Join Our Telegram channel to stay up to date on breaking news coverage

Explore investment potential with the top five cryptocurrencies under $1 for November 19. Diversify your portfolio affordably and seize growth opportunities.

Bitcoin, the leading cryptocurrency, is priced at $36,673, showcasing a marginal 0.16% gain in the last 24 hours. Concurrently, Bitcoin’s dominance experienced a slight decline of -0.15%, presently at 50.86%.

5 Best Cheap Crypto to Buy Now Under 1 Dollar

These fluctuations in market cap, trading volume, and individual coin performance highlight the ongoing volatility within the cryptocurrency landscape. Investors and observers keen on market trends will find these metrics informative for assessing the crypto sphere’s current dynamics and potential shifts.

1. Oasis Network (ROSE)

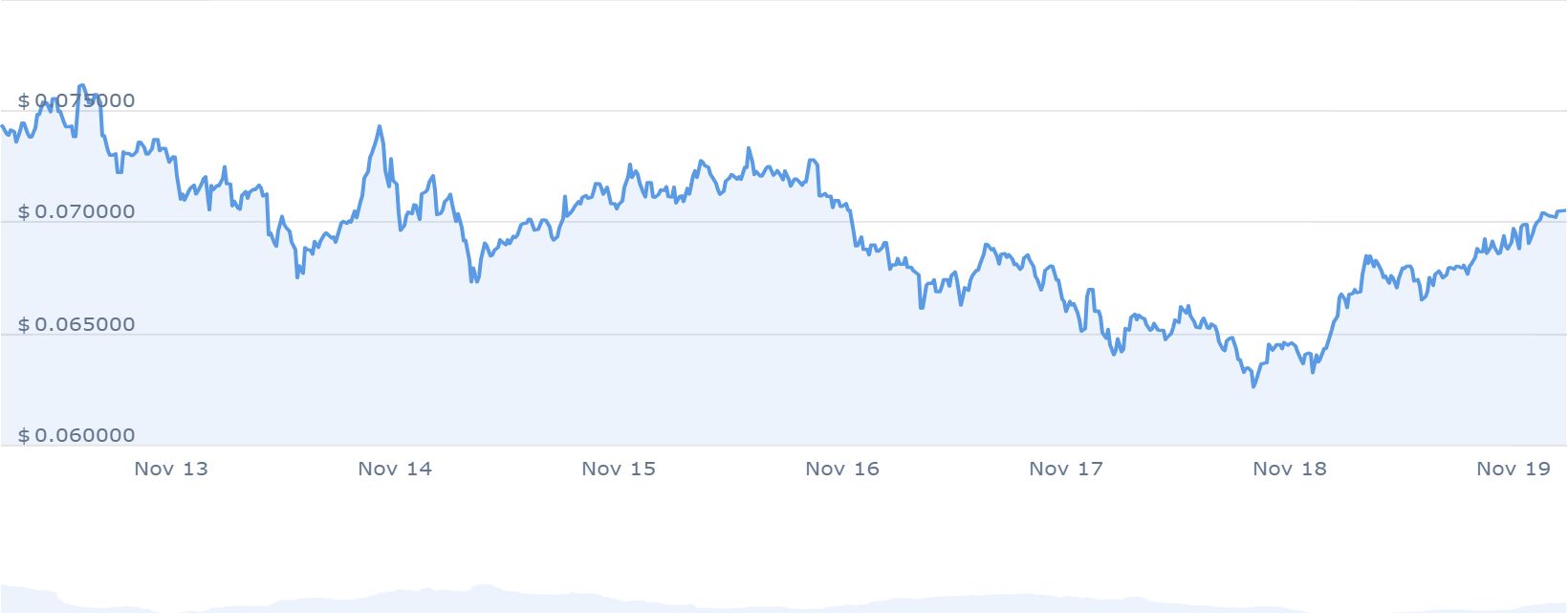

The current Oasis Network (ROSE) statistics show a trading price of $0.070553, with a 24-hour trading volume hitting $63.13 million and a market cap of $461.58 million. Over the past day, the token has increased by 6.53%. Its highest price to date was $0.592943 on Jan 15, 2022, while the lowest recorded was $0.032259 on Nov 26, 2020. Following its peak, the lowest dip reached $0.033464, and the subsequent high stood at $0.085614.

Currently, the sentiment surrounding the Oasis Network is bullish, in line with a Fear & Greed Index rating of 66 (Greed). Regarding supply dynamics, 6.54 billion ROSE are in circulation out of a maximum supply of 10 billion. The yearly supply inflation rate has been at 30.13%, creating 1.51 billion ROSE over the past year.

The project holds the #15 position in the Proof-of-Stake Coins sector and ranks #4 in the AI Crypto sector. Over the past year, it has demonstrated robust growth, with its value surging by 52%, outperforming 65% of the top 100 crypto assets. Notably, it has consistently traded above the 200-day simple moving average. It has experienced positive trading days on 21 occasions out of the last 30, accounting for 70%.

The Oasis Engineering team is dedicated to empowering the Oasis ecosystem and Web3 landscape with the technology we need to scale Web3 and data privacy to the masses

October was another exciting month — Here are the updates: 🧵 pic.twitter.com/ioLbanI0A9

— Oasis (@OasisProtocol) November 19, 2023

Key indicators also highlight the token’s high liquidity based on its market capitalization and availability for trading on Binance, a major exchange platform.

Overall, the recent performance and metrics of the Oasis Network underscore a significant increase in both value and market positioning, suggesting a promising trajectory within the cryptocurrency landscape.

2. Kaspa (KAS)

Kaspa has shown notable price fluctuations over the last year. It has shown remarkable growth over the last 12 months, boasting a staggering 2,182% increase. Hence, it is outperforming 99% of the top 100 crypto assets. Notably, it has also outpaced leading cryptocurrencies like Bitcoin and Ethereum in this period.

On November 18, 2023, Kaspa peaked at $0.147381, hovering near its all-time high. Conversely, its lowest recorded price was $0.000171 on May 26, 2022, but it has consistently remained above the cycle low at $0.133201. The current sentiment around its price prediction is bullish, accompanied by a Fear & Greed Index score of 66 (Greed).

From a technical standpoint, the coin trades above its 200-day simple moving average, indicating a positive trend. With 21 out of the last 30 days seeing gains (70% green days), Kaspa demonstrates significant strength. Moreover, it is close to its all-time high and cycle high, reflecting strong market sentiment.

🎉Incoming… #Binance Futures will launch the USDⓈ-M KAS perpetual contract at 🗓Nov 17 2023, 02:00 (UTC).https://t.co/cBoKr8d2jI https://t.co/TPbsMPBrYe

— Kaspa (@KaspaCurrency) November 16, 2023

Regarding supply dynamics, the circulating supply stands at 21.59 billion KAS out of a maximum supply of 28.70 billion KAS. Over the past year, a supply inflation rate of 64.66% has created 8.48 billion KAS. Kaspa holds the #5 position in the Proof-of-Work Coins sector and is ranked #16 in the Layer 1 sector, benefiting from high liquidity based on its market cap.

3. Polygon (MATIC)

Polygon is trading at $0.843414 with a 24-hour trading volume of $708.36M. Its market cap stands at $6.75B, capturing 0.48% of the market. Over the past day, MATIC, Polygon’s native token, saw a 2.43% increase. The highest price point for Polygon was $2.91 on Dec 27, 2021, while its lowest recorded price was $0.003049 on May 9, 2019.

Since hitting its all-time high, Polygon dipped to a low of $0.322074, with the highest post-cycle price at $1.559350. Market sentiment leans bullish, and the Fear & Greed Index registers at 66 (Greed).

With 8.01B MATIC tokens circulating out of a maximum supply of 10.00B, Polygon ranks #7 in Proof-of-Stake Coins. Furthermore, it is ranked #3 in Ethereum (ERC20) Tokens and #1 in Layer 2 by market cap. Other highlights include trading above the 200-day simple moving average, which is a positive performance compared to the token sale price.

