Traded by societies for thousands of years, gold remains one of the world’s most valuable commodities and is regarded as the ultimate safe-haven asset by many investors. Having maintained its value during times of uncertainty and rarely experienced huge volatilities, gold is popular among traders looking to hedge against inflation and diversify their portfolios.

Today, online gold trading is more accessible than ever before, with many CFD brokers allowing you to speculate on its price without owning any underlying assets. But how do you know which gold broker is right for you?

We’ve reviewed a wide range of the best trading platforms to bring you the three best gold brokers for 2024. We’ve also provided a step-by-step guide detailing how to trade gold for yourself.

On this Page:

How to Trade Gold in Three Quick Steps

1. Open a Trading Account

Create a free trading account with our recommended gold broker, eToro. You'll just need to provide a few basic details to sign up.

2. Deposit Funds

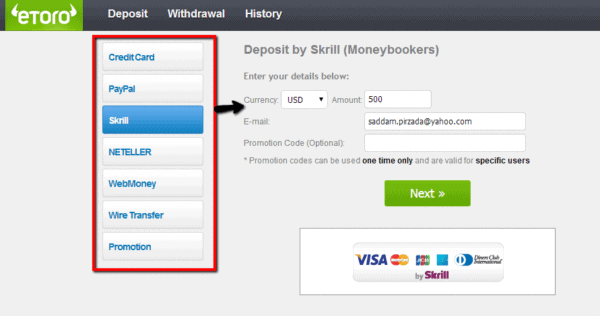

Once you're signed up, you can deposit funds into your account. eToro offers a range of deposit options, including PayPal, Neteler and Skrill.

3. Trade Gold

Now you've got a funded account you can begin trading gold. You can use the eToro demo account to practice before investing real money.

75% of retail investors lose money when trading CFDs with this provider.

Step 1: Sign Up to a Gold Trading Platform

Before you start trading gold, you need to find an online trading platform to sign up to. There are loads to choose from, which is why we’ve reviewed many platforms and created a list of the three best gold trading brokers for 2024.

”1.

This eToro review shows it requires a minimum deposit of $200 to get started, although you can trial the platform with a $100,000 demo account, and you can deposit through a range of methods, including PayPal. Regulated by FCA, CySEC and ASIC, it’s be of the most reliable and secure gold trading brokers around.

” image0=”” pros1=”0% commission” pros2=”Fractional ownership trading” pros3=”Social trading tools” withdrawal fee cons2=”$5,000 account minimum for CopyPortfolios” cta-label=”Visit eToro Now” cta-url=”https://insidebitcoins.com/visit/etoro” disclaimer-text= 68% of retail investors lose money when trading CFDs with this provider.” paragraphCount=”1″]

Step 2: Understand How the Gold Trading Market Works

Gold market basics

Gold has been sought after and traded by humans all the way back to ancient civilizations. It is one of the world’s most valuable metals, due to visual beauty, malleability and scarcity. Gold is used in numerous industries, from manufacturing to jewellery, and is held in reserves by many countries around the world.

The price of gold is affected by many factors, including supply and demand, inflation and deflation, interest rates, and geopolitics, among others. Since gold is priced in US dollars, it is also inherently linked to the strength of that currency.

In terms of trading, gold futures were first introduced back in the 70s as the country’s abandoned the gold standard concept. The Chicago Mercantile Exchange is currently the world’s largest gold exchange, though gold futures are also offered on several other exchanges, including the International Exchange in London (ICE).

Why is gold a good investment?

Gold is of interest due to many traders due to its reputation as a “safe-haven” asset, as it has traditionally withstood market turbulence and retained its value during periods of inflation and economic crises. Let’s take a closer look at why gold is of interest to so many investors.

- Safe haven: Gold is probably the most stable financial instrument given that it rarely loses value in the face of inflation, deflation, political uncertainty or economic crisis. On the contrary, it has time and again proven its ability to thrive under pressure. For instance, gold rose in value tremendously during the historic financial crisis in the 1930s as well as in 2008 when almost every other financial asset shed value significantly.

- Portfolio diversification: Gold’s ability to withstand, and even thrive, in the direst economic and political situations, makes it the perfect investment choice should you consider diversifying your portfolio. Investments in physical gold bullions, coins and CFDs serve the same purpose.

- Highly liquid: Gold is also one of the most traded instruments in the markets. This means that even if you invested a significant portion of your capital in gold, either to save it from high inflation or as a diversification move, you can easily convert it to cash if needed.

- Hedge against your stock portfolio: Due to its enduring value, investors with interests in specific stocks are always using CFDs as a hedge against their physical stock holdings. As it’s supply changes little year-on-year, it’s always used to hedge against inflation.

- Direct investment gains: The demand for gold is insatiable. Its price is often rising, giving you a chance to derive significant returns from these price movements.

Ways of investing in gold

Today, there are a number of different ways to invest in gold, from futures to CFDs.

Physical ownership – The most traditional way of investing in gold is by purchasing the metal itself in the form of gold bullions or coins. The upside to this is that you don’t have to worry about brokerage fees. Physical gold, however, carries with it several associated costs like buying the safe box, insurance and the risk of theft.

Futures contracts – A Gold futures contract is an agreement between two parties to exchange a specific amount of gold at a set price on a predetermined date. Traders invest in futures with the aim of selling them on and making a profit as the value increases. The COMEX Gold futures is the benchmark futures contract for gold prices and is traded on the Chicago Mercantile Exchange.

Gold CFDs – Contracts for difference (CFDs) present a more accessible and affordable way to trade gold without investing in the underlying asset or contract. Instead, you’re simply trading on the price movements of golds, making CFDs popular among day traders. With online CFD brokers, you can trade gold with leverage, meaning you borrow capital from the broker to make larger trades. You can also go short, meaning you can speculate on the price of gold going down.

Gold ETFs – Gold exchange-traded funds (ETFs) are funds backed by gold which allow investors to track and reflect the price of gold without owning the underlying asset. The oldest gold ETF is the SPDR Gold Shares (GLD), which trades on the New York stock exchange. Each share represents one-tenth fo an ounce of gold.

Mining stocks – Another way to indirectly invest in gold is to buy stocks of mining companies, which you can either buy or trade as CFDs. However, gold mining stocks don’t necessarily follow the same price trends as gold itself.

Pros and cons of gold trading

- Its continued scarcity guarantees the continuity of its bullish trend.

- Less prone to uncertain market conditions and volatilities than other commodities.

- It can be used to offset inflation or hedge against most other commodities and financial assets.

- Its demand is almost always on the rise.

Cons

- Gold CFDs are often subjected to higher brokerage fees in the form of spreads and commissions compared to most other commodities or currencies.

- Diminished incidence of huge inflation beat the significance of its use as a hedge

Step 3: Learn a Gold Trading Strategy

In order to trade gold successfully, you’ll need to implement a trading strategy. There are many gold trading strategies out there, but we’ve covered the most popular to help you kick things off.

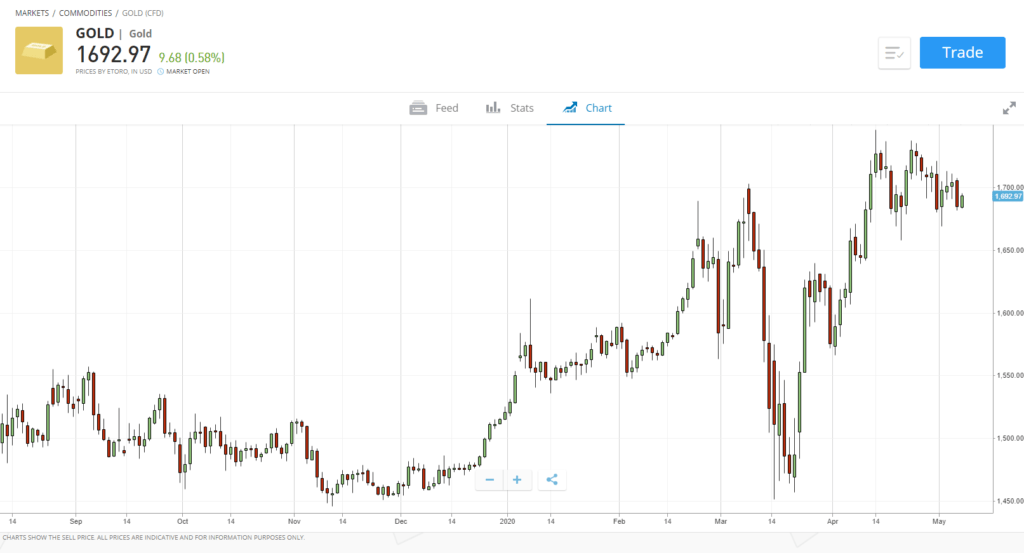

Trading gold using technical analyses

Much like with stock trading, technical analysis is used by many day traders to determine their gold investments. It lays more emphasis on analyzing the price actions over a given period of time, rather than fundamental factors, and using the analysis to predict its next course. When choosing an online stockbroker, most gold CFDs traders will consider the chart outlays and the number of premium analytical tools available on the platform.

Gold technical traders are always paying close attention to gold trading price charts, checking on the market movements and concentrating on the highs and lows and trend lines and patterns. These play a key role in helping the trader understand the current trends, such as whether the market is racing up or down a trend or stuck in a range. Technical traders then apply analytical tools, such as the Fibonacci retracements levels and Oscillators, to determine the best entry and exit points.

Trading gold using fundamental analyses

Fundamental analysis for both gold and any other commodities involves combining a host of market influences to determine the most likely price movement direction in the future. Unlike technical traders, who focus primarily on the possible price of gold in the next hour or minute, fundamentalists are largely position holders who are more interested in the price of the commodity a few weeks or months down the line.

Fundamental trading involves the analysis of the underlying factors that are likely to affect the value and price of the commodity. In the case of gold, a trader has to do a thorough examination of the current market environment in a bid to establish the forces that may impact gold trading prices in the long run. Such factors may include supply and demand, economic performance, interest rates set by central banks, and the value of the US dollar.

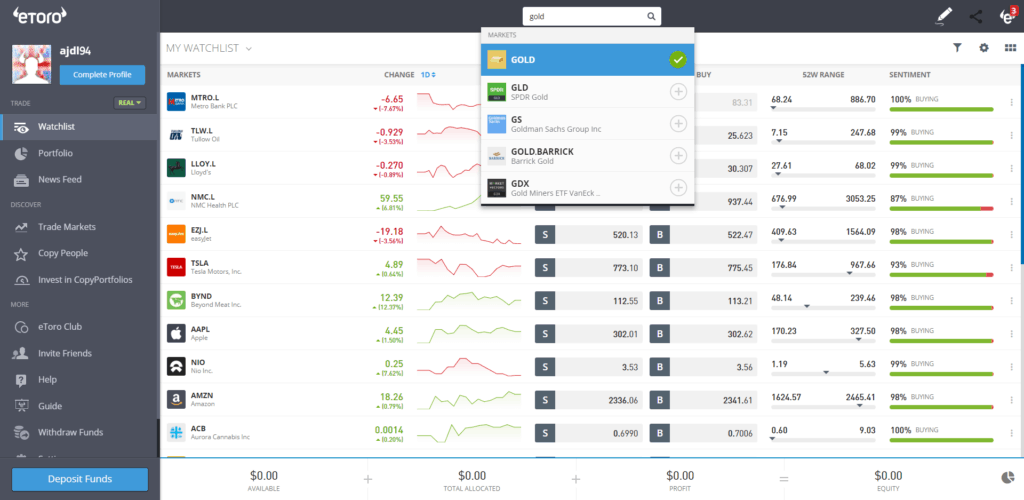

Step 4: Begin Trading Gold

When you feel like you have a sound understanding of the gold trading market, you can sign up to an online stockbroker account and begin trading. We recommend you go with eToro, due its strict regulation, low fees, helpful social trading tools and intuitive platform.

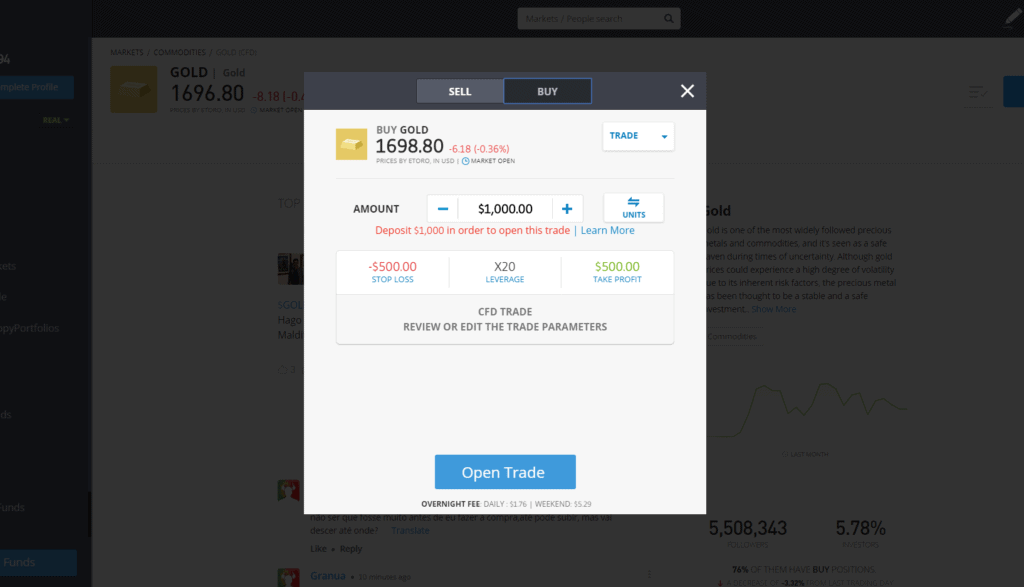

You can sign up to eToro within minutes by providing some basic personal information such as your name, email and date of both. Once you’ve created your account, trading gold CFDs is simply. First, search for gold in the search bar.

Click on gold and you’ll then be taken to the gold market page, where you can place an order or trade. Simply set the trade amount, stop loss, leverage and take profit, then simply click ‘Open Trade’.

Conclusion

There are many potential benefits that come with trading gold, from its status as a safe haven commodity to its high liquidity. That doesn’t mean it’s a guaranteed money maker, but if you do your research, use a strategy and invest wisely, gold can be a valuable asset to hold and trade.

If you want to trade gold for yourself, we recommend signing up to eToro, our pick for the best gold broker.

FAQs

Who can invest in gold?

Virtually everyone, both individuals and institutions, can engage in online gold trading. The high global demand for the commodity and even higher liquidity make it an interesting commodity to hold for both individuals and enterprises. With CFD trading, you can invest in gold with a lower budget than if you're trading futures or buying the underlying asset.

How do I invest in gold?

You first have to make a decision on the form of gold you want to invest in, depending on your interests and the amount of disposable income. You can need to find a regulated gold broker, such as eToro, that offers your preferred markets.

How do gold investors and traders make money?

Like any other commodity trader and investors, gold investors and traders make money when the price of gold rise above the point at which they acquired it. Gold CFD traders, however, have the opportunity to short the commodity and make money when it loses value.

What is the current trend in gold trading?

Gold assumed an untamed uptrend for the better part of the 1970s, hitting an all-time high price level of $2076 per ounce of Gold in Feb 1980. The rally, however, slowed in the next four years and stabilized at $700 by the end of 1984. The next big gold rally would take place during the last financial crisis between 2005 and 2015 when it hit the highs of $1400 per ounce. Today, it has stabilized around the $1200 range.

What is the best time to trade gold?

Most traders regard 7:00 to 17:00 GMT to be the best gold trading hours as you can trade during both the European and US sessions.

How much money do I need to trade gold?

This depends on the way in which you're trading gold as well as the minimum deposit limits of your chosen broker. As eToro offers fractional gold trading and has a $200 minimum deposit, so you'll need that much to get started.