Solaxy, the sector’s first layer-2 network for the Solana ecosystem, has raised over $40 million from presale buyers. This innovative project offers unlimited scalability, near-zero transaction fees, and cross-chain compatibility, providing Solana Program Library (SPL) projects with superior performance metrics.

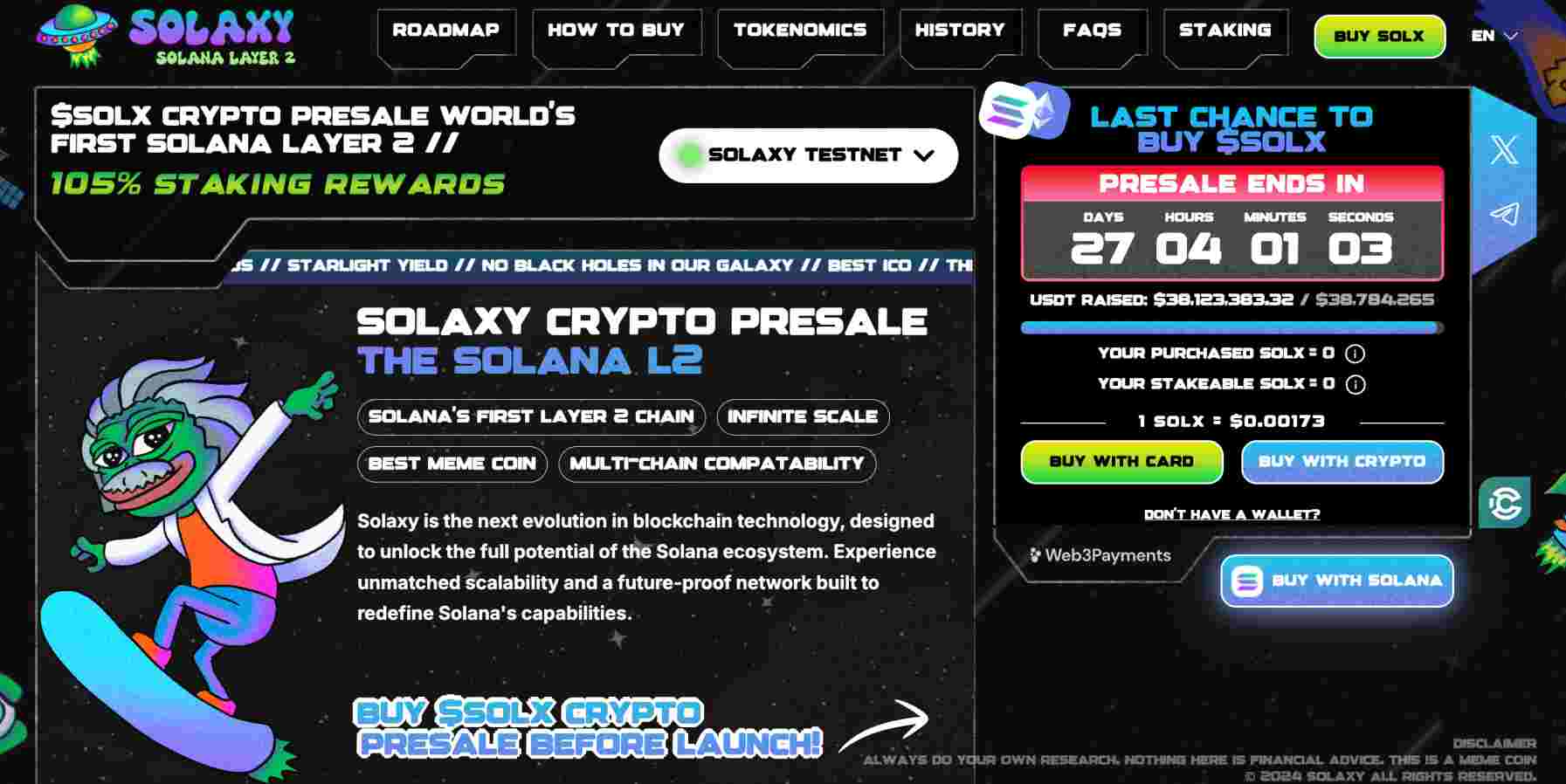

With under a month left in the crypto presale, investors have one last chance to buy $SOLX at a discounted price before the exchange launch. This guide explains how to buy Solaxy in under five minutes, how its layer-2 solution functions, and what utility $SOLX unlocks for the broader SPL arena.

How to Buy Solaxy – Quick Guide

Let’s start with a brief overview of how to buy Solaxy before the presale closes:

- Get a Non-Custodial Wallet – First, download a reputable crypto wallet that offers non-custodial storage. The presale supports the Ethereum and Solana networks, so ensure the wallet is compatible with one of these blockchain standards.

- Add a Payment Coin to the Wallet – Deposit one of the accepted payment coins into the crypto wallet: Ethereum ($ETH), Tether ($USDT), or Solana ($SOL). You can buy these cryptocurrencies with fiat money on an online exchange and in some cases, directly in the wallet interface.

- Connect to Solaxy – Visit the Solaxy website to connect your crypto wallet. Open the wallet to approve the connection request.

- Decide How Much $SOLX to Buy – Participants should assess their investment budget before placing their presale order. While 1 $SOLX is the minimum purchase requirement ($0.00173), you also need to cover network fees.

- Buy Solaxy – Select the payment coin, enter the purchase amount, and open the connected wallet to confirm the presale investment. You can claim your $SOLX tokens when the presale ends. Consider staking the tokens to earn passive rewards right away.

What Is Solaxy?

Solaxy is the first layer-2 sidechain built for the Solana ecosystem — the team created the network to streamline SPL transactions during all market cycles. Despite claiming to be the “made for mass adoption”, Solana has experienced multiple outages since the mainnet went live in 2020. These network issues arise when the broader markets turn bullish, as the ecosystem draws significant interest from meme coin speculators. The result is delayed and even failed transactions for extended periods.

Solaxy offers an alternative way to verify transactions. Its layer-2 ecosystem validates token movements off-chain and groups them into smaller batches. Those batches post to the main Solana blockchain for security verification. With Solaxy offering unlimited scalability, the outcome is 100% uptime, fastest transactions, and lower fees.

The project not only streamlines SPL transactions but also offers a range of additional Web 3.0 features. The Solaxy block explorer ensures a transparent ecosystem — all transaction details are posted in real-time, so stakeholders can track and analyze wallet movements. The network also has cross-chain features, including a decentralized bridge to the Ethereum blockchain. The team recently announced its “Igniter Protocol” feature, too, which enables users to create and launch their own SPL tokens.

As platform users need $SOLX to pay fees, the token offers real ecosystem utility, organic demand, and long-term price appreciation. $SOLX is also a staking token, with a dynamic 106% APY offered to presale investors.

How to Buy Solaxy – Complete Guide

Here’s a comprehensive walkthrough on how to buy Solaxy at presale prices.

Step 1 – Get a Non-Custodial Wallet

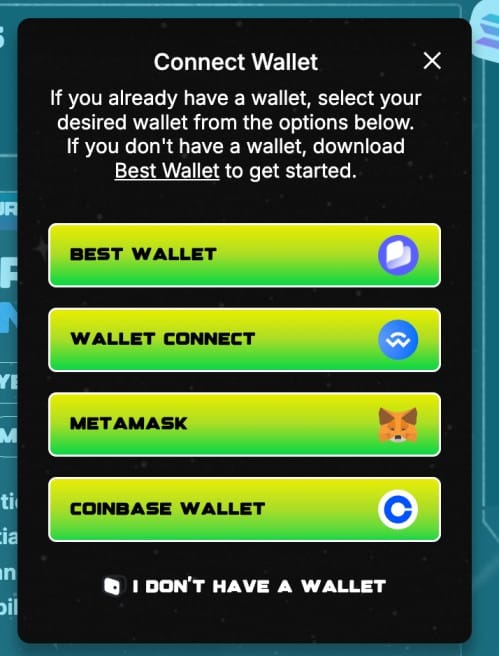

You need a crypto wallet to invest in the Solaxy presale event. The wallet will also store your $SOLX tokens until you’re ready to sell. Ensure the wallet provider offers non-custodial storage, a user-friendly interface, and support for the Ethereum or Solana blockchain, depending on which network standard you prefer.

Beginners prefer Best Wallet for its simple layout and institutional-grade security, plus support for over 60 blockchains (including Ethereum and Solana). We’ll explain how to buy Solaxy with Best Wallet, but you may also consider MetaMask, Phantom, Exodus, or Coinbase Wallet.

Visit the Best Wallet website to download its iOS or Android app. Then follow these steps to set up and secure Best Wallet:

- Enter and verify an email address

- Choose a strong PIN

- Write down the 12-word backup passphrase

- Activate biometrics (e.g., fingerprint ID)

- Activate two-factor authentication (2FA)

Step 2 – Add Crypto to the Wallet

You need to add some digital assets to the crypto wallet before investing in the Solaxy presale. Transfer $ETH, $USDT, or $SOL to the wallet if you already own a supported payment coin.

If not, you can buy $ETH with a credit card, debit card, e-wallet, or bank transfer on the Best Wallet app. The wallet supports over 20 local currencies, low fees, and an anonymous experience.

Tap the “Trade” button, then click “Buy.” Choose a currency, payment type, and purchase amount — ensure $ETH is selected as the receiving coin. Then securely enter and confirm the payment details, and $ETH shows in the Best Wallet balance right away.

Step 3 – Connect to the Solaxy Website

Visit the Solaxy presale wallet and tap “Buy SOLX”.

You’ll see a pop-up box that asks for the wallet provider — choose Best Wallet and open the app to confirm the connection request.

Step 4 – Decide How Much $SOLX to Buy

As an inclusive presale project, Solaxy lets participants buy any amount of $SOLX without minimum or maximum requirements. The final presale price is $0.00173 per $SOLX, so a $100 purchase yields over 57,000 tokens.

While some experts claim that Solaxy is one of the best layer-2 coins to buy, it’s a presale project without a mainnet product. Most features are still in development, so ensure you only risk amounts you’re comfortable losing.

Step 5 – Buy Solaxy

On the presale form, select the payment coin and the investment size — you’ll see the $SOLX equivalent appear.

Finally, open the Best Wallet app to confirm the presale investment. The app releases the payment coins to Solaxy, and you can claim your $SOLX tokens when the presale event ends.

Optional Step: Stake $SOLX Tokens

Presale investors already staked almost 11 billion $SOLX tokens, as early backers took advantage of the huge interest rates on offer. The APY is currently 106%, although a smart contract adjusts it based on how many tokens users stake.

If you want to stake $SOLX right away, click the “Staking” button followed by “Buy and Stake” (you don’t need to buy more tokens). You claim the staking rewards when the token generation event (TGE) goes live.

How Does Solaxy Work?

This section provides a more extensive explanation of how Solaxy works.

Layer-2 to Streamline Solana Transactions

The development team built a layer-2 network for the Solana blockchain. The primary use cases are more efficient and reliable transactions — SPL projects use Solaxy to achieve unlimited scalability, lower fees, and faster settlement speeds. Stakeholders avoid Solana’s constant network issues, as Solaxy ensures 100% uptime regardless of ecosystem demand.

A recent example was Solana’s meme coin rally in 2024, where waves of speculative tokens produced life-changing gains. The network couldn’t handle the sudden inflow of demand from traders, bots, and market makers, with a reported 75% of transactions failing over several days.

Cross-Chain Functionality

Solaxy also offers cross-chain functionality with the ERC-20 standard— this means the layer-2 network connects with Ethereum, the world’s largest ecosystem for decentralized applications (dApps).

One use case for Solana stakeholders is access to Ethereum’s growing decentralized finance (DeFi) base, including dApps for liquid staking, lending, and secured loans.

Igniter Protocol

The Igniter Protocol is Solaxy’s latest product, announced recently on the project’s X page. The Protocol offers a consumer-friendly launchpad service — $SOLX holders can create new cryptocurrencies without programming knowledge.

Creators select a project name, ticker symbol, and image, and those tokens launch on the blockchain automatically. This feature is another utility-driven use case that can drive demand for $SOLX.

$SOLX – The Native Crypto of Solaxy

Solaxy has created several use cases for the native token, $SOLX. This section explains how $SOLX provides utility for ecosystem users.

Network Fees

The Solaxy network uses $SOLX as the gas payment currency, similar to layer-2s on Ethereum, Bitcoin, and other blockchains.

All transactions require fees, including wallet transfers and smart contract requests for token swaps, DeFi yields, and other dApp uses. This payment structure ensures that $SOLX demand increases and its layer-2 ecosystem attracts more dApps, platform users, and total value locked (TVL).

Staking

Solaxy uses the proof-of-stake consensus mechanism to ensure fast, scalable, and cost-effective transaction settlement. $SOLX holders stake their tokens to keep the network secure and decentralized, and earn passive rewards.

Staking payouts adjust dynamically and are distributed over three years to ensure token sustainability.

dApp Development

Analysts confirm that a growing dApp ecosystem is crucial for the $SOLX price. The ecosystem focuses on utility dApps that provide real long-term value, so it moves away from Solana’s meme coin-heavy ethos. dApps include the fastest-growing Web 3.0 concepts like DeFi 2.0, gamification, NFT collections, and AI models.

The team has allocated a portion of $SOLX tokens for incentives as it aims to encourage top developers to build and operate dApps. While those tokens dilute the overall supply, they contribute to the project’s long-term vision of becoming a leading Web 3.0 platform.

Governance

The whitepaper mentions that $SOLX may be used as a governance token, so holders can vote on important project developments. This use case isn’t confirmed yet, although it would make the Solaxy network more inclusive and democratic.

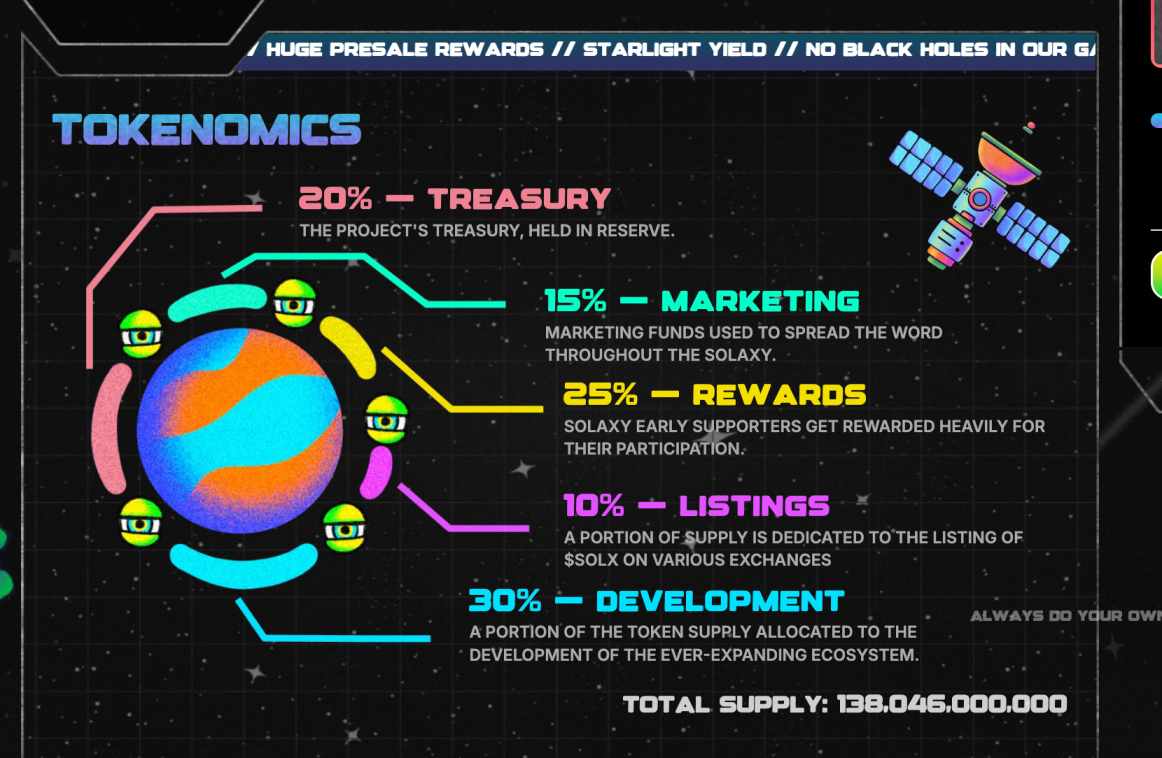

A Look Into Solaxy Tokenomics

As verified by a Coinsult contract audit, the total $SOLX supply is capped at 138,046,000,000. $SOLX is initially an ERC-20 token but will likely migrate to Solaxy’s native standard when the mainnet launches.

Here’s how the team will allocate the $SOLX supply after the presale ends.

Development – 30%

The largest token allocation goes to development. The funds enable the core team to build and secure the layer-2 network, dApp ecosystem, and Igniter Protocol. The whitepaper suggests that new products and features will launch over time, so the 30% reserve ensures sufficient capital for long-term upgrades and improvements.

Rewards – 25%

Solaxy implements a rewards-heavy approach to encourage early network adoption. This allocation includes presale incentives, where early backers earn competitive APYs while they lock their tokens in the staking pool.

Ecosystem adopters, including dApp users, also earn $SOLX rewards, although the whitepaper provides little information about how the tokens are distributed. Some $SOLX tokens are reserved for developer incentives, too, encouraging the sector’s best programmers to choose Solaxy.

Treasury – 20%

Approximately 27.6 billion $SOLX goes to the project treasury, which provides the founders with capital for business operations, strategic partnerships, and talent acquisition.

Marketing – 15%

The blockchain market is highly competitive, so the team has allocated 15% of the $SOLX supply for marketing. The marketing campaign targets user acquisition and ecosystem expansion, helping to drive daily transaction activity and $SOLX demand.

Listings – 10%

A small percentage of tokens are used for exchange liquidity. The team provides decentralized and centralized exchanges with $SOLX to ensure stable market conditions, favorable slippage, and sufficient trading volumes for future listing applications.

What Lies Ahead for Solaxy?

Solaxy’s roadmap runs over three core phases:

- Presale Process: The presale provides Solaxy with operating capital for project development, business operations, marketing, and other company requirements. This roadmap phase also includes activation of the presale staking pool.

- TGE, Bridge, and Listings: In the second phase, the team launches $SOLX tokens on exchanges. Some products go live, too, including the cross-chain bridge and blockchain explorer.

- Solaxy Deployment: The final roadmap phase releases the mainnet layer-2, so SPL projects can bridge to Solaxy to streamline transactions. The Igniter Protocol also launches, which enables $SOLX holders to create and launch new cryptocurrencies.

The whitepaper doesn’t provide specific roadmap deadlines, so it’s best to stay updated on the Solaxy X page.

What Factors Could Drive the Solaxy Price in the Future?

Here’s what project and market forces contribute to the $SOLX price after the TGE.

Presale Raise

The presale raise determines how much operating capital the team has access to, including product development and partnerships. Solaxy has raised over $38 million so far, so it already has a massive war chest to meet its roadmap goals.

Three weeks remain before the presale ends, so the final raise could be significantly more.

TGE Platform and Price

The TGE refers to the initial exchange listing after the presale finishes. The team plans to list $SOLX on decentralized exchanges (DEX) like Uniswap, the norm for new ERC-20 launches. They also aim for centralized exchanges — securing major platforms like OKX and Crypto.com is highly beneficial for the $SOLX price. Tier-one exchanges provide new projects with a stamp of approval, as only a small percentage of the broader market trades on them.

The TGE price is also important. The founders must balance presale incentives with sustainability — a listing price could prompt early backers to sell at the TGE. While a low TGE price might result in reduced presale funding.

Ecosystem Adoption

$SOLX’s value comes from real ecosystem adoption — platform users purchase tokens to access reliable and efficient transactions, Web 3.0 dApps, and the launchpad tool. The $SOLX price may align with daily active user growth, TVL, and dApp expansion.

Investors can monitor these metrics after the main net launch. Consistent growth is crucial for $SOLX to become the next 1000x crypto.

Market Conditions

With a $2 trillion market capitalization, Bitcoin ($BTC) represents over 60% of the broader crypto market — a significant amount when you factor in the millions of digital assets that exist. This dynamic means that the $BTC price influences the wider altcoin space — a strong Bitcoin performance increases capital flows into smaller projects, and vice versa when prices decline.

According to most financial analysts, the $BTC price will record multiple all-time highs in 2025. Standard Chartered predicts a $250,000 peak, valuing the world’s largest crypto at almost $5 trillion. This outcome could attract unprecedented inflows into undervalued startups like Solaxy.

Solaxy Price Prediction

Solaxy founders have set the final presale price at $0.00173 per token, providing the project with a TGE market capitalization of about $239 million. This is the fully diluted valuation (FDV), and it includes the full 138,046,000,000 supply — a majority of tokens will be locked initially to protect the broader ecosystem.

With the TGE launch scheduled in about three weeks, an initial price rally is possible. Broader markets are bullish, Bitcoin trades near previous highs, and the Solaxy presale is on track to surpass $40 million. The team holds a substantial marketing budget, allowing it to promote the TGE event across crypto media sites and social networks. All factors considered, the $SOLX price could reach $0.012456 in Q4 2025. This prediction gives the project a $1.7 billion FDV and TGE gains of over 7x.

The mainnet release in 2026 enables the $SOLX price to reach new heights. Growing dApp adoption and TVL growth may see Solaxy reach a $6.8 billion FDV and a 52-week high of $0.049824.

Solaxy Socials

Join these channels to keep tabs on the Solaxy presale and get real-time development updates:

Conclusion

The Solaxy presale will end soon, but there’s still time to join. It takes minutes to participate and secure a discounted price. All you have to do is connect a wallet and swap $ETH, $USDT, or $SOL.

The layer-2 network for Solana has already raised over $40 million, making it one of the biggest presale events this year.

FAQs

What is Solaxy?

What use cases does $SOLX offer?

How many $SOLX tokens are there?

How to invest in Solaxy?

When will I receive my $SOLX tokens?

References

- Solaxy whitepaper (Solaxy)

- Memecoin mania drives Solana toward all-time highs (Solana)

- Nearly three-quarters of Solana transactions have failed throughout March amidst rising DEX volume (FXStreet)

- Web 3.0 market size, share, and trends 2025 to 2034 (Precedence Research)

- Bitcoin could soar 266% to $250,000 next year if ETF inflows stay strong, Standard Chartered says (Business Insider)