Following the success of crypto interest accounts like Nexo, Accru Finance Ltd are a London, UK based firm that pay 12% APY (annual percentage yield) on stablecoins and 7% on BTC or ETH holdings. Founded in 2019, they launched their crypto savings account platform Aqru for desktop and mobile in Dec 2021.

Well-suited to beginner investors that want to earn high interest on crypto without the requirement to deposit large amounts, their APY is high and flat – there are no tiers (e.g. the highest BlockFi interest requires holding $40,000 or more on the platform, as does Crypto.com).

This means the 7% or 12% applies to your entire wallet balance, not just amounts above a certain threshold, so there is little upfront commitment or risk for investors on a budget.

Aqru – How it Works

Via the Aqru.io platform website

Users can deposit fiat currency in GBP or EUR or USD or deposit with crypto and convert between them within the platform. .

For stablecoin interest Aqru holds your funds in a mixture of stable coins – Tether (USDT), USD Coin (USDC) and DAI, digital assets which are pegged to the value of the US dollar and not volatile like Bitcoin and Ethereum. That stable 12% is better suited to risk averse investors.

Those with a high risk/reward tolerance holding BTC and ETH can potentially earn from both the 7% interest and the value of those cryptos rising over time – Bitcoin since beginning trading over a decade ago has risen in price from under $2 to an ATH of $69,000. Ethereum has also outperformed BTC returns for the past two years.

Market crashes can also happen though – Bitcoin opened 2022 at a price of $46,000. Holding your coins in a crypto savings account in cold storage however prevents you from panic selling them or being chopped up trying to trade the market swings – most day traders lose money.

Aqru Signup Steps

To get started earning interest on crypto follow these steps:

- Click the ‘Sign Up’ links on the Aqru website

- Enter your email and choose a secure password of 10 characters – upper and lower case letters and numbers

- Verify your email, choose a currency GBP or EUR or USD and enter the platform – your free $10 (about £7 or €8) will be credited instantly to your balance and begin earning interest in realtime

- Buy crypto investments with fiat through the platform – earn a free $75 for depositing $500+ equivalent

- Alternatively, buy cryptocurrency on a third party crypto platform like eToro and transfer it to your Aqru account

- To make withdrawals on your investment, you’ll need to verify your identity by uploading ID documents to meet KYC (know your customer) regulations – normal on licensed platforms

Accepted Payment Methods

Accepted payment methods for Fiat currency are bank transfer, debit card and credit card.

The minimum deposit amount is $100. There isn’t a minimum withdrawal as long as the withdrawal fee is covered.

Aqru Platform

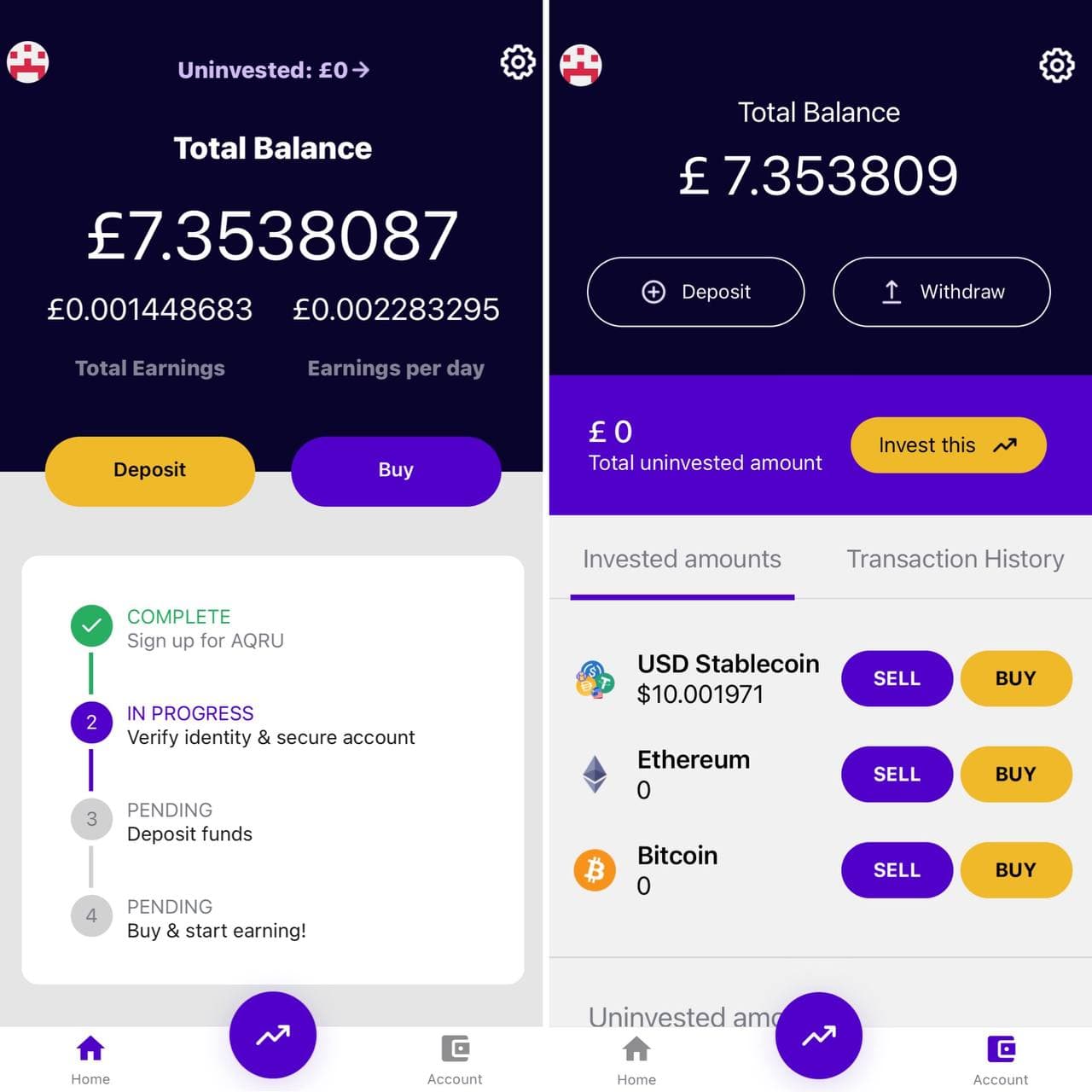

Below is a screenshot of how your Aqru wallet will then appear after creating an account, on the mobile app for iOS and Android – you can also log in via PC or Mac.

The free $10 instantly appears in your Aqru balance, alongside any pending ID verification, buttons to buy and sell cryptos, earnings per day, and your transaction history.

The uninvested amount shown is fiat currency you have just deposited or are about to withdraw – which you can move into and out of your investment wallet seamlessly. You can also withdraw in crypto however this comes with a $20 withdrawal fee whereas fiat withdrawals are free.

You can also quickly convert some of your BTC or ETH into fiat during a market crash, then back into crypto to buy the dip if you time it right, to compound your holdings. That flexibility is unlike some crypto interest providers on which your funds are locked.

Aqru Reviews

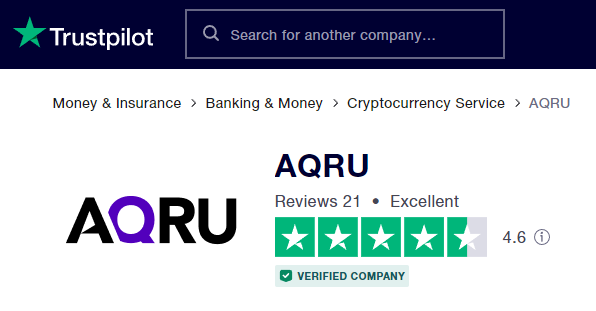

Aqru currently have a verified and excellent Trustpilot rating although only based on 21 user reviews. Read those testimonials here.

The Aqru Reddit r/Aqru is also small as it is a new crypto savings platform. View that subreddit here.

Aqru TrustPilot 4.6/5 rating

Comparison with other Crypto Interest Platforms

See our guide to the best crypto interest accounts that also features Crypto.com and Nexo. In terms of BlockFi and Celsius see below:

Aqru vs BlockFi

APY

Aqru offers investors a high risk/reward tolerance holding BTC and ETH to potentially earn 7% interest per year. Aqru lends out the digital tokens of users to borrowers, earning a higher rate of interest on the funding agreement. The platform also offers 12% per year on coins like Tether, USD Coin, and DAI. For lending out supported digital tokens, Aqru crypto savings accounts come without lock-up terms. This enables users to withdraw funds anytime without any fines.

BlockFi is a specialist crypto lending platform. The earnings on your digital tokens are influenced by the specific token you choose and your investment amount. For instance, you can earn around 5% at BlockFi by holding Ethereum and is only payable up to the first 1.5 ETH deposits. Between 1.5 and 5 ETH, the APY will be 1.5% and for investments beyond 5 ETH, the APY is 0.25%.

Fees

There is no minimum or maximum deposit on BlockFi, Aqru has a €100 (£110.80) minimum deposit and no maximum deposit.

Cryptocurrency withdrawal charge on Aqru is $20, which is charged in the currency of the withdrawal asset. Withdrawal limits and charges on BlockFi vary according to the cryptocurrency withdrawn. For instance, the withdrawal limit is 100 BTC in a week with 0.00075 BTC as the fee. Withdrawing LTC has a limit of 10,000 LTC per week and a fee of 0.001 LTC.

Regulation

Aqru is regulated by the Republic of Lithuania and VASP under Lithuanian law. BlockFi is licensed with the Bermuda Monetary Authority and is in the process of receiving a go-ahead from the SEC.

Payments

Aqru supports a few payment methods. These include debit cards and credit cards, bank transfers, and crypto wallet deposits.

BlockFi enables payment methods like debit/ credit cards and bank transfers. The Fiat deposited will automatically be converted into Gemini Dollars (GUSD) for further transactions.

Accessible Platforms

You can access the Aqru website on a desktop or use the app, which is compatible with both Android and iOS devices.

The BlockFi platform is also available for web access and on its app. The app can be downloaded and used by both Android and iOS users.

Aqru vs Celsius

APY

With Aqru, investors could hold BTC and ETH to potentially earn 7% interest per year. Aqru lends out the digital tokens of users to borrowers, earning a higher rate of interest on the funding agreement.

On the other hand, by transferring your crypto to Celsius, you could earn up to 17.78% APY.

Fees

Aqru has a €100 (£110.80) minimum deposit and no maximum deposit. The cryptocurrency withdrawal charge is $20 and it is charged in the currency of the withdrawal asset. Withdrawal limits and charges on Celsius vary from one cryptocurrency to another.

Celsius has a minimum withdrawal of $1. Apart from this, every transaction on the platform is free. There is no deposit fee, no transaction fee, and no withdrawal charges.

Regulation

Aqru is regulated by the Republic of Lithuania and VASP under Lithuanian law. Celsius is an SEC-complaint cryptocurrency platform.

Payments

Aqru supports a few payment methods. These include debit cards and credit cards, bank transfers, and crypto wallet deposits.

Celsius also enables debit/ credit card payments, bank transfers, wire transfers, etc.

Accessible Platforms

The Aqru platform is available for web access and as an app. The app can be downloaded and used by both Android and iOS users.

Celsius too is available on website on a desktop or as an Android and iOS app.

Aqru Review – the Verdict

The high yield with no tier requirements, and bonus promotions make Aqru.io one of the best crypto staking platforms on the market purely in terms of return on investment (ROI). The free $10 + $75 alone for a small $500+ investment is an instant 17% account gain.

What remains to be seen is whether this lesser known company will stand the test of time like BlockFi and other providers have, which have been operating for years despite SEC crackdowns and are backed by large investors.

InsideBitcoins recommends diversifying your portfolio by making use of several different crypto interest providers – Binance, Coinbase and eToro offer staking – and sources of passive income online, to protect your capital.

If you are disillusioned with traditional banks and ‘all in’ on crypto, keep the majority of your capital on an FCA regulated platform such as eToro.com, where you can also earn passive income through Ethereum staking or copytrading, and buy and hold the cryptocurrency that you then deposit into crypto savings accounts. You can also maintain a fiat currency balance, and withdrawals in fiat from Aqru to eToro are free of charge.

Update – BlockFi and Celsius have now closed operations, but Aqru remains active.

FAQs

What are Aqru's fees?

Crypto withdrawals incur a $20 withdrawal fee to cover operating costs, and fiat currency cashouts are free.

What are the deposit methods on Aqru?

Accepted payment methods are debit card and credit card, bank transfer, and deposits from your crypto wallet onto Aqru (supported coins are BTC, ETH, USDT, USDC and DAI).

How do crypto interest sites make money?

Crypto savings accounts are also crypto lending platforms - just like traditional banks, they loan money, in this case crypto assets, to institutions and retail borrowers for an APR. The Aqru terms and conditions state these are 100% collateralised.

Is Aqru regulated and safe?

Aqru state they operate in compliance with legal regulations to act as a virtual assets service provide (VASP) and Accru Finance UAB is listed with the company no. 305944953 on the Aqru website. Aqru crypto wallets are said to be insured with a $30 million insurance policy and protected against hacking by Fireblocks software.

What are the Aqru withdrawal times?

Cryptocurrency withdrawals are processed in a matter of minutes and bank transfer cashouts may take 1-5 working days depending on your country of residence.