Dogecoin is back in the headlines with billionaire Elon Musk changing the Twitter logo to the DOGE icon in April 2023, causing a spike in the Dogecoin price.

DOGE investors are optimistic that crypto will somehow be integrated into the social media platform and raise more awareness of the meme coin and digital currencies. In this guide, in addition to learning how to buy Dogecoin, you will also learn the different factors that pump the DOGE price and whether it is a worthy investment in 2024.

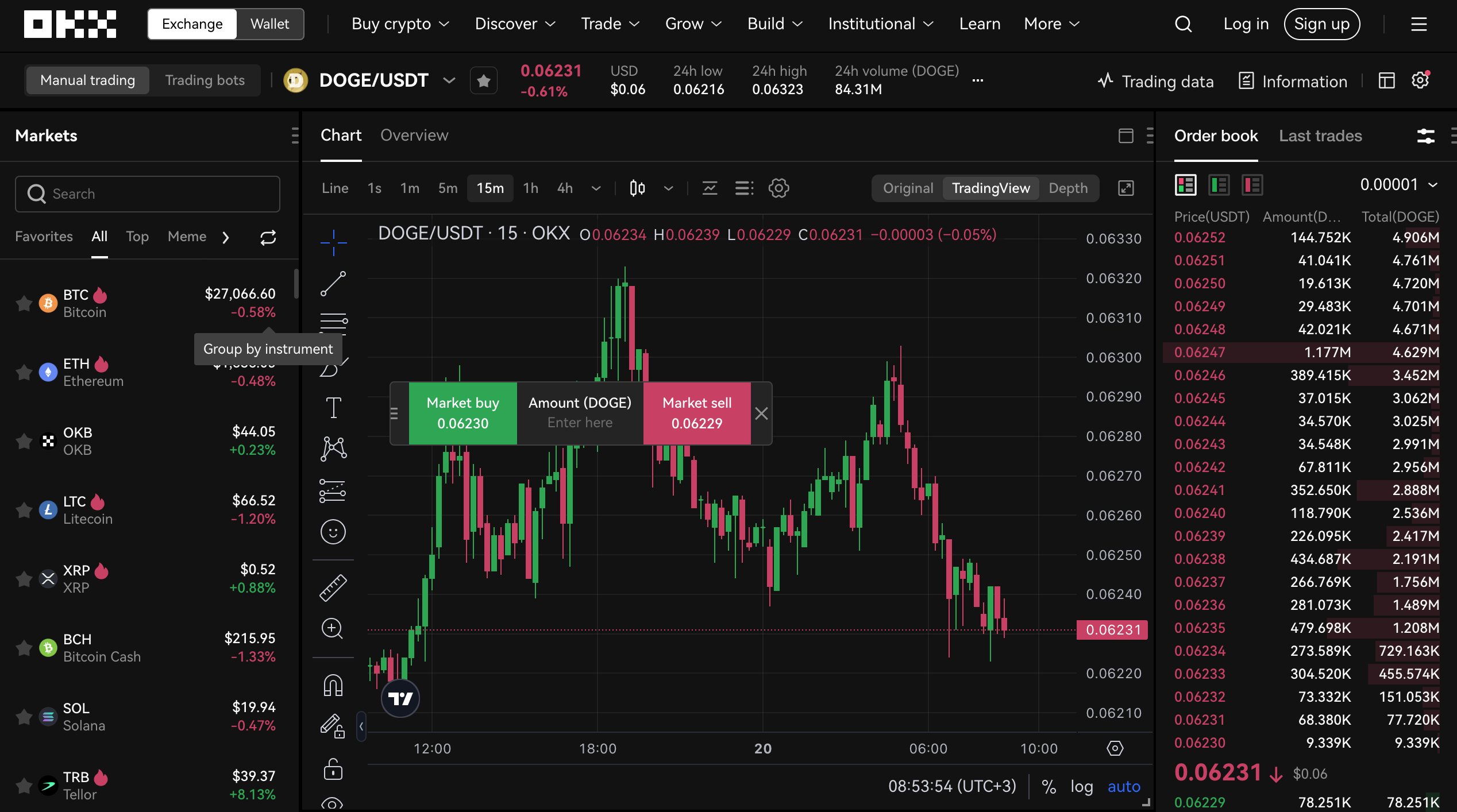

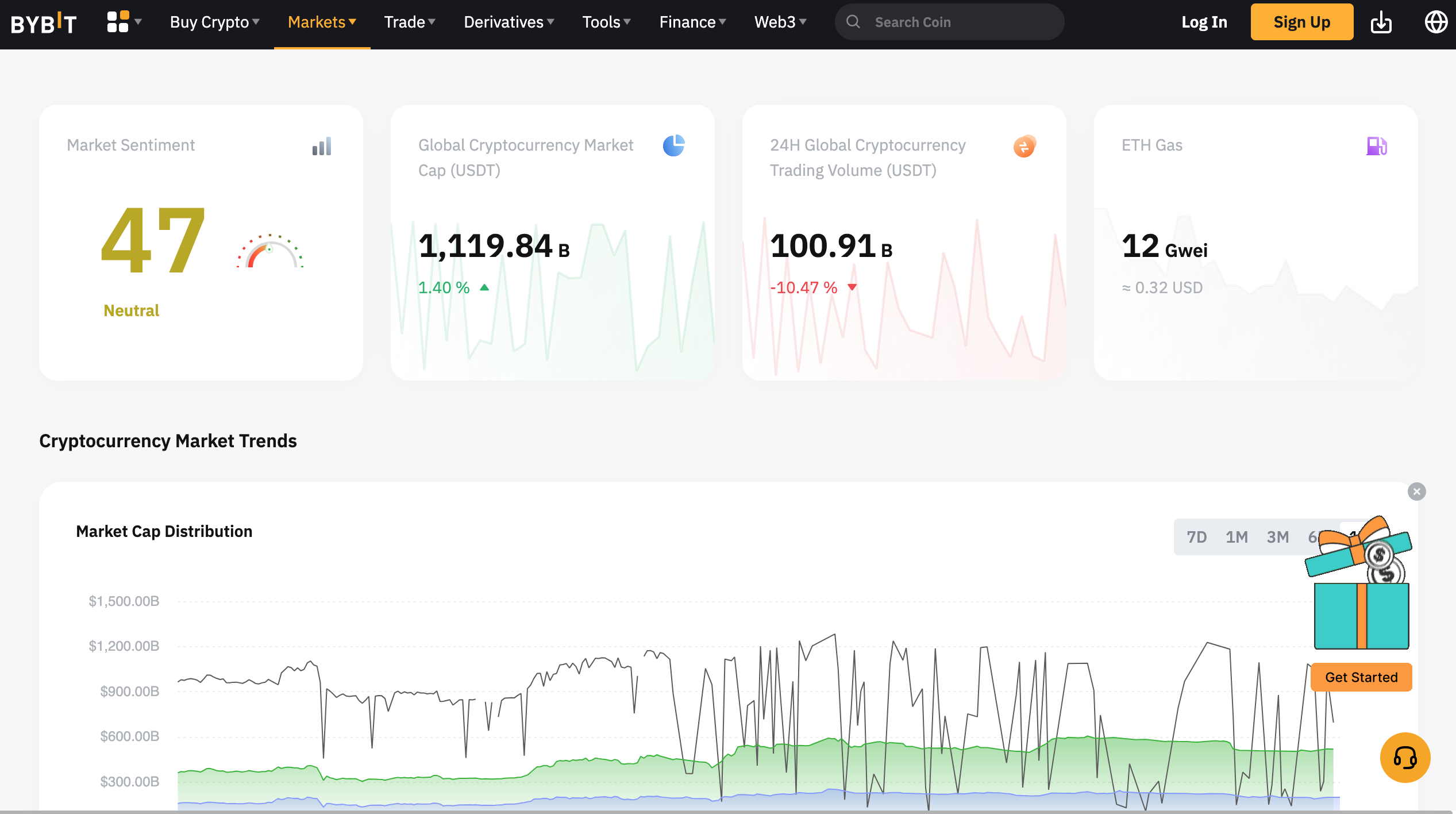

Want to learn how to buy Dogecoin right away? Just follow these quick steps to buy Dogecoin instantly. Our top choices for buying Dogecoin include: Dogecoin is one of the most popular cryptocurrencies available in the market today. Created in 2013, Dogecoin is inspired by the famous Japanese Shiba Inu dog. Like crypto heavyweights names like Bitcoin and Ether, Dogecoin runs on blockchain technology. Holders can carry a copy of the Dogecoin blockchain, and Dogecoin can also be mined in the same manner as the other top assets mentioned. Dogecoin creators copied Bitcoin’s code word for word and only changed the Bitcoin keyword in its whitepaper. They replaced the word ‘Bitcoin’ with ‘Dogecoin.’ One significant difference between the two is their maximum supply. While Bitcoin has a hard cap of 21 million coins as supply, Dogecoin has no limit. There’s no limit to the number of Dogecoin released to the public. As for use cases, Dogecoin can be used for payments and asset transfers. However, it doesn’t quite work as a store of value. Its price is incredibly volatile – even more so than Bitcoin. As stated earlier, Dogecoin was created in 2013. The asset was developed by Billy Markus and Jackson Palmer – two software engineers – as a way of poking fun at Bitcoin and other cryptocurrencies with lofty plans to change the world. Markus and Palmer didn’t have a use case or plan for Dogecoin. But it eventually caught on. Dogecoin’s main value proposition is its community. In its early days, fans gathered funds to sponsor the Jamaican bobsled team for the 2014 Winter Olympics. They also sponsored a NASCAR driver that same year. To this day, there isn’t much to it – save for the community of adoring fans, which now includes celebrities like Snoop Dogg, Jason Derulo, and Elon Musk. Dogecoin’s popularity has risen over the years. This dog-inspired meme coin now has a thunderous bark. This has led to its rapid adoption and accessibility across exchanges. There’s no shortage of companies facilitating Dogecoin trading, from crypto-facing trading platforms to regular online brokers. However, the issue with variety is that it makes it difficult to choose the best place to buy Dogecoin. In this guide, we took our time to vet hundreds of platforms and developed this shortlist. Our list of places to buy Dogecoin includes their features, fees, and why each one is unique. To save you from researching dozens of different platforms, below, you will find the best places to buy Dogecoin this year. OKX is one of the leading cryptocurrency exchanges. OKX features a simple-to-use interface through which users can buy DOGE through spot trading or directly using a card. And like other platforms, OKX allows users to access the asset’s market value on the trading module. Other utilities OKX offers include the Earn program, Copy trading, crypto loans, staking, and more. OKX has also introduced OKB and OKT chains that developers can use to develop decentralized applications or other crypto assets. Institutional DOGE investors will get access to tools like the liquid marketplace, APIs, VIP loans, and more on OKX. Regarding fees, OKX has a standard maker/taker fee model that can be reduced depending on the number of OKB tokens a user holds. Despite the platform’s intuitiveness, it is unavailable in the US. Thankfully, OKX also features OKX DEX, which is accessible across the globe. Bybit is a 2017-launched cryptocurrency exchange that earned renown through the crypto space with its aggressively inclusive approach and listing of innovative cryptocurrencies. Users can buy Dogecoin on Bybit using crypto transfers and credit/debit cards. Other fiat methods, like the UPI, are available in some regions. Bybit supports spot and margin trading – margin trading is offered up to 10x leverage. Bybit also has an audited proof of reserve – a validation that it holds the asset stored by the customers. The platform has a 1:1 reserve on all user’s assets, and they are published openly and transparently. Users can validate their reserve using a visual verification page. Binance is currently the largest crypto exchange by daily transaction volumes, Binance handles over $20 billion in trades every day. It provides access to hundreds of assets and a seamless trading service that will help you to make money quickly. Binance’s benefits are quite impressive. Trading commissions are a flat 0.1 percent, which is beyond competitive. The exchange provides abundant deposit and withdrawal options, and expert traders can also access sophisticated tools like futures and margin trading. Add this to Binance’s excellent liquidity, and you’ll see why it is so popular. On the flip side, Binance is limited to crypto only. The exchange also has expensive credit card transaction fees, and the main platform isn’t beginner-friendly. In addition, the Binance platform is not the most beginner-friendly. The charts and several menu options could be confusing for first-time Dogecoin buyers. Based in San Francisco, Coinbase is the world’s third-largest crypto exchange. It is also the most valuable publicly traded crypto company, with billions in daily transactions. Coinbase has several benefits. It provides different payment gateways, and its user interface is much better for beginners than Binance. Coinbase has a $2 minimum balance, so anyone can open an account and begin trading. Coinbase has two platforms that cater to both beginner and professional traders. In addition to its trading services, Coinbase offers a payment platform for retail businesses and a suite of services targeted at institutions. As for its drawbacks, there are a few. For one, the fees on Coinbase are much higher than many of its competitors. You’ll need to switch to Coinbase Pro to lower your fees – note that switching is free. The exchange also has a complex fee structure, with costs ranging from 0.5 to 4.5 percent depending on your coin choice, payment gateway, and transaction volume. Dogecoin has been the first meme cryptocurrency ever to gain incredible popularity, which started at the end of 2020. After being in the shadow for eight years, the coin closed in 2020 with a price of $0.0046, which was already 20 times higher compared to its initial price at the beginning of 2013. From 2021 to 2023, Dogecoin (DOGE) embarked on a whirlwind journey of extreme highs and lows. This was mainly influenced by tech mogul Elon Musk and external market factors. Investors were taken on a rollercoaster ride with this meme-based cryptocurrency, showcasing the inherent volatility and unpredictability of the crypto space. In 2021, Elon Musk made headlines as a vocal supporter of Dogecoin. He endorsed it for purchases and even influenced Tesla to accept the cryptocurrency. The impact was remarkable – by May 2021, DOGE experienced an astonishing surge of over 12,000%, surpassing the gains of established digital currencies like Bitcoin and Ethereum. However, the following year brought what many called “crypto winter,” which affected Dogecoin due to its limited real-world usability. After almost reaching $0.6 in November 2021, DOGE started 2021 with a trading price of $0.1705. The downtrends in the crypto market, including the crash of the LUNA crypto project, led Dogecoin to lose its value which dropped to $0.06 in October 2022. DOGE made some recovery attempts in the following days crossing the $0.1 mark again and reaching $0.12. However, November brought yet another severe crash in the crypto space, this time related to the FTX token. By the end of 2022, DOGE already was down the $0.1 mark, and its closing price for the year was $0.07. As the general crypto market showcased some signs of recovery at the beginning of 2023, DOGE followed the trends and was almost close to hitting $0.1 again. However, this optimistic trend was short-lived as the coin experienced a sharp decline, $0.065, in March 2023. This was followed by another short bullish trend leading DOGE to $0.096, after which DOGE got back to the lowes of $0.06. Throughout June, the price of Dogecoin fluctuated between $0.06 and $0.07. However, an uptrend in the crypto space, driven by the SEC vs. Ripple case decision, created some buzz in the market, and Dogecoin also benefited, increasing to $0.081 in July. Unfortunately, this surge was short-lived, and the price eventually settled around $0.06 once again. Dogecoin is currently trading at a price of $0.062 and is the 8th largest cryptocurrency by market cap. Though its extreme volatility Dogecoin still remains one of the favorite coins among many crypto enthusiasts. Its path follows the trends of the general market even though the coin is of now valuable use and is mostly used for speculation. Along with its price performance, the support that Doge gets on social media is another reason to believe that this crypto still has room for growth. It not only has the support of celebrities and such prominent people as Elon Musk, who proclaims Doge as the “people’s coin,” but also has a huge army of followers who actively promote the coin on social media platforms. Still, Dogecoin is a risky investment, and you should be cautious only investing the money you can afford to lose. As of today’s trading session, the price of Dogecoin stands at $0.06276. It has experienced a slight increase of 0.77% over the past 24 hours. During this period, cryptocurrency has witnessed a trading volume of $208.7 million and currently holds a market capitalization of $8,849,373,649. In the crypto space, Dogecoin maintains a market dominance of 0.84%. The current circulating supply of Dogecoin is approximately 141 billion DOGE. When exploring its market standing, Dogecoin holds a significant position. Among the Proof-of-Work Coins, it secures an impressive #2 rank. This showcases its impact as a cultural phenomenon in the Meme Coins sector, where it reigns at #1. Additionally, Dogecoin stands strong at the #5 spot within the Layer 1 sector. Reflecting on its historical price trajectory, Dogecoin reached its peak on May 8th, 2021, soaring to an all-time high of $0.738595. In contrast, its lowest point was recorded on May 7th, 2015, when it dropped to an all-time low of $0.00008547. It is worth mentioning that after reaching the all-time high, the cryptocurrency experienced a subsequent downturn with a minimum value of $0.049701 during a specific cycle. However, it managed to rebound and achieved a post-cycle peak price of $0.156883. The current prediction of market sentiment and outlook for Dogecoin is neutral, as indicated by the Fear & Greed Index—a measure of market sentiment—which stands at 43. This balanced reading reflects the cautious approach of both investors and traders. The Moving averages are Bearish, with two indicators having bullish and four indicators having bearish results. With all this being said, it is important to note that the whole market is currently down and in a bearish cycle. Depending on which direction the general market will take, Dogecoin can increase in value or decrease. As meme cryptocurrencies continue to enjoy popularity, Dogecoin still remains one of the most popular ones among them. Dogecoin enjoys full support from its DogeArmy and many celebrities, which can push the coin to new peaks if the market takes a bullish trend. Still, however profitable DOGE may seem, it is also quite a risky investment, and you need to be careful investing in this coin. Dogecoin might differ significantly from Bitcoin, but it is here to stay. Despite the attempts from copycats and regulators to clamp down on Dogecoin, the asset’s value has continued to rise, posting over 4,000% return within the first three months of 2021. It’s clear many are buying Dogecoin for speculative purposes. If you’re ready to take the plunge to get in on the action, you can complete your crypto journey using our recommended platform OKX. Getting your account set up and ready to purchase Dogecoin only takes a few minutes. You should also remember the following: Read more:

There are always risks in buying digital assets. The major risk is in the possibility of Dogecoin's price falling off the cliff or the asset becoming worthless.

From a fundamental perspective, Dogecoin has little value. The coin has also not witnessed many institutional adoptions like Bitcoin. However, it has enjoyed numerous price volatility and could enjoy more. Trading Dogecoin in the short term could be very profitable if you time the market properly.

The easiest way of buying Dogecoin ASAP is to use a reputable and widely-used platform like OKX.

Looking to buy Dogecoin anonymously? One smart way of buying altcoins is by using Bitcoin to fund the transaction. To buy Bitcoin anonymously, you can use a Bitcoin ATM.

Dogecoin is still not as widely used as Bitcoin. However, there is an increasing number of stores that are now accepting the joke-coin, including pet stores, sports franchises, and travel agencies.

Dogecoin is built on the blockchain and shares security similarities with Bitcoin. Before the Dogecoin can be hacked or altered, an attacker needs to control about 51% of the hash power.

Trading DOGE daily could help you make a lot of money if you time the market correctly. The asset has the potential to be a lucrative short-term investment, but you should only invest an amount you're willing to lose.

It's possible, but it depends. So far, Twitter celebrities and top business leaders like Elon Musk have spurred DOGE's price movement. The cryptocurrency offers virtually no utility compared to Ethereum or Bitcoin. Right now, it has lost its thunder and is only waiting for the next big push so it can rally around and try to push towards its ATH. Best Place to Buy Dogecoin in December 2024

Compare Popular Crypto Brokers & Exchanges

What is Dogecoin?

Where to Buy Dogecoin – Best Exchanges

1. OKX

Pros

Cons

2. ByBit

Pros

Cons

3. Binance

Pros

Cons

4. Coinbase

Pros

Cons

Is it Worth Buying Dogecoin in 2024?

Dogecoin Price Predictions: Where Does Dogecoin Go From Here?

OKX – Best Place to Buy Dogecoin

FAQs

Any risks in buying Dogecoin now?

Should I buy Dogecoin?

How can I buy Dogecoin instantly?

How can I buy Dogecoin anonymously?

Where can I spend my Dogecoin?

Is it safe to buy Dogecoin?

Will Dogecoin make me rich?

Will Dogecoin ever hit $1