The invention of the internet has upended countless aspects of our lives. It has completely transformed how we work, communicate, and share our ideas with others. The next frontier seems to be the crypto industry, which is already revolutionizing finance and beginning to reshape how we organize and govern ourselves. One of the most innovative developments in the crypto space is the advent of Decentralized Autonomous Organizations or DAOs for short.

DAOs might sound overly technical at first, but at its core, they are just a new way for people to work together. For many people, it’s more than a minor development as it lets anyone around the world collaborate without having to deal with bosses, banks, and the usual middlemen.

DAOs are popping up everywhere in the crypto market these days, and they’re already spreading to all corners of the internet. They are even starting to pop up in art collectives, gaming communities, investment groups, and much more.

DAOs operate on blockchain technology, and they promise something big: giving us more control over the things we care about. Let’s see what this means.

What is a DAO? Decentralized Autonomous Organizations (DAOs) Explained

DAO stands for Decentralized Autonomous Organization. A DAO is simply an organization run by rules that are written in computer code and voted on by its members. Unlike traditional organizations, the rules aren’t written by the CEO, the founder, or the board of directors. No single person is calling all the shots. Everyone who holds a piece of the DAO, usually in the form of tokens, can vote on decisions.

Think of this as a digital co-op but with major upgrades: it is global, fast, and open 24/7.

So, why do people care about this?

Decentralized autonomous organizations (DAOs) are designed to be transparent and democratic. This means that every action, vote, and fund movement is openly presented on the blockchain and viewable by anyone. This builds trust among the people who hold a piece of the DAO.

DAOs operate without a headquarters or location. They are borderless, which means that people from around the world can join in without having to form a traditional legal entity.

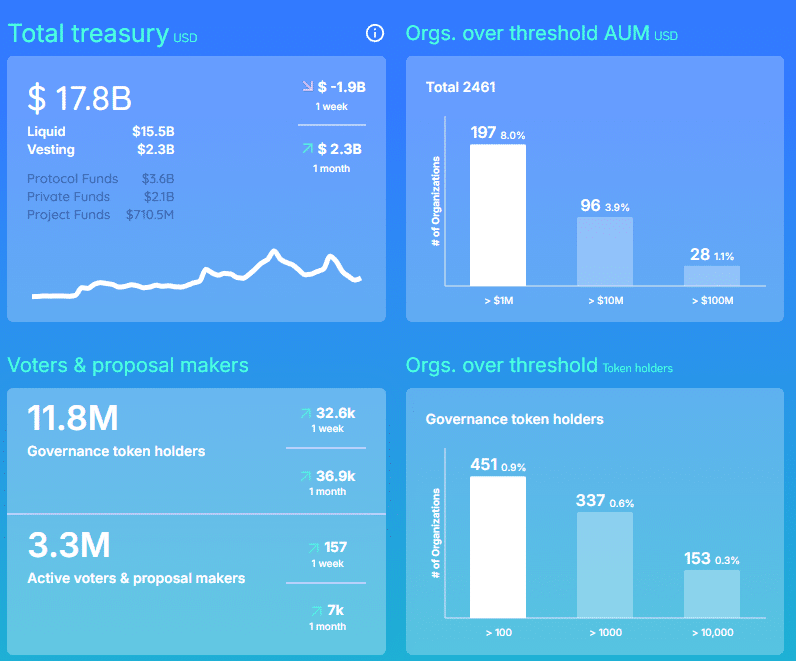

According to DeepDAO, there are now over 12,000 active DAOs and these organizations already have billions of dollars in their treasuries as of 2025.

Decentralized autonomous organizations are still young, and there are still plenty of kinks to work out. However, for many people, they represent an entirely new and very unique kind of community. People who prioritize open, democratic solutions are drawn to DAOs because they offer something traditional organizations don’t: shared control.

How do DAOs Work?

At a basic level, DAOs operate on smart contracts. A smart contract is a self-executing code that lives on a blockchain. Smart contracts define and execute DAO’s rules. They decide who can vote, how the funds are spent, what happens if a vote passes or fails, and so on. They can do everything from managing a treasury to helping facilitate cryptocurrency transactions between members (or with external platforms) and much more.

Once the rules are on the blockchain, they cannot be changed without a consensus from the community.

The most interesting part of decentralized autonomous organizations is ownership and voting power. These two usually come from tokens. If you own DAO tokens, you get to vote on proposals. Typically, the more tokens you have, the more voting weight you carry in the decision-making process.

Unlike traditional corporations, DAOs don’t have CEOs and managers who decide on these important matters behind closed doors. Everything that happens in DAO projects is out in the open.

In most DAOs, the members own tokens that are called governance tokens. While some governance tokens have other utility outside of voting like for transaction fees or staking, their main purpose to enable democratic governance.

Many DAOs have two types of tokens: one for governance and one for utility or rewards. In MakerDAO, for instance, the governance token is MKR, which is used for voting, and the DAI stablecoin is used for payments and lending.

MakerDAO is one of the oldest and best-known DAOs. It issues and manages the DAI stablecoin, a popular stablecoin pegged to the U.S. dollar.

Anyone who holds MKR (Maker tokens) can propose or vote on changes to the system. If someone proposes adjusting the interest rate for borrowing DAI, for instance, the members vote to make a decision. If the majority approves, the smart contract will update the rate automatically. There is no bank and no boardroom, just code and community.

Let’s consider another example.

Krause House is a DAO with a pretty wild goal: to buy an NBA team. Members buy into the DAO by investing in tokens. These tokens give them voting rights on DAO decisions, like which team to target, or how to raise funds to buy a team.

While they haven’t bought a team yet, the DAO has already raised millions of dollars. They have also partnered with sports figures to move things forward.

Pros and Cons of DAOs

Like any technology, DAOs come with both benefits and challenges. Let’s take a closer look at where DAOs shine and where they fall short.

Pros of DAOs

DAOs offer exciting advantages, especially for people who value transparency and community decision-making. While they are still evolving, the core benefits are pretty clear and include:

- Decentralization. There is no centralized leadership in DAOs. No single person or group controls the organization. Decisions come from the collective group of token holders.

- Transparency. Every vote, transaction, and rule is recorded on the blockchain. Anyone can check and verify the process and see the changes.

- Global participation. Anyone with an internet connection and tokens can take part in DAO projects, no matter where they live.

- Autonomy. The smart contract executes the actions automatically. There is no need to wait for approval from leadership or other middlemen.

- Low barriers to entry. In most cases, you don’t need a traditional business structure or a bank account to launch or join a DAO.

- Community-driven projects. Members feel more invested in such projects because they can directly influence their direction.

Cons of DAOs

DAOs sound great in theory, but they are still in the early stages and come with many challenges. Some of these problems are natural consequences of the technology, but others come down to human behavior. Let’s see what the major cons of DAOs are:

- Voter apathy. Many token holders don’t vote. This usually leaves the major decisions in the hands of the few who do vote.

- Lack of legal clarity. In many countries, DAOs don’t have a clear legal status. This can make contracts, taxes, and liability pretty messy.

- Security risks. If there is a bug in a DAO’s smart contracts, it’s possible that it could be exploited. One of the earliest and most famous examples is The DAO (2016). Due to a smart contract vulnerability, hackers had the DAO drained of about $60 million worth of Ether, though it was eventually reversed with a hard fork.

- Slow or chaotic decision-making. Since there are no leaders in the DAO structure, getting consensus on complex issues often gets difficult and chaotic.

- Token concentration. Wealthy token holders can dominate the votes simply because they own more governance tokens.

- Hard to scale. As DAOs grow, managing operations and communication without traditional leadership roles is more complicated.

5 Largest DAOs

DAOs are just starting to grow in number and develop in the crypto community. The nature of the organizations brings us diverse DAOs. Some of the existing DAOs manage huge sums of money. Others have tried to buy sports teams and historical documents.

Here are five DAOs that stand out for their size, their bold ideas, or their unique governance models.

| DAO | What It Does | Launched | Governance Token |

| MakerDAO | Manages the DAI stablecoin and its collateralized debt system | 2017 | MKR |

| Uniswap DAO | Governs the Uniswap decentralized exchange | 2020 | UNI |

| Constitution DAO | A one-time DAO that was formed to bid on a copy of the U.S. Constitution | 2021 (now disbanded) | PEOPLE |

| Arbitrum DAO | Governs the Arbitrum Layer 2 scaling solution for the Ethereum network | 2023 | ARB |

| Aave DAO | Manages the Aave lending protocol and the GHO stablecoin | 2020 | AAVE |

Let’s take a closer look at each of these DAOs.

1. MakerDAO

Founded in: 2014 by Rune Christensen

Launched: DAI stablecoin in December 2017

Governance token: MKR

MakerDAO governs the DAI stablecoin, the popular stablecoin pegged to the U.S. dollar. It maintains its value through overcollateralized loans, using a variety of crypto assets.

As one of the first DAOs, MakerDAO pioneered decentralized finance (DeFi). Its “Endgame” plan is to restructure governance by creating MetaDAOs to simplify finance and decision-making.

Maker Endgame: The SubDAOs

MakerDAO serves as the core of the Maker ecosystem, ensuring the stability and longevity of the Maker Protocol and DAI on the Ethereum network.

Beyond that, the implementation of peripheral strategies vital for DAI's growth will be delegated to… pic.twitter.com/RWxpXBsMgI

— Sky (@SkyEcosystem) May 7, 2024

In MakerDAO, MKR token holders propose and vote on changes to the protocol. This includes risk parameters and collateral types. The voting power is proportional to the amount of MKR tokens held by the member.

2. Uniswap DAO

Founded in: November 2018 by Hayden Adams

DAO established: September 2020

Governance token: UNI

Uniswap is a decentralized exchange (DEX) that allows users to swap ERC-20 tokens without intermediaries. To do this, it uses automated liquidity pools.

Uniswap revolutionized trading with its Automated Market Maker (AMM) model. It is one of the largest DEXs by trading volume and the first one to hit over $3 trillion in trading volume.

Uniswap DAO was launched in 2020 as a way to let the community govern one of the largest decentralized exchanges worldwide. UNI token holders vote on protocol upgrades, fee structures, and treasury allocations. The large holders, like venture capital firms, have the most influence.

3. ConstitutionDAO

Founded in: November 2021

DAO members: Over 17,000 contributors

Governance token: PEOPLE (now defunct)

ConstitutionDAO was a one-time effort to buy an original copy of the United States Constitution at an auction. The DAO raised over $47 million but was outbid when the auction took place.

Despite its short lifespan, ConstitutionDAO showed how great DAOs can be at mobilizing funds quickly when members share the same goals.

ConstitutionDAO members received PEOPLE tokens, intended for governance. However, the DAO disbanded after the auction. This event highlighted the challenges in refunding contributions due to high gas fees on the Ethereum blockchain.

We didn't get the Constitution, but we made history nonetheless.

We broke records for the largest crowdfund for a physical object and most money crowdfunded in 72h, which will of course be refunded to everyone who participated.

To all our 17,437 contributors, THANK YOU ❤️

— ConstitutionDAO (📜, 📜) (@ConstitutionDAO) November 19, 2021

When the DAO shut down, users were told they could redeem their contributions by returning their PEOPLE tokens and getting back their ETH. However, the gas fees on Ethereum can be pretty high, often $20 to over $100 during congestion.

Many contributors had only donated small amounts, so claiming a refund might have cost them nearly as much as the value of the refund itself. As a result, many people chose not to redeem their tokens, so they effectively lost their contribution.

Despite the failed attempt to buy the constitution, PEOPLE token didn’t go anywhere. In fact, it took on a second life as a meme token. Even after its official use was over, PEOPLE was listed on exchanges like OKX and Gate.io and started trading rather speculatively. At one point, its price surged well above its refund value, so those who kept their tokens made a solid profit.

The idea was so original and successful (despite the unsuccessful purchase) that it led to a short film, “@ConstitutionDAO: An Ethereum Story”.

Here's the short film, "@ConstitutionDAO: An Ethereum Story"! The wild story of how thousands of strangers coordinated to try and buy the U.S. Constitution.

Mint the short film on @zora: https://t.co/K4J8HyYPup

Watch more Ethereum Stories at https://t.co/cw9gpPJfAm pic.twitter.com/uTHG59upke

— Vitalik: An Ethereum Story (@EthereumFilm) August 28, 2024

4. Arbitrum DAO

Founded in: March 2023

Governance token: ARB

Arbitrum is one of the most popular Layer 2 scaling solutions built on Ethereum. The idea behind it is to improve transaction speed on the blockchain and reduce costs.

Arbitrum DAO governs the Arbitrum One and Nova networks. It manages a treasury and oversees protocol upgrades. It also introduced a Security Council for emergency actions, and holds elections for it semiannually. The Council is made of 12 members who are making sure that the network is secure and performs well.

Council members are elected by the DAO members. ARB token holders propose and vote on changes. The voting power can be delegated.

ArbitrumDAO controls a substantial treasury with over $1.3 billion in assets. These are used to fund development, grants, and other initiatives.

5. Aave DAO

Founded in: 2017 as ETHLend; rebranded to Aave in 2018

DAO established: October 2020

Governance token: AAVE

Aave is a decentralized lending protocol that allows users to borrow and lend cryptocurrencies. Aave introduced features like flash loans and a native stablecoin called GHO. It now operates across multiple blockchains and has a total value locked (TVL) of around $25.67 billion.

AAVE token holders can participate in governance through proposals and votes. The DAO structure is a delegation system, allowing members to delegate their powers to others to help deal with the problem of voter apathy.

How to Create Your Own DAO

Creating a DAO might sound complicated, but thanks to modern tools, it is now more accessible than it was a few years back. You don’t need to be a coder to create your own DAO (though this sure helps if you want to make it unique or complex).

Here is a simple overview of how you can create a DAO:

1. Define Your Purpose

First things first. Why do you need a DAO? What will its purpose be?

Maybe you want to create a group investment fund, a community project, an innovative NFT collection, or a new DeFi product. Regardless of your choice, your goal must be clear and specific. This is what will attract members and eventually guide the decision-making process.

2. Choose a Blockchain

Most of the largest DAOs operate on the Ethereum blockchain, but this is not a rule of thumb. You can also use Arbitrum, Polygon, Solana, or other blockchains. Make sure to consider factors like gas fees, community, and available tools.

3. Set Up a Governance Token

DAOs usually use governance tokens to give members voting power. These can be created using platforms like Aragon, DAOhaus, Tally, and Juicebox, to name a few.

When you set up a governance token, you can define things like token supply, distribution, and decide on the organizational structure (i.e., how voting works).

4. Create a Treasury

Your DAO will now need a place to hold funds. This is usually done through multi-signature wallets like Gnosis Safe, which require multiple people to approve the transactions. Some platforms like DAOhaus will do this for you if you want to keep it simple.

5. Launch the Community

At this point, your DAO will exist on-chain, so it will be time to invite members. Use platforms like Discord, Telegram, X (Twitter), or Farcaster to build a community of like-minded individuals.

6. Proposals & Voting

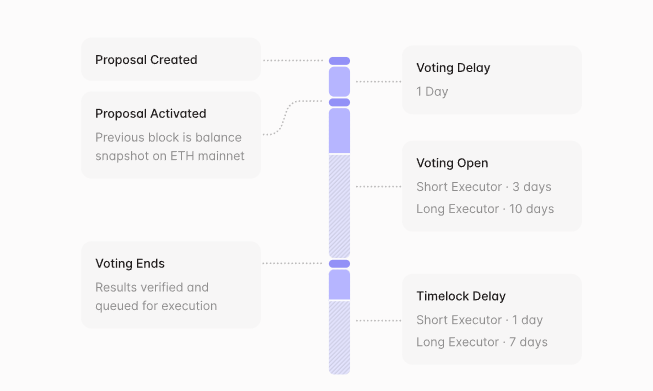

Members can now submit proposals. They can propose a project to fund, rule changes, or start partnerships. The proposals are voted on using your DAO’s governance token. If the proposal passes, it gets executed.

Reading this list, DAOs can sound futuristic and overly complex, especially if you aren’t a coder. However, creating a DAO with today’s tools is much easier than you might think. Still, it would be useful to have some coding experience to ensure that the smart contracts you create come without bugs.

The Future of DAOs

DAOs are still in their early days. They are constantly evolving, and we are most likely only scratching the surface of what is possible with this kind of technology.

As blockchain tools improve and more people understand how DAOs work, it’s likely that the number and scope of DAOs will only continue to grow. DAOs could potentially manage anything from global charities to city governments to decentralized social media.

That being said, there are still many challenges linked to these organizations. The challenges include legal uncertainty, voter participation troubles, and, of course, technical barriers. Despite these hurdles, the potential of DAOs seems endless.

FAQs

Are DAOs legal organizations?

DAOs exist on blockchains, which makes them global. However, most countries don't yet have clear frameworks for them. Some DAOs register as LLCs to gain legal recognition and limited liability protection, but most still operate in a legal grey area.

Can anyone join a DAO?

Do I need to know how to code to participate in a DAO?

No. Developers are an important part of the organization, but many DAOs also need writers, designers, marketers, organizers, and translators.

How do DAOs make decisions?

DAOs make decisions through proposals and voting. Token holders vote on what the DAO should do, and once it is decided, it is automatically executed.

What happens if a DAO gets hacked?

DAOs rely on smart contracts and, like any code, they can have bugs. This is why audits and community reviews are important. If a DAO gets hacked, the funds can be lost. However, some DAOs have emergency protocols or insurance in place.

How do I find DAOs to join?

You can check platforms like Tally, DeepDAO, and DAOhaus to see active DAOs and statistics. You can also scour social media like X or Discord to see what fits your interests.