Staking has gained in popularity in recent months, and ETH’s expanding use case has prompted multiple investors to jump into the currency. Crypto staking, which was created to secure a blockchain network, has taken off, and more investors are looking for sites where they may stake Ethereum. Simply put, staking Ethereum is the act of storing a given quantity of Ethereum for a particular period for the purpose of contributing to the security of the blockchain network and also receive Ethereum staking rewards.

What Is Ethereum 2.0?

Ethereum 2.0, also known as Serenity or ETH 2.0, is a multi-level update to Ethereum. Its main goal is to enhance Ethereum’s transaction capacity, lower fees, and make the network more sustainable. Ethereum 2.0 (ETH2) is a network upgrade that attempts to improve the security and scalability of the Ethereum network. Ethereum’s existing mining process will be replaced by a staking model as part of this upgrade.

The method on which the earlier and new versions of Ethereum are based or used is the critical difference between them. The Proof of Stake (PoS) consensus mechanism is used in Ethereum 2.0, while the Proof of Work (PoW) consensus mechanism is used in Ethereum.

What Is Ethereum Proof of Stake?

Ethereum protocol developers have switched from a proof-of-work (PoW) consensus model to a proof-of-stake (PoS) consensus model as part of their intentions to enable a faster and more environmentally friendly transaction validation procedure. Unlike mining, staking can be done on regular PCs or laptops, eliminating the need for electricity mining equipment.

Ethereum Proof-of-stake is a consensus mechanism that blockchain networks use to reach distributed consensus in which users must stake a certain amount of Ethereum to become validators, as opposed to proof-of-work, which requires users to buy and run mining equipment, or proof-of-authority, which requires users to show proof of their identities. Validators, like miners in proof-of-work, are in charge of arranging transactions and constructing new blocks so that all nodes can agree on the network’s state.

Why Ethereum 2.0 Is Moving To PoS?

One of the primary reasons for the consensus switch is to drastically lower the amount of energy required to validate transactions and create new ETH. Proof-of-work is the original mechanism used by blockchains. To execute transactions and receive rewards, PoW needs computers to compete against one another. This process consumes a lot of energy and takes a lot of time.

As a result, some emerging cryptocurrencies have chosen a different path: proof-of-stake. Because the present cost of transactions on Ethereum’s network is excessively expensive and inhibits many people from using it, the upgrade to version 2.0 will see it switch to PoS. If this update is successful, the lower rates it would bring to the network will make it more accessible to average users.

The proof-of-stake system improves on the proof-of-work approach in several ways. There is a higher level of energy efficiency so mining blocks do not require a lot of energy. Moreover, there are fewer entrance hurdles and fewer hardware requirements, you don’t require top-of-the-line technology to create new blocks. Because it’s easier to use, the new 2.0 system has a good advantage in attracting additional node operators. This will aid in the decentralization of the new network.

PoS on Ethereum is also intended to set the framework for “sharding,” which is a partitioning technique that allows numerous parallel chains to efficiently share data and transaction load. When paired with a supplementary scaling component called “rollups,” these shard chains could allow Ethereum to process up to 100,000 transactions per second. That’s a significant increase above the 10-15 transactions per second it now executes.

How Ethereum Staking Works

The PoS-powered blockchain, unlike the PoW-based blockchain, bundles 32 blocks of transactions during each round of validation, which lasts on average 6.4 minutes. These clumps of blocks are referred to as “epochs.” When two more epochs are added to the blockchain, it is considered complete, meaning the transactions it holds are irreversible.

Stakeholders are divided by the Beacon Chain into 128 “committees” and assigned to a certain shard block during the validation phase (also known as the “attesting process”). Each committee has a designated period for proposing new blocks and validating the transactions within them, referred to as a “slot.” Each epoch has 32 slots, which means each epoch requires 32 sets of committees to complete the validation process.

Once a committee has been assigned to a block, one member at random is given the exclusive power to propose a new block of transactions, while the remaining 127 members vote on the proposal and attest to the transactions.

The new block is added to the blockchain and once majority of the committee has attested to its insertion, a “cross-link” is created to validate it. The staker who was chosen to propose the new block receives their reward only after that. The action of connecting separate shard states with the main chain is known as cross-linking. Through cross-linking, the final state of each shard must be reflected on the Beacon Chain.

It’s worth noting that the payment schemes for block proposers and remaining members assigned to the block are not the same. The staker who proposed the block is rewarded one-eighth of the reward, or “B,” and the attester is rewarded the remaining 7/8 B, which is modified depending on how long the block proposer takes to submit the attestation. The attester must submit the entire 7/8 B award as soon as feasible to get it. Each slot which passes without the attester, along with the attestation to the block, reduces the reward. If two slots pass before the attestation, the reward is decreased by 7/16 B, 7/32 B if three slots pass, and so on.

The issuance rate of Ethereum 2.0 is mostly determined by the base reward. The more Ethereum 2.0 validators are connected, the smaller the base reward for every validator. This is because the square root of the combined balance of all Ethereum 2.0 validators is inversely proportional to the base reward.

ETH staking overview

How To Stake Ethereum

Using a trustworthy crypto exchange or staking pools is the quickest and easiest way to start staking on Ethereum 2.0. This technique is best for beginners who don’t have the technical skills to run a full node or who don’t have the required 32 ETH. For infrastructure, security, and convenience, these platforms may charge a fee ranging from 15% to 25% of the staking returns.

To begin staking ETH, first download the eToro Money app on your mobile device and sign up.

- Then you can move ETH from the eToro investment platform to your eToro Money app’s crypto tab. Please keep in mind that ETH sent to the eToro Money app cannot be refunded.

- Request the amount of ETH you want to stake (minimum 1 ETH), and it will be transmitted to the staking address automatically. Please note that staked ETH will be locked until the ETH 2.0 blockchain is launched, as per Ethereum’s protocol.

Within the eToro Money app, you can check the status of your ETH 2.0 as well as the accumulated staking rewards in the crypto wallet. You will have access to the original assets and rewards once the ETH 2.0 blockchain is activated.

Best Exchanges for Staking Ethereum

1. eToro, a social trading platform with over 20 million users, is a popular alternative. eToro, which started out as a stock trading program, has quickly evolved and transitioned into the crypto space, supporting both large and small-cap cryptocurrencies.

eToro just announced eToro Staking, a staking-as-a-service product. Only three cryptocurrencies are now supported by eToro, which allows you to lock your ETH tokens for a period of time while also paying you with more ETH tokens as compensation for securing the Ethereum network.

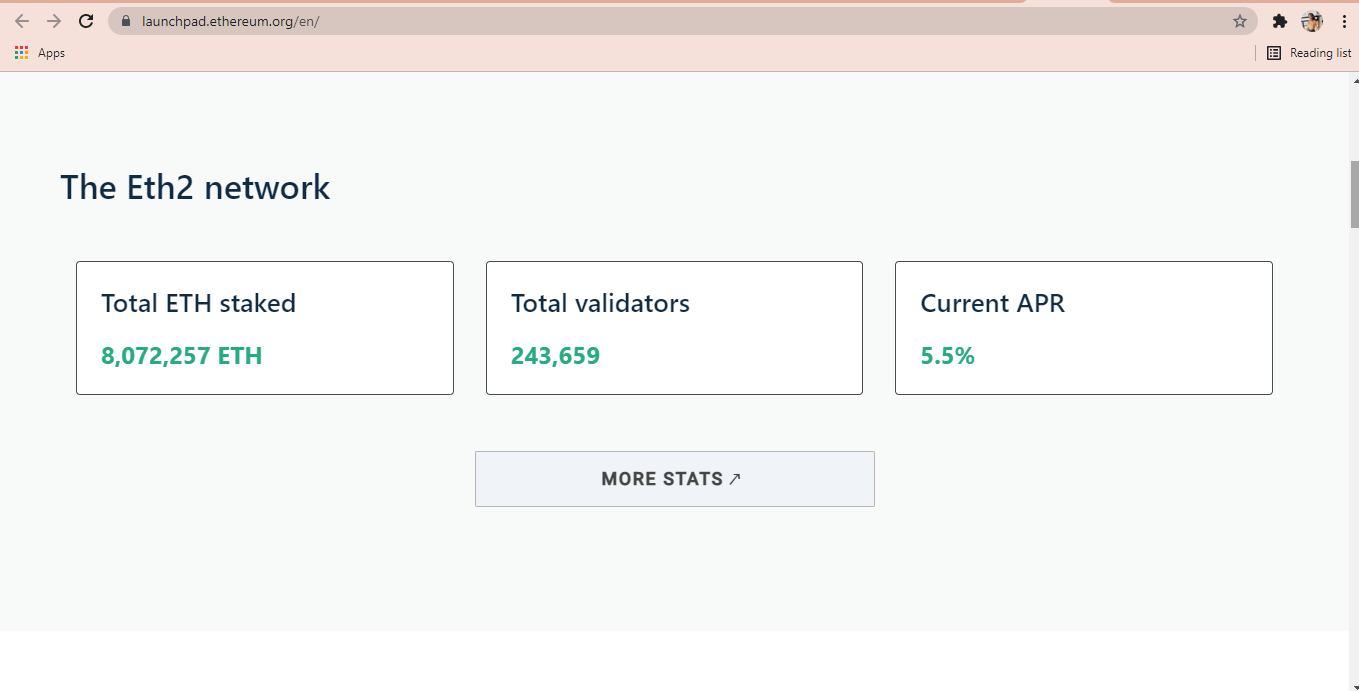

According to Staking Rewards, Ethereum 2.0 staking is the third biggest staked network, with over $26 billion in total value locked (TVL). This is owing to the network’s intention to switch to a proof-of-stake (PoS) consensus method in the coming months.

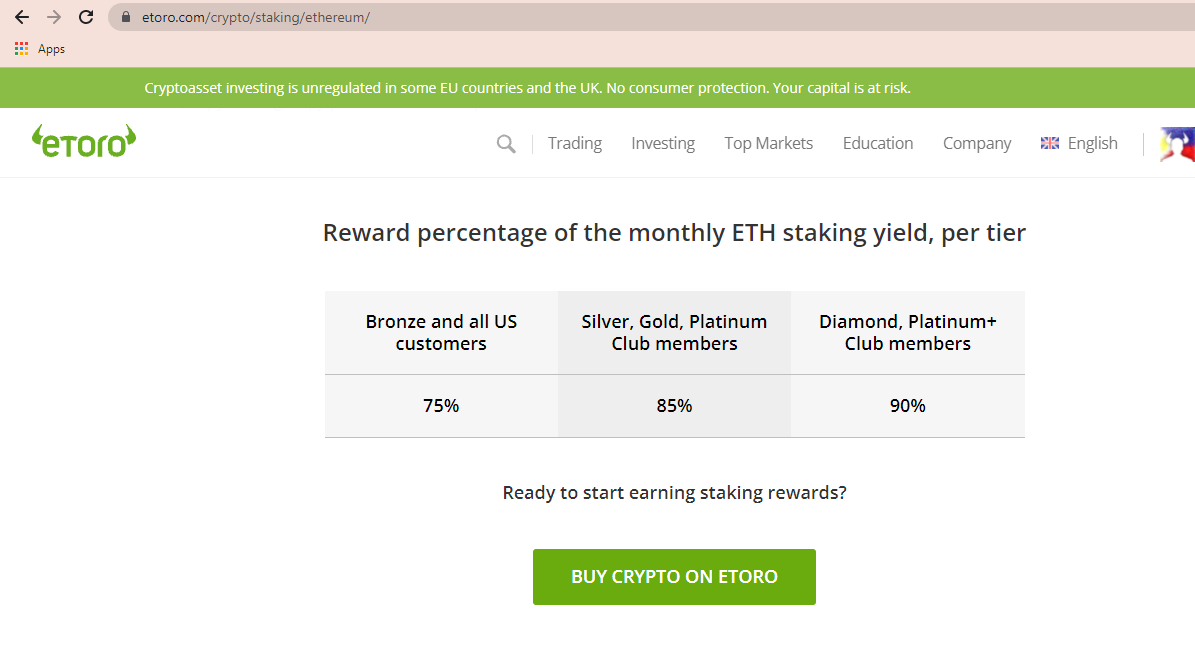

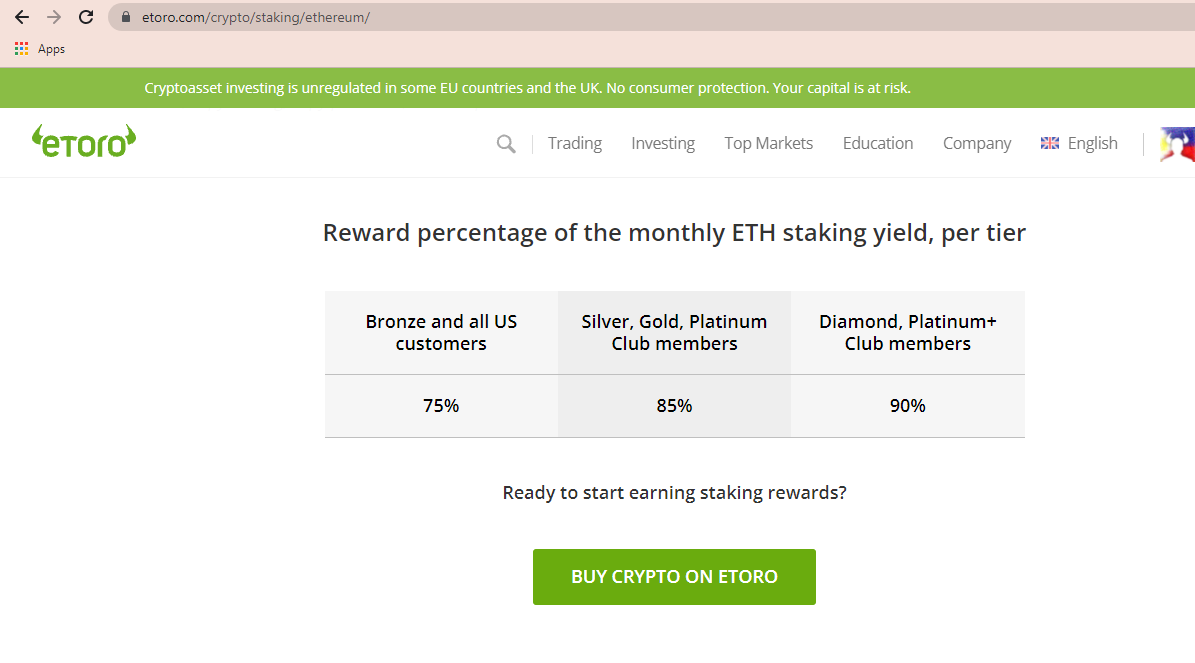

eToro Staking offers profits varying from 75 percent to 90 percent of the platform’s monthly ETH returns in order to best serve its worldwide customers. This reward % is determined by a user’s tier system membership option. eToro also promises a possible earnings ratio of 5 to 6.25 percent, making it one of the top Ethereum staking platforms to take advantage of the staking frenzy.

Update – As of 2025, the only cryptocurrencies eToro users in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

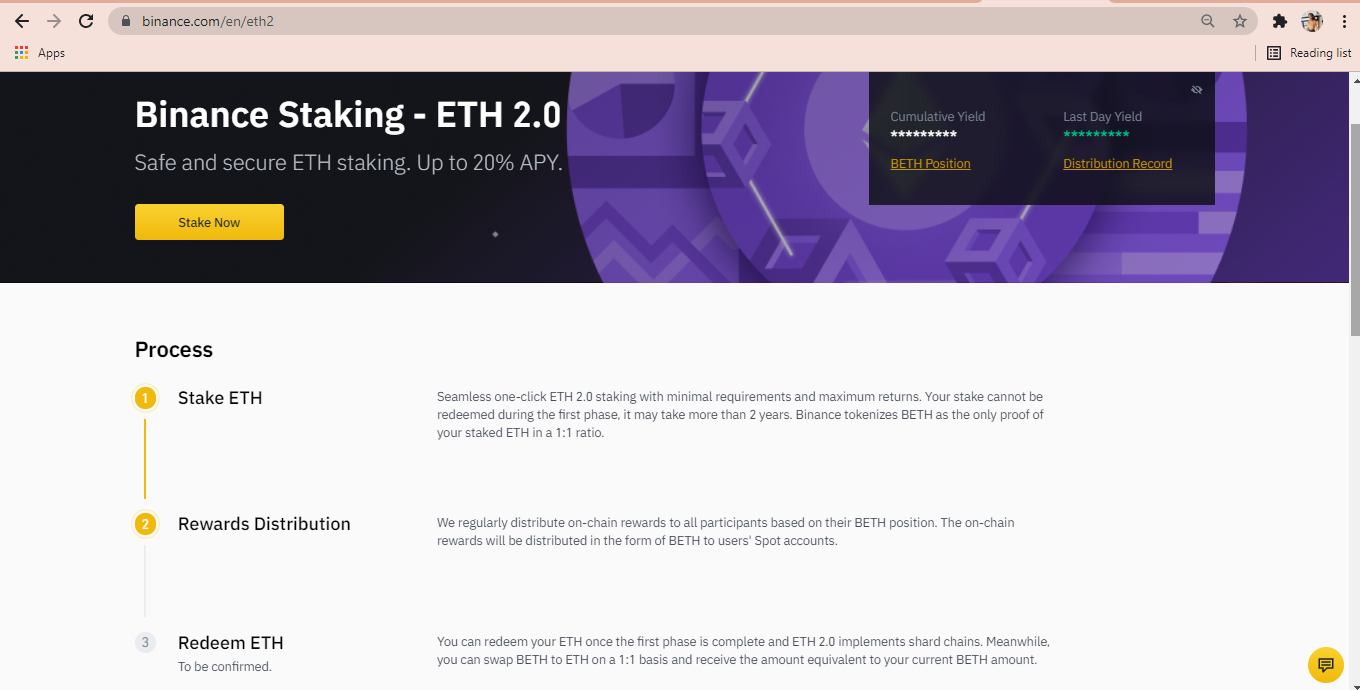

2. Binance has quickly established itself as the premier destination for the world’s thriving crypto community. Binance is the world’s largest crypto-focused exchange, with a minimum of $50 billion in transactions each day on its Bitcoin exchange. It hasn’t primarily relied on buying and selling bitcoins, though.Binance Earn, which was launched late last year, has quickly become a popular choice for investors hoping to earn passive income from their staked tokens. Staking Ethereum 2.0 has swiftly established itself in the huge Binance Earn pool, and you can earn Binance’s version of ETH, BETH, on a 1:1 staking ratio.

Users’ spot accounts are credited with rewards on a daily basis. Binance has little control over the annual percentage yield (APY), which is mostly determined by the number of ETH staked on the network. That is to say, the more ETH you invest in Binance pools, the lower the APY you will receive, and vice versa. Binance, on the other hand, claims to be low-risk, implying that you have a good chance of collecting your ETH payouts. Because of Binance’s popularity, ETH staking is a bit difficult to come by, as many investors are waiting to stake Ethereum. After staking your ETH for a day, you will receive your rewards.

