Did you know that with a market capitalization nearing $17 Billion, Ethereum remains one of the most popular and most traded cryptocurrencies, second only to Bitcoin? And with its daily market volume well above $5 Million one can easily tell that Ether is also one of the most liquid crypto assets around. These plus the fact that it is easily available and that you can buy a portion of it, say 0.5 ether makes it a must-have asset if you hope to diversify your investment or trade in crypto markets.

Nevertheless, the fact that it has gained over 18% since the start of the year and 12% in the last one month simply means that you still have the chance to profit from the all-new technology that seeks to revolutionize the internet. But why should you invest in ethereum and where should you invest.

eToro - Our Recommended Crypto Platform

- 30 Million Users Worldwide

- Buy with Bank transfer, Credit card, Neteller, Paypal, Skrill, Sofort

- Free Demo Account, Social Trading Community

- Free Secure Wallet - Unlosable Private Key

- Copytrade Professional Crypto Traders

On this Page:

Why should you consider trading Ethereum?

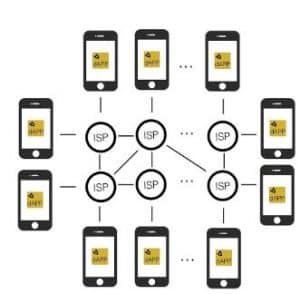

Ethereum is more than just a cryptocurrency. It is a revolutionary technology on which a host of activities can be undertaken safely and without regulation. Ideally, ethereum is a decentralized network on which individuals and institutions can build different apps and has soared in popularity not just because it is a pioneering technology but also because of its guarantee of safety and security. Since its establishment, it has witnessed the onboarding of numerous prominent individuals and institutions either as traders, investors, and users of its underlying technology.

The high regard with which ethereum technology is held by in the crypto community is evidenced by the formation and excellence of the Enterprise Ethereum Alliance, a consortium of fortune 500 and big brand companies devoted to pushing forward the ethereum technology. By investing or trading in the technology, you will be buying ether tokens that are used within its platform.

Here are some reasons why you should you invest in the ether

- More uses than most other cryptos: Ethereum isn’t just a digital currency, it is a technology with limitless potential. This implies that it will live on long after the digital coins craze dies and the gets infiltrated by numerous crypto tokens.

- Backing by leading technology companies: The EEA foundation is led by multinational financial and technology leaders like Microsoft, Intel, and JPMorgan who believe in Ethereum’s ability to transform the global FinTech scene. So should you.

- Large-scale adoption by financial institutions: Adoption by mainstream brands features as one of the key drivers of crypto coins value rise. The fact that such entities as Bank of America have embraced ethereum and are using it to build apps may thus be interpreted as a buy signal.

- Long term profitability: Microsoft, Bank of America, JPMorgan, BP, and countless other global household names are still exploring the numerous ways they could use ethereum technology to enhance the speed and security of their products and their services. As more join in and launch their products and services on the network, the higher the coin will rise in value.

What are the pros and cons of ethereum trading?

Pros

- More companies currently accept Ether payments

- It is more affordable than Bitcoin

- Led by a talented team of crypto experts

- Highly liquid markets and easily accessible

- Availability of secure deposits like ethereum paper that guarantee the safety of your investments

Cons

- Super high volatilities have seen it lose massively in relatively short periods in the past

- High incidences of hacking and security breaches with online crypto storage companies

- Previous breaches like the ether. Classic breakout and several security breaches have made highly unpopular with traders

How to invest in Ethereum

Top ethereum trading brokers

There are two primary ways of trading ethereum tokens with any of these brokers. These include: Referred to as day trading by most financial brokerage firms, active trading involves going long or short on the ether CFDs or actually buying the physical tokens and only holding onto it for short periods. It involves executing multiple positions every day and scalping any returns made from the tokens move in your direction. If you hope to day trade actual ethereum tokens or their corresponding CFDs, you must first learn how to analyze the price movement using the analytical tools provided by your broker. How to day trade The cryptocurrency market is considered the most volatile trading environment where the price of a token has the ability to gain or lose immensely in the shortest time possible. On 27th December 2018 for instance, Ethereum token gained over 14% in under 24 hours. In the occasional super volatile markets, especially after major news or announcements, the crypto prices have the ability to change drastically in just a few minutes or even seconds. This necessitates the need to enter trades instantly if you are to benefit from the sudden storm or exit to avoid huge drawdowns. And even with a broker with the fastest order execution speeds, you stand a chance of entering or exiting late thereby infringing on potential returns or maximizing loses. It is, therefore, highly advisable that you consider engaging a reliable expert advisor that guarantees faster market data analyses and an even faster execution order execution speed. As ethereum traders consider day trading, investors look to buy Ethereum with PayPal and hold, expecting to sell the assets at a higher price in the foreseeable future when they anticipate the price of ether will have improved. Ethereum investors ride on the belief that the digital currency’s ultimate trend is going up, basing this theorem on the fact that the crypto-coin once reported 4500% gain. They bet on the onboarding of the different institutions and mass adoption of the technology to help push the price further. How to position trade ethereum Unlike day traders who focus more on technical analyses tools in determining possible future price movements? Position traders are more focused on news, announcements, and sentiments. They are closely monitoring news and major announcements with regards to the coins as well as the sentimental analyses tools that gauge the market trust on ethereum. For instance, if Bank of America expressed interest in building a new DApp project on the ethereum network, this would signal a buy decision while uncertainties about governmental regulation or suspected breach would signal a sell order. Ethereum, and the crypto coins by large falls in the most traded markets. Its industry players are also the most targeted by hackers. On 15th January 2019 for instance, a New Zealand crypto exchange Cryptopia is reported to have suffered a data breach (HACK) that saw them lose ether token worth an estimated 16 million. How then do you secure your ethereum investments? Trading ethereum CFDs or actual tokens with a crypto exchange is no different from trading currencies and other financial instruments. You only have to brace for super volatilities where market prices are bound to change drastically in the shortest time possible. This creates room for the recording of abnormal profits or abnormal losses depending on your trading strategy, the effectiveness of your chosen broker, and adoption of expert advisors. The secret to making it here nonetheless lies not just in the mastery of the trading techniques and perfect determination of price patterns but in understanding the factors acting on the price to buy ethereum. More importantly, you need to learn how to avoid the ever-increasing security breaches aimed at crypto traders and investors by learning how to keep your investments offline and your broker trading account private.

Ethereum refers to a highly secure and decentralized blockchain technology on which individuals and businesses can create Apps, DApps and run different projects securely and in a decentralized manner. Ether, on the other hand, refers to the ethereum platform’s native token.

The primary difference between bitcoin and Ethereum, though they use almost similar underlying blockchain technology, is that Bitcoin is designed to serve as a digital currency while ethereum works as a technological platform on which businesses and apps can be launched and hosted.

Ethereum was first introduced to the global crypto markets in 2015 with its price peaking in 2018. You are however not too late in getting into the trade as it has only started gaining momentum with its adoption by technology and finance industry players.

No. You can easily analyze markets, enter and exit trades manually. The high volatility witnessed in this market, however, stacks several odds against a manual trader and increases the possibility of being locked out of profitable ethereum trades or losing out more than you could have if you were using a reliable automated trader.

Yes. While it was primarily meant for use within the ethereum platform its soaring popularity has seen most ecommerce stores and businesses accept the tokens alongside fiat currencies for payments of goods and services. It is however not an accepted legal tender.

To a large extent, yes. You can trade ether tokens through a crypto exchange or such highly regulated financial instrument brokers as Forex.com. Unlike stocks that allow for Direct Investment with the parent company, ethereum is a global community without an option of direct investment.

As at the end of April 2019, there are over 105.8 Million tokens in circulation. The upside to this is that ethereum doesn’t have an upper ceiling that its coins must not exceed implying that token generation, though mining and otherwise, will go on into the foreseeable future. Unlike bitcoin whose supply will not exceed 21 million coins

Yes. The proof of work system allows for the mining of ethereum cryptocurrency. You will, however, want to invest in graphics cards and be prepared to foot substantial amounts in electricity bills. How to trade Ethereum crypto coins:

1. Active trading

2. Buy and hold/ position trading

How to secure your ethereum assets?

Bottom line

FAQs

What is ethereum different from ether?

What is the difference between ethereum and Bitcoin?

Is it too late to invest in ethereum tokens?

Must I day trade ethereum with an expert advisor?

Can ethereum be used as a currency?

Do I have to invest in ethereum through a broker?

How many ethereum are there today?

Can I mine ethereum?