On this Page:

Layer 2 blockchains are secondary networks that support layer-1 blockchains, often to increase scalability and reduce fees. The most active layer-2 networks like Polygon and Base have entire ecosystems, including meme coins and decentralized finance (DeFi) protocols.

Layer 2s generally verify transactions off-chain, making them significantly more efficient than layer 1s. Therefore, the broader Web 3.0 industry is increasingly turning to layer-2 solutions, considering they’re more suitable for day-to-day transactions.

This guide explores the best layer-2 crypto to buy, considering key factors like use cases, network demand, total value locked (TVL), and price potential. Read on to discover high-growth layer-2 cryptocurrencies for 2025.

| # | Coin | Price | 24h % | Market Cap | Volume | 24h Range |

|---|---|---|---|---|---|---|

| 1 |

|

current price: $0.0017 | raised: $39,661,135 | Learn more | ||

| 2 |

|

$0.37 | -12.43% | $1,806,103,163 | $338,552,836 |

$0.37

―

$0.43

|

| 3 |

|

$0.69 | -12.53% | $1,179,106,669 | $257,875,426 |

$0.68

―

$0.79

|

| 4 |

|

$0.58 | -9.53% | $1,061,468,845 | $40,339,468 |

$0.57

―

$0.64

|

| 5 |

|

$0.14 | -12.57% | $441,592,446 | $49,832,231 |

$0.14

―

$0.16

|

| 6 |

|

$0.15 | -9.64% | $384,293,026 | $49,085,896 |

$0.15

―

$0.17

|

| 7 |

|

$0.0046 | -7.99% | $216,555,125 | $13,387,622 |

$0.0046

―

$0.0051

|

| 8 |

|

$0.03 | -5.86% | $210,189,165 | $17,312,808 |

$0.03

―

$0.03

|

| 9 |

|

$0.06 | -8.54% | $209,312,599 | $39,759,050 |

$0.06

―

$0.06

|

| 10 |

|

$2,632.30 | -3.79% | $199,056,046 | $2,996,254 |

$2,594.48

―

$2,745.66

|

| 11 |

|

$18.34 | -10.68% | $116,895,276 | $13,012,452 |

$18.32

―

$20.53

|

| 12 |

|

$0.09 | -3.10% | $114,728,556 | $19,054,763 |

$0.09

―

$0.10

|

| 13 |

|

$0.27 | -13.01% | $112,062,839 | $24,202,974 |

$0.27

―

$0.31

|

| 14 |

|

$0.03 | -10.71% | $100,411,082 | $26,785,046 |

$0.03

―

$0.03

|

| 15 |

|

$0.45 | -6.19% | $85,906,242 | $17,539,973 |

$0.45

―

$0.49

|

| 16 |

|

$1.52 | -4.58% | $36,532,777 | $200,786 |

$1.52

―

$1.60

|

Solaxy

SOLX 🔥Selling Fast 🎯presale stageArbitrum

ARBOptimism

OPImmutable

IMXStarknet

STRKMovement

MOVENervos Network

CKBAstar

ASTRZKsync

ZKWrapped Ether (Mantle Bridge)

WETHMetis

METISLoopring

LRCManta Network

MANTAAltLayer

ALTLisk

LSKEthernity Chain

ERN

Top Layer-2 Coins in 2025

According to our research, the best layer-2 crypto to buy are Mantle, Arbitrum, Optimism, Movement, and Stacks. Read on to learn why we’ve picked these cryptocurrencies.

1. Mantle (MNT)

Mantle is the first layer-2 crypto project to consider. Like many layer-2s, Mantle serves the Ethereum blockchain. It offers high speeds, low transaction fees, and a significant increase in scalability. It’s designed specifically for on-chain finance, making difficult-to-reach investment products available to the masses.

This includes an institutional-grade fund, offering fully managed and diversified access to digital asset baskets. Mantle will also offer decentralized Bitcoin-related products, allowing Web 3.0 investors to unlock new BTC opportunities. Another Mantle feature is mETH, a restaking token offering competitive yields and real-time liquidity in DeFi applications.

Mantle Price Chart

(MNT)Mantle (MNT)

Mantle has already secured financial backing and partnerships with big industry players, including ByBit, VenEch, Galaxy, and TON. Mantle’s ecosystem token, MNT, pays for network fees. It also provides governance rights. MNT rallied from about $0.05 to $1.51 after launching in July 2023. Like many cryptocurrencies, MNT has since entered a substantial market correction.

Find out more about Mantle:

2. Arbitrum (ARB)

Arbitrum is another layer-2 network for the Ethereum network. One of its biggest advantages is institutional-grade scalability. It can handle tens of thousands of transactions per second, making it ideal for the Web 3.0 era. That’s why some of the biggest DeFi projects have already bridged to Arbitrum’s network.

This includes the major stablecoins – Tether, USDC, and Dai. Not to mention Chainlink, Maker, Uniswap, The Graph, and Lido DAO. Arbitrum’s key objective is to attract innovative developers, with the long-term goal of becoming a mainstream Web 3.0 ecosystem. It’s currently offering developer grants to achieve these aims.

Arbitrum Price Chart

(ARB)Arbitrum (ARB)

Arbitrum’s native token, ARB, was initially airdropped to early adopters. Launching in March 2023, many airdrop recipients immediately sold their tokens. The result is that ARB now trades at a small fraction of its original listing price. Moreover, about 4.4 billion ARB are currently in circulation. This is just 44% of the total supply, representing unfavorable tokenomics.