Binance staking process

3. Coinbase is a famous cryptocurrency exchange in the United States. This long-standing and reputable company has a fantastic user experience and is the first port of call for cryptocurrency traders in the United States and other adjacent nations. Coinbase is one of the greatest Ethereum staking platforms in the world because of its very intuitive and simple-to-understand exchange.

Coinbase, like several other Bitcoin exchanges, provides Ethereum staking.

Users receive a fixed rate of 5% APR on the amount of ETH they have staked at any given time. All technical aspects of staking are handled by Coinbase. On your staking rewards, Coinbase takes a hefty 25% commission. However, if you don’t mind, Coinbase is a great place to start staking Ethereum due to its less complicated staking process.

4. Kraken is the fourth-largest cryptocurrency exchange in the world, with a 24-hour trading volume of more than $1 billion. This demonstrates that Kraken is a popular cryptocurrency exchange.

Kraken also offers staking services for cryptocurrencies, including Ethereum. After commission, which is changeable, staking payouts are set at 5 to 7% per year. Every two weeks, you will receive a payout, which will be available in your spot wallet. After you stake Ethereum token, Kraken will issue you an ETH 2 derivative token, which will cover your investment 1:1. You can also use the exchange to swap your fresh ETH. The vast repository of the exchange makes it one of the greatest Ethereum staking sites for producing passive income.

What Are The Profit Margins?

Ethereum staking is becoming increasingly popular. More individuals are becoming interested in Ethereum 2.0 than ever before. When it comes to staking Ethereum, you have numerous options, but you need first learn what staking is and whether it is profitable before doing so.

Staking Ethereum has the potential to be profitable. Although it is still in its early stages, Experts agree, however, that it can be profitable. Staking appeared to be hardly profitable when Ethereum 2.0 was revealed, yet it however resulted in profits. Adjustments have raised that number, making it appear more profitable.

The amount of reward given to stakers is determined by the total amount of ETH invested as well as the number of validators on the network. The annual interest rate rises as the pool of staked ETH decreases.

Last year, for example, when there were only about 500,000 ETH invested, the annual percentage rate of interest (APR) was just over 20%. The APR has reduced to around 6.0 percent because there are more than 6,800,000 ETH locked on the blockchain today.

As the stakeholder pool gets large enough to maintain a decentralized ecosystem, the interest rate declines. For the time being, staked coins and earned rewards cannot be withdrawn, at least until Ethereum 2.0 and Ethereum 1.0 merge.

ETH staking rewards percentage on eToro

What Are Taxes And Regulations For Ethereum Staking?

The long-awaited Ethereum 2.0 has finally arrived, but the upgrade has raised concerns regarding the tax treatment of Ethereum 2.0. What will the taxation be for Ethereum 2.0? It will be taxed similarly to the original Ethereum cryptocurrency in many ways. Those that engage in staking and get staking benefits, on the other hand, must deal with a variety of tax concerns.

The tax on Ethereum 2.0, like other cryptocurrencies, is based on capital gains, with the rate varying depending on how long you owned the token. Proof-of-stake incentives are generally recognized as income to the receiver, and must be reported together with other income and taxed according to your normal tax bracket.

However, the fact that Ethereum 2.0’s proof-of-stake rewards would be locked for the initial phase raises a tax problem. When you have jurisdiction and control over a cryptocurrency token, it is usually regarded “received.” Staking rewards, on the other hand, may be addressed differently in the early stages of ETH 2.0.

This Ethereum 2.0 tax question has sparked heated debate among our cryptocurrency tax lawyers and the Ethereum community at large, and there is currently no formal IRS guidance available. However, based on other IRS guidelines, we can make an educated guess.

One could argue that because the staked ETH 2.0 is “locked” for two years under the contract, the income should not be declared until the two-year term has expired and the coins can be withdrawn, swapped, and sold.

Even if you believe this, the IRS is likely to classify staking as an ETH 2.0 loan, and the accrued (but unpaid) rewards should still be recorded and taxed annually under the Original Issue Discount regulations.

While no clear answer has yet been issued, we expect the IRS to take the stance that the same rules apply to ETH 2.0 validators, and that staking rewards will be considered “received” once they are given, even if you can’t access or manage them right away.

How Ethereum Staking Compares to Other Crypto

Rival blockchains like Cardano, Binance Smart Chain, Solana, and Polkadot are chasing behind Ethereum 2.0, which is still in development.

Ethereum is currently in the middle of one of its biggest updates, also known as Ethereum 2.0. Ethereum 2.0 is a series of updates moving Ethereum to a more efficient consensus architecture called Proof of Stake (POS), which means Ethereum uses at least 99.95% less electricity. This includes the highly anticipated EIP1559, Ethereum’s upgrade proposal, which also aims to correct gas tariff volatility and make Ether a scarcer asset through the introduction of coin burning.

Much is at stake for Ethereum and its London hard fork, which is one of the key updates to Ethereum 2.0. With the update planned so far, the dominance of Ethereum on the smart contract market and DeFI is unlikely to loosen. On the other hand, if Ethereum 2.0 faces further delays, Cardano, BSC and Polkadot could capture more market share and reduce Ethereum’s dominance.

The dominance of Ethereum in the DeFi business can also be seen in terms of total value locked (TVL). The entire net valued locked is currently US$103.6 billion, with Ethereum accounting for US$77.2 billion, or more than 75% of the TVL. Kraken provides an attractive crypto staking range, with major additions such as Polkadot and Kusama providing a 12 percent annual percentage yield.

ETH staking on eToro

What Are the Risks of Staking Ethereum?

The User Agreement and any other terms that may be presented at the moment you choose to stake apply to the ETH staking service. Staking with ETH is experimental and comes with some risks, including the possibility of the network failing. Before you decide to stake, be sure you independently examine, understand, and accept the associated risks.

In proof-of-stake, the prospect of a 51 percent attack still remains, but it’s considerably more dangerous for the attackers. You’d need to possess 51% of the staked ETH to accomplish so. Not only is this a large sum of money, but it will almost certainly depreciate the value of ETH. There’s little reason to devalue a currency in which you own a majority stake. There are greater financial incentives to keep the network safe and secure.

To avoid additional acts of bad behaviour, the beacon chain will execute stake slashings, ejections, and other penalties. Validators will also be in charge of reporting these occurrences.

The chance of losing your staked assets (sometimes known as your “principal money”) due to slashing or hidden software risks is an important risk to be aware of. Slashing is a protocol-level punishment imposed in response to a network or validator failure.

Each ETH 2.0 validator must select its own specification from five distinct teams that developed ETH 2.0 in a variety of languages. Regardless of how well testing proceeded in the second half of 2020, those specs could include exploitable flaws. One of the reasons developers set staking rewards so high is because of this.

Staking in ETH 2.0 implies your ether will be locked up for months or even years. You are allowed to gaze at it but not to touch it.

Conclusion

The advantages of staking ETH 2.0 is more than only generating ETH in the form of passive rewards. To validate the ETH 2.0 Beacon Chain, a significant amount of Ether is locked up which helps ensure the ecosystem’s long-term viability. To encourage additional developers to the network, this will result in faster transaction speeds, lower costs, lower energy use, and increased reliability.

It is vital to note that ETH rewards cannot be withdrawn until the Ethereum 2.0 upgrade is entirely completed, whether investors stake Ethereum solo with 32 ETH or join a staking pool with a lower amount utilizing a cryptocurrency exchange.

Read more: