The world of cryptocurrencies moves fast. New coins, chains, and technologies emerge constantly, so it is easy to feel overwhelmed these days. One of the most important innovations to follow right now is the rise of sidechains, a promising area of blockchain technology set to revolutionize blockchain scalability and interoperability.

Sidechains are central in the decade-long fight to scale blockchains and improve interoperability between them. In this article, we will break down what sidechains are, how they work, how you can use them effectively, and dive into a few of the most popular sidechains available today.

What Is a Sidechain?

The largest and most popular crypto networks, namely Bitcoin and Ethereum, often face issues like high fees and slow transaction times, largely because they sacrifice scalability for decentralization and security. Other networks, such as Solana or Binance Smart Chain (BSC), use much more centralized consensus mechanisms to speed up transactions and keep fees down.

A sidechain is a separate blockchain that runs in parallel to the main one (often referred to as the mainchain). The sidechain is connected to the main blockchain through a two-way bridge, which allows assets to move easily between the two.

Even though it might sound like it, sidechains aren’t just clones of their mainchains. Sidechains operate independently and have their own consensus mechanisms, rules, and validators. This independent operation is what makes them so powerful. They allow developers to experiment, scale, and even add features without messing with the core blockchain.

Why Do Sidechains Exist?

Sidechains were created to solve the limitations of major blockchains like Bitcoin and Ethereum. The networks can be expensive and slow when busy, and sidechains offer the perfect solution to this problem. They offer ways to run smart contracts, scale transactions, and/or support custom applications with low fees and fast transactions, all without clogging up the mainchain.

You can think of them as specialized highways that connect to the main freeway. They help relieve traffic and allow for faster travel, and they can be tailored to different kinds of vehicles. However, instead of cars and trucks, sidechains host dApps, games, DeFi tools, and more.

How Sidechains Work

At a high level, sidechains function by connecting to the main blockchain using a two-way bridge. The two-way bridge works like any other crypto bridge, allowing users to lock up assets on the mainchain and then unlock the corresponding amount on the sidechain. Later, they can also reverse the process and move the funds back.

Let’s say that you decided to move ETH from Ethereum to a sidechain like Polygon PoS. Here’s what you would need to do.

You would navigate to Polygon’s official bridge and deposit your ETH into its smart contract. The same amount would then appear on Polygon as wrapped ETH. Note that transaction fees on Polygon are paid with Polygon (MATIC), so make sure to transfer at least a few MATIC tokens as well. Once the transaction finishes, you can now use the wrapped ETH in apps running on Polygon, which is often much faster and cheaper. Once you are done, you can simply move your funds back to the parent blockchain using the same bridge.

Each sidechain runs its own version of the blockchain, following different rules. It can have lower transaction fees, faster block times, or even support features that the main blockchain doesn’t offer (like different consensus mechanisms or smart contract languages).

Because sidechains are independent, they are responsible for their own security and validation. It’s what makes them more flexible. However, this also means that they don’t benefit from the security of the mainchain.

Layer 2 Blockchains vs. Sidechains Explained

People often confuse sidechains with layer 2 solutions. These two technologies are very similar, but there is one key difference: security.

Layer 2 blockchains like Optimism or Arbitrum are built on top of a mainchain, and therefore, they inherit its security. They rely on cryptographic mechanisms like fraud proofs or validity proofs to ensure that everything is correct. So, if something goes wrong on layer 2, the base chain can still enforce the correct state.

Sidechains, on the other hand, have their own consensus mechanisms, which could be Proof of Stake, Proof of Authority, or something else entirely. So, what does this mean?

It means that the security of the sidechain depends on its own validator set, not the mainchain. If the validators go rogue, the assets on the sidechain could be at risk. This is much more likely to happen with small sidechains than large blockchains like Ethereum, though it’s still a rare occurrence.

Another important difference is how the assets are being moved. On layer 2s, funds are usually moved using rollups or optimistic bridges that are integrated with the mainchain. However, sidechains use more centralized or semi-trusted bridges, which are faster but come with trade-offs in decentralization.

| Feature | Sidechain | Layer 2 Blockchain |

| Security | Own consensus mechanism | Inherits security from mainchain |

| Bridge Type | Two-way, often centralized or semi-trusted | Trustless or semi-trustless |

| Independence | Operates independently | Tied closely to mainchain |

| Speed/Fees | Usually fast and cheap | Also fast, but more variable |

| Examples | Polygon PoS, SKALE | Optimism, Arbitrum, zkSync |

Pros and Cons of Sidechains Explained

Sidechains are an important innovation in blockchain technology. They aim to solve two of the greatest challenges that cryptocurrencies face: scalability and interoperability. Still, they come with their own set of disadvantages. Here is a breakdown of the positive and negative sides of sidechains.

Pros of Sidechains

Sidechains come with a variety of benefits that help improve blockchain flexibility, performance, and functionality. These include:

Scalability

Sidechains are a scalability solution. They help reduce congestion on the mainchain by handling your transactions off-chain. In return, this leads to much faster and cheaper transactions. Transactions on most sidechains cost a fraction of a cent compared to a few dollars on Bitcoin or Ethereum.

Flexibility

Sidechains can adopt different consensus models (like Proof of Authority or Delegated Proof of Stake).

Upgradeability

Mainchains like Bitcoin and Ethereum evolve slowly to avoid messing things up or breaking things. Sidechains, on the other hand, can experiment since they are processing transactions off-chain, so they have more frequent updates.

Added functionality

Sidechains can support custom features that aren’t available on the mainchain. These can include anything from confidential transactions to native tokenomics to more advanced smart contracts.

Interoperability

Sidechains serve as bridges between blockchain networks that are otherwise incompatible. They can also process multiple transactions with significantly lower transaction costs.

Cons of Sidechains

Sidechains also introduce significant downsides that users should be aware of, especially when it comes to security and decentralization. These include:

Security risks

Sidechains don’t inherit the security of the main chain. If their validators are compromised, user funds are put at risk.

Bridge vulnerabilities

Bridging assets requires a lot of trust in the bridge infrastructure as many of them are centralized. Sidechains and their bridges have also become popular targets for exploits as they are often less secure than mainchains and store tons of crypto at any given time. Some of the largest exploits in the history of crypto, like the Wormhole and Ronin hacks, have targeted sidechains.

Centralization concerns

Some sidechains, like Polygon PoS, for instance, rely on a small validator set or even trusted entities. This means that it would be easier to form a cartel to take over the network, raising concerns about centralization.

Fragmentation

When you spread assets and apps across multiple sidechains, the user experience and liquidity can become fragmented.

Most Popular Sidechains

Here are a few major sidechains that are trending nowadays:

