Join Our Telegram channel to stay up to date on breaking news coverage

- Prediction Summary:

- XRP will undergo competitive stimulus in Q4 2019

- XRP will grow alongside the remainder of the altcoin market

- Upon surpassing previously acquired all-time highs, XRP will fluctuate even further, obtaining higher highs

- XRP will reach $10 / XRP by the end of 2020, or $25 / XRP assuming expedited development progress and growth of the remaining market.

Ripple: A Price Background Overview

Prior to final predictions on price outlook of Ripple’s XRP cryptocurrency for 2020, consider the following previous price action of XRP. Of course, prior results do not indicate future results:

XRP Early Volume Breakthrough

- XRP’s first movements in terms of price were in 2014, while under a different moniker; however, its purpose has since remained the same as XRP’s modern vision. In the times of 2014-2015, XRP maintained an average daily volume in the hundred thousand areas. It wasn’t until the later 2016’s, with the influx of cryptocurrency market interest, that XRP began producing consistent $1M+ daily volumes. It was around this time we saw extremely uneven vectors amongst price and volume, which has come to serve as an indicator for potential price movement.

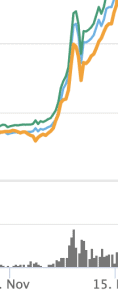

- We’ve seen XRP price skyrocket over 100% upon breaching relative levels of volume, shown in January, 2015:

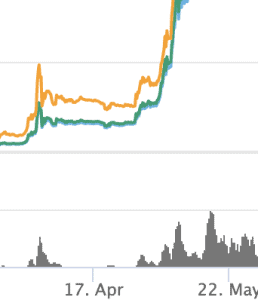

- April, 2017:

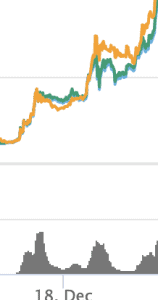

- December 2017:

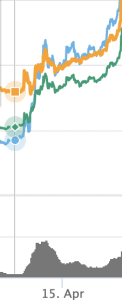

- April 2018:

- And more all dialing up to today’s date.

Bull Market Behavior

In the finite number of bull markets in the cryptocurrency market that we currently have, XRP has demonstrated a clear correlation to altcoin performance relative to Bitcoin market performance.

Bitcoin trading is often referred to as the trading of the cryptocurrency market ‘leader’. In fact, it can be traded on all of the most popular auto trading robots out there, such as Bitcoin Code and Bitcoin Future. Altcoins, which XRP is grouped amongst, are also increasingly appearing among the trading options of these robots because they oftentimes perform very similarly in terms of performance to other altcoins. Now, if we look at XRP’s performance during all previous ‘bull’ markets that have been placed upon the digital markets, we can see that XRP underperformed very largely during times when Bitcoin increased and the remainder of the crypto market did not; however, during the time when Bitcoin increased and the remainder of the crypto market did as well, overtaking the 50% market share threshold that you could buy Bitcoin with, XRP was amongst some of the best performing assets.

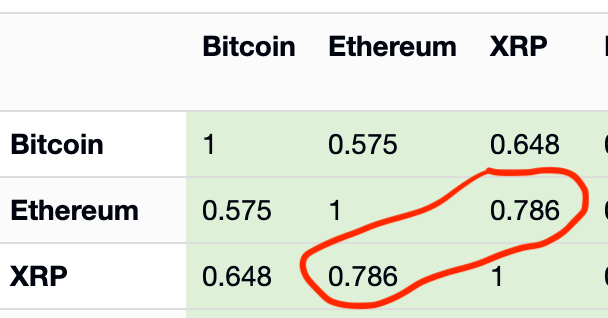

Ethereum (ETH) Correlation

Ripple’s XRP has demonstrated a very high correlation to the Ethereum cryptocurrency, moving very similar to it in multiple market conditions. Correlation is the expectation that with every movement 1 asset moves, a parallel asset will move 0-1 relative that asset. For example, XRP has an extremely high correlation rate within the cryptocurrency market with Ethereum, amongst the highest to date. As of current writing, that correlation is approximately .79 / 1:

This means subsequently that for every 1% that Ethereum increases or decreases in price, XRP is expected to move .79% in that same direction. For example, let’s say there is a long-lasting track record for XRP’s correlation to Ethereum, then one day, Ethereum increases by 100%, but XRP has not moved yet. If there is a high level of confidence in the correlation, then a trader would bet that XRP will increase ~79%, since the correlation between those two are highly efficient.

We’ll also be using this correlation to predict the price of XRP in 2020.

Fundamentals That Affect the Growth of Ripple (XRP)

This past year was various for digital markets, and many started to get involved just starting this year. One of the biggest developments of the year was Facebook launching a cryptocurrency project. The news came to surprise to many, however, many believe Facebook might actually overtake cryptocurrencies such as Ripple (XRP) in its effort to be a global transaction currency. Max Keiser, the avid Bitcoin bull and altcoin bear, stated that he believes Facebook’s cryptocurrency will overtake all cryptocurrencies except Bitcoin, starting with Ripple.

However, our prediction would disagree with that. What we’ve seen through the consistent cycles of cryptocurrency market movements is that remaining altcoins will very often increase in value purely because the remainder of the market does. Also, Facebook’s coin will apply pressure to Ripple’s main infrastructure and XRP token, which doesn’t need to be seen as the apocalypse, but rather healthy competition that both firms are suited for.

Both Facebook and Ripple are billion-dollar firms. There’s no doubt they’ll be competing with one another. However, this competition can only positively stimulate the cryptocurrency market; the end result, in our opinion, is a beneficial Facebook cryptocurrency as well as a higher priced XRP.

Technical Analysis

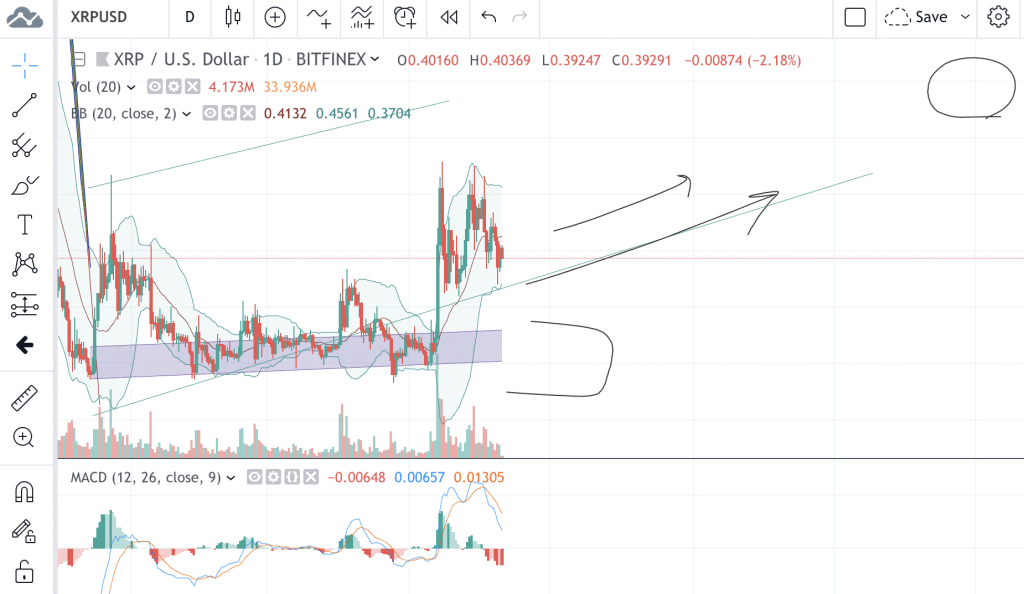

XRP’s technical analysis can give us relative (Not finite) insights as towards where the price of the asset might be headed in 2020, those who trade cryptocurrencies may resonate with this.

In the graph above, the circle is equivalent to the price of XRP in 2020 (Which essentially means if you were to duplicate the candlestick chart, you’d be in 2020 territory. The biggest notable factor in current technical analysis of XRP to USD is that its volatility is generally increasing on a monthly chart, which equates to higher swings in the upwards direction.

You can also see that the volatility is increasing by looking at the MACD indicator, whereby the rate at which positive and negative price movements occur is not only increasing in speed but is also increasing in size of the movement.

As shown in the shaded darker channel, any movement back down to this level ($0.28-.33 / XRP) would indicate more bearish price movement. However, the recently large magnitude movements in price point towards continued upwards growth. Then, it becomes a matter of the internal growth of Ripple’s proprietary firm as well as the adoption for Ripple.

Final Prediction

Due to an increased number of signed institutions, investment banks pledging XRP usage, a stimulus in competition with the new Facebook stable coin, as well as planned developments for 2020, fundamentally, Ripple’s future is positive. Previous results, as well as statistical components of the XRP asset, allude to the continued growth of the digital asset to reach new all-time highs.

Predictions:

- XRP will further establish itself in its own niche market, leading to further network expansion and asset growth.

- We predict the price of XRP/USD will reach $10/XRP (Up over 1,000% ROI from its current rate) by the end of the year 2020.

- XRP will become more of an institutionalized, global asset by the first quarter (Q1) of 2020.

- XRP will be a forefront leader for regulatory, legally compliant cryptocurrencies

—

John Iadeluca is the Managing Partner and Founder of Banz Capital.

This post and the information contained herein is for informational purposes only. Under no circumstances does any of the information posted represent a recommendation or solicitation to buy or sell any securities or interests. Any such offer or solicitation can and will only be by means of the appropriate offering materials, only in jurisdictions in which such an offer would be lawful, and only to individuals who meet the investor suitability and sophistication requirements in such materials — which should be read in the entirety before considering such investment.

This demonstration is solely to illustrate a prediction based on the analysis of different asset classes, methods, and their earlier performance. Past performance of strategies or assets does not indicate future results.

Join Our Telegram channel to stay up to date on breaking news coverage