The Bitcoin Hyper ($HYPER) presale has attracted significant media and investor attention, with over $1.0M raised so far. The fundraising campaign offers access to $HYPER, the native token that backs a new layer-2 initiative for the Bitcoin blockchain.

This guide provides a Bitcoin Hyper price prediction for 2025 to 2030. Learn where the $HYPER price is headed after the presale event and why some analysts rate the layer-2 token as the next billion-dollar gem.

Bitcoin Hyper Price Prediction

$HYPER unlocks decentralized finance (DeFi) solutions for $BTC investors and provides faster and more cost-effective transactions. How will it fare in the market? Read on to explore the $HYPER price potential in the short and long term.

Bitcoin Hyper Price Prediction 2025

Bitcoin Hyper must complete its fundraising campaign before $HYPER tokens launch on public exchanges. The initial presale price was $0.011500, and each stage lasts for three days, or until that token allocation is sold. The presale structure ensures that early participation is rewarded, as the $HYPER price rises as each stage completes.

The $HYPER whitepaper shows that the presale ends in Q3 or Q4 2025, when the team initiates the token generation event (TGE) in line with broader market conditions. Strong market sentiment is preferred to give $HYPER the best chance of delivering an immediate rally.

While the team announces the specific listing date closer to the presale’s conclusion, they’ve confirmed the exchange launch price is $0.012975. The total token supply of 21 billion $HYPER means the project launches with a $272 million market capitalization, providing sufficient upside for long-term holders.

Moving on to broader market expectations, Fundstrat’s Tom Lee predicts Bitcoin will reach $150,000 by the year’s end. A CNBC study shows that participants price Bitcoin in the $200,000 to $250,000 range, although macroeconomic policy plays a crucial role, including Federal Reserve interest rates and U.S.-China relations.

The consensus is that Bitcoin may record multiple all-time highs in 2025, altcoin valuations will breach previous peaks, and the $BTC dominance drops below 50%.

These predictions provide the perfect platform for $HYPER’s TGE, since investors may possess a much higher risk appetite, particularly from the institutional segment. We anticipate that Bitcoin Hyper closes the year at $0.080445, reflecting a 6.2x gain from the TGE and a fully diluted market capitalization of about $1.6 billion.

Bitcoin Hyper Price Prediction 2026

Web 3.0 analysts predict that 2026 could be a significant period for Bitcoin Hyper. The whitepaper shows that all development milestones will be live by Q1 at the latest. Once the ecosystem opens, $BTC holders may migrate to Bitcoin Hyper to access much lower fees, faster transactions, and a more energy-efficient footprint.

The layer-2 platform will also have fully-fledged dApps in 2026, delivering real value to the Bitcoin community. Analysts predict that dApps may include staking, lending, and asset tokenization — popular Web 3.0 features that the Bitcoin blockchain lacks. Other key niches include gamification and decentralized physical infrastructure network (DePIN) services, such as cloud and data storage.

The important takeaway is that all Bitcoin Hyper transactions require $HYPER for network fees, and in some cases, to access premium dApps. This demand-centric framework creates real adoption, where stakeholders purchase $HYPER to access real products and services rather than purely for speculative gains.

In terms of our Bitcoin Hyper price prediction for 2026, the bullish case again relies on strong market sentiment. Analysts’ ratings suggest a broad $BTC range of $200,000 to $500,000, which assumes continued buying pressure on a government and institutional level, and rising adoption in the retail space. This outcome could see $HYPER reach a $4.6 billion valuation, pricing the token at $0.220575 and delivering 17x growth based on the TGE rate.

The bearish outcome revisits the historical four-year cycle, which suggests crypto valuations peak in late 2025 or early 2026, before they enter a prolonged downturn. This cycle stage has seen Bitcoin drop 70-80% from its peak, with altcoins producing even bigger declines. This scenario would hinder $HYPER’s growth potential, with the token potentially dropping to lows of $0.0402298.

Bitcoin Hyper Price Prediction 2030

Some presale participants are short-term traders who target quick gains before moving onto the next opportunity, yet the biggest growth potential often comes when holding long-term.

Polygon ($MATIC) highlights this point. As one of the first layer-2 solutions for the Ethereum blockchain, Polygon was an unknown entity when it raised funds in 2019. Those who risked capital on Polygon in the seed round paid just $0.00079 per $MATIC and the token price reached $2.92 at its all-time high, reflecting growth of almost 370,000%.

Some analysts predict a similar price trajectory for $HYPER, although, unlike Polygon, the initial fundraising event is open to the public. This means that even retail investors with small budgets can gain exposure to Bitcoin Hyper from the ground up.

The key focus for analysts is ecosystem adoption. Similar to other layer-2 networks, Bitcoin Hyper generates revenue from network fees, paid by platform users whenever they transact. The correlation between adoption growth and the $HYPE price is clear — the ecosystem attracts more network activity as it onboards more dApps. By 2030, the Bitcoin Hyper platform may host thousands of dApps, including DeFi protocols, derivative exchanges, and lending solutions for the Bitcoin community.

The network also serves Bitcoin holders who want to transact more efficiently, with analysts citing its single-second transfer times and significant cost savings.

All factors considered, our Bitcoin Hyper price prediction for 2030 is a potential all-time high of $0.531975. This projection values the project at approximately $11 billion and yields a 41x gain from the presale launch price.

A Look at the Bitcoin Hyper Presale & Tokenomics

The Bitcoin Hyper presale launched in the second week of May 2025. The event was an immediate success, as the team raised over $100,000 in the first 24 hours. Those who bought $HYPER in the first stage paid $0.011500 per token, as the price increases every few days. This presale system provides all participants with a slight upside before the TGE, although the gains are marginal, which ensures a sustainable supply and discourages short-term speculation.

The presale investment process requires a non-custodial wallet and a supported payment coin. Bitcoin Hyper accepts Ethereum ($ETH) and Tether ($USDT). Participants connect their wallet to the presale website, enter the purchase size, and approve the smart contract request.

The claim window opens at the TGE, and the team sends $HYPER tokens to the same wallet address used to participate. While $HYPER is locked until the presale ends, you can stake your tokens to earn passive rewards. this process increases your holdings without requiring additional investment. Be aware that a seven-day grace period applies to staked tokens, so they unlock a week after the TGE goes live.

What Is Bitcoin Hyper?

Bitcoin Hyper is a new crypto startup in the layer-2 niche. It offers a decentralized sidechain for the original Bitcoin blockchain, providing $BTC holders with a more efficient transaction framework.

Here’s the existing issue: Bitcoin transactions take 10 minutes to verify, and fees are often high, making $BTC unsuitable as a medium of exchange. The blockchain lacks scalability capabilities, too, with Bitcoin limited to seven transactions per second. These performance metrics do not align with Satoshi Nakamoto’s Bitcoin whitepaper, since the pseudonymous developer created $BTC as a “peer-to-peer electronic cash system”.

Bitcoin Hyper’s solution is a layer-2 network built on the Solana Virtual Machine. It streamlines $BTC payments to single-second settlements, sub-cent fees, and scalability in the thousands of transactions per second. The network, which also reduces energy consumption by over 99%, supports $BTC deposits via a canonical bridge. The protocol locks the user’s $BTC in a secure smart contract and releases it instantly when they request a withdrawal.

Bridging $BTC to Bitcoin Hyper also unlocks an entire ecosystem of dApps, since the network supports smart contracts, unlike Bitcoin. This feature lets Bitcoin holders maximize the return on investment through DeFi tools like lending, yield farming, and staking. Bitcoin Hyper dApps also covers play-to-earn gaming, NFT ownership, asset tokenization, and other popular crypto services.

Factors That Will Determine the Price Performance Of Bitcoin Hyper

These variables play a crucial role in $HYPER’s price potential in 2025 and beyond.

1. Presale Success

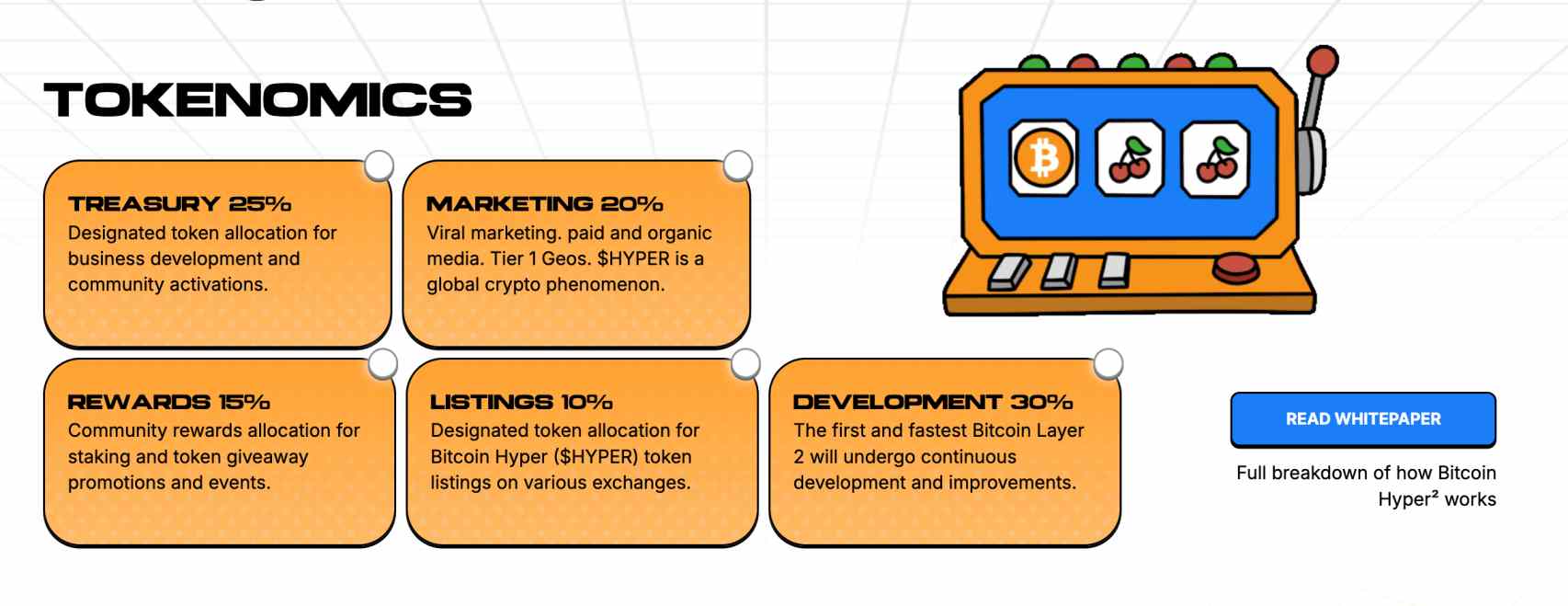

The presale event carries significant importance for Bitcoin Hyper. It enables the project to raise startup capital and provides much-needed resources for the development team. The layer-2 network and dApp ecosystem are under development, so a sufficient treasury ensures roadmap targets are reached on time and that the mainnet product meets market expectations.

The team also allocates presale funds to other core areas, including marketing, developer grants, and community rewards. The whitepaper doesn’t state a presale target, although early backers have invested about $192,000 in the initial few days. This figure suggests that Bitcoin Hyper may raise several million dollars before the TGE.

2. Market Conditions at the TGE

The founders understand the importance of launching the TGE when broader market conditions are strong. The whitepaper confirms that the TGE happens in Q3 or Q4 2025 as per wider crypto sentiment, so the exchange launch may happen in July at the earliest.

The ideal launch period aligns with altcoin season, where smaller-cap cryptocurrencies vastly outperform the market leaders. Investors increase their risk tolerance to find the next 100x altcoins, which may lead to rising demand for $HYPER.

3. Roadmap Goals

While Bitcoin Hyper is a utility project that offers real value to the $BTC community, its core product is in the development and testing phases. The roadmap states that the mainnet launch happens in Q3 2025. Meeting this milestone on time may push the $HYPER price to substantial heights after the TGE, especially if broader crypto sentiment is high.

Bitcoin Hyper also benefits from rising demand as the ecosystem grows. Stakeholders need $HYPER tokens for gas fees and to unlock premium dApps. The team plans to onboard dApps from DeFi, gaming, and NFTs in Q4 2025 and offers financial incentives to attract the sector’s best Web 3.0 developers.

Altcoin Market Cycles and Narratives

While past performance does not guarantee future results, the Bitcoin and altcoin markets have historically moved in four-year cycles.

The cycle starts with the Bitcoin halving event, where the $BTC mining reward is reduced by 50%, making the world’s largest digital asset scarcer. The $BTC price rallies for several months, with new all-time highs recorded and altcoin valuations also rising.

The next stage sees $ETH outperform $BTC for extended periods, and Bitcoin’s dominance declines, with increased capital shifting to higher-risk altcoins. The final stage is altcoin season, which typically lasts for 2-3 months and results in parabolic growth for most projects. The cycle ends when the altcoin season peaks. An extended bear market follows, and many cryptocurrencies lose substantial amounts, often at least 80% from the all-time high.

Monitoring popular narratives enables investors to maximize returns from the bull cycle. These investing categories, niches, or stories attract significant attention, and generally outperform the broader altcoin benchmarks. Analysts predict that layer-2 solutions like Bitcoin Hyper (Bitcoin), Arbitrum (Ethereum), and Solaxy (Solana) may perform well during the next altcoin season, as rising sector adoption demands higher scalability and lower fees.

DeFi is another narrative, particularly protocols prioritizing user-friendly interfaces, institutional-grade security, and sustainable investment yields. Substantial investment is also entering the real-world asset (RWA) tokenization narrative, where conventional assets like commodities, real estate, and government securities are tokenized on the blockchain.

Crypto narratives are often unpredictable and shift quickly, so keeping tabs on market developments is crucial.

Bitcoin Hyper Price Potential – A Case Study

While Bitcoin Hyper price predictions are speculative, the project shares similarities with other innovative crypto startups. One example is Arbitrum ($ARB), the popular layer-2 solution for the Ethereum blockchain.

Arbitrum raised funds from early backers in April 2019, over 30 months before the mainnet network opened to the public. The network promised lightning-fast transactions for ERC-20 projects at a fraction of Ethereum’s gas fee, with scalability rising to thousands of transactions per second.

The Arbitrum team sold $ARB for just $0.004648 in the initial round. The token price climbed to $2.40 in January 2024, reflecting gains of over 51,000%. This price trajectory means a $1,000 investment during the seed round stage could be worth over $515,000 at the market peak.

Bitcoin Hyper offers a similar opportunity, although unlike Arbitrum, there’s no seed round for institutional investors and strategic partners. Anyone can join the Bitcoin Hyper presale and buy $HYPER tokens at a pre-listing discount. The minimum investment requirement is under a cent, and no ID document is needed.

Some analysts argue that Bitcoin Hyper’s market reach is much bigger than Arbitrum’s, as it serves the sector’s largest and most valuable asset, Bitcoin. $BTC commands a $2 trillion market capitalization, almost seven times that of Ethereum.

Is Bitcoin Hyper a Good Investment?

Here’s why Bitcoin Hyper could be one of the best layer-2 cryptocurrencies to buy in 2025.

Invest From the Ground Up

The most successful blockchain projects, including Polygon, Arbitrum, Solana, and Avalanche, offered preferential prices to seed round investors. These investment rounds leave retail clients at a disadvantage, since they’re open only to pre-approved buyers who can meet large-scale investment minimums. The result is that retail clients pay a much higher price when the public round opens.

Bitcoin Hyper eliminates these unfair practices. Its presale event is open to anyone with a crypto wallet and some $ETH or $USDT. Everyone benefits from an early price discount and a first-mover advantage, so casual investors can experience the full growth cycle.

Provides Real Solutions for Bitcoin

While most new crypto launches are speculative meme coins without use cases, Bitcoin Hyper is a legitimate utility project that provides real solutions to the Bitcoin blockchain.

Its canonical bridge turns Bitcoin into a medium of exchange. Transactions take seconds to verify regardless of where the sender and receiver are located. Sub-cent fees ensure viable micro-transfers and the layer-2 network increases scalability from seven to thousands of transactions per second.

The project also enables $BTC holders to access dApps in the DeFi, NFT, and gamification markets.

Demand-Driven Token Use Cases

Most cryptocurrencies in the top 100 by market capitalization have a common denominator, namely that their underlying token offers demand-driven utility. Bitcoin Hyper is no different. Those who bridge to the layer-2 network need $HYPER tokens for gas fees and to access premium features. As stakeholders buy $HYPER to unlock proprietary services, rising demand helps drive the token price in the long run.

Earn Passive Rewards During the Presale

The presale event enables participants to stake their tokens right away. A smart contract adjusts the staking APY based on demand, so the highest rates are available in the early presale phases.

Those staking $HYPER today earn 2.2% APYs and the tokens unlock just seven days after the TGE. Staking long-term increases $HYPER holdings significantly without needing further investment.

How To Buy Bitcoin Hyper – Quick Guide

While we have a separate article on how to buy Bitcoin Hyper, here is a summarized walkthrough:

- Ensure you have a non-custodial wallet funded with $ETH or $USDT

- Visit the Bitcoin Hyper website and connect the wallet

- Select the payment coin and enter the purchase amount

- Open the connected wallet to approve the transaction

- Return to the Bitcoin Hyper website after the presale to claim your $HYPER tokens

Bitcoin Hyper Social Media Handles

Stay updated on Bitcoin Hyper developments by joining the project’s social channels:

Our Verdict

The $HYPER presale offers a rare opportunity to invest in a real utility project from the ground up. It’s open to all investors rather than select institutional or strategic partners, so everyone gets a first-mover advantage.

Bitcoin Hyper’s layer-2 ecosystem offers huge potential, as it enables $BTC holders to reduce fees, increase speed, and access Web 3.0 dApps. For these reasons, our $HYPER price prediction for 2025 is $0.080445, while the long-term forecast is an all-time high of $0.220575 by the decade’s end.

FAQs

What is Bitcoin Hyper?

Bitcoin Hyper’s a layer-2 network on the Solana Virtual Machine. It serves the original Bitcoin blockchain with more efficient transactions and access to Web 3.0 dApps like staking and NFTs.

Will the $HYPER price go up in the coming year?

After its TGE launch price of $0.012975, $HYPER could hit $0.080445 by the end of 2025.

References

- Bitcoin Hyper whitepaper (Bitcoin Hyper)

- Bitcoin is about to clear a big overhang, and the crypto will recover from its slump to reach $150,000 by year-end, Fundstrat’s Tom Lee says (Business Insider)

- The boldest bitcoin predictions for 2025 are in — and most see prices doubling to $200,000 (CNBC)

- Bitcoin cycles, entering 2025 (ARK Invest)

- Bitcoin: A peer-to-peer electronic cash system (Bitcoin Whitepaper)

- Real-world assets (RWAs) explained (Chainlink)