Find out more about Arbitrum:

3. Optimism (OP)

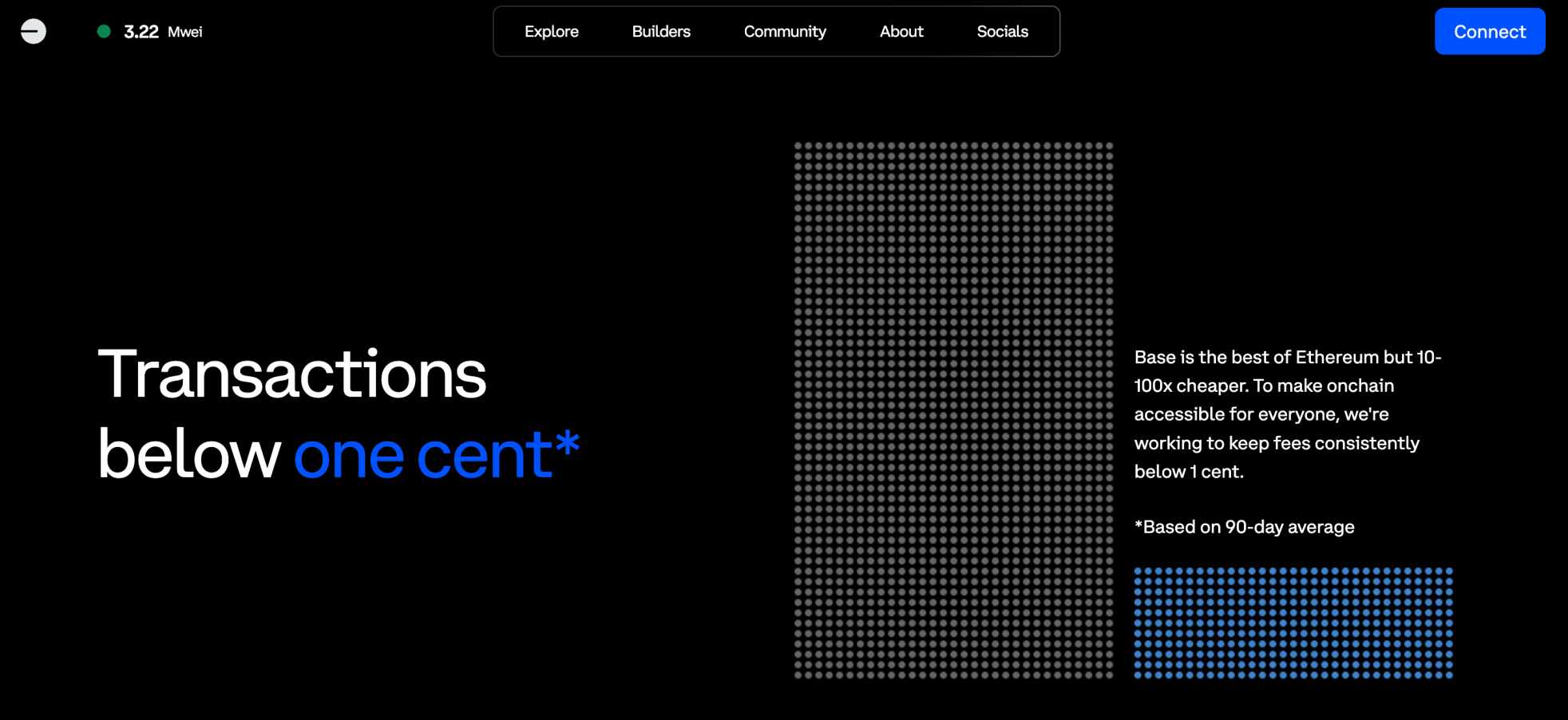

Some experts claim that Optimism is the best layer-2 crypto to buy. Similar to Mantle and Arbitrum, it offers Ethereum-based projects reduced fees and increased scalability. What sets Optimism apart is its “Superchain” concept. It aims to become a broader ecosystem of layer-2 networks, ensuring seamless connectivity between each.

Currently, the Optimism Superchain also hosts the world’s most active layer-2 ecosystem, Base. This is in addition to Zora, Redstone, Fraxtal, and Mode. Anyone can create a new layer-2 network and join the Superchain. Another feature is the Retroactive Public Goods Funding (RPGF) initiative.

Optimism Price Chart

(OP)Optimism (OP)

The RPGF aims to bring the world on-chain, helping open-sourced developers and research entities with grants. The RPGF is funded by Optimism revenues, ensuring long-term substantiality and growth. The native ecosystem token, OP, trades considerably lower than its 2022 launch price. Even so, its existing market capitalization offers an attractive entry point.

Find out more about Optimism:

4. Movement (MOVE)

Movement is the next Ethereum layer-2 network on this list. It offers enhanced security and premium performance, with the target marketing being DeFi applications. It leverages the “Move” language, initially developed for Facebook. Move is potentially more suitable for non-blockchain developers, considering its real-world application.

Movement has already attracted a wide range of DeFi projects, including wallets from Bitget and Leap. Mosaic also uses the Movement network, a growing decentralized exchange (DEX) aggregator offering industry-leading swap rates and yields. The Movement ecosystem also includes decentralized GPU resources, meme-based games, lending platforms, and liquid staking launchpads.

Movement Price Chart

(MOVE)Movement (MOVE)

Movement has a stamp of approval from some significant market leaders, including Binance Labs and Polychain. Its native token, MOVE, was launched on exchanges in late 2024, right when the broader markets entered a substantial correction. As such, the Movement price has been on a downward trajectory since.

Find out more about Movement:

5. Stacks (STX)

Last on this list and the first outside of the Ethereum ecosystem is Stacks. In a nutshell, Stacks is a layer-2 network for the original Bitcoin blockchain. It brings a multitude of solutions for existing BTC holders, including access to smart contracts and DeFi applications.

This means the Bitcoin ecosystem can benefit from Web 3.0 products without losing its decentralized and secure framework. For instance, BTC holders can engage in staking, lending, borrowing, and even liquidity provision. This ensures BTC investments maximize rewards rather than being left idle in a crypto wallet. Stacks also performs significantly faster than Bitcoin.

STACKS Price Chart

(STACKS)STACKS (STACKS)

Transactions take seconds rather than 10 minutes. Moreover, transaction fees, including DeFi smart contracts, are super cost-effective. The ecosystem token, STX, has produced modest growth since launching in 2019. It does, however, trade at a fraction of its 52-week high. This could be the final chance to secure such a reduced valuation.

Find out more about Stacks:

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- 250,000+ Monthly Active Users

How We Selected These Layer-2 Projects

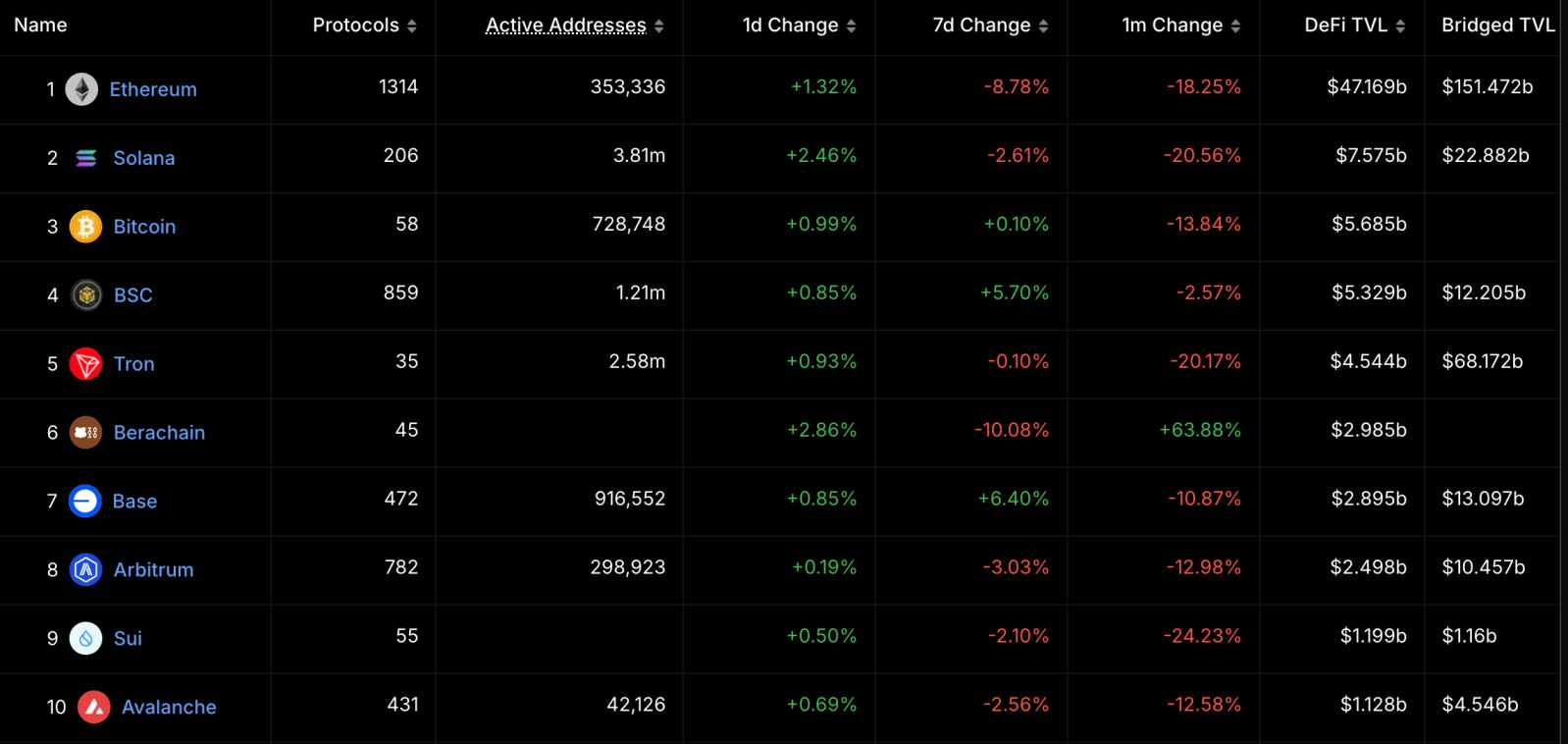

We analyzed a wide range of data when selecting the best layer-2 crypto to buy. Core research metrics include adoption rates, developer activity, and TVL. Not to mention performance levels, covering scalability, fees, and decentralization.

Read on for more information about our layer-2 methodology.

Adoption Rates

Adoption rates are one of the key factors when exploring layer-2 ecosystems. After all, the layer-2 network won’t serve much purpose if nobody is using it. The most active ecosystems attract two key sets of stakeholders.

First, layer-2 networks require top-quality projects, including DeFi applications. For example, a wide range of finance-based protocols have bridged to Mantle for its low fees and high scalability. This includes Ethena USDe, Ondo US Dollar Yield, Cashtree Token, AUSD, and USDa.

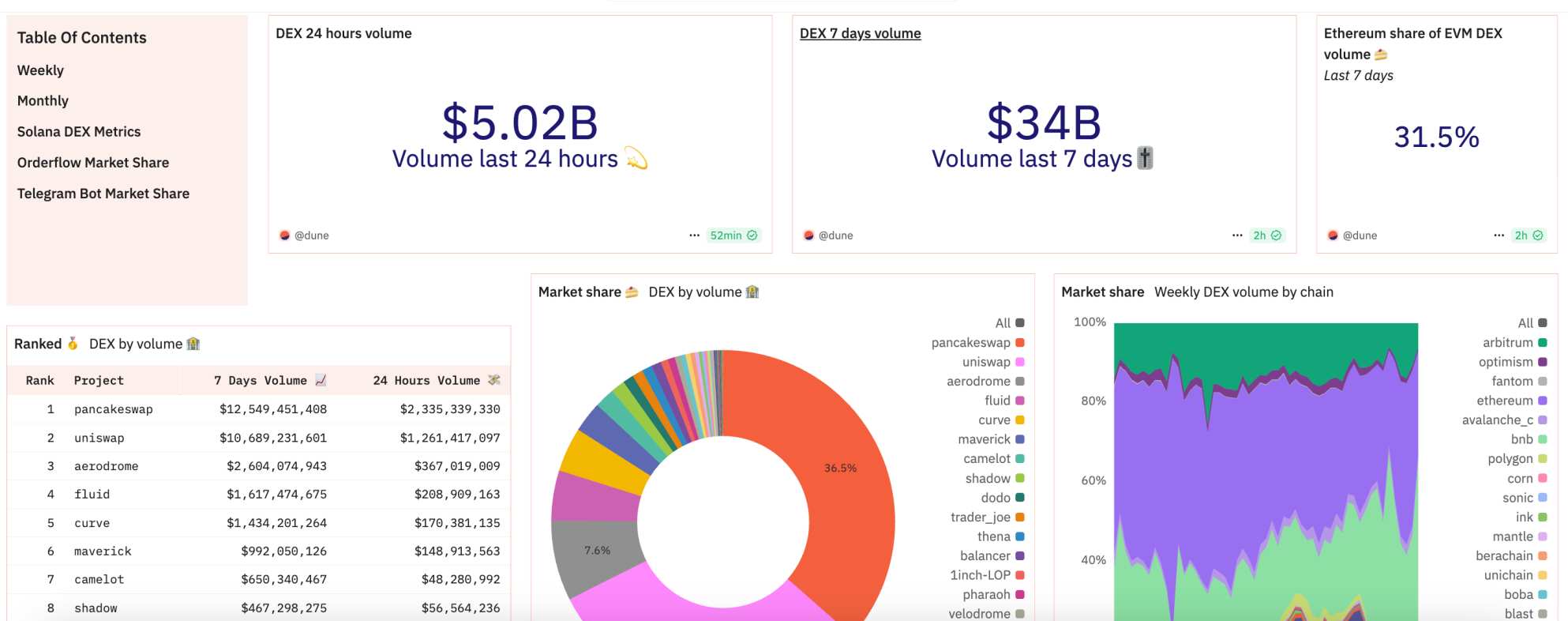

Similarly, some of the biggest DeFi ecosystems have bridged to Arbitrum. This included DEXs like Uniswap and SushiSwap, plus leading earning platforms like Yearn.finance, Curve, and Lido DAO. Crucially, this shows that Web 3.0 projects have a strong demand for more efficient transactions while retaining the security of layer-1 blockchains.

In addition to projects, adoption rates must also incorporate actual users. Networks generate revenues from transaction fees, which demand high throughputs, so the layer-2 network won’t survive without constant traffic.

Therefore, we analyzed blockchain analytics for average daily and monthly transactions per layer-2 ecosystem. This is the most accurate way of evaluating adoption rates, as it’s based on real transactions rather than just hype.

Developer Activity

We also assessed developer activity when choosing the best layer-2 crypto to buy. The layer-2 market is quickly becoming oversaturated, especially on the Ethereum blockchain. Therefore, the most successful ecosystems benefit from constant development and improvement, often funded by network transaction revenues.

For example, we mentioned Optimism’s Retroactive Public Goods Funding initiative. This invites skilled developers to build through financial incentives.

Base, the layer-2 network backed by Coinbase, offers a similar concept. Arbitrum is another layer-2 project that’s highly active. It frequently engages on GitHub, allowing like-minded developers to track its progress.

Scalability, Fees, and Speed

The main purpose of layer-2 networks is to make a layer-1 blockchain more efficient. For example, Arbitrum, Base, and Polygon allow Ethereum-based projects to operate with lower fees. The cost savings must be significant to make the transition worthwhile. This is almost always the case with ERC-20 layer 2s, considering Ethereum’s high gas fees.

The best layer-2 crypto to buy should also offer unprecedented scalability improvements. For example, consider that Ethereum can handle about 12-15 transactions per second. This is a fraction of what Ethereum-based applications require, making layer-2 solutions pivotal.

However, many claims made by layer-2 networks are based on “theoretical” transactions per second. For example, the network might claim to be able to handle 100,000 per second. But if it’s currently only handling 20 per second, there’s no knowing how it will react to much bigger transactions throughput.

Another important performance metric is speed. For instance, while Ethereum verifies blocks in approximately 12 seconds, Base is about six times faster. This is a major improvement, especially for transactions that require near-instant finality.

Security and Decentralization

There’s no denying that layer-2 networks are cheaper, more scalable, and faster than the layer-1 blockchain they’re supporting. However, this is often at the expense of security and decentralization. Therefore, these were also key metrics when choosing the best layer-2 crypto to buy.

A good example is Stacks. Unlike other DeFi solutions for Bitcoin, Stacks has developed a unique consensus mechanism called Proof-of-Transfer. This ensures that transactions are secured by the base Bitcoin blockchain. In contrast, solutions like Wrapped Bitcoin operate on Ethereum, which lacks Bitcoin’s robust security and decentralization.

Ultimately, however, it’s important to remember that no layer-2 network is completely decentralized. It’s simply not possible based on the existing framework. That said, several projects claim to be working toward decentralization, including Base and Arbitrum.

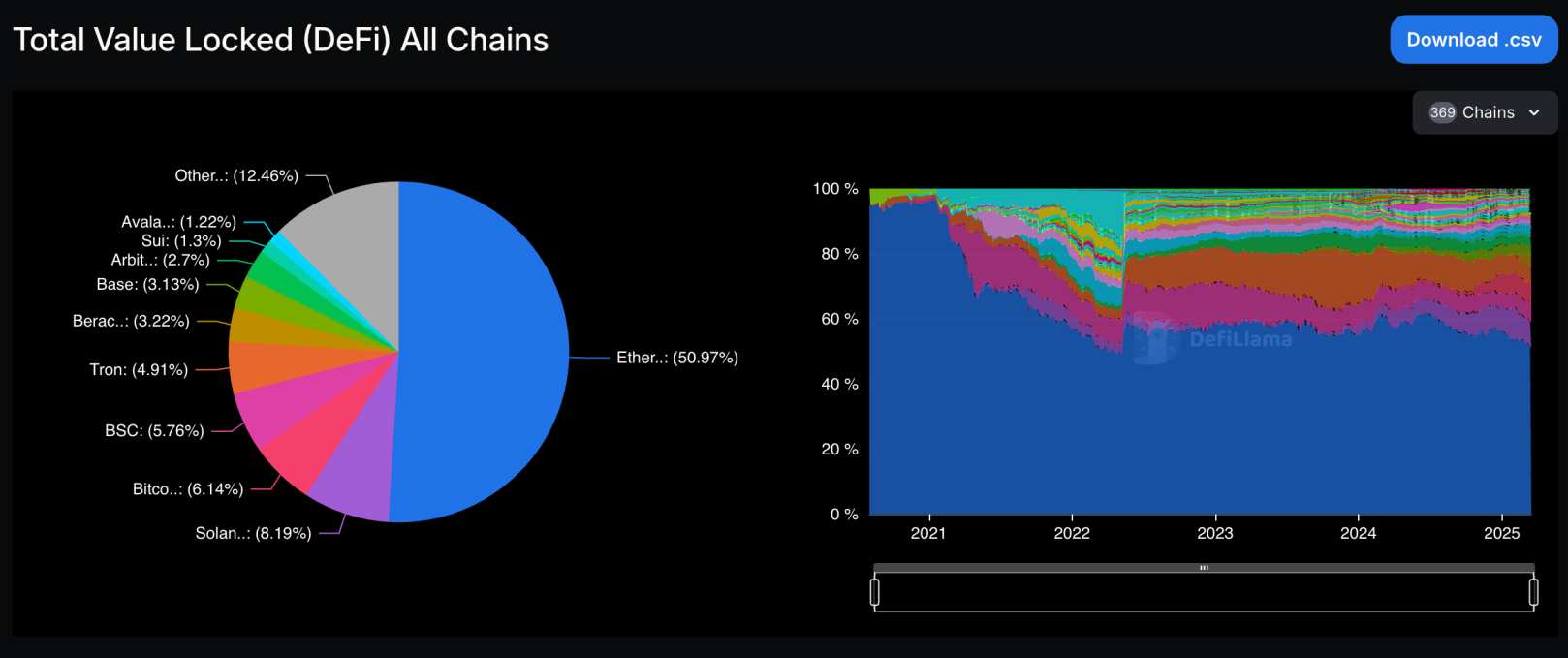

Total Value Locked (TVL)

The TVL not only shows that layer-2 networks are actively being used but it also demonstrates how much trust the broader markets have in them. This is because the TVL highlights the amount of capital that’s currently locked in the respective ecosystem. A wide range of DeFi products count toward the TVL figure.

For instance, those providing liquidity to Uniswap via the Arbitrum network contribute to the TVL. That liquidity remains locked in the ecosystem until it’s withdrawn by the investor. Similarly, staking tokens, lending them out, or even using them for margin to trade derivative products also increases the TVL.

Multiple blockchain analytics websites provide real-time TVL figures for each layer-2 network. They also provide trends and insights, a great way to assess where capital flows are moving. Currently, Base is by far the largest layer-2 for TVL, although it doesn’t have a native token. After that, it’s Polygon, Optimism, Linea, and Arbitrum.

Market Growth Potential

So far, our methodology has focused on the fundamentals, including adoption rates, scalability levels, and TVL. However, growth potential will be the most important factor for many investors. Capital is being risked into the respective layer-2 token, so investors should expect a suitable return.

First, crypto whales and institutional investors prefer secure exchanges like Coinbase and Kraken. These platforms are not only regulated and safe but they also support over-the-counter (OTC) services. Therefore, the best layer-2 crypto to buy will have major exchange listings.

Layer-2 investors should also consider the existing market capitalization. Investing in a larger-cap project typically offers more stable growth and less volatility spikes. However, those seeking bigger gains might consider a layer-2 project with a much smaller valuation. The risks and expected volatility rates are higher, but lower-cap projects offer more room to grow.

Broader market narratives will also play a role in the growth potential. For example, suppose meme coins on the Arbitrum network have outperformed the market for the past few weeks. ARB will be a direct beneficiary, considering it’s required to pay network fees. It’s also important to analyze the token supply, which isn’t always favorable when investing in layer-2 projects.

Mantle has a total supply of 6.21 billion tokens but just 3.36 billion are currently circulating. Arbitrum’s supply dynamics are even more unfavorable, with just 44% currently in the public float. Many layer-2 tokens are often held by early backers who secured the lowest cost basis.

The tokens will be “vested”, meaning they can’t be sold for a certain time frame. When the vesting unlock eventually arrives, a large quantity of tokens could be sold on public exchanges. This will have a big impact on the token price, although it’s typically temporary for the best layer-2 ecosystems.

Latest Market News

How to Buy Layer-2 Cryptos

We’ve explained how to select the best layer-2 crypto to buy. The next step is understanding where to invest.

Some investors preferred centralized exchanges (CEXs) like Coinbase, Binance, Crypto.com, and Kraken. Others prefer trading on DEXs like Uniswap and SushiSwap.

Best Exchanges for Layer-2 Tokens

Read on to explore the key benefits and drawbacks of CEXs and DEXs, ensuring you choose the right option.

CEXs

The vast majority of layer-2 tokens trade on CEXs. This is because they’re unique to the respective network, meaning they have their own token standard. For example, MNT and ARB back the Mantle and Arbitrum networks, respectively. Therefore, MNT doesn’t function on ARB and vice versa.

CEXs generally accept fiat payments too, making it easier for beginners to invest. For example, Coinbase enables users to buy cryptocurrencies instantly with Visa, MasterCard, PayPal, and even local banking networks like ACH and SEPA. CEXs do, however, increase the risks when investing in layer-2 crypto tokens.

Unlike DEXs, there’s a single point of failure. All client-owned cryptocurrencies are stored by CEXs, meaning they also control the private keys. So, if the exchange’s servers are hacked remotely, they could access and steal client funds. This has happened many times previously, even with the so-called tier-one exchanges.

Another drawback is that CEXs have enhanced their know-your-customer (KYC) controls, as per increased pressures from global regulators. Registered users often need to provide a government-issued ID, proof of address, and sometimes a selfie. These measures are considered cumbersome and intrusive by crypto investors.

DEXs

DEXs are a great alternative to CEXs. No account is required, so KYC can be avoided entirely. Users connect a wallet to the DEX and perform crypto-to-crypto swaps. DEXs use smart contracts to execute trades, so users never lose control of their private keys. Put otherwise, DEXs never hold client-owned tokens, even when they’re being swapped.

However, we should mention that not all layer-2 tokens have sufficient volumes and liquidity on DEXs. For example, about $81 million worth of Mantle was traded in the past 24 hours. Of that amount, approximately $300,000 was traded on DEXs. Stacks is even more inaccessible, with no DEXs supporting STX.

That said, Arbitrum commands reasonably strong volumes on DEXs, with about $10 million traded on Uniswap in the past day. Ultimately, you’ll first need to check which DEXs support the preferred layer-2 token, along with available liquidity and average trading volumes. If these metrics aren’t sufficient, you’ll need to use a CEX.

How to Store Layer-2 Cryptos Safely

Storage is the next factor to consider after choosing where to buy layer-2 cryptocurrencies. Under no circumstances should you keep investments stored on a CEX. You don’t have true ownership of the purchased layer-2 assets, considering the CEX controls the private keys. Therefore, experts recommend withdrawing cryptocurrencies to a non-custodial wallet.

In doing so, you’ll retain full control of the layer-2 tokens, plus their respective private keys. Moreover, you can freely transfer, trade, or stake tokens when they’re kept in a non-custodial wallet. No permission is needed, unlike the custodial service available on CEXs.

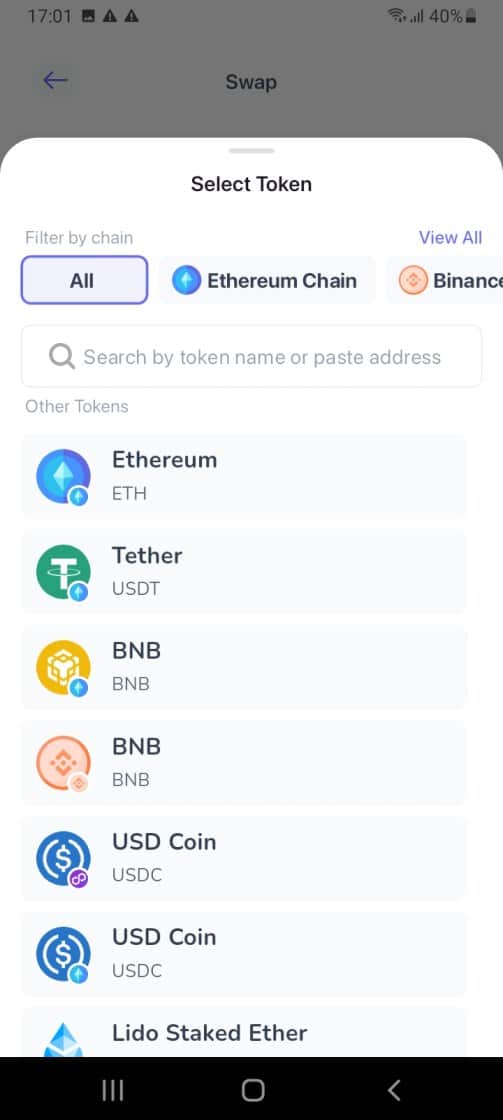

Having researched the best Bitcoin wallets for layer-2 storage, we found that the Best Wallet app is a great option. Best Wallet users have full autonomy over their assets. The wallet’s unique private key is encrypted and stored on the user’s mobile device, ensuring its owner is the only person who can authorize transactions.

Best Wallet users are also protected with advanced security features like biometrics (e.g. fingerprint ID) and two-factor authentication. Crucially, Best Wallet supports the leading layer-2 networks like Base, Arbitrum, and Polygon. Custom tokens can be added to these networks, providing access to their respective ecosystems in one safe place.

Best Wallet also comes with in-built trading tools, allowing users to buy, sell, and trade layer-2 tokens without KYC procedures. For example, you can instantly buy POL anonymously with a credit card. You can then swap those POL tokens for cryptocurrencies from other networks, or invest them in Polygon DeFi applications via WalletConnect.

Other Wallet Options When Storing Layer-2 Tokens:

While Best Wallet is our overall top pick, here are some other options when storing layer-2 cryptocurrencies:

- MetaMask: Used by over 100 million people, MetaMask supports most layer-2 networks on the EVM standard. This includes Arbitrum, Base, Linea, Celo, Optimism, and Polygon. MetaMask offers non-custodial storage via its mobile app and browser extension. However, MetaMask isn’t a good fit if you’re also looking to store Bitcoin or Solana, as it doesn’t support these network standards.

- Ledger: One of the safest ways to store layer-2 tokens is via Ledger’s hardware wallet. Prices range from about $79 to $400 depending on the required model. As a cold storage solution, Ledger ensures internet threats are avoided. Private keys are encrypted and stored within the physical device. Several layer-2 networks are supported, alongside layer-1 cryptocurrencies like Bitcoin, Ethereum, and Litecoin.

- Trust Wallet: A popular non-custodial wallet app and browser extension supporting over 100 blockchains and network standards, including all layer-2 tokens. Trust Wallet is free and user-friendly, although third-party services can be expensive. This includes token swaps and fiat purchases. Nonetheless, Trust Wallet provides seamless access to DeFi applications, including Uniswap, PancakeSwap, and Curve.

Security Tips for Protecting Your Investments

Knowing how to keep layer-2 cryptocurrencies safe and secure is crucial. The following security tips will ensure your funds are protected at all times.

Always Back Up the Layer-2 Wallet Offline

According to security experts, wallets should always be backed up offline. This means writing the wallet’s secret passphrase on a sheet of paper. Unfortunately, newbies often store secret passphrases online, such as on a Word or Google document. This is strongly discouraged, considering the document could be hacked remotely.

By extension, the hacker would have access to the secret passphrase and thus, full control of the wallet funds. The best practice is to ensure the passphrase is written down in the correct order and stored somewhere safe and accessible. It will be required if you can no longer access the wallet. For instance, if you forget the login password.

Ensure You’re Using the Right Network

Another mistake frequently made by beginners is sending cryptocurrencies to the wrong network. For example, suppose you’re holding ETH on the Ethereum blockchain. You transfer that ETH via the Base network, a layer-2 ecosystem supporting Ethereum. Those funds could be lost forever, considering they’ve been transferred through the incorrect network standard.

This issue often happens when withdrawing funds from an online exchange. For example, Coinbase offers fee-free ETH transfers when selecting Base. Beginners are often unaware that unless the wallet address supports the Base network, that ETH will be challenging to retrieve.

Ensure Two-Factor Authentication is Used

When storing the best layer-2 crypto to buy, experts strongly recommend activating two-factor authentication (2FA). Some providers send the 2FA via SMS, while others use third-party apps like Google Authenticator.

Either way, 2FA offers a significantly strong layer of security. For instance, suppose a hacker obtained the wallet password. Without the 2FA, they still wouldn’t be able to access the wallet funds.

However, it’s important to use 2FA on a different device from the wallet. Otherwise, a fully compromised device (like a stolen smartphone) could mean the hacker has access to all credentials, including the password and 2FA code.

Always Be Alert About Potential Wallet Threats

Non-custodial wallets are the expert recommendation, but security features can’t protect your layer-2 cryptocurrencies 100%. On the contrary, personal responsibility also comes into play. Approving a transaction means that the funds must be released, as per the nature of non-custodial storage.

Therefore, you should always be alert to potential threats and scams.

- For example, suppose you receive a message on social media about a new airdrop, available only to those holding a particular layer-2 token.

- The scammer states that you need to connect a wallet to the airdrop dashboard to claim the tokens.

- You proceed, thinking it’s a legitimate process.

- However, connecting the wallet means that the scammer will immediately drain its contents.

Similarly, we strongly suggest avoiding clicking links that you’re unfamiliar with. This is another way for scammers to access your cryptocurrencies. The link could install a keylogger or a virus, meaning the wallet could be compromised remotely.

Trading & Investing Strategies for Layer-2 Cryptos

Now, let’s move on to proven trading strategies employed by seasoned crypto investors. Read on to improve profitability and reduce risk when trading layer-2 tokens.

Short-Term vs. Long-Term Holding Strategies

Long-term strategies are encouraged when investing in layer-2 cryptocurrencies. Unlike meme coins, layer-2 networks are built for the long run. Therefore, it’s wise to be patient during bearish market conditions. Beginners will often panic sell when prices drop, only to see them recover a few days later.

Crucially, you shouldn’t be selling because of short-term volatility, especially if the fundamentals haven’t changed.

- For instance, suppose Arbitrum has seen its TVL and daily active users increase for 12 consecutive months.

- However, ARB has declined by 30% over the same period.

- This should be viewed as an opportunity rather than a drawback.

- After all, the fundamentals are strong and you can buy ARB at a 30% discount.

An even better strategy is to avoid investing lump sums into the chosen layer-2 projects. Nobody can predict the perfect time to buy cryptocurrencies, so lump-sum investments vastly increase the risks. You could end up entering the market at the peak, meaning no ability to take advantage of broader dips.

Instead, consider the dollar-cost averaging strategy. Set an amount and frequency, ensuring it’s affordable. Dollar-cost averaging only works when it’s stuck to religiously. For example, if you’ve $200 spare each week, use those funds to invest in layer-2 cryptocurrencies. Repeat weekly, preferably with an auto-invest feature.

However, dollar-cost averaging isn’t a guaranteed way to make money. The strategy assumes continued growth over time. If the purchased layer-2 tokens don’t recover with the broader market, it could be time to reassess.

Building a Diversified Layer-2 Portfolio

Dollar-cost averaging is best combined with a diversification strategy. Crucially, nobody knows which layer-2 networks will dominate the industry. The market consensus was previously Polygon. Then Arbitrum came along, before losing market share to Base. As such, layer-2 trends and capital flows can change at a moment’s notice.

Consider spreading your investment funds across several layer-2 projects, focusing on ones with the best fundamentals. In addition, regular portfolio rebalancing should also be implemented. Consider reducing exposure to underperforming projects and moving those funds to the top performers.

How to Identify Undervalued Layer-2 Projects

The most challenging aspect is knowing how to choose the best layer-2 crypto to buy. The best practice is to focus on projects that are considered undervalued. This means the respective layer-2 token trades at a discount when compared to its perceived value. While subjective, there are various ways to achieve this goal.

First, experts strongly suggest starting with the fundamentals. Some of the key factors to explore include adoption rates (e.g. average daily transactions), TVL (totals and trends), and partnerships with notable companies. Ongoing development goals should also be considered, especially if the team has a proven track record in meeting its roadmap objectives.

Importantly, the best layer-2 projects are those with continued growth in each area. After all, increased user activity means the layer-2 network generates more revenue. It also means increased demand for its ecosystem token, considering it’s required for transactions and DeFi activities.

That said, it’s also important to consider market capitalizations when exploring undervalued layer-2 projects. A good example is Optimism. The markets valued Optimism at over $4.7 billion in March 2024, a bullish period for most cryptocurrencies. Optimism’s value has since declined by over 80%.

Now, our research shows that Optimism remains a high-quality layer-2 project, with increased adoption, a growing DeFi ecosystem, and more partnerships. As such, many experts argue that an 80% decline isn’t reflective of Optimism’s true valuation.

Layer-2 Expansion Beyond Ethereum

We’ve established that most layer-2 networks have been designed for the Ethereum ecosystem. This makes sense, considering Ethereum is home to thousands of fully-fledged DeFi applications, from DEXs and metaverses to play-to-earn games and staking pools.

Bitcoin, for example, has the Lightning Network, which vastly improves speed, fees, and scalability. While Bitcoin transactions take 10 minutes, this is reduced to micro-seconds when using the Lightning Network. Similarly, Bitcoin also has Stacks. This layer-2 network provides smart contract functionality, meaning Bitcoin can benefit from DeFi opportunities.

Moreover, even high-performing networks like Solana and BNB Chain can leverage layer-2 solutions. For example, Nitro helps the Solaan ecosystem achieve blockchain interoperability with EVM-compatible networks. This includes Ethereum, BNB Chain, Avalanche, and others. The result is that stakeholders are no longer confined to just one network standard.

For example, cross-chain solutions mean BNB can be traded for SOL. Additionally, those holding ETH can benefit from Solana-based DeFi platforms. The possibilities are endless, reducing cross-chain friction and creating a more inclusive Web 3.0 era.

- Major Partnerships & Institutional Adoption of Layer-2: While increased user adoption is crucial, major partnerships can take layer-2 networks to the next level. For example, Coinbase selected Optimism when building its Base network. This provides Optimism with a stamp of approval from the world’s most trusted exchange.

- Potential Growth in DeFi, Gaming, and NFT Markets: Layer-2 solutions will be crucial during the Web 3.0 era, where DeFi transactions are expected to increase exponentially. This means DeFi users will expect low fees and fast settlement times, two core characteristics of most layer-2 networks. These performance metrics will also help gaming and NFT markets.

FAQs – Best Layer-2 Crypto to Buy in 2025

What is a layer-2 crypto?

Layer-2 cryptocurrencies are native tokens backing a layer-2 network. For example, ARB and OP are layer-2 cryptocurrencies backing Arbitrum and Optimism, respectively.

Why are layer-2 solutions important for Ethereum?

Layer-2 solutions are crucial for the Ethereum blockchain, which suffers from high fees and weak scalability. Layer-2 networks provide an instant solution, with significantly cheaper and more scalable transactions.

What are the best layer-2 scaling technologies?

Base and Arbitrum are considered the best layer-2 scaling technologies for Ethereum, both capable of handling thousands of transactions per second. The Lightning Network and Stacks are the market leaders for Bitcoin.

How do I invest in layer-2 cryptos safely?

The safest way to invest in layer-2 cryptocurrencies is via a regulated centralized exchange. Alternatively, consider a decentralized exchange to avoid counterparty risks.

Can layer-2 projects compete with layer-1 blockchains?

Yes, layer-2 networks can compete with layer-1s, especially when offering increased scalability, faster transactions, and lower fees. Demand for the respective layer-2 token will increase as adoption rates rise.

Which layer-2 crypto has the highest growth potential in 2025?

Our research shows that Mantle, Optimism, and Arbitrum have solid growth potential in the coming years. Keep an eye on Base too, which could eventually launch a native token.

Are layer-2 cryptos a good long-term investment?

Layer-2 cryptocurrencies could be a good investment, considering some layer-1 blockchains will eventually become dependent on them. It's best to diversify, as nobody knows which layer-2 ecosystem will dominate long-term.

References

- Decentralised Finance in the EU Development and Risks (European Securities and Markets Authority)

- What Is Layer 2? (Chainlink)

- The Current State of Interoperability Between Blockchain Networks (EU Blockchain Observatory and Forum)

- Coinbase to Launch Blockchain Network as Part of DeFi, NFT Expansion (Bloomberg)