Ethereum options are becoming a popular way to trade cryptocurrencies. They let you manage risks or try to profit from Ethereum’s price swings without having to directly buy or sell ETH right away. Advanced crypto traders value the flexibility that Ethereum options provide compared to simply holding Ether directly.

Unlike regular buying and selling, options give you choices. You can decide whether or not to go through with a trade depending on how the market moves. This flexibility, paired with the built-in leverage and diverse trading strategies, makes them exceptionally useful in the unpredictable crypto market.

What Are Ethereum Options?

To understand Ethereum options, you need to first understand stock options. A stock option is a contract that gives a buyer the right to buy (call option) or sell (put option) a stock at a predetermined price before an expiration date but not the obligation. In simple terms, options let you bet on whether the price of an asset, like a stock or crypto, will go up or down without actually owning it.

These options derive their value from the underlying stock. They can be used for countless different strategies, the most common being hedging and speculation.

Similar to stock options, Ethereum options are contracts that provide the right, but not the obligation, to buy or sell Ethereum (ETH) (or ETH futures contracts) at a set price on or before a certain date. A futures contract is simply an agreement to buy or sell an asset (like ETH) for a fixed price, regardless of the current market price.

Options are a type of derivative, which means that their value is derived from the price of the coin, in this case, Ethereum. In fact, Ethereum options are often technically derivatives of derivatives, given that Ethereum futures are also derivatives. That being said, traders mostly use Ethereum options to hedge against price volatility or speculate on future price movements.

ETH options can be traded on both centralized and decentralized exchanges.

How Ethereum Options Work

To trade Ethereum options effectively, you need to understand the two main types of options, as well as terms like strike price, expiration date, and moneyness. Let’s dig a bit deeper into this.

Call and Put Options

There are two main types of options:

- Call Option: Grants the right to buy ETH at a predetermined price (also known as the strike price) before a certain date (the expiration date). Traders usually use calls when they anticipate ETH’s price will rise.

- Put Option: Grants the right to sell ETH at the strike price before expiration. Traders often use puts when they expect ETH’s price to decline.

Expiration Date

The expiration date is the last day the option can be exercised. Once this date passes, the option becomes void.

Ethereum options can have different expiration periods, ranging from daily to monthly or even longer, depending on the platform. The expiration date influences the value of the option due to time decay. As the expiration date approaches, the value reduces.

Based on the expiration date, you can have daily, weekly, or monthly options.

Here, it is also important to understand the term “open interest.”

Open interest refers to the total number of active or unsettled option contracts for a specific strike price and expiration date. Unlike volume, which counts the trades that occurred on a given day, open interest shows how many contracts remain “open.” But why does that matter?

Well, for starters, higher open interest means more liquidity. Secondly, a sudden increase in open interest along with price movement can indicate new capital entering the market. Finally, low open interest on your chosen strike/expiry may make entering or exiting positions hard, especially when using complex spreads.

Moneyness: ITM, ATM, OTM

When you trade Ethereum options, one of the key terms to understand is moneyness. The term moneyness tells you whether an option is currently profitable or not. This is based on the relationship between the strike price and Ethereum’s current market price.

There are three main categories for moneyness:

- In-the-Money or ITM

- At-the-Money or ATM

- Out-of-the-Money or OTM

Let’s take a closer look at ITM, ATM, and OTM and what they mean.

| Moneyness | Call Option (Buy ETH) | Put Option (Sell ETH) | Value |

| In-the-Money (ITM) | Strike price is below ETH’s market price | Strike price is above ETH’s market price | Intrinsic value; more likely to be exercised |

| At-the-Money (ATM) | Strike price is equal to ETH’s market price | Strike price is equal to ETH’s market price | No intrinsic value, may have time value |

| Out-of-the-Money (OTM) | Strike price is above ETH’s market price | Strike price is below ETH’s market price | No intrinsic value; less likely to be exercised |

Now, let’s see what each moneyness level looks like in practice. Let’s say ETH is trading at $2,500.

In-the-Money (ITM)

- A call option with a strike price of $2,300 is ITM. You could buy ETH cheaper than the market.

- A put option with a strike price of $2,700 is ITM. You could sell ETH for more than it’s worth.

At-the-Money (ATM)

- A call or put option with a strike price of $2,500 is ATM. The option is exactly at the market price for Ethereum.

Out-of-the-Money (OTM)

- A call option with a strike price of $2,700 is OTM. You would be buying ETH for more than market value.

- A put option with a strike price of $2,300 is OTM. You would be selling ETH for less than market value.

Popular Ethereum Options Strategies

If you are new to Ethereum options, it is helpful to learn a few basic strategies. Options are used by traders to manage risk, hedge positions, or try and profit from price moves.

Here are a few simple strategies you can use:

1. Covered Call

“Covered call” is a relatively conservative strategy that can work well if you already own some ETH and think the price will stay flat or rise, but only slightly. Here is how it works:

- You hold ETH and sell a call option at a higher strike price.

- If ETH stays below the strike price, you keep the premium and your ETH.

- If ETH goes above the strike, your ETH may be sold at that strike price, but you still get to keep the premium.

Example:

You own 1 ETH at $2,500. You sell a call with a $2,800 strike price. If ETH stays below $2,800, you keep your ETH plus the premium.

Why use it?

You can use the covered call strategy to generate income from your ETH holdings when you don’t expect major price moves. On platforms like Bitopex, ETH holders have used this strategy to generate income when markets are flat or moving slowly.

The risks:

If ETH rallies and pushes far above the strike price, your gains are capped because you will be forced to sell at the lower strike price, missing out on larger profits.

2. Protective Put

A protective put means that you’d be hedging your ETH holdings. This means that you buy a put option while holding Ethereum. That way, you have the right to sell your ETH at a set price, even in case the market crashes.

Think of it like buying insurance for your ETH holdings. You will still hold ETH in hopes it goes up, but if it drops below the strike price, your put option helps soften the blow.

Here is how this works:

- You own ETH and buy a put option at a lower strike price.

- If ETH drops, your losses are limited and the put gains in value.

- If ETH goes up, you lose the cost of the put (premium), but your ETH increases in value.

Example:

You hold ETH at $2,500 and buy a $2,300 put. If ETH drops to $2,000, the put gives you the right to sell it at $2,300.

Why use it?

You should use protective puts to hedge your existing holdings. By doing this, you’d be protecting your downside risks, kind of like buying insurance for your Ethereum holdings.

The risks:

If you are wrong and the price of ETH stays flat or increases through the expiration date, the put will expire worthless, and you will lose the entire premium you paid for the option.

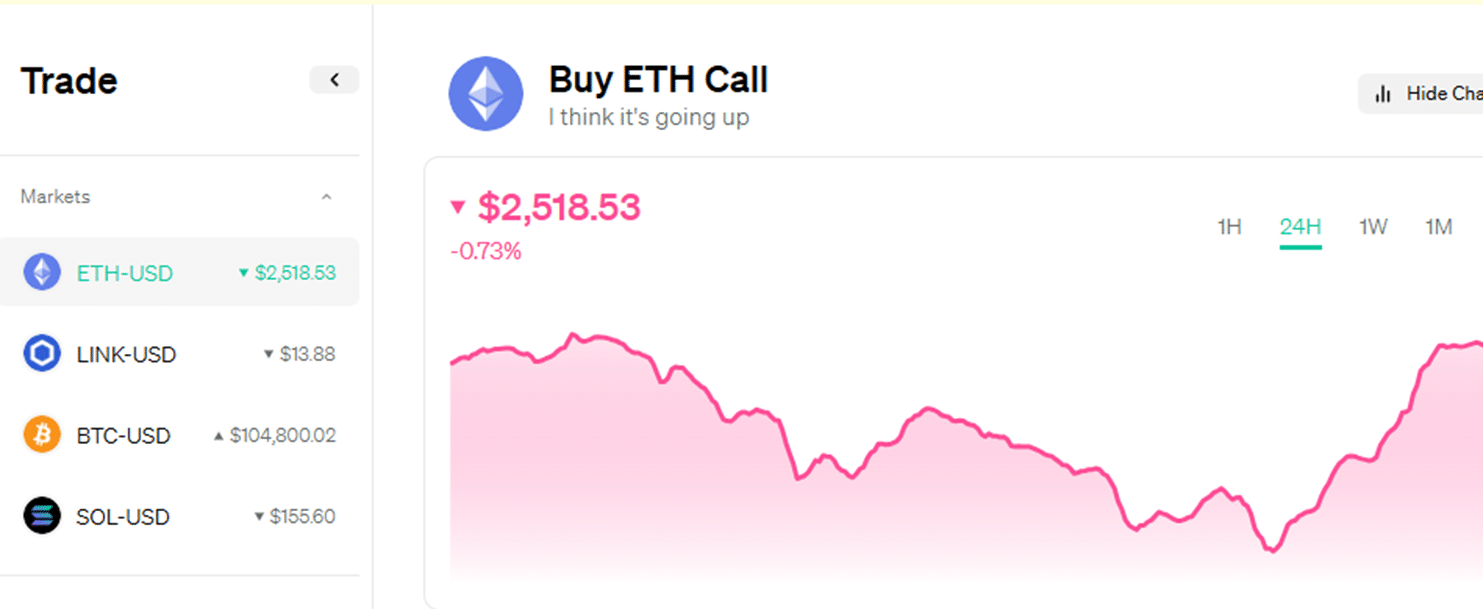

3. Long Call

A long call is a bullish bet. Say that you don’t own ETH, but you believe the price will go up, so you decide you want to profit without buying ETH outright. Here is what you could do instead:

- You buy a call option at a strike price you think ETH will rise above.

- If ETH goes higher than the strike + the premium cost, you make a profit.

- If ETH doesn’t go higher, you lose the premium you paid.

Example:

You buy a call option with a $2,700 strike. ETH shoots up to $3,000 after you do this. You can now buy ETH cheaper than the market or sell the option before expiry and lock in a profit.

Why use it?

You can use the long call strategy to speculate on ETH going up if you don’t want to buy the coin directly. This is one of the most common and basic strategies involving Ethereum options.

The risks:

If your prediction is wrong and ETH trades sideways or moves down by the expiration date, the call will expire worthless, and you will lose the premium you paid for it. However, you could minimize losses by selling it before expiration if you expect ETH won’t rise further.

4. Long Put

The long put is the bearish version of the long call. You are betting that ETH will drop and want to profit from it. Here is what you do:

- You buy a put option at a strike price higher than where you expect ETH to fall.

- If ETH drops below the strike, you make a profit.

- If ETH stays flat or rises, you lose the premium you paid.

Example:

You buy a $2,500 put, and ETH drops to $2,200. Your put gains value as ETH declines.

Why use it?

You should use the long put strategy to profit from downward moves when you don’t want to buy the coin directly.

The risks:

If ETH’s price increases by the expiration date, your put will expire worthless, and you lose the premium you paid. Like long calls and protective puts, you can always sell it early if you expect your prediction was wrong to try to minimize losses.

Best Ethereum Options Platforms

If you are ready to try Ethereum options, the next step to take is to find the best crypto options trading platform for you. Not every crypto exchange supports options trading, and even fewer do this well.

That being said, here are some of the best places to trade ETH options right now.

1. Deribit

Founded in 2016 in the Netherlands, Deribit is a major platform for crypto derivatives trading. It offers futures and options for Bitcoin and Ethereum. Deribit introduced Ethereum options in Q1 2019, which marked a significant development in the market.

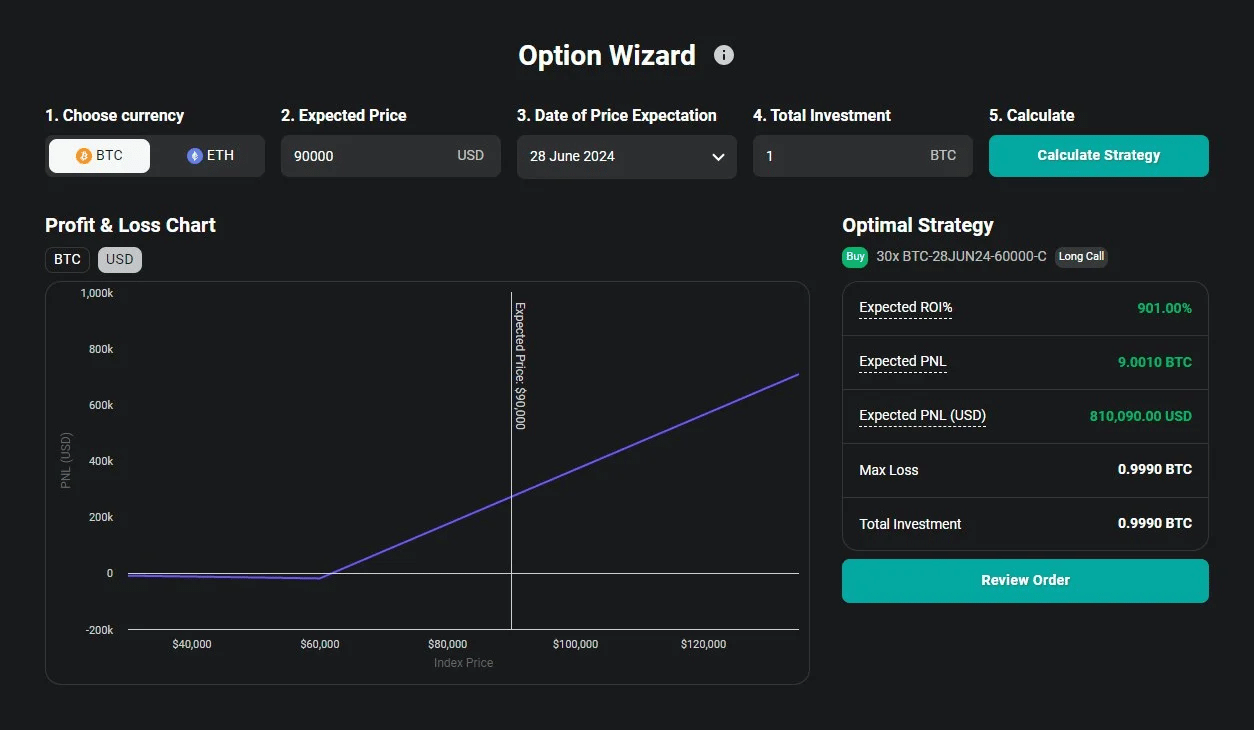

Deribit has a very useful feature called “The Option Wizard.” This feature assists traders in finding the best option strategy based on their price prediction, investment amount, and timeframe.

Ideal for: Experienced traders seeking deep liquidity and advanced features.

| Pros | Cons |

| High liquidity and tight spreads for ETH options | Not available in the United States |

| Advanced trading tools and analytics | Interface is complicated for beginners |

| Competitive fee structure |

2. OKX

OKX (formerly OKEx) was launched in 2017. It is a versatile crypto exchange with many services, including spot trading, futures, and options. One of its best features is its surprisingly low fees compared to other platforms. OKX began offering ETH options on June 4, 2020.

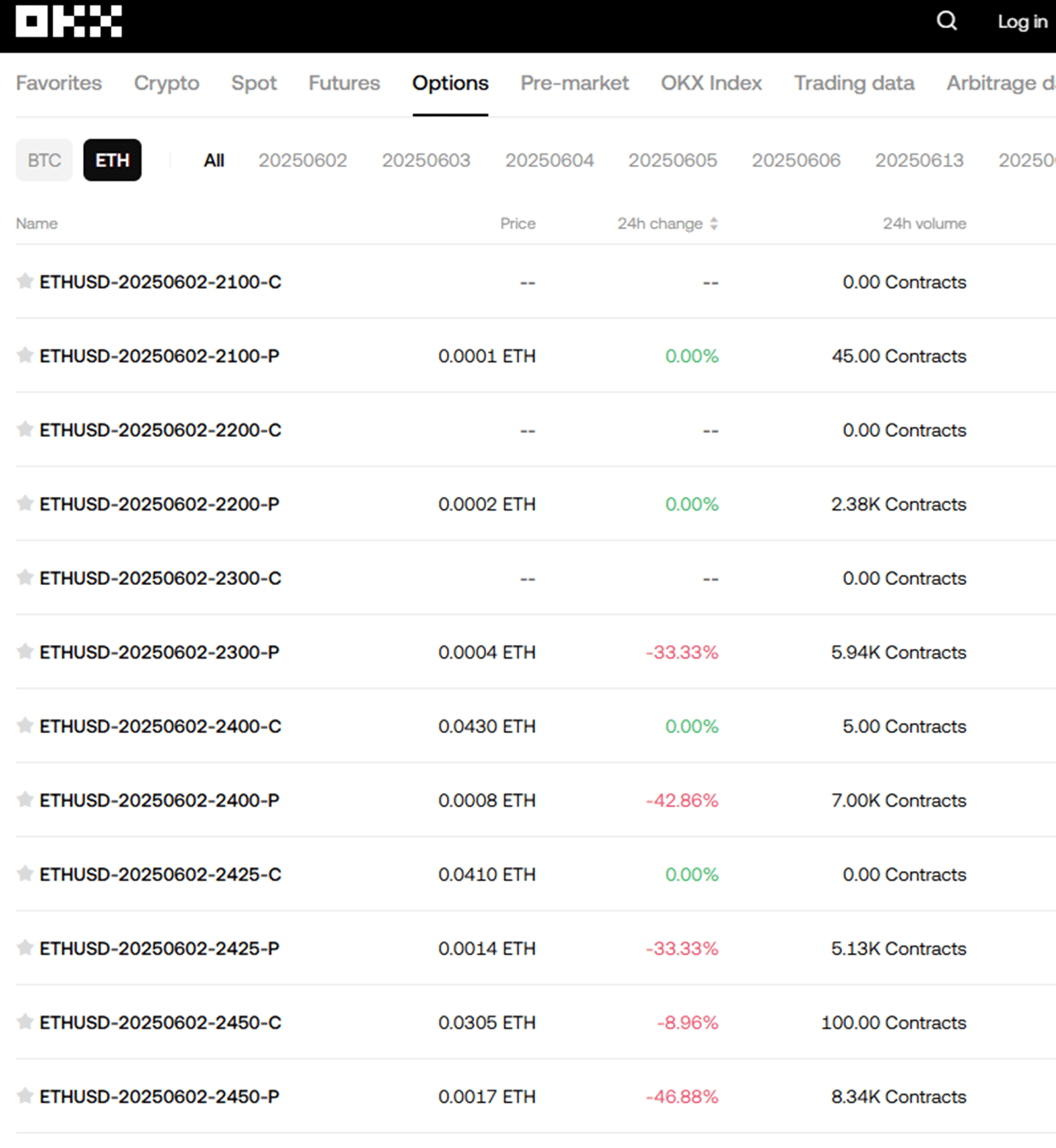

Here is what trading options on OKX looks like:

Source: OKX

Ideal for: Traders looking for a platform with many trading options.

| Pros | Cons |

| High liquidity and tight spreads for ETH options | Not available in the United States |

| Advanced trading tools and analytics | Interface can be a bit complicated for beginners |

| Very low fees |

3. Binance

Founded in 2017, Binance is one of the largest cryptocurrency exchanges in the world. Today, it offers a variety of trading options, including spot, futures, and options. Binance launched its Options trading platform in September 2022, introducing ETH options. It also runs various promotional events and competitions to reward its users from time to time.

Trade $ETH and $XRP Options to Share 50,000 $USDT in #Binance Futures Vouchers!https://t.co/vcUU7JVvP3 pic.twitter.com/sty9Uq8Psi

— Binance (@binance) June 4, 2020

In July 2024, Binance conducted a special early listing of BTCUSDT and ETHUSDT options contracts, with an expiration date of November 8, 2024.

Ideal for: Traders seeking a comprehensive platform with high liquidity.

| Pros | Cons |

| High liquidity and trading volume | Regulatory restrictions in some countries |

| Intuitive interface, good for beginners | Advanced features can be overwhelming for new users |

| Wide range of cryptocurrencies and trading pairs |

4. Bybit

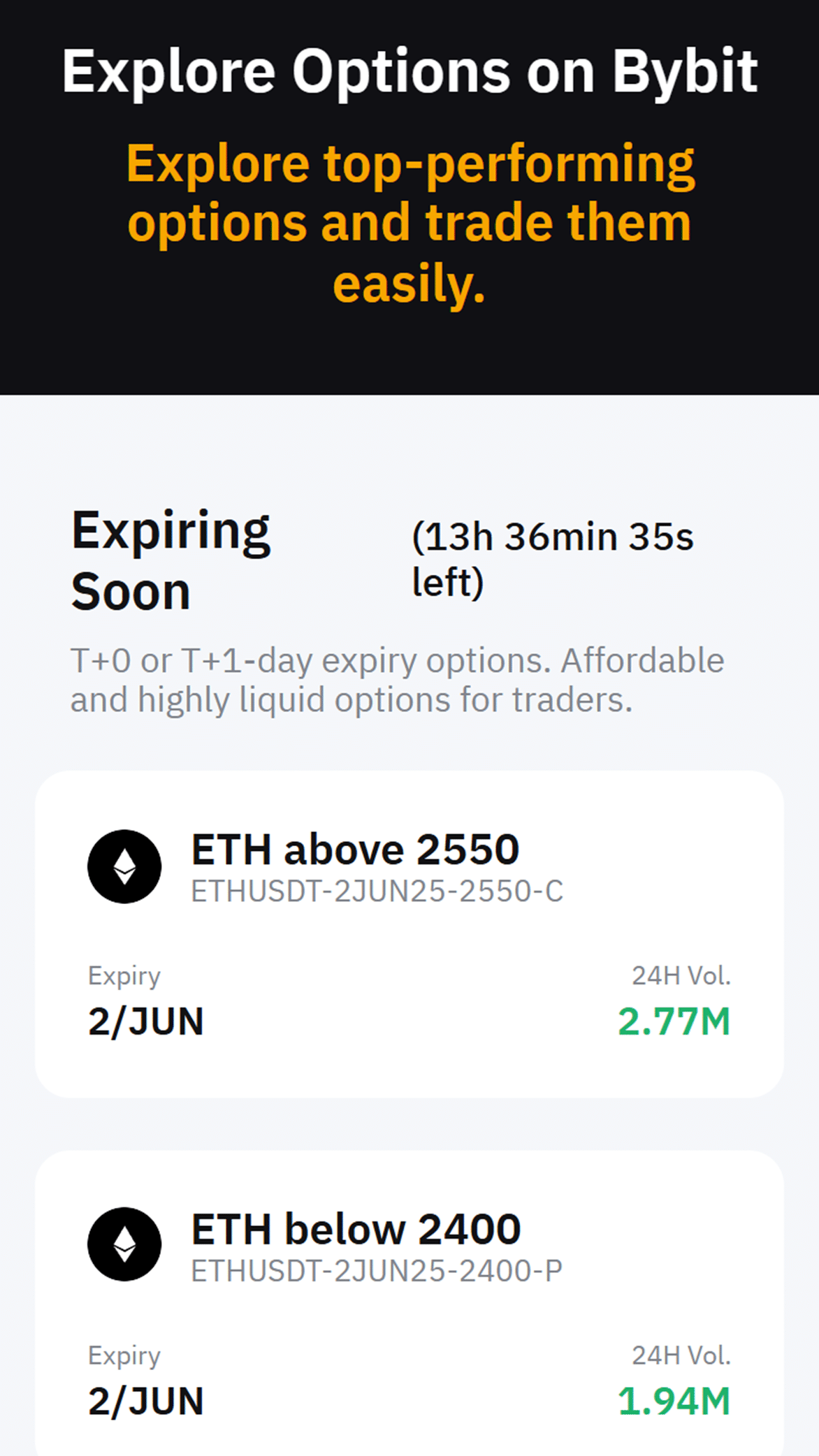

Established in 2018, Bybit is a cryptocurrency derivatives exchange known for its simple interface and robust trading engine. It has long been a favorite platform for advanced crypto and derivatives traders as it offers an incredibly long list of derivatives and cryptos. Bybit launched ETH options in 2023.

In addition to the official options trading list, you can explore top-performing options at Bybit:

Ideal for: Traders looking for a straightforward platform with flexible contract options.

| Pros | Cons |

| Extensive list of supported derivatives | Limited support for fiat currencies |

| Competitive fee structure | Not available in certain jurisdictions |

| Strong customer support |

5. Lyra

Lyra is a decentralized options trading protocol launched in July 2021. It is built on Ethereum Layer 2 solutions, so it offers lower gas fees. Lyra allows users to trade options in a fully decentralized manner, without intermediaries.

Ideal for: Users interested in decentralized finance (DeFi) and non-custodial trading.

| Pros | Cons |

| Decentralized and non-custodial platform | Lower liquidity compared to centralized exchanges |

| Low gas fees due to Layer 2 integration | May have a steeper learning curve |

| Transparent and community-governed |

How to Start Trading Ethereum Options

Ethereum options can be a powerful tool if you want to hedge risk, speculate on price movements, or boost your returns. However, they come with added complexity and risk. This is why we created a simple breakdown of how you can get started:

1. Choose a Crypto Exchange

Start by selecting a reputable exchange that supports ETH options, like the ones we listed above. Check whether the exchange is accessible from your jurisdiction and whether it supports the options you want to trade.

2. Deposit Funds Into Your Account

Once you choose your account, you need to complete any necessary KYC or verification steps. Next, you will be asked to deposit crypto (usually BTC, ETH, or USDT) or fiat currency, but this depends on the platform you choose.

On platforms like Deribit, ETH options are margin-settled in BTC. Always double-check what collateral is accepted.

3. Make Sure You Understand the Basics

Before you place a trade, it’s important to understand the derivatives and strategies that you plan to use, from call and put options to moneyness and implied volatility. Luckily, many of the top crypto options platforms offer helpful educational resources to help you get started. Deribit, for instance, has free tutorials and its detailed Options Wizard to help you choose the right strategy.

4. Develop a Strategy

There are many strategies for trading crypto options, some simpler, like the ones we listed above, and some more complex. Do your research and pick one based on your price expectation, time horizon, and risk tolerance.

5. If Available, Test with Paper/Copy Trading

Some platforms, like OKX, offer demo modes or copy trading features where you can simulate trades without risking real money and observe top-performing options traders.

If your platform doesn’t support this, consider starting with minimal capital to learn how this works.

6. Place a Trade and Monitor Your Position

If you’ve gone through the steps above, you are ready to place your trade. When you are ready, follow these steps:

- Select your desired expiry date and strike price

- Review the premium, max profit/loss, and break-even point

- Use limit orders to avoid slippage

- Monitor Greeks (Delta, Theta, Vega) and market moves

7. Manage Risk and Set Exit Plans

Remember, options can expire worthless. If you pick weekly options, for instance, at the end of the week, your capital will be gone if you don’t sell or exercise it before expiry. To protect it, you can use stop-losses or roll your position when the trade moves against you. You can also exit manually if the premium value spikes in your favor, even if the contract hasn’t expired. Many crypto options traders rarely exercise their options, choosing to sell them early.

The Risks of Trading Ethereum Options Explained

Ethereum options offer a powerful way to make a profit, but they are packed with risks, especially if you are an inexperienced trader. Here is what you should know before jumping in.

You Can Lose Your Entire Investment – and Fast!

If you buy call or put options and the market doesn’t move in your favor before expiration, your options can expire worthless. This means that you lose 100% of the premium you paid. This sometimes happens within minutes or a few hours if you are trading short-dated contracts. Stock options are incredibly risky, especially if you don’t know what you’re doing, and crypto options are generally even more risky, given the market’s inherent volatility.

For example, if you buy an ETH call option that expires today, expecting ETH to surge, but the price stalls or dips. Your option could be worth $0 in no time. This is not trading; it’s more like gambling. No one can reliably and accurately predict such short-term price movements. This is why most traders choose longer expiration dates,

Short-Dated Options = High Risk, High Decay

Ultra-short-term options like 1-day or weekly options come with intense theta decay (the loss of value over time). Even if ETH moves the way you want it, if it doesn’t move fast enough, your option might still lose value because of time erosion.

Crypto Volatility Can Also Be Your Enemy

Crypto is notoriously volatile, and Ethereum is no exception to this. Volatility is part of what makes options so attractive, but it also makes them extremely unforgiving. A single market event can cause a massive change in the price. The options pricing will react accordingly, often before you can act.

The Crypto Options Market Is Just Starting Out

Compared to traditional finance, the market for Ethereum options is still relatively small. This means fewer participants, lower liquidity, and wider bid-ask spreads. That makes it harder to get fair prices, especially if you are trading larger amounts or using more advanced strategies.

Thin liquidity also means greater slippage in many cases.

How to Manage Risk

Finally, here are a few important ways that crypto options traders use to manage risk:

- Start small: Don’t risk more than you are prepared to lose, especially in the beginning.

- Use long expirations: They are more expensive, but they can give you more time and lower theta decay.

- Avoid strategies you don’t understand: Don’t write options unless you know the risks.

- Practice: Start out with small investments or test your strategies with tools like the Option Wizard.

Conclusion

Ethereum options are not for beginners. However, with education, caution, and the right tools, you can learn to use them wisely and make a profit from them.

After a few trades, go back and analyze. What went right? Did your strategy fit your market prediction and budget? How did volatility and time decay affect your trade? Always be looking for mistakes and ways to improve your trading strategies.

Use the experiences to refine your trading framework. Derivatives are one of the most complex parts of crypto trading, so it takes some time and experience to master them.

Even though options can be profitable, don’t mistake these for a quick win. This is a high-risk product in a market that is already very volatile.