With the advent of cryptocurrencies, there is a gradual trend of decentralization in the financial sector. Bitcoin is the cryptocurrency that has been leading this trend as the first and most valuable digital asset. This asset is widely considered a good store of value and has gained exponential growth, smashing new all-time highs repeatedly.

However, despite the impressive winning streak of Bitcoin, critics believe that there is a negative side to it. Bitcoin’s blockchain is based on a proof-of-work protocol, implying that it relies on miners for a block to be released. These miners solve complex mathematical puzzles using heavy computations; thereby resulting in the blockchain consuming a lot of electrical power which has raised global concerns.

Attention is being paid to other cryptocurrencies that are perceived to consume less electrical power, usable, transparent, and secure. In this article, we would be exploring the major digital assets that are seen as perfect alternatives to bitcoin and likely to grow relative to this perception.

On this Page:

Best Crypto Platforms to buy Altcoins in June 2025

[fin_table id=”14095″]Best Bitcoin Alternatives – Top 3 List

- Ethereum (ETH)

- Ripple (XRP)

- Dogecoin (DOGE)

- Sandbox (SAND)

- Solana (SOL)

Best Alternatives to Bitcoin in 2022 – Analysis

As the cryptocurrency industry evolves, attention is gradually shifting to viable alternatives to the dominant cryptocurrency, Bitcoin. Currently, there are thousands of cryptocurrencies in existence with a lot of use cases; however, not all of them possess the characteristics to be a better alternative to Bitcoin.

To consider another cryptocurrency as a suitable alternative to Bitcoin, the asset must be a good store of value, offer transactional efficiency, and most importantly, be sustainable to the environment. This would put an end to the Bitcoin energy FUD and ensure that blockchain technology retains its relevance and expands.

For this reason, several analysts have looked into great projects and we are going to explore four of them in this article.

Ethereum (ETH)

Ethereum is the second-largest digital currency by market cap. Ethereum started off the year 2022 with a price of $2,604.37. This cryptocurrency is a useful blockchain and has contributed largely to the development of the crypto space by hosting decentralized applications (Dapps).

It is considered as one of the top alternatives to Bitcoin as its mining consumes less energy, but most importantly, the ETH network would soon be migrating to a proof-of-stake which would eliminate mining and make it a more efficient network. Comparatively, ETH gained 148.71% in 2021 while BTC gained only 48.30%.

ETH/USD on eToro.com

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

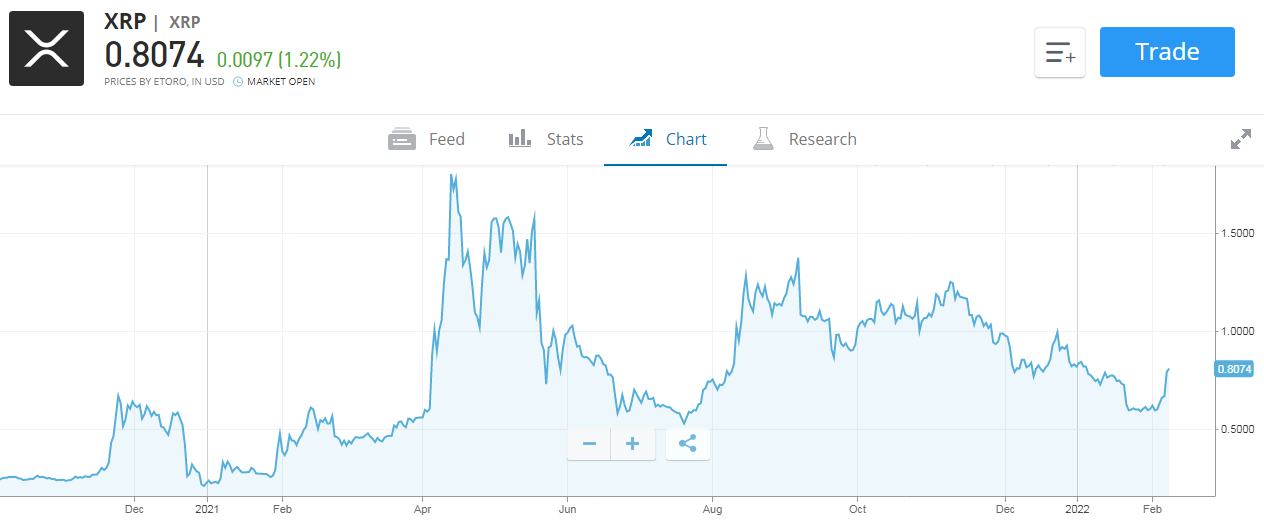

Ripple (XRP)

The price of Ripple in 2022 opened approximately at $0.6. Unlike Bitcoin, Ripple (XRP) is a staking network that relies on validators to consent to newer blocks, which makes it one of the environmentally friendly alternatives. The network is one of the top 10 cryptocurrencies and its open-source protocol is fixed on a distributed ledger database and not blockchain-based.

Ripple is aiming to become a swift payment method for businesses as it is capable of conducting transactions speedily with less cost. Comparatively, XRP has gained 67.53% in 2021 while Bitcoin gained only 48.31%.

XRP/USD on eToro.com

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

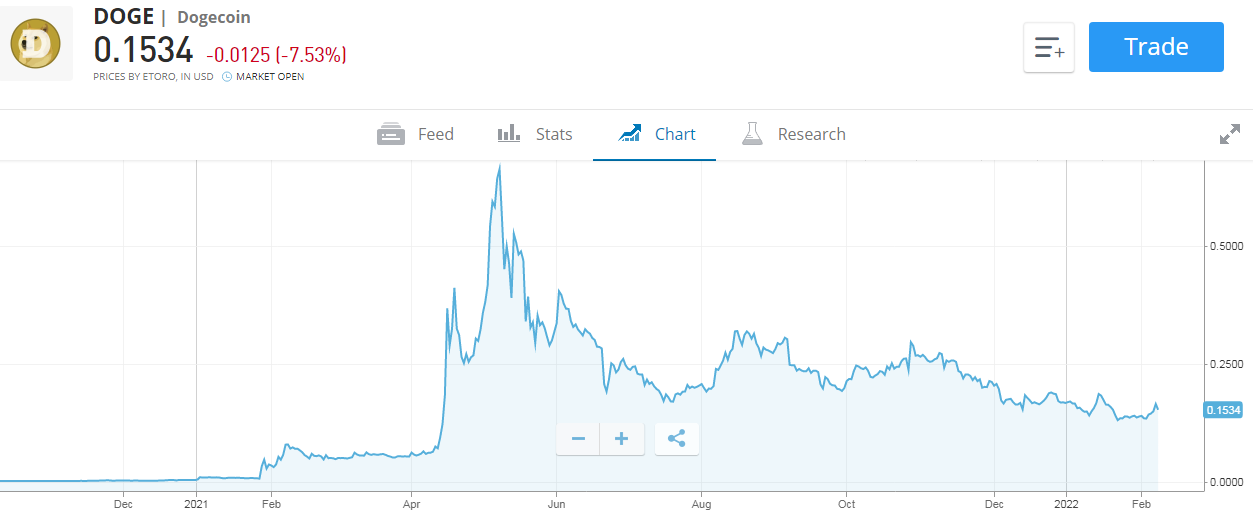

Dogecoin (DOGE)

Dogecoin (DOGE) began the year 2022 with a price of $0.17. It is seen as a meme cryptocurrency but has been performing quite well for a while now. This cryptocurrency is ably supported by renowned technocrats like Elon Musk, the CEO of Tesla. Dogecoin does not rely on a proof-of-work protocol like Bitcoin because it uses Scrypt technology.

Interestingly, DOGE is a fork of Litecoin which is another popular cryptocurrency and can be mined alongside it. Comparatively, Dogecoin has gained 3,215% and Bitcoin 45.51 percent in 2021.

DOGE/USD on eToro.com

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Libra (DIEM)

Now known as Facebook Diem, this cryptocurrency is the brainchild of numerous top-tier institutional entities like PayPal, Mastercard, Facebook, Coinbase, and Bison Trials. However, with the exit of PayPal and Mastercard, the social media giant Facebook has been an active contributor to its development. This project would implement a novel blockchain called ‘Diem’ while integrating several stablecoins to make multi-currency payments easier.

DIEM is not yet available to buy on any crypto exchange, but is expected to be in 2025.

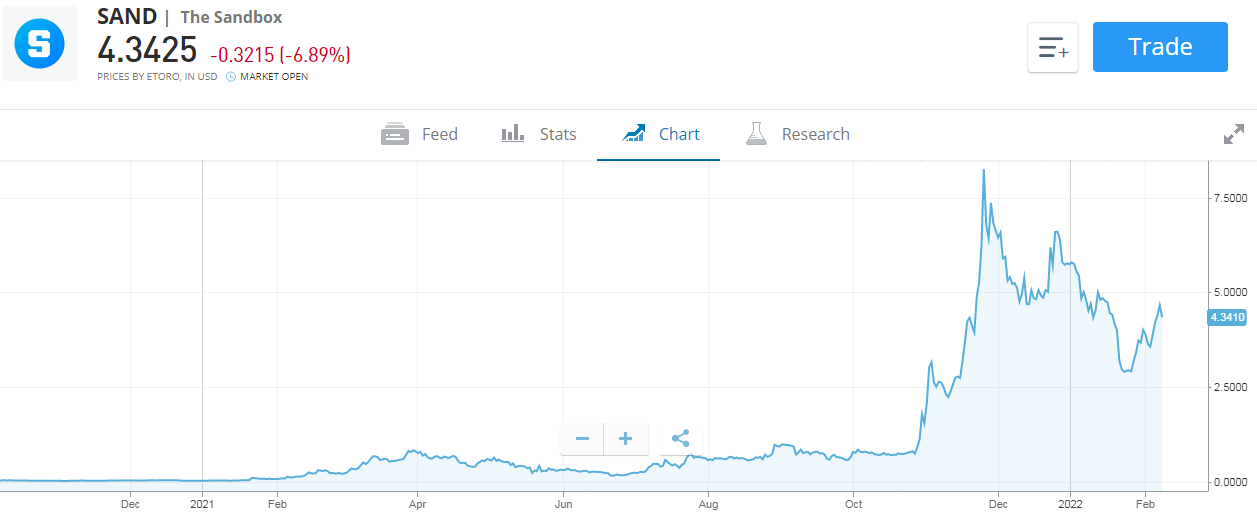

Sandbox

Sandbox started this year with a decent price of $5.97. At the time of writing, this crypto is ranked 33 in terms of its market capitalization in the crypto ecosystem. Developed by Pixowl in 2011, the Sandbox is a pay-to-win game, where users could make, buy, and trade digital goods in a game-like environment.

The primary goal of the Sandbox platform is to successfully introduce blockchain technology into mainstream gaming. In this blockchain-based virtual world, Sandbox brings up a decentralized platform for the gaming community with the help of decentralized autonomous organizations (DAO).

This platform’s primary purpose is to enhance a creative “play-to-earn” model that allows users to be both creators and gamers at the same time. SAND utility tokens, which are introduced through blockchain technology, perform the transactions on this platform. These tokens are the basis for all gaming transactions and interactions. They could be obtained easily by taking part in Sandbox’s games and contests.

Otherwise, you can also get them through any recognized crypto exchange. Sandbox’s goal is to revolutionize the gaming industry by introducing a virtual universe where games could make and sell their blockchain assets. Considering its goals and offerings, it carves out a niche for itself in this gaming industry.

This crypto has already got off to a fast start by attracting support and investments from a slew of big names in the gaming industry. Given its high growth in very little time, Sandbox is here to stay for long in the crypto game.

SAND/USD on eToro.com

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Solana

In 2022, the price of Solana opened at approximately $178.52. At the time of writing, this crypto is ranked 8th in terms of its market capitalization in the crypto space. Solana has risen in value by over 100% in the last year, thereby placing itself among the top-performing cryptocurrencies.

Many new investors are pouring money into this cryptocurrency because it presents itself as the best alternative to Ethereum. Solana, also known as the Ethereum killer, offers faster processing speeds and lower transaction fees than Ethereum. Furthermore, it supports smart contracts functionality on its blockchain technology, just like Ethereum.

It is a highly functional open source project that leverages the decentralized network nature of blockchain technology to offer decentralized finance (DeFi) solutions. The Solana protocol is intended to make it easier to create decentralized apps (DApps).

It combines a proof-of-history (PoH) consensus with the proof-of-stake (PoS) consensus of the blockchain for improving scalability. This combination has garnered the attraction of every small-time and institutional investor. On top of it, you can process 50,000 transactions in a single second on this blockchain without sacrificing decentralization.

Overall, this blockchain is secure, efficient, fast, and has the in-built technology that would make it globally accessible. Last year, it started with an opening price of about $6, and it has risen dramatically since then.

Moreover, its network already has around 400 projects. In the crypto world, some projects are well-known, such as Chainlink, Serum, USDC (the Circle stable coin), and Audius. Considering all these reasons, Solana possesses considerable powers, which aids in attracting big investors.

SOL/USD on eToro.com

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Other Cryptocurrencies as Possible Bitcoin Alternatives

Just as we mentioned earlier, the cryptocurrency world is quite large, and newer cryptocurrencies are birthed regularly. A good number of them, although new, are backed by an excellent development team that claims them to be useful, efficient, and secure. Crypto analysts are actively studying the concept and potentials of these blockchain-based networks even as diverse institutions continue to adopt them.

Of course, the ‘best-above-all’ alternative to Bitcoin might be developed anytime soon. Nevertheless, the available options must satisfy the criteria required to be considered as useful tokens and ultimately, as perfect alternatives to Bitcoin. One of the most important criteria analysts look out for is the market cap, however, this can be swayed as newer entrants might not have a large-sized market cap just after their release.

Below are some other likely alternatives to bitcoin that have attained some of the required characteristics of a proper blockchain and are glowing of massive potential.

Litecoin (LTC)

This digital currency is often seen as the “lighter version of Bitcoin”. It has a huge market cap and operates its blockchain using Scrypt technology. Litecoin mines its blocks faster than Bitcoin, thereby ensuring that transaction speed is swift enough.

Polkadot (DOT)

Polkadot is a budding cryptocurrency that has held the attention of institutional investors for a long. This asset operates on a proof-of-stake protocol and encourages interoperability with other blockchains.

Bitcoin Cash (BCH)

Bitcoin Cash is the result of a split in Bitcoin. The hard fork emerged after Bitcoin underwent a turbulent period due to scalability issues. BCH increased its block size to eight MBs instead of Bitcoins one MB to ensure that transactions flowed easily.

Stellar Lumens (XLM)

Stellar positions as a peculiar blockchain that is structured to provide enterprise solutions via the facilitation of large transactions. Normally, traditional financial systems might take days to perform large-scale transactions but XLM performs them nearly instantly.

Binance Coin (BNB)

Initially an Ethereum-based token, BNB is the native utility token of Binance Exchange. Binance is one of the largest crypto exchanges in the world and it offers its users a discount if they trade with the BNB. The value of crypto has grown exponentially so far.

Best Brokers to Purchase Bitcoin Alternatives

Before we proceed, we must highlight some of the best brokers where you can find these Bitcoin alternatives. These brokers are renowned in the crypto world as they feature useful digital currencies from time to time.

Cryptocurrency brokers and exchanges are better rated if they can fulfill the needs of users without any hassles. The above brokers are distinguished and have the peculiarities that a trader needs to affect the purchase and sale of digital currencies.

Unlike a myriad of other brokers, the above listed are dedicated to offering a wide array of cryptocurrencies. This is to ensure that their users are not limited to less conventional options and can flexibly trade in the versatile crypto market. Another prominent feature of these exchanges is the application of industry-standard fees which makes it easy to place trades and access near-instant liquidity. A user can easily deposit and withdraw their funds through diverse channels like credit/debit cards, bank accounts, crypto transfers, and peer-to-peer services.

Most importantly, these exchanges are rated highly in terms of customer support as they are always responsive to customer issues and efficient enough to avert further distress. Their security mechanisms are commendable as well, implying that it is less likely to have your assets tampered with by prowling hackers and scammers.

Why Investors Prefer Bitcoin Alternatives to Bitcoin

In the crypto sphere, alternative cryptocurrencies to Bitcoin are known as “altcoins”. They include digital currencies from Ethereum. Their popularity has been increasing and they are consistently gaining massive adoption. The reason for this is that a couple of them are quite useful in the mainstream and are capable of solving real-life problems.

The ability to solve problems by leveraging blockchain technology is an indispensable feature of the cryptocurrency world. With the Decentralized Finance (DeFi) space evolving, more digital assets are gaining prominence; a good example being PancakeSwap.

Bitcoin is a blockchain that is better appreciated as a store of value and not as a usable network. Bitcoin does not have an ecosystem like Ethereum or Binance Coin. However, being the foremost blockchain, Bitcoin is considered to be very secure, making its transactions slower in comparison to other blockchains.

Polkadot, Cardano, Polygon, Ripple, PancakeSwap, and Uniswap are some of the crypto assets that are rapidly embracing the outstretched arms of retail and institutional investors alike. These investors come in the form of assets managers, Exchange Traded Funds (ETFs), technological entities, and more. The wish list of an institutional investor for a digital asset often includes store-of-value, security token offering, and utility tokens.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

The Environmental Impact of Bitcoin

Bitcoin is a decentralized public ledger which implies that it is not controlled by a single entity like the central or commercial banks. To keep the blockchain running, there is a need for digital miners who compete to solve complex mathematical problems using computational power.

If a miner solves the puzzle, he is rewarded a block which is added to the bitcoin network. The high-level energy consumption for these computations is pegged at 133.68 TWh annually according to Digiconomist.

Environmental experts claim the network uses more electrical energy than the entire nation of Argentina and than most industries. A majority of Bitcoin miners employ energy sources that are not renewable like coal and fossil fuels. World-renowned billionaire and Tesla Chief Executive Officer Elon Musk decried the negative impact of Bitcoin on the environment leading to his company suspending the digital asset as a payment option.

The Chinese government has also been on the heels of Bitcoin by putting a crackdown on its mining activities in the country. This resolution has resorted to miners leaving the Asian country to other accommodating locations. However, not all Bitcoin miners use nonrenewable energy. More miners are rapidly adopting renewable energy and Tesla has promised to reinstate Bitcoin as a payment method once it overcomes this phase.

How to Choose the Perfect Broker to Purchase Bitcoin Alternatives

There are hundreds of brokers and exchanges that offer cryptocurrencies, making it quite difficult to settle one. We understand this challenge and we are going to help you settle it. Major brokers and exchanges are rated highly because they incorporate amazing features that most brokers would ignore.

To determine the perfect broker, you must settle for one that has added security features with very little history of breaches. Another important feature is the regular transaction fees as most brokers charge quite heavily when they offer liquidity. One must also pay attention to the tools available for trading and the interface of the broker.

Compare Platforms to Buy & Trade Altcoins

[side_by_side_comparison id=”14046″ type=”Crypto”]Future Projects for Bitcoin Alternatives

Major altcoins are gathering momentum in development and value. The prospects of these digital assets are supported by a dedicated community and enduring use cases. This is the reason we highlighted some assets above as the most suitable alternatives to Bitcoin. If these cryptocurrencies are not consistently evolving, they would likely lose steam which would trigger a widespread disinterest.

Ethereum, Dogecoin, Libra, and Ripple are some of the most developing blockchains in the crypto market. All four have witnessed massive growth during the crypto boom in the first and second quarters of 2021.

Ethereum for instance is migrating its protocol to a proof-of-stake blockchain soon, with the London hard fork upgrade already within reach. Others like Ripple and Libra would facilitate easier institutional fund transfers and cross-border payments without so much fuss.

It would be beneficial for potential or active crypto enthusiasts to invest in the crypto boom that is surging at this time. Following the market capitulation that Bitcoin and some altcoins suffered in May, investors are engaging other cryptocurrencies that would not easily be affected by so many factors like Bitcoin. The cryptocurrencies we listed above are perceived by analysts to be the pivots of the incoming crypto boom.

Understanding the Concept of Mining

Crypto mining is the method where the units of certain cryptocurrencies are entered into the circulating supply. Cryptocurrencies like Bitcoin and Ethereum are mined, however, Bitcoin remains the largest mined asset. To set up a mining rig, one is expected to own several tools like ASIC or GPU miners as well as access to dependable energy supply.

The concept is attractive to investors as one can make a substantial income from it without investing directly in the asset. However, crypto mining can be very complex and therefore not suitable for every investor. This is because most minable assets like Bitcoin are competitive and it might take quite a while before earning your first reward.

Investing in digital assets directly is a great way to earn from the cryptocurrency world. An investor can choose to trade, stake, or lend digital assets to make profits. You can also leverage platforms that offer accurate market predictions to trade profitably. These predictions come from analysts that have had years of experience in the cryptocurrency sphere and have made solid efforts to maximize it.

Understanding the Concept of Automated Trading

Crypto is a trending market, this means that it is active at all times. You can trade cryptocurrencies round the clock unlike other financial markets like stocks and forex. To maximize this feature, automated trading programs can be very useful.

Automated trading enables you to trade digital assets actively without having to constantly monitor your trading device. If you are too occupied to monitor market trends to buy and sell at the right time, automated trading might be a great option.

There are automated trading platforms that offer this concept via trading bots. When you sign up for an account, you are permitted to choose a peculiar trading strategy; this is to ensure that the trading bot would perform autonomously even if you’re absent.

This concept is featured on several crypto brokers like Coinbase Pro, Bitmex, Kraken, and Binance. These brokers might integrate Application Programming Interfaces (APIs) to effect automatic trading, while others go as far as incorporating smart contracts.

How to Invest Safely in Cryptocurrency

The cryptocurrency world has grown massively in the terms of adoption and investments. Since the bull run of 2017, more investors have paid attention to this industry; with some winning and some losing.

Cryptocurrencies are naturally volatile. The ever-fluctuating prices of these assets are based on diverse factors, thereby predicting their next moves might be a strenuous task. To effectively manage your funds as a crypto investor, it is advised that you know the factors that affect their values and what you can do to prevent them from hurting your investment.

You can employ the bankroll management method in your crypto ventures, knowing how to invest in the right assets and the importance of diversifying your portfolio. You should also remember that the speculative nature of cryptocurrencies might liquidate all your funds, therefore invest sparingly; only what you can afford to lose.

Most times, the market trend can take such a negative turn, it is essential you know when you are approaching a dead end and pull out so as not to incur further losses. The cryptocurrency market would always bounce back and you’d have more opportunities to invest.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Understanding Crypto Taxation in the US

In 2014, the U.S Internal Revenue Service (IRS) classified Bitcoin and other digital currencies as “assets” or “properties”. Which means that they are liable to taxation like other traditional commodities. While this might be counterproductive as cryptocurrencies are also seen as “currencies” by numerous investors, it is pertinent that its activities are conducted with legal regulations until a better measure is developed.

For cryptocurrencies, there are capital gains tax and income tax events. The former is for activities related to the liquidation of crypto for fiat, purchase of goods and services with crypto, and trading or swapping them; while the latter is taxed on airdrop events, block rewards and staking, and payment in cryptocurrencies.

There have been significant modifications to these laws in 2017 which appear confusing to some investors. To stay updated, keep your crypto transaction history safe and fill the necessary forms required like the form 8949 and schedule D.

Conclusion

With the advent of blockchain technology, financial systems are gradually metamorphosing into decentralized scenarios. While the increased crypto adoption rate is commendable, concerns that the leading crypto is harmful to the environment have triggered a look into major alternatives.

These alternatives have ample use cases, they are swift, less expensive, and decentralized. Since Bitcoin is primarily a value store, several institutions are opting for other blockchains that could be useful to the development of their industry.

Therefore, it is safe to say that they would be attaining meteoric growth sooner than expected. Diversifying to altcoins would drastically reduce the dominance of Bitcoin in the crypto market; the result of this would be less volatility.

For further reading see the comments of one of the best crypto traders to follow on Twitter, who predicts that Ethereum will overtake Bitcoin in marketcap – ‘the flippening’ – over the next few years. Also see the comments of some billionaire investors such as Mark Cuban who are more bullish on Ethereum than Bitcoin.

eToro - Our Recommended Crypto Platform

- 30 Million Users Worldwide

- Buy with Bank transfer, Credit card, Neteller, Paypal, Skrill, Sofort

- Free Demo Account, Social Trading Community

- Free Secure Wallet - Unlosable Private Key

- Copytrade Professional Crypto Traders

FAQ

What are the best alternatives to Bitcoin?

Cryptocurrencies that are considered worthy alternatives to Bitcoin must possess some features of Bitcoin and even better. Notable features are store-of-value, scalability, decentralism, usability, and transparency. There are several old and new coins that have attained these requirements and are receiving more attention.

What other cryptocurrencies can I invest in?

A smart crypto trader or investor should always look for utility tokens. These are cryptocurrencies that perform useful functions and are indispensable to the blockchain like Ethereum, Binance Coin, Uniswap, and PancakeSwap. That way your investment is held in a secure asset that would not likely falter at any time.

What are environmentally friendly alternatives to Bitcoin?

Environmentally friendly alternatives to Bitcoin are cryptocurrencies that require sustainable processes to be generated. Bitcoin mining consumes a lot of electrical power because it is based on a POW protocol. Environmentally friendly alternatives often rely on validators to add more blocks. Cardano, Ripple, Litecoin, and Dogecoin are perfect examples.

What legitimate alternatives to Bitcoin are the most promising?

Factoring in our considerations, these cryptocurrencies are the most promising as suitable Bitcoin alternatives. They are - Bitcoin Cash (BCH), Stellar Lumens (XLM), Ripple (XRP), and Binance Coin (BNB).

What are the most popular alternatives to Bitcoin?

The major alternatives to Bitcoin that have grown in popularity are - Ethereum (ETH), Dogecoin (DOGE), Ripple (XRP), Litecoin (LTC), and Binance Coin (BNB).