For proof generation, MidenVM uses the RPO hash function. Though traditional hash functions like BLAKE3 are very fast, they are not optimal for use inside zero-knowledge proof systems. For efficient recursive proof generation, you need a ZK-friendly hash function.

But why use… pic.twitter.com/gEG3k1oSap

— Polygon Foundation (@0xPolygonFdn) November 3, 2023

Polygon demonstrates a positive trend, with 20 out of the last 30 days marked as green, accounting for 67% of favorable trading days. Additionally, the project exhibits robust liquidity, substantiated by its market capitalization. These factors contribute to the overall positive assessment of Polygon’s recent performance within the cryptocurrency market.

4. XRP (XRP)

XRP, a cryptocurrency traded on Binance, has recently witnessed substantial price fluctuations. In the last year, XRP’s price surged by 63%, surpassing 71% of the top 100 cryptocurrencies—an impressive feat within the market.

Currently, XRP holds a value of $0.623537, boasting a market capitalization of $33.50B. It maintains a robust 24-hour trading volume of $1.45B, indicating significant liquidity backing its market cap. Its market dominance is 2.38%, solidifying its place in the crypto sphere.

From a technical perspective, XRP maintains a position above its 200-day simple moving average, a commonly used indicator signaling a potential bullish trend. Recent trading activity shows 17 positive days out of the last 30, accounting for 57% of positive market movement.

UBRI Connect brings together scholars, researchers, and thought leaders in the #UBRI network to showcase blockchain initiatives, share knowledge, and inspire future research.

Catch all of the sessions from this year's event in Toronto now on YouTube. 📹 https://t.co/GahdQTCRRt

— Ripple (@Ripple) November 15, 2023

Based on historical performance, XRP achieved its highest value of $3.92 on Jan 4, 2018, and its lowest point of $0.002802 on Jul 7, 2014. Following its all-time high, it experienced a low of $0.113268 and a subsequent high of $1.977930. Presently, XRP’s price prediction sentiment remains neutral, and the Fear & Greed Index sits at 66, suggesting a period of market greed.

Regarding supply dynamics, XRP’s circulating supply stands at 53.72B out of a maximum supply of 100.00B XRP. Notably, a 16.44% yearly supply inflation rate resulted in the creation of 7.58B XRP over the past year. Ranked #4 in the Layer 1 sector based on market capitalization, XRP maintains a notable position among other projects in this category.

5. Bitcoin Minetrix (BTCMTX)

Bitcoin Minetrix operates as a cloud mining platform, aiming to solve issues in this sphere through tokenization. Its core objective is to offer a secure and transparent means for individuals to participate in decentralized Bitcoin mining.

#BitcoinMinetrix introducing a new perspective on the process of #Bitcoin Cloud Mining!

✨ Ideal for newcomers entering the field.

💸 Affordable, no need for equipment costs.

🏠 Bid farewell to concerns about space, noise, and heat.

🔄 Effortless, smooth upgrades await. pic.twitter.com/VSzSocLMM9— Bitcoinminetrix (@bitcoinminetrix) November 19, 2023

The project has attracted substantial interest, evidenced by the over 400,000 BTCMTX tokens currently staked. Notably, it promises an annual percentage yield (APY) of 103,225%, albeit this figure is anticipated to decline as more tokens are staked.

Regarding token distribution, Bitcoin Minetrix allocates 42.5% of BTCMTX tokens to mining operations and earmarks 35% for marketing and growth purposes. Additionally, 15% is reserved for community rewards based on active involvement. In comparison, 7.5% is set for BTCMTX staking rewards until the cloud mining platform is fully operational.

The project has raised over $4,162,805.46 through an ongoing presale, offering BTCMTX tokens at $0.011 each. Out of a total token supply of 4 billion, 70% (2.8 billion BTCMTX) is available during this presale, purchasable using Ethereum (ETH) or Tether (USDT). The minimum investment threshold of $10 aims to make this opportunity accessible to a broad spectrum of investors.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage