Join Our Telegram channel to stay up to date on breaking news coverage

Financial advisory firm Bernstein has projected that Bitcoin (BTC) could reach $200,000 by late 2025, independent of the upcoming U.S. presidential election results. Known for its expertise in emerging markets, including digital assets, Bernstein’s recent forecast has garnered interest across the cryptocurrency sector.

This optimistic outlook signals the firm’s confidence in Bitcoin’s strength and long-term growth potential, underpinned by factors beyond political changes. In light of this, investors are searching for affordable tokens to capitalize on the forecasted market growth, particularly the best altcoins to buy now.

5 Best Altcoins to Buy Now

The HBAR Foundation has revealed a collaboration with Chainlink as part of the Chainlink SCALE initiative. AGDEX has partnered with Pyth Network, a leading oracle protocol that links market data sources to applications across numerous blockchains.

Amid a crowded space of animal-themed meme coins, Flockerz ($FLOCK) seeks to differentiate itself with a “vote-to-earn” (V2E) model. Meanwhile, GALA’s price is currently at $0.018141, marking a 0.41% increase in the past 24 hours. In other developments, Coinbase, a16z, and others have contributed over $78 million to a pro-crypto political action committee (PAC) focused on the 2026 election.

1. Hedera (HBAR)

The HBAR Foundation recently announced its partnership with Chainlink through the Chainlink SCALE program, which is aimed at fostering the expansion of blockchain and layer-2 networks on X. This program is part of Chainlink Economics 2.0, a broader initiative focused on improving data security while cutting the operational costs of oracle services. Together, these efforts highlight a commitment to advancing blockchain technology’s reliability and efficiency.

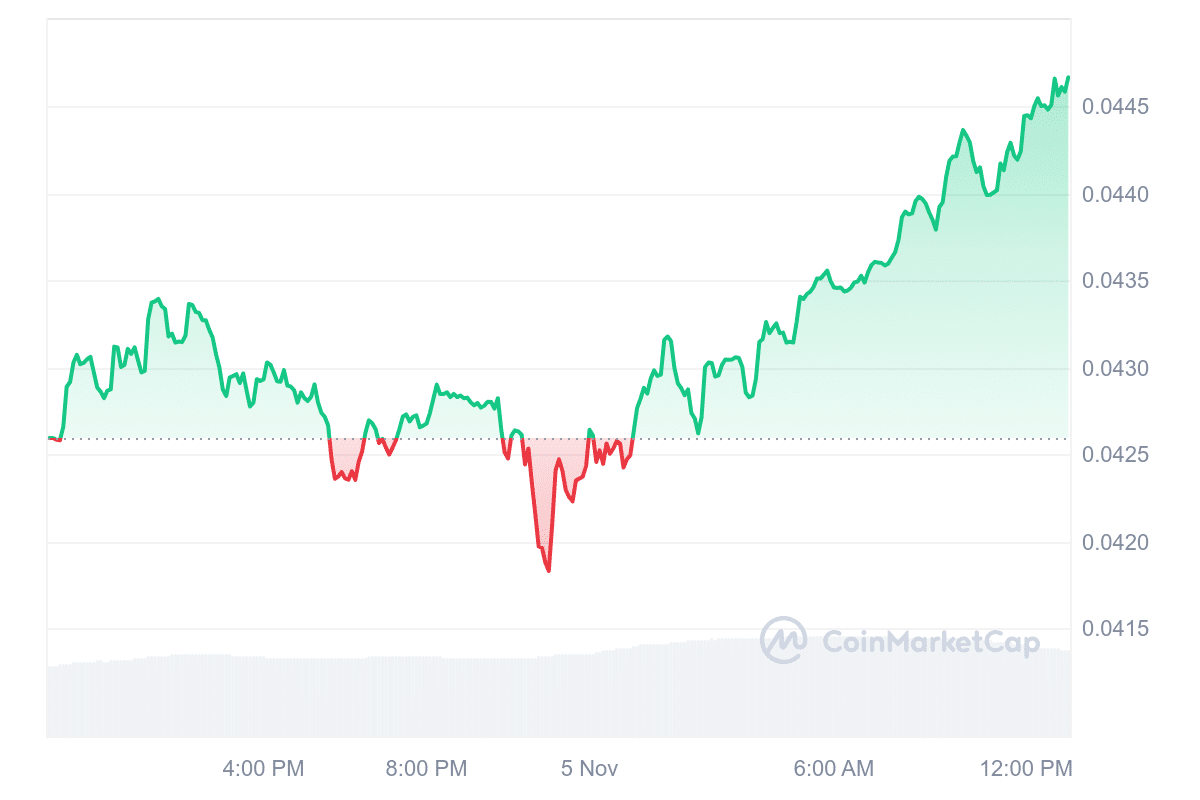

Hedera Hashgraph’s (HBAR) price currently stands at $0.044656, marking a 3.87% increase over the past 24 hours. However, market sentiment around HBAR remains bearish, even as the Fear & Greed Index shows 69, indicating a “greed” sentiment among investors.

The launch of @bonzo_finance marks a pivotal point in #Hedera DeFi, enabling both retail and institutional users to take advantage of advanced decentralized borrowing and lending capabilities bolstered by network features unique in #web3.

Learn more ➡️ https://t.co/FNwv2iTWHp pic.twitter.com/GqXLWgM08J

— Hedera (@hedera) November 1, 2024

With a 24-hour volume-to-market cap ratio of 0.0684, HBAR exhibits relatively high liquidity to its market capitalization, which may appeal to traders looking for an active market.

2. Pyth Network (PYTH)

AGDEX recently partnered with Pyth Network, a prominent oracle protocol connecting market data sources to applications across various blockchains. This collaboration aims to improve AGDEX’s DeFi ecosystem by integrating Pyth’s robust data feeds, enhancing the security and reliability of its platform for users.

Unipay, another platform in this ecosystem, leverages Pyth’s data for its virtual credit card services. By staking crypto, Unipay users can receive virtual credit cards with credit based on staking yields. Pyth’s integration enables Unipay to calculate user credit scores accurately and issue on-chain credit seamlessly, enhancing the platform’s trustworthiness and user experience.

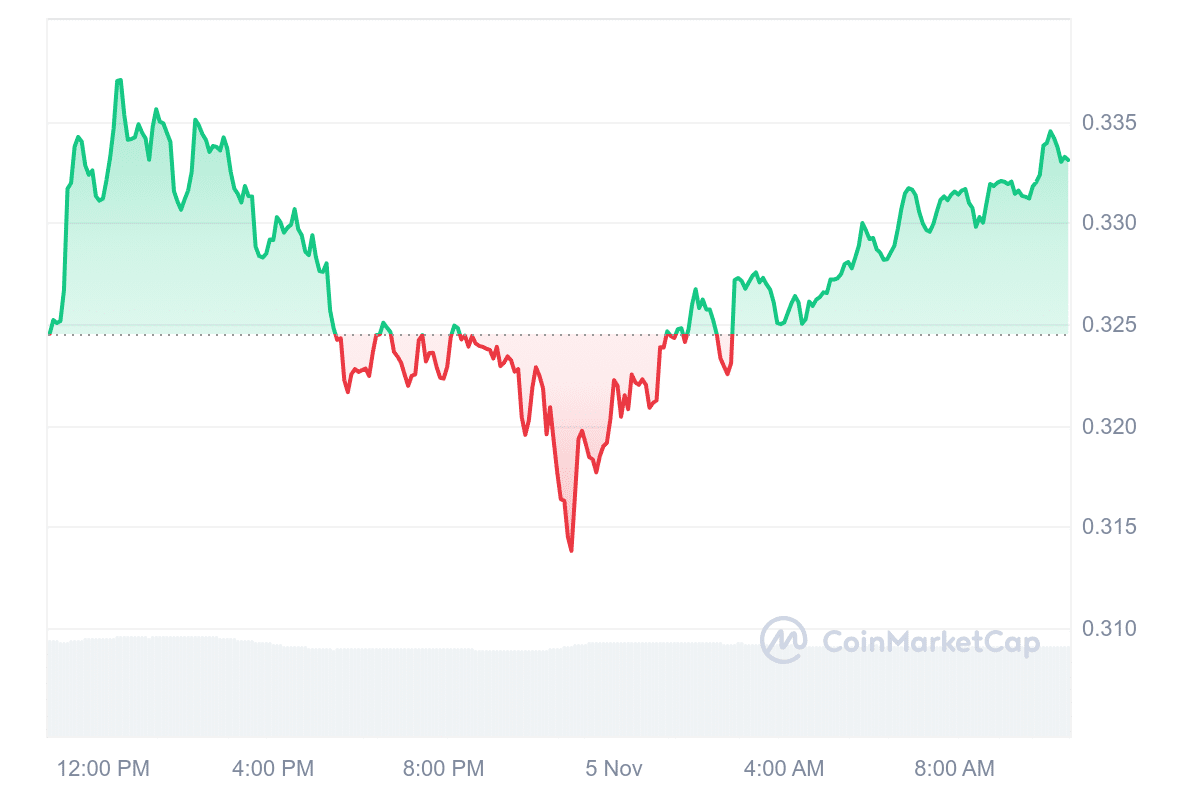

Pyth Network’s token (PYTH) currently trades at $0.3337, reflecting a slight decrease of 0.39% over the past 24 hours. The market sentiment appears bearish for now, although the Fear & Greed Index signals a level of greed at 69. Forecasts for November 2024 suggest a potential for price growth, with estimates ranging from $0.3324 to $1.1296, indicating possible returns of up to 238.51% if the market trend shifts.

.@UnipayHQ is a platform enabling users to stake their crypto assets to get instant virtual credit cards, enabling them to spend now and repay through staking yields.

They are now powered by Pyth 🔮

”By integrating Pyth's accurate and secure data feeds, Unipay ensures reliable… pic.twitter.com/DaDDgSLh71

— Pyth Network 🔮 (@PythNetwork) November 4, 2024

In December, predictions suggest PYTH could trade between $1.0281 and $1.5710. If these projections hold, investors might see a return of approximately 370.79% by year-end, though, as with all market predictions, actual outcomes may vary.

3. Flockerz ($FLOCK)

In a market flooded with animal-themed meme coins, Flockerz ($FLOCK) aims to stand out with its unique “vote-to-earn” (V2E) structure. Positioned as a “People’s Meme Coin,” Flockerz invites token holders to participate in the project’s governance through a decentralized autonomous organization (DAO) called Flocktopia. This setup allows each member, or “Flicker,” to contribute equally to decision-making while receiving rewards in $FLOCK for active involvement. Since the presale launch, Flockerz has gained notable traction, reportedly raising $1.25 million within weeks.

The V2E feature of Flockerz enables users to earn additional tokens for voting on governance issues, thereby aligning community engagement with project success. By encouraging frequent participation, the DAO model helps democratically steer the project’s direction, creating a sense of ownership among the community.

The ongoing presale offers $FLOCK at a rate of $0.0057699, though this price will increase to $0.0059571 in under two days. This limited-time pricing encourages early investment and broader participation ahead of anticipated exchange listings. Flockerz also reserves funds for marketing and exchange liquidity, which is essential to achieve wider recognition and ensure smooth post-launch trading.

Were only puffing on the finest of gainz over here in the flock.

You want the next hit? 😤📈 pic.twitter.com/3qi8huRweZ

— Flockerz (@FlockerzToken) November 2, 2024

To reassure investors, Flockerz has undergone a smart contract audit by Coinsult to establish credibility within the space. Influencers, such as Jacob Crypto Bury, have shown interest in the project and predicted growth potential, which could help increase awareness.

4. Gala (GALA)

Gala, a Web3 ecosystem powered by its layer-1 blockchain GalaChain, is built to support Gala’s entertainment network, which initially included Gala Games, Gala Music, and Gala Film. However, GalaChain has recently expanded to welcome external developers from various industries, offering open-source tools to make integration easier. Through resources like the GalaChain SDK and Creator Portal, Gala aims to empower creators across sectors to bring Web3 benefits to their communities.

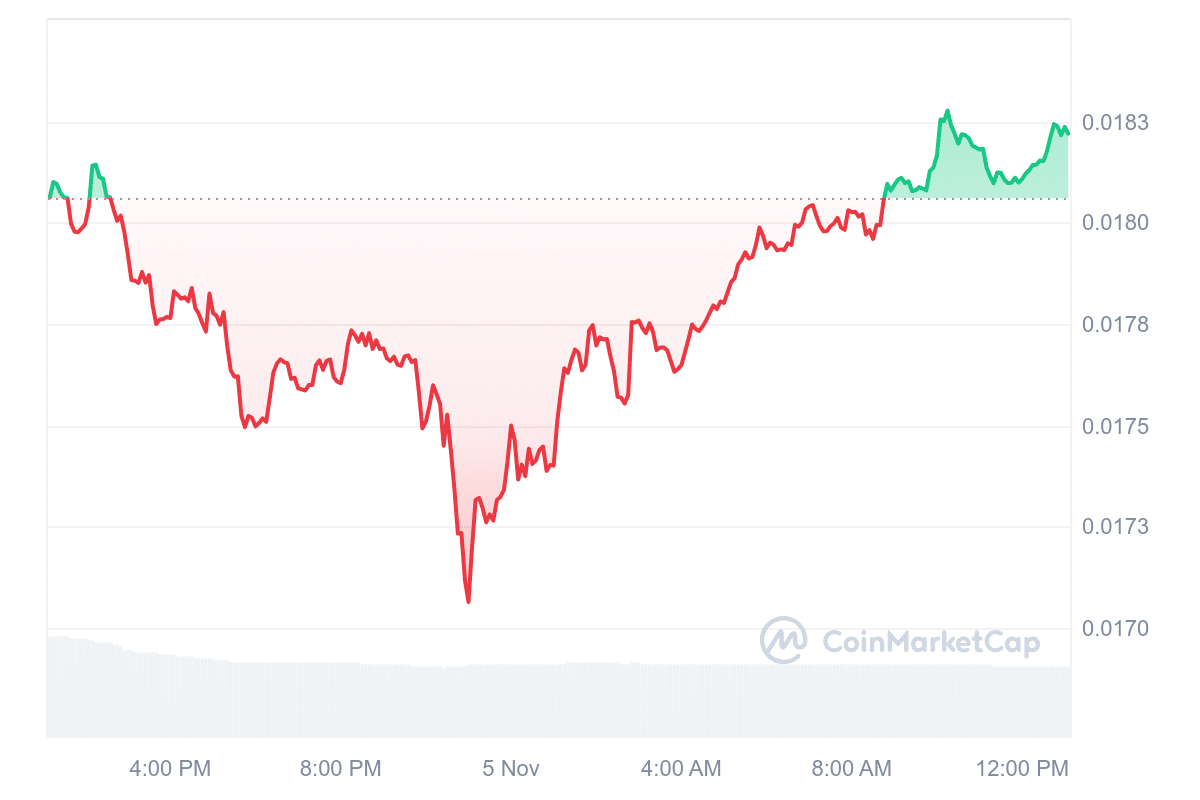

Currently, GALA’s price stands at $0.018141, reflecting a 0.41% rise over the last day. Although liquidity remains high relative to its market cap, the market sentiment leans bearish despite a Fear & Greed Index score 69 (indicating greed). Over the past month, GALA has recorded a moderate level of volatility (7.37%) with a green day ratio of 47%, suggesting mixed investor confidence.

What’s a #DApp? It's a decentralized app that puts control in your hands, not in the hands of a single company. Learn more about how DApps are shaping the #Web3 world! #Blockchainhttps://t.co/Tb9bBmOXXG

— Gala Games (@GoGalaGames) November 4, 2024

According to recent forecasts, November could see GALA’s price moving towards $0.035429, with a potential trading range between $0.01788 and $0.060912. If investors buy now and later sell at predicted highs, a return of around 236% could be possible.

Looking further ahead, GALA’s value in December 2024 may fluctuate between $0.055434 and $0.084739, translating to a potential profit margin of roughly 367% if predictions hold.

5. Core (CORE)

Over recent years, the demand for greater utility and yield opportunities in Bitcoin has risen significantly. Innovations like Ordinals, BRC-20 tokens, Bitcoin Layer 2 solutions, and Bitcoin sidechains have aimed to meet this demand, bringing functionalities such as NFTs and basic smart contracts to Bitcoin’s ecosystem. However, another promising development may lie in Core Blockchain’s approach to providing sustainable yield on Bitcoin.

The Core blockchain operates as a Proof of Stake (PoS) layer for Bitcoin, offering new yield-generating opportunities without modifying Bitcoin’s original Proof of Work (PoW) protocol. Core’s approach aims to deliver the benefits of staking to Bitcoin holders without adding new trust dependencies. This critical feature addresses long-standing concerns within the crypto community about asset custody.

Core’s time-lock feature also encourages a long-term holding strategy, often called having “diamond hands.” By locking their assets, users are less prone to sell during volatile market periods, which could suit those who believe in Bitcoin’s long-term value potential. Staking provides yield and supports Core’s network security and decentralized finance (DeFi) activities, both of which help transparently generate this yield.

Core is unlocking groundbreaking opportunities for Bitcoin. 🔶@cryptonews_eng explains how Core is transforming Bitcoin from a passive asset into a yield-bearing powerhouse. 🔥👇https://t.co/X1sLCp1P1j pic.twitter.com/PTXD5zUqo3

— Core DAO 🔶 (@Coredao_Org) November 4, 2024

From a market perspective, Core DAO’s price trends appear to support its potential. Core DAO’s price is approximately $0.80, with a slight 0.17% decrease over the last 24 hours. Over the past year, however, it has gained 76%, outperforming 60% of the top 100 crypto assets. It trades above its 200-day simple moving average (SMA) by nearly 14%, signaling a relatively strong price position near a recent high.

Learn More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage