Join Our Telegram channel to stay up to date on breaking news coverage

Proceeding with our previous conversation regarding the best altcoins to invest in right now, we present an updated selection of assets for you to consider.

In other crypto news, the cryptocurrency industry is actively engaging with Washington to advocate for establishing new regulatory frameworks. Termed “Stand with Crypto,” this initiative, primarily spearheaded by Coinbase and over 50 crypto company founders, recently saw them address Capitol Hill.

This concerted effort to seek industry-friendly regulation could lead to increased investor confidence and informed decisions in cryptocurrency. Investors may consider exploring cost-effective cryptocurrency investment options with growth potential.

5 Best Altcoins to Invest In Right Now

Major cryptocurrencies typically command higher purchase prices and currently have a strong upside.

This scenario could open up a bullish period for altcoins. Here are the top five digital currencies worth considering for inclusion in your portfolio.

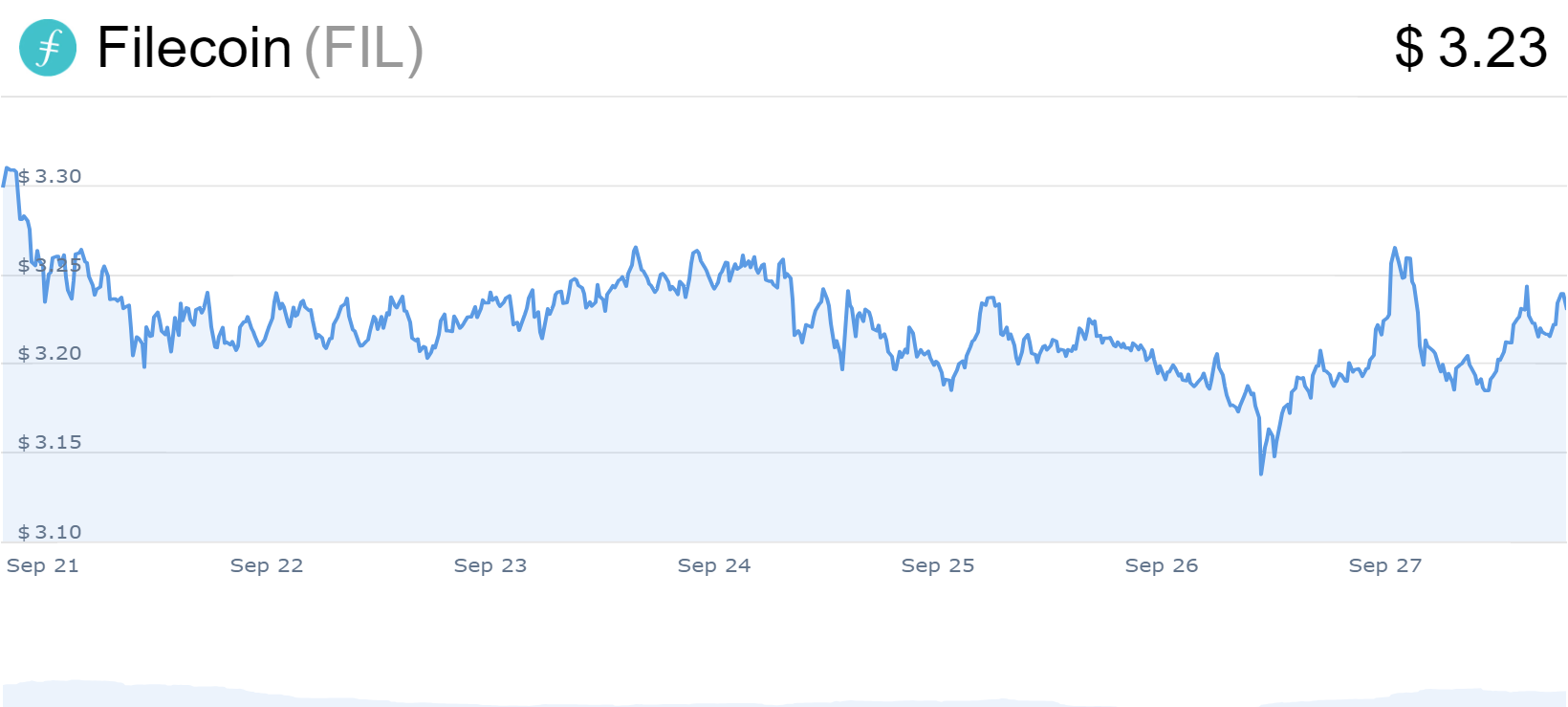

1. Filecoin (FIL)

Filecoin operates as a decentralized file storage network, establishing a robust data storage and retrieval marketplace. It adheres to an open-source and decentralized ethos, ensuring the community handles all governance responsibilities.

Built upon the InterPlanetary File System (IPFS) protocol, Filecoin allows users to choose their preferred storage solutions. This democratic approach encourages users to store their data securely or provide storage space to fellow users, thus fostering decentralization and broader accessibility.

Filecoin’s core mission centers on decentralized data storage by distinguishing itself from centralized cloud storage providers often facing centralization-related issues. The operational backbone of Filecoin lies in integrating blockchain technology and IPFS.

The blockchain acts as a transaction ledger, meticulously tracking Filecoin wallet balances. Similarly, it preserves the agreements forged between data requesters (clients) and storage providers (miners).

📢 Join @momack28, Engineering & Research Lead @ProtocolLabs, for her talk "Building the 2024+ Filecoin Roadmap".

🗺 Gather with community members across Filecoin to map the improvements & build our collective 2024 community roadmap.

Happening at #FILDevSummit23 Iceland. pic.twitter.com/27uRf4KWRE

— Filecoin (@Filecoin) September 27, 2023

The scalability of Filcoin’s rewards is directly correlated to the storage capacity offered by miners. Notably, Filecoin prioritizes transparency, as transaction proofs are indelibly etched into the blockchain, permitting clients to validate their data’s secure storage.

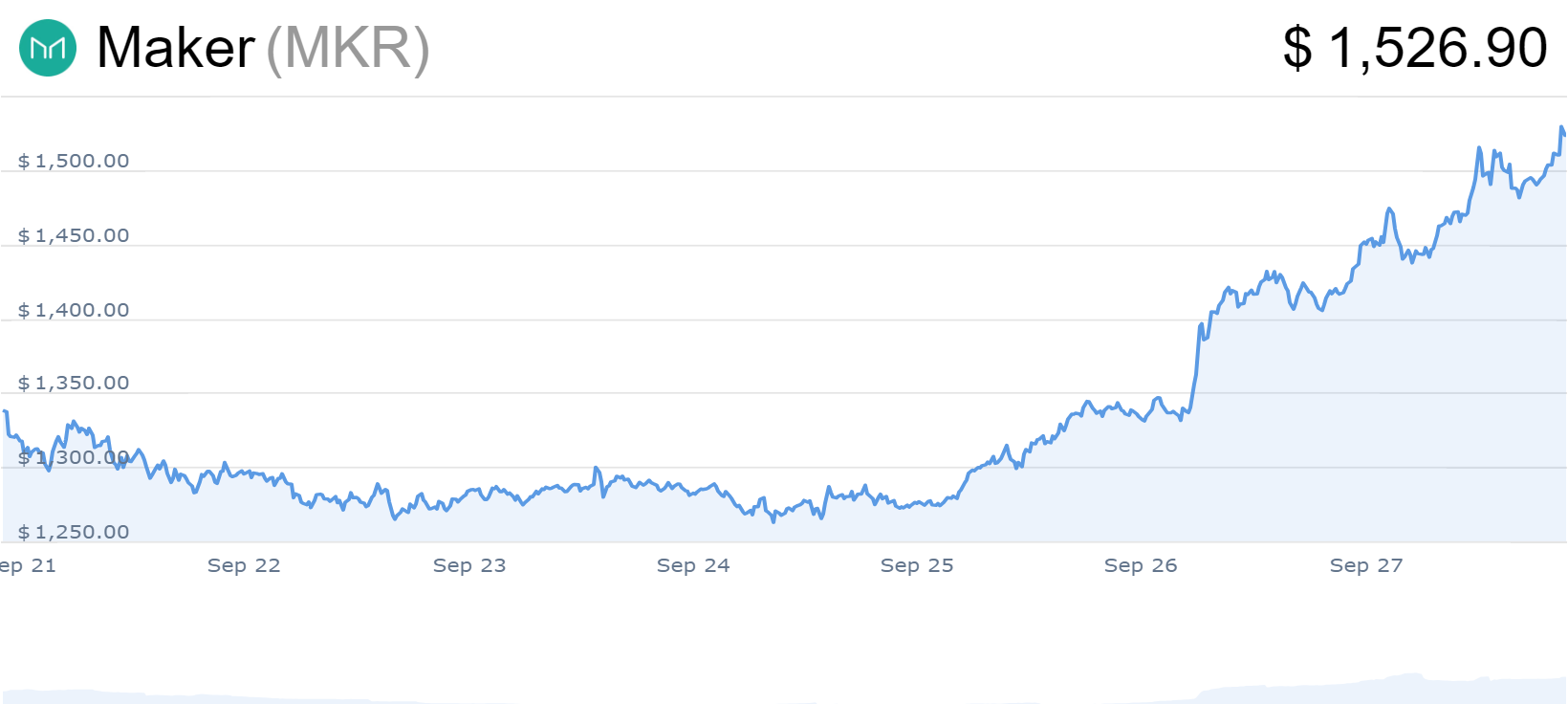

2. Maker (MKR)

MKR serves as the Maker Protocol’s governance token and operates as an ERC-20 token on the Ethereum blockchain. Its primary function is to empower MKR holders to actively participate in the Maker Protocol’s governance process. Through MKR, stakeholders can propose and vote on changes to various parameters within the protocol, such as stability fees and governance procedures.

MKR plays a pivotal role within the Maker ecosystem. It functions as a utility token, enabling the payment of fees related to Dai generation. Each MKR transaction results in the burning of tokens, thus reducing the overall supply. This supply mechanism is intrinsically linked to the demand for Dai.

The token’s value is tied to its association with Maker, a prominent decentralized finance (DeFi) protocol within the Ethereum ecosystem, and the widespread utilization of the Dai stablecoin in DeFi activities. The opportunity for MKR holders to engage in protocol governance is a significant motivator.

Furthermore, Maker’s established presence in the Ethereum space inspires confidence in its long-term sustainability. Maker’s flagship product, the Dai stablecoin, stands out for its stability, as it maintains a soft peg to the US dollar.

This unique feature ensures that Dai can be seamlessly converted into other fiat currencies, providing users with a sense of security in the face of potential economic fluctuations. Unlike other stablecoins, Dai operates exclusively on the blockchain.

At Korea Blockchain Week, @RuneKek and @pythianism discussed the rise of RWAs and laid out the vision for MakerDAO's Endgame.

Full 📽️👇👇👇 pic.twitter.com/q0Qx8DlfKF

— Framework Ventures (@hiFramework) September 26, 2023

Maker effectively addresses a fundamental challenge in the cryptocurrency space—volatility. Stabilizing Dai’s value allows crypto enthusiasts to trade or hold assets without excessive concern about market volatility. The security measures outlined in Maker’s whitepaper further enhance the platform’s resilience against volatility risks.

3. Terra (LUNA)

Terra (LUNA) is a public blockchain protocol from Terra Classic. Its initial stablecoin, TerraClassicUSD (UST), has since been rebranded as LUNC, with collateralized UST.

The platform’s core objective is establishing a decentralized network geared towards swift and scalable settlements linked to stable currencies. Terra’s approach effectively resolves prevalent issues within the stablecoin sphere. Specifically addressing concerns like centralization, limited scalability, and volatile swap rates.

Operating on the Proof-of-Stake (PoS) consensus mechanism, Terra introduces self-stabilizing stablecoins through its programmable infrastructure. It achieves stability by actively managing the supply of stablecoins, thereby ensuring their consistent peg to underlying assets.

The network employs a flexible and pragmatic monetary approach to effectively navigate challenges related to stability and economics. LUNA serves as the native token on the Terra network, finding utility in staking. Similarly, it aids in enhancing network security and facilitating governance voting.

Ahead of their official launch, learn more about @sayve_protocol — a project aimed at leveraging AI, NFTs, and Web3 incentives to empower users to master new languages — in our latest Terra Project Spotlight, courtesy of @mc_ust ✏️https://t.co/KQxIZkmBZ1

— Terra 🌍 Powered by LUNA 🌕 (@terra_money) September 20, 2023

Terra’s blockchain security relies on a proof-of-stake consensus algorithm based on Tendermint. LUNA token holders participate by staking their tokens as collateral to validate transactions, receiving rewards commensurate with their staked LUNA holdings.

Terra offers a promising solution for stable and scalable settlements while effectively addressing existing stablecoin drawbacks. Its underlying technology and the role of LUNA tokens in network operations position it as a notable player in the blockchain landscape.

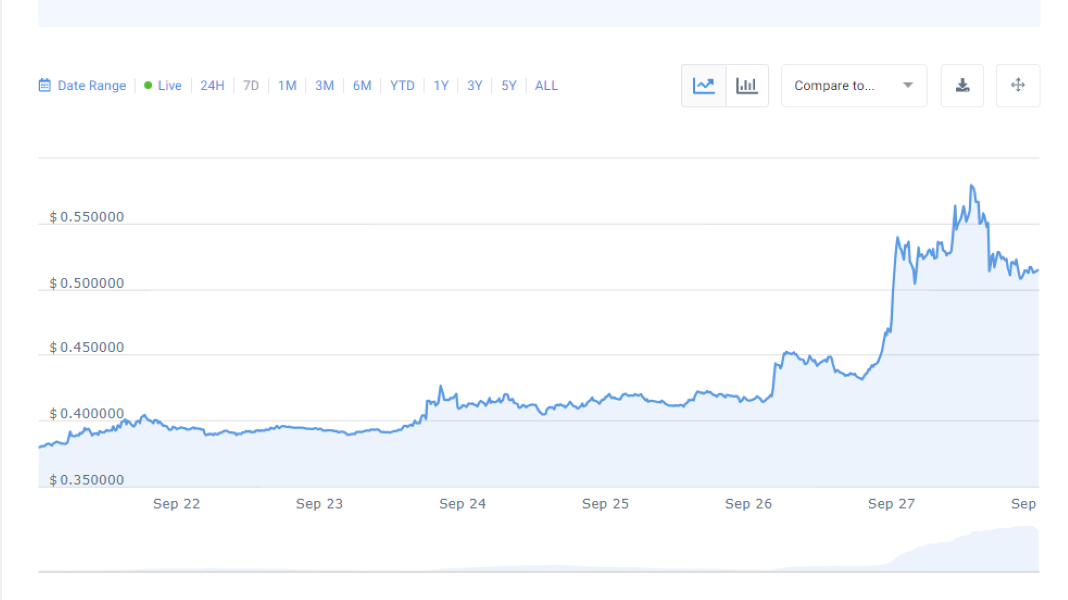

4. yPredict (YPRED)

yPredict aims to foster collaboration among AI/ML experts, financial quants, and traders within the crypto industry. The ecosystem offers a range of analytical tools and platforms.

It also employs advanced financial prediction techniques and alternative data sources to deliver data-driven insights and analytics. A notable feature is the prediction marketplace, allowing financial data scientists to offer their predictive models as subscription services.

This is essential in alleviating the need for direct involvement in trading operations. To support its ongoing development, yPredict has initiated a public presale of its native YPRED token.

This presale offers 80% of the total token supply, amounting to 100 million YPRED tokens, to prospective buyers. Token holders are promised attractive staking rewards, up to 45% quarterly, and discounts on yPredict’s AI tools. Furthermore, they are granted lifetime free access to the platform’s highly regarded crypto price prediction system.

Ypredict is currently in 7th presale phase, with the tokens available at $0.1 each. However, it’s important to note that once the presale reaches the $4.58 million mark, the token’s price will increase to $0.11.

We #yPredict are thrilled to be a first AI ecosystem using AI for crypto analytics. With our successful $3.88M presale, we're building models combining ARIMA & LSTM to make accurate Bitcoin & Ethereum price forecasts.

Our subscription marketplace will connect quant analysts &… pic.twitter.com/73zjPdrhRb

— yPredict.ai (@yPredict_ai) September 19, 2023

Subsequently, upon listing on cryptocurrency exchanges later in the year, yPredict will be valued at $0.12. This presents early presale participants with the potential for a 20% paper gain.

Concerns about insider token supply dumps are partly addressed by the allocation of the remaining 20% of tokens to liquidity (10%), treasury (5%), and development (5%). This balanced tokenomics structure minimizes the risk of unexpected market manipulation or a “rug pull” scenario within the yPredict ecosystem.

5. Bitcoin Cash (BCH)

The primary objective of Bitcoin Cash is to enhance its suitability as a medium of exchange by implementing various updates aimed at increasing scalability, resulting in more cost-effective and rapid transactions.

Bitcoin Cash aspires to establish itself as a global digital currency, prioritizing swift payments, affordability, privacy, and a larger block size. It operates as a permissionless cryptocurrency, eliminating the need for trusted intermediaries.

Thanks to its expanded block size, BCH offers expedited transaction processing and reduced fees in comparison to Bitcoin. Moreover, Bitcoin Cash introduces support for smart contracts and ecosystem applications.

With a capped supply of 21 million coins, Bitcoin Cash emphasizes its scarcity and ease of spending, akin to physical cash. Transactions within the network are typically executed swiftly, with fees often amounting to a fraction of a cent.

#BitcoinCash has a limited supply of 21 million coins. So, unlike fiat currency, you can't just print more 🖨️

Gin Chao, Chief Strategy Officer at @Binance, puts it into perspective: “In the past 6 months, 6 trillion dollars have been printed…"

Watch: https://t.co/YE3SItR2Tq pic.twitter.com/KNiCHrUYCR

— BitcoinCash.org (@bitcoincashorg) October 9, 2020

Similar to Bitcoin, Bitcoin Cash relies on PoW for security, where miners solve intricate puzzles to validate transactions and create new blocks. In summary, Bitcoin Cash aims to offer a practical alternative in the world of digital currencies, addressing the limitations of its predecessor while staying aligned with the core principles of decentralized cryptocurrencies.

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage