After testing a range of crypto copy trading platforms, we found that MEXC, OKX, and Binance offer the best experiences for most people.

MEXC stood out for its massive selection of lead traders, more than any other platform we tested, along with detailed stats and filters that make it easy to find traders by ROI, risk score, asset type, and more. If you want choice and data, this is where to start.

OKX offers the most user-friendly experience, especially for beginners. Its copy trading interface is clean, and it clearly displays each trader’s win rate, PnL history, and risk profile. It’s a solid option if you want transparency without complexity.

Binance combines copy trading with the largest and most liquid crypto exchange in the world. You’ll get access to top-performing traders across both spot and futures markets, along with robust filtering tools and the trust that comes with a household name in crypto.

We focused on ease of use, trader transparency, platform reliability, and overall value. In this guide, we compare these top contenders, along with a few others, to help you choose the best crypto copy trading platform for your style, budget, and risk appetite.

The Top 6 Crypto Copy Trading Platforms Unveiled

Below, we rank the top cryptocurrency copy trading platforms, with reviews of each to follow.

- MEXC – Best for Cryptocurrency Selection

- OKX – Best for Trading Bots

- Binance – Best for DCA Copy Trading

- Bybit – Best for Diverse Asset Trading, Including TradFi

- BingX – Best for New Traders

- Kucoin – Best for Trending Altcoins

The 6 Best Crypto Copy Trading Platforms in 2025 Reviewed

We reviewed the top 6 cryptocurrency copy trading platforms, comparing features, customizability, user-friendliness, and more. We also considered various essential criteria, including the number of traders, trading pairs available for copy trading, and fees. Let’s start with our top pick.

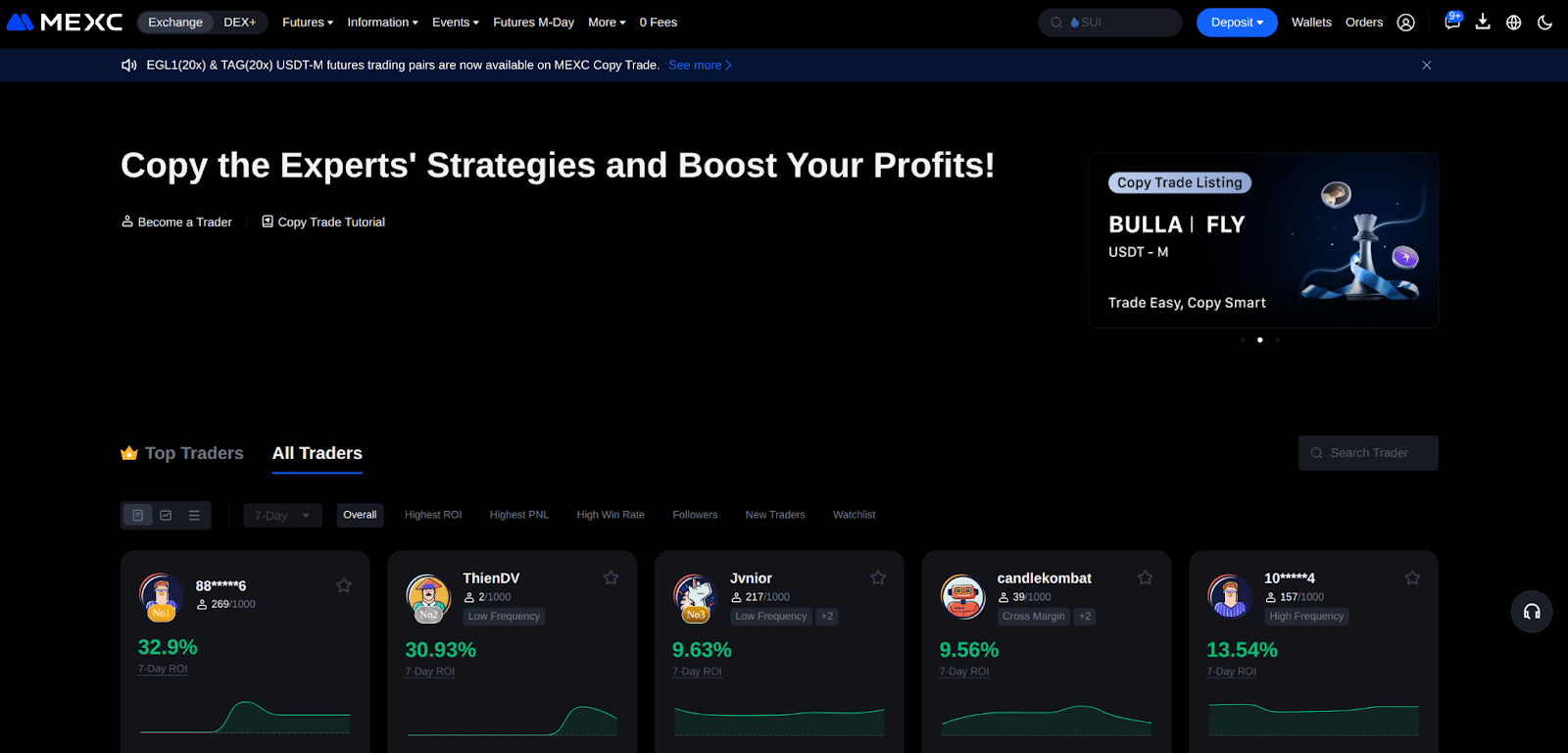

1) MEXC – Best for Cryptocurrency Selection

What is the best platform to trade crypto? For many traders, the answer is MEXC. With nearly 3,000 cryptocurrencies available, MEXC offers one of the largest selections in crypto. The platform also provides a vibrant perpetual futures trading platform with up to 500x leverage on key pairs. This combination of trading tools and variety provides rocket fuel for a growing number of lead traders on the platform.

Copy trading is limited to futures pairs, allowing the prudent use of leverage to maximize trade profitability. Copy traders can also limit their exposure to more volatile cryptocurrencies by selecting preferred pairs for each lead trader they follow.

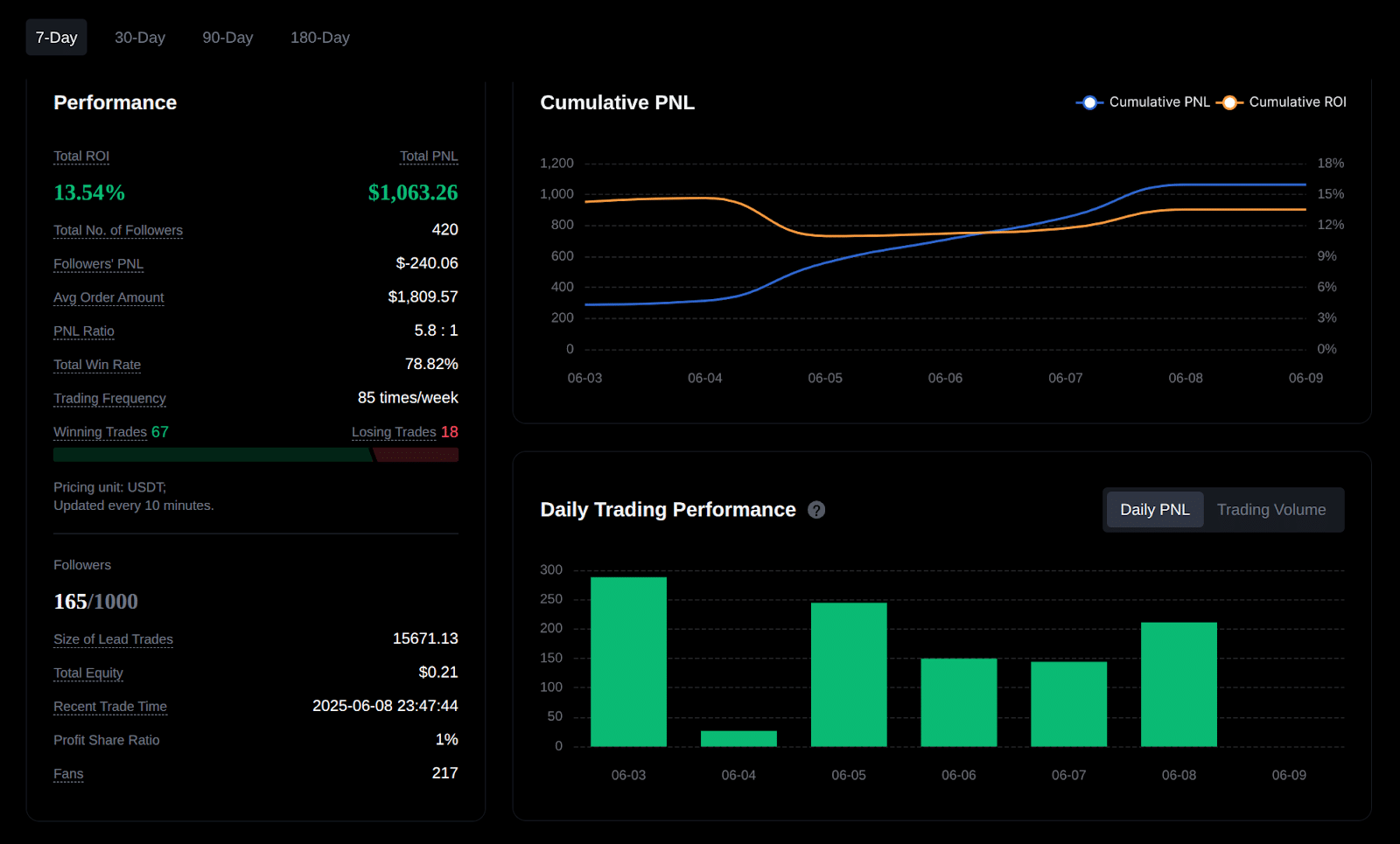

MEXC provides detailed stats for each lead trader, including performance against market trends for up to 180 days and return on investment. Charts show historical performance at a glance.

Often, copy trading is about learning from experienced traders. MEXC also offers a demo account where you can test your trading strategies against real-world markets without risking real money.

MEXC Copy Trading Features

| Feature | MEXC Copy Trading Details |

| Availability | Global with some restrictions |

| Supported Trading Types | Spot, Futures (only futures for copy trading) |

| Follower Control/Customization | Customizable copy settings (adjustable leverage, position size, leverage type) |

| Lead Trader Selection/Transparency | Categorized leaderboard with performance metrics |

| Profit Sharing (for Lead Traders) | Yes, variable percentage |

| Unique Features | Non-mandatory KYC for up to 10 BTC daily withdrawal, extensive token selection |

Pros

- Nearly 3,000 cryptocurrencies

- No KYC requirement (10 BTC daily withdrawal limit)

- Low trading fees

- 200x and 500x leverage options

Cons

- Limited fiat access

- May be complex for new traders

- Limited native trading bot support

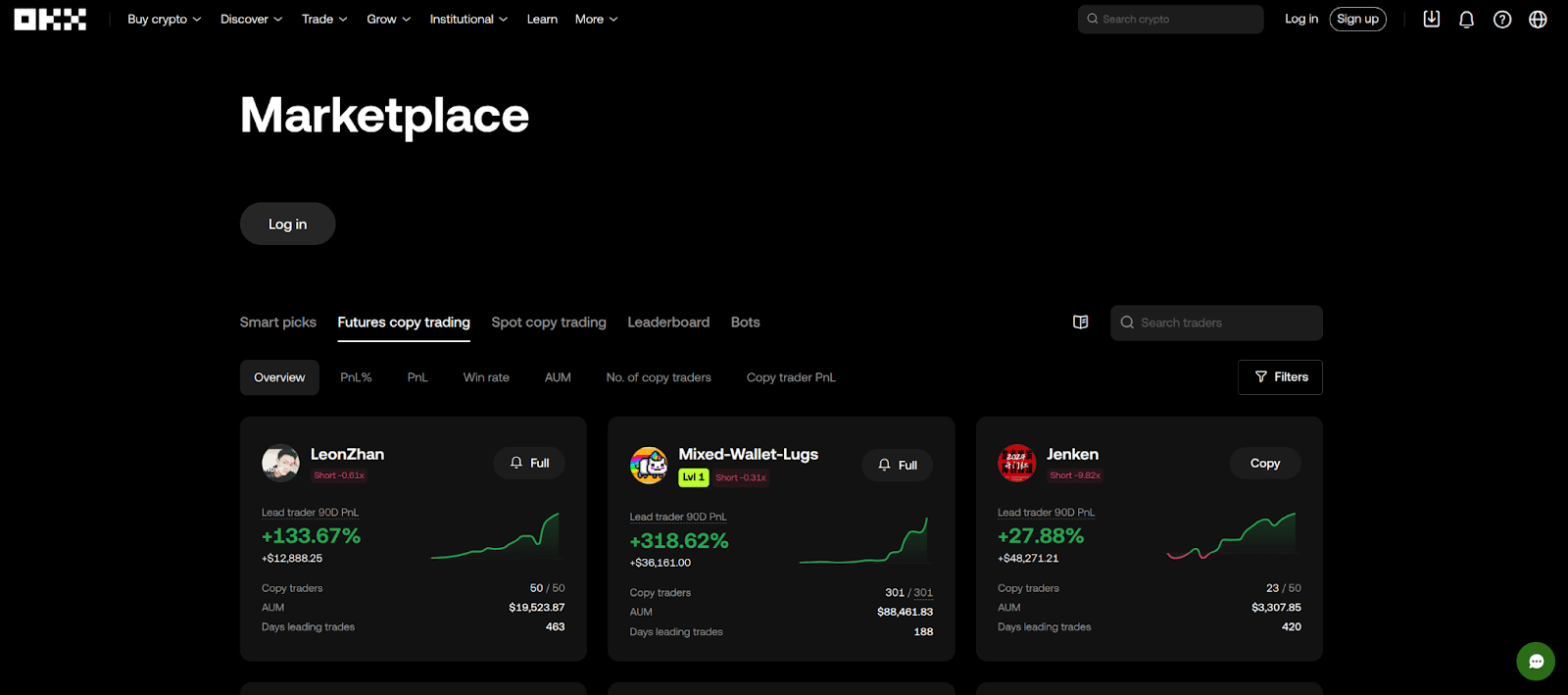

2) OKX – Best for Trading Bots

With 300+ cryptocurrencies, OKX benefits from high trading liquidity in key pairs. The platform supports copy trading for both spot and futures trades, as well as copy-trade bots. A variety of other trading tools, including crypto options, give traders opportunities to explore outside of copy trading.

OKX became well-known for its no-risk demo account and its impressive trading bots. Trading bots include a curated selection from OKX as well as bots designed by users, some of which are revenue sharing (the lead trader earns a percentage of profit). However, the platform also hosts a growing copy trading community featuring both spot market and futures trading, targeting various market trends.

By default, OKX displays 90-day performance for lead traders, providing a more meaningful snapshot of longer-term performance. Even given this longer time frame, many of the featured traders boast impressive trading profits of 300% or more. You can also compare spot trading performance with futures performance for each trader.

OKX Copy Trading Features

| Feature | OKX Copy Trading Details |

| Availability | Global with some restrictions |

| Supported Trading Types | Spot, Futures, Trading bots |

| Follower Control/Customization | Enter/exit positions independently |

| Lead Trader Selection/Transparency | Transaction histories, P&L, risk levels. Advanced filtering (AUM, win rate, PnL%, # of followers) |

| Profit Sharing (for Lead Traders) | Yes, lead traders receive a percentage of profits |

| Unique Features | Demo account, Trading bots (free, revenue share, monthly fee) |

Pros

- Advanced trading tools, including options

- Wide selection of trading bots

- Low trading fees

- Direct fiat deposits (varies by region)

- No-risk demo trading account

Cons

- Complex for beginners

- Limited fiat withdrawals

- KYC strictly enforced

3) Binance – Best for DCA Copy Trading

As the world’s largest crypto exchange by trading volume, Binance offers a well-developed copy trading platform that features both spot and futures trading. The platform’s massive trading volume helps ensure unparalleled liquidity in top trading pairs for smooth trading, essential for leveraged trades and volatile pairs.

Binance also supports mock copy trading through its demo account. Test lead performance without risking real funds. This, combined with detailed trader stats, provides a way to compare performance over time to select a lead trader that matches your trading goals.

The platform supports invite-only portfolios for followers and fixed amount or fixed ratio allocations. However, one of the most popular features is Auto Invest for Copy Trading. This allows followers to dollar cost average (DCA) into a larger position according to a budget they define.

Binance’s scale brings several advantages compared to smaller platforms, ranging from a wider selection of traders to hard-to-find tools like expiry futures and crypto options trading. Learn the ropes as a copy trader and then expand to other trading tools.

Binance Copy Trading Features

| Feature | Binance Copy Trading Details |

| Availability | Global with some restrictions |

| Supported Trading Types | Spot, Futures, and Mock Copy Trading |

| Follower Control/Customization | Set investment amount with trade size adjusted proportionally. Follow up to 10 lead traders using Mock Copy Trading |

| Lead Trader Selection/Transparency | ROI, trading history, strategies, pairs |

| Profit Sharing (for Lead Traders) | Yes, lead traders earn a share of profits |

| Unique Features | Mock Copy Trading with up to 10 lead traders |

Pros

- High liquidity and fast execution

- Spot and futures copy trading

- Mock copy trading

- DCA features for copy traders

- Private portfolios for followers

Cons

- Regulatory challenges

- KYC enforced

- Complex trading platform

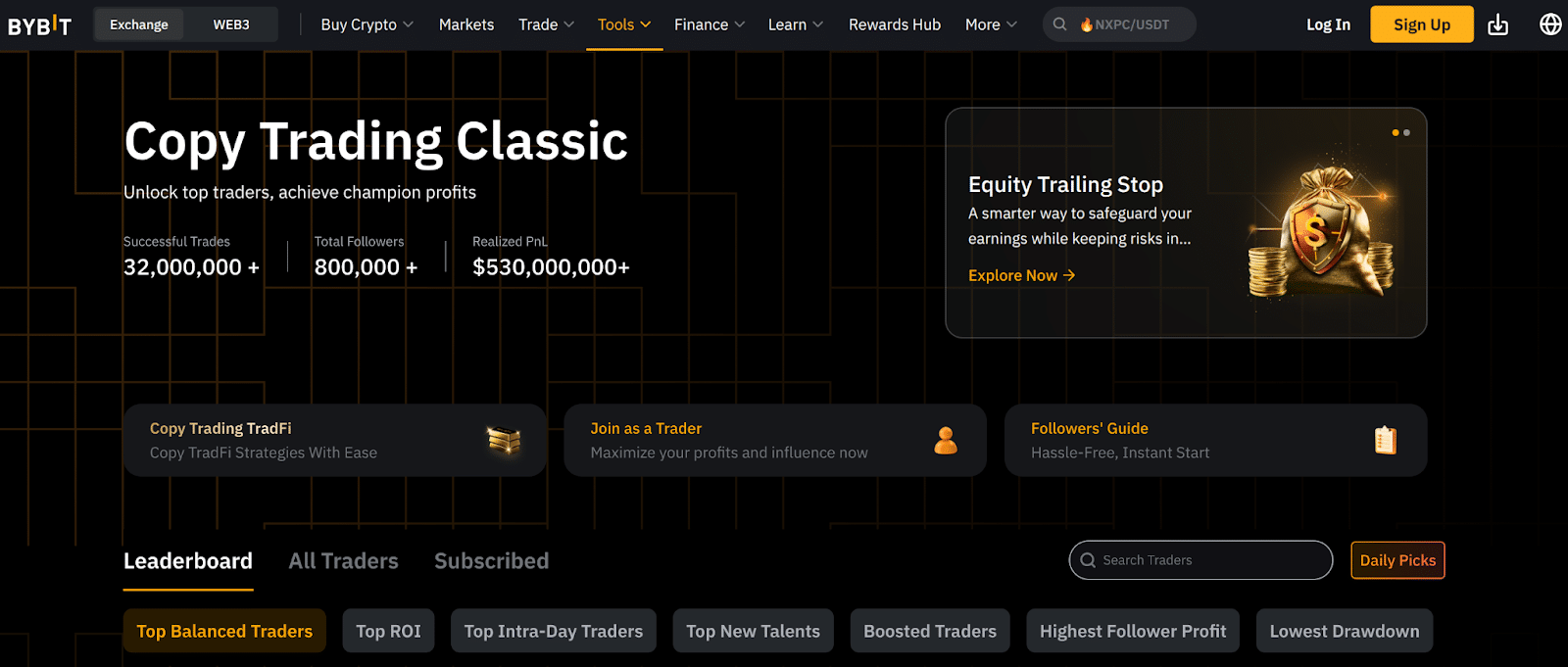

4) Bybit – Best for Diverse Asset Trading, Including TradFi

With Copy Trader Classic, Copy Trading Pro, and Copy Trading TradFi, Bybit offers one of the industry’s premier selections of tools for copy traders. Classic provides access to a wide range of USDT perpetuals. Pro provides lead traders to spot markets, USDT perpetual futures, and USDC perpetual futures, allowing them to identify the opportunities with the best liquidity. Pro also requires a time commitment, limiting the risk of large withdrawals that can affect a trade position.

Bybit’s Copy Trader TradFi lets you mix traditional finance assets like gold with your crypto assets. Asset classes may move at different times based on news or macroeconomic factors. TradFi gives traders access to assets that may not move in lockstep with BTC and other leading crypto assets.

Bybit became best known for its thriving crypto options markets, making the exchange a haven for advanced traders. Copy trading and user-friendly UI enhancements now make this powerful platform accessible to traders of all experience levels.

Bybit Copy Trading Features

| Feature | Bybit Copy Trading Details |

| Availability | Global with some restrictions |

| Supported Trading Types | Spot, futures, TradFi |

| Follower Control/Customization | Smart Copy Mode (fixed ratio, optimized entry) and Advanced Copy Mode (customize order settings). Can set take profit/stop loss. Cannot manually close positions without TP/SL/Unfollow. |

| Lead Trader Selection/Transparency | Leaderboard with detailed stats (7, 30, 90 day) |

| Profit Sharing (for Lead Traders) | Yes, variable profit share for followers |

| Unique Features | TradFi copy trading and expanded markets for Pro |

Pros

- Extensive trading tools, including futures, inverse futures, options

- Minimal slippage and efficient execution

- Three copy trading modes, including TradFi

Cons

- Steeper learning curve for beginners

- Restrictions for Copy Trader Pro

- Limited fiat withdrawals in some regions

5) BingX – Best for New Traders

More than 20,000 elite traders on BingX provide copy traders with more choices than on many competing platforms. Recent upgrades to the platform make it easier than ever to get started with copy trading. A demo trading platform underscores BingX’s dedication to making the platform accessible to users learning to trade while giving experienced traders a way to test strategies.

Beyond copy trading, BingX offers one of the more innovative platforms in crypto, including spot and futures trading, trading bots, and the ability to trade TradFi assets such as indices, Forex, and commodities using crypto as collateral for leverage trades.

BingX puts copy trading on autopilot with one-click trades that automatically select prudent defaults, with the ability to customize your trade risk settings as needed.

BingX Copy Trading Features

| Feature | BingX Copy Trading Details |

| Availability | Global with some restrictions |

| Supported Trading Types | Perpetual Futures, Spot, Trading Bots |

| Follower Control/Customization | Smart Copy Mode with prudent defaults (fixed ratio, optimized entry) and Advanced Copy Mode (customize order settings). Can set TP/SL. Cannot manually close positions (unfollow or TP/SL only) |

| Lead Trader Selection/Transparency | Leaderboard, All Traders tab. Master Traders undergo an approval process |

| Profit Sharing (for Lead Traders) | Yes, profits are shared with traders |

| Unique Features | 20,000 elite traders, TradFi trades with crypto margin |

Pros

- 20,000 elite traders

- Autoreplicate lead trader’s position

- 125x leverage for crypto

- TradFi futures with copy trading

Cons

- Spotty security history

- Limited direct fiat support

- Limited liquidity for niche pairs

6) KuCoin – Best for Trending Altcoins

A massive selection of nearly 1,000 cryptocurrencies makes KuCoin one of the top destinations for altcoin traders. The platform’s reputation as an altcoin hub helps ensure better liquidity on hard-to-find coins and tokens, providing more opportunities for traders and copy traders. KuCoin offers more than 300 pairs for futures trading, providing access to emerging tokens alongside leading crypto assets.

The platform supports USDT, USDC, and coin-margined futures, giving lead traders more options to find the best trades. KuCoin’s high-performance matching engine helps ensure smooth trade entries for copy traders, reducing slippage to replicate lead trader positions as accurately as possible.

API integration for lead traders allows for near-instant trades with KuCoin matching trades for followers. The platform delivers advanced features while making copy trading easy and efficient for copy traders.

KuCoin Copy Trading Features

| Feature | KuCoin Copy Trading Details |

| Availability | Global with some restrictions |

| Supported Trading Types | Futures (USDT-margined, USDC-margined, coin-margined) |

| Follower Control/Customization | Fixed ratio and fixed amount copy modes, 0.5% slippage protection |

| Lead Trader Selection/Transparency | Sort top-performing lead traders by AUM, ROI, assets, followers, and more |

| Profit Sharing (for Lead Traders) | Yes, lead traders earn a share of profits |

| Unique Features | API integration for automated lead-trader strategies, supports over 300 futures contracts |

Pros

- Large altcoin selection

- Competitive trading fees

- 300+ futures pairs

- Advanced trading bots

Cons

- Regulatory concerns

- Prior security breaches

- Complex for new traders

What is Crypto Copy Trading?

Crypto copy trading refers to a tool available on select platforms that allows users to follow profitable traders in their trades. Followers, also known as copiers, choose a lead trader to follow and allocate a budget to trades made by that lead trader. In most cases, this duplicates the same leverage used and other trade details, although some platforms allow further customization.

Lead traders go by several monikers, depending on the platform, including Master Trader, Signal Provider, Leader, and Provider. Crypto copy trading platforms typically offer detailed stats, including performance, to help traders find a lead trader that’s well-suited to their trading goals.

For example, on MEXC, you can view lead traders on a leaderboard that supports filters like win rate and number of followers. This allows you to find the best crypto traders to copy based on your criteria. Once you choose a lead trader, you allocate funds to the copy trade. The platform supports Fixed Amount copy trades ($5 minimum) and Fixed Ratio copy trades ($100 minimum). Based on your choice, the platform enters the same trades as the lead trader. You can also customize specific trade details, such as leverage type and amount. Options vary by platform.

The lead trader earns a percentage of profits (not trade amounts), which provides an incentive to make well-reasoned trading decisions with judicious use of leverage to minimize risk. If the trade loses money, you won’t pay a commission to the lead trader, but trading fees and funding costs still apply.

How We Picked The Top 6 Crypto Copy Trading Platforms

In comparing crypto copy trading platforms, we looked at several factors. These range from active traders to trading fees, as well as the user experience.

Most Active Traders

We looked for platforms with the highest number of active users. This is the market speaking, with the best platforms attracting more users through word-of-mouth and marketing efforts. Recommendations and marketing can’t make users stay, however. The top platforms deliver features that make them sticky for users.

Active traders also form the foundation for the top crypto copy trading platforms. A large user base attracts the top lead traders, which in turn, attracts more crypto copy traders. For copy traders, a broad range of lead traders helps ensure they can find a signal provider who aligns with their trading goals.

Tradable Cryptocurrencies

A wide variety of trading pairs offers opportunities for less-crowded trades. We favored platforms with an ample range of altcoins as well as blue-chip crypto assets.

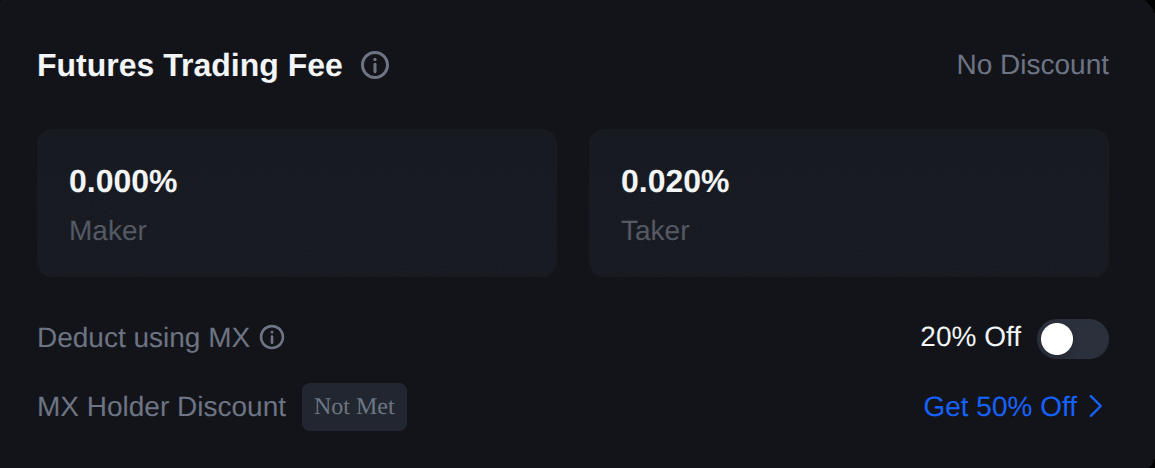

Affordable Trading Fees

Crypto copy trading centers on leveraged futures trades. Leverage lets you amplify gains by 10x, 50x, 100x, or sometimes more, making it a more efficient use of trading capital if the trade goes well. However, Leverage also increases the trading amounts by 10x, 50x, or 100x compared to a non-leveraged spot trade. Exchanges with low trading fees for futures ranked well.

Best User Experience

We also evaluated the user experience, considering factors like ease-of-use as well as liquidity, funding options, and available filters for researching lead traders.

Quickest Trade Execution Speeds

In high-leverage trades, milliseconds count. We evaluated execution speed on the leading crypto copy trading platforms, again considering liquidity levels that can affect execution costs. Ultimately, you want trades to execute quickly with plenty of traders on the other side of the trade to help ensure smoother transactions.

Best Crypto Copy Trading Features To Hunt For

Affordable fees and a vibrant community are essential to effective copy trading. Other features to prioritize include risk management tools, detailed performance reports, and portfolio management tools.

Risk Management Tools

Many platforms let users customize settings like stop-loss to limit the downside if a trade doesn’t go as well as hoped. This protects your capital for the next trade. More advanced settings let copy traders adjust margin mode or specify when to exit a trade using take-profit or stop-loss settings.

Performance Metrics

Look for platforms with in-depth performance metrics that let you explore trading performance over a longer time period. For example, MEXC spotlights 7-day performance but also offers 30-day, 90-day, and 180-day trading performance details. Other meaningful details include win rate, trading frequency, and number of followers.

Social Trading Tools

The best crypto social trading platforms typically differ from well-known copy trading platforms like eToro in that the social aspect often occurs on other platforms, like X or Telegram. In the crypto space, platforms may provide detailed stats rather than a social feed, instead providing links to the lead trader’s social profiles. These can become watering holes for the community, where they can rally around the latest trade.

Portfolio Management Tools

The best platforms provide ways to manage your portfolio, including filters to hone in on specific pairs. For example, MEXC allows users to filter SOL trades or BTC trades. So, if you prefer Bitcoin copy trading over more volatile altcoins, you can manage your trading portfolio using built-in tools.

How to Crypto Copy Trade in 2025: Easy Guide

Let’s walk through the steps required to get started with copy trading. In this example, we’ll use MEXC. The MEXC exchange offers nearly 3,000 cryptocurrencies for trading with some of the lowest trading fees in the industry. The platform also boasts a booming copy trading community with a wide selection of lead traders and detailed trading stats to help you make an informed choice.

1) Sign Up for an Account on MEXC

Visit the MEXC website to open an account. Enter an email address or phone number and choose a secure password. The platform also supports signups via Google ID, Apple ID, Telegram, or Web3 wallet.

Then, click on Copy Trade under the Futures menu.

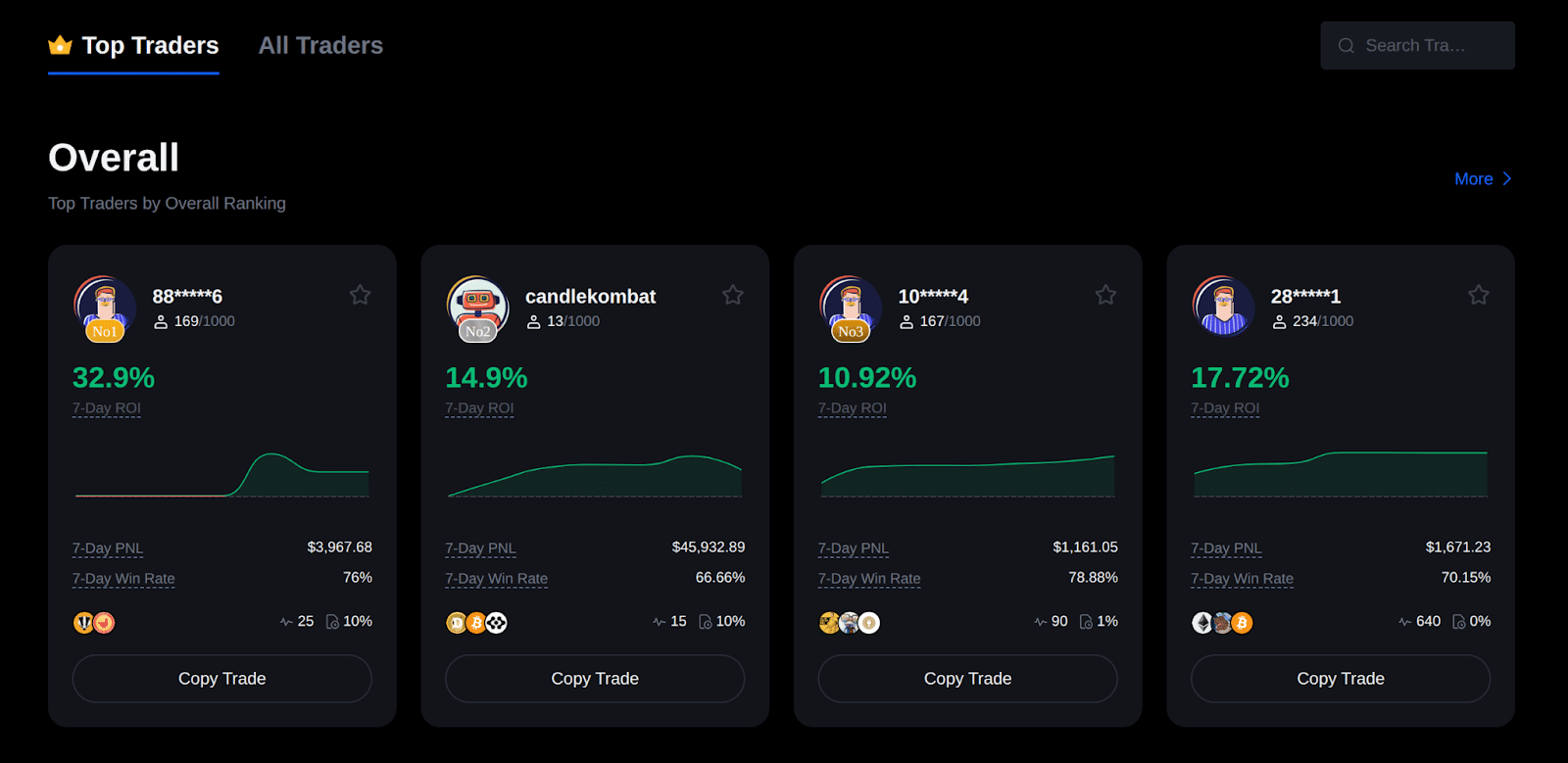

2) Choose a Lead Trader

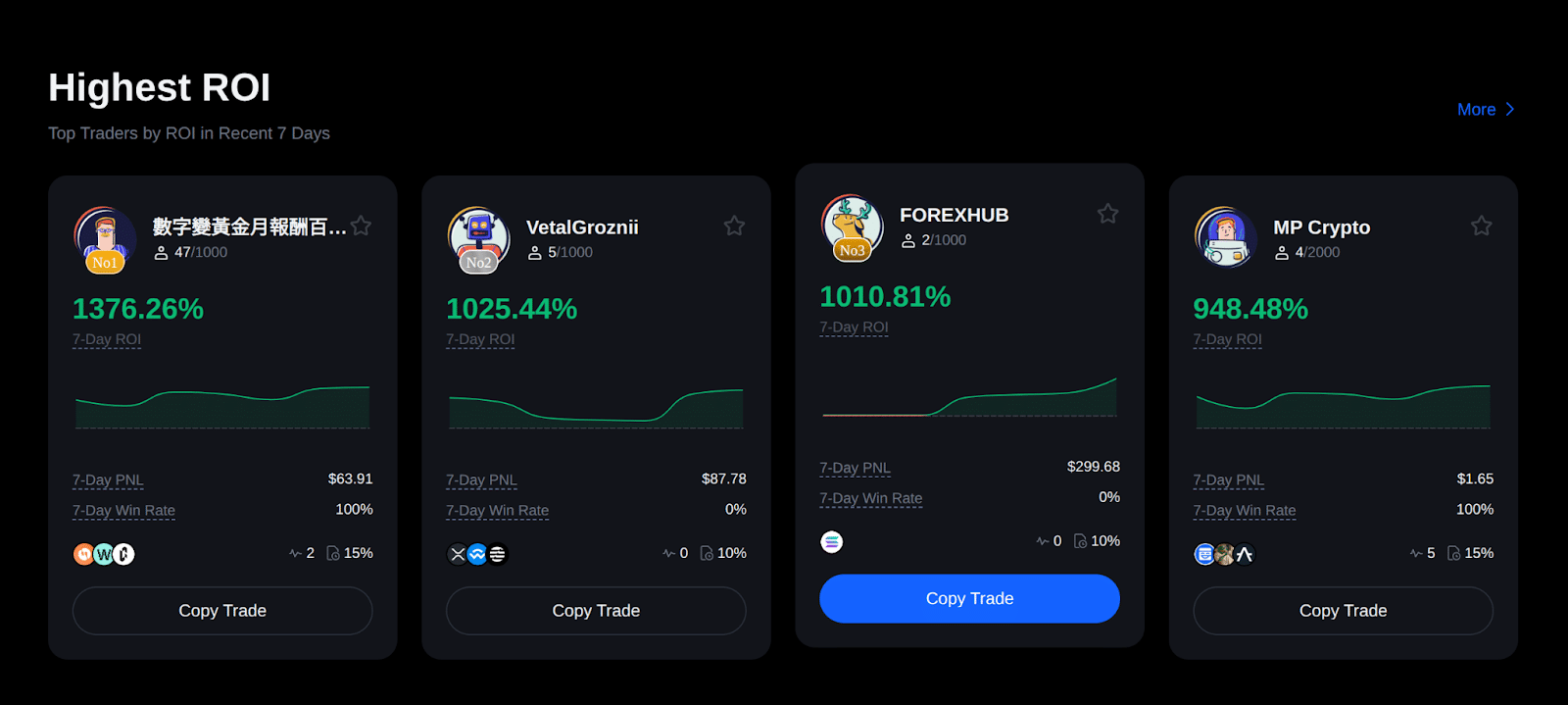

MEXC highlights lead traders in several sections, sorted by stats. These include top traders, highest return on investment, and most followers. You can also add more filters based on trading pairs and other criteria.

Lead traders on the MEXC copy trading platform can have a maximum of 2,000 followers. If the trader you want to follow has reached this limit, you can set a reminder to follow the trader when a slot becomes available.

Once you choose a lead trader, agree to the terms and conditions to continue.

3) Fund Your Account

You’ll need USDT to use copy trading on MEXC, and the deposit must be to your spot trading account. If you haven’t already funded your account, look for Deposit on the menu. MEXC supports deposits through several methods, depending on location. Crypto deposits are usually the most efficient way to fund your account if you already have crypto in another wallet. MEXC also supports third-party providers, peer-to-peer purchases, and quick buys in some regions.

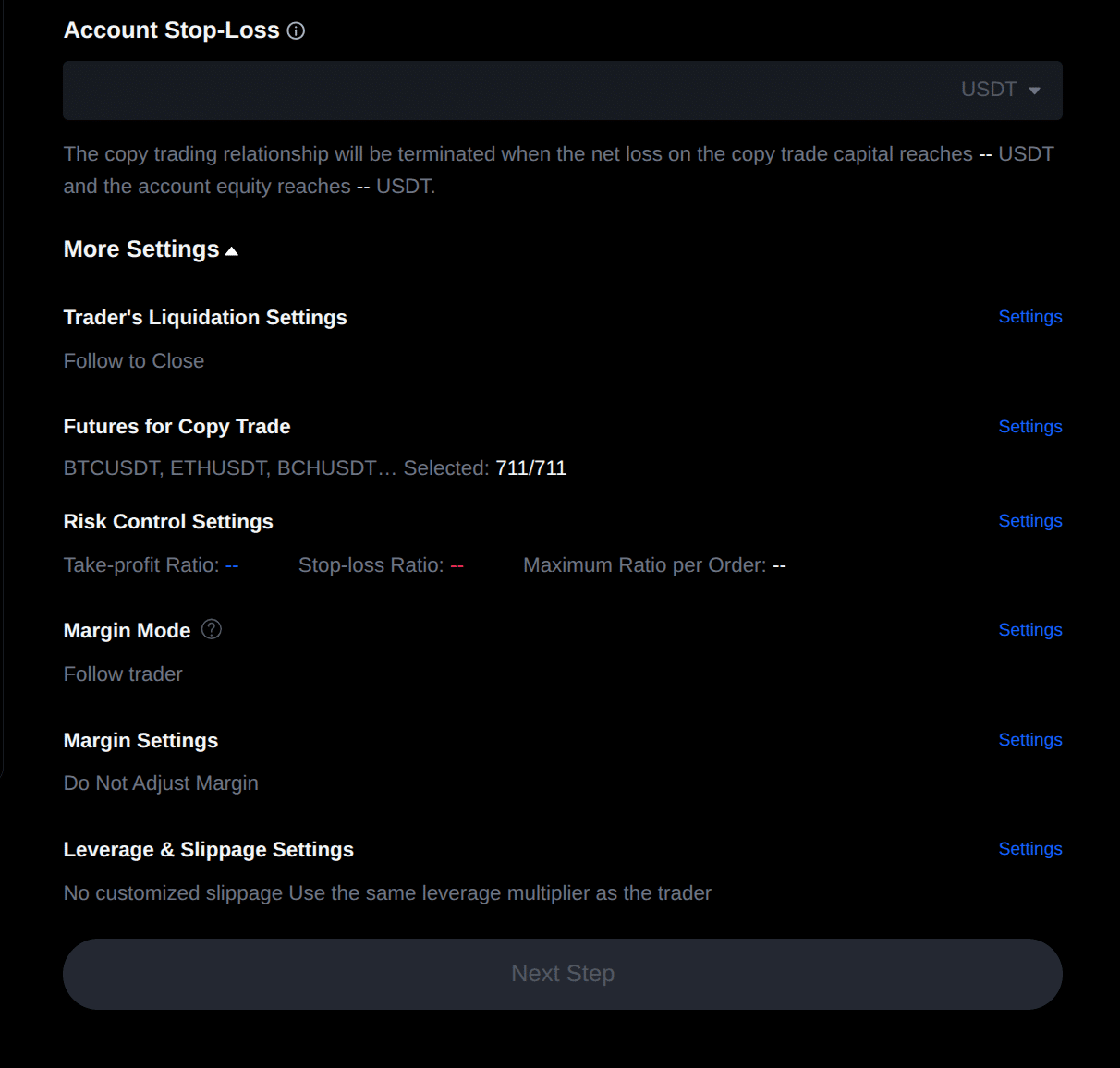

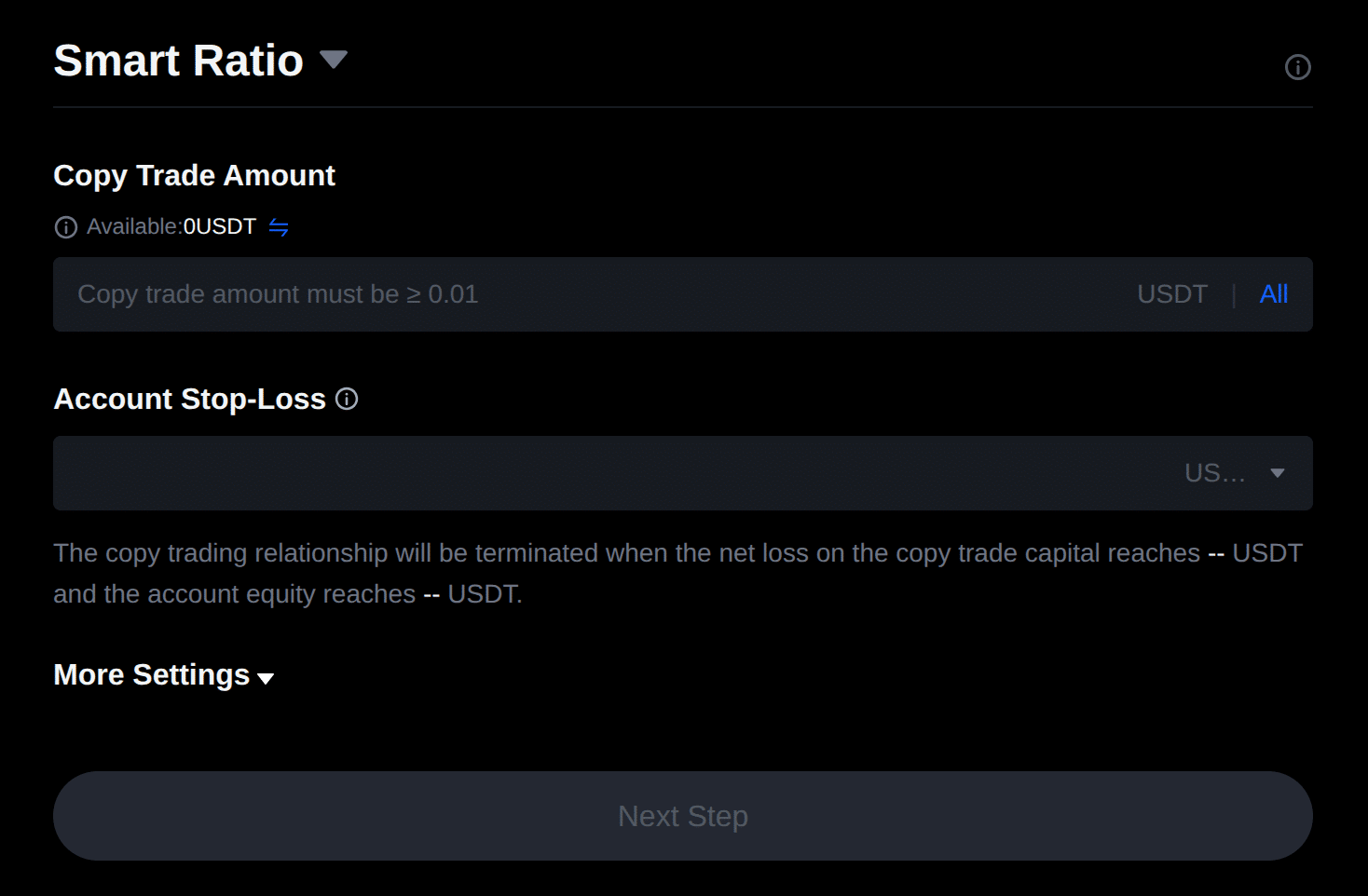

4) Choose an Amount for Your Copy Trade

Now, it’s time to set up your copy trade preferences. Choose an amount you want to commit to copying the lead trader. You can also set a stop-loss to protect your downside if the market goes against the trade or set a take-profit level to lock in profits.

You can also fine-tune your copy trade preferences further by clicking on More Settings.

Review your selections. If everything looks correct, open your copy trade position by clicking on the Next Step button on the lead trader’s profile page. MEXC will allocate the amount you’ve chosen to follow the lead trader’s trading activity.

Is Crypto Copy Trading Profitable?

Cryptocurrency copy trading can be profitable, but copying crypto traders doesn’t guarantee profits for any single trade or even a series of trades. Instead, copy traders are relying on a track record that suggests a higher or lower expected profit based on an ongoing series of trades.

For example, MEXC provides cumulative stats for lead traders, including how many wins or losses, as well as a chart indicating return on investment (ROI) over time. A single win or loss becomes less meaningful to long-term stats as more trades occur, but each can have a meaningful impact on your account balance.

Consistency matters, and every leader trader can make or lose money on a single trade or series of trades. Over time, the success rate and ROI can help you identify which lead trader is more likely to produce profitable trades (on average). Short-term ROI stats of 1,000% or more are unlikely to be sustainable. Research the trader’s history over a longer period of time to get a better indication of long-term ROI.

Let’s explore some of the pros and cons of crypto copy trading to better understand whether this trading tool is a good fit for your portfolio.

Accessibility to Beginners

More consistent profitability is one key reason to consider copy trading. We noted several examples in which the lead traders were profitable but the followers had sizeable losses, on average. This suggests that many of these followers were looking for guidance in trades after having lost money on their trade picks. Copy trading gives newer traders a way to improve their odds by following an experienced trader.

Convenience

Choosing your own trades can take an enormous amount of time and research. Additionally, crypto trading benefits from technical analysis, including chart patterns, indicators, and off-chart data such as news or money flow. Copy trading allows traders to hand off this work to an experienced trader with more exposure to charts and technicals, who may know exactly where to find other relevant information.

Learn from Lead Traders

Copy trading is also a powerful learning tool if you observe the structure of trades, and especially if the crypto social trading platform provides a way for lead traders to explain their trades. While copy trading comes with additional costs (profit sharing), the lessons learned could be much more expensive if learning on your own.

Minimized Emotional Involvement

Crypto trading can be stressful. Copy trading lets someone else set up the trade, including risk mitigation. Additionally, many crypto copy trading platforms allow you to fine-tune your trade settings to set stop-loss levels or other settings. The US Securities and Exchange Commission (SEC) warns against the risks of emotional stress arising from frequent trading.

Copy trading helps create a buffer. Rather than watch the charts, you can do other things, knowing you’ve protected your downside and that an experienced trader is controlling the trade.

Potential Losses

Market volatility or imperfect timing can lead to losses, especially when the trade uses higher leverage. At 100x leverage, a 1% move in price against your position can cause a liquidation. Expect occasional losses and allocate capital appropriately so you still have capital for the next trade.

Additional Trading Costs

Copy trading often uses leverage, which means that the larger trade amounts will amplify trading fees. Futures trades may also come with funding fees, although this cost to one side of the trade may work to your advantage. However, in most cases, you’ll also pay a percentage of your profit from the copy trade to the lead trader.

Reliance on Lead Trader

Copy trading can offer a powerful learning experience as the lead trader provides a blueprint for trades you can study and use in future trades. Often, though, copy traders instead rely on the lead trader, missing the opportunity to learn for themselves.

Risk to Funds

While we focus on the best crypto copy trading platforms in this guide, crypto exchanges have a spotty history as a whole. As early as 2011, Bitcoin traders learned the risks of entrusting their crypto to a third party when hackers stole 647,000 bitcoins from the Mt. Gox exchange. Although security has improved in many ways, exchanges present a tempting opportunity for hackers and scammers.

Regulatory Concerns

Most copy trading focuses on perpetual futures using leverage. In practice, you’re borrowing against collateral to fund a larger trade. This type of trading has come under increasing scrutiny from regulators such as the Commodities and Futures Trading Commission (CFTC).

Conclusion

So, which platform is best for crypto trading? The answer depends on your trading goals. Platforms like BingX provide an army of lead traders, whereas platforms like Binance offer industry-leading liquidity. For most traders, MEXC provides the best balance of features, combined with low fees for futures trading. MEXC offers a transparent way to compare lead traders over short or longer time frames. The platform also allows copy traders to customize their trades for additional safety.

MEXC’s no-KYC policy caters to privacy-conscious traders while still allowing traders to withdraw up to 10 BTC in value daily without identity verification. In addition, the platform supports demo trading, allowing new traders to learn without risk or more experienced traders to test their strategies. In short, although known for its advanced trading features, MEXC lets new traders learn while providing ample tools as traders develop their skills.