Chainlink provides trusted data from outside the blockchain that can be used in smart contracts. Need the price of gold for a decentralized application? Chainlink oracles can do that, and the entire network runs on the Chainlink (LINK) token. In this guide, we’ll learn how to buy Chainlink.

We’ll also explore the protocol in detail, including Chainlink’s ambitious goal of blockchain interoperability, making data from disparate blockchains available on other blockchains. Few projects aim to change the crypto world and bridge the gap between traditional finance and blockchain like Chainink.

Let’s learn how to buy Chainlink before discussing the project and its potential as an investment in more detail.

How to Buy Chainlink in 4 Easy Steps

Chainlink’s popularity means the token is available on several trading platforms. However, you don’t need to use an exchange. In this example, we’ll buy LINK tokens using Best Wallet. The tokens will be deposited into a crypto wallet that you control.

- Step 1: Download Best Wallet: Visit the Best Wallet download page to install the Best Wallet app for iOS or Android.

- Step 2: Create a New Wallet: Follow the on-screen instructions to create a new wallet in the app. You can also import an existing wallet if you already have one.

- Step 3: Select “Trade”: The trading portal on Best Wallet lets you buy Chainlink and other popular assets. Chainlink is supported on several networks. Search for “LINK” and choose your preferred network (Ethereum or BNB Smart Chain).

- Step 4: Buy Chainlink: Best Wallet automatically chooses the best exchange rate from several providers. Choose a purchase amount and select your payment method. If everything looks correct, confirm your order. Your LINK tokens will be deposited directly into your crypto wallet.

Key Takeaways on Chainlink

- Launch and platform: Chainlink (LINK) launched in 2017 following an ICO as an ERC-20 token on the Ethereum blockchain. Its main net launched in 2019.

- Tokenomics: Maximum supply of 1 billion tokens, about 65% of which are circulating. 35% of the supply was allocated for the ICO and private placements, 35% for staking, and 30% for founders and development.

- Presale: 350 million tokens, ranging in price from $0.09 to $0.11, were sold between private sales and ICO purchases.

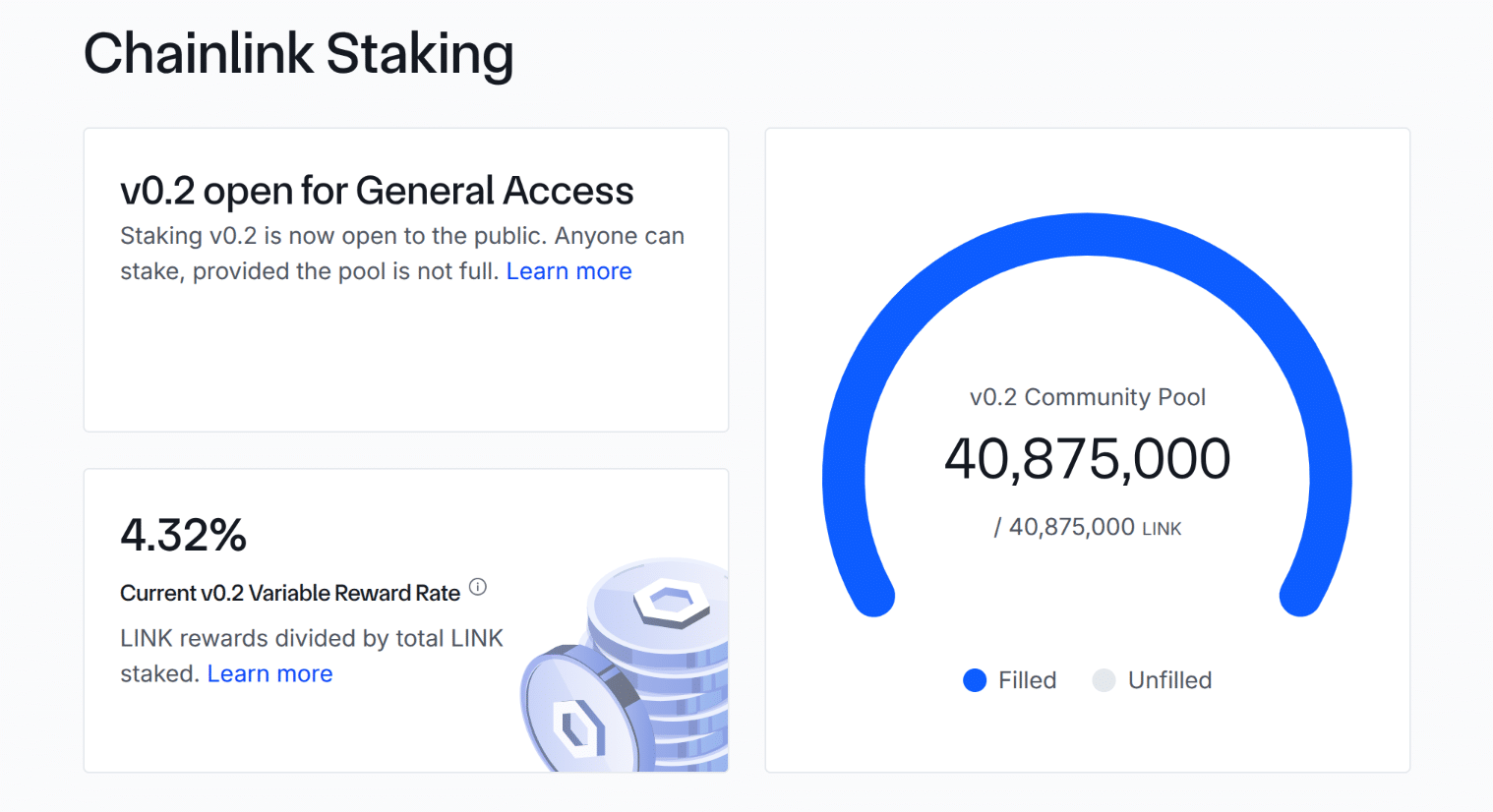

- Staking: Community staking supported; v0.2 pays a variable yield based on pool participation, with a current minimum yield of 4.32%.

- Key Features: Provides external (off-chain) data to smart contracts, including financial data, weather, sports, and other data points, via trusted oracles.

- Long-term vision: Chainlink’s long-term goals include enabling cross-chain interoperability and tokenization of real-world assets (RWAs).

How to Buy Chainlink – Step-by-Step Guide

Let’s examine how to buy Chainlink with an explanation of each step. We’ll also discuss where to buy Chainlink. Most well-established crypto exchanges offer the LINK token, providing options worldwide. In this case, we’ll use the MEXC exchange, a global exchange known for high liquidity and low-cost trading.

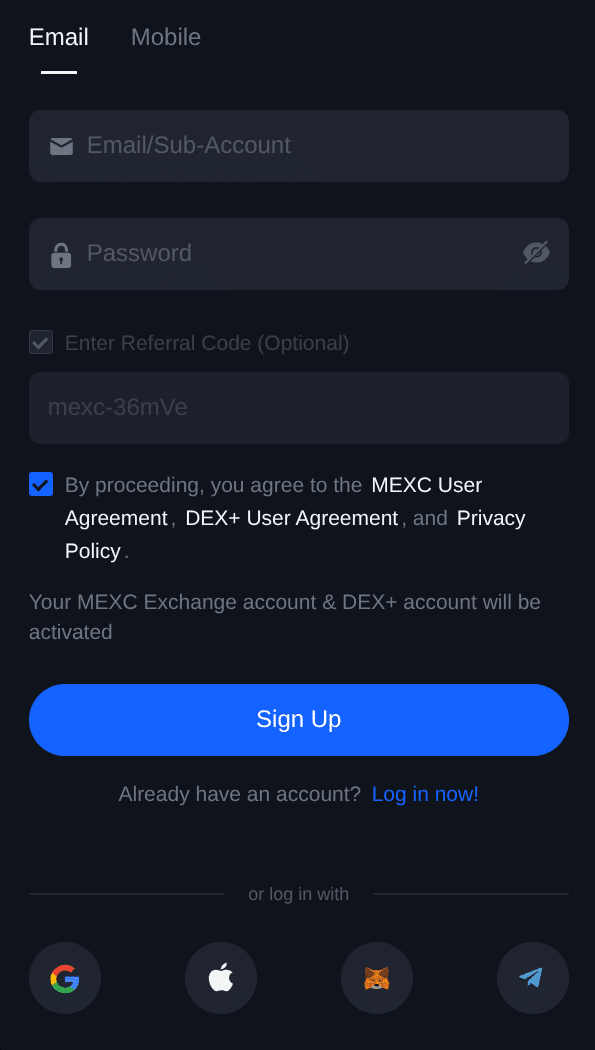

1) Create an MEXC Account

Sign up for an account on the MEXC website. MEXC lets you use an email address, phone number, or social login. Choose a strong password to secure your account. After creating your account, you can also set two-factor authentication on the settings page.

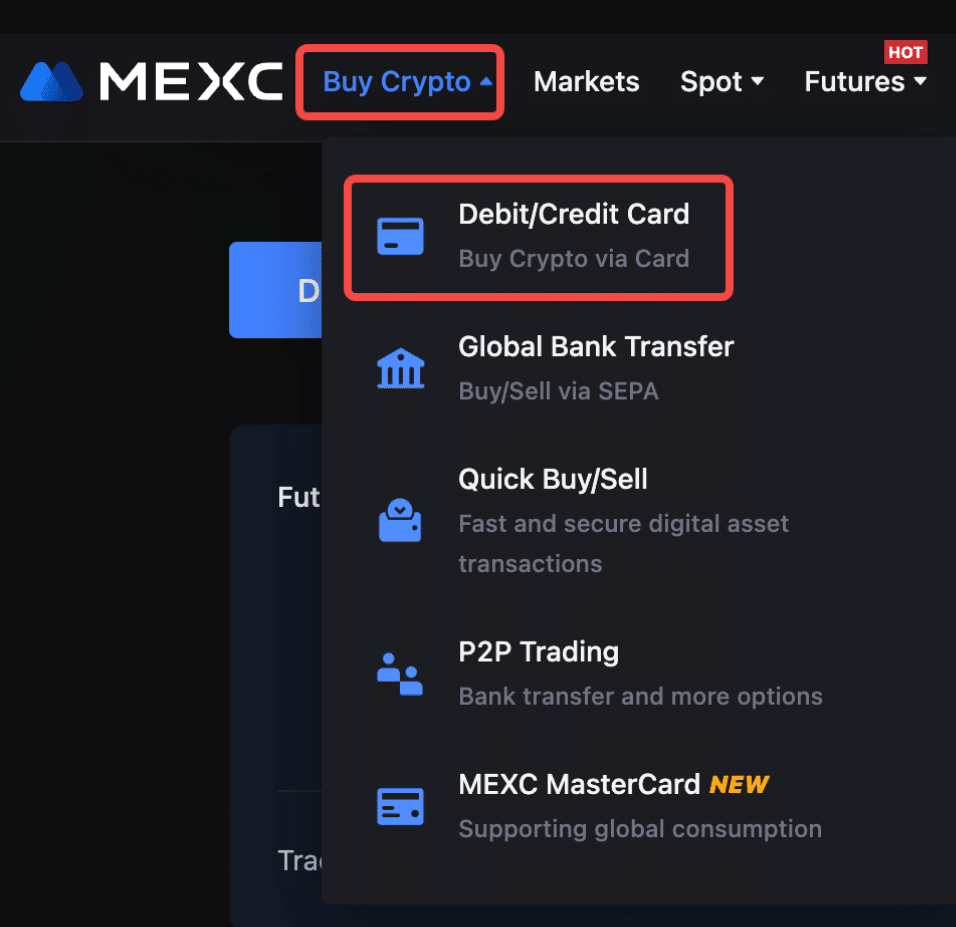

2) Choose Funding Method

If you already have crypto in another wallet, you can deposit crypto to make trades on MEXC. Alternatively, you can buy using a debit card or bank-funded deposits. Payment options vary by region. The exchange also supports several well-known third-party providers that allow buyers to pay by credit, debit, or bank transfer.

MEXC uses the USDT token in a trading pair with Chainlink, so you’ll want to buy USDT or swap to USDT if you deposit a different cryptocurrency. For example, to buy $100 worth of LINK, you’ll need 100 USDT.

Depositing crypto and bank-funded purchases are often the most cost-effective ways to trade on MEXC. The platform doesn’t charge any additional fees for crypto deposits; network gas fees apply. By comparison, third-party providers can have varying fees and spreads.

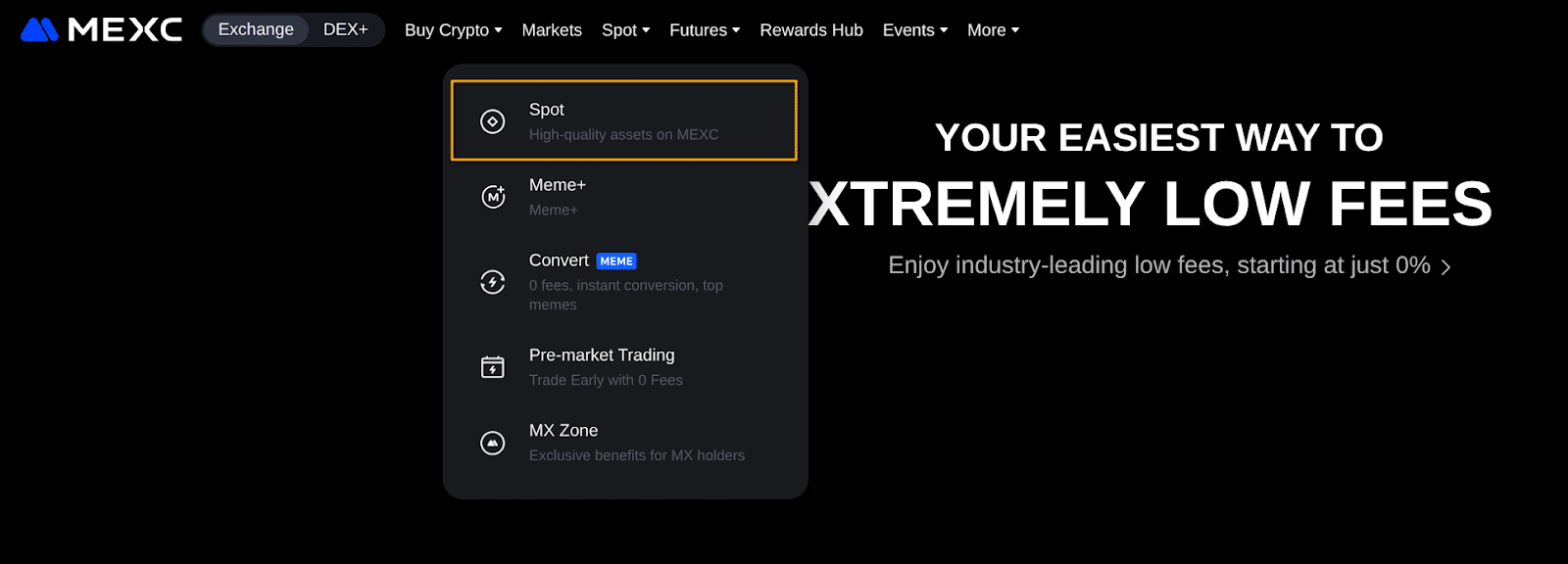

3) Find Chainlink Trading Pairs

Click on “Spot” on the main menu or use the search function to find Chainlink (LINK). Buying on the Spot market allows you to send the tokens you buy to a non-custodial wallet rather than leaving them on the exchange.

4) Make Your LINK Purchase

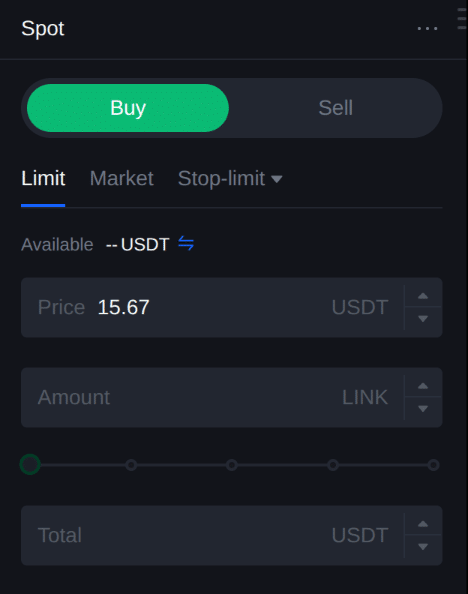

After you’ve funded your trading account, you’re ready to buy Chainlink. Select a limit or market order and enter the USDT amount you want to invest.

- Limit orders use fixed prices. This lets you choose your price.

- Market orders use the existing orders on the exchange to fill your order at the current market price.

After you place your order, MEXC will send your tokens to a custodial crypto wallet on the exchange. In a later section, we’ll discuss non-custodial wallets that allow you to withdraw your tokens from the exchange for safety.

What Is Chainlink?

Chainlink is a decentralized data provider that provides off-chain data to smart contracts using a network of trusted oracles. The Chainlink token (LINK) acts as a currency within the network. Decentralized applications that need data from Chainlink oracles generally pay for data using LINK tokens. While several competing protocols offer similar or specialized data to decentralized applications (dApps), Chainlink remains the leading decentralized oracle network. The project is also exploring solutions for cross-chain interoperability and strategies to tokenize real-world assets.

History of Chainlink

Chainlink was founded in 2017 by Sergey Nazarov and Steve Ellis. The project aimed to solve a critical problem in the blockchain ecosystem centered on the need for reliable off-chain data. Generally, blockchains are only aware of events that occur on their specific chain. This isolation is essential for security, but also creates limitations for smart contracts that may need outside data. For example, an oracle can provide the current price of gold, the weather in Toledo, Ohio, or stats for EPL teams. Chainlink and similar projects give smart contracts superpowers, allowing developers to build dApps in nearly any category.

The Chainlink team’s Initial Coin Offering (ICO) in September 2017 raised $32 million. The team used these funds to develop the Chainlink network and its oracle infrastructure. Chainlink’s mainnet launched in 2019.

Although Chainlink wasn’t the first project to identify the need for external data for blockchain applications, it’s now widely regarded as the first truly decentralized oracle network. This first mover advantage, as it relates to decentralized protocols, has helped catapult Chainlink into a market leader position.

Chainlink’s native token (LINK) uses the ERC-677 token standard, making it compatible with ERC-20, with an added function that allows the token to be used in smart contracts. In short, receipt of the tokens can trigger a call for the smart contract. On other networks, such as BNB Smart Chain or Solana, messaging from Chainlink’s cross-chain interoperability protocol (CCIP) instructs the receiving contract.

Next, let’s explore the LINK token’s distribution and its role in the ecosystem.

Tokenomics of Chainlink

Unlike many tokens that offer staking rewards, Chainlink is not inflationary. The maximum supply of LINK tokens is capped at 1 billion, with approximately 65% of the tokens in circulation. The remaining tokens are allocated for staking, development, and other purposes.

The LINK token itself serves several vital functions within the Chainlink network:

- Payment for Services: LINK acts as a currency within the Chainlink network, paying for data services.

- Staking: Users can stake LINK tokens in a universal pool to earn a yield. The protocol delegates staked tokens to node operators. Yields encourage participation, whereas the risk slashing (removing staked tokens) discourages malicious or negligent behavior by node operators.

Although 35% of the supply was reserved for staking rewards and ecosystem development, future staking rewards are expected to come from platform fees.

Chainlink’s tokenomics aim to create a sustainable incentive while also limiting supply.

Use Cases of Chainlink

Data provided by Chainlink’s oracles enables a wide range of use cases, ranging from decentralized finance (DeFi) applications, such as lending and decentralized exchanges (DEXs) to real-world crossovers, such as insurance, real estate tokenization, and much more.

- Decentralized Finance (DeFi): Chainlink provides price feeds for decentralized exchanges, lending platforms, and other DeFi applications. For example, a lending platform might use oracle data to trigger price-based liquidations for borrowers.

- Insurance: Chainlink’s oracles can provide data for smart contract-based insurance products. For example, real-world rainfall data can be used in crop insurance.

- Supply Chain: Supply chain paperwork can increase shipping times by up to 50% or more. Chainlink’s oracles can track and verify the movement of goods in the supply chain using tools like dynamic NFTs that replace documents while incorporating data from IoT or RFID to streamline supply chains.

- Gaming: Chainlink’s oracles can enable fair and transparent gaming experiences by providing random number generation through Verifiable Randomness (VRF). Chainlink’s dynamic NFTs can also play a role in gaming, adapting to real-world data.

- Real Estate: Chainlink can also aid in real estate management or tokenization. Existing projects like RealT leverage Chainlink’s data feeds to assess property valuations.

Chainlink’s oracles are in use in decentralized applications and real-world industries now, but there may still be significant room for growth, particularly as real-world businesses adopt blockchain as part of their processes.

Community

Chainlink’s governance combines direction and development from Chainlink Labs with input from the community on protocol changes and upgrades. The community, often comprised of builders and users, can propose Chainlink Improvement Proposals (CIPs). Over time, Chainlink intends to move toward more decentralized governance, allowing the community a greater voice.

Chainlink uses several channels to bring its community members together, including an active X account and a Telegram channel, in addition to a Chainlink Advocate program comprised of development experts and community advocates. A separate Discord channel and GitHub page cater to developers and builders.

Why Buy Chainlink: Is it a Good Investment?

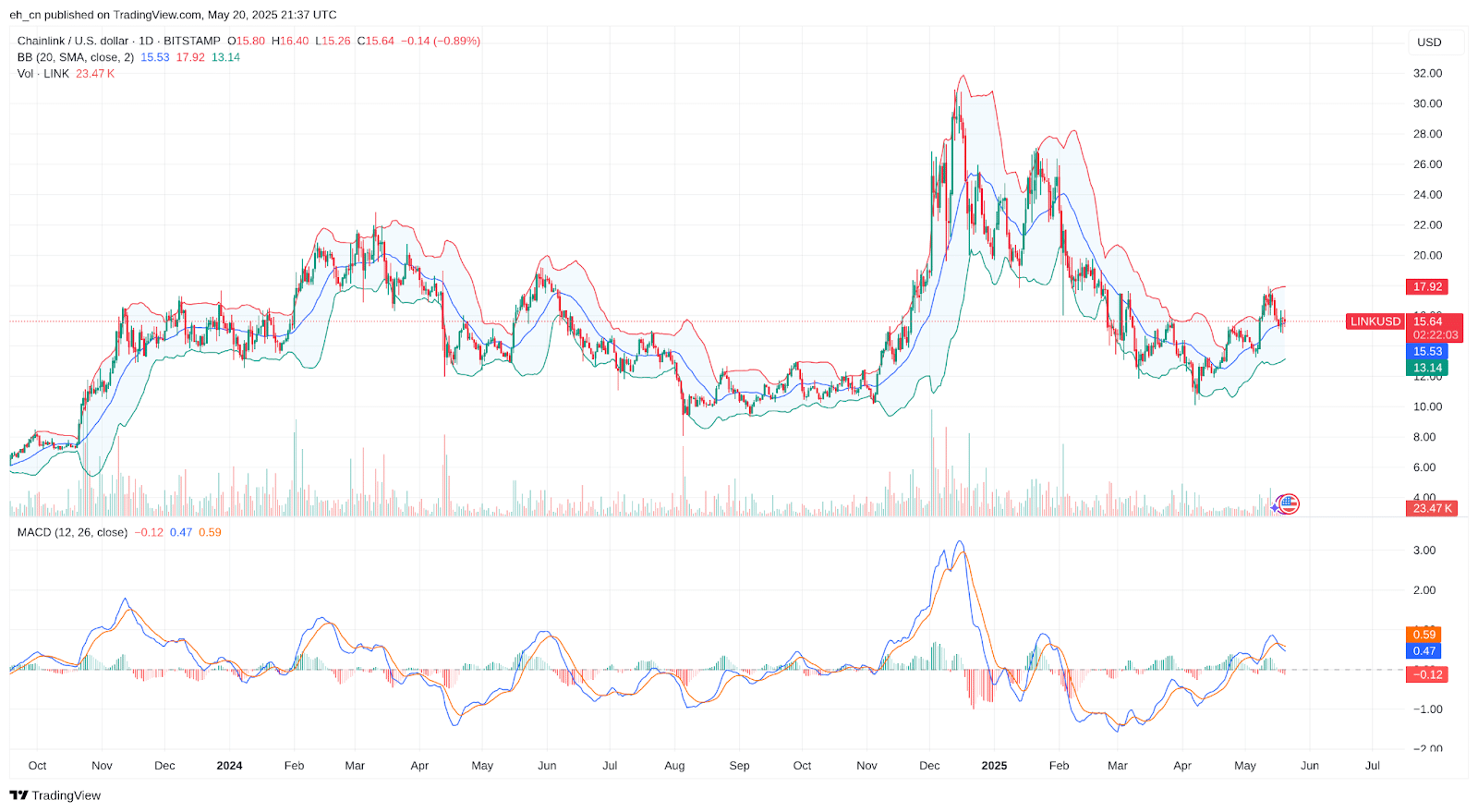

Earlier, we learned how to buy Chainlink, but is it still a good investment? Early investors enjoyed gains as the token skyrocketed from $0.10 to more than $50 at its highs. Now trading at under $16, Chainlink looks like a more attractive value again.

Innovations like CCIP have made Chainlink the undisputed leader in the space, providing data on dozens of chains and connecting disparate chains. A transaction on Chain A can trigger a contract on Chain B. An asset on chain C can secure a loan on Chain D. As integrations evolve, we can expect real-world assets to back on-chain assets in a much more extensive way than we see today.

However, Chainlink isn’t the only data provider in the space, and it’s essential to weigh the risks associated with adoption, regulatory concerns, (still) centralized governance, and uncertain staking revenue in the future. Let’s explore some of the key considerations to weigh before you invest in Chainlink.

Market Position and Adoption

Although Chainlink still leads the market, other protocols excel in specific areas. For example, the Pyth Network, which focuses on financial market data, offers lower latency and can be more affordable due to its on-demand structure. Similar to Chainlink, the protocol supports multiple blockchain networks, although using different rails to provide data across chains. A growing selection of oracle providers threatens to chip away at Chainlink’s leadership position.

However, these competitors aren’t as well-known, and Chainlink is exploring areas well beyond oracles. The project’s development speaks to a much larger vision that connects blockchain to blockchain and bridges the crypto world with traditional finance.

Indications point to continued growth for Chainlink, although niche providers may take market share in specific use cases, such as Pyth for DeFi.

Technological Innovation

At its core, Chainlink provides data. However, in its journey to become the leading decentralized oracle provider, Chainlink Labs has pioneered several technological innovations.

- Decentralized Oracle Networks (DONs): Chainlink’s network is comprised of Sybil-resistant (attacks that use fake identities) nodes throughout the world. These nodes aggregate data to deliver to smart contracts. Decentralized applications can use this data from other chains or the analog world as triggers. If this condition exists, do that.

- Off-Chain Reporting (OCR): Off-chain reporting reduces gas costs by allowing nodes to aggregate data before submitting it on-chain. This structure reduces the cost of data delivery.

- Hybrid Smart Contracts: Chainlink’s hybrid smart contracts allow more complex functionality by combining off-chain data and computation.

- Verifiable Random Function (VRF): Although Chainlink is best known for its data delivery, the project also provides a cryptographically secure and provably fair source of on-chain randomness. Applications range from gaming to lotteries.

- Proof of Reserve (PoR): Assets like USDT or WBTC represent a staggering amount of liquidity in crypto markets. They derive their value from convertibility to underlying assets, such as bonds, cash, and BTC for USDT or locked BTC for WBTC. Chainlink PoR provides a way to verify asset backing to ensure faith in markets through transparency. TrueUSD (TUSD) already leverages Chainlink PoR. As the tokenized real-world asset market grows, expect Chainlink to play a larger role in this market niche as well.

- Chainlink Automation: Chainlink allows smart contracts to use various triggers, including price thresholds, time-based triggers, or off-chain computations, to automate tasks. This gives developers granular control over condition-based actions.

Cross-Chain Interoperability Protocol (CCIP)

Although Chainlink’s several notable innovations have shaped the DeFi world, its cross-chain interoperability protocol (CCIP) aims to connect blockchains, sharing data from otherwise siloed blockchains. However, a much larger use case centers on connecting traditional finance to the blockchain world. For example, Chainlink CCIP can communicate with SWIFT (Society for Worldwide Interbank Financial Telecommunication). The possibilities of messaging rails that connect TradFi and DeFi make Chainlink worth a closer look.

Chainlink is also exploring the tokenization of real-world assets (RWAs), which could revolutionize massive worldwide markets, including commodities, equities, real estate, and even everyday assets. While other projects are also building in the RWA space, Chainlink’s larger strategy, including CCIP, could put the project in a stronger position.

Tokenomics and Economic Model

Perhaps one of the most compelling reasons to consider buying Chainlink centers on the project’s tokenomics in the context of future demand. While a capped supply isn’t meaningful without demand, if you combine a leadership position in a potentially massive market, a fixed supply can become rocket fuel for the token price.

However, Chainlink’s maximum supply of 1 billion tokens brings advantages and potential disadvantages. The LINK token powers the network and acts as a collateral asset for staking. Demand for the token stems from ecosystem growth as well as demand for staking. The latter is where investors should consider Chainlink’s long-term model.

Staking rewards are currently subsidized by an early token allocation that put aside 35% of the initial supply for staking rewards and ecosystem incentives. In the longer term, the project expects to transition to revenue-based staking rewards. In effect, the dilemma mirrors that of Bitcoin, which provides a mining subsidy until all of the bitcoins have been mined. At that point, network security is incentivized by network fees.

Regulatory Environment

Chainlink’s focus on infrastructure rather than speculative assets likely makes it a safer play than many tokens. Chainlink Labs has also worked with groups in Washington, D.C., such as the SEC’s Crypto Task Force. This proactive approach reduces the risk of regulatory problems as the project seeks clarity and works to build relationships with financial institutions and regulatory bodies.

However, in the past, even projects as large as Ethereum fell under scrutiny by regulators. A change in administration could put projects like Chainlink in the crosshairs, particularly in light of the sizeable ICO and private sales, which represented 35% of the initial supply. Famously, Ripple Labs, which shares some similarities with Chainlink Labs (large ICO/presale), spent several years in court after the SEC sued the company for allegedly selling unregistered securities.

Under the prior SEC, Chainlink was not targeted. However, investors should consider the possibility of regulatory headwinds in the US or elsewhere.

Competitive Landscape

Several competing projects target some of Chainlink’s primary use cases, including cross-chain data and delivering data from off-chain sources.

Chainlink Competitors

- Pyth Network

- API3

- Band Protocol

- Tellor

- DIA (Decentralized Information Asset)

- UMA (Universal Market Access)

- Chronicle Protocol

- SupraOracles

However, Chainlink distinguishes itself in several ways, most notably its growing interoperability with traditional finance and additional focus on RWAs.

Long-Term Potential

In a later section, we explore some Chainlink price predictions. However, it’s useful to consider long-term potential and price in the context of the pros and cons we’ve just discussed.

Early investors saw Chainlink rise from

to more than $50 per token during the 2021 crypto bull market. The LINK token later fell from its all-time high of $52.99 down to $5.16 in the bear market in 2023. Since then, Chainlink has recovered from its lows, showing resiliency yet still providing a lower entry point in comparison to its bear market highs.

LINK has proven more volatile than established cryptocurrencies like BTC and ETH. However, many consider the token to be a blue-chip crypto and may see the current lower range of $15 to $16 as an attractive entry.

Storing Chainlink (LINK) in a Wallet

Earlier, we discussed how to buy Chainlink. If you use Best Wallet, the tokens you buy through the app will be sent directly to your app. By contrast, if you buy through a crypto exchange, the exchange holds your tokens, securing your account with a password or other authentication methods.

A crypto wallet holds the private keys that control your blockchain assets. In a custodial exchange wallet, the exchange controls the wallet’s private keys. Non-custodial wallet apps like Best Wallet give users control over the private keys.

Non-custodial crypto wallet apps also allow you to connect to decentralized applications where you can stake LINK, swap for other tokens, or lend your tokens. You’ll also have a choice between hot wallets, which are installed on a device connected to the internet, and cold wallets, which store the private keys offline.

Let’s review some of the leading wallets that support Chainlink. Wallets that support Ethereum ERC-20 tokens support LINK, so some of the most popular and well-tested options are well-suited to the job.

Software Wallets

- MetaMask: Easily the most well-known Ethereum wallet, MetaMask offers a proven open-source app that’s available for iOS or Android. MetaMask also provides a browser extension for Firefox and Chromium-based browsers.

- Best Wallet: The easy-to-use Best Wallet app gives an intuitive interface to powerful features. This app, available for Android and iOS, uses an innovative approach to security by splitting the private key into three encrypted shards. In total, Best Wallet supports more than 60 blockchains, making it well-suited to multi-chain users.

- Phantom Wallet: The popular Phantom Wallet offers a simple interface with support for Bitcoin, Ethereum, Polygon, Sui, Solana, and a curated selection of other chains. Similar to MetaMask, Phantom Wallet offers a mobile app for iOS and Android alongside a browser extension for Chromium-based browsers.

Hardware Wallets

- Ledger: The Ledger line of wallets provides a companion app (Ledger Live), but can also pair with select hot wallets, including MetaMask and Phantom. This allows you to easily connect to dApps using a hot wallet while protecting your private keys offline.

- Trezor: As the first hardware crypto wallet, Trezor has become a trusted name in the space. Most Trezor devices benefit from open-source software and firmware, making them a popular choice for transparency-minded users.

Chainlink Price Prediction 2025-2030

Chainlink’s price performance mirrored that of BTC, approaching the 2021 bull market. However, as the market peaked, we began to see divergences. As Bitcoin peaked and investors looked for opportunities in alternative cryptocurrencies, tokens like LINK benefited. In the years following, LINK traded largely in sympathy with BTC and the broader market, albeit with dramatically larger price swings at times.

Let’s explore some Chainlink price predictions based on traditional trading patterns and projections that consider Chainlink’s unique role in the market.

2025 Chainlink Price Prediction

Most long-term estimates for LINK remain bullish for 2025 and beyond, attributing bullish moves to a 1 billion token maximum supply combined with increasing market reach. However, LINK has shown weakness in recent months, falling from its recent highs between $25 and $30 down to $11, and later rebounding to the $15 to $17 level.

In the short term, low exchange volume suggests that LINK could drift further downward, with strong support in the $10 to $11 level. However, notably higher DEX trading could indicate that LINK is in a crucial support zone.

Michael van de Poppe, CEO of MN Trading, believes that LINK could reach $25 to $30 based on strong fundamentals, anticipated demand, and technical indicators, such as volume. This widely followed trader has long advocated for Chainlink, seeing it as an often undervalued token in the space. If LINK can break prior resistance at the $25 level, a move to $30 or higher could be in the cards.

2026 Chainlink Price Prediction

Historically, Chainlink has seen less correlation to BTC’s movements than other leading tokens. However, to predict prices for 2026 and beyond, we have to consider an extension of the bull run that typically follows Bitcoin halvings. During the 2021 bull run, Chainlink peaked after BTC reached its highs.

If this pattern continues, predictions like those from Changelly put the price between $29 and $34. Looking into the future gives reason for optimism, with several potential catalysts on the horizon. Chainlink’s potential to become a bridge between TradFi and DeFi, combined with expected increases in CCIP adoption, favors increased demand.

Given a previous all-time high of $52.99 set during the 2021 bull market, a high range in the mid-$30 zone may even be conservative. However, LINK’s higher volatility in comparison with other leading tokens also suggests caution.

2030 Chainlink Price Prediction

Many expect the intersection of crypto and traditional financial markets to be well-defined by 2030. Several of Chainlink’s technological advancements could be essential in shaping blockchain’s future, including CCIP, hybrid smart contracts, and the infrastructure for RWAs. Chainlink price predictions for 2030 show this optimism.

Changelly predicts a range of $109 to $130 in 2030. This aligns with other notable predictions for Bitcoin, which often sets the tone for the broader crypto market. ARK Invest sees Bitcoin reaching as much as $710,000 to $1.5 million under bullish conditions, with a more conservative $300,000 target as a bearish prediction.

For Bitcoin, this could represent more than a 10x increase. Leading blue-chip crypto projects could follow a similar trend, possibly putting Chainlink in the $160 range by 2030. A capped supply of 1 billion tokens could send prices even higher if Chainlink sees greater adoption in key markets, such as RWAs and CCIP integrations.

Potential Highs & Lows of Chainlink

Below is a summary of our Chainlink price predictions for 2025, 2026, and 2030.

| Year | Potential Low | Potential High |

| 2025 | $11.03 | $29.93 |

| 2026 | $25.67 | $36.12 |

| 2030 | $48.12 | $138.29 |

What Influences the Price of Chainlink?

Several factors influence the price of Chainlink (LINK). Understanding these factors can help investors make more informed decisions. Here are some of the key influences:

- Market Demand and Adoption: The LINK token is key to oracle access and secures the chain through staking. Adoption is key. Initial optimism for initiatives like CCIP could wane if adoption by TradFi (in addition to DeFi) is slow to materialize.

- Technological Innovations: Chainlink’s continuous development of new features and protocols, such as the Cross-Chain Interoperability Protocol (CCIP) can attract new users and investors. Again, the risk rests on adoption.

- Regulatory Environment: Chainlink strives to build within regulatory frameworks. The regulatory environment continues to evolve, however, creating headwinds or tailwinds depending on the stance on crypto by governments worldwide.

- Competitive Landscape: Although smaller in scale and more focused on specific markets, several competing projects could affect demand for Chainlink.

- Economic Factors: As in all markets, economic factors play a role. These can range from growth in the money supply, which often fuels speculation, to economic downturns, which could cause speculative markets like crypto to contract.

- Tokenomics: Chainlink’s capped supply of 1 billion tokens and the allocation for staking and development create a sustainable economic model. However, the future transition to revenue-based staking rewards can also impact the token’s value.

- Partnerships and Integrations: Strategic partnerships with prominent blockchain projects and traditional enterprises can enhance Chainlink’s credibility and drive up the demand for LINK tokens.

Conclusion: Should You Buy Chainlink?

By some measures, Chainlink is trading well below its relative market value. No other project has the same reach across dozens of leading blockchains. A maximum supply of 1 billion tokens also bodes well for future prices. However, with 35% of the supply still not circulating, prices may be slow to rebound as these tokens reach the market.

Chainlink’s viability as a promising investment hinges on adoption. Although Chainlink’s oracles are omnipresent in DeFi, several competitors now offer solutions for on-chain data. Where Chainlink’s promise lies is in its newer initiatives, such as bridging TradFi with DeFi and providing rails for RWAs. Again, several projects are jockeying for positions in these markets.

Chainlink still looks like the most promising all-around investment in the markets it addresses, but recent price action reflects the reality: Chainlink isn’t the only solution. While most remain bullish on the project, investors should consider the big picture and weigh Chainlink’s solutions against those of competing projects.

FAQs

How can I buy Chainlink crypto?

Can Chainlink reach $100?

What is the best platform to buy Chainlink?

Is Chainlink worth buying?

What is better than Chainlink?

References

- Chainlink VRF (chain.link)

- The backbone of blockchain. (x.com)

- Chainlink Official (t.me)

- Chainlink Official (discord.gg)

- Smart Contract Kit (github.com)

- TUSD Reserves (chain.link)

- Chainlink’s Work With Swift, Euroclear, and Major Banking and Capital Markets Institutions (chain.link)

- Statement on the Agency’s Settlement with Ripple Labs, Inc. (sec.gov)

- ChainLink (icodrops.com)

- MetaMask (github.com)

- LINK Price (changelly.com)

- ARK’s Price Target For Bitcoin In 2030 (ark-invest.com)