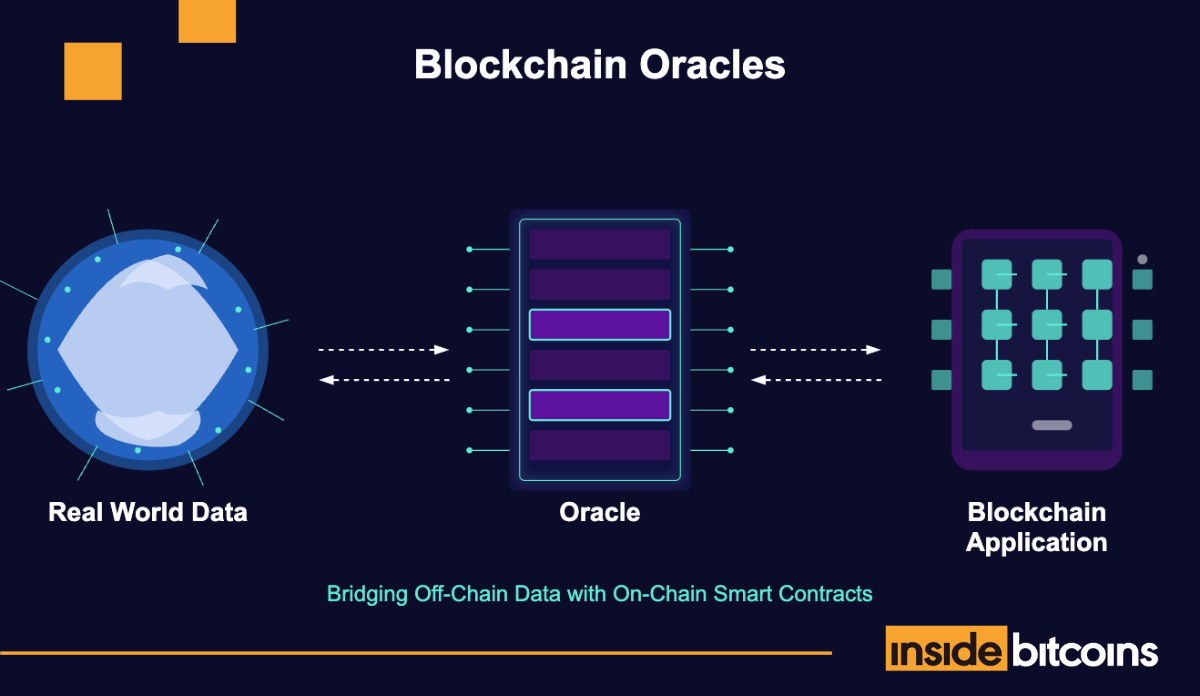

Blockchain oracles are third-party services that connect smart contracts with external data sources, allowing blockchains to access real-world information they couldn’t otherwise obtain.

Smart contracts, self-executing code that automatically implements agreement terms, face a limitation: they can only access data already on their blockchain. Without oracles, these contracts remain isolated from essential real-world information like asset prices, weather conditions, or sports outcomes. Oracles solve this “isolation problem” by being a trusted bridge between on-chain smart contracts and off-chain data, expanding blockchain applications beyond their native networks.

Key Takeaways

What are Blockchain Oracles?

A blockchain oracle is a third-party service that provides smart contracts with external information. Think of oracles as the messengers between the isolated blockchain and everything that exists beyond it. Without oracles, smart contracts would be severely restricted, able to access only data that already exists on their network.

Oracles play an active role in querying, verifying, and authenticating external data before delivering it to smart contracts. This ensures that the information being fed into the blockchain is accurate and reliable.

What is “The Oracle Problem”?

The “oracle problem” refers to a challenge in blockchain technology: how can we trust the data being fed into a blockchain from external sources?

Blockchains are created to be trustless systems where consensus is reached through decentralized mechanisms. However, when external data enters the blockchain through an oracle, users must trust that this data is accurate. This creates a potential security vulnerability, as the smart contract is only as reliable as the oracle feeding it information.

If an oracle relies on a single source of truth (centralized), it can be susceptible to manipulation or failure. A compromised oracle could potentially feed false information to smart contracts, leading to incorrect executions that can’t be reversed due to the immutable nature of blockchain.

This challenge has led to the development of various oracle solutions, particularly decentralized oracle networks that distribute trust across multiple data sources and node operators.

Types of Blockchain Oracles

Oracles take various forms, each with a specific purpose. Understanding these different types helps clarify how oracles function in various scenarios.

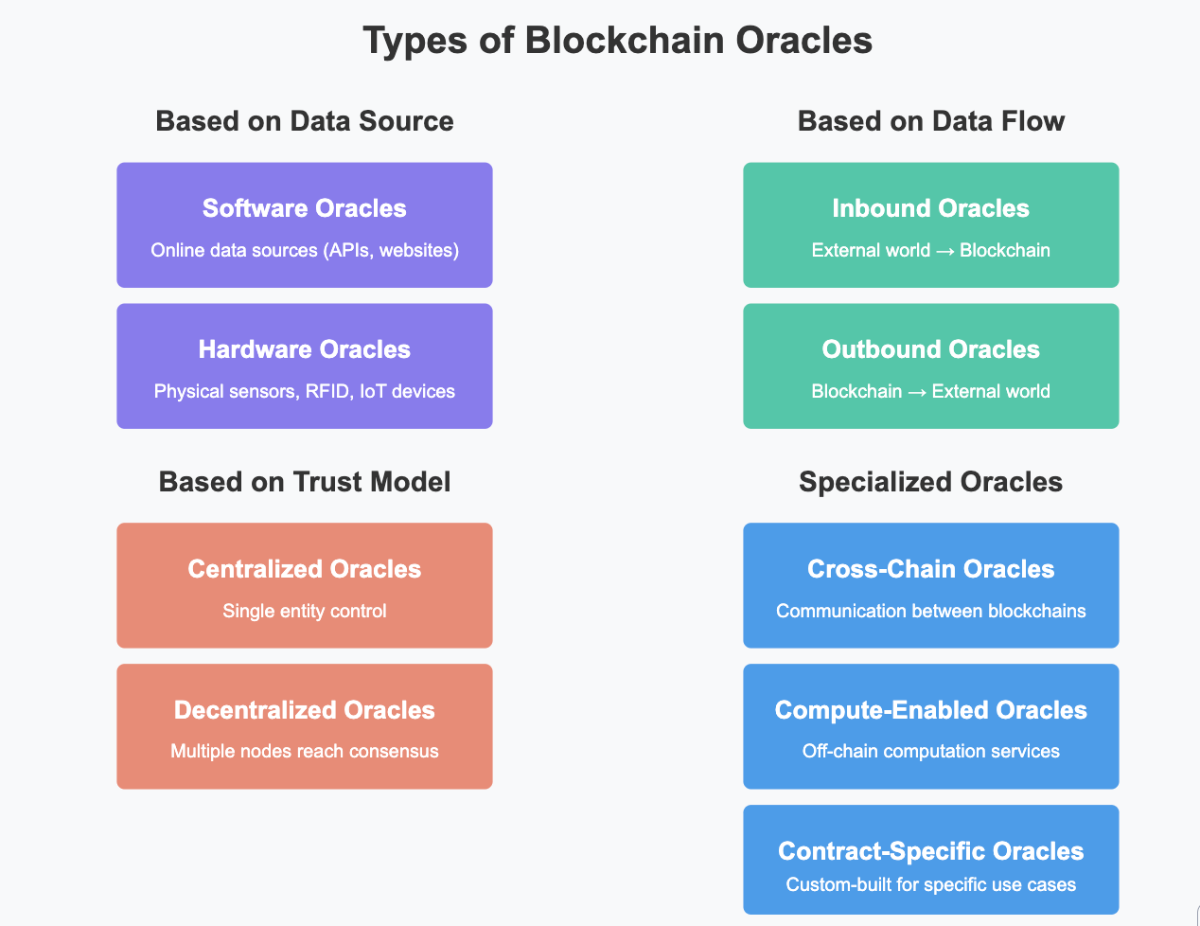

Based on the Data Source

Software Oracles

Software oracles connect with online sources of information and transmit this data to the blockchain. They retrieve information from online databases, servers, websites, and any digital source available on the internet.

Common examples are:

- Price feeds for cryptocurrencies and traditional assets

- Real-time exchange rates

- Digital asset market data

- Flight status information

- Weather data from digital weather services

Software oracles are the most common type, as they can connect to the information available online and update smart contracts in near real-time.

Hardware Oracles

While software oracles deal with digital information, hardware oracles are designed to get information from the physical world into the blockchain. They interface with real-world sensors, RFID tags, barcode scanners, and other physical devices.

Applications include:

- Supply chain tracking via IoT sensors

- Temperature and humidity monitoring for agricultural insurance

- Car sensor data for auto insurance contracts

- Building security access information

- Medical device readings for healthcare applications

These oracles are crucial for blockchain applications that need to track or respond to real-world physical events.

Based on Direction of Data Flow

Inbound Oracles

Inbound oracles transfer information from the external world to the blockchain. They’re the most common type and essentially act as the “eyes and ears” of smart contracts, feeding them real-world data needed for execution.

For example, a decentralized insurance contract might use an inbound oracle to receive weather data and determine whether conditions meet payout criteria.

Outbound Oracles

Outbound oracles work in the opposite direction – they send information from the blockchain to the outside world. These oracles inform external systems about events that have occurred on the blockchain.

A practical example would be a smart contract that triggers a payment through a traditional banking system once certain conditions are met on the blockchain.

Based on the Trust Model

Centralized Oracles

Centralized oracles are controlled by a single entity that is solely responsible for providing data to the blockchain. While they’re typically faster and more straightforward to implement, they present a single point of failure. If the oracle provider acts maliciously or experiences technical issues, the integrity of the smart contract is compromised.

Decentralized Oracles

Decentralized oracles distribute the responsibility of providing data across multiple participants. They use a network of independent nodes that collect and verify information from various sources, then reach consensus on the accuracy of that data before submitting it to the blockchain.

This approach lowers the risk of manipulation or failure by preventing any single entity from having complete control over the data feed. Decentralized oracles are closer to the trustless philosophy of blockchain technology.

Specialized Oracles

Cross-Chain Oracles

They create communication between different blockchains like Ethereum, Solana, and Cosmos, solving the blockchain interoperability challenge. For example, Chainlink’s Cross-Chain Interoperability Protocol (CCIP) lets developers to build applications that work across multiple chains, transferring both data and assets.

In practice, this allows a smart contract on Ethereum to trigger actions on Polygon or Arbitrum, creating more seamless multi-chain experiences without users needing to navigate multiple bridges manually.

Compute-Enabled Oracles

Compute-enabled oracles like Chainlink’s Off-Chain Reporting (OCR) perform complex calculations off-chain and deliver only the verified results to smart contracts. This approach solves the prohibitive gas cost issue – for example, calculating the median price across 30 exchanges would cost hundreds of dollars on-chain, but can be done efficiently off-chain.

These oracles also enable advanced functionalities like zero-knowledge proofs for privacy and verifiable randomness for gaming applications, processing the complex math outside the blockchain to save users money.

Contract-Specific Oracles

Contract-specific oracles are custom-built for particular applications rather than serving as general data providers. Insurance platforms like Etherisc, for instance, use specialized weather oracles created for crop insurance that monitor precise agricultural metrics like rainfall amounts in particular regions.

Similarly, prediction markets like Polymarket use oracles to verify specific event outcomes with specialized dispute resolution mechanisms. These purpose-built oracles offer greater efficiency and accuracy for their specific use cases than general-purpose alternatives.

How Do Blockchain Oracles Work?

While implementation details are different between various Oracle solutions, the general process follows similar patterns.

Data Retrieval and Verification

When a smart contract requires external data, it makes a request to an oracle. The oracle then:

- Receives the data request from the smart contract

- Queries the appropriate external data sources (APIs, web services, IoT devices, etc.)

- Collects the required information

- Processes and formats the data for blockchain compatibility

- Verifies the data’s authenticity and accuracy through various methods, such as cryptographic proofs

For decentralized oracles, this process includes additional steps where multiple nodes independently collect data from various sources and reach consensus on the correct values.

Data Transmission to Smart Contracts

Once the data has been retrieved and verified, the oracle transmits it back to the requesting smart contract on the blockchain:

- The oracle signs the data with its private key to prove authenticity

- The data is formatted into a blockchain-compatible structure

- The oracle creates a transaction containing the verified data

- This transaction is submitted to the blockchain

- Once confirmed, the smart contract can access and utilize this data

This transmission process ensures that the external data is securely and reliably delivered to the smart contract.

Feedback Loops

Blockchain oracle systems often implement feedback loops to maintain data accuracy over time. Smart contracts can request regular data updates to stay current. Similarly, many oracle networks actively monitor data sources and push updates when they detect changes, ensuring smart contracts operate with the most recent information.

Advanced oracle systems like Chainlink and UMA also include dispute resolution protocols where network participants can flag suspicious data and trigger verification processes. These continuous feedback mechanisms are especially crucial for DeFi applications and prediction markets that rely on time-sensitive information, helping prevent costly errors from outdated or incorrect data inputs.

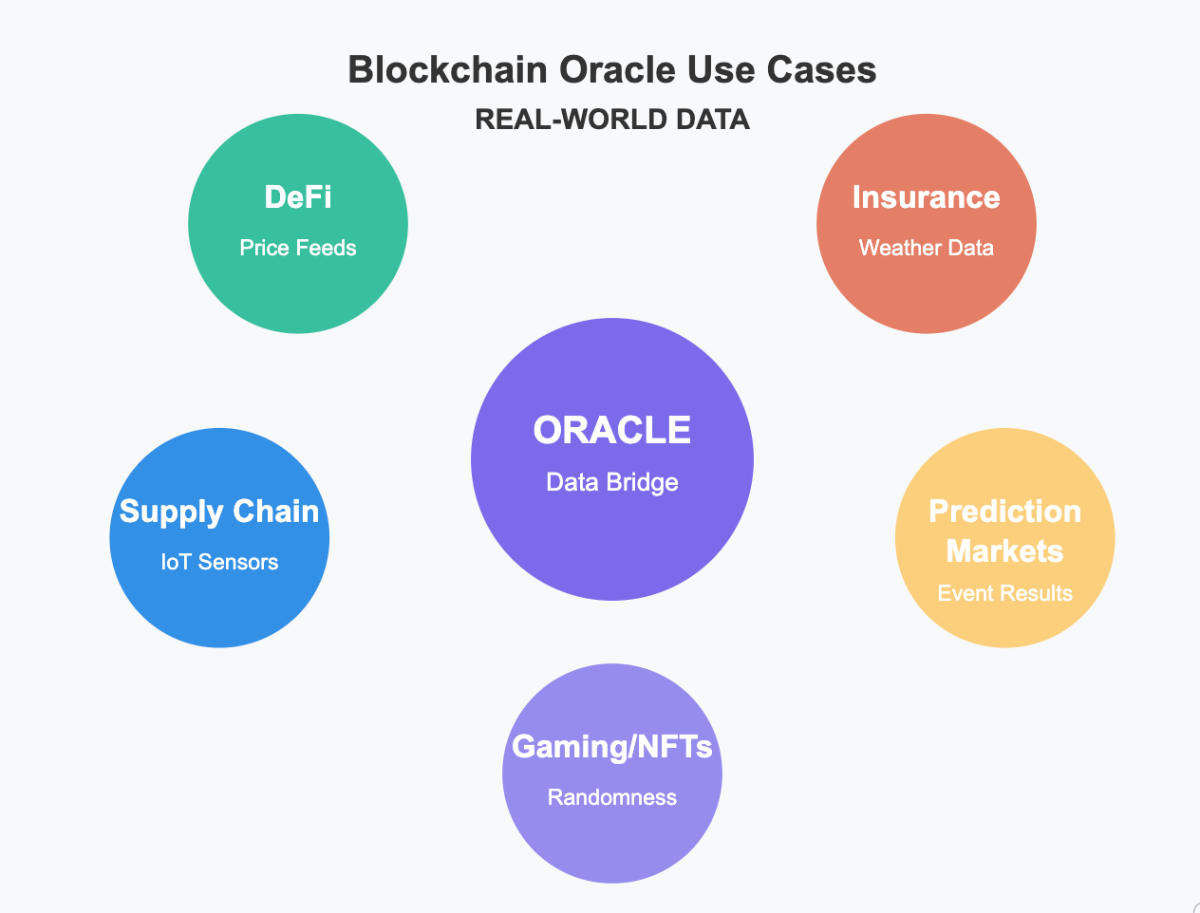

Use Cases of Blockchain Oracles

After understanding what Oracles are and how they work, it’s time to see some of the most significant use cases:

Decentralized Finance (DeFi)

DeFi applications heavily rely on oracles to function properly. Price feeds are the backbone of DeFi protocols, providing the crucial price information needed to determine loan collateralization ratios, liquidation thresholds, and trading pairs. Lending and borrowing platforms like Aave and Compound depend on price oracles to monitor collateral values in real-time, automatically triggering liquidations when positions become undercollateralized.

Derivatives and synthetic assets similarly track underlying asset prices through oracle-provided data, enabling users to gain exposure to traditional markets without leaving the blockchain.

Insurance

Smart contract-based insurance solutions leverage oracles to create automated, transparent coverage models. Parametric insurance policies use oracles to verify when predefined conditions are met, enabling instant payouts without manual claims processing.

For example, flight delay insurance contracts can track flight status information and automatically compensate travelers when delays exceed agreed thresholds. In agricultural sectors, crop insurance smart contracts utilize weather data from oracles to determine when drought or flooding conditions warrant payments to farmers, reducing wait times compared to traditional insurance models.

Supply Chain Management

Oracles create more transparent and efficient supply chains by connecting physical world events to blockchain records. Hardware oracles like RFID scanners confirm product movements through various supply chain stages, while IoT sensors monitor conditions such as temperature, humidity, and location during transport. This real-time data flows through oracles to smart contracts, enabling:

- Automated compliance verification with shipping conditions

- Instant payment is released when delivery milestones are met

- Tamper-proof product provenance records

These capabilities significantly reduce fraud while improving supply chain visibility and efficiency.

Gaming and NFTs

The gaming and NFT sectors use oracles in increasingly creative ways. Dynamic NFTs can evolve based on real-world events reported by oracles, creating digital assets that respond to external conditions. Chainlink’s Verifiable Random Function (VRF) provides provably fair randomness for NFT distributions and gaming mechanics, solving a critical challenge for blockchain games that require unpredictable outcomes.

Online games also use oracles to incorporate real-world events into gameplay, creating more engaging and dynamic player experiences that blend virtual and physical worlds.

Prediction Markets

Blockchain-based prediction markets depend entirely on oracles for their operation and resolution. These platforms allow users to bet on future outcomes, with oracles being the authoritative source for event verification. When markets resolve, oracle networks determine which outcome occurred, ensuring fair distribution of rewards.

Continuous data feeds enable more sophisticated prediction markets based on changing variables like stock prices or election polling. Platforms like Augur implement decentralized oracle systems where token holders themselves report and verify outcomes, creating a trustless mechanism for market resolution even for contentious events.

Leading Oracle Projects

Several projects have been leading the way in the blockchain oracle space, each with unique approaches and strengths.

Chainlink dominates the oracle space with over 70% market share and secures $15+ billion in smart contracts across 14 blockchains. As the first decentralized oracle network, it pioneered multi-layered verification through a network of 2,000+ independent node operators.

Band Protocol offers cross-chain compatibility through the Cosmos ecosystem, supporting 25+ blockchains with lower costs than Chainlink. Its BandChain validators use a delegated proof-of-stake model where validators stake BAND tokens as collateral, creating strong economic incentives for honest data reporting.

UMA takes a unique “optimistic” approach to oracles, where data is assumed correct unless specifically challenged. This design dramatically reduces gas costs by eliminating redundant verifications, with disputed data resolved through a Data Verification Mechanism (DVM) where token holders vote.

Augur specializes exclusively in prediction market resolution through its Reputation (REP) token system. Market outcomes are determined when REP holders stake tokens on event results, with economic incentives encouraging truthful reporting.

And lastly, Pyth Network focuses on high-frequency financial data provided directly by 70+ leading trading firms and exchanges. Unlike other oracles, Pyth delivers sub-second price updates with microsecond-level timestamps, making it ideal for advanced trading applications.

| Oracle Project | Architecture | Key Features | Specialization | Industry Adoption/Backing |

| Chainlink | The decentralized network of node operators retrieving data from multiple sources | VRF (Verifiable Random Function)

Proof of Reserve Automation for smart contracts Three layers of decentralization |

General-purpose oracle network with wide coverage | Secured tens of billions in smart contract value across DeFi, insurance, and gaming |

| Band Protocol | Built on Cosmos SDK with cross-chain compatibility | Verified data providers stake tokens as collateral

High throughput Low-cost data requests |

Cross-chain data delivery and scalability | Serves multiple blockchains in the multi-chain ecosystem |

| UMA | Optimistic oracle design (assumes data is correct unless disputed) | Reduced verification overhead

Economic incentives against false reporting Dispute resolution system |

Financial contracts and synthetic assets | Popular for derivatives and synthetic assets in DeFi |

| Augur | Token holder-based reporting and dispute system | Decentralized event verification

Reward/penalty system for reporters Community-driven resolution |

Prediction market outcomes and resolution | First major decentralized prediction market platform |

| Pyth Network | Low-latency data network with high-frequency updates | Microsecond-level data updates

Direct first-party data sources Sub-second price feeds |

High-frequency financial data for trading | Backed by major trading firms and exchanges providing direct market data |

Challenges and Considerations

Despite their potential, blockchain oracles face several challenges that developers and users must navigate carefully.

Security Concerns

Security remains the main concern. Oracle manipulation poses a critical vulnerability – if an attacker compromises the oracle itself, even the most secure smart contract becomes susceptible to exploitation. The Maker DAO flash crash demonstrated this risk when price oracle failures led to over $8 million in liquidations.

Data tampering presents another threat vector, where malicious actors might manipulate information at its source before it reaches the oracle. Centralized oracles compound these issues by creating single points of failure that fundamentally undermine the decentralized security model blockchains aim to achieve. These concerns have driven the development of multi-layered security approaches, including cryptographic verification, reputation systems, and node collateralization.

Latency and Reliability

Oracle performance characteristics impact their practical utility across different use cases. Time-sensitive applications like high-frequency trading require near-instantaneous data updates, while less time-critical applications can tolerate longer refresh intervals. Consistency is a major challenge for decentralized oracle networks, as they must ensure all nodes report substantially similar data despite potential network delays or node failures.

This “Oracle consensus” problem becomes particularly acute during market volatility or network congestion, when timely data is most crucial. Different applications have dramatically different requirements for data freshness and consistency; a lending platform might need price updates every minute, while an insurance contract might only need weather verification once daily.

Cost Implications

Oracle services introduce multiple cost considerations for blockchain applications:

- Service fees charged by Oracle providers typically range from a few cents to several dollars per call

- On-chain gas costs for recording oracle data, which can spike during network congestion

- Economic security expenses for high-value contracts requiring additional security guarantees

For small-value applications, these costs can sometimes outweigh the benefits of blockchain automation. However, for high-value applications like DeFi protocols managing millions in assets, these costs represent a tiny fraction of the value secured. Balancing these expenses against the benefits of reliable external data remains a key consideration for developers.

Regulatory and Compliance Issues

As blockchain applications increasingly interact with traditional systems, regulatory considerations become unavoidable. Data privacy regulations like GDPR and CCPA create compliance challenges when personal data passes through Oracle networks. Questions of legal enforceability arise when oracle-driven smart contracts execute actions with real-world legal implications.

Liability determination becomes particularly complex when oracle failures cause financial losses – who bears responsibility when a decentralized network provides incorrect information? These regulatory considerations intensify as blockchain applications scale beyond experimental projects into regulated industries like finance, healthcare, and real estate.

The Future of Blockchain Oracles

Blockchain oracles are the crucial bridge between the isolated blockchains and the complex reality of external data. By solving the oracle problem, these systems expand the potential applications of smart contracts and blockchain technology.

Zero-knowledge proofs and advanced cryptographic techniques are dramatically enhancing data privacy and verification capabilities while reducing costs. Hybrid oracle models now intelligently balance on-chain security with off-chain computational efficiency, addressing previous scalability limitations.

Cross-chain functionality has improved substantially, with projects like Chainlink’s CCIP enabling seamless data transfer across 14+ blockchains. These innovations are driving oracle adoption beyond DeFi into healthcare (for secure patient data verification), government services (connecting public records to blockchain applications), real estate (automated property verification and rental agreements), and intellectual property management (transparent royalty distribution).

Trust mechanisms continue to advance through better reputation systems that track node performance across thousands of data points, community-governed oracle networks that decentralize parameter decisions, and enhanced transparency tools that visualize oracle operations in real-time.

As of 2025, the Oracle services market has grown to $500+ million annually, showing us its essential role in connecting blockchain technology to real-world applications.

As the technology matures, we can expect to see better, secure, and efficient oracle solutions that further minimize trust requirements while maximizing the utility and reliability of external data in blockchain applications.