This year, non-fungible tokens (NFTs) have grown in popularity as a result of their recent skyrocketing values. If you didn’t know, Beeple sold an NFT at Christie’s for $69 million. Jack Dorsey, the founder of Twitter, sold his first tweet for 1,630.58 Ether (about $2.9 million at the time).

The NFT, like any other piece of art, is valued depending on the artist’s credibility, the nature of the artwork, the effort put into the creation, the story behind the artwork, and the artist’s social currency.

But there must be something that determines the value of NFT, and can you also create, buy and sell NFT’s?

Read ahead as we answer all your questions revolving around the NFT price, the relation between NFT and Cryptocurrency price, and how can you be a trader in NFTs.

Let us delve in without much ado.

What Determines NFT Price

The price of NFT is weighted variably across four components depending on the asset that the NFT represents. The four components are utility, the identity of the issuer or previous owner, future value, and liquid premium.

This paradigm can be used by investors to determine whether an NFT is worth investing in, as well as by NFT developers to consider ways to raise the value of NFTs to attract users and investors.

The cost of creating an NFT

Let’s look at how much it costs to create an NFT in a marketplace. There are two primary possibilities, and which one you choose is up to you and your project’s plan. Anyone can make an NFT, and accounts on all main platforms, including as OpenSea, Raible, and Mintable, are simple to set up.

The other good news is that when minting an NFT, all of these platforms provide at least two, if not more, blockchains to choose from. But while we look into the cost of creating an NFT, it is important to note that the price changes depending on the blockchain one is using to create an NFT.

For E.g. Cardano NFTs are much cheaper compared to Ethereum NFTs so they make cheaper NFTs. You can check how to buy Cardano exchange here. But with so many NFTs launching in the market it is important to find the best NFTs to buy and invest in.

The reputation of the artist, collection, and the project

But apart from the four factors what also is turning the NFT’s are famous artists and celebrities. The NFT, like any other piece of art, is valued depending on the artist’s credibility and reputation, the nature of the artwork, the value of the collection, and the effort put into the creation of the artwork and the artist’s social currency.

The cryptocurrency boom of 2021 ushered in not only new NFT token prices but also new markets, metaverse NFT price, and NFT stock prices such as those for digital collectibles and non-fungible tokens (NFTs).

This year has been a watershed moment for the industry, with these one-of-a-kind digital objects fetching millions of dollars each. The NFT revenues reached $14.4 billion in 2021. Stand-alone pieces of art, such as The Disaster girl meme, which sold for half a million dollars, the Beeple NFT, which sold for $69 million at Christie’s and several NFTs of the Bored Ape Yacht Club (BYAC).

BYAC NFT (read more about the most expensive NFTs)

Thousands of NFT collections, as well as behind-the-scenes projects like the avatar-generating CryptoPunks, metaverse Decentraland, and play-to-earn blockchain game Axie Infinity, were the greatest victors.

Possible application of that NFT

When Beeple’s “Everyday: The First 5000 Days” digital artwork was auctioned for $69 NFTs gained a mainstream boost. For the time being, NFTs are connected with the art world, but what does the future application of NFT’s hold. Let us see:

Gaming

Gaming is expected to be one of the next areas of application to witness a significant fundamental change away from NFTs. The arrival of the Play-to-Earn paradigm has stepped up the NFT demands, in this players take part in a game- add value to the ecosystem through their actions, and earn NFT digital assets. Gamers can sell their NFTs and make money in partnership with the game creator if they possess these assets.

Metaverse

Metaverses are virtual environments that, in essence, bring the internet to life. Within metaverse worlds, you can create your existence, communicate with real people in virtual communities, create your avatar, work, play, and explore new worlds.

Entire virtual worlds are being envisioned and built with the help of improved AI, the adoption of global standards, and ever-increasing computer processing power.

NFTs will be a critical component of metaverses, serving as the foundation for assets that may be used throughout all of these realms. In Metaverse Decentraland NFT is a big example and is gaining a lot of popularity by having a first-mover advantage.

Social Impacts

What’s fascinating is the potential for NFTs to make a good impact on the globe. Jeremy Dela Rosa is the creator of Leyline, a non-profit that is pioneering the use of NFTs for social impact.

Users earn NFT collectibles by doing good things in the world on their platform. Their NFTs signify a cause or objective for which people worked hard, as well as a specific point in time when the world was a better place.

Real Estate

The real estate market is primed for a shake-up. Contracts, certificates, ownership, and claim history will all be maintained and available on the blockchain.

Eliminating a large amount of paperwork and also preventing fraud. NFTs contracts are maintained on a secure blockchain and thus are nearly impossible to alter, easy to verify, and permanently stored.

Current NFT market trends

NFT’s are edging closer to the traditional art market, where people buy and sell tangible pieces, in terms of value. According to the most recent projection from a 2021 report, sales of traditional art and antiques will surpass $50 billion in 2020.

According to the Art Basel and UBS Global Art Market study, that number fell from the previous year, owing in part to the COVID-19 pandemic.

The NFT market appears to be holding up well beyond 2022. According to the most recent figures from NonFungible.com, NFT sales reached half a billion dollars in just one week. The classic Bored Ape Yacht Club and CryptoPunks NFT collections lead sales, followed by Doodles, the Sandbox, and Art Blocks.

In 2021, we’ve seen a lot of incredible pieces hit the market, some of which have completely transformed our perceptions of how this technology can be used, as well as how it can connect communities.

The sense of belonging and status that has developed around the Bored Ape Yacht Club and the CryptoPunk movements, for example, is simply incredible. While several celebrities have launched their lines, there have been a few brands that have put together some stunning collections.

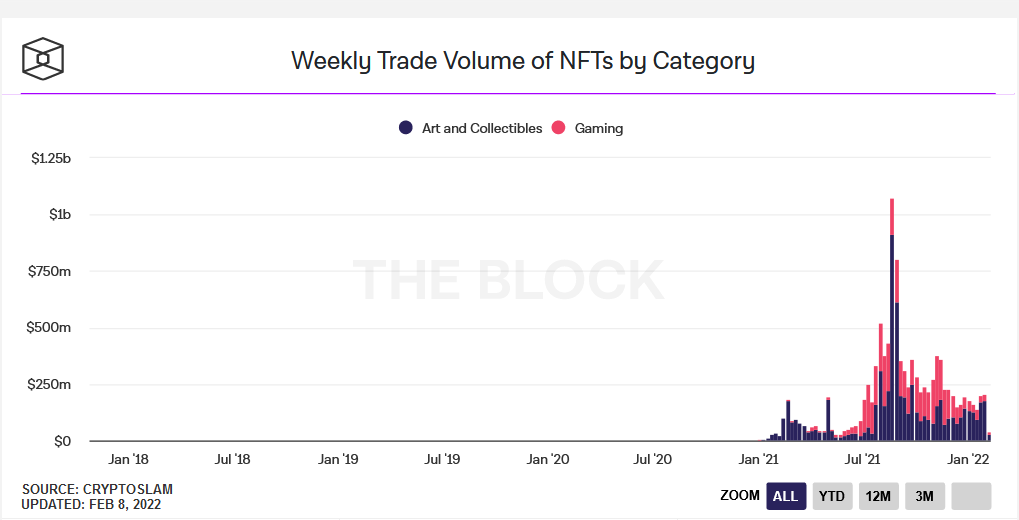

Source – The Block

The market for non-fungible tokens, which are digital works of art linked to blockchain technology, will be worth $41 billion by the end of 2021. Total NFT sales would be considerably greater if digital collectibles generated on blockchains other than Ethereum were included, according to the Financial Times, which first reported the new figure.

Some most expensive NFTs and buzz creating NFTs include Twitter founder selling his first tweet via NFT Marketplace, the most expensive NFT based meme sold at $4 million, The Merge by Pak sold at $91.8 million and the most expensive NFT sold at $532 million were the top highlights which created a major buzz in the NFT market.

You can also learn to sell and make NFT from this excellently explained article- How to Make and Sell NFTs. But to start trading in the NFT market it is important to understand which are the best NFT marketplaces so get an in-depth understanding before delving in into NFTs and Cryptocurrency.

How is the NFT market tied to Cryptocurrencies

While NFTs are exchanged using cryptocurrencies, they have several distinct characteristics that are important to keep in mind when trying to comprehend them. Even if they have some asset-like features, cryptocurrency is primarily meant as a currency. NFTs, on the other hand, are designed to be used solely as assets.

The term “non-fungible” in the NFT name is a good indicator of this distinction. One of the fundamental properties of cryptocurrencies and money, in general, is fungibility, or interchangeability (one bitcoin is the same as another bitcoin, and one dollar the same as another). The non-fungibility of NFTs is one of the most valuable asset qualities.

Taking reference from a paper by Michael Dowling on Is non-fungible token pricing driven by cryptocurrencies? Where a regressive methodology explained the NFT and Cryptocurrency interlink.

Let us observe the table below taken from the paper mentioned above

|

Decentraland |

CryptoPunks |

AxieInfinity |

Bitcoin |

Ether |

||||||

|

Price |

Return |

Price |

Return |

Price |

Return |

Price |

Return |

Price |

Return |

|

| Mean | 1108.64 | 0.0214 | 4439.30 | 0.0649 | 61.07 | 0.0294 | 13428.90 | 0.0252 | 390.41 | 0.0243 |

| Median | 826.48 | −0.0076 | 269.01 | 0.0212 | 15.65 | −0.0299 | 9537.82 | 0.0172 | 228.16 | 0.0169 |

| Std Dev | 1069.41 | 0.2754 | 14065.13 | 0.6203 | 117.84 | 0.6241 | 11600.17 | 0.0859 | 419.70 | 0.1066 |

| Minimum | 372.04 | −0.5788 | 41.51 | −1.7731 | 2.81 | −1.5452 | 3898.49 | −0.3174 | 123.55 | −0.3766 |

| Maximum | 8321.89 | 0.6955 | 100753.50 | 1.7350 | 684.37 | 2.3206 | 57360.48 | 0.2360 | 1880.29 | 0.4289 |

| Skewness | 4.69 | 0.3283 | 4.72 | 0.0332 | 3.29 | 0.4346 | 2.48 | −0.2077 | 2.45 | −0.0949 |

| Kurtosis | 25.92 | 0.0050 | 24.99 | 0.3235 | 11.60 | 1.6132 | 5.51 | 1.9385 | 5.06 | 3.2186 |

Descriptive statistics for selected NFT and cryptocurrency markets from March 2019 to March 2021. Returns are based on weekly data.

Prices are USD equivalents at the time of the trade. Data sourced from coinmarketcap.com (Bitcoin and Ether) and nonfungible.com (Decentraland, CryptoPunks, AxieInfinity).

Weekly pricing plots as named for all NFTs and cryptocurrencies, March 2019 to March 2021.

In terms of volatility transmission, NFT pricing appears to be considerably different than the bitcoin price. Low-correlation assets are highly valued for their diversification features, which has important implications for investment portfolios.

To prove NFTs’ low-correlation status, we need to look into their pricing in comparison to other asset classes.

The volatility spillover analysis also revealed that there is little spillover between NFT markets, which is an interesting finding. This is in contrast to cryptocurrencies and stock markets (Bhattarai et al., 2020), both of which have a substantial spillover impact between their particular markets. NFT markets may have many asset classes in this case.

Another finding is that, despite the low volatility transmissions between NFTs and cryptocurrencies, wavelet coherences show some co-movement between the two markets.

This shows that understanding cryptocurrency pricing behavior can be useful when it comes to NFT pricing. There’s a chance that both markets are driven by the same variables. Consider whether mood and uncertainty are driving both asset groupings.

Cryptocurrency research has exploded in recent years, and being able to apply what we’ve learned to NFT pricing and valuation can help us learn more quickly. Regardless of our primary finding, NFTs appear to be a distinct (and interesting) new asset class.

What is the average cost and price of NFT?

NFTs are minted on many blockchains, their prices change from one to the next, and even within the same blockchain, the cost of one NFT may differ from that of another. This, on the other hand, can be attributable to a variety of factors, including project quality, data size, transaction speed, and gas fee, among others.

In terms of pricing, the average cost of an NFT is also determined by rarity, which means that, in addition to the previously mentioned reasons, the price of an NFT can skyrocket due to the law of scarcity.

As a result, the cost of minting an NFT can range from as little as $1 to as much as $900, or possibly more. The overall cost, however, is mostly dictated by its rarity. The most costly single unit NFT to date was $69.3 million and was entitled “Everyday – The First 5,000 Days.” Similarly, Jack Dorsey, the founder of Twitter, sold his first tweet for $2.9 million.

The typical price of NFTs varies each marketplace, ranging from $900 on Mintable to $500 on OpenSea to $150 on Valuable, among others. Despite this, the cost of NFTs is frequently higher on weekdays due to a lot of on-chain activity. This also implies that the cost of minting NFTs is lower on Saturdays and Sundays.

According to DappRadar, NFT sales volume reached $24.9 billion in 2021, up from $94.9 million the year before.

The average sale price suggested by the most prominent NFT sites is astonishingly high- around thousands of dollars. As of this writing, the average price of an NFT sold on SuperRare is 2.15 ether, or $5,800; the average price on MakersPlace is 0.87 ether, or $2,400; and the average price on Foundation is 1.27 ether, or $3,500, according to OpenSea rankings.

So yes, don’t fall under the misconception that all your friends in NFT are getting rich. If you too are interested in buying the best NFTs or selling your NFT’s you can check this amazing and detailed article on the same – How to Make and Sell NFTs

How to Buy ETH for NFTs, Create It and Set its Price

The majority of NFT transactions take place on a dedicated exchange. Here’s a quick walkthrough on how to create and buy NFTs in a step by step process:

Creating your NFT

Understanding what an NFT is and what goes into constructing one is the first step in resolving the seemingly difficult question of how to make an NFT.

We live in an NFT-obsessed world where almost anything may become an NFT. Memes, recipes, digital art, songs, and even entire enterprises are currently being sold on NFT platforms. The types of content that can be “tokenized” and turned into an NFT are now limited to the bare minimum.

Because the technology is still in its infancy, now is a perfect time to experiment with it for your work, especially as the market and demand for digital art grow. Avoiding transforming copyrighted content or assets into NFTs is an unsaid rule.

Now that we know what an NFT is and how to make NFT art how does NFT art finance price is set and enjoyed by the owner?

Answering your question we know that millions of people have seen Beeple’s artwork, which sold for $69 million, and the image has been duplicated and shared numerous times.

Furthermore, the artist retains copyright ownership of their work in many cases, allowing them to continue producing and selling copies. On the other side, the buyer of the NFT owns a “token” that indicates they own the “original” piece. So they earn similar profit as a copyright owner does.

The process of creating an NFT is similar to that of advertising an item for sale or auction on a website like eBay. You can create your NFT by simply uploading a digital file of your assets, such as an image or original design, after making an account with one of these services.

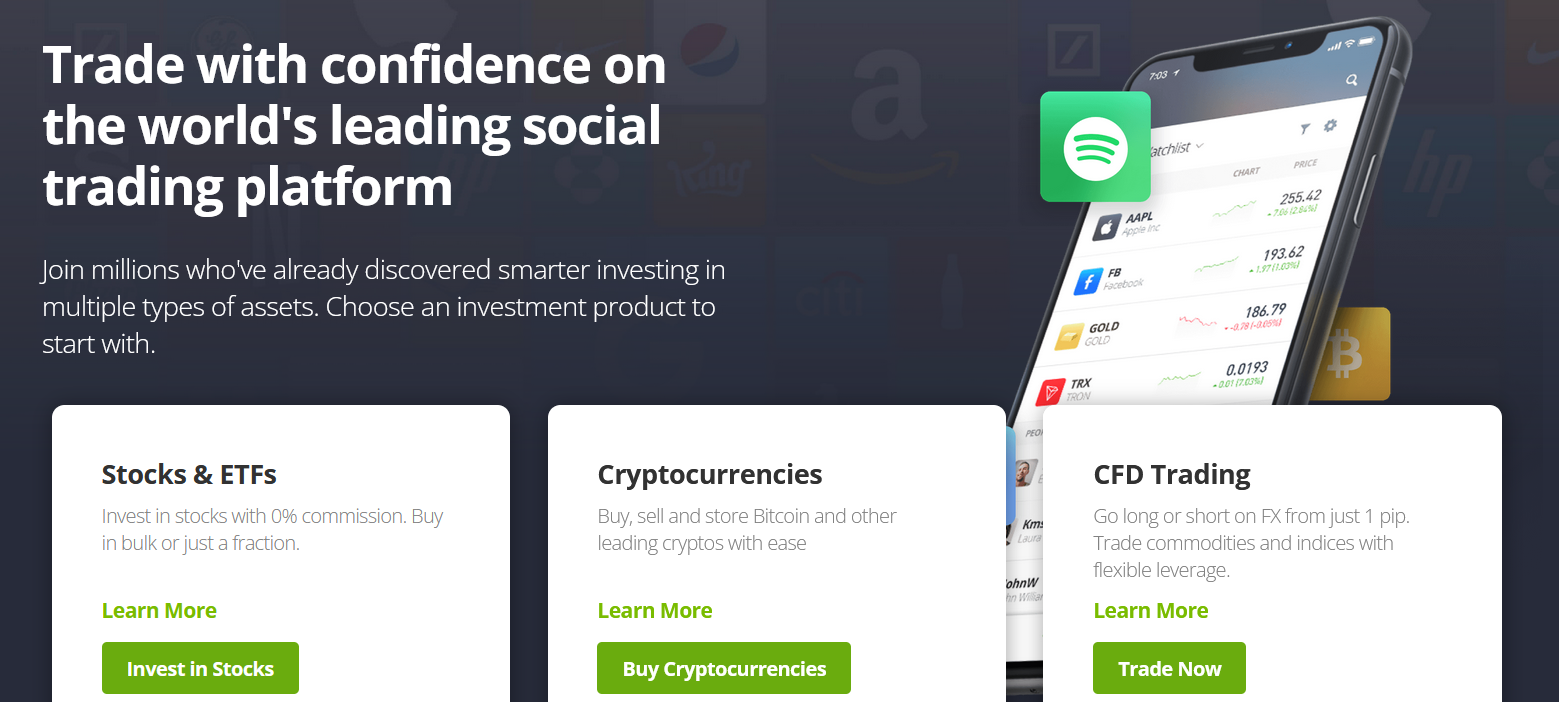

Buy ETH for NFT

The Ethereum network is now used by the majority of markets to power their transactions.

- To purchase an NFT, you’ll need Ether, Ethereum’s native token. If you don’t already have one, you can open an account with a cryptocurrency exchange like eToro and buy the tokens there.

- You’ll also need to set up an Ethereum-compatible crypto wallet. A cryptocurrency wallet is a digital address where you can save your coins. Wallets can be created on various platforms like MetaMask or Coinbase and then deposit funds into your eToro account.

- To open a wallet with the platform of your choice, you must first go to their website and register. You’ll need to send the ether you acquired from the exchange to the wallet’s address after you’ve opened the wallet.

- Select the marketplace where you wish to purchase the NFT. NFTs can be found on a variety of platforms. OpenSea, Raible, SuperRare, and Foundation are some of the most popular NFT marketplaces.

- Create an account on the marketplace of your choice. The registration procedures for various marketplaces differ.

- Make a connection between your wallet and the marketplace. On most marketplaces, there is a simple ‘Connect wallet’ option.

- Look through the marketplace for an NFT that appeals to you. For purchasing NFTs, most marketplaces use an auction system. You must bid for the NFT you want. You will finish the transaction after a successful bid, and the required amount will be deducted from your wallet.

Remember that the marketplace may charge you a transaction fee, which will vary depending on the site.

Setting price in NFT

It is important to be patient with pricing and then create your product value. Look into the NFT market to see what’s been going on. It’s best to follow the crowd, as popular NFT artifacts can easily sell for more money if your art is unique.

The next step is checking how rare is your NFT. You must also choose if you want to display art collections. It’s entirely up to you.

Because NFTs has such a diversified market, you can expect to see a wide range of customers there. Some customers would place the highest price for your luxury products, while others would think twice before purchasing a cheap art treasure from you.

As a result, categorizing your art is the greatest way to assure liquidity in sales. The ones you believe are unusual should be priced expensive and reserved for high-profile bidders. You can charge as little as 0.01 to 0.02 ETH for your art treasures.

It’s fine to pay 0.02 ETH for a decent art item. You must initially strive to establish yourself as a brand, even if this means paying more gas than the original price of your product.

Decide on your pricing floor. Your pricing floor is where you should begin pricing your things right now. As previously said, the pricing floor should remain at a lower level at first, gradually increasing as more customers arrive.

Conclusion

The price of an NFT market can be driven by several things. These factors include a wide range of topics, from market conditions to buyer demand. Market demand, buyer arousal, etc.

Other elements, such as an asset’s potential for use and cultural importance, contribute to an NFT’s overall value. Simply put, all of the often-linked factors may be summed up in one word: hype.

When you decide to develop an NFT, make sure it has a lot of traction. This distinction can come from your association or seal of approval if you have a huge online following. The number of likes on a popular piece of content, such as a viral tweet, might help to drive demand for it. Adding digital signatures or transferring proof of ownership can assist you to drive the token’s value in specific instances.

You may choose how to value your NFT for optimal benefit as a buyer or seller by keeping these points in mind. This allows you to not only manage the complicated world of these popular assets but also to take advantage of the various opportunities they present.