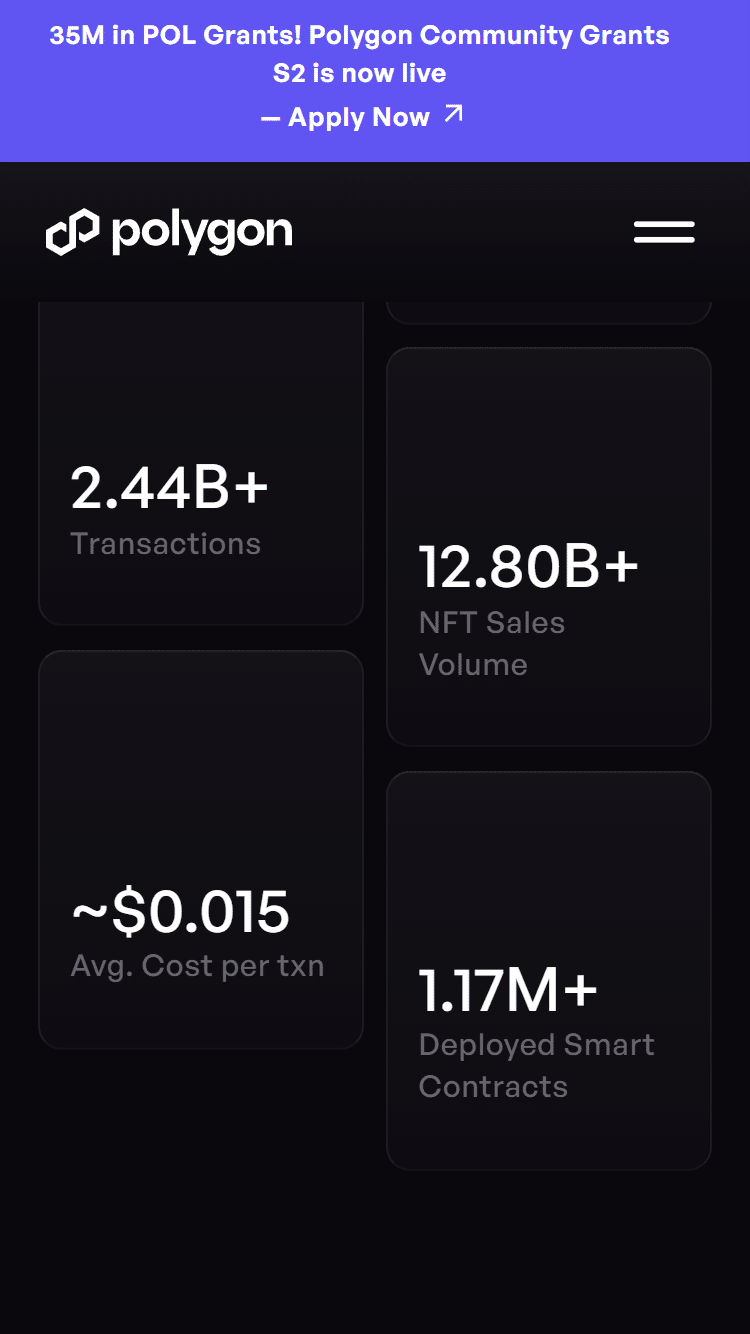

1. Polygon PoS (Ethereum Sidechain)

Polygon PoS is one of the most popular sidechains, built specifically to scale Ethereum and help the main blockchain by offloading transactions. It supports DeFi, gaming, NFTs, and more. Many of the most popular dApps on Ethereum also support Polygon.

Native Token: MATIC

Consensus: Proof of Stake (PoS) + Plasma

Launched: 2020

| Why it’s popular | Security | Notable features |

| One of the most widely adopted Ethereum sidechains | Operates its own validator set of 100+ validators | Supported by major exchanges like Binance and Coinbase |

| Offers rapid transactions | Doesn’t inherit Ethereum’s security directly | Extensive developer tooling, integrations, and SDKs |

| Home to major DeFi platforms (Aave, Uniswap), NFT projects (OpenSea), and games (Zed Run) | Relies on its own staking-based consensus | Has its own official bridge for Ethereum-to-Polygon asset transfer |

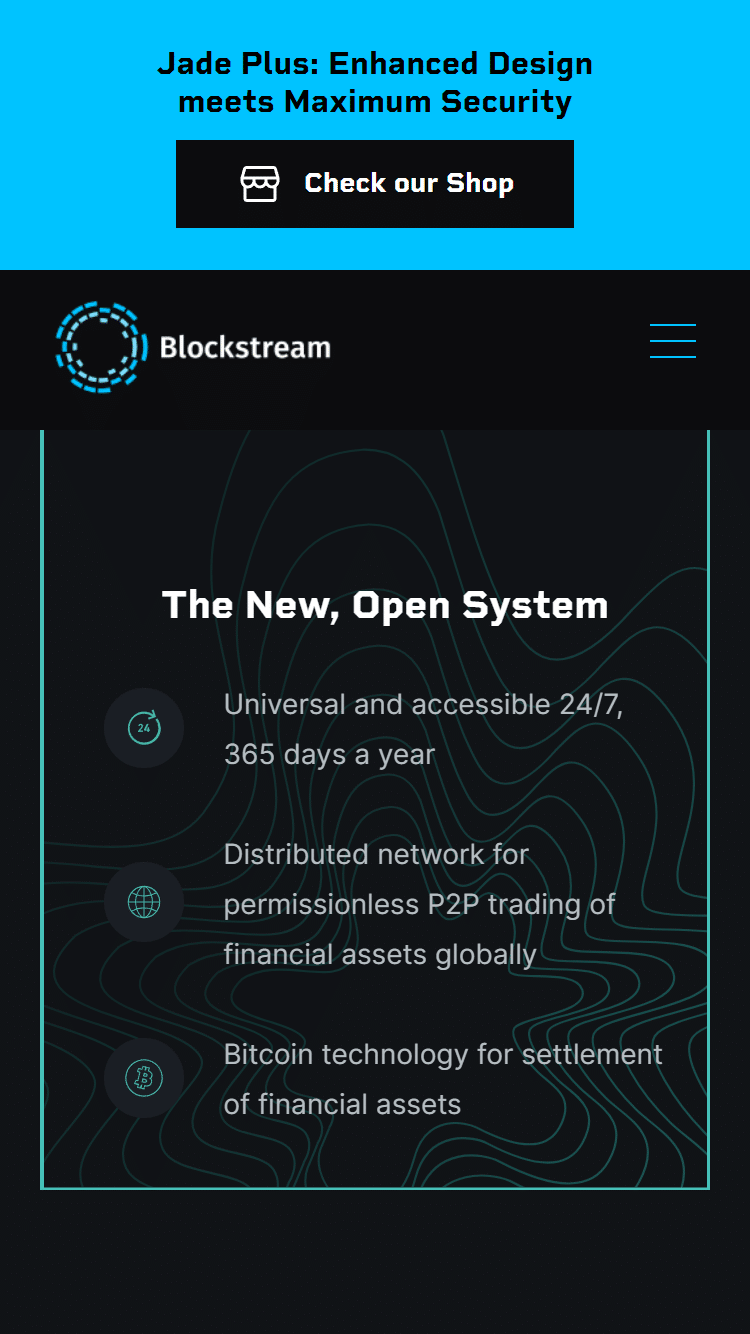

2. The Liquid Network (Bitcoin Sidechain)

The Liquid Network is a Bitcoin sidechain designed for fast and confidential transactions and tokenized assets. It is widely used by exchanges and institutions using the Bitcoin blockchain, and it is one of the most popular sidechains in the industry.

Native Token: L-BTC (1:1 pegged to BTC)

Consensus: Federated (Strong Federation)

Launched: 2018

| Why it’s popular | Security | Notable features |

| Built by Blockstream to support faster and confidential Bitcoin transactions | Governed by a federation of ~15 functionaries like Bitfinex and OKX | Supports token issuance like Tether or Liquid |

| Commonly used by exchanges and OTC desks for quick BTC settlements | Funds are secured using multi-signature governance | Great for institutions that need more privacy and speed |

3. Gnosis Chain (Ethereum Sidechain)

Gnosis Chain is a stable, low-cost sidechain for the Ethereum blockchain network. It is used for payments, DAOs, and community projects.

Native Token: xDai (though GNO is its governance and staking token)

Consensus: Delegated Proof of Stake (dPoS)

Launched: 2018 (rebranded as Gnosis Chain in 2021)

| Why it’s popular | Security | Notable features |

| Known for fast, stable transactions using xDai | Independent consensus | Super low fees and ~5s block times |

| Favored by DAOs and public-good projects like Giveth and BrightID | Secured by GNO stakers and validators | Integrated with Gnosis Safe multisig and DAO tooling |

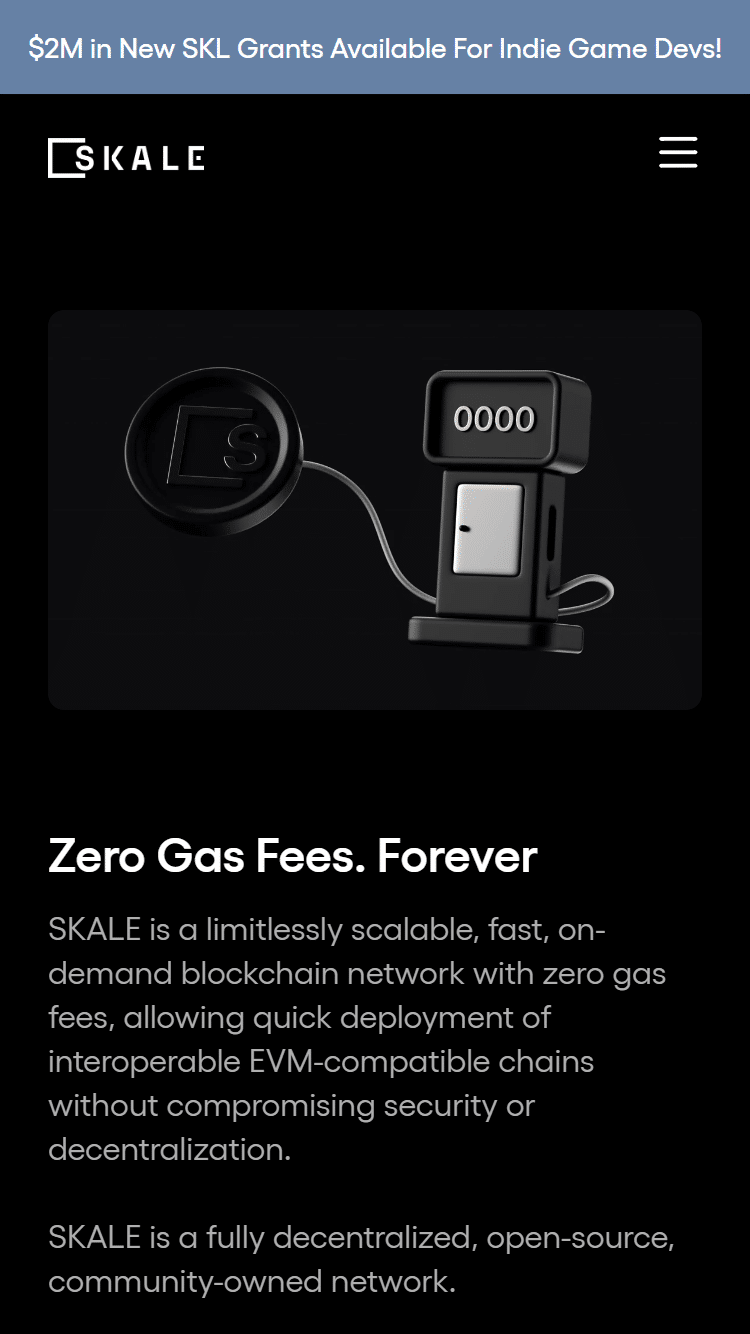

4. SKALE Network

SKALE is a highly scalable, Ethereum-compatible sidechain that’s focused on gaming and DeFi apps. It offers zero gas fees for its users.

Native Token: SKL

Consensus: Proof of Stake

Launched: Mainnet in 2020

| Why it’s popular | Security | Notable features |

| Offers zero-gas-fee environments for users | Uses pooled validator resources across elastic sidechains | Instant finality and fast block times |

| Used for Web3 games, social apps, and DeFi projects that require high throughput | Validators are staked with SKL and rotate across SKALE chains | Integrated with tools like MetaMask and Web3.js |

5. Rootstock (Bitcoin)

Rootstock, or RSK, is a smart contract sidechain for Bitcoin. It brings Ethereum-like functionality to the Bitcoin ecosystem.

Native Token: RBTC (pegged to BTC)

Consensus: Merge-mined with Bitcoin

Launched: 2018

| Why it’s popular | Security | Notable features |

| Adds smart contract functionality to Bitcoin using EVM | Shares Bitcoin’s mining power | Ethereum-style smart contracts and DApps, but backed by BTC |

| Ideal for DeFi on Bitcoin (such as Sovryn, Money on Chain) | Peg-in/peg-out is managed by a federation, but security grows with BTC hash rate | Open-source and updated often |

How to Use Sidechains

Now that we know what sidechains are and what they mean for blockchain scalability, it is time to learn how to actually use them. Using a sidechain usually involves bridging assets from the main blockchain. To help you understand how to use them, we’ll take Polygon as an example. Its bridge is user-friendly, and it has broad ecosystem support.

Here is how you can bridge ETH to Polygon:

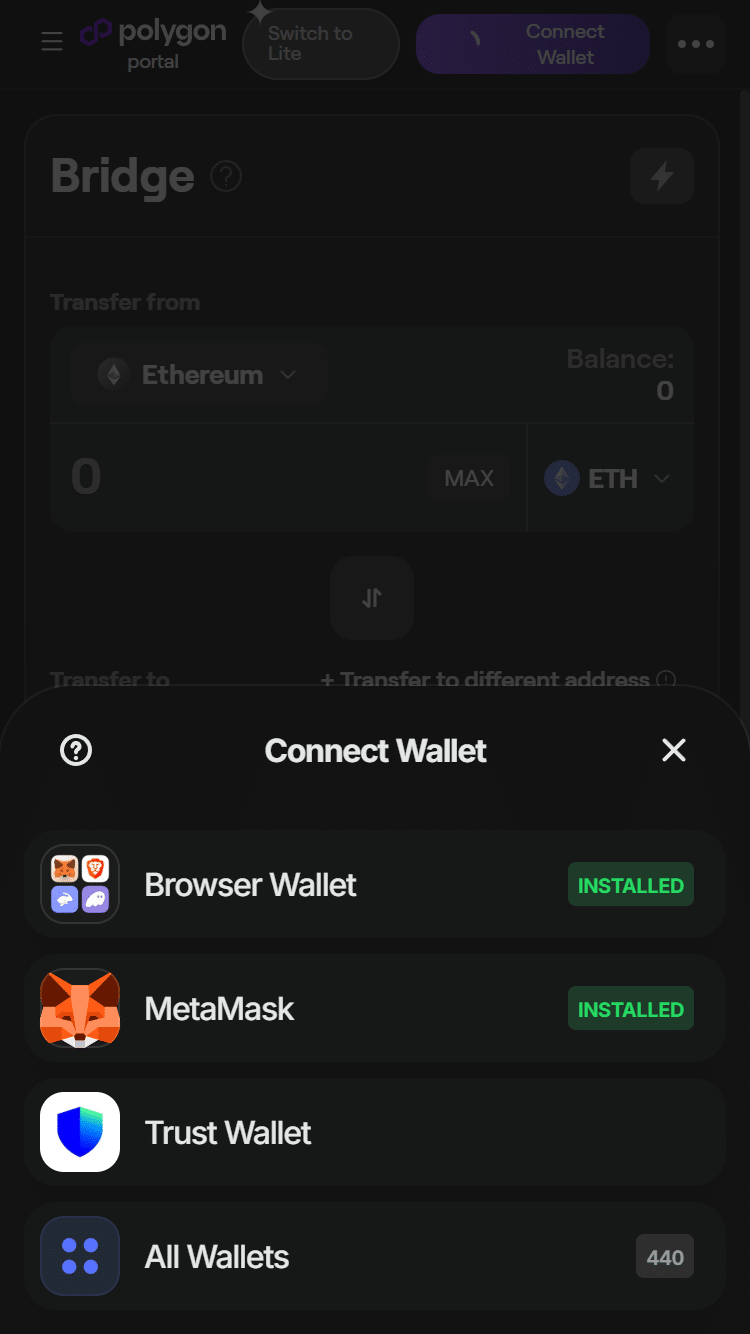

1. Get a Crypto Wallet

If you don’t already have a personal crypto wallet, you will need to install one before you can use a bridge. Popular choices include MetaMask, Coinbase Wallet, and Trust Wallet. Once your wallet is set up, you can send your Ethereum to it. Triple-check the address before you hit send as any mistakes may result in lost funds.

2.Visit the Official Polygon Bridge and Connect Your Wallet

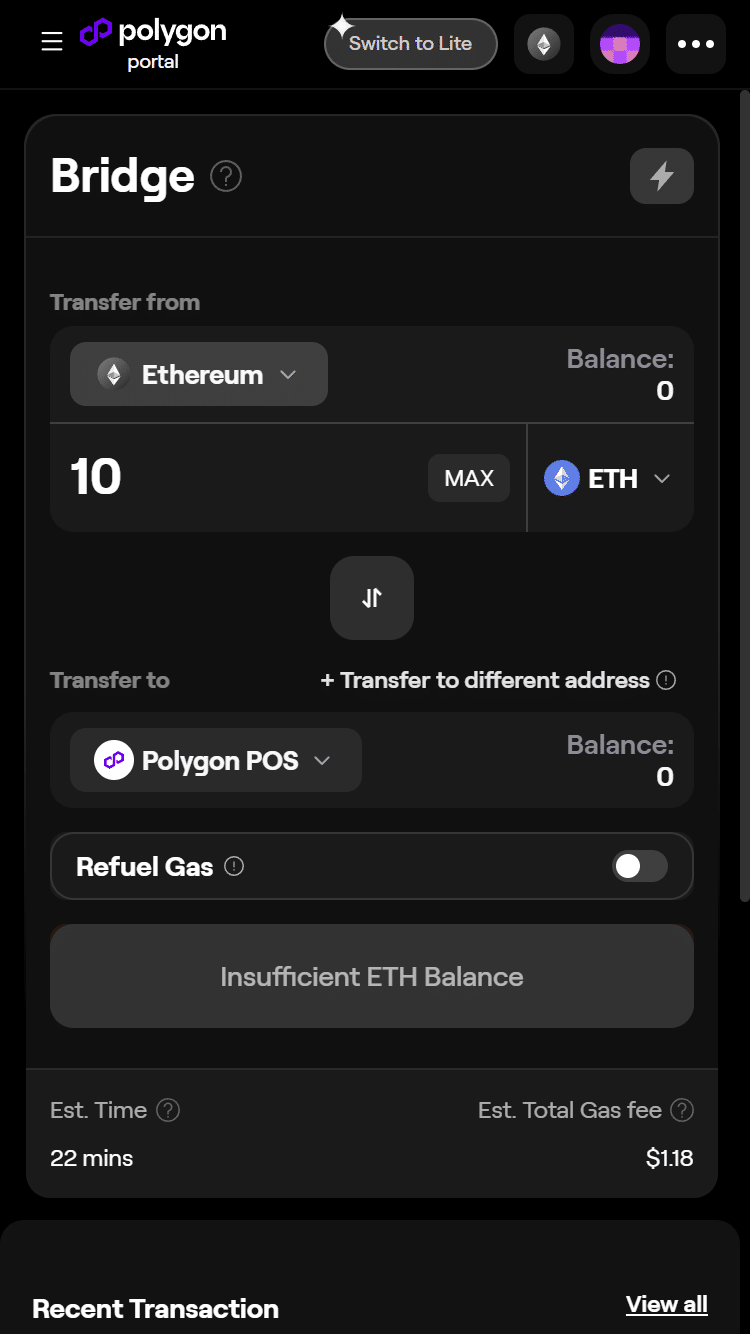

Next, navigate to Polygon’s official bridge and connect your wallet. All you need to do is click “Connect Wallet” in the top right corner, select your wallet in the menu, and then confirm the connection in your wallet.

3. Start the Transfer

As soon as your wallet is selected, you can select the token (e.g., ETH or USDC) and the amount you want to transfer. Once you submit the transaction, your wallet should prompt you twice: first to confirm a spending limit (which grants permission to transfer your tokens), and second to approve the final transaction.

After a short wait, typically 20-45 minutes (but can take longer), you should be able to see your funds on Polygon. You may need to import the token to your MetaMask or other wallet before you can see it.

Now you can switch your MetaMask network to Polygon and start using dApps like Aave and OpenSea.

Polygon offers detailed docs that can help you navigate these processes if you want to read more.

Keep in mind that other sidechains will have different processes, so the steps might not be the same. However, the general flow, i.e., locking tokens on the main blockchain and releasing or minting them on the sidechain, remains the same.

The Future of Sidechains Is Bright

Sidechains already play an important role in scaling crypto and connecting diverse ecosystems. They offer speed, flexibility, and expanded functionality. They aren’t a perfect solution since they come with security challenges and varied trust assumptions. Still, they remain a powerful tool for developers and users. As the adoption of blockchain technology and networks grows, sidechains are likely to develop further, become more secure, and remain a major part of the blockchain ecosystem.

FAQ

What is a sidechain?

A sidechain is a separate blockchain that runs parallel to the main blockchain. It's connected via a two-way bridge and allows users to move assets between the two.

How are sidechains different from Layer 2 solutions?

Sidechains and Layer 2s both aim to improve scalability, but sidechains have their own consensus mechanisms and security, while Layer 2s rely on the security of the main chain.

Are sidechains safe to use?

Sidechains are generally safe, but come with risks. Since they have separate validators or governance, they don't inherit the full security of the main blockchain.