Tron is an established project and has been around for several years now. In this guide, we shall take a look at its past price movements and potential for growth in the coming years.

Tron Price Chart

[ccpw id=”432727″]Why TRON Prices Rise and Fall

TRON’s price movements have been shaped by a variety of pivotal moments and external influences. The acquisition of BitTorrent in 2018 is as a key factor that initially spurred excitement among investors. Integrating BitTorrent’s file-sharing system into TRON’s network introduced new functionality and helped fuel a significant rise in TRX’s value, with the potential for decentralized content distribution creating positive market sentiment. Naturally, this meant massive growth for the project, but many were skeptic about the project’s growth being the result of a marketing gimmick and not organic.

Thanks to those in doubt, controversy has not been absent within the Tron ecosystem. In 2020, accusations of insider trading against TRON’s founder Justin Sun cast a shadow on the project. These claims led to uncertainty, sparking a temporary price decline as investors questioned the transparency and decentralization of the platform. These concerns were magnified when critics pointed to Sun’s influence on the project, despite its promises of decentralization.

TRON’s expansion into decentralized finance (DeFi) in 2021 was another catalyst for upward momentum. The launch of several DeFi platforms and the facilitation of USDT transfers on TRON’s network added real utility to TRX, helping it gain traction during the broader bull market. However, global regulatory crackdowns in regions like the U.S. and China created headwinds, causing price stagnation as regulatory uncertainty loomed over the entire market.

TRON’s entry into the NFT market in 2021 had also managed to spark another wave of interest within the ecosystem. Its low transaction fees positioned TRON as a strong choice for NFT projects, with collaborations like APENFT helping to further boost demand for TRX. But issues related to network scalability, as well as sporadic congestion, tempered investor enthusiasm, preventing any sustained price growth during this time.

In recent years, the economic conditions and changing crypto space have played a significant role in the shaping of Tron’s price. The crypto market’s downturn in 2022, influenced by rising inflation and global interest rate hikes, hit TRON alongside other cryptocurrencies. Despite continuous updates and attempts to drive new use cases, TRX’s price has remained sensitive to macroeconomic shifts and market-wide sell-offs. While it has definitely taken a hit and trades well below its all-time high, the token has still managed to sustain value and maintain an active community.

TRON Historical Prices

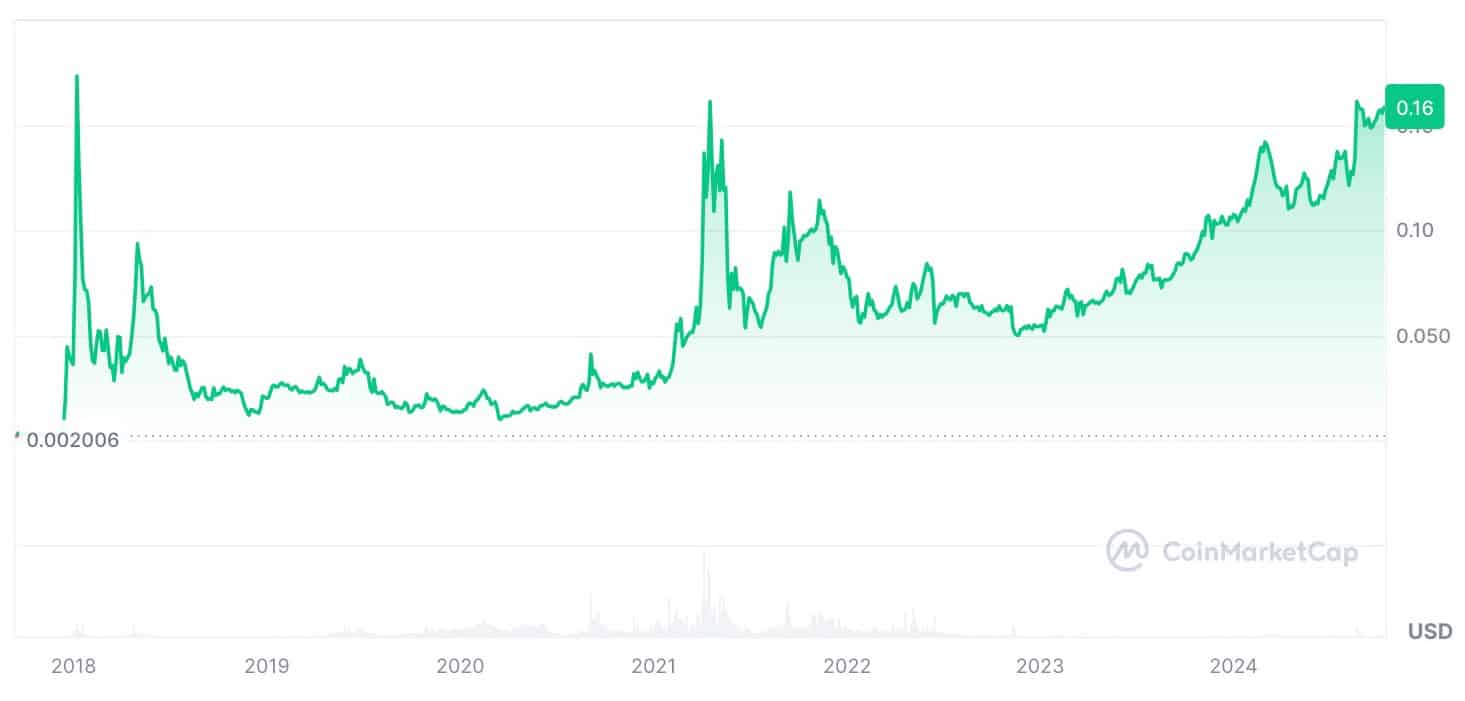

When TRX first entered the market after its initial coin offering (ICO), the token traded for fractions of a cent. It wasn’t until the massive surge in early 2018 that TRX saw its first major breakout, reaching over $0.25 per token in January of that year. However, this meteoric rise was short-lived. Within a few months, TRX plummeted to just above $0.03, marking a significant resistance level that persisted throughout most of 2018.

Following this dramatic crash, TRX continued to struggle with resistance around the $0.05 mark. For brief periods in 2018 and 2019, the token managed to push above $0.05, but each surge was followed by a quick retreat. By mid-2019, TRX settled into a support range between $0.01 and $0.03, where it lingered for much of 2020, with no significant movements above those levels due to a lack of major news and developments around the project.

Entering 2021, TRON’s price saw renewed upward momentum thanks to the broader crypto market rally and its expansion into DeFi and NFTs. TRX managed to break above $0.10 again, revisiting levels that hadn’t been seen since 2018. Throughout 2021, TRX consistently hit resistance at around $0.15 to $0.16, but this level has held strong as the upper boundary for the token.

The most recent price movement shows that TRX is experiencing a renewed push towards this $0.16 level, with current market conditions supporting another rally. Support now sits at approximately $0.10, providing a solid foundation for further upward movement. The token’s ability to sustain this upward trajectory over the last few months suggests renewed interest and activity in the TRON network, leading to speculation that TRX could soon surpass previous resistance levels and potentially reach new highs in the near future.

Key resistance zones in the chart can be identified at $0.16, a critical level that TRX has struggled to break through consistently. Meanwhile, support has been established around $0.05 during bearish periods. Recent developments in 2024 show that TRX is again nearing its highest resistance level, signaling a potential breakout if sustained momentum continues. The token currently has a market cap exceeding $10 billion, and many speculate that it will race toward and surpass the $20 billion mark in the coming months.

TRON Future Price Predictions

TRON Price Prediction for Q4 2024

In the final quarter of 2024, TRON is in a critical phase, nearing a major resistance level of $0.16. This threshold has proven difficult for TRX to break through consistently in the past. If the token successfully pushes past this point, it could signal a bullish movement that may elevate its value. However, despite the active efforts by the community and its growing usage within the decentralized finance and NFT space, TRON’s underlying technology has not stood out compared to other leading blockchain networks.

This lack of differentiation means that if the community engagement declines or enthusiasm wanes, the token could experience a pullback. With a lot of the recent momentum depending on the active involvement of developers and users, any drop in these metrics could result in TRX slipping back toward its lower support level around $0.10 or even lower. Thus, Q4 2024 holds a crucial position in shaping the next phase for TRON, with potential for both growth and retracement.

TRON Price Prediction for 2025

By 2025, TRON’s price outlook depends heavily on its community’s commitment and activity. In the past, TRON has thrived largely due to the dedication of its user base, which has rallied around the token during periods of market uncertainty. The community has acted as a stabilizing force for the project, helping it recover from setbacks and even driving token utility through DeFi and NFTs. However, the project’s reliance on its vocal and engaged user base poses risks if that enthusiasm begins to fade.

To establish more sustainable growth, TRON needs to shift its dependency away from marketing and founder-driven hype, especially the charismatic promotions from its founder, Justin Sun. Sun’s role has often sparked temporary price surges, but to maintain a higher trajectory, the project must grow beyond this reliance and focus on organic developments.

If TRON manages to secure more partnerships and improvements to its platform, it could begin to challenge its previous market cap highs and potentially enter the $50 billion market cap range. The token’s future would then be shaped by real-world use cases, innovation, and strategic alliances rather than marketing-led momentum.

TRON Price Prediction for 2030 and Beyond

By 2030 and the years beyond, the long-term success of TRON will be determined by adoption and real-world use cases. If TRON is able to achieve the widespread adoption of its blockchain, ensuring that TRX becomes an essential part of global decentralized applications, the token could see significant price growth over the decade. The network’s original vision of decentralized entertainment and content sharing remains compelling, and if the project can deliver on this promise, the TRX token could become a cornerstone in the ecosystem.

However, any lack of significant technological advancements or use case developments could dampen this optimism. Without innovations that differentiate TRON from its competitors, it will be challenging for TRX to maintain a steady growth path.

For TRON to see substantial price appreciation by 2030, it must evolve technologically and provide a robust solution that continues to attract users and developers globally. If the platform stagnates in terms of utility or adoption, TRX may struggle to see significant price increases, potentially limiting its market position. On the other hand, strong adoption and sustained relevance could see TRX experience considerable value appreciation in the long term.

Should You Buy Tron?

TRON has already established itself as a high-potential cryptocurrency with a solid market presence, consistently ranking among the top blockchain networks. The project has shown resilience and adaptability, positioning itself for significant growth in the coming months. However, while TRON’s large market cap and ecosystem offer substantial value, it is crucial that it maintains the same level of growth and community activity to sustain its momentum.

That said, because TRON is already a big player in the space, the level of growth it may see could be relatively limited compared to smaller, emerging projects. It is also worth considering that the TRON token’s promises per roadmap have been rather dicey too, with some developments happening, and many yet to commence, indicating more volatility in the coming months.

This is why exploring early-stage cryptocurrencies could offer excellent opportunities for those looking to diversify their portfolios. An example of such a project is Flockerz, which is gaining attention for its innovative concept and impressive presale performance.

Flockerz: A Promising Memecoin with a Vote-to-Earn Concept

Flockerz has quickly become one of the most talked-about memecoins in the space, thanks to its creative storytelling and decentralized governance model. The project has raised nearly $500k in a short period during its presale, capturing the interest of both investors and influencers. Its compelling narrative, which revolves around the “Vote to Earn” mechanism, has drawn in a dedicated community.

The storyline of Flockerz takes a unique approach, following the rise and fall of a fictional king “birb” and his kingdom, symbolizing the impact of centralized leadership. The eventual shift to a decentralized power structure, where the community takes control through the Vote to Earn system, represents the core functionality of the project. This engaging metaphor highlights Flockerz’s aim to create a decentralized entity driven by community participation, where users are rewarded for their involvement.

Built on the Ethereum blockchain, Flockerz ensures security and transparency through audits by leading firms like SolidProof and Coinsult. The project’s ecosystem, dubbed “Flocktopia,” envisions a vibrant, community-driven world where governance is determined by its users, offering them the ability to shape the direction of the platform.

Flockerz has already garnered endorsements from well-known influencers, including trending YouTuber ClayBro, positioning it as a potential 10x project. With its native token FLOCK currently priced at $0.005746 and staking rewards offering an APY of over 2900%, Flockerz provides a great chance for those looking to get in early. This rate of return is expected to decrease over time, highlighting the benefits of joining the project sooner rather than later.