware wallet provider that enhances asset management and staking within the IOTA ecosystem. This integration simplifies transactions while maintaining a balance between security and convenience.

IOTA Rebased builds on established tech with our own enhancements:

✅ Secure, efficient consensus

✅ Local fee markets

✅ Feeless sponsored TXs

✅ Predictable gas fees

✅ Fair validator selection

✅ MultiVM L1 support (EVM & more).Dive in at https://t.co/hncXNcfJB5 pic.twitter.com/0f8j53Ps1s

— IOTA (@iota) February 7, 2025

IOTA’s market performance has also shown resilience. Its price is currently trading above the 200-day simple moving average, which indicates positive sentiment and high liquidity, supported by increased trading volume.

Overall, IOTA Rebased continues to strengthen its foundation with incremental improvements, strategic partnerships, and growing market confidence. While further developments will shape its long-term success, its trajectory suggests steady progress toward a more robust ecosystem.

4. UXLINK (UXLINK)

UXLINK has recently announced two notable collaborations that could influence its adoption and usability in the Web3 space. The first partnership is with AEON Community, a blockchain-based payment protocol. This collaboration will integrate UXLINK’s token ($UXLINK) into AEON Pay, enabling in-store payments in various countries, particularly Southeast Asia. This could enhance the token’s real-world utility and support its broader adoption in digital transactions.

Additionally, UXLINK has teamed up with SOON, a project focused on blockchain scalability. SOON aims to enhance Layer 1 performance through its roll-up technology, making blockchain adoption more efficient. This partnership aligns with UXLINK’s objective of expanding Web3 applications.

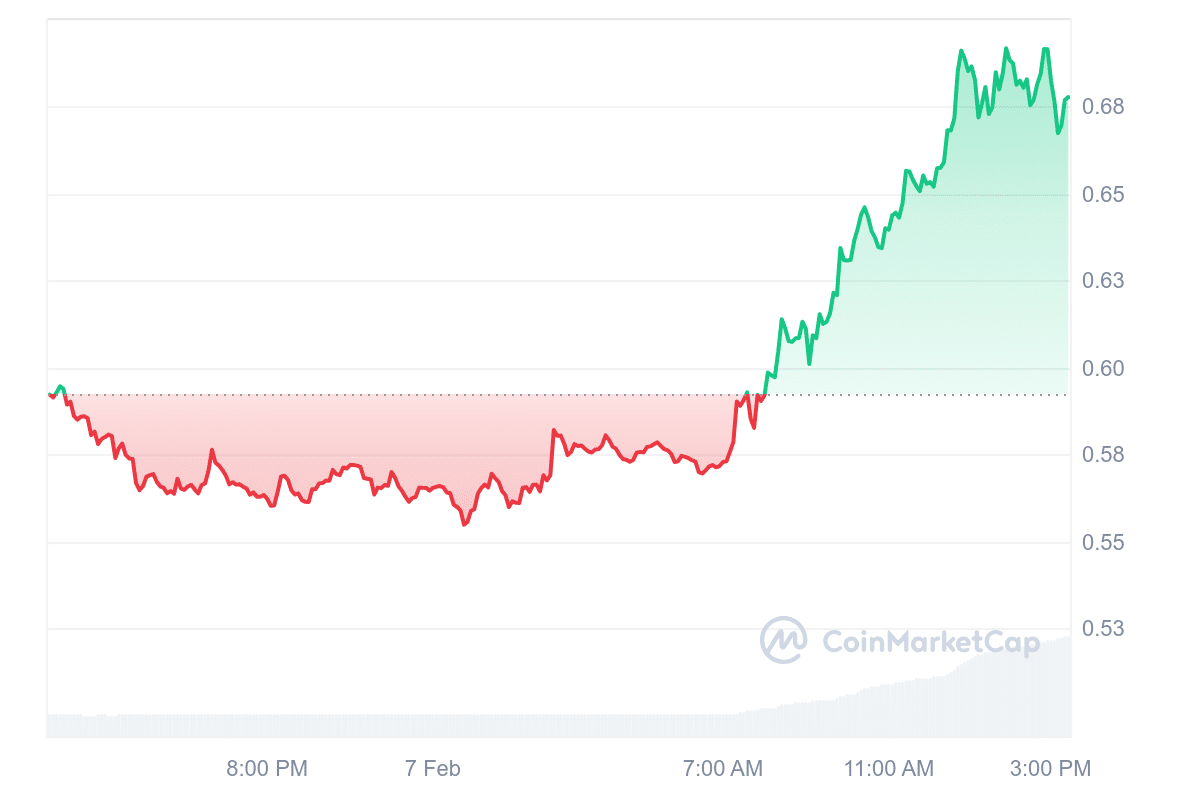

In terms of market activity, $UXLINK has experienced significant movement. At the time of reporting, it is valued at $0.6727, reflecting a 14.12% increase within the past day. The token’s market capitalization has reached $227.51 million, while its 24-hour trading volume has surged by 341.05% to approximately $153.18 million.

🫡Glad to be partnership with @AEON_Community, a leading #WEB3 payment protocol. $UXLINK will be supported by #AEON Pay and tens of millions #UXLINKfams could use their token to make in-store payment in real world in dozens of countries especially in South East Asia.

UXLINK… https://t.co/SD2DgteH3K

— UXLINK (@UXLINKofficial) February 7, 2025

These developments suggest that UXLINK focuses on increasing its token’s usability and scalability. However, as with any digital asset, the long-term impact of these partnerships will depend on adoption rates and market conditions.

5. Solaxy ($SOLX)

Solaxy gained attention in 2025 as a meme coin project, with its SOLX token presale nearing the $20 million mark. Despite market fluctuations, it continues to attract investors. Several factors contribute to its rapid progress. Since its launch, Solaxy has been compared to platforms like Arbitrum and Optimism due to its focus on layer-2 solutions. However, it stands out by incorporating meme culture into its framework. The project blends humor with science, featuring a frog mascot inspired by Einstein. This fusion makes it appealing to a broad audience.

While Solaxy actively engages users through social media, it aims for more than short-term hype. The project maintains a strong online presence, with around 66,000 followers on Twitter and 6,000 members on Telegram. Its marketing strategy relies on bold visuals and narratives, which help build a loyal community.

The combination of technical innovation and cultural appeal has attracted significant interest. This approach has contributed to its expanding audience and growing investor confidence. However, whether this momentum leads to long-term stability remains uncertain. The project must deliver on its promises to sustain its success.

Solaxy’s presale highlights the potential of merging blockchain advancements with internet trends. While its marketing and community support have fueled its growth, its future will depend on continued development and real-world utility. Investors will likely watch closely to see if it can maintain its current trajectory.

Learn More

Our Previous Best Cheap Cryptocurrencies to Buy Under 1 Dollar Post

Join Our Telegram channel to stay up to date on breaking news